What is a budget, its types, and how is it prepared?

Table of contents:

- What Is a Budget?

- What Are the Types of Budgets?

- What Are the Steps to Prepare a Budget?

- What Is the Importance of a Budget?

- What Are the Characteristics of a Budget?

- What Are the Components of a Budget?

- What Are the Objectives of a Budget?

- The Difference Between a Budget and a Financial Plan

- What Are the Stages of the General Budget?

- What Are the Challenges in Estimating a Budget?

- Mistakes to Avoid When Preparing a Budget

- How Does Daftra Help You in Preparing a Budget?

- Frequently Asked Questions (FAQs)

Are you seeking to achieve financial success for your company or project? Many people search for the best way to plan the financial system of their business in an increasingly competitive era. Accurate financial planning has become essential for the success of any enterprise.

In this context comes the role of budgeting, which enables companies to maintain future stability. It helps establish strong financial foundations and make sound economic decisions, contributing to sustainable growth and increased profits.

In this article, we will explore the elements and role of budgeting, its importance, how to prepare it, and how it can be applied effectively to support the financial and economic success of any organization.

Key Points

- A budget is an estimated or future forecast statement of all activities of the organization. Its purpose is to determine potential financial outcomes, resource requirements, and the amount of money needed to cover these resources in order to achieve the desired objectives, and to compare them with actual results.

- Budgets vary in type based on classifications, time frame, and activity level, such as: Short-term budget, Long-term budget – Continuous/rolling budget – Operating budget – Capital budget – Financial or appropriation budget – Static budget – Flexible budget.

- Preparing a budget is a vital part of financial planning and management. It includes: collecting data on past and current budgets, forecasts, and predictions; considering internal and external factors; involving key stakeholders and investors; developing a financial allocation plan; reviewing and analyzing data; preparing the budget report; and implementing and monitoring the budget.

- The importance and role of the budget in organizations and companies are numerous. Among the most important are: resource management and allocation – guidance and setting the general framework, making wise decisions, tracking and monitoring, reducing financial risks and increasing transparency.

- Budget estimation includes several key terms and components, such as revenues, expenses, time period, assumptions and projections, and fixed vs. variable costs.

- Budget objectives include: performance control and evaluation; supporting strategic planning; defining financial and operational goals; increasing efficiency and motivation; and improving decision-making.

- The public budget goes through four stages: preparation and planning, approval, implementation, monitoring, and evaluation.

