Working Capital and Invested Capital and the Difference Between Them

Table of contents:

- What is Working Capital?

- What is Invested Capital?

- What is the difference between working capital and invested capital?

- What is the Invested Capital Return Equation?

- What are the characteristics of working capital?

- What are the types of working capital?

- What is the importance of calculating working capital?

- What is Net Working Capital?

- What are the components of working capital?

- What factors should be considered for efficient working capital management?

- How can working capital be read?

- What is the working capital ratio?

- What are working capital financing policies?

- What is the working capital cycle?

- How to calculate the working capital cycle?

- How is working capital calculated with a practical example?

- How can you track working and invested capital through Daftra?

- Frequently Asked Questions

- What is working capital financing?

Have you ever wondered how investors achieve enormous profits from businesses? Or how do companies maintain financial stability and their ability to continue and expand?

The answer lies in working capital. Yes, it is a pivotal element of financial accounting and one of the most important tools institutions rely on to finance their daily activities and operate efficiently.

The most important question is: how can businesses manage working capital effectively to help them avoid financial problems and risks and achieve substantial returns?

This is what we will explore in today’s article, in which we provide a comprehensive guide, based on our accounting experience, on working and invested capital, their importance, how to calculate them practically, and the difference between the two.

Summary of Key Points

- Working capital is the value obtained by subtracting current liabilities from current assets to assess the institution's operational capacity and efficiency. Working capital is divided into two main categories: positive and negative working capital.

- Invested capital is defined as working capital (current assets − current liabilities) plus all long-term assets. The formula for calculating invested capital is as follows: (Invested Capital = Working Capital + Long-Term Assets) or (Invested Capital = Equity + Long-Term Liabilities).

- The importance of calculating working capital lies in using it to increase profits and positive cash flows, improve creditworthiness, build a good business reputation, and, finally, in accurate working capital analysis, ensure transparency in financial reports.

- Working capital is characterized by features such as liquidity, flexibility, operability, and balance.

- The most important factors affecting working capital include industry standards and requirements specific to the business field, analyzing incoming and outgoing cash flows and comparing them, understanding economic variables and their impact on working capital needs, and monitoring inventory turnover and accounts receivable.

- The working capital cycle refers to the time it takes for an institution to convert net working capital into cash.

What is Working Capital?

Working capital for companies is defined as current assets minus short-term obligations, reflecting a company’s operational efficiency.

Working capital shows the institution’s financial capacity and efficiency. If it yields a positive number, it confirms the institution's economic strength. However, if the company’s current assets are less than its due liabilities, this signals a risk that must be addressed in advance.

What is Invested Capital?

Invested capital is defined as the funds that a company collects by issuing securities to shareholders and debts to bondholders, plus long-term deductions such as debt obligations and capital leases.

Invested capital is not considered an item in the company’s financial statement, as debts, capital lease contracts, and shareholders’ equity are detailed in the company’s balance sheet.

What is the difference between working capital and invested capital?

After mentioning the concept of both working capital and invested capital, it should be noted that there are a set of differences between working capital and invested capital in various aspects, including:

1- Difference in Calculation Method

The method of calculating invested capital differs from that of working capital. Working capital is calculated by subtracting current liabilities from current assets and measures a company’s short-term operational liquidity.

Invested capital, on the other hand, is usually calculated by adding working capital to fixed or long-term assets, or by adding equity to total debt. It is used to evaluate the actual amount of funds invested in the company’s long-term operations.

a- How to Calculate Working Capital

Working capital is calculated using the following equation:

Working Capital = Current Assets - Current Liabilities

The term "current assets" refers to all assets that can be converted into cash within a short period, such as inventory, readily liquidated investments, and foreign currency.

The term "current liabilities" refers to amounts that a company or institution must pay within a short period, usually 1 year, such as taxes due, employee salaries, and other obligations.

The result of this equation indicates whether the institution has sufficient short-term assets to cover its short-term debts.

