What are the Accrual Basis and Cash Basis of Accounting, and the Differences Between Them

Table of contents:

- Summary of Key Points

- What is the Definition of the Accrual Basis Concept?

- What is the Definition of the Cash Basis Concept?

- What is the Difference Between the Cash Basis and Accrual Basis?

- What are the Advantages of the Accrual Basis?

- What are the Advantages of the Cash Basis?

- What are the Disadvantages of the Accrual Basis?

- What are the Disadvantages of the Cash Basis?

- What are the Types of Accrual Basis Accounts?

- What are the Uses of the Accrual Basis and Cash Basis?

- How to Choose Between Accrual Basis and Cash Basis

- Example of Accrual Basis Accounting

- Example of Cash Basis Accounting

- Why Transition from Cash Basis to Accrual Basis?

- Record Entries Based on Your Preferred Accounting Method Through Daftra

The availability of financial information and data is considered one of the indicators of an organization's success and growth level. Accounting systems and information processing have experienced significant growth due to technological advancements and the increasing globalization of the economy.

There have been doubts about the effectiveness of accounting principles and systems that collect financial and accounting information, which contribute to decision-making and performance evaluation. Accounting principles and systems differ in each organization according to the economic and financial variables that control the organization's operations, coinciding with the development of international accounting standards.

As a result, opinions have varied when comparing the cash basis and accrual basis in recording financial information and data. In this article, we will explore the nature of the cash basis and accrual basis through practical application, alongside explaining the main types of accrual basis accounts, all while providing a comprehensive comparison of the key differences between the cash basis and accrual basis of accounting.

