What is the Balance Sheet and How to Prepare It

Table of contents:

- Summary of Key Points

- What is the Balance Sheet

- Components and Elements of the Balance Sheet

- What Account Does Not Appear in the Balance Sheet?

- Importance and Uses of the Balance Sheet

- How to Read the Balance Sheet?

- Who is Responsible for Preparing the Balance Sheet?

- How to Prepare the Balance Sheet

- Practical Example of Preparing a Balance Sheet

- Net Financial Position

- What is the Difference Between a Balance Sheet and a Statement of Financial Position?

- Difference Between Income Statement and Balance Sheet

- How is the Balance Sheet Presented According to IFRS Accounting Standards?

- What is the Difference Between a Trial Balance and a Balance Sheet?

- How Can You Prepare a Balance Sheet in Daftra?

- Frequently Asked Questions

We often hear the term "financial position" especially in accounting operations related to preparing financial reports and closing final accounts, but what is financial position in accounting and companies? This question can be answered with the best definition of the balance sheet as a fundamental document and standard tool that proves the financial health of an organization during a specific time period. The balance sheet statement serves as the key that explains the secrets of company success and the strength of their financial management by helping to provide a detailed explanation of the effects resulting from investing in different assets and obligations resulting from debts, long-term liabilities, and shareholders' equity. Ultimately, business owners and decision makers use all this data to take necessary actions that help maximize profitability and maintain financial stability. Perhaps the strength of your organization's financial accounting department lies in its ability to read, understand, and analyze financial statements. Therefore, we present to you today from our accounting experience a comprehensive guide explaining the balance sheet, its components and contents, and also the steps for how to prepare a balance sheet with practical examples.

Summary of Key Points

- The balance sheet is the statement that shows the true picture of the organization's financial position and performance based on what it owns in assets and what comes out of it in obligations and shareholders' rights.

- The contents of the balance sheet consist of assets (current and fixed, and tangible), liabilities (non-current and current), and shareholders' equity (profits, capital, and shares).

- The difference between the income statement and the balance sheet is that the balance sheet statement, sometimes known as the "balance sheet," provides a more detailed picture of the organization's financial condition compared to the picture shown by the profit and loss statement, which relies only on revenue and expense elements.

- The importance and uses of the balance sheet lie in being one of the financial means that help determine the trends and decisions necessary to be taken for managing financial affairs, and is considered one of the necessary financial documents to attract the trust of investors and businessmen, as balance sheet data helps accurately evaluate the organization's financial health and its ability to manage risks or use assets optimally to generate positive cash and meet due obligations.

- The person responsible for preparing the balance sheet is determined according to the size of the organization and the nature of its financial transactions. It can be done by the accountant or by consulting one of the external financial analysts, or prepared by a group of accountants and auditors in the case of large companies.

- The balance sheet is prepared through a series of basic steps consisting of determining the time frame, collecting data specific to balance sheet contents, classifying balance sheet items, obtaining profit or loss value from the income statement to complete the shareholders' equity item in the balance sheet, and finally creating the balance sheet table with the necessity of equality between its assets and liabilities values at the end.

What is the Balance Sheet

The balance sheet can be defined as the company's financial statement that includes assets, liabilities, and capital during a specific time period. The balance sheet is considered one of the most prominent financial statements used in the business sector, as it shows the true picture of the following:

- Assets owned by the company, or what is known as "assets"

- Company liabilities, or what is known as "liabilities"

- Rights of company owners and shareholders

This means that the balance sheet is one of the financial analysis tools through which a comprehensive vision can be formed about the actual financial position and status of any organization during a specific time period, whether quarterly, semi-annually, or annually.

The basic accounting equation for the balance sheet is:

Assets = Liabilities + Shareholders' Equity

This logical equation shows what the organization must pay for anything it owns, "assets," by borrowing money, "liabilities or obligations," or by taking money from investors, “shareholders' equity.”

The figure in the assets column must equal the sum of obligations required from the organization, shareholders' rights, and their capital.

Accordingly, the balance sheet must always maintain balance in its basic components, and in case balance is not achieved, this may indicate some problems in the balance sheet or that the data in the statement is incorrect, or in the wrong place, or that there are errors during inventory, or others.