You can download a working capital cycle calculation template to perform this process without needing accounting knowledge of its rules and how to calculate it.

b- How to Calculate Invested Capital

Invested capital can be calculated using the following equations:

Invested Capital = Working Capital + Long-Term Assets

Invested Capital = Equity + Long-Term Liabilities

You can complete the calculations of working and invested capital easily using the Daftra accounting software, which provides these calculations automatically and accurately.

2- Difference in Purpose

The purpose of calculating working capital differs from that of invested capital. The purpose of calculating working capital is to determine the financing needed to sustain operations, while the purpose of calculating invested capital is to determine the financing needed for expansion and the purchase of fixed assets. Here are the differences in purpose between working and invested capital:

a- Purpose of Calculating Working Capital

The importance of working capital for companies includes the following:

- It is used to efficiently finance operational processes within the institution.

- It helps pay short-term obligations, such as employee salaries and taxes, even if the institution faces cash flow problems.

- It assists in financing new projects without borrowing.

- It strengthens the institution’s position if it needs to obtain financial loans, provided the working capital indicator is positive.

- It helps provide a clear view of the institution’s financial situation.

- It helps maintain sufficient cash to cover obligations and facilitate operations during emergencies and crises.

- It helps mitigate fluctuations in sales and revenue that the institution experiences from time to time.

- If the institution has a high amount of working capital during a certain period of the year, it can purchase excess raw materials to save for times when revenues are low.

b- Purpose of Calculating Invested Capital

The importance of invested capital for companies includes the following:

- It serves as a source of financing for the company if it wants to expand its activities.

- It helps purchase fixed assets, such as land, buildings, and equipment.

- It can be used instead of borrowing from banks to avoid increasing obligations due to loan interest.

3- Difference in Value

Invested capital is greater in value than working capital because its calculation formula includes working capital plus long-term assets.

It is clear from the differences between working and invested capital that working capital is used to finance short-term operational processes and is calculated by subtracting current liabilities from current assets.

Invested capital, on the other hand, is used to finance expansions and purchase long-term assets. It is calculated by adding long-term assets to working capital or by adding equity and long-term liabilities. Invested capital is also higher in value than working capital because it includes additional long-term elements.

What is the Invested Capital Return Equation?

The purpose of the return on invested capital (ROIC) is to show how efficiently the company uses its funds to increase revenue and to indicate how profitable the company’s investments will be in the future.

Invested capital can be calculated using the following accounting formula:

Invested Capital = Current Receivables + Long-Term Debt + Common Stock + Retained Earnings + Cash from Financing + Cash from Investment

The return on invested capital can be calculated using the following accounting equation:

Net Operating Profit After Taxes (NOPAT) / Invested Capital

ROIC calculations can be automated using Daftra accounting software to ensure accuracy and reduce errors.

What are the characteristics of working capital?

Working capital is a fundamental element in the financial management of any company, as it represents the difference between current assets and current liabilities, and helps the company manage its daily operations. Therefore, it is essential to know the most prominent features of working capital, which are:

- Liquidity: Determines the company’s ability to meet its short-term financial obligations.

- Flexibility: The ability to adapt to sudden operational and financial changes.

- Balance between risk and return: This is achieved through effective working capital management, in which the company must balance maintaining sufficient liquidity with achieving a rewarding return.

- Operation: One of the most important characteristics of working capital is its close link to the company’s daily operations and its status as a crucial part of operating cash flows.

It becomes clear that the features of working capital are: liquidity, which ensures the fulfillment of short-term obligations; flexibility to face operational changes; a balance between risk and return through effective management; and, in addition to its close link to daily operations, its central role in operating cash flows.

What are the types of working capital?

It is important to know the types of working capital to understand how it is classified based on its nature of use and its relation to the company’s daily operations, as it helps determine how to manage short-term financial resources in line with operational needs. Working capital includes several types, which are:

1- Positive Working Capital

In this type, the total current assets are greater than the total current liabilities. This is considered a good indicator of the company’s ability to meet its current obligations on time.