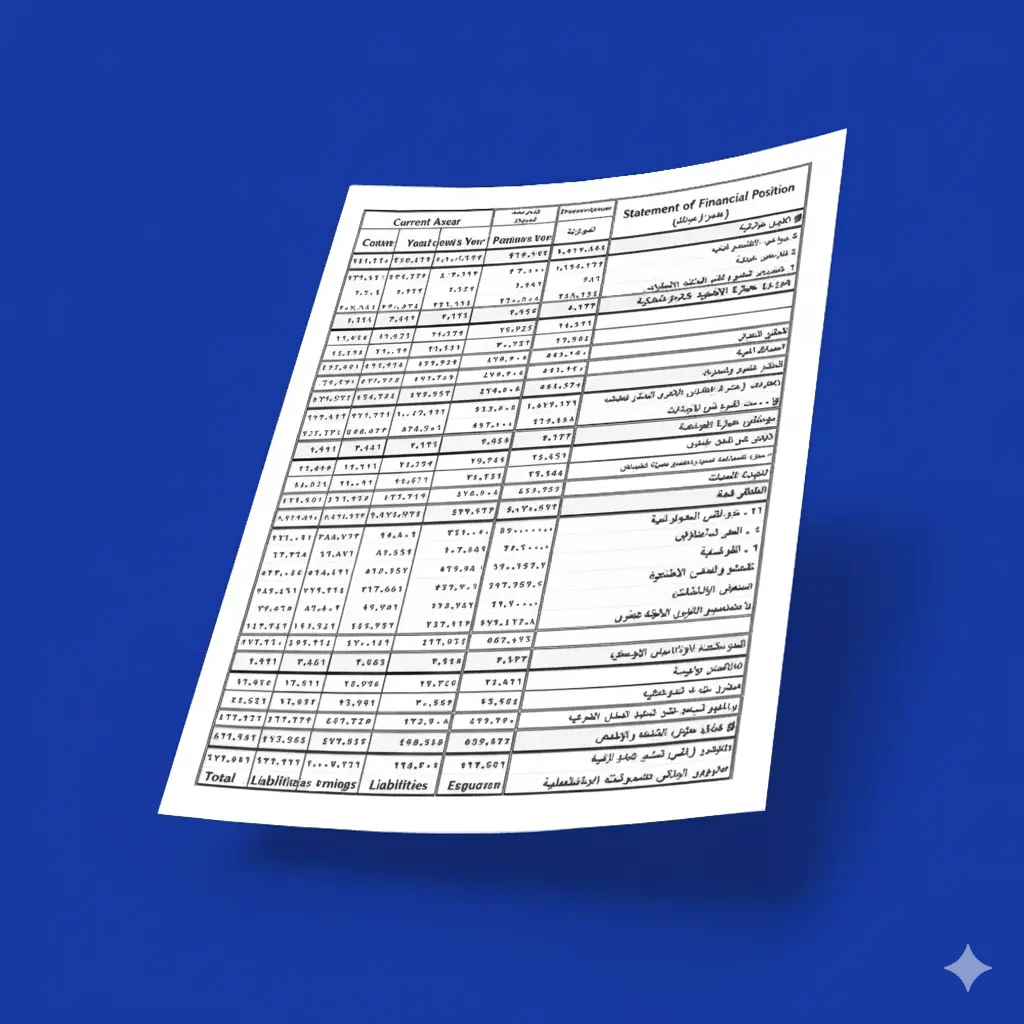

- A balance sheet is an accounting tool that shows the company’s financial position at the end of the year, whereas a budget is a planning process that defines the upcoming financial direction, relying on future expectations. The balance sheet is based on past data, while the budget relies on future forecasts. The balance sheet reviews the company’s past performance, while the budget guides management toward achieving future goals.

What Is a Budget?

A financial budget is an estimated statement predicting all future activities of an organization, including expected revenues and expenses over a future period. The purpose of budgeting is to forecast potential financial results and the required resources, as well as the money needed to cover these resources to achieve desired objectives and compare them with actual outcomes.

It falls within the field of project management, as it helps manage costs. Accountants and business owners use previous financial data and current economic trends to estimate future budget needs. These estimates reflect the following:

- Production levels

- Sales volume

- Employee and workforce requirements

- Potential changes in costs

What Are the Types of Budgets?

We use different types of budgets to manage and allocate resources, make sound decisions, and reduce financial risks as much as possible. Budgets vary according to several classifications, as shown in the table below:

| Budget Classifications | Types of Budgets |

| By Time Period | - Short-Term Budget - Long-Term Budget - Continuous (Rolling) Budget |

| By Expenditure Classification | - Operating Budget - Capital Budget - Financial or Appropriation Budget |

| By Activity Level | - Static Budget - Flexible Budget |

1. Short-Term Budget

A short-term budget is the process of estimating income and expenses over a short period, such as a month, a quarter, or a year. It is essential for managing daily operations, such as ordering supplies in advance and paying bills. To implement it effectively, realistic and achievable goals must be set.

2. Long-Term Budget

A long-term budget is the process of forecasting revenues and expenses over an extended period, typically three to five years. Its purpose is strategic growth planning, such as expanding the product line, investing, and scaling the business. To achieve financial budgeting effectively, organizations must ensure that goals, plans, and commitments are aligned with competitive advantages and customer needs. This also includes estimating future income based on growth assumptions, market research, and scenario analysis.

3. Continuous (Rolling) Budget

A continuous budget involves forecasting future activities in ongoing cycles. It relies on using historical data for future prediction and is applied in business to estimate financial needs more accurately, make better strategic decisions, and allocate resources efficiently.

4. Operating Budget

An operating budget is a detailed projection of a company’s expected revenues and expenses. It is usually prepared near the end of the year to show expected activity for the following year. The more accurate and detailed the operating budget is, the greater its value and importance within the company. The operating budget includes:

- Revenue Budget: The total revenues the organization expects to generate, including projected sales volume and pricing of new product lines.

- Expense Budget: Costs related to operations and production expected to be spent in the future, such as rent, raw materials, salaries, and marketing expenses. Previous expense records and expected changes are used to estimate future expenditures.

5. Capital Budget

A capital budget focuses on estimating the costs of long-term assets and projects, such as modern equipment, buildings, machinery, and IT systems. It helps determine the total capital expenditures that can be undertaken based on projected cash flows, analysis of investment returns, payback period, net present value (NPV), and other evaluations related to proposed projects.

6. Financial or Appropriation Budget

A financial or appropriation budget is a predictive financial plan created using cost estimates. It involves compiling all expected costs for a given period. Business owners and project managers use it to plan new projects, analyze performance, and understand spending behavior. This method helps reduce waste, improve efficiency, and lower the overall project cost—ultimately increasing profitability.

7. Static Budget

A static budget is a forecast of expected values and outcomes based on predetermined inputs before the start of the desired period or year. It remains unchanged regardless of increases or decreases in sales volume or production. Because of this, the final results of a static budget may differ significantly from actual results. The primary purpose of a static budget is to provide a financial plan that guides business activities and helps management measure performance by comparing actual outcomes with the planned projections. Comparing actual figures with the budget allows the finance team to assess performance and take corrective actions when necessary.