Components and Elements of the Balance Sheet

The contents of the balance sheet consist of 3 basic elements that ultimately show the data that management needs from this economic statement. The components of the balance sheet are as follows:

First: Assets

This is the first element in the statement, representing everything the company owns in resources that can be converted to cash later. The assets item in the balance sheet shows to what extent the organization can use these assets in future expansion operations, and also shows the extent to which the organization needs to take financial loans to continue its work. Assets are divided into more than one type:

1- Current Assets: These include company funds that can be utilized in the short term, such as the organization's bank balances, inventory, notes receivable, and others.

2- Fixed Long-term Assets: These are what the company owns in facilities or equipment that contribute to enabling the organization to practice its field of work, such as land, buildings, work equipment, and others.

3- Intangible Assets: These are assets that the company owns in an abstract rather than tangible manner, such as the organization's goodwill, trademark, intellectual property rights, and others.

Second: Liabilities

These are considered the organization's obligations or what is required from it, and this is the second element of the balance sheet items. They are divided into short-term obligations, which take less than one fiscal year to pay, and long-term obligations, which exceed one fiscal year to pay.

The accounting department in each organization determines which obligations must be paid immediately and those that can be scheduled over the coming years. The most prominent obligations in various organizations are as follows:

- Loans

- Organization debts

- Installments due on organization equipment

- Money is paid for purchasing raw materials needed by the organization

- Monthly employee salaries

Third: Shareholders' Equity

Companies make their shares available for public trading to provide capital that can be used easily. The organization's obligations toward these shareholders are calculated through capital calculation, retained earnings, and others.

It should be noted that items in the balance sheet statement must be arranged starting from the most liquid cash accounts, then those that can be converted to cash within a short financial period.

You can use the Daftra accounting system to prepare the balance sheet with complete ease by selecting account reports, then choosing balance sheet preparation, and specifying the time period. The system automatically links all accounts related to the statement.

What Account Does Not Appear in the Balance Sheet?

There are several types of accounts that do not appear in the balance sheet, either because they do not reflect the company's position or are not related to the movement of money coming in or going out of accounts. Learn about accounts that do not appear in the balance sheet:

- Revenue and Expense Accounts: Such as sales, cost of goods sold, administrative expenses, and other revenues and expenses appear in the income statement and not in the balance sheet.

- Income Summary Account: Used to accumulate revenues and expenses during a specific accounting period and does not appear in the balance sheet.

- Temporary or Accumulated Accounts: Such as accumulated depreciation and adjustments in the book value of assets do not appear as separate accounts in the balance sheet, but rather adjust the value of related assets.

- Personal Withdrawal Accounts: Personal withdrawal accounts for owners or partners in sole proprietorships or partnerships show how money is withdrawn from the business for personal use and do not appear in the balance sheet in accounting.

Importance and Uses of the Balance Sheet

The importance of the balance sheet can be summarized as being a fundamental tool used by managers, investors, and analysts to understand the current financial position of the organization. This statement is primarily used alongside two other types of financial statements: the income statement and the cash flow statement.

- It helps provide early warning before the organization falls into trouble because the assets owned by the organization are less than the liabilities it owes, as this shows that the organization is at risk of bankruptcy, which necessitates taking some quick strategic steps to improve the company's financial position.

- Banks seek to review the balance sheet of any organization to know whether your business is qualified to obtain an additional loan or not.

- Current or potential investors are interested in understanding the company's financial position clearly before they decide to put their money in it, to anticipate what they will get in the future from this financing. They also appreciate organizations with high cash assets because this shows that the company will grow and prosper in the future.

- The balance sheet enables small business owners to recognize the value of their businesses faster and evaluate their position.

- The balance sheet helps determine the directions that should be taken in managing your organization's financial affairs, especially regarding dealing with customers and suppliers.

- The balance sheet contributes to answering a set of important questions, including:

- Is the organization's net worth or profit indicator positive?

- Does the organization have sufficient cash and short-term assets to enable it to cover its obligations?

- What is the size of the debts that the organization bears compared to its competitors?

- Does it take longer to pay your suppliers due to a cash deficit?

- Do your customers take longer to pay you for the services they receive?

How to Read the Balance Sheet?