2- Negative Working Capital

Here, the value of short-term liabilities is greater than the value of current assets in the working capital calculation. This indicates financial difficulties the company faces in meeting its obligations, requiring management to make decisions that increase revenues and reduce expenses.

3- Permanent Working Capital

This represents the minimum amount of working capital that the company needs to ensure the efficient operation of its activities. It is considered part of fixed assets that are not expected to be converted into cash during the current financial year.

4- Temporary Working Capital

This is the working capital that changes with fluctuations and temporary changes in operational activities.

Across the different types of working capital, it becomes clear that each reflects a specific financial situation within the company, whether in its ability to meet short-term obligations or to manage operational processes.

Use the Compound Return Calculator to analyze the rate of return on your investments automatically and for free.

What is the importance of calculating working capital?

Calculating working capital is a fundamental aspect of financial management for companies, as it helps improve overall financial performance. Calculating working capital provides the company with several advantages. The key points highlighting the importance of calculating working capital are as follows:

1- Increasing profits and cash flows

Accurately determining working capital is important for improving the company's overall profitability by increasing cash flows, maintaining a healthy budget, and avoiding financial risks and negative outcomes that may result from inaccurate working capital accounts in receivables and client payment collections.

2- Efficient inventory management

Accurate working capital records also help manage inventory and allocate resources optimally, preserving cash flows that can be used for purchases without unnecessary expenditure, by using them for investment and expansion into new products and businesses, which helps create a positive cash flow for the company.

3- Improving creditworthiness and building a good reputation for the company

Planning to determine and accurately calculate the company’s working capital needs enables it to pay suppliers and creditors on time, improving its creditworthiness, gaining the trust of financiers and investors, and building a good market reputation by using this creditworthiness as a guarantee and clear evidence of the company’s ability to meet obligations on time.

4- Transparency of financial reports

Accurate analysis of working capital through reviewing the balance sheet and its components of assets, liabilities, and shareholders’ equity, analyzing the income statement, cash flow statement, and ratio analysis for unusual changes in figures, such as gross profit margin analysis, contributes to improving the accuracy and transparency of financial reports.

These provide business owners and stakeholders with a comprehensive view of the company’s financial position and performance, helping them make the best administrative financial decisions.

The importance of calculating working capital appears in its role in increasing profits and cash flows, managing inventory efficiently, improving creditworthiness and company reputation, and ensuring the accuracy of financial reports, enabling the company to manage its resources effectively and make informed financial decisions.

What is Net Working Capital?

Net working capital is defined as the main component of the balance sheet equation, which is formulated as follows:

Net Working Capital + Long-Term Assets = Non-Current Liabilities + Equity

From this formulation, we deduce that:

Net Working Capital = Cash + Other Current Assets - Current Liabilities

What are the components of working capital?

Working capital consists of the difference between current assets and current liabilities. Below is a detailed explanation of the main elements of working capital:

1- Current Assets

These are all assets that can be converted into cash within a short-term period. Current assets in working capital are divided into:

- Accounts Receivable

Accounts receivable form an essential part of current assets. They represent amounts invoiced by the company to its customers or, in general, any amounts owed to the company that have not yet been collected from clients.

- Inventory

Inventory is the second component of the company’s working capital. Managing and controlling its level is essential, starting from raw materials inventory to finished goods inventory. This involves monitoring quantities, determining when to purchase more materials, and managing stock accumulation in warehouses, among other tasks.

- Cash and Bank Balances

This part represents all that can be easily converted into cash for the company. Proper financial management of this component is crucial for maintaining the company’s working capital. A company's efficiency is determined by its free cash flow.

2- Current Liabilities

These are obligations due by the company within a short-term period, and include:

- Accounts Payable

These constitute the company’s current liabilities, which are settled at a specific time to ensure the smooth continuation of production, such as:- Short-term debts (bonds, promissory notes, loans, overdrafts).

- Accrued profits.

