What is Double-Entry Bookkeeping with Practical Examples

Table of contents:

- Quick Points

- What is Double-Entry Bookkeeping?

- How Does the Double-Entry Theory Work?

- What are Some Practical Examples of Double-Entry Operations?

- What is the Difference Between Compound Entries and Double-Entry Bookkeeping?

- What are the Advantages of Double-Entry Bookkeeping?

- What are the Disadvantages of Double-Entry Bookkeeping?

- What is the Role of Technology in Double-Entry Bookkeeping Efficiency?

- How Does Daftra Make Double-Entry Bookkeeping More Efficient?

- Frequently Asked Questions

Over time, with the changes that companies face, it has become difficult to continue applying single-entry bookkeeping as business transactions increase and companies expand. Tracking financial problems takes considerable time and effort, but after the emergence of double-entry bookkeeping, it became easy to monitor all financial and accounting transactions.

In this article, we will understand what double-entry bookkeeping is and its role in ensuring the accuracy and integrity of accounting records. We will also look at how to use double-entry bookkeeping and the factors that must be considered during its implementation, as well as practical examples demonstrating how to apply double-entry bookkeeping in various industries, in addition to tips and guidance on how to use this software in your organization or company.

Quick Points

- Double-entry bookkeeping is used to record each transaction in two accounts to maintain balance in the accounting equation.

- In double-entry bookkeeping, the transaction is divided into two sides: a credit side that is reduced from its account and a debit side that is added to it.

- Total assets must always equal total liabilities plus company equity.

- To ensure double-entry bookkeeping is applied correctly, the credit and debit sides must be equal.

- A compound journal entry is a type of double-entry bookkeeping that includes more than one account on both sides, while a simple journal entry includes one account on each side.

- Double-entry bookkeeping helps reduce errors and increase the efficiency of transaction recording.

- Double-entry bookkeeping has some disadvantages, including high costs for recording transactions, consumption of human and material resources, and increased human errors.

- Double-entry bookkeeping is considered an effective tool for internal control and auditing, as it makes it difficult for employees to alter the books and hide fraudulent activity.

- Modern accounting software and artificial intelligence technologies are important tools that have facilitated the use of double-entry bookkeeping in our current era.

What is Double-Entry Bookkeeping?

Double-entry bookkeeping is a standardized accounting method used to record each transaction in at least two accounts, as credit and debit, to maintain balance in the accounting equation. Double-entry bookkeeping provides a systematic and comprehensive record of all financial transactions for the entity.

So what does double-entry bookkeeping mean in accounting? What do we conclude from the previous concept? We conclude the following from the concept:

- Transaction Recording: Every business transaction or journal entry must be recorded in at least two accounts in the books.

- Balance: Total credit accounts must equal total debit accounts.

- Equality of Total Assets with Total Liabilities: Total assets must always equal total liabilities plus company equity.

- Control Mechanism: The double-entry software provides a simple but accurate control mechanism that prevents errors and fraudulent activities.

How Does the Double-Entry Theory Work?

The basic concept behind double-entry accounting is the accounting equation, which states that Assets = Liabilities + Equity. This means that a company's total assets always equal the sum of its liabilities and owner's equity. In order to maintain this balance between both sides of the equation, the accounting transaction is recorded as a debit entry in one account matched by a credit entry in another account.

Double-entry bookkeeping is applied as follows:

| Description | Debit | Credit |

| Land (Assets) | xxxxx | |

| To: Cash (Capital) | xxxxx |

We conclude from the following model that assets such as equipment and land are debit in nature, while capital and loans are classified as credit.

How to Record Some Major Financial Operations Using Double-Entry Bookkeeping:

Double-entry bookkeeping is fundamental in accounting operations, where it is used to record all financial operations in a double-entry manner that reflects their impact on the company as a whole. It includes some journal entries as follows:

- Opening Journal Entry: This entry records the company's opening capital and initial financial resources used at the beginning of its operations. This entry is recorded on the debit side of appropriate accounts and the credit side of the cash account or accounts payable.

- Sales Journal Entry: When the company sells its products or services, this operation is recorded by recording revenue on the debit side of the revenue account, and at the same time, an increase in assets such as cash or accounts receivable is recorded on the credit side.

- Purchases Journal Entry: When the company purchases raw materials or goods for use in its operations, an increase in inventory or purchased assets is recorded on the debit side of the accounts, and at the same time, an increase in the credit account, such as cash or accounts payable, is recorded.

