A Comprehensive Guide to Journal Entries

Table of contents:

- What are Journal Entries?

- Types of Journal Entries

- The Importance of Journal Entries in Business Continuity and Performance

- Steps for Recording Journal Entries

- What Happens After Recording Journal Entries?

- Objectives of Journal Entries

- How Are Journal Entries Posted to the General Ledger?

- What Types of Errors Occur in Journal Entries?

- Most Important Journal Entries

- Examples and Exercises on Journal Entries

- How to Learn Journal Entries?

- How Does Daftra Make Your Journal Entries Easier?

- Frequently Asked Questions

A Comprehensive Guide to Journal Entries Companies use accounting as a tool to achieve financial management, without which no entity can enjoy continuity and continue performing its functions, whether for-profit or non-profit. For accounting to be able to perform this role, it relies on several theories and foundations, and takes certain procedures, among the most important of which are “journal entries.”

In this topic, we will answer several important questions, including: What are journal entries? What are their types? How do they work? Where do they fit in the accounting cycle? And other questions, so let's go!

What are Journal Entries?

Journal entries are the means by which all financial transactions of the project are documented and recorded at the time they occurred, with clarification of both parties to the transaction - the creditor and debtor, and the issuing and receiving accounts for this financial transaction. They are considered a tool through which the financial position of the entity can be analyzed and understood, and correct decisions can be made.

These entries are recorded in a set of accounting books, including the correspondence register, inventory and balance sheet book, general journal, draft book/diary, general ledger, and trial balance book.

It is worth noting that with the technological development that the world is experiencing in all fields of work, many entrepreneurs have turned to adopting electronic accounting systems in managing accounting affairs. Hence, these books have become automated rather than paper-based, and recording journal entries has become easier and more accurate than before.

Types of Journal Entries

Journal entries can be classified into two main categories: simple entries and compound entries, in terms of the number of accounts mentioned on both the debit and credit sides. As for the purpose and nature of the entry, journal entries can be divided into three main types: journal entries, adjusting entries, and closing entries, which we will explain in detail below.

1- Simple Entry

The simplest definition of a simple entry is an entry that includes only one account on each side - both debit and credit. An example of a simple entry is: a company paying workers' wages.

| Debit | Credit | Description |

| 12,000 | 12,000 | From A/c (Workers' wages expense) To A/c (Bank) |

2- Compound Entry

A compound entry is the opposite of a simple entry, and it is an entry where one or both sides - debit or credit - include more than one account. It has become customary when writing this type of entry to write "From various accounts" or "To various accounts" before the side that includes more than one account, depending on whether it is a debit or credit account. Examples of compound entries include the following:

When the entry is compound on the credit side:

| Debit | Credit | Description |

| 4,700 | 4,000 700 | From A/c (Assets - Furniture) To various accounts: A/c (Cash) A/c (Bank) |

When the entry is compound on the debit side:

| Debit | Credit | Description |

| 10,000 55,000 | 65,000 | From various accounts: A/c (Bank) A/c (Cash) To A/c (Accounts Receivable/Customer X) |

When the entry is compound on both debit and credit sides:

| Debit | Credit | Description |

| 2,000 1,000 | 750 2,250 | From various accounts: A/c (Internet expense)<br>A/c (Gas expense) To various accounts: A/c (Bank) A/c (Cash) |

After clarifying simple and compound entries, which are the two types of journal entries in terms of the number of accounts on each side of the entry, we now move to differentiating between types of journal entries in terms of their nature and purpose. We previously mentioned that they are divided into journal entries, adjusting entries, and closing entries. Two other types are added to these three main types: opening entries and reversing entries, and we will explain each of them in the following lines.

3- Journal Entry

The journal entry is the foundation upon which the entry theory in accounting is based. It is a tool for documenting every financial transaction that occurs in the entity with the aim of achieving tight financial management and determining the result of activity at the end of each period as profit or loss. In application of the principles of preparing journal entries, the entry should consist of two sides, one debit and the other credit, and the balance should be equal between the two sides. Examples of journal entries include:

| Debit | Credit | Description |

| 3,000 | 3,000 | From A/c (Bank) To A/c (Capital) |

It is worth noting that journal entries are the initial recording procedure for daily transactions in journal books, and they differ from adjusting entries, closing entries, and other types of entries that are each considered to have a special character and come for a specific purpose.

