Retained Earnings and How to Calculate Them

Table of contents:

- What are retained earnings?

- What is the purpose of retained earnings?

- How are retained earnings calculated?

- A practical example of how to calculate retained earnings

- How does net income affect retained earnings?

- How do dividends affect retained earnings?

- What is the retained earnings statement?

- What is the difference between retained earnings and retained profits (carried-forward profits)?

- Advantages of retained earnings

- Disadvantages of retained earnings

- Frequently Asked Questions

- Conclusion

Supplying profits is considered the primary objective for most companies and institutions that offer their products and services in the markets. Ensuring the supply of profits guarantees the company’s continuity in providing its services and expanding them in the long term, and it also indicates its ability to meet its obligations toward its shareholders and external parties it deals with.

Considering profits as the main source of income for companies, management needs good planning when it comes to distributing its profits in a way that balances between fulfilling its obligations to its shareholders and enhancing the company’s financial position, and one of the most prominent tools for achieving this balance is retained earnings.

What are retained earnings?

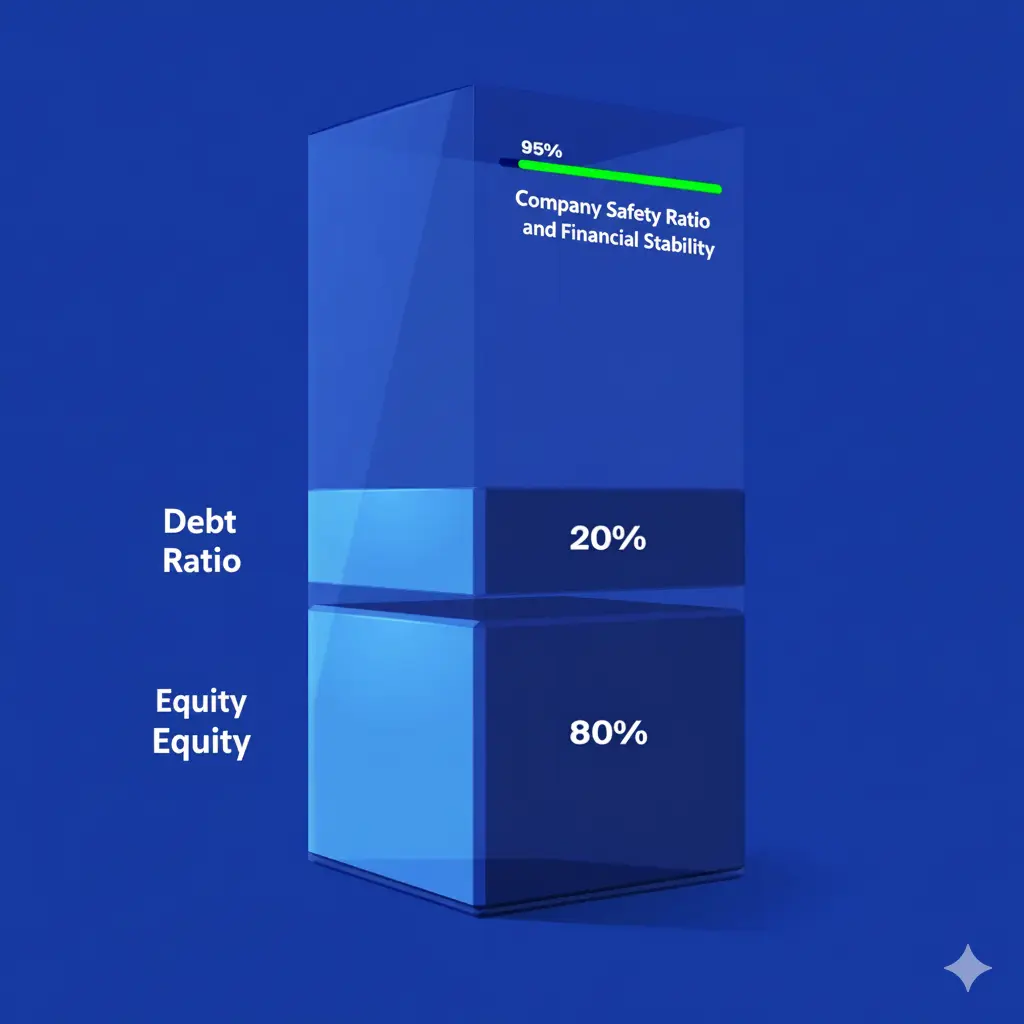

Retained earnings are the portion of net profits that the company has not distributed to its shareholders in the form of dividends or otherwise, and retained them for the purpose of investment, expansion, or debt repayment. Usually, company management is responsible for decisions regarding distributing or retaining profits, based on its assessment of the company’s financial situation and future needs.