The balance sheet is one of the main financial statements, and reading it correctly is important to ensure the financial health of the organization. From our accounting experience, we present you with a set of steps that should be followed when reading the balance sheet:

- First, you must know well how to classify balance sheet items, which is known as "balance sheet structure," which includes the basic elements represented in assets, liabilities, and shareholders' equity. Each of these items contains a set of important details and notes.

- When reading the assets section in the balance sheet, be sure to look at and consider their types and understand them well. Basically, assets are accounts that generate future cash flows, and they are divided into two types:

- Current Assets: Also called short-term assets, because they can be converted to cash within a short time period, including cash and bank accounts, and inventory of goods and products.

- Fixed Assets: These are assets that cannot be converted to cash liquidity within a period of less than one year, such as buildings, real estate, equipment, and vehicles.

- You can use some measures to evaluate current assets, such as sales volume and the available cash ratio.

- Be sure to compare fixed assets with depreciation policies and their productive life when reading them. You can use measures such as the asset turnover ratio and capital expenditure ratio to analyze non-current assets.

- When reading the liabilities section, know that they express the organization's obligations toward external parties that arise from business operations and financing activities. They are divided into current liabilities, which are due for payment in less than one year, and long-term liabilities, which can be paid in a period exceeding one year.

- Pay attention to the different categories of common stock and preferred stock, as well as retained earnings, other accumulated comprehensive income, and contributed surplus. All these indicators are very important when reading the equity or shareholders' section in the balance sheet.

Who is Responsible for Preparing the Balance Sheet?

The person responsible for preparing the balance sheet for any organization varies from one organization to another, depending on the actual size of the organization. For example: For Small Companies: The company owner or its accountant may be sufficient to prepare the company's balance sheet. For Medium-Sized Companies: In this case, an external accountant may be consulted to review what was prepared internally in the balance sheet. For Large Corporations: The process of preparing balance sheets for large and public companies requires a great deal of accuracy in work; therefore, these companies may consult a group of accountants from outside the organization who are recognized for their competence to review and audit this financial statement.

How to Prepare the Balance Sheet

The proper preparation of the balance sheet in accounting depends on a set of basic steps to provide a comprehensive financial statement for all aspects and basic items that represent the specified time period. Learn the steps for preparing the balance sheet:

1. Determine the Time Frame

Determine the time period for which you will prepare the balance sheet, which is usually at the end of the fiscal year, which is the recognized timing for preparing financial statements and final accounts for the organization.

2. Collect Key Data for Balance Sheet Contents

Collect all data related to balance sheet items such as financial assets including (cash balances, inventory, stocks, bonds, long-term investments, real estate, equipment, etc.), as well as liabilities which may include (debts, credit facilities, accrued expenses, taxes, wages, long-term loans), and finally shareholders' equity represented in (capital, retained earnings, treasury shares).

3. Classify Balance Sheet Contents

After collecting items related to balance sheet elements, all these items are classified into groups according to their type. For example, cash and inventory fall under current assets, while long-term investments, equipment, furniture, and vehicles are within fixed assets. Similarly, short-term debts and accrued expenses such as wages and income tax are within current liabilities, while long-term loans and debt bonds fall under non-current liabilities.