- Taxes.

- Salaries and wages.

The components of working capital include current assets—accounts receivable, inventory, cash, and bank balances—along with current liabilities —accounts payable and short-term obligations such as debts, accrued profits, taxes, and salaries. Together, these elements determine the company’s ability to cover short-term obligations and manage its financial resources.

You can use Daftra Asset Management Software to easily manage your assets, adjust the balance sheet, and track cash flows. You can add your assets, manage depreciation, sell or write off assets, and generate comprehensive reports, such as the general ledger and balance sheet, to increase profits and improve asset utilization.

What factors should be considered for efficient working capital management?

To manage working capital efficiently, a set of factors affecting the company’s ability to finance daily operations and meet financial obligations must be considered. Working capital needs can be assessed through the following factors:

1- Field of Business

Analyze industry standards and requirements for the company’s field of business. This step includes comparing competitors in the same industry, identifying their strengths and weaknesses, and using this information to determine areas for improvement and the required working capital.

2- Cash Flows

Estimating working capital depends on analyzing the company’s incoming and outgoing cash flows and comparing them across different financial periods.

3- Economic Variables

Understanding economic variables such as inflation, supply and demand rates, currency fluctuations, business seasonality, and how each affects cash flow to evaluate the working capital required to finance activities and meet obligations.

4- Economic Expansions

Study planned growth and expansion strategies for the future and forecast future cash flows from the company, such as expenses and costs, or incoming revenue and profits.

5- Performance Indicators Analysis

Monitor working capital performance indicators by calculating the volume of outstanding sales and inventory turnover, known as the cash conversion cycle, which is one of the most important factors affecting working capital determination. The cash conversion cycle refers to the period required to convert inventory from materials and products into cash and is calculated using the following formulas:

- Average Inventory = Opening Inventory + Closing Inventory / 2

- Cash Conversion Cycle (Days of Inventory Outstanding) = Days Payable Outstanding Average Inventory / Cost of Sales

6- Financial Risk Assessment

Determining the required working capital to complete operational processes depends on assessing potential financial risks and evaluating their impact on cash flow, such as economic contraction or delayed customer payments.

7- Review of Accounts Receivable

Review accounts receivable and the agreed payment terms and schedules to determine the proportion of working capital needed to provide the cash flow required to meet payments on time.

In general, determining the working capital needs of your company relies on three main indicators:

- Assessing current and future cash flows.

- Estimating inventory turnover.

- Calculating accounts receivable turnover.

The main factors for efficient working capital management include: field of business, cash flows, economic variables, economic expansions, performance indicators analysis, financial risk assessment, and accounts receivable review. Determining needs primarily involves evaluating cash flows, inventory turnover, and accounts receivable turnover.

Also read:Definition of the direct method for calculating cash flows.

How can working capital be read?