However, shareholders have the ability to reverse the decision through a majority vote. If the company retains profits or part of them, it is obliged to record the value of retained earnings within the shareholders’ equity.

What is the purpose of retained earnings?

The importance of calculating retained earnings lies in being an internal source of investment that can support the company’s growth and financial stability in the long term, and the company may decide to retain earnings and use them for several purposes, the most prominent of which are:

- Supporting expansion plans: Companies use retained earnings to determine mergers and acquisitions or partnerships the company plans to engage in, as well as to determine the possibility of expanding the scope of the company’s operations geographically or quantitatively.

- Supporting proper investments: Retained earnings are used to support and enhance investment in launching new products or providing additional services, or investing in company departments such as research and development and marketing.

- Fulfilling obligations: Sometimes, the purpose of retained earnings is to pay off any debts due by the company.

- Improving the company’s market value: Retained earnings reflect the company’s ability to manage its resources efficiently to achieve profit, which in turn improves the company’s credit rating and increases financing opportunities available to it.

- Buying bonds: Retained earnings are used to provide additional fixed income by purchasing bonds, improving liquidity, and supporting the company’s financial stability.

How are retained earnings calculated?

Understanding how to calculate retained earnings contributes to recognizing their impact on the company’s performance and financial position in general. The steps to calculate retained earnings are as follows:

1- Collect financial data

The necessary financial information for calculating retained earnings includes:

- Total sales or revenue income.

- Net profit is calculated by subtracting expenses from revenue.

- Dividend distributions to be paid to shareholders according to their shares and the prescribed ratios.

2- Calculate net profit

Net profit for the given period is calculated for retained earnings by subtracting costs from sales revenue. These data are available in the income statement and financial statement reports, such as the income statement and balance sheet, which can easily show net profit through an integrated accounting program like Daftra Cloud.

3- Determine dividend distributions

Determining dividend distributions for retained earnings depends on the overall financial situation of the company, the policy followed for distributing profits, and the obligations due by the company. Dividend distributions may be in the form of cash or stock distributions.

4- Calculate retained earnings

Retained earnings are calculated by adding the remaining profits from the previous financial period to the net profit or loss of the current financial period, then subtracting dividend distributions either in cash or stock. You can rely on the Daftra Accounting Guide software to obtain the necessary financial data to accurately calculate retained earnings in the shortest time and with minimal effort, and to calculate net profit. This allows you to determine retained earnings easily with just a few clicks.

You may also be interested in: How to Create a Sales Invoice in Word and Excel Step by Step

A practical example of how to calculate retained earnings

Retained earnings can be calculated using the following equation:

Total retained earnings = previously retained earnings at the beginning of the accounting period (retained earnings) + net income (net profit or loss) – cash dividends and stock dividends

For clarification, we can assume that a certain company achieved profits of four million pounds during a specific financial period, in addition to previously retaining profits amounting to five million pounds.

If this company decides to distribute part of its profits, estimated at one million pounds in the form of cash dividends, in addition to two million pounds in the form of stock dividends, the total retained earnings of the company would be:

5,000,000 + 4,000,000 - (1,000,000 + 2,000,000) = 6,000,000

While its retained earnings during that financial period would be: 4,000,000 - (1,000,000 + 2,000,000) = 1,000,000

How does net income affect retained earnings?

Retained earnings increase if net income represents a net profit, while retained earnings decrease if net income represents a net loss. We can also infer the effect of all elements that impact net income on retained earnings, such as depreciation, direct and indirect production costs, and other expenses and revenue items.

It is essential not to ignore the effect of adjustments to retained earnings from previous financial periods on the total retained earnings, as these adjustments may result in the total retained earnings balance becoming either a credit or a debit before adding the net profit of the current financial period.

For example, retained earnings from previous financial periods may exceed the net losses of the current financial period, allowing the total retained earnings to maintain a positive value.

How do dividends affect retained earnings?

In addition to net income, dividends also affect the final value of retained earnings. Dividends may take one of two forms: cash dividends or stock dividends, and in general, dividends reduce retained earnings.

In the case of stock dividends, a portion of retained earnings is allocated to common stock and paid-in capital accounts. In the case of cash dividends, these distributions represent a reduction in the cash transactions account, resulting in the loss of part of the liquid assets held by the company.

What is the retained earnings statement?

The total amount of profits accumulated by the company since the beginning of its operations appears in a document called the retained earnings statement, which is part of the statement of changes in equity.