Summary of Key Points

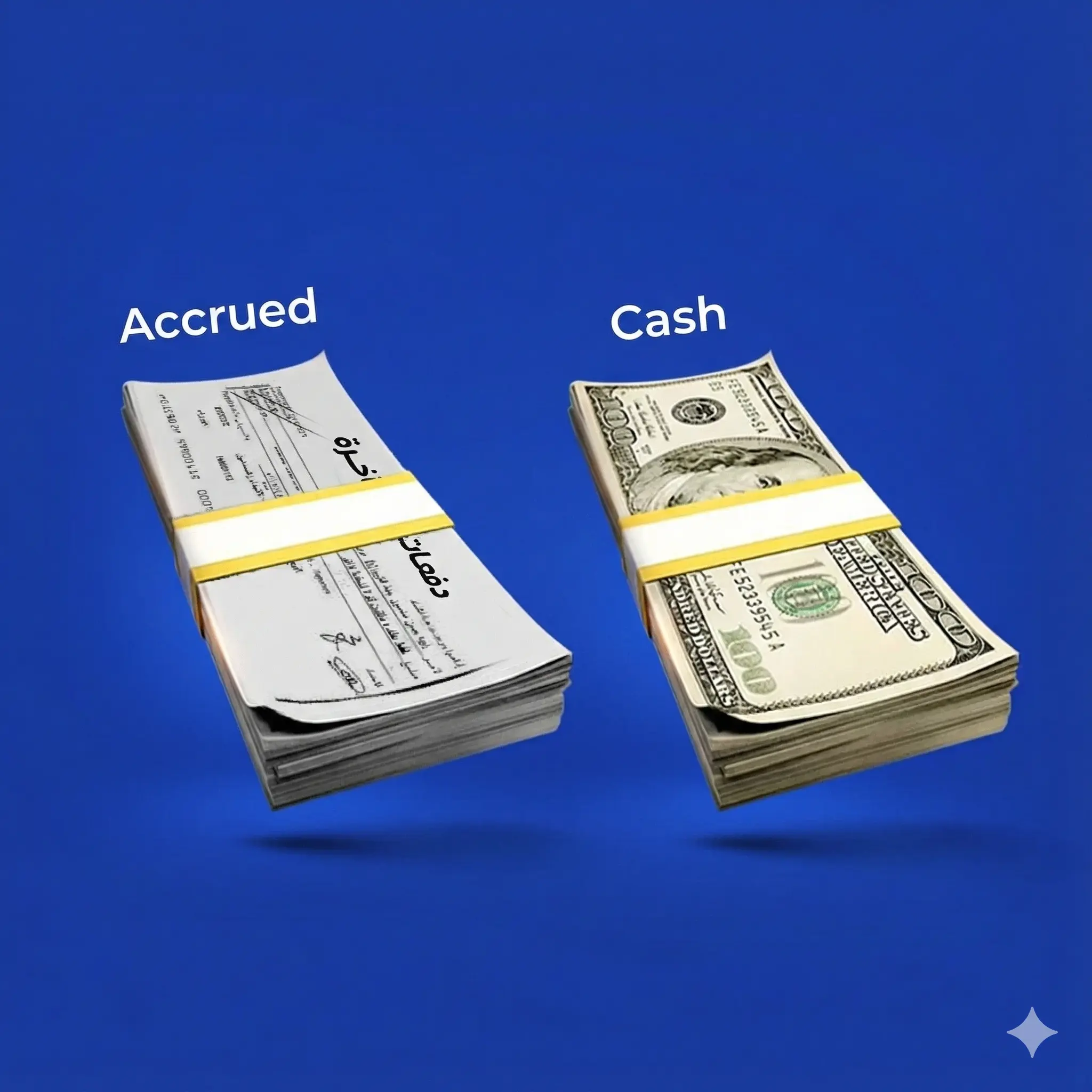

- The accrual basis is one of the accounting treatments whereby financial transactions are recorded at the time they occur, not when cash is actually received or paid.

- The cash basis is an accounting treatment that depends on recording financial transactions at the time of actual cash collection or payment.

- The most important difference between the cash basis and accrual basis is that the latter is more accurate than the former in terms of precisely recording financial transactions and providing a complete and comprehensive picture of the organization's resources represented in its assets and inventory, as well as the liabilities and debts owed by it. This helps in evaluating performance and financial position and making appropriate decisions, unlike the cash basis, which provides incomplete financial information that cannot be relied upon to produce accurate financial reports, especially in organizations and companies with extensive activities and financial transactions.

- The main advantage of applying the accrual basis is contributing to improved financial management efficiency and making estimates about future financial periods by estimating operational expenses and costs. On the other hand, the main advantage of applying the cash basis is its suitability for small and medium enterprises, and it provides an actual picture of cash flows.

- The main drawback of applying the accrual basis is the delay in providing information about fiscal year accounts until they are settled, and one of the worst drawbacks of applying the cash basis is the failure to distinguish between capital expenditures and revenue expenditures, which affects the company's final accounts.

- Accrual basis accounts include accounts receivable and accounts payable, and accrued interest accounts.

What is the Definition of the Accrual Basis Concept?

The accrual basis is considered the method through which accounting data and transactions are recorded and maintained on the date the event occurs, regardless of whether cash is paid or received. For example, when contracting to purchase certain goods, accounting transactions are conducted despite not paying cash or receiving cash.

According to the accrual basis, all revenues belonging to the period or financial cycle are recorded whether they have been collected or not, and all expenses are recorded in the books whether they have been paid or not yet paid. Additionally, the accrual basis is the most widely used in commercial enterprises.

| The chart of accounts software in the Daftra system helps you record daily transaction entries and balance them accurately, as well as display account records in the general ledger for assets and liabilities, expenses and revenues, and their related subsidiary accounts, thus providing the financial data necessary to apply the accrual basis accurately. |

What is the Definition of the Cash Basis Concept?

The cash basis is considered one of the most important accounting methods through which accounting and financial transactions are recorded and maintained when cash is paid or received. This means it centers around cash and cash flow movements, and financial operations are not recorded in the books until cash collection or payment of due amounts occurs.

The general principle of the cash basis in accounting is the necessity of paying cash in order to conduct accounting transactions and record expenses and revenues in the books.

| The comprehensive accounting software for company management from the Daftra cloud system helps you apply the cash basis accurately through the suite of smart automated solutions that the program provides for managing expenses and revenues, tracking them according to precise classification, and managing cost centers. |

What is the Difference Between the Cash Basis and Accrual Basis?

The main difference between the cash basis and accrual basis lies in the timing of revenue and expense recognition. The accrual basis recognizes revenues when earned and expenses when incurred, regardless of the actual time of payment or receipt, unlike the cash basis, which recognizes revenues and expenses at the actual time of expenditure or payment.

After discussing the definition of both the cash basis and accrual basis, the following are the most prominent differences between them:

1- Method of Application

The cash basis requires little skill from auditors and accountants and is easy to apply, unlike the accrual basis, which requires training for employees and integration of records, alongside implementation through the use of advanced systems and technologies.

2- Cost of Use

The cash basis is considered low-cost compared to the accrual basis, which requires many specialized employees and accountants.

3- Misunderstanding

The cash basis is considered easier to understand compared to the accrual basis, but both are easy to work with, especially the accrual basis, which follows auditing and accounting standards.

4- Accuracy and Comprehensiveness of Financial Information

The accrual basis helps manage cash flows, as it provides information and data about the costs of future activities and projects and their expenses, alongside information about cash and liabilities, which clarifies the financial position of the company or organization and helps in the evaluation and accountability process, unlike the cash basis, which provides only some key information without going into details.