- Receivables Collection Journal Entry: When the company receives cash payments from customers for previous sales, an increase in cash or accounts receivable is recorded on the debit side of the accounts, and at the same time, an increase in accrued revenue is recorded on the credit side.

- Payables Settlement Journal Entry: When the company pays debts or payables to suppliers for previous purchases, an increase in the credit account for cash or accounts payable is recorded on the debit side of the accounts, and at the same time, an increase in accounts payable is recorded on the credit side.

What are Some Practical Examples of Double-Entry Operations?

Many people need some examples of double-entry bookkeeping to better understand its mechanism. Here are some practical examples:

Example 1

The following example illustrates operations carried out by a food company. The company sent the following data to its accountant to record its journal entries:

On October 1, 2023, a food company began its operations with the following assets:

- Land $500,000

- Factory $200,000

- Furniture $50,000

- Accounts Payable $90,000

- Unearned Revenue $250,000

In November, the company sold merchandise worth $60,000, and the transaction was on account. In December, it purchased goods worth $8,000 on credit, and at the end of the year, it paid for the merchandise and purchases.

The accountant applied the double-entry bookkeeping as follows:

Opening Journal Entry

| Date | Description | Debit (USD) | Credit (USD) |

| October/2023 | Land A/c | 500,000 | |

| Factory A/c | 200,000 | ||

| Furniture A/c | 50,000 | ||

| Accounts Payable A/c | 90,000 | ||

| Unearned Revenue A/c | 250,000 | ||

| To: Accounts Payable | 90,000 | ||

| To: Capital | 1,000,000 |

Sales Journal Entry

| Description | Debit (USD) | Credit (USD) |

| Accounts Receivable A/c | 60,000 | |

| To: Sales | 60,000 |

Purchases Journal Entry

| Description | Debit (USD) | Credit (USD) |

| Purchases A/c | 8,000 | |

| To: Accounts Payable | 8,000 |

Receivables Collection Journal Entry

| Description | Debit (USD) | Credit (USD) |

| Cash A/c | 60,000 | |

| To: Accounts Receivable | 60,000 |

Payables Settlement Journal Entry

| Description | Debit (USD) | Credit (USD) |

| Accounts Payable A/c | 8,000 | |

| To: Cash | 8,000 |

Example 2

A company purchases new equipment for $15,000 on account on June 1, 2022, then made the payment in October 2022, and wants to record it as double entries, so it does the following:

Equipment Purchase Entry

| Description | Debit (USD) | Credit (USD) |

| Purchases A/c | 15,000 | |

| To: Accounts Payable | 15,000 |

Equipment Payables Settlement Entry

| Description | Debit (USD) | Credit (USD) |

| Accounts Payable A/c | 15,000 | |

| To: Equipment | 15,000 |

What is the Difference Between Compound Entries and Double-Entry Bookkeeping?

Many people may wonder if there is a difference between compound entries and double-entry bookkeeping. Through the following section, we will clarify the differences and how compound entries are part of double-entry bookkeeping.

A compound entry is a type of double-entry where double-entry bookkeeping is divided into:

- Simple entry

- Compound entry

A compound entry is an entry that includes more than one account on either or both sides, whether credit or debit. It can be divided into a compound entry from the debit side, a compound entry from the credit side, and finally a compound entry from both sides. Meanwhile, a simple entry includes only one account on both the credit and debit sides. Therefore, compound entries are classified as double-entry bookkeeping.

Use the compound return calculator to automatically analyze your investment return rate for free.

What are the Advantages of Double-Entry Bookkeeping?

There are many advantages to double-entry bookkeeping, which include complete recording of various transactions, accurate error detection, and facilitating control and financial planning. In the following sections, we will explain the advantages of double-entry bookkeeping in more detail:

1- Complete Transaction Recording

One of the main features of double-entry bookkeeping is that it provides a complete record of all organizational transactions. By requiring two entries for each transaction, credit and debit with equal amounts, double entries capture complete details of all money exchanges, providing a strong audit trail and improving transparency in accounting.

2- Error Detection and Improved Accuracy

Double-entry bookkeeping facilitates error detection by always maintaining account balance and allowing easier error correction. It also increases financial reporting accuracy and provides accurate and understandable financial data for internal and external users, thereby increasing transparency of financial operations and facilitating their understanding and analysis.