In some cases, a company may not have a separate statement documenting retained earnings; instead, this information may be recorded in the company’s balance sheet or income statement, or included as an attached document to either one.

This document shows the company’s net profit and stock dividends, indicating the amount of earnings that will be directed toward covering any losses or fulfilling the company’s various obligations apart from dividend distributions, and each document covers a specific time period mentioned within it.

What is the difference between retained earnings and retained profits (carried-forward profits)?

The main difference between retained earnings and carried-forward profits is the period over which the accumulated profits are represented. Carried-forward profits reflect what has accumulated over the years during which the company has operated, while retained earnings represent only the profits of the current financial period.

Carried-forward profits can be defined as retained earnings accumulated from previous financial periods, whether their value is positive or negative, and they are listed under the credit side of equity.

The value of carried-forward profits provides an indication of the company’s performance in previous years; however, achieving significant profits or losses in a single financial period may cause the picture reflected by carried-forward profits to be unrepresentative of the company’s current financial position.

On the other hand, total retained earnings are considered the most updated and accurate reflection of the company’s current status, as they take into account the results of previous financial periods in addition to the current one.

Advantages of retained earnings

Companies commonly rely on retained earnings for the purposes mentioned earlier because of the advantages they offer, including:

- Retained earnings provide the company with a source of financing that does not require offering guarantees typically demanded by financing entities, and they also allow expansion without affecting the company’s assets.

- The company does not need to issue any bonds, shares, or equity rights to investors when allocating part of its profits to retained earnings, which saves the company the costs and legal implications associated with such procedures.

- The company typically does not incur losses when using retained earnings for investment or debt repayment, unlike when directing those profits toward other paths with higher risk levels.

Disadvantages of retained earnings

Despite their advantages, caution should be exercised against excessive reliance on retained earnings due to some drawbacks, such as:

- Retaining earnings results in reduced dividend distributions, which may cause dissatisfaction among shareholders if it happens repeatedly.

- Continuous retention of earnings, or a significant portion of them, may raise questions regarding the company’s financial management.

- The company may need to compensate shareholders for reduced dividends by issuing bonus shares, which leads to a decrease in the company’s share value.

- Some investors, especially those seeking quick returns, may show a tendency to direct their investments toward companies that offer higher dividend payouts at the expense of reducing retained earnings.

- Retaining earnings does not grant any additional tax benefits.

Frequently Asked Questions

What does a high value of retained earnings indicate?

A company with high retained earnings may indicate financial stability and consistent profitability; however, it may also suggest that the company has unusually low dividend distributions. In general, analyzing retained earnings requires observing them over several years to identify a useful pattern for understanding the company’s financial situation.

What does a negative retained earnings value indicate?

A negative retained earnings value indicates a weak financial position and that the company is suffering from consecutive losses or losses that exceed its generated profits.

What is the retained earnings distribution entry?

The retained earnings distribution entry is the accounting treatment applied to retained earnings. This entry reflects a reduction in retained earnings by the same amount as the dividends distributed. For example, if a company has retained earnings of 100,000 and decides to distribute 30,000 to shareholders:

The retained earnings distribution entry would be as follows: Debit: Retained Earnings 100,000 Credit: Dividends 30,000

Are retained earnings debit or credit?

The retained earnings account is always a credit because it reflects accumulated profits owed to owners or shareholders.

What are retained earnings in the trial balance?

Retained earnings in the trial balance are the profits that have not been distributed to shareholders but are kept for debt repayment, expansion, and growth.

Are retained earnings part of shareholders’ equity?

Yes, retained earnings are part of shareholders’ equity and appear in the equity section of the trial balance under “retained earnings” or “reserves.”

What transactions are included in retained earnings?

The transactions or accounts that affect retained earnings include sales revenues, the cost of goods sold (including material costs, direct labor costs, and operating expenses), as well as depreciation, which reduces net profit and therefore reduces dividends and retained earnings.

Can dividends be paid from negative retained earnings?

No, dividends cannot be paid from negative retained earnings because negative retained earnings indicate losses. This occurs when total net profits are subtracted from accumulated earnings, resulting in a negative retained earnings balance. This means the company has incurred losses over a continuous period and therefore cannot distribute dividends to shareholders, increasing its risk of bankruptcy.

Conclusion

Retained earnings are a means for a company to achieve its long-term investment objectives, serving as a safe, low-risk source of financing. They also allow a company to meet its obligations and debts without resorting to external parties such as banks. Retained earnings are primarily affected by the company’s net profit or loss, as well as cash and stock dividends. They are calculated at the end of each financial period and are considered an indicator of the company’s financial stability, or lack thereof.