The cash basis is criticized for not providing information about non-cash assets, unlike the accrual basis, which provides information about all types of assets.

5- Financial Position Assessment

The accrual basis is characterized by credibility and transparency, unlike the cash basis, especially since it fails to provide a vision and perspective on the organization's financial position. The accrual basis is also characterized by comprehensiveness, unlike the cash basis.

6- Priority of Use When Creating Financial Reports

The accrual basis helps provide a comprehensive picture of the entity's financial resources. On the other hand, the cash basis does not provide the same degree of accuracy in financial reports compared to the accrual basis, which helps monitor some basic indicators of financial statements, such as the income statement and balance sheet.

What are the Advantages of the Accrual Basis?

Many government and private institutions have recently decided to implement the accrual basis of accounting in preparing financial statements and accounting operations, according to the following reasons:

- It helps provide future financial vision, based on which appropriate decisions are made, due to the accuracy of data and information provided about the institution's economic position and the results of different activities.

- It contributes to improving financial management efficiency due to the existence of control over spending and consumption.

- It provides a good view of the institution's financial position, as it helps make comparisons between revenues and expenses.

- It differentiates between capital expenditures and revenue expenditures.

- Through the accrual basis, estimates can be made about future financial periods.

- It helps investors monitor work in their projects and future activities, which may extend for more than one financial period.

- It assists in planning the preparation of costs and expenses for future operations and activities.

What are the Advantages of the Cash Basis?

Despite the discussion and debate that supports the ineffectiveness of the cash basis, it enjoys many advantages that we will clarify in the following lines:

- The cash basis is characterized by relatively low cost in terms of recording financial transactions and accounting procedures, and is suitable for small business owners.

- It gives companies and institutions an accurate picture of the amount of cash available at the current time.

- The cash basis facilitates the inventory counting process.

- The cash basis is considered objective because it is not subject to personal judgments or preferences, meaning that no personal estimates can be applied to it due to its limited options.

- It is characterized by ease of application and ease of preparing financial statements and treatments through it, so it is preferred for use by many accountants.

- The results of the cash basis can be relied upon in preparing the future budget, alongside implementing the general budget.

- The cash basis does not require any accounting adjustments at the end of the financial period.

What are the Disadvantages of the Accrual Basis?

Despite the popularity that the accrual basis enjoys from institutions, governments, and many companies, it suffers from some negatives. The following are the most prominent shortcomings of the accrual basis:

- The accrual basis is considered expensive because it requires implementation by a large number of auditors and accountants, and this basis also requires the presence of accounting software and software to develop the accounting policies in use.

- The accrual basis is considered somewhat non-objective, meaning it may be subject to personal estimates and judgments, which contribute to providing inaccurate results.

- It may lead to disruption in the institution's financial position and cash liquidity situation, due to its focus on future activities and operations whose profits may not be collected.

- Delayed provision of information about fiscal year accounts until they are settled.

What are the Disadvantages of the Cash Basis?

There are many doubts and questions that question the effectiveness of the cash basis, according to the following reasons:

- It does not help provide information and data that clarify short-term or long-term vision about the institution's financial and economic position.

- It does not differentiate between capital expenditures and current expenditures, which affects the company's final accounts.

- It ignores the existence of debts and expenses, which threatens the principle of transparency and significantly affects the decision-making process.

- Difficulty in predicting the costs of future projects and activities whose implementation extends for more than one financial cycle.

- The cash basis does not concern itself with accounting cycles, meaning it does not measure each accounting cycle as an independent cycle with its own revenues and expenses.

- Applying the cash basis may contribute to increased spending due to fear of reduced allocations in the future.

- It hinders the role of legal oversight and accountability.

What are the Types of Accrual Basis Accounts?

The following are the most prominent types of accrual basis accounts:

1- Accounts Payable

These are accounts in the organization's accounting books that show specific financial amounts resulting from purchasing some products and goods, or in exchange for some services, that have not been paid in advance. Accounts payable are considered short-term liabilities, as they are expected to be paid to creditors or suppliers within one financial cycle, meaning that accounts payable are debts owed by the company.

2- Accounts Receivable

These accounts include financial invoices or financial amounts due from customers to the company or organization in exchange for providing a service or purchasing goods or commodities, meaning that accounts receivable are debts owed to the company.

See also: Debtor debit liability calculation form, ready to use for free.

3- Accrued Interest Account

This type includes interest due to be paid to the company or organization that has not yet been settled, and is calculated and determined on the last day of the accounting period.

4- Accrued Tax Liabilities Account

These are obligations and financial amounts required from the company or organization to the tax authority in a specific time period, but were not paid in that period, meaning they represent interest on taxes for the company resulting from the timing difference between recording taxes on the company or organization and the date when the organization paid the required amount.