8. Flexible Budget

A flexible budget is characterized by its ability to adjust based on changes in activity levels, revenues, and costs throughout the financial year, especially when predictability is limited. The flexible budget allows companies to adapt to changing conditions—such as increased demand for products or rising raw material costs. Actual revenues are incorporated into the budget at the end of the accounting period. The actual outcome is then compared to the financial budget. However, when preparing the budget, it is essential to distinguish between fixed and variable costs of the activity. By using the Daftra accounting system, you can determine the estimated budget for each department or cost center individually, allowing you to forecast both revenues and expenses for each period.

What Are the Steps to Prepare a Budget?

Preparing a budget is a vital part of financial planning and management. It involves collecting relevant data, making informed forecasts, and following a series of structured steps. Below are the key steps to prepare budget estimates:

1. Collect Data on Previous and Actual Budgets

Budget estimates should be based on historical data. Analyzing past budgets and actual expenditures provides a baseline for forecasts. Data from previous budgets, actual spending, revenues, and other metrics over the past three to five years should be compiled. Studying past trends helps identify cycles and other patterns in the numbers.

2. Forecasts and Projections

Using historical data, accountants can make projections for the upcoming budget period. Forecasts extend past trends and patterns into the future for all organizational activities.

3. Consider Internal and External Factors

All internal and external factors that can affect spending and revenues should be taken into account.

- Internal factors include upcoming business plans, strategic changes, capacity expansions, past performance, management and leadership methods, and allocation of financial and human resources.

- External factors involve economic conditions, market trends, competition, and other external influences relevant to the budget.

4. Involve Key Stakeholders and Investors

Collaboration with department heads, division managers, and other key stakeholders is essential when preparing budget estimates. They provide valuable insights into future needs, risks, and opportunities, helping create more accurate and realistic budgets aligned with organizational goals.

5. Develop a Financial Allocation Plan

This step involves creating a detailed plan to allocate financial resources across various activities and projects within the organization, which is a core part of budget preparation. Key aspects of developing a financial allocation plan include:

- Managing resources to align with strategic goals and priorities.

- Balancing funding across departments in terms of business operations, maintenance, and new project financing.

- Anticipating key emerging areas that will increase revenue and investment returns.

- Identifying all expected costs for the financial period and allocating resources proportionally to achieve specific financial objectives.

- Evaluating and analyzing the performance of the financial allocation plan at the end of the period to determine successes and potential improvements for the future.

6. Review and Analyze Data

A comprehensive review and analysis of figures is necessary to ensure forecast accuracy and alignment with strategy. Key benchmarking questions include:

- Are revenue forecasts realistic and achievable compared to previous years and current economic conditions?

- Have all potential income sources been identified and accounted for?

- What is the reason for increases or decreases in expenditures?

- Which department is expected to generate the highest revenue?

