What is the Chart of Accounts, Its Components, and Steps to Build It

Table of contents:

- Definition of the Unified Chart of Accounts

- Objectives of the Unified Chart of Accounts

- What are the Advantages of Having a Unified Chart of Accounts?

- Components of the Chart of Accounts

- What are the Steps to Build a Chart of Accounts?

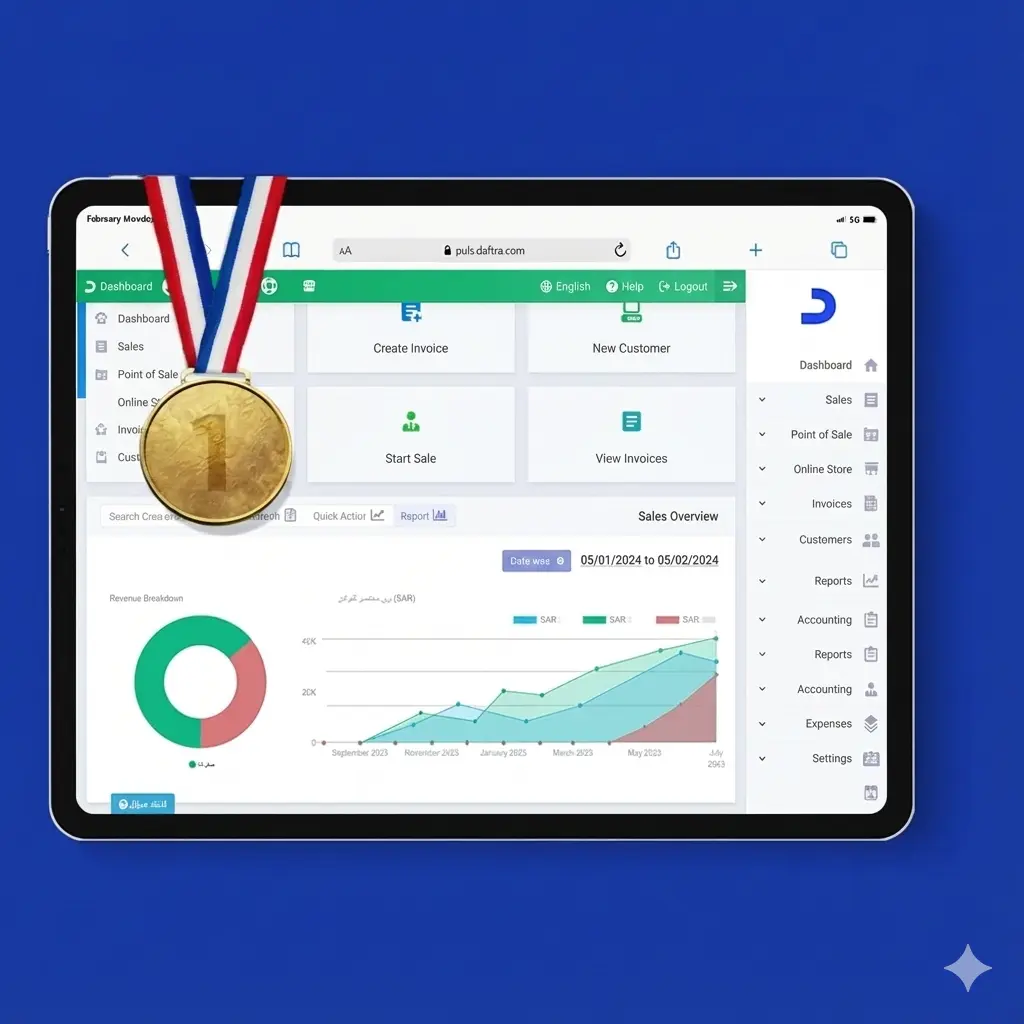

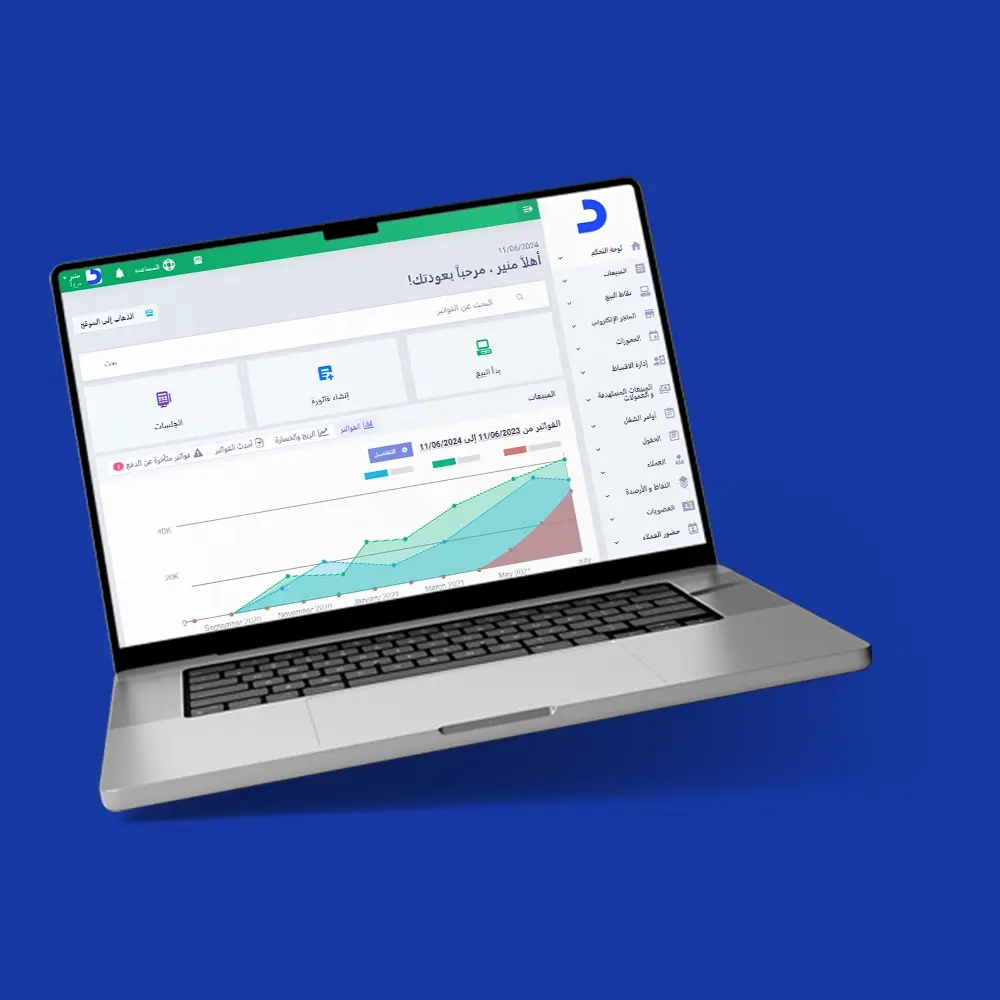

- How Does Daftra Help Build a Unified Chart of Accounts?

- Frequently Asked Questions

The financial and business markets worldwide are constantly experiencing numerous economic transformations, with a greater focus on modern economic and commercial methods instead of traditional economic approaches.

In conjunction with economic development, there was a necessity to reconsider the accounting and administrative software of companies and organizations through adopting comprehensive development programs and plans using modern methods and implementation tools.

Many voices have called for the necessity of modifying and developing accounting software according to the latest international accounting standards.

The accounting software development process included organizations creating a unified chart of accounts that encompasses all accounting operations of the institution and explains how to prepare financial statements and reports.

In this article, we will address the definition of the chart of accounts concept, explain its importance and components, clarify the advantages of having a chart of accounts, and outline the steps to build a unified chart of accounts.

Definition of the Unified Chart of Accounts

The chart of accounts is one of the most important components of the unified accounting software. It is an index for cataloging all accounting items and operations performed by the company, whether commercial, industrial, or economic, through a coding process where each account or operation is defined by a specific number.

What are the Sections of the Chart of Accounts?