4- Adjusting Entry

In some cases, the entity may incur some expenses that belong to the year but have not been paid, and the company may execute some contracts during the financial year but does not receive the full value of these contracts. In such cases, the importance of adjusting entries emerges.

Adjusting entries are those through which situations are corrected that appear to violate certain accounting principles, such as the accrual principle and the matching principle. These adjustments are made to modify account balances so that the activity result and financial position can be accurately reflected for each accounting period.

First: Adjusting Accrued Revenues These are funds that the company is entitled to during the year in exchange for a service or product it provided, but has not yet received its dues. Examples include:

A company provided environmental consulting to a client worth 35,000 riyals and did not receive its dues until the end of the accounting year. The entry would then be as follows:

| Debit | Credit | Description |

| 35,000 | 35,000 | From A/c (Accrued environmental consulting revenue) To A/c (Consulting revenues) |

Then the entry is posted to the general ledger.

Second: Adjusting Deferred Revenues Deferred revenue is what is paid to you before providing the service or product in exchange for this revenue, and the revenue has been recorded in the books. In this case, the percentage of revenue that belongs to the current year is determined, and anything beyond that is included as a current liability in the balance sheet. Examples include:

A company renting its administrative headquarters to another company for three years for 300,000 riyals with full advance payment. The entry would then be as follows:

| Debit | Credit | Description |

| 100,000 | 100,000 | From A/c (Deferred rental revenue) To A/c (Rental revenues) |

Then the entry is posted to the general ledger.

Third: Adjusting Accrued Expenses Accrued expenses can be defined as expenses related to the accounting period that have not yet been recorded in the books or paid. Examples include:

The value of workers' wages in a company is 250,000 riyals, and the wages balance in the trial balance was 210,000 riyals. The entry would then be as follows:

| Debit | Credit | Description |

| 40,000 | 40,000 | From A/c (Wages) To A/c (Accrued wages) |

Then the entry is posted to the general ledger.

Fourth: Adjusting Prepaid Expenses Prepaid expenses are those paid during the accounting year even though they belong to more than one subsequent year. In this case, only what belongs to the current year is determined, and anything beyond that appears as a current asset in the balance sheet. Examples include:

A company paid a check worth 200,000 riyals for two years' rent. The entry would then be as follows:

| Debit | Credit | Description |

| 100,000 | 100,000 | From A/c (Rental expenses) To A/c (Prepaid rent) |

Then the entry is posted to the general ledger.

5- Closing Entry

At the end of the financial year, the accountant takes one of the most important accounting procedures regarding entries, which is closing all nominal accounts, which are revenue and expense accounts, so that they can prepare the income statement and know the actual result of activity, whether profit or loss.

Accordingly, closing entries are as follows:

First: Closing Expenses Entry Contrary to their debit nature in the accounting entry, expenses are closed as a credit account, and on the other side of the entry is the profit and loss account, as follows:

| Debit | Credit | Description |

| XXX | XXX | From A/c (Profit and Loss) To A/c (Expense) (Closing expense) |

Second: Closing Revenues Entry As is the case with the expense closing entry, revenues are treated contrary to their credit nature in the accounting entry, so that they are debited in the closing entry, and on the other side is the profit and loss account as well, as follows:

| Debit | Credit | Description |

| XXX | XXX | From A/c (Revenue) To A/c (Profit and Loss) (Closing revenue) |

6- Opening Entry

Also called the establishment entry, this is the entry with which the company begins the financial year, whether it is newly established or transitioning from one financial year to another. Therefore, we have two cases: one is an opening entry for a newly established company, and the other is an opening entry for a company transitioning from a previous financial year to the subsequent financial year.

