Accounts Payable and Accounts Receivable: Definitions, Characteristics, and Differences

Table of contents:

- What are Accounts Payable and Accounts Receivable?

- Examples of Accounts Payable

- Examples of Accounts Receivable

- Accounts Receivable and Payable Turnover

- The Difference Between Accounts Receivable and Accounts Payable

- How to Analyze Accounts Payable and Accounts Receivable

- Journal Entries for Accounts Payable and Accounts Receivable

- What Are the Characteristics of Accounts Receivable and Accounts Payable?

- Frequently Asked Questions

Recording all company accounts promptly is not a luxury but an accounting necessity for management and relevant parties to understand the obligations the company bears and the gains it expects to receive in the near future. All of this falls under the scope of accounts payable and accounts receivable for companies.

What are Accounts Payable and Accounts Receivable?

Many people confuse accounts payable with accounts receivable and barely distinguish between them due to their similarities in recording across many accounts. However, there is a fundamental difference between the two concepts that must be noted, because any error in accounting may lead to discrepancies in your financial statements and an imbalance in your accounting equation, resulting in numerous incorrect decisions.

Definition of Accounts Payable

Accounts payable are defined as the liability accounts that the company owes to a third party, which could be a bank, another company, or a group of suppliers.

Accounts payable are recorded in the company’s balance sheet under current liabilities, which the company must settle within a specified period to avoid the consequences of default. If the payable account balance increases compared to last year, it indicates that the company is increasingly relying on credit to purchase goods or services.

Conversely, if the figure is lower than in previous periods, it shows that the company is settling its obligations more quickly. These indicators reveal how the company manages cash flow and help management or investors make informed decisions.

Management can control the company’s cash flow through accounts payable. For example, if the company wants to increase its cash reserves during a certain period, it can extend the time taken to settle its outstanding payables.

However, management must balance flexibility in deferred payments with maintaining strong relationships with suppliers and other parties by settling obligations promptly, which helps enhance the company’s reputation in the market.

Download now: Accounts Payable Ledger template, ready for editing and free to use from Daftra.

Definition of Accounts Receivable

Accounts receivable, on the other hand, refer to the money owed to the company by other parties or clients for various reasons.

Companies record accounts receivable as assets on their balance sheet because the customer is ultimately obligated to pay these debts within a specified period, usually short-term. Accounts receivable are considered part of working capital and can be used by companies as collateral for loans from various financial institutions.

Download now: Accounts Receivable Account template, ready for editing and free to use from Daftra.

Also read: What are Debtor and Creditor and the Difference Between Them.

Examples of Accounts Payable

One of the most well-known examples of accounts payable is a company's purchases of raw materials to manufacture its products or provide services to customers. Many companies rely on splitting the payments into short-term or long-term periods instead of paying them immediately. Accounts payable also include income taxes, loan installments, equipment and tools purchases, and others.

Examples of Accounts Receivable

Accounts receivable include everything that other parties, such as banks, other institutions, and even customers, owe to the company, such as financial dues for selling products and services to customers.

Accounts Receivable and Payable Turnover

Measuring the turnover rates of accounts payable and receivable for companies is very important for both management itself, the institutions dealing with it, and investors intending to invest in those companies.

First: Accounts Payable Turnover

Accounts payable turnover is defined as a financial measure that shows the efficiency of the company in fulfilling its obligations and paying the required dues within a specified period, usually extending to one year. This measure is considered a clear indicator of the company's financial health and operational efficiency.

A high accounts payable turnover indicates the company's ability to manage cash flow efficiently through its capability to pay its suppliers or other institutions on time. A low turnover rate is a clear indication of cash flow problems within the company.

Companies should maintain an appropriate turnover rate for their accounts payable to strengthen positive relationships with other institutions, as timely payment of obligations leads to better terms in future dealings. Investors and lenders also use accounts payable turnover ratios in their financial analysis to assess the company’s liquidity and financial stability, helping them make informed decisions.

Second: Accounts Receivable Turnover

Accounts receivable turnover helps measure the company's success in collecting its dues from customers, other parties, distributors, and stores quickly. This rate evaluates the period it takes the company to collect money resulting from selling products or providing services to others.

If the company cannot control and manage the turnover of its financial receivables effectively over a long period, it indicates management failure in sending due invoices to customers and reminding them to pay on time. This may expose the company to the risk of not receiving money earned from its products on time, potentially leading to significant financial problems.