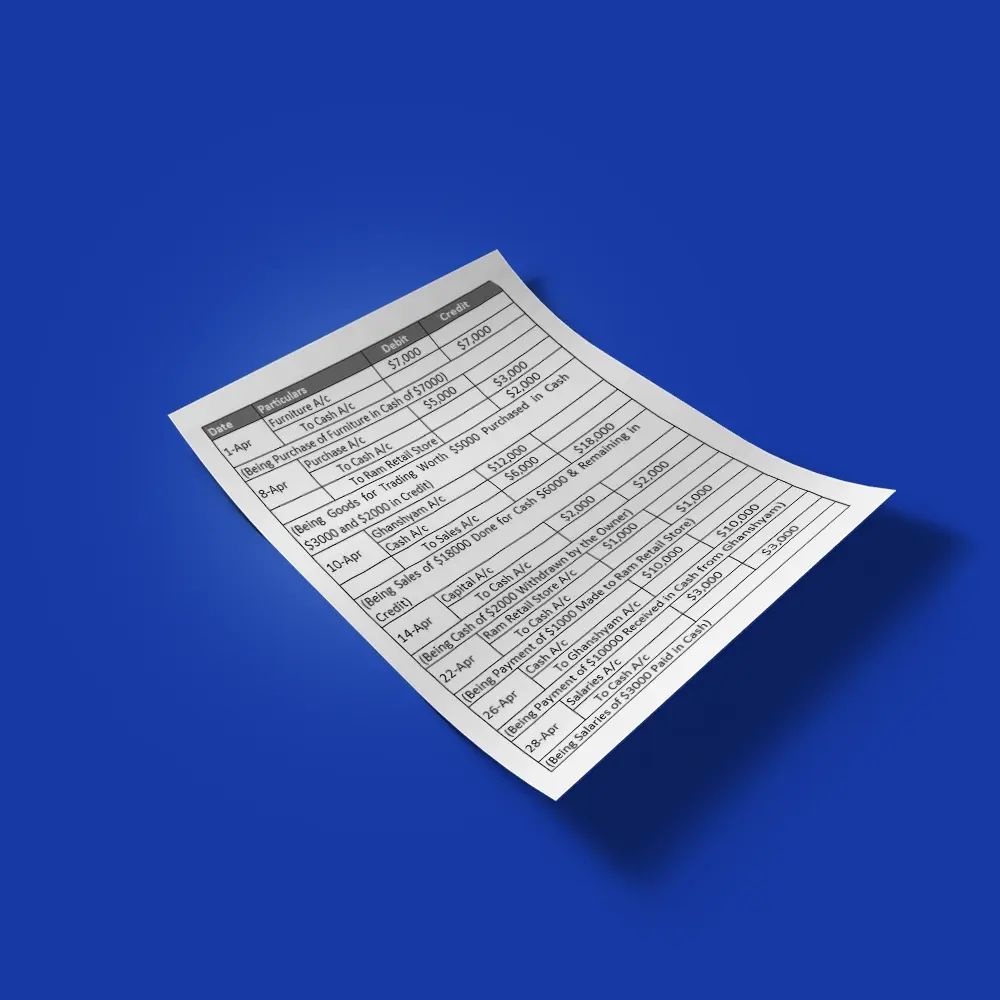

7. Prepare the Budget Report

The budget report details assumptions, forecasts, and logical principles behind the projected numbers for a specific period. The report should include:

- An executive summary highlighting key budget information.

- Expected and potential cash flows.

- Future capital expenditures.

- The projected balance sheet.

- Detailed revenue and expense projections.

- Appendices and supporting documents for the estimates.

8. Implement and Monitor the Budget

The budget should be clearly communicated to all departments and executives. Each department must understand its allocated budget. Budgeted amounts should be reviewed and compared with actual results achieved or expected, ensuring effective monitoring and control.

The Daftra program helps you link the budget to cost centers, analyze variances, and continuously monitor financial data.

What Is the Importance of a Budget?

Budgets play multiple roles and hold significant importance in organizations and companies. One of the primary objectives of budgeting is to enhance transparency and achieve financial stability. The following key elements highlight the importance of a budget:

1. Resource Management and Allocation

A budget is an essential tool for planning and determining how to allocate limited resources. By forecasting or predicting the costs of various activities and operational items, executives can optimize the distribution of funds, equipment, and workforce. Effective budgeting requires analyzing needs and priorities to evaluate resources efficiently.

2. Guidance and Framework Setting

An accurate budget provides comprehensive guidance on the expected financial framework for the upcoming period by analyzing all cash-related factors, projecting revenues, expenses, and capital returns. Therefore, the budget serves as a foundation for operational decision-making.

3. Making Informed Decisions

Budgets help business owners make more informed decisions rather than relying on unclear or ambiguous insights. Executives use budget projections of expenses and returns to guide purchasing and investment decisions based on the financial data provided.

4. Tracking and Monitoring

Budgets allow organizations to monitor all levels of spending and identify economic and financial challenges. Tracking deviations or inconsistencies in certain budget items enables management to take corrective action to align with organizational needs. Comparing actual figures with forecasts and estimates helps control costs and resources effectively.

5. Reducing Financial Risks and Enhancing Transparency

Budgets help reduce financial risks by providing accurate predictive figures for all potential revenues, expenses, and future cash flows, helping avoid unexpected events that could impact the organization’s liquidity. Budgets also enhance transparency by clearly assigning responsibilities and defining objectives for each person or department within the organization.

What Are the Characteristics of a Budget?

Budgets have several characteristics that make them highly important in financial management and help organizations achieve their goals efficiently and effectively. The main characteristics of a budget include:

1. Comprehensiveness

A budget should clearly define all financial and operational objectives to help direct resources toward the desired outcomes.

2. Flexibility

A budget should have a degree of flexibility that allows it to be adjusted in response to changing conditions and to meet the organization’s needs.

3. Accuracy

A budget should be based on precise and realistic estimates derived from historical data and market analysis. It should include detailed projections of revenues and expenses.

4. Measurability

A budget should rely on clear and measurable standards, making it easier to control and monitor, identify deviations, and take corrective actions as needed.