If the company is newly established and has not previously conducted business, the company will not have any previous data that can be included in the opening entry. In this case, the opening entry is treated as follows:

| Debit | Credit | Description |

| XXX | XXX | From A/c (Assets) To A/c (Capital) |

In the case of an opening entry for a company transitioning from a previous financial year to the subsequent financial year, the accounting treatment for the opening entry involves extracting the balances shown in the balance sheet, which in turn represent the beginning balance of the new period, after taking all accounting steps in closing these accounts.

7- Reversing Entry

A reversing entry is one of the types of entries with a special nature and is only resorted to in special cases, which is when an error occurs in switching between the debit and credit accounts in the accounting entry. To correct this error and settle each account in its correct position in terms of whether it is a debit or credit, the accountant resorts to the reversing entry.

The Importance of Journal Entries in Business Continuity and Performance

Journal entries form a clear importance in business continuity and efficient performance of functions. The following are the most prominent points that illustrate the importance of journal entries:

Maintaining Organized Financial Records

Daily journal entries and other types of entries help arrange and organize operations and activities in financial records, which positively reflects on the smoothness and transparency of other accounting operations, thus reducing potential risks and legal penalties that result from accounting violations such as accounting manipulation, tax evasion, and others. These financial records also help understand the trends of revenues, expenses, assets, and liabilities of the entity.

Monitoring and Tracking Financial Performance

The accurate data provided by journal entry records of various types helps document financial transactions for different activities precisely, and then use this data to create trial balances and financial statements that, in turn, reflect the actual financial position of the institution. This helps evaluate the entity and its financial performance, facilitates the detection of any accounting errors or illegal manipulations, and all of this contributes to maintaining the entity's reputation and its compliance with laws and accounting principles that form and govern the general accounting structure. All of this ultimately supports the entity's credibility before external customers, investors, creditors, suppliers, and others.

Making Sound Financial Decisions

The comprehensive vision provided by journal entry data helps administrative bodies concerned with managing financial affairs make strategic decisions related to financial planning, budget preparation and estimated budgets, inventory management and effective resource allocation, expense control, revenue enhancement, tracking key financial performance indicators, identifying strengths and weaknesses and areas for improvement, and other sound decisions that ensure the continuity of the entity's work efficiently and effectively.

Steps for Recording Journal Entries

Journal entries achieve one of the most important objectives of accounting, which is documenting financial transactions, because documentation contributes effectively to achieving other objectives of accounting.

Journal entries consist of two sides: debit and credit, which is called double entry, such as journal entries for salaries and wages. Each entry represents a financial movement from one account to another account, and the same applies to the general journal in which transactions are recorded daily, to be later posted to the general ledger.

The steps for recording journal entries represent great importance to ensure accuracy and transparency of companies' financial accounts, so it is important to know how to record entries correctly.

Steps for Recording Journal Entries:

First, Determining the Event, Value, and Concerned Accounts

This involves determining creditor accounts and debtor accounts. For example, "Al-Noor" company sold merchandise (T) and (J) worth 15,000 riyals, so accordingly:

- Event: the sale operation

- Value: 15,000 riyals

- The entry was recorded in two accounts: the sales account and the cash account.

Thus, we have determined the event, value, and accounts concerned with the accounting operation.

Second, Determining Entry Direction

This means determining the effect of the financial operation on the account by an increase or a decrease. For example, Al-Noor company sold merchandise worth 15,000 riyals as mentioned previously. What is the entry direction in this operation?

Answer: Both the sales account and cash account increase if payment is in cash, but in the case of deferred payment, the customer's account is affected (which is an account used to track customers for collecting due amounts).

However, when the "Al-Noor" company decides to purchase supplies worth 15,000 riyals, the goods account increases, and the bank or cash account decreases.

Third, Determining Credit and Debit Accounts

Following the previous example, Al-Noor company sold for 15,000 riyals, and we determined the types of accounts, which are sales and cash. Since the sold merchandise is a monetary amount due to the company, it is recorded in a credit account, and recorded in cash in a debit account.