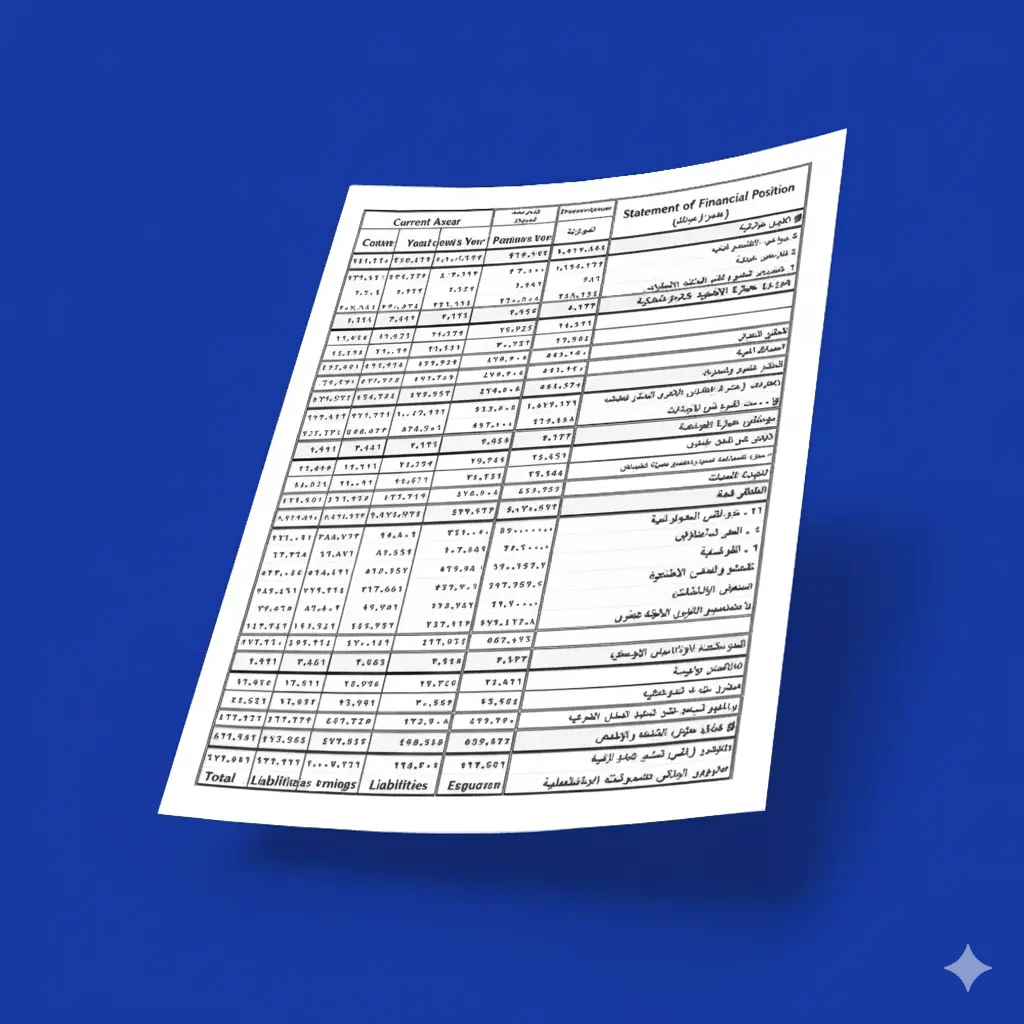

The chart of accounts consists of two main sections: balance sheet accounts and income statement accounts. Here are more details about these sections:

- Company Balance Sheet Accounts: These aim to provide a view of the company's financial position and include assets, liabilities, and equity.

- Income Statement Accounts: These show the results of the company's operations and activities, whether profit or loss, and include revenue and expenses.

It's worth noting that the five main accounts (assets, liabilities, equity, revenue, and expenses) branch into sub-accounts, then more specialized accounts, and so on until we reach the final account used in processing and recording operations.

Therefore, the chart of accounts is called the "account tree" because it branches into main accounts, then sub-accounts, then more specialized accounts.

Example of a Chart of Accounts?