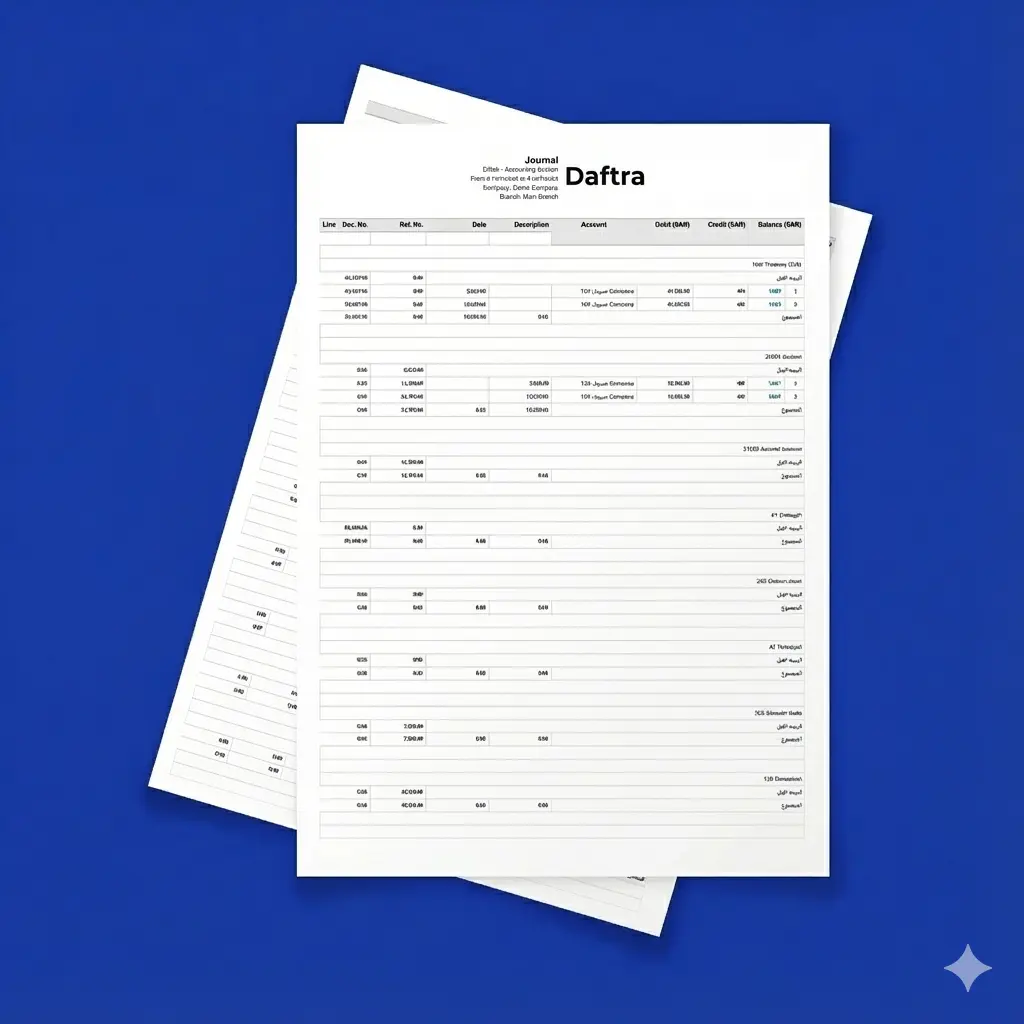

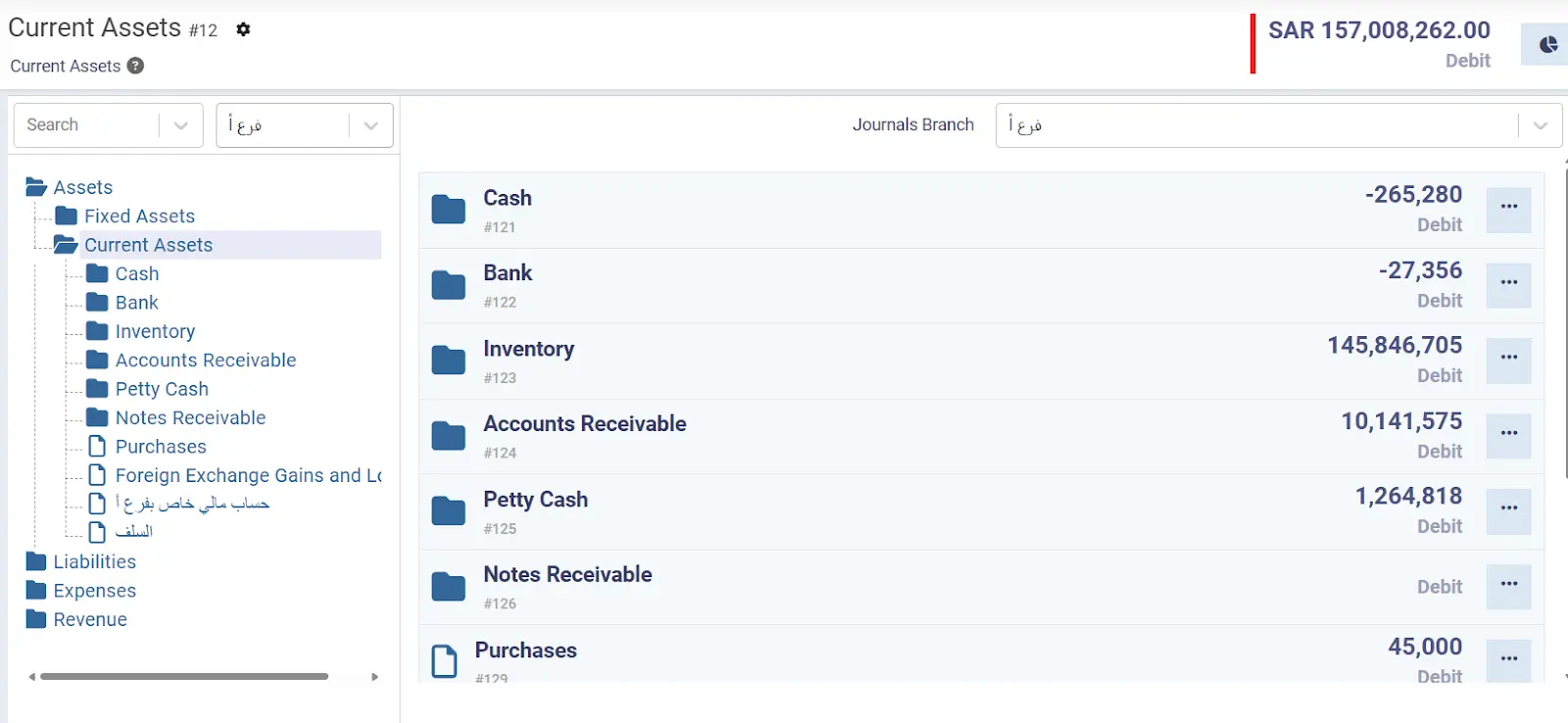

Reading and analyzing working capital requires using smart financial and accounting software. By using the Daftra Chart of Accountsprogram, updated financial reports on transactions related to current assets and liabilities can be obtained.

Additionally, analyzing financial ratios and using their results as indicators can measure the company’s financial health and its ability to manage current assets efficiently in a way that generates profit while meeting short-term obligations.

What is the working capital ratio?

The working capital ratio (Working Capital Ratio), also known as the current ratio, indicates a company’s ability to cover its short-term obligations using current assets. It can be calculated using the following formula:

Working Capital Ratio =Current Assets / Current Liabilities

It should be noted:

- If the working capital ratio is less than 1, the working capital is negative, which means the company may face difficulties in meeting its short-term obligations.

- If the ratio equals 1 or more, the working capital is positive, meaning current assets match current liabilities.

- If the working capital ratio is greater than 1, the company has a surplus of current assets, reflecting good financial management and a stable financial position.

What are working capital financing policies?

Working capital generates internal cash flow, and it can be financed by following one of the policies represented in:

- Increasing liabilities and equity: This means the company has increased funds through borrowing, debt, or by selling part of its equity.

- Reducing assets: This means the company has liquidated an asset to convert it into cash.

What is the working capital cycle?

The working capital cycle refers to the time it takes for a company to convert net working capital into cash. It determines the period for purchasing raw materials needed for production and the expected period to generate cash revenues from services, products, and goods.

The shorter the working capital cycle, the greater the company’s ability to provide cash quickly and efficiently, increasing operational efficiency. Conversely, a longer working capital cycle prevents the company from obtaining the required cash, affecting expected returns.

The working capital cycle can be shortened by reducing credit periods granted to customers, negotiating with suppliers to extend credit terms, and implementing sales strategies to achieve higher sales in a shorter period, which affects inventory turnover days.

The length of the working capital cycle depends on the type of products the company offers, customer demand, product shelf life, government financial policies, and unexpected economic events.