In case the company purchases supplies worth 15,000 riyals, we record them in the purchases account and bank/cash account. The purchases account is the creditor, and the cash account is the debtor.

Therefore, we have implemented the first two steps: determining the affected account and then classifying its type.

Fourth, Preparing the Journal Entry

There must be a balance between the debit and credit accounts. As mentioned previously, Al-Noor company sold for 15,000 riyals, so when it is recorded in the sales account, it must be equal in the cash account at 15,000 riyals when recorded.

- Debit: 15,000 riyals in cash account

- Credit: 15,000 riyals in sales account

Fifth, Recording the Journal Entry

The entry date must be written for easy access. Following the previous example, the entry is recorded in Al-Noor Company's general journal:

Date: February 15, 2024

- Debit: 15,000 riyals in cash account

- Credit: 15,000 riyals in sales account

Sixth, Describing the Entry Recording Process for Easy Understanding

Example:

February 15, 2024

15,000 From A/c Cash

15,000 To A/c Sales

(Sale of merchandise to "Al-Manara" company)

We indicate the debtor with "From" and the creditor with "To" in the entry recording process.

Seventh, Verifying Entry Accuracy Before Confirming Recording

Ensuring entry accuracy in terms of recorded date, creditor and debtor accounts, and the financial value of the entry.

What Happens After Recording Journal Entries?

Recording journal entries is one of the first and most important accounting procedures performed by an accountant. In this procedure, the accounting cycle continues and moves to its subsequent stages to achieve the rest of its objectives, where these transactions are posted after being recorded, their sources are known, and they are established with their accounts in the general ledger.

From the general ledger, which is considered the comprehensive guide for all the company's financial transactions, a trial balance is prepared in preparation for producing the final financial statements. But before that, some adjusting entries are usually made - which we have explained above - in case there are any accrued or deferred transactions.

Then after that, the final trial balance is prepared and the last step is performed, which is preparing the financial statements: income statement, balance sheet, cash flow statement, shareholders' equity statement, and comprehensive income statement, to be used in evaluating the company's financial performance and setting a financial plan and clear vision for its future.

It is worth noting that when starting a new accounting cycle, the first thing the accountant does is the opening entry. From here, we realize that the entire accounting system is based on the entry theory.

Objectives of Journal Entries

Understanding the objectives of journal entries is an integral part of applying accounting principles and practices used to maintain the accuracy and transparency of financial information. The following is a detailed explanation of journal entry objectives:

Ensuring Accuracy and Credibility of Financial Information

Implementing the principle of financial accountability is one of the main objectives of journal entries, implementing internal and external audit controls to eliminate unauthorized fraudulent activities, and applying the necessary accounting rules and standards for recording financial transactions.

Achieving Transparency and Financial Disclosure

Journal entries enhance, through their accurate records, the principle of transparency that requires companies to disclose and report financial information that concerns stakeholders and participating parties.

Compliance with Tax Requirements

Documenting and proving all sales and purchase transactions accurately through journal entries helps in tax return filing purposes and preparing annual tax reports.

Data Analysis and Financial Report Preparation

Journal entries help track local accounting standards and record all expenses and revenues according to general accounting standards. This accurate documentation of data in journal entries helps track assets and accurately assess their value based on their consumption over time. This data also facilitates the book review process and verification of their financial accuracy and freedom from any manipulation or errors, with the aim of preparing comprehensive financial reports that accurately reflect company performance.

How Are Journal Entries Posted to the General Ledger?

There is a set of steps that must be followed when posting journal entries to the general ledger:

- Understanding the journal entry before posting and ensuring the completeness of its items and parties, where it must contain one debit account and another credit account with appropriate amounts.

- Identifying the concerned accounts in each entry that will be posted to the general ledger, such as sales or purchase accounts.

- Posting each part of the entry to the concerned account in the general ledger, where debit accounts are recorded on the left side of the account in the general ledger, while credit accounts are recorded on the right side.

- Recording entry details such as date, description, and amount in the general ledger under the designated account.

- Verifying balance after posting all entries and ensuring that the total of debit accounts equals the total of credit accounts in the general ledger.