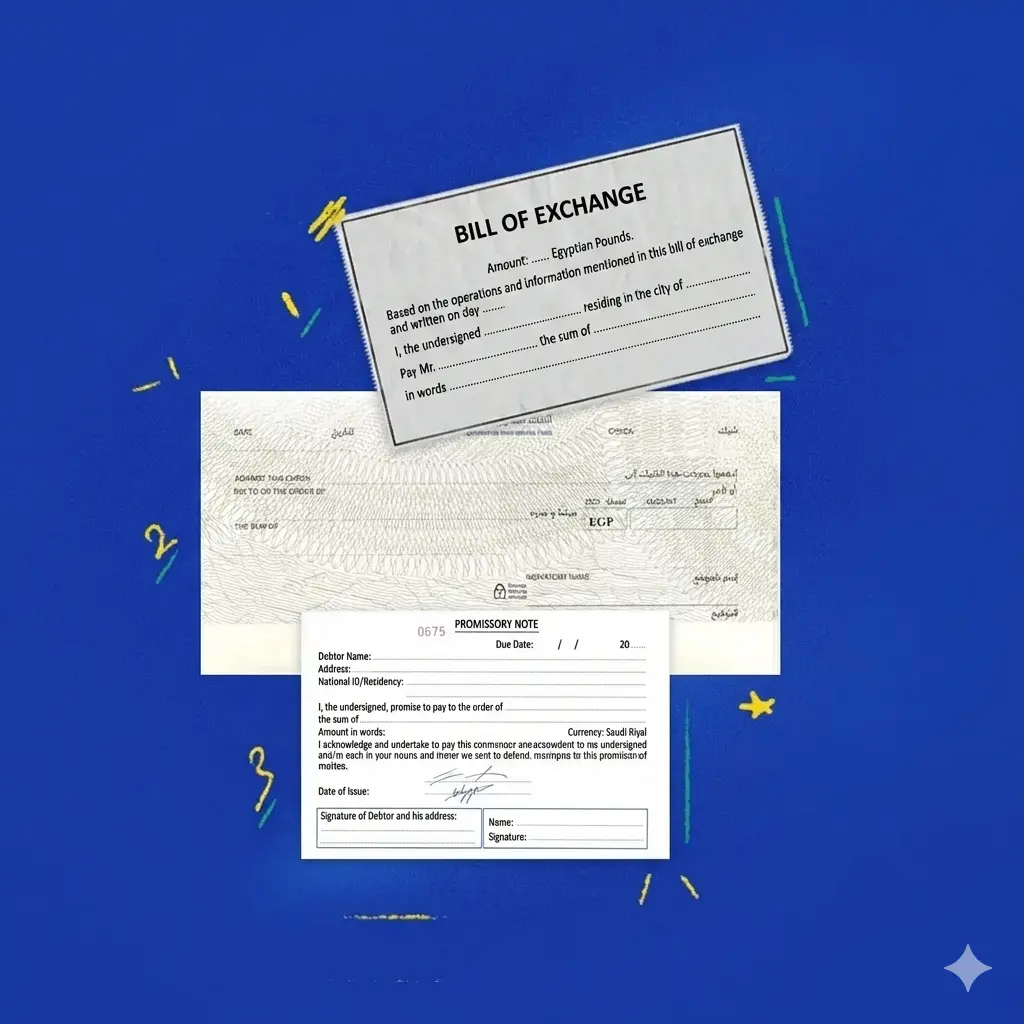

What Are the Components of a Budget?

A budget consists of several elements and items that are essential to understand in order to prepare an accurate and effective budget, improve goal-setting, and achieve objectives. Key components of a budget include:

1. Revenues

Revenue projections form an important part of budget estimation. Estimating expected revenues involves analyzing past performance data, current operations, and forecasts for future conditions. Common sources of revenue include product and service sales, membership fees, interest income, and others.

2. Expenses

Expense estimation is equally important. Expenses include ongoing operational costs that can be predicted, such as salaries, rent, supplies, and utilities. It is important to accurately project both fixed and variable expenses based on historical data, known changes, and future assumptions.

3. Capital Expenditures

In addition to operating expenses, organizations need to budget for periodic capital expenditures and major investments in assets such as equipment, buildings, and technology. Capital budgeting requires long-term planning for these purchases.

4. Time Period

Most organizational budgets cover a one-year period, although some are prepared semiannually or follow other calendar cycles. The budget timeline should align with the organization’s operations and needs.

5. Assumptions and Projections

Budgeting relies heavily on making informed assumptions and forecasts. Past data provides a starting point, but financial managers must assess internal and external factors that could affect revenues, expenses, and future capital requirements.

6. Fixed Costs vs. Variable Costs

Classifying costs as fixed or variable helps guide budget estimates. Fixed costs remain unchanged regardless of sales or production levels and include expenses such as rent, salaries, and insurance. Variable costs change based on factors like sales volume. Understanding these cost types leads to more accurate budget forecasts.

Read also: Spreadsheets: What are they? What is their importance? And how to use them.

What Are the Objectives of a Budget?

Budget estimation serves several important objectives for an organization, the most significant of which are maintaining financial stability and making the best financial decisions. Key objectives of a budget include:

1. Control and Performance Evaluation

By comparing actual financial results with budget estimates, variances between revenues and expenses can be identified early. This helps take corrective actions to maintain performance and ensure spending aligns with set targets. Additionally, budgets provide control by authorizing spending levels for different activities and programs.