How to calculate the working capital cycle?

Calculating the working capital cycle is important because it helps the company manage its financial resources. It can be calculated using the following formula:

Working Capital Cycle = Inventory Days + Accounts Receivable Days - Accounts Payable Days

For example, if a company’s inventory turnover period is 150 days, accounts receivable turnover is 75 days, and accounts payable turnover is 170 days, the working capital cycle is calculated as:

150 + 75 - 170 = 55 days

This means the company will not receive cash or achieve returns until 55 days have passed.

How is working capital calculated with a practical example?

Al-Hamad Saudi Food Products Company achieved cash of $50,000 from its current assets in the fiscal year ending December 31, 2015. These current assets consisted of (short-term investments, securities, accounts receivable, inventory sales, prepaid expenses, and other assets held for sale).

On the other hand, the company recorded current liabilities for the same fiscal year amounting to $38,000 from (accounts payable, accrued expenses for taxes and salaries, loans, and notes payable).

Required: Calculate the working capital of Al-Hamad Company that helps it continue its business operations and meet its obligations:

Working Capital = Current Assets of Al-Hamad Company - Current Liabilities

= 500,000 - 380,000 = $120,000

How can you track working and invested capital through Daftra?

Whether you want to track your current assets that represent your working capital or the funds injected by investors and beneficiaries of your investment services not related to the company’s core activity through receipts vouchers, Daftra’s accounting software provides clear and detailed financial information that helps you manage your capital efficiently.

Frequently Asked Questions

Why is working capital called by this name?

Because it refers to the capital that works continuously in a company’s operating activities to ensure that operations run smoothly, efficiently, and effectively.

What is the difference between working capital and equity?

The difference between working capital and equity lies in the scope of assets and liabilities considered. Working capital represents the difference between short-term assets and current liabilities, whereas equity represents the difference between total assets and total liabilities in general, meaning it includes all types of current and non-current assets and liabilities in one equation.

How do managers manage a company’s working capital?

Managing working capital requires achieving a balance between liquidity and efficiency. Below are the key strategies for improving working capital:

- Controlling incoming and outgoing cash flows, while maintaining a cash reserve to deal with sudden opportunities and challenges.

- Defining credit and collection policies to ensure timely collection of receivables, by monitoring debtors and taking action in case of delayed payments.

- Managing inventory by monitoring and tracking inventory levels to ensure the availability of products and materials needed for production and operations without excess or shortages.

- Managing the payables side by controlling the company’s due obligations, setting clear payment policies for suppliers, and negotiating the best possible payment terms and facilities.

- Identifying financing needs and choosing the best source of short-term financing, while controlling financial costs by balancing self-financing and external financing.

What does negative working capital mean?

Working capital is negative if the following equation appears:

Current Assets − Current Liabilities < 1

This indicates that the company is managing its working capital inefficiently in terms of receivables, cash reserves, and inventory. However, in some factories and institutions, negative working capital may be acceptable when considering other ratios and circumstances.

What is working capital financing?

Working capital financing means using different financing sources to achieve the required balance. The main types of working capital financing include:

- Self-financing: When the company finances itself by using retained earnings or funds generated from internal activities to finance current assets.

- Bank financing: Through obtaining short-term loans or credit facilities from banks to finance current assets.

- Trade financing: Occurs when negotiating flexible payment terms with suppliers to improve the company’s liquidity.

- Debt financing: Using short-term debts such as loans.

- Asset financing: Using existing assets, such as receivables or inventory, as collateral to obtain new financing.

What are the advantages and disadvantages of invested capital?

Advantages of invested capital include:

- Providing the necessary financial resources for companies to start new projects or expand without the need to borrow.

- Enhancing the company’s credibility, as attracting investors—especially well-known businesspeople—supports its credibility and trust, which in turn helps attract more investors and financiers.

- Sharing financial risks that may occur from time to time, thereby reducing the financial burden on founders.