What are the Uses of the Accrual Basis and Cash Basis?

In this illustrative comparison, you can learn about the uses of accrual basis and cash basis, which help you choose the appropriate accounting basis for your business activities:

| Uses of Accrual Basis | Uses of Cash Basis |

| Comparing financial data across different time periods and analyzing trends helps monitor growth and financial performance accurately to make sound decisions. | Reflects actual cash flows for companies and is more suitable for startups and small enterprises. |

| It is heavily relied upon in the scope of financial accounting and can be applied in different industries and fields regardless of the company's size and level. | Can be used in services and customer-related matters such as invoice processing and recording cash flow transactions. |

| Helps determine the entity's assets and liabilities, thus facilitating the preparation of financial reports smoothly and transparently. | The ease and simplicity of using the cash basis help analyze figures faster and are suitable when there is a need to produce quick financial reports. |

How to Choose Between Accrual Basis and Cash Basis

The choice and preference between accrual basis and cash basis can be made based on three main axes:

- The size of the entity and the nature of its business.

- The extent to which the accounting basis used complies with accounting laws and applicable standards.

- Evaluating the strengths and weaknesses related to both accrual basis and cash basis, and comparing them with the entity's basic financial needs, such as financial analysis, accuracy of data and financial reports, and profitability assessment.

Example of Accrual Basis Accounting

If a company entered into an agreement to rent a building from a real estate investment company for 3 years for 150,000 Saudi Riyals, and the three years are (2016, 2017, 2018).

The rent was paid in full for all three years in 2016, and the company had expenses for other items totaling 50,000 Saudi Riyals in the same year, while on the other hand, it achieved revenues of 100,000 Saudi Riyals. According to the accrual basis, which recognizes recording financial transactions when they occur and not at the actual timing of paying and receiving cash, an adjusting entry is made for the accounts at year-end, so that 2016 expenses would be as follows:

50,000 + 150,000 = 200,000 Riyals, and 100,000 Riyals is excluded (appears in the balance sheet under prepaid expenses, meaning it was paid for future years and represents a right from others, therefore it appears on the assets side)

So in the end, the company's expenses for 2016 based on the accrual basis are only 100,000 Saudi Riyals.

If we want to evaluate the company's financial position, we must subtract expenses from revenues to get profit or loss, and by application:

Net profit or loss for 2016 = 100,000 - 100,000 = 0

So, based on applying the accrual basis for the company during 2016, we find that it achieved neither profit nor loss.

You may also be interested in: Download Word Cash Receipt Form.

Example of Cash Basis Accounting

Applying the same data from the previous example to observe the difference between accrual basis and cash basis, if a company entered into an agreement to rent a building from a real estate investment company for 3 years for 150,000 Saudi Riyals, and the three years are (2016, 2017, 2018).

The rent was paid in full for all three years in 2016, and the company had expenses for other items totaling 50,000 Saudi Riyals in the same year, while on the other hand, it achieved revenues of 100,000 Saudi Riyals.

According to the cash basis, which recognizes recording financial transactions upon actual cash payment and receipt, the company incurred expenses totaling 200,000 Saudi Riyals during 2016.

If we want to evaluate the company's financial position, we must subtract expenses from revenues to get profit or loss, and by application:

Net profit or loss for 2016 = 100,000 - (150,000 + 50,000) = -100,000

So, based on applying the cash basis for the company during 2016, we find that it incurred a loss of 100,000 Saudi Riyals.

Why Transition from Cash Basis to Accrual Basis?

The reasons for transitioning from cash basis to accrual basis accounting in Saudi Arabia and other countries include:

- The accrual basis provides a more accurate and transparent picture of the company's financial position because it takes into account all accrued revenues and expenses, whether they have been actually collected or paid or not.

- Accrual basis complies with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), making it preferred for large companies and those listed on stock exchanges.

- The accrual basis helps analyze company performance better by matching revenues with related expenses in the same period.

Record Entries Based on Your Preferred Accounting Method Through Daftra

Whether you record your entries on an accrual basis or a cash basis, you can control the timing of entry input in Daftra accounting software, where transactions can be recorded automatically or through manual journal entries.

This is in addition to the accuracy and speed of accounting transactions, and ultimately obtaining comprehensive, detailed reports at the click of a button that won't cost you time and effort but will keep you informed of every detail of the business whenever you want, from any device and from anywhere.

Thus, the article has covered the explanation of the concept of cash basis and accrual basis, along with the advantages and disadvantages of each, as the article also discussed the main types of accrual basis accounts, in addition to making a comparison between cash basis and accrual basis to identify the key differences between them.