- Recording the difference on the lesser side is what is known as the balancing process. The difference here represents the account balance in the general ledger. If the difference is recorded on the debit side of the account, then the balance is a credit, and the opposite happens if the difference is recorded on the credit side, then the balance becomes a debit.

What Types of Errors Occur in Journal Entries?

Since journal entries are among the main pillars upon which the accounting cycle is based, errors in them may affect the entire accounting process. This, in turn, calls for the necessity of caution and care when preparing these entries. Nevertheless, errors occur for several reasons, including oversight or ignorance. Among the most prominent of these errors are the following:

- Error in writing the financial amount, whether on the debit or credit side, which affects the accuracy of the journal entry, although if the data of other entries is accurate, this error will be easily discovered.

- Overlooking recording a financial transaction from the beginning, since the role of journal entries is to record every financial transaction, no matter how small or large.

- An error resulting from the accountant's ignorance or lack of experience in correctly determining the debit account and credit account for the financial transaction.

- An error resulting from performing an accounting operation incorrectly, such as addition or subtraction, also leads to the incorrectness of the journal entry.

- Error in writing the correct account, such as switching debit with credit or vice versa, which leads to recording the transaction in the wrong account.

- Error in repeating the entry, i.e., recording it in the general journal more than once.

- Errors are corrected through journal entries, such as reversing entries, not through deletion.

Most Important Journal Entries

Let us first agree that every journal entry is important because otherwise there would be no need to record it. However, it is possible to highlight the most common and used journal entries that have the greatest impact on determining the company's financial position. Among the most prominent of these entries are the following:

-

- Customer account entries

- Supplier account entries

- Salary and wage account entries

-

- Inventory account entries

- Capital account entries

- Purchase account entries

In addition to the most important journal entries falling under these accounts, there are also depreciation account entries, custody account entries, loan account entries, installment account entries, and bank account entries.