3- Facilitating Control and Auditing

Double-entry bookkeeping makes it difficult for employees to alter books and hide fraudulent activity, as it is considered an effective tool for internal control and auditing. It allows recording financial operations twice and makes it easy for external auditors to verify the accuracy of financial records.

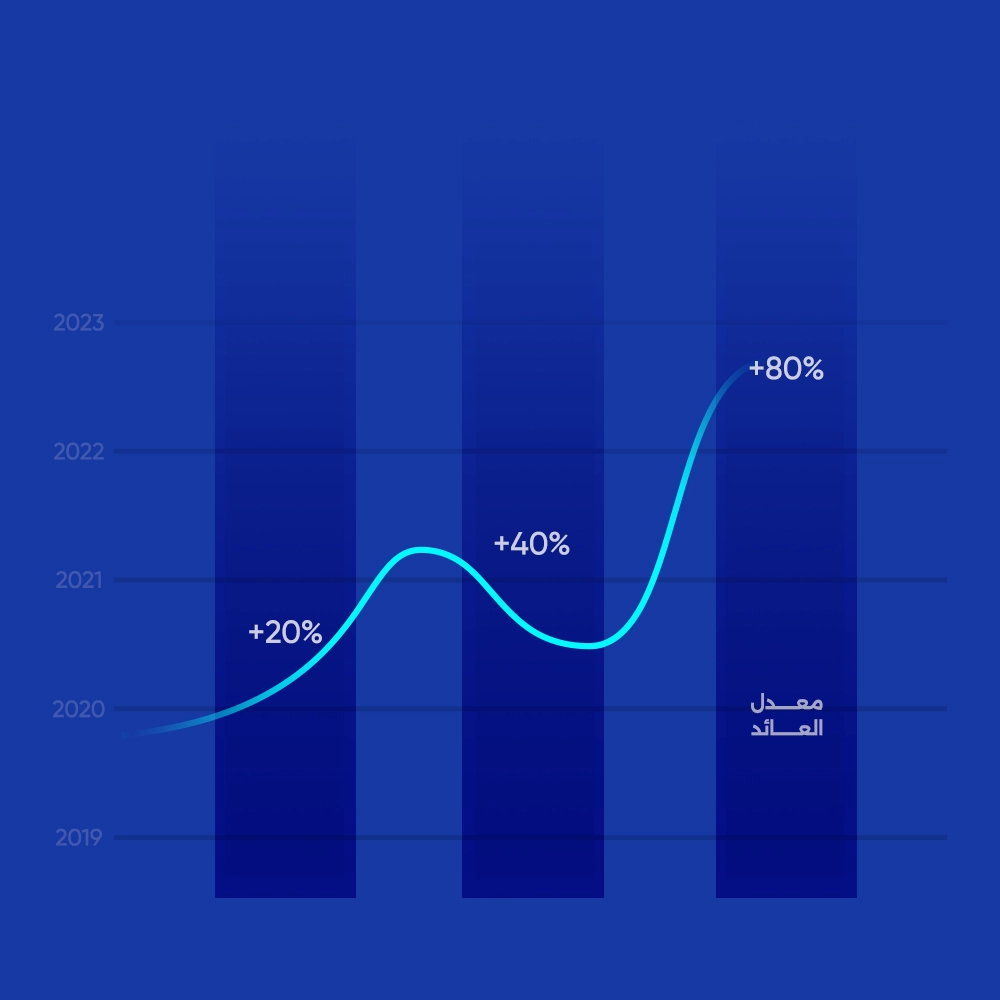

4- Assistance in Financial Planning and Increasing Future Forecast Accuracy

Double-entry bookkeeping facilitates understanding financial trends and estimating the company's past financial performance. This data can also be used to predict future trends and develop financial planning strategies for the company. Accordingly, it becomes easy to set financial goals and future strategies that contribute to the company's long-term growth and prosperity.

What are the Disadvantages of Double-Entry Bookkeeping?

There are some disadvantages present in double-entry bookkeeping that may slightly affect different organizations. It is somewhat complex to use, errors may occur, it consumes some time, and is high cost. Additionally, it consumes human resources. We will answer in the following sections the question of what are the disadvantages of the double-entry software are, but in some detail:

1- More Complex Than Single-Entry Bookkeeping

The double-entry process requires recording each transaction twice, once as a debit amount and once again as a credit amount. This method makes the process more complex than recording transactions only once in the single-entry accounting software, and this complexity increases the likelihood of errors occurring.