For example, the assets account, which is one of the main accounts in the tree, branches into sub-accounts such as current assets and non-current assets.

Current assets branch into more specialized categories, such as inventory and cash, and cash branches into, for example, cash in domestic banks and cash in foreign banks, and so on.

Then comes the stage of coding each group of accounts using numerical coding with sequential numbers, which will later be used in data entry, processing, and retrieval operations, as will be explained later in the steps to build a chart of accounts.

Objectives of the Unified Chart of Accounts

The chart of accounts is the cornerstone of the accounting software and the essential element for achieving company objectives. Therefore, all companies, whether startup, medium, or large, strive to design it accurately, whether manually or using the latest programs and software.

The following are the most important objectives of the chart of accounts:

- Decision-making assistance: Helps company management make appropriate decisions by providing necessary data and information about the company's financial and commercial status.

- Ensuring compliance with standards: Ensuring that all financial and accounting operations comply with international accounting standards.

- Providing security: Protecting all company assets and knowing the volume of cash flows, revenue, and when and how to collect them.

- Control: Monitoring financial management performance.

- Validating company statements: Helps accountants validate the company's financial statements.

- Organization: Organizing the company's accounting data and information, whether manually or through modern applications and programs, which saves a lot of time, effort, and money.

- Complete supervision: Helps the company headquarters supervise all subsidiary units and their accounts.

- Ensuring accuracy: Guaranteeing accuracy and quality in all company accounting operations and reducing errors when applying financial and commercial accounting procedures.

- Facilitating operations: Simplifying the process of collecting, classifying, and recording data for all company accounts.

In summary, the objectives of the chart of accounts include decision-making assistance, ensuring compliance with standards, providing security and control, ensuring organization, complete supervision, ensuring accuracy, and facilitating various operations.

What are the Advantages of Having a Unified Chart of Accounts?

Experts describe the chart of accounts as the roadmap on which the company's accounting software depends. Without it, the company and its accounting software cannot succeed. It's not just about containing names and numbers of all company accounting operations, because the chart of accounts confirms the quality of management work and transparency of decisions.

The following are the most important advantages of having a unified chart of accounts in companies:

- Continuous review: Reviewing all accounts at all times and easily recording all daily transactions.

- Avoiding errors: Prevents errors or duplication of numbers for multiple operations.

- Clear vision: Provides accurate insight into the company's financial position, helping evaluate company performance and achievement of main objectives.

- Unlimited operations: Having unlimited levels and accounting groups, meaning adding many operations and accounts.

- Debt awareness: Knowing the volume of debts and expenses and how to rationalize the company's financial consumption.

- Planning: Assisting in developing financial growth plans for the company and attracting investments, projects, and commercial and financial activities.

- Report preparation: Helps prepare company financial reports and statements and facilitates auditors' and accountants' work.

- Profit awareness: Knowing the volume of cash flows and profits.

- Easy modification and updates: Flexibility in adding, modifying, or updating all data.

- Risk avoidance: Reducing financial risks and violations because the chart of accounts includes all internal administrative controls that all companies must implement.

- Employee support: Ensuring employee work efficiency, as it serves as a reference for all employees to implement company policies and achieve objectives.

Components of the Chart of Accounts

To ensure accuracy and success in achieving financial objectives, companies must focus on accurate charts of accounts design from the beginning and ensure all elements and components are available. The chart of accounts is designed only once, and errors in it will negatively impact the company's financial position.

The following are the main components of the chart of accounts:

Balance sheet and income statement accounts, called the first level, comprise five accounts: assets, liabilities, equity, expenses, and revenue.

From this level, branch sub-levels and detailed levels explain the first-level accounts and their subdivisions.

Assets

- Including real estate, equipment, investment properties, biological and intangible assets, and long-term investments (non-current assets).

- Cash, inventory, assets held for sale and investment, accounts receivable (current assets).

Liabilities

- Loans, provisions, long-term bonds, financing (non-current liabilities).

- Accounts payable, accrued expenses, tax liabilities, and unearned revenue (current liabilities).

Equity

- Profits, share capital, reserves, treasury shares.