2. Supporting Strategic Planning

Budgets allow organizations to evaluate the costs of strategic initiatives and set priorities based on the expected return on investment. Budgets transform strategy from a conceptual plan into a financially actionable roadmap.

3. Setting Financial and Operational Goals

Budgeting requires establishing specific financial and operational objectives that are measurable in terms of performance, such as quantitative targets, revenues, costs, productivity, and other relevant metrics.

4. Improving Decision-Making

Budgets provide accurate and systematic financial information, supporting both strategic and tactical decision-making based on reliable data.

5. Increasing Efficiency and Motivation

The figures provided in a budget help departments achieve the highest possible expected revenues. Budgets also serve as a motivator by encouraging departments to meet expected results and align actual outcomes with planned targets.

The Difference Between a Budget and a Financial Plan

Understanding the difference between a budget and a financial plan (budgeting vs. planning) is essential for effective and sustainable management of financial resources. Both the financial plan and the budget are distinct financial tools used for different purposes, each focusing on different aspects of financial management. The differences are as follows:

| Aspect | Budget | Financial Plan / Budgeting |

| Term | A term in financial accounting. | A term in managerial accounting. |

| Mechanism / Form | Based on actual figures and previous statistics. | An estimated process based on future projections. |

| Importance | A financial statement showing the company’s financial position. | A financial plan outlining the course of action for the upcoming period. |

| Timing | Prepared at the end of the year to evaluate overall company performance. | Prepared at the beginning of the year to organize the company’s future path. |

| Purpose | To clarify the company’s economic status and customer balances. | Used for planning purposes, such as forecasting sales volume and future revenues. |

What Are the Stages of the General Budget?

The general budget is a planning process aimed at guiding the use of financial resources in a balanced manner within an organization, whether it is a company, a government organization, or a non-profit organization. The difference between a general budget and an estimated budget lies in the time frame.

The general budget is based on actual financial data for a period (usually one year), while the estimated budget relies on preliminary projections for a future period. The general budget goes through a cycle consisting of four stages. This cycle includes all activities and processes involved in the state’s general budget, taking time into account, as the budget links the past, present, and future. The stages are as follows:

1. Preparation and Planning Stage

This stage is carried out by the executive authority of the state by directly estimating public expenditures and using automated and direct methods to estimate public revenues. The automated revenue estimation method is divided into three approaches:

- Preceding Year Method: Using actual revenues from the previous financial year.

- Relative Increase/Decrease Method: Applying the percentage of actual increase or decrease in revenues compared to previous rates.

- Average Method: Comparing the two previous years and taking the average of actual revenues.

2. Approval of the General Budget

This stage falls under the legislative authority, such as financial councils and the parliament, which oversee the executive branch. The prime minister sends the draft budget to the national assembly one month before the start of the next year. The Ministry of Finance presents the financial letter of the budget to the legislative councils. The councils may not increase expenditures but are allowed to reduce some expenses.

3. Implementation of the General Budget

This stage involves executing public expenditures and revenues, including treasury operations, i.e., disbursing funds and collecting revenues. The budget is officially published in all official state sources. The Financial Budget Department issues financial directives approved by the Minister of Finance and implemented by all ministries.

4. Monitoring and Evaluation of Implementation

The legislative authority oversees this stage by performing roles such as:

- Monitoring revenues collected and expenses incurred.

- Monitoring the implementation of projects.

Legislative authorities may appoint departments to facilitate monitoring and reporting on ministries’ compliance with objectives, such as the Budget Department, the Audit Bureau, and the Ministry of Finance. Their responsibilities include:

- Auditing financial orders.

- Identifying the official responsible for signing financial orders.

- Ensuring expenditures do not exceed allocated limits and are spent as intended.

- Ensuring the budget is applied according to laws and regulations.

What Are the Challenges in Estimating a Budget?

Budget preparation faces several challenges requiring accuracy and long-term planning, including:

- External factors that can affect budget estimates, creating uncertainty and fluctuations. These include economic conditions (inflation, recession), policy changes, natural disasters, and other unpredictable events.

- Limitations in data collection or lack of comparable data, making forecasting more difficult.

- Conflicting interests among business owners and departments, as each group pressures to prioritize its own needs, complicating objective estimates.

- Lack of skilled personnel or insufficient use of modern technical systems, such as accounting software.

Mistakes to Avoid When Preparing a Budget

Some common errors in budget preparation can lead to inaccurate financial estimates. Key mistakes to avoid include:

- Failing to clearly define financial objectives, affecting proper allocation of budget resources.

- Overestimating or inaccurately estimating revenues, which may result in budget deficits.

- Ignoring unexpected or emergency expenses, potentially causing sudden deficits.