The accounts receivable turnover rate varies between companies depending on the industry they specialize in. However, a high turnover rate usually improves the impressions of potential investors and lending institutions, encouraging them to make positive decisions in favor of the company.

Measuring accounts receivable turnover ratios contributes to understanding the speed of the company’s collection of dues, which helps determine the timing of settling obligations and planning strategic future investments in a well-studied manner. These ratios also indicate whether the company's policies in dealing with customers support maintaining good cash flow or require substantial adjustments.

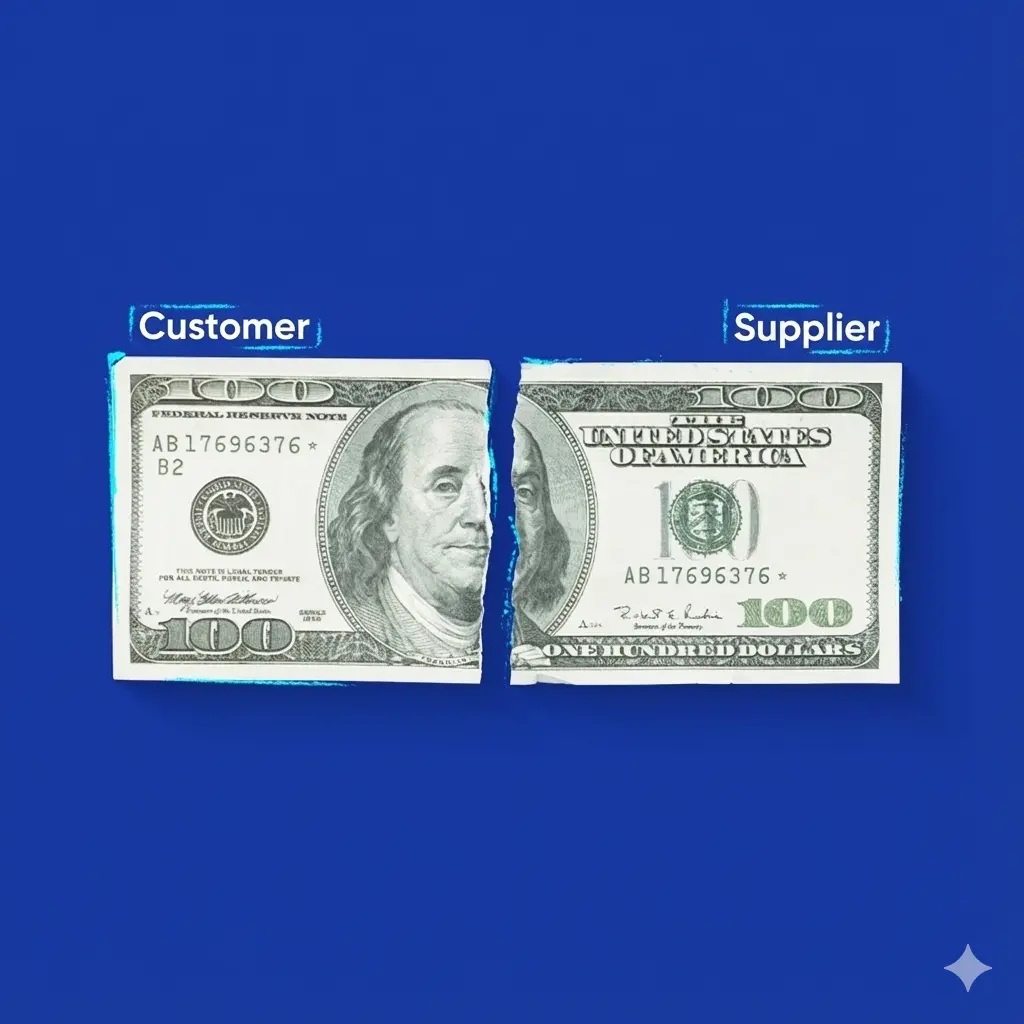

The Difference Between Accounts Receivable and Accounts Payable

Accounts receivable and accounts payable have clear differences in terms of their position in the balance sheet, management performance, and time period. Here are the differences between accounts receivable and accounts payable in detail:

1- Position in the Balance Sheet:

Accounts payable are recorded under liabilities in the balance sheet, while accounts receivable are recorded under assets.

2- Management Performance:

Management achieves the best performance in accounts payable by paying its dues on time, whereas performance is at its highest in accounts receivable if the company can collect its dues from customers at the appropriate times.