Examples and Exercises on Journal Entries

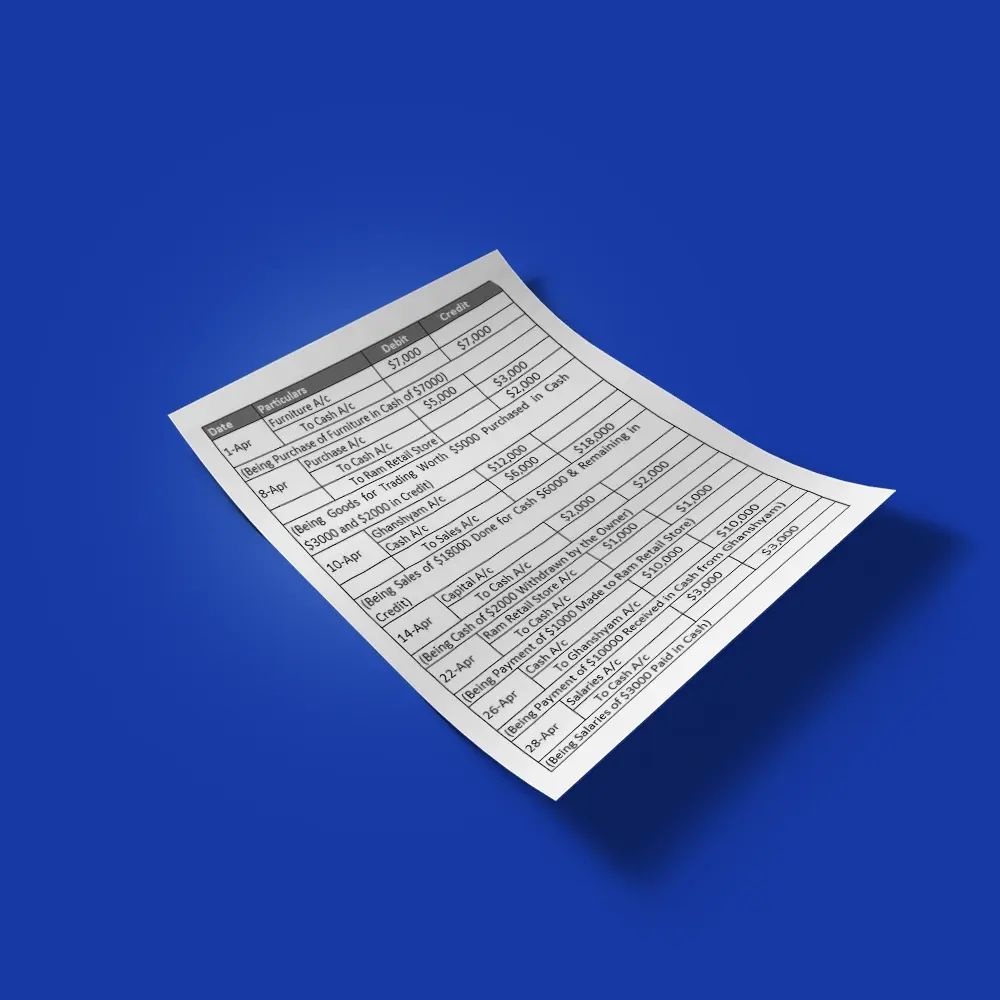

In the previous lines, we looked together at a set of individual examples of journal entries while discussing their types. Now, let us review a comprehensive real example that includes several financial transactions so you can learn how to record journal entries practically.

Comprehensive Practical Example of Daily Journal Entries: The following operations took place in the Advanced Company, and what is required is to make the necessary entries for these operations:

- Establishing the company by depositing capital worth 5,000,000 riyals in the International Bank on February 1.

- Paying rent for the company's administrative headquarters, worth 20,000 riyals, for February.

- Depositing 50,000 riyals in the office safe from the current account on April 20.

- Purchasing equipment and machinery from the Local Company worth 100,000 riyals, 20,000 riyals paid in cash, 30,000 by check, and the rest on account, on June 1.

- Purchasing office furniture from the Furniture Company worth 70,000 riyals, 25,000 riyals paid by check, and the rest on account, on June 15.

- Paying the electricity bill worth 2,000 riyals in cash on August 1.

Recording the necessary daily journal entries for these financial operations:

| Entry No. | Debit | Credit | Description |

| 1 | 5,000,000 | 5,000,000 | From A/c Bank<br>To A/c Capital<br>(Depositing capital in the bank) |

| 2 | 20,000 | 20,000 | From A/c Administrative headquarters rent<br>To A/c Cash box<br>(Paying rent in cash) |

| 3 | 50,000 | 50,000 | From A/c Cash box<br>To A/c Bank<br>(Withdrawing 50,000 from bank and depositing in cash box) |

| 4 | 100,000 | 20,000<br>30,000<br>50,000 | From A/c Equipment and machinery<br>To various accounts:<br>A/c Cash box<br>A/c Bank<br>A/c Creditors (Local Company)<br>(Purchasing equipment and machinery in cash, by check, and on account) |

| 5 | 70,000 | 25,000<br>45,000 | From A/c Office furniture<br>To various accounts:<br>A/c Bank<br>A/c Creditors (Furniture Company)<br>(Purchasing office furniture by check and on account) |

| 6 | 2,000 | 2,000 | From A/c Electricity expenses<br>To A/c Cash box<br>(Paying electricity bill in cash) |

How to Learn Journal Entries?

Journal entries can be learned through a set of steps represented in:

- Understanding the basic principles of accounting and the components of journal entries, such as debit and credit, assets and liabilities, and revenues and expenses.

- Studying accounting rules and understanding the steps of their application according to different accounting cases and transactions.

- Practical training in preparing journal entries through using real examples and practical exercises on purchase entries, sales, payments, receipts, and others.

