A Guide to Government Accounting

Table of contents:

- What is the definition of government accounting?

- Characteristics of Government Accounting

- Objectives of Government Accounting

- What is the difference between financial accounting and government accounting?

- Some Government Accounting Entries

- Frequently Asked Questions

- Is Daftra suitable for managing the accounting of government companies?

It is obvious that documenting profits and achieving more of them is one of the goals of accounting in general, but despite this, there are accounting types that fall under non-profit institutional accounting, and under this type fall other types, the most critical of which is government accounting, which works to evaluate and assess accounting aspects in government agencies, and government accounting revolves around preserving public property and proper management of expenditures.

What is the definition of government accounting?

Government accounting is considered one of the most important branches of accounting science, as government organizations rely on it to evaluate their financial accounts. Government accounting also differs from other types of accounting, as it is non-commercial and does not aim to achieve profits. In addition, it is responsible for creating and improving financial reporting standards, and helps the accounting officer understand and use the financial records of local government, and then money is disbursed to pay a number of expenses related to providing services by the competent government agencies.

Characteristics of Government Accounting

- It does not aim to achieve profits, but rather to provide services to society at a nominal fee or sometimes free of charge, such as the Ministry of Health and the Ministry of Education.

- Government units are divided into revenue units, such as the Ministry of Petroleum, and non-revenue units, such as the Ministry of Higher Education, and there is no connection between the state's revenues and expenditures, as the state's expenditures do not work to generate revenues, so there is complete independence between them.

- The absence of capital for government units (which is the difference between the assets owned by any institution that generates profits and the liabilities that are considered obligations on the institution), and the state conducts its activity on an annual basis, in light of estimates provided for public expenditures and public revenues during the year.

- The absence of competition and ordinary trade elements for government activities, where there is no speculation or competition, but rather the goal is to achieve development and services for citizens.

- Revenues are not compared with expenditures, and each expenditure should not stimulate profit. Rather, the Ministry of Finance distributes the required funds to each government sector to achieve its objectives.

- The legislative authority oversees government spending, and there are laws specific to the finances and resources of government sectors to rationalize expenditure and allocate it to deserving activities, thereby avoiding embezzlement and manipulative creative accounting methods.

- Government accounting has established and largely standardized rules that are easy to apply, allowing them to be implemented in different countries.

- There is no separate legal personality created for each government entity, unlike some types of companies. However, officials are considered fully responsible for managing government resources in the best way; otherwise, they may be subject to corruption cases.

Objectives of Government Accounting

- State resources are considered the property of the entire people; therefore, dealing with them must be done with integrity and efficiency, which is the primary function of government accounting.

- As with the nature of accounting in general, one of the primary objectives of government accounting is to record government financial transactions related to the state's revenues and expenditures across its various government sectors. This involves systematically recording both estimated and actual public spending, as well as estimated and actual revenues.

- Taking laws and regulations into consideration when taking any accounting action.

- Government accounting enables people and the public to share some achievements and spending methods, thereby adding transparency to government financial transactions.

- It encourages citizens and others to comply with the taxes imposed on them, as they receive fair services in return, due to the state's effective control over its financial and accounting transactions.

- Developing more effective methods for accounting measurement, including monitoring financial accounting aspects as well as operations.

- Helping officials make correct economic and political decisions based on information resulting from government accounting.

- Facilitating judicial cases related to state sectors, as well as helping administrative and oversight organizations related to state affairs and various ministries.

- Financial information resulting from government accounting helps managerial accounting in planning and preparing budgets for each government entity separately, and, of course, the government's general budget as well.

- Issuing reports and documents continuously that benefit from evaluating the current situation of each government entity.

- Providing high-quality services at the lowest possible cost.

- Preserving public property and assets and not leaving them vulnerable to vandalism and looting without oversight, as well as maintaining their safety and conducting periodic maintenance.

- Preserving public money and conducting oversight over payments and receipts.

What is the difference between financial accounting and government accounting?

Financial accounting differs from government accounting in objectives, as well as in the mechanisms that help achieve these objectives. Here is a comprehensive comparison that shows the differences between them:

| Difference Criteria | Financial Accounting | Government Accounting |

| Objective | The objectives of financial accounting are represented in the continuous annual output of financial statements and periodic reports, which show profits and losses, cash flows, as well as the institution's financial position and cash flow movements. | It does not seek to achieve profits in a way similar to companies, but the goal is that public money is not wasted and that revenues and expenditures of government agencies are monitored and organized. |

| Accounting Theory Relied Upon | There is an accounting unit responsible for bearing the financial consequences of the company, which varies according to the type of company. If it is a capital company, the company often has a legal personality, and it is common for personal companies to conduct business with the company on a professional basis. | In government accounting, each agency or ministry is divided, and a special amount is allocated for its expenses, which somewhat resembles cost centers in cost accounting, with the big difference between them, and the financial appropriation, i.e., the amount allocated to each government agency, is considered the accounting unit on the basis of which this agency is held accountable. |

| Measurement Method | Financial transactions are recorded on an accrual basis even if these amounts were not collected at the time of recording. | Either the accrual basis or the cash basis can be used, which requires that no financial transaction be recorded until after it is collected or paid. |

| Types of Expenses | Each type of expense and revenue is dealt with independently. Expenses that generate returns in the same year and are treated as revenue are treated differently from expenses spent to purchase an asset that generates profits over long periods. Revenue expenses are reported on the income statement, and capital expenses are reported on the balance sheet. | Both types of expenses and revenues are the same for government accounting. |