Expenses

- Operating expenses: Related to manufacturing and production activities.

- Administrative expenses: Salaries and wages.

- Financing expenses: Interest and loans.

Revenue

- Activity-related revenue, such as sales results and marketing offers.Non-activity-related revenue, such as capital gains.

- The chart of accounts also includes, as mentioned earlier, all internal controls of the company's accounting software, financial reporting, and statement preparation software.

- The guide also includes a section for reviewing all operations and accounting items at the end of each month and year, which are examined when evaluating the company's financial performance at the end of each financial period.

What are the Steps to Build a Chart of Accounts?

Building a chart of accounts is a process that follows several steps that must be executed accurately to ensure achieving desired results. The following are the steps to build a unified chart of accounts:

- Define the objective: First, determine the purpose of creating the chart of accounts, as this objective determines how to present the company's accounts.

- Divide accounts: Company accounts are divided into five main items called the first level, including assets, liabilities, revenue, expenses, and equity.

- Create sub-groups: Each first-level item includes sub-groups, and each sub-group contains groups that explain its content in more detail, structured as follows: main group, then sub-group, then detailed, until reaching the final level containing accounts used in recording operations.

- Create a table: Create a table with several columns, where the first column represents the account or item number, and the second column represents the account type and name.

- Number the groups: Number the main account groups with sequential numbers from 1 to 5, then number the sub-groups branching from main accounts with sequential numbers as well, meaning each account and its branches are distinguished by a specific number.

- Example: For instance, the assets item, which is a main branch in the account tree and one of the five main accounts in the chart of accounts, takes the number or code 1. From the assets branch, the following sub-accounts are: current assets with code 11, and non-current assets with code 12.

- From the non-current assets branch, the following: buildings, as an example, so building number 1 takes code 121, and building number 2 takes code 122, followed by more specialized branches such as a section of building number 1, which would be numbered 1211, and so on.

- Example of an expense item: This is also a main branch in the account tree, numbered 4. From it branches a sub-item like administrative expenses, with code 41, meaning administrative expenses are the first element under the expenses item. Administrative expenses are divided into salaries taking number 411, then salaries are divided according to company departments or job grades, taking numbers 4111 and 4112, and so on.

There are several criteria to consider during the chart of accounts building steps:

- Company activity nature: Oil company accounts differ from those of commercial companies, partnerships, and corporations.

- Flexibility: Allowing the addition of new accounts without affecting current and old accounts.

- Future expansion of company activities: Leading to increased accounting operations in the future.

Read also: Arithmetic tables: what are they? What is its importance? How to use it

How Does Daftra Help Build a Unified Chart of Accounts?

Daftra's accounting software provides you with a pre-prepared chart of accounts that you can use or easily modify to suit your business needs. Automatic and manual accounting entries are automatically posted to the chart of accounts within the account to which this entry belongs, making your accounting work faster and more accurate than ever before. You can register with Daftra for free for 14 days, during which you can review the chart of accounts and all software features.

Frequently Asked Questions

What sections are in the chart of accounts?

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

What is the benefit of a chart of accounts?

The chart of accounts helps with many things, including organizing financial data, improving accuracy and transparency, decision-making assistance, compliance with accounting standards, and easy financial performance monitoring. The chart of accounts also helps facilitate financial auditing and saves effort and money.

What is the purchases account in the chart of accounts?

The purchases account is specific to the cost of goods and services the company buys to help operate its business and usually falls under the expenses category.

What is an industrial chart of accounts?

It is a chart of accounts specific to industrial companies and includes all company-specific accounts, such as inventory, assets, expenses, and other financial accounts and operations specific to the company, suitable for an industrial nature, such as costs, maintenance, and others.

What is the unified chart of accounts for government entities?

It is a document for recording financial and accounting operations specific to government entities. This document facilitates account review and study, and obtaining accurate financial information.

Conclusion: The chart of accounts has become a necessity for companies, not a luxury. It is the fundamental pillar on which the company's entire accounting software depends. For the software to meet all the company's financial and accounting objectives, it must be based on a precisely organized chart of accounts.