- Neglecting past financial performance and results when preparing the budget.

- Creating a budget that is inflexible and cannot be adjusted according to economic changes and organizational needs.

- Not involving stakeholders in the budgeting process.

- Preparing only a short-term budget without considering long-term goals, negatively affecting financial sustainability.

- Failing to continuously monitor and evaluate the budget to ensure it stays on track.

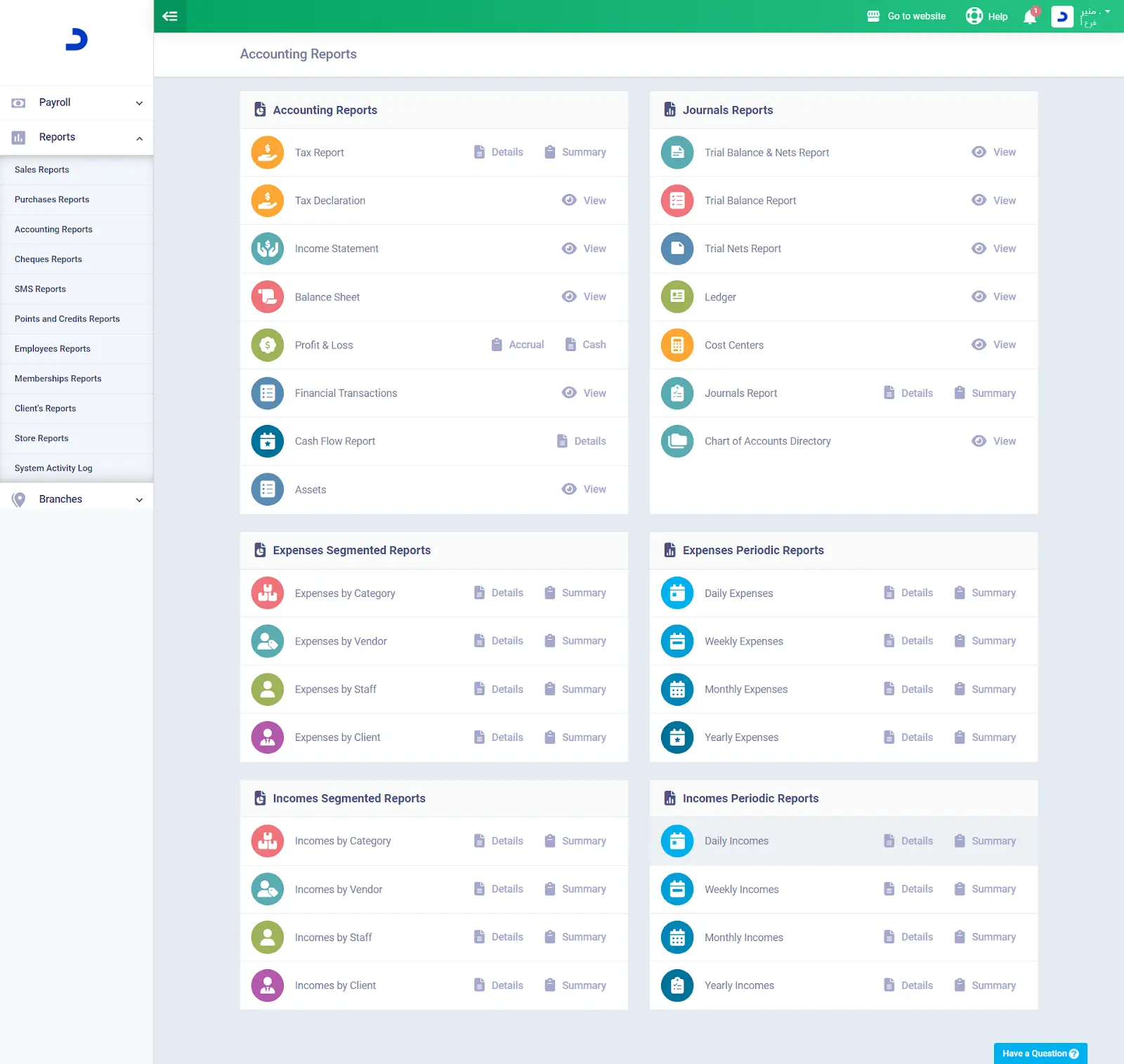

How Does Daftra Help You in Preparing a Budget?

Daftra helps in defining financial objectives related to expenses, revenues, and all their associated data, as well as allocating and classifying them easily.

This is made possible through the program’s automated interface, which provides smart solutions for managing and tracking income and expenses anytime and from anywhere. Additionally, Daftra’s accounting software allows you to analyze the gaps between the budgeted figures and the actual achieved numbers.

This is done through the financial reports generated by the system, which detail all transactions, movements, and their timing. Ultimately, this facilitates performance improvement and enables corrective actions that support financial growth and success.