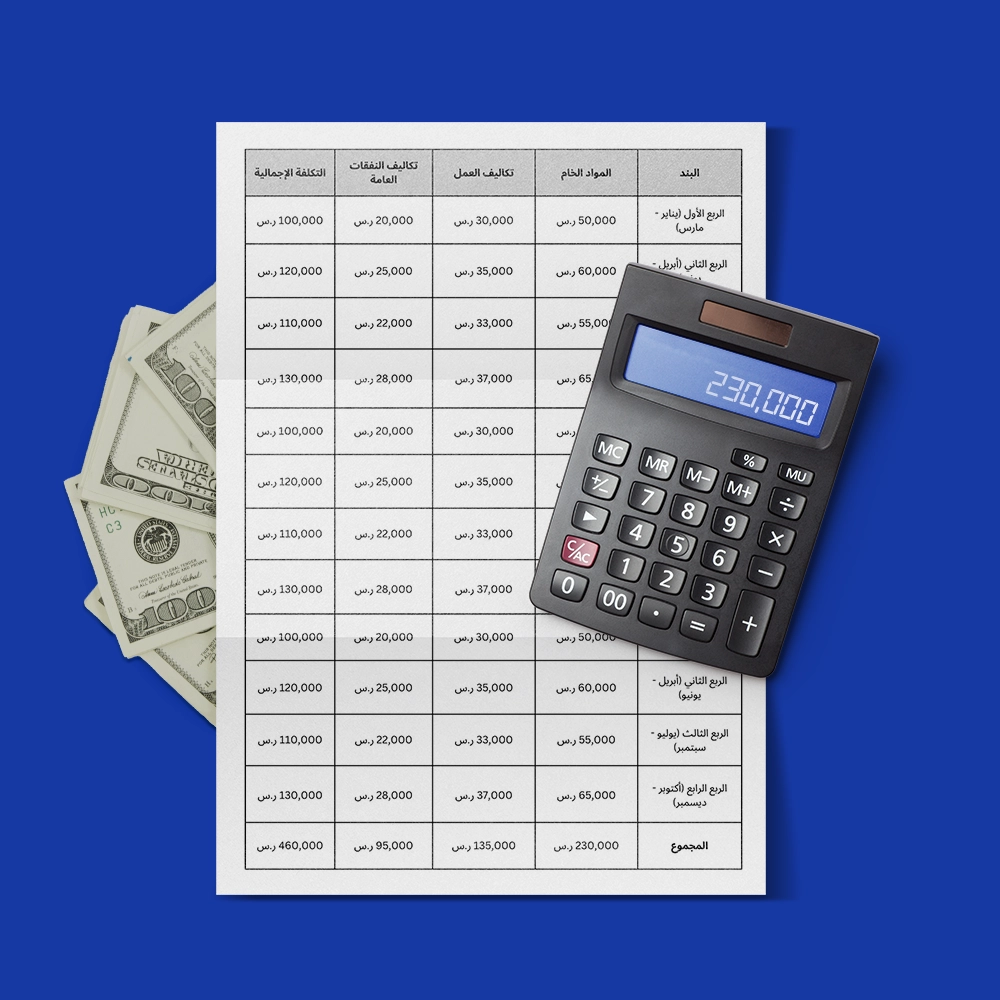

4. Calculate Basic Financial Data from the Income Statement

The balance sheet cannot be prepared without obtaining basic data related to total revenues and expenses, which result in net profit or loss from the income statement, as net profit is primarily used in the liabilities and equity section of the balance sheet.

5. Create the Balance Sheet Table

After obtaining the necessary data and classifying it, a chart is prepared for the balance sheet, divided into two columns with assets on the right side and liabilities and equity on the left side of the table. The total of assets and liabilities together must be equal.

6. Analyze the Balance Sheet

After preparing the balance sheet, it is analyzed using vertical or horizontal analysis, and using financial indicators resulting from it, such as liquidity, profitability, and coverage ratios, which are necessary to evaluate financial position and performance and identify strengths and weaknesses.

Practical Example of Preparing a Balance Sheet

If you know that the trial balance account balances for one of the Saudi companies were as follows:

| Debit | Credit | Account |

| 500,000 | Bank | |

| 200,000 | Cash | |

| 95,000 | Accounts Receivable | |

| 35,000 | Inventory | |

| 260,000 | Land | |

| 50,000 | Equipment | |

| 90,000 | Vehicles | |

| 145,000 | Stocks and Bonds | |

| 17,000 | Furniture | |

| 10,000 | Goodwill | |

| 200,000 | Marketing Expenses | |

| 220,000 | Salaries | |

| 9,983 | Administrative Expenses | |

| 7,000 | Insurance Expenses | |

| 25,000 | Maintenance Expenses | |

| 30,000 | Other Expenses | |

| 105,000 | Suppliers | |

| 500,000 | Long-term Loans | |

| 800,000 | Capital | |

| 120,000 | Maintenance Services Revenue | |

| 117,000 | Engineering Supervision Revenue | |

| 90,000 | Rental Revenue | |

| 85,000 | Engineering Consulting Revenue | |

| 60,000 | Construction Work Revenue | |

| 1,877,000 | 1,877,000 | Total |

Required: Prepare the Balance Sheet

Solution: Extract Net Profit Value from Income Statement:

| Amount | Total | Classification |

| Revenues | ||

| 120,000 | Maintenance Services Revenue | |

| 117,000 | Engineering Supervision Revenue | |

| 90,000 | Rental Revenue | |

| 85,000 | Engineering Consulting Revenue | |

| 60,000 | Construction Work Revenue | |

| 472,000 | Total Revenues | |

| Expenses | ||

| 200,000 | Marketing Expenses | |

| 220,000 | Salaries | |

| 9,983 | Administrative Expenses | |

| 7,000 | Insurance Expenses | |

| 25,000 | Maintenance Expenses | |

| 30,000 | Other Expenses | |

| 491,983 | Total Expenses | |

| (19,983) | Net Loss |

Prepare Balance Sheet:

| Amount | Assets | Amount | Liabilities and Shareholders' Equity |

| Current Assets | Short-term Liabilities | ||

| 500,000 | Bank | 105,000 | Suppliers |

| 200,000 | Cash | 105,000 | Total Short-term Liabilities |

| 95,000 | Accounts Receivable | Long-term Liabilities | |

| 35,000 | Inventory | 500,000 | Long-term Loans |

| 145,000 | Stocks and Bonds | 500,000 | Total Long-term Liabilities |

| 975,000 | Total Current Assets | Shareholders' Equity | |

| Non-current Assets | 800,000 | Capital | |

| 260,000 | Land | (19,983) | Loss |

| 50,000 | Equipment | 780,017 | Total Shareholders' Equity |

| 90,000 | Vehicles | ||

| 17,000 | Furniture | ||

| 417,000 | Total Non-current Assets | ||

| Intangible Assets | |||

| 10,000 | Goodwill | ||

| 10,000 | Total Intangible Assets | ||

| 1,402,000 | Total Assets | 1,385,017 | Total Liabilities and Equity |

You can now download a ready-to-edit balance sheet template for free from Daftra.

Net Financial Position

Net financial position is a term used to describe the difference between the total value of assets and liabilities in an organization. Net financial position is considered a measure of how wealthy a company or financial entity is, as it serves as an important indicator of the company's financial health and its ability to meet its long-term obligations.

Net financial position is calculated using the following equation:

Net Financial Position = Total Assets - Total Liabilities

If assets are greater than liabilities, the company has a positive net financial position, indicating a stronger financial position. However, if liabilities are greater than assets, the company has a negative net financial position, which may indicate financial problems.

What is the Difference Between a Balance Sheet and a Statement of Financial Position?

The difference between a balance sheet and a statement of financial position can be determined through the following elements:

Difference in Terms of Definition:

The balance sheet is the statement through which the company's financial position can be known during a specific time period, whether quarterly or annually, in the form of a comprehensive and detailed picture of assets and liabilities of all types, as well as shareholders' equity, including retained earnings and changes in capital. The statement of financial position, however, is part of the financial report that indicates what the company owns and what it owes.

Difference in Terms of Purpose:

The primary purpose of the balance sheet is to monitor and track the organization's overall financial health and detect any errors or manipulations in financial and accounting transactions. The purpose of the statement of financial position is limited to determining the company's assets and expenses. Based on this, we find that the statement of financial position provides superficial data, while the balance sheet provides more comprehensive and in-depth information that helps make informed decisions by concerned parties such as creditors, investors, banking institutions, governments, customers, and suppliers.

Difference in Terms of Components:

The statement of financial position consists of assets, liabilities, and shareholders' equity, while the balance sheet includes all the contents of the statement of financial position in addition to the income statement that shows revenues, costs, and expenses incurred during the financial period, and the cash flow statement that shows the cash entering and leaving the company.

Difference in Terms of Integration:

A balance sheet cannot be prepared without preparing the statement of financial position, while the statement of financial position can be prepared at a stage preceding the balance sheet and be complete. In addition to these elements, the difference between the statement of financial position and the balance sheet can also be determined by the fact that the balance sheet shows the entity's assets, liabilities, and equity at any specific accounting period, while the statement of financial position shows the same picture of financial position but at the end of the organization's accounting period.