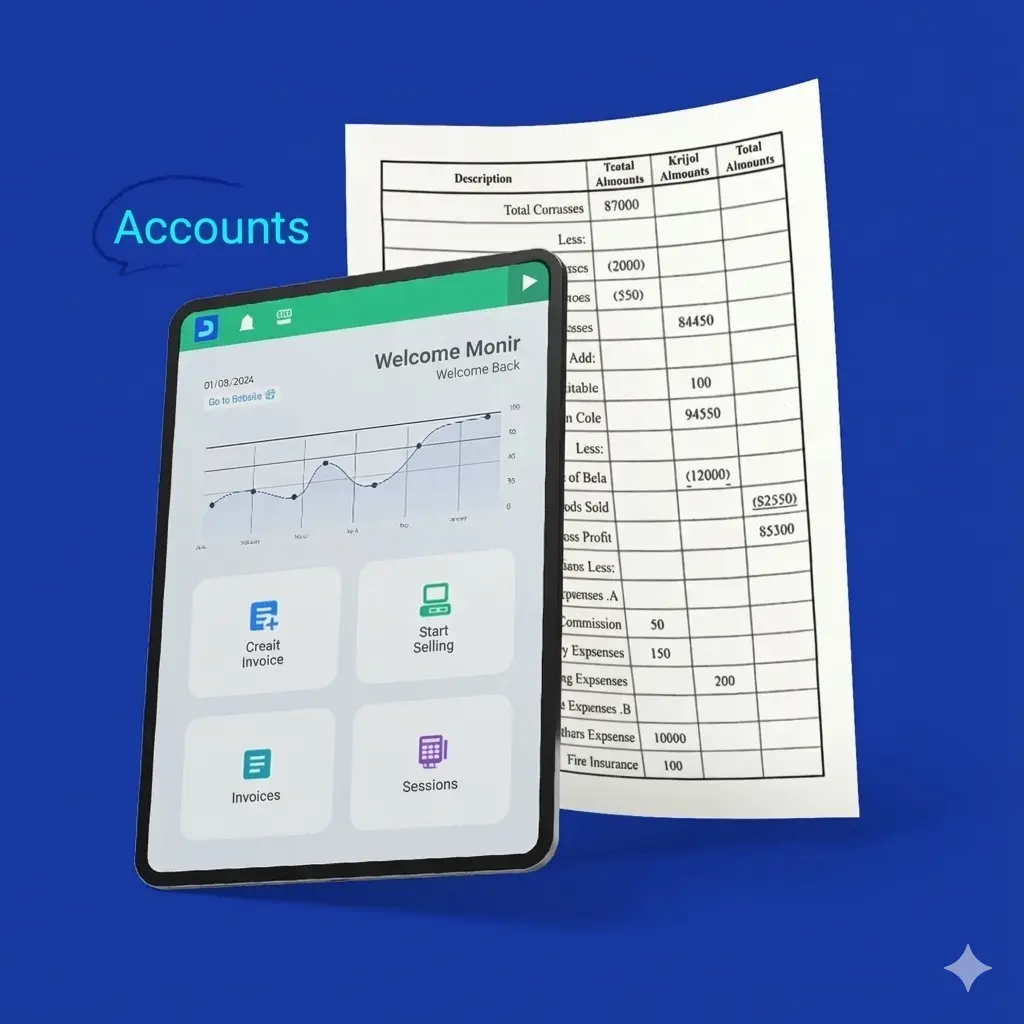

- Learning how to use popular accounting software that helps in recording and organizing journal entries, most notably the Daftra program.

- Subscribing to training courses offered online or by academic institutes specialized in the accounting and financial management fields.

- Continuous learning of accounting rules, as well as becoming familiar with changes and updates occurring in international accounting laws and standards.

- Reading and researching accounting books and available scientific sources that cover accounting topics in detail.

- Joining available field training opportunities in accounting and finance departments in various companies, which support practical and professional experience.

How Does Daftra Make Your Journal Entries Easier?