| Depreciation Calculation on Assets | Based on the previous principle, where there are fixed assets with an independent list, these assets are treated, and depreciation is calculated accordingly. | Depreciation is not calculated, as assets are like any other expense and do not have special treatment. |

| Inventory and Inventory Adjustments | The balance sheet is a fundamental principle in financial accounting, which requires continuous inventory to determine the financial position of the institution at the moment of inventory and subsequent adjustments. | Inventory and inventory adjustments are not used to determine a financial position, as there is no balance sheet in government accounting; however, they can be performed for monitoring purposes to ensure that state assets have not been misused or neglected in any illegal manner. |

| Result Accounts | There is a separation between the result of commercial work in financial accounting, and results are divided into profit accounting and loss accounting to distinguish between them. | There is only one account where all expenses and revenues are recorded, and it is called the final account. |

| Budgets | The financial resources of companies control the aspects of spending that can be covered based on these resources, and budgets are based on this. | On the contrary, in government accounting, the state determines the projects that will be funded and what these projects require, then provides the necessary expenses to cover them. |

| Principle of Caution and Care | The principle of caution and care is one of the important accounting principles, and it is based on favoring losses in entries in case of confusion. | Such a principle is not considered in government accounting. |

Some Government Accounting Entries

(Administrative agencies, central agencies, external agencies, investors, taxpayers, and other revenue payers, the public, which includes the general public, excluding the previous categories) These categories help with productivity as well as communicating financial information related to government activities. Government accounting also has several functions, including providing information necessary for financial and administrative accountability, facilitating oversight purposes, and providing data for preparing national accounts. Accounting entries are made in the manner shown below:

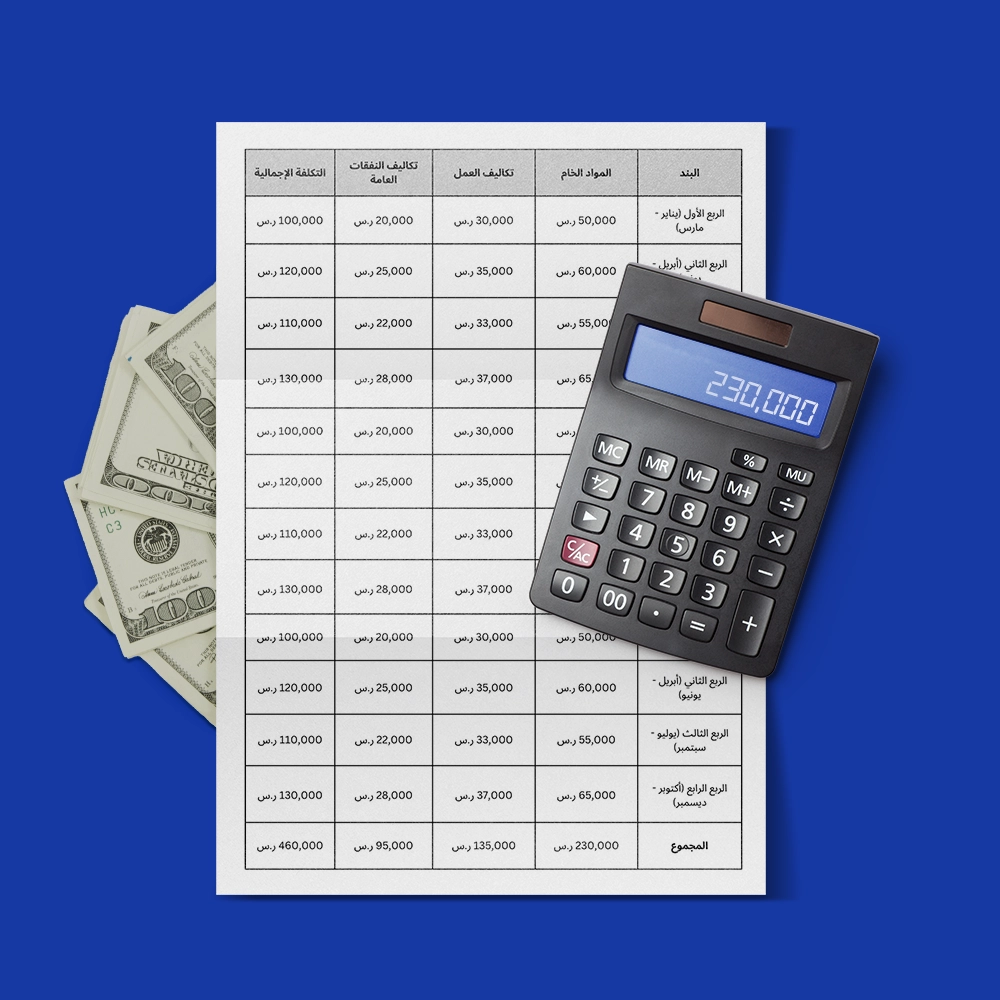

Accounting Entries in the Main Accounting Unit (which has budget appropriations)

When spending on current expenses (the entry is made as follows):

From A/c Expenses -- Relevant Items

To Mentioned

A/c Creditors -- Various Deductions

A/c Payment Order -- Current

When paying deductions and spending on the same budget item (the entry is made as follows):

From A/c Creditors -- Type of Deductions (Taxes -- Pensions -- Unions and Associations -- Solidarity Fund)

To A/c Payment Order -- Current

Taking into account that payments between government agencies are executed through a settlement order on the system.

After settling the payment order and printing the account statement through the system (the entry is made manually as follows):

From A/c Payment Order -- Current

To A/c Central Accounting Unit -- Relevant Account.

Frequently Asked Questions

What are the standards of government accounting?

Just like the international accounting standards related to financial accounting, there are standards for government accounting