Difference Between Income Statement and Balance Sheet

Although the income statement and balance sheet are two important financial statements in any organization's financial accounting system, there are precise and fundamental differences between the two statements, which we mention as follows:

First: Income Statement

The income statement focuses on showing the flow of money to the organization by clarifying the losses and profits it earns. The income statement shows the volume of money flow to the company through sales returns and investments, in addition to the money the company pays in salaries, taxes, and others. It focuses on clarifying the organization's cash flow during a specific time period that is annual, semi-annual, or quarterly. The organization's revenues are recorded under credits, while the organization's expenses are recorded under debits. It is presented in the form of a list arranged so that products are above expenses.

Second: Balance Sheet

The balance sheet provides a more comprehensive picture of the organization's financial condition compared to that provided by the income statement. It highlights everything the organization owns in assets, all obligations it bears, and all shareholders' rights in the organization. However, it lacks showing the daily details of cash flow volume that the income statement provides. Usually, investors or shareholders are more interested in reviewing the balance sheet than the income statement. Regarding presentation method, assets are placed on one side and liabilities, including obligations and shareholders' equity, on the other side. Its preparation requires conducting a complete inventory of all assets and liabilities during the accounting period, which is usually one year.

How is the Balance Sheet Presented According to IFRS Accounting Standards?

According to International Financial Reporting Standards (IFRS), IFRS emphasizes clear and accurate presentation of financial information and requires providing information that helps evaluate the company's financial performance and financial position. Under this type of accounting standard, the balance sheet is presented in a way that shows assets, liabilities, and equity. The general structure is as follows:

Assets:

- Current Assets: such as cash and cash equivalents, trade receivables, and inventory.

- Non-current Assets: such as fixed assets, long-term investments.

Liabilities:

- Current Liabilities: such as trade payables, short-term loans.

- Non-current Liabilities: such as long-term loans.

Equity:

- Paid-in capital, retained earnings, and any other accounts related to equity, such as the current account.

- The total assets must equal the total liabilities and equity.

What is the Difference Between a Trial Balance and a Balance Sheet?

The trial balance records all closing balances from the general ledger and is not considered a financial statement. In it, all accounts are divided into credit and debit balances, and it is used internally among concerned parties in the company. The trial balance does not require an auditor's signature, nor is there a specific rule or format for formatting trial balance books.

The balance sheet is a financial statement that records the company's assets, liabilities, and equity, with the aim of verifying that the value of the company's assets equals liabilities plus equity, thus proving the accuracy and correctness of financial resources. The balance sheet is used by external parties such as investors, suppliers, or even the public. It also requires an auditor's signature, and there is a specific format for arranging balance sheet items.

How Can You Prepare a Balance Sheet in Daftra?

The balance sheet is one of the most important financial statements in accounting, which is sought by anyone using accounting software. Therefore, Daftra accounting software provides you with balance sheet preparation through its flexible system dashboard. It provides a comparative view of assets versus liabilities, detailing the components of each in both summary and detail. The program allows you to control the time period for which you want to issue the statement, whether it is annual, quarterly, or as you prefer. The system allows you to print the statement as a PDF file or an Excel sheet, and stores all data in the cloud, making it easily accessible for review or comparison purposes at any time.

Frequently Asked Questions

Where Does the Partner's Current Account Appear in the Balance Sheet?

In the balance sheet, it is used to track transactions between partners and the company, such as capital contributions, drawings, and profit distributions. If the account has a debit balance, this means the partner owes the company, and if it has a credit balance, this means the company owes the partner.

Do Drawings Appear in the Balance Sheet?

Personal drawings by partners or owners do not appear directly as an item in the balance sheet. Instead, the effect of these drawings appears in the equity account. Drawings reduce equity because they are considered distributions to owners from retained earnings or capital.

Do Sales Appear in the Balance Sheet?

Sales do not appear in the balance sheet but rather appear in the income statement, which is the financial statement that shows revenues, expenses, and profit or loss during a specific accounting period. The balance sheet shows assets, liabilities, and equity at a specific point in time and does not include details of revenues or expenses.

Conclusion In conclusion, it can be said that behind every business activity is a financial story told by the numbers represented in the components of the financial position - assets, liabilities, and equity. It is not merely a statistical document, but rather the backbone for analyzing financial performance and making crucial decisions. If you are an accountant or financial manager in a company, always ensure to follow the steps for preparing the balance sheet correctly, so it serves as your guide for prudent management of the financial landscape in your organization.