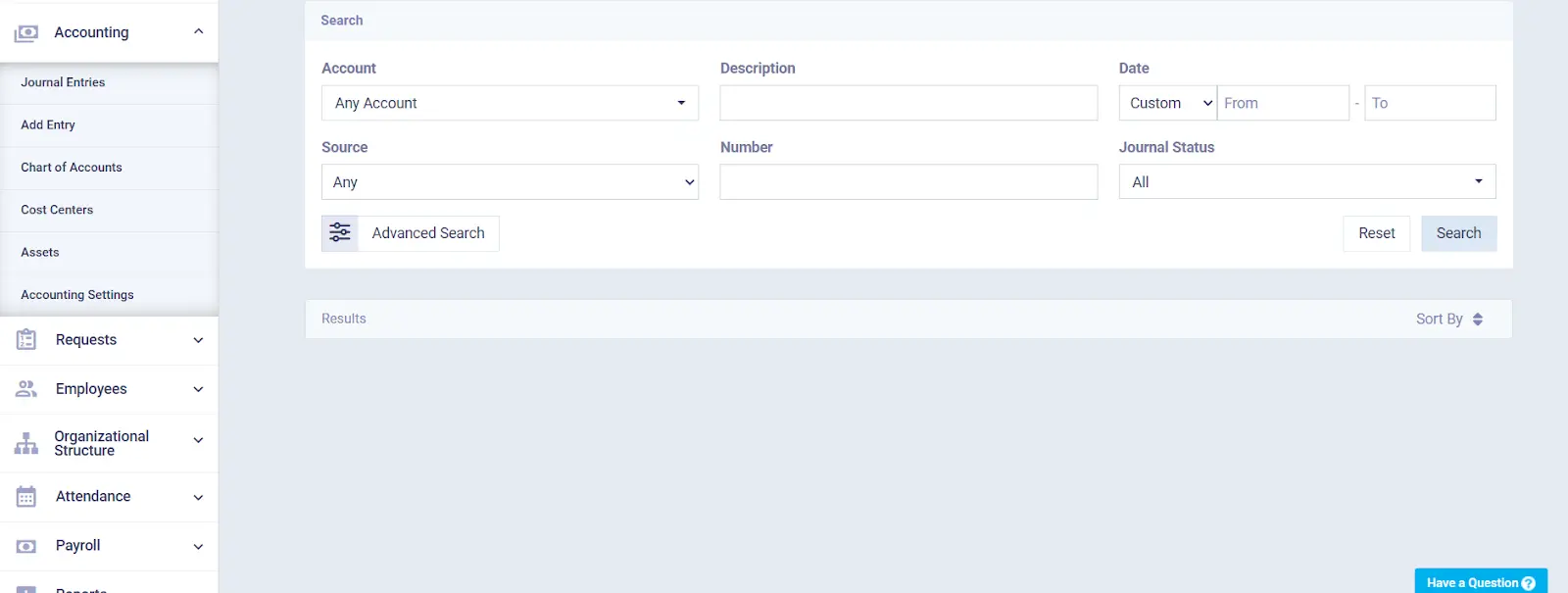

The general accounts program in Daftra provides you with comprehensive management of all journal entries through a set of features and advantages, including manually adding entries where you can make adjustments to financial accounts according to accounting needs by recording entries manually, adding a description for the entry, and a description for each account within it, and document attachment features. You can also rely on the system to automatically add entries for every financial transaction that takes place on the account and post them to the general ledger.

In addition to the features of recording entries automatically and manually, you can view the sources of automatic entries through a link that directs you to the source responsible for creating the entry so that you can easily track operations and review them, while displaying a list of cost centers related to the entry. This is in addition to the feature of customizing the entry template and the ability to modify and design it to suit the company's identity, as well as many customization advantages available through the template designer in the account.

Frequently Asked Questions

Are accounting constraints the same as journal entries?

Accounting constraints and journal entries differ in terms of their basic objective, where accounting constraints refer to the principles and foundations on which financial statements are prepared and presented, while the basic purpose of journal entries is to record financial transactions in account books for financial statements and comply with accounting principles in recording.

What does cost center mean in journal entries?

A cost center is used in journal entries to allocate costs and revenues to specific parts separately. The purpose of cost center entries is to distribute general costs and determine the duration of their impact on financial statements and accounting reports, which helps in accurately analyzing the financial performance of different departments and making administrative decisions based on proper analysis of costs and revenues.