3- Time Period:

Both accounts payable and accounts receivable are measured over short-term periods.

How to Analyze Accounts Payable and Accounts Receivable

Analyzing accounts payable and accounts receivable is an important task for companies. This is done through several steps, such as defining the objective, collecting information, reviewing data and correcting errors, analyzing data, and other steps that help achieve accurate analysis. Here is how to analyze accounts payable and accounts receivable in detail:

1- Defining the Objective of the Analysis:

Initially, the objectives of the analysis must be clearly defined, such as understanding the company’s current obligations and its ability to meet them, assessing the level of cash flow, and identifying how quickly customers pay the company for products sold to them.

2- Collecting Information from Various Sources:

All documents and information related to accounts payable and accounts receivable must be collected from reliable sources, such as invoices, journals, ledgers, and accounts payable records. The data should be organized systematically to facilitate analysis.

3- Reviewing Data and Correcting Errors:

After collecting the data, it must be carefully reviewed to correct any errors or duplicate entries that could affect the analysis results.

4- Analyzing Data and Extracting Results:

After performing the analysis, effective strategies and plans should be identified to help the company improve its ability to settle obligations, as well as methods and approaches to accelerate the collection of receivables from customers.

Journal Entries for Accounts Payable and Accounts Receivable

There are clear differences in recording accounts payable and accounts receivable in the company’s journal, and they must be understood precisely to avoid any disruption in the company’s accounts.

When entering accounts payable in the journal, you are recording the money you are required to pay. When recording accounts receivable, you are entering the money you expect to receive within a specific period. Accounts payable remain under liabilities until the company settles them, while accounts receivable remain under assets unless it is confirmed that they will not be received at all.

When auditors review the entries in the ledger, for example, they look for any entry where management has deferred a payment related to an obligation to a later date or added it to other expenses unrelated to that obligation.

When reviewing accounts receivable in the books, auditors also check for cases where fictitious revenues were recorded or recorded as assets that have already been paid, contrary to reality, to show inflated profits.

What Are the Characteristics of Accounts Receivable and Accounts Payable?

Accounts receivable and accounts payable have certain characteristics that distinguish them, such as having a due date, specifying the amount due, and including late fees. Here are the features of accounts receivable and accounts payable, explained in more detail:

1- Presence of a Due Date

Accounts payable and receivable are characterized by having a due date by which the company must pay its obligations or collect its receivables.

2- Specifying the Amount Due

Accounts payable and receivable are characterized by documents and invoices that clearly state the amount to be paid or received, along with specifying the penalties for failing to meet these conditions.

3- Presence of Late Fees

Any party that fails to fulfill its obligations, whether as a creditor or debtor, is subject to penalties imposed by the beneficiary of these dues.

Frequently Asked Questions

Are Accounts Receivable Current Assets?

Yes, companies can classify accounts receivable as current assets because it is expected that the other party will pay them within one year or less. Current assets are assets that can be easily converted into cash, such as cash, cash equivalents, inventory, and others. Non-current assets are those that cannot be easily converted into cash within one year, such as tangible property, long-term investments, intellectual property, trademarks, and others.

What is the Allowance for Accounts Receivable?

It is an amount calculated based on studies and statistics and is considered an expected loss for the company due to the inability of customers to pay their debts.

What is Accounts Receivable Financing?

It is the process of selling invoices to a financing company, meaning that the owner of the goods sells the invoices to a financing company to receive immediate cash, and the company collects the amount from the customer.

What is the Difference Between a Creditor and a Debtor?

- Creditor: The person or company that lends money or goods and expects compensation or payment in return for the service, goods, or money.

- Debtor: The person, company, or institution that receives the money or goods and is required to pay the corresponding amount.

What is the Difference Between Interest Receivable and Interest Payable?

- Interest Receivable: Interest paid by the company or person on the funds they have received.

- Interest Payable: Interest earned by the company or the bank that lent the money.

Are Sales Creditor or Debtor?

Sales are considered creditors, not debtors, and are recorded in accounts on this basis.

In conclusion, this article explained two of the most prominent concepts in accounting, namely accounts payable and accounts receivable, along with all related details, in a simple and clear manner. If you are passionate about delving deeper into accounting, follow our blog to get the latest articles promptly. Through the accounting software in Daftra, you can manage accounts receivable and accounts payable easily and simply by tracking dues, their deadlines, debtor names, and other distinctive services provided by Daftra.