Disadvantages of invested capital include:

- Loss of full control, as some investors request management rights according to their shares and investment rights.

- The impact of returns paid to investors on the remaining net profit.

- Impact on organizational culture, as some investors may seek to achieve certain objectives that could affect the company’s vision and culture.

- Pressure on companies to achieve high and rapid returns, which may affect management decisions and future growth and expansion plans.

Can high working capital be harmful?

Yes, sometimes high working capital can be harmful because it may indicate that the company is holding large amounts of current assets in the form of inventory, which leads to freezing financial resources that could have been used for suitable investment opportunities.

In addition, a high proportion of working capital tied up in receivables indicates difficulty in collecting payments from customers, which negatively affects available liquidity.

What is the difference between working capital and net working capital?

The difference is that working capital is part of net working capital. Net working capital shows the surplus or deficit in working capital after deducting certain current liabilities or illiquid assets that cannot be easily sold or converted into cash, in order to obtain a clearer picture of actual available liquidity.

The difference can be better understood through the accounting formulas for each:

- Working Capital = Total Current Assets

- Net Working Capital = Current Assets − Current Liabilities

Is working capital considered an element of investment?

Yes, working capital can be considered an investment element, as efficient working capital management can improve liquidity and enable the company to invest in new opportunities.

In general, working capital is one of the most important factors to consider in financial and investment planning, as it helps determine the financing needs required for expansion, growth, and achieving higher profits and revenues.

What is the difference between working capital and capital?

The difference between working capital and capital is clarified by their respective time horizons. Working capital relates to the company’s ability to cover its short-term obligations, while capital is usually used to assess the company’s long-term ability to grow and expand, drawing on various financial elements, whether derived from equity or financing and loans.

How is working capital calculated?

Working capital is calculated using the following formula:

Working Capital = Current Assets − Current Liabilities

What are the forms of working capital?

- Positive working capital: When current assets are greater than current liabilities, enabling the organization to meet its obligations.

- Negative working capital: When short-term liabilities exceed current assets, indicating weak financial resources.

- Permanent working capital: The minimum amount of capital required to ensure the continuity of operations.

- Temporary working capital: Changes according to seasonal or operational fluctuations in the company’s activity.

What is the difference between capital and assets?

- Capital: The funds owned by the company to operate the business, whether from owners or loans.

- Assets: The company’s properties (such as cash, inventory, and equipment) are used to generate revenue.

What is the relationship between working capital and invested capital?

The relationship between working capital and invested capital is as follows:

Invested Capital = Working Capital + Fixed Assets

That is, invested capital is working capital plus long-term assets.

What is the return on working capital?

It is a ratio or measure used to determine the ability of the capital employed to generate profits for the organization. It is calculated using the following formula:

Return on Working Capital = Net Sales ÷ Working Capital

To calculate the return on working capital percentage:

(Net Sales ÷ Working Capital) × 100

What is the formula for calculating working capital and invested capital?

The formula for calculating working capital is:

Working Capital = Current Assets − Current Liabilities

The formula for calculating invested capital is:

Invested Capital = Working Capital + Long-Term Assets

Invested Capital = Equity + Long-Term Liabilities

What are working capital requirements?

They are the basic operational needs that working capital must provide, including:

- Purchasing raw materials and covering operating expenses.

- Paying salaries.

- Settling debts owed to suppliers.

Conclusion

In conclusion, after explaining all the details related to working capital, its requirements, and its calculation formula with practical application, we find that all companies need to rely on more than one type of capital to achieve commercial and investment success.

Therefore, it can be said that working capital is not merely a set of numbers representing available cash and financial assets, but rather a key that enables investors and business owners to achieve profitable returns on their investments.

An efficient accountant or financial manager is the one who understands the importance of working capital and maximizes its benefits for the organization in a way that helps it cover short-term obligations and finance its daily activities without disruption, enabling it to expand and take advantage of new business opportunities to enhance productivity, profitability, and competitiveness.