2- Error Opportunity

When using double-entry bookkeeping, errors can occur when transactions are not recorded correctly as credit and debit. If debit and credit balances are not balanced, this leads to errors in accounting records that must be corrected.

3- Time and Money Consumption

Recording each transaction twice takes longer compared to single-entry bookkeeping. Account reconciliation also takes longer with double-entry bookkeeping to ensure credit and debit balances match, making periodic and annual closing entries more difficult. Additionally, extra costs associated with implementing double-entry bookkeeping, such as costs of training employees on this software and using specialized accounting software, will be a burden on small companies or organizations with limited budgets.

4- Human Resource Consumption and Human Errors

Double-entry bookkeeping may require employing a larger number of accountants or using employees with advanced accounting skills, which increases human resource consumption and labor costs. Although double-entry bookkeeping aims to increase financial data accuracy, it may increase the risk of human errors, especially if not applied correctly or if there is insufficient employee training.

What is the Role of Technology in Double-Entry Bookkeeping Efficiency?

Technology facilitates double-entry bookkeeping recording and simplifies accounting processes. Here are some ways that technology contributes to improving double-entry bookkeeping:

- Modern Accounting Software: Advanced modern accounting software provides user-friendly methods that enable accountants to record financial transactions using double-entry bookkeeping efficiently and smoothly.

- Integration with Various Enterprise Management Software: Advanced technology enables integration between accounting software and company management software, such as human resource management software and customer relationship management software, which facilitates the process of recording and analyzing financial data.

- Artificial Intelligence Technologies: Advanced technologies such as artificial intelligence can be used to record and analyze financial data more accurately and quickly, to detect any potential errors in accounting records.

- Cloud Accounting Technologies: Cloud accounting provides easy access to financial data from anywhere, at any time, and facilitates collaboration and exchange between accounting team members, such as the Daftra accounting software, which provides tools for easier accounting, such as automatic transaction completion, invoicing, financial management, and much more.

How Does Daftra Make Double-Entry Bookkeeping More Efficient?

Through Daftra, your double-entry bookkeeping will be more accurate through the tools and features that Daftra provides, such as having a complete chart of accounts for your various accounts, and creating daily journal entries automatically without the need for time and effort.

Daftra supports both compound and simple entries, in addition to accuracy and error monitoring. Finally, Daftra provides you with detailed and periodic financial reports for all your operations, and these features make double-entry bookkeeping more efficient.

In conclusion, it can be said that double-entry bookkeeping is fundamental in accounting software for companies and organizations, as it provides accuracy and transparency in financial data and facilitates strategic and financial decision-making processes.

By recording each financial operation twice, double-entry bookkeeping ensures providing accurate information for financial analysis and future planning, which helps in setting goals and developing necessary strategies to achieve them.

Despite some potential disadvantages such as complexity of the accounting process and additional costs, the benefits provided by double-entry bookkeeping highlight its importance and necessity in achieving financial success and sustainability for companies and organizations.

Additionally, newer software can automate parts of the process, and double-entry logic supports modern accounting practices.

Frequently Asked Questions

What is the difference between daily entries and double-entry bookkeeping?

Daily entries are recording transactions on a daily basis and only once in either a credit or debit account, while double-entry bookkeeping records transactions twice in two different accounts, one credit and one debit, and maintains balance in the accounting process.

What is the principle of double-entry bookkeeping?

The principle of double-entry bookkeeping is that whenever a transaction occurs, there must be an opposite transaction of the same value. This means that the amount in the credit account must be the same as in the debit account and should not be more or less.

Is double-entry bookkeeping the same as the general ledger?

No, double-entry bookkeeping is specific to entering transactions in both credit and debit accounts, while the general ledger collects all different financial transactions.

What is the difference between single-entry and double-entry bookkeeping?

Single-entry bookkeeping records the transaction in only one account, while double-entry bookkeeping records transactions in both credit and debit accounts.

Who is the founder of double-entry bookkeeping?

The founder of double-entry bookkeeping was the Italian Luca Pacioli in 1494.

What is the difference between books and double-entry bookkeeping?

Books are used to record various data, while double-entry bookkeeping is responsible for recording financial transactions in credit and debit accounts.