.webp)

Frequently Asked Questions (FAQs)

What is a capital budget?

A capital budget focuses on planning and managing the use of capital and investments in long-term projects and assets such as equipment and buildings.

What is the difference between an operational and a capital budget?

The operational budget focuses on forecasting daily expenses and revenues of the company, while the capital budget deals with long-term investments and capital management.

What does a cash budget mean?

A cash budget involves planning and controlling cash flows in a company, focusing on ensuring sufficient liquidity to cover obligations and fund operational activities.

What is an open budget?

An open budget is a type of budget that allows frequent and flexible adjustments to financial plans to adapt to changes in the working environment.

What is an investment budget?

An investment budget focuses on planning and managing investments in new projects or expanding current activities, aiming to achieve long-term growth and profitability goals.

Who prepares the budget?

It is usually prepared by a specialized financial team within the company, in collaboration with different departments such as executive, finance, and general management.

When is the budget prepared?

The timing of budget preparation depends on the company’s policies and practices, often prepared before the start of the new fiscal year to ensure effective planning and control over expenses and revenues.

What factors affect the budget?

Several interconnected factors influence the budget:

- Increased revenue allows for a larger budget allocation for public services, while higher expenses can impact the budget’s deficit or surplus.

- Economic growth periods increase revenue, while recessions and inflation reduce the budget.

- The ratio of public debt to GDP affects budget conditions.

- Social changes, such as demographic shifts, influence supply and demand, impacting budget estimates.

- Global economic or health crises (e.g., pandemics) affect the budget by pressuring expenses and revenues.

What are the principles of budgeting?

General budgets are governed by several principles, each with exceptions:

- Unity of the budget: All state expenditures and revenues are included in one document, regardless of multiple sources or branches.

- Annuality of the budget: Each fiscal year has an independent budget for its revenues and expenses.

- Budget balance: Public expenditures should not exceed public revenues, relying only on general revenues for financing.

- Universality of the budget: The budget is prepared without assigning each revenue to a specific expenditure.

What is a personal budget?

A personal budget is a tool for managing an individual’s income and expenses over a specific period to organize finances.

What is a comprehensive budget?

A comprehensive budget is a financial plan or tool used to control all aspects of financial operations within a company during a specific period, such as a year or half-year, including all company activities.

What is a planning budget?

A planning budget is an estimated process for future plans, including financial operations and expected results over a specific period. Its goal is to set objectives and measure them.

What is an example of a cash budget?

Example: Al-Noor Company expects sales of 20,000 SAR in the first half of the year, 10,000 via bank transfer, and 10,000 in cash. Here, Al-Noor prepares a cash budget to estimate the available cash at the end of the specified period.

What is the difference between a budget and a comparison?

A budget estimates future revenues and expenses, while a comparison analyzes and compares two sets of actual financial data to identify differences and similarities in the report.

What is the difference between a budget and a financial position?

A budget sets a financial plan for the future, while a financial position focuses on the current period’s financial situation.

What are the advantages of zero-based budgeting?

Zero-based budgeting helps reduce costs and expenses, plan for efficiency improvements, optimize resource allocation, and achieve pre-set financial objectives.

What are the types of public budget deficits?

Types of public budget deficits include: primary deficit, fiscal deficit, structural deficit, and cash deficit.

What is the principle of budget balance?

The principle of budget balance ensures revenues equal expenditures, meaning no profit or loss, aiming to avoid debt defaults or negative revenue surplus.

What is the difference between a budget and a financial statement?

A budget is a financial plan estimating future revenues and expenses, while a financial statement shows the actual revenues and expenditures.

What is a budget report?

A budget report is a financial document outlining the planned revenues and expenditures for a specific period. It is used to estimate future values and compare data over different periods.

What is a current budget?

A current budget is a financial plan prepared to estimate revenues and expenses over a short period, typically for daily financial operations.

What are the steps for preparing a zero-based budget?

The steps for preparing a zero-based budget start with defining objectives and success criteria, then identifying potential sources of income and expenses. This is followed by allocating income to expenses, and finally, periodically reviewing the budget to ensure that the objectives are achieved.

What are the rules for preparing an estimated budget?

The rules for preparing an estimated budget include being realistic in reflecting actual financial conditions, comprehensive in covering all aspects of departments and activities within the company, maintaining a balance between revenues and expenses, and, most importantly, ensuring that the estimated budget is flexible and can be easily adjusted.

Conclusion: Budgeting is essential for organizations to reasonably forecast financial resources, identify risks, and make informed decisions on resource allocation. It transforms unclear concepts into actionable and measurable numbers, providing clear insights into expected expenditures and supporting data-driven decisions. Investing time in creating realistic budgets aligned with organizational goals ensures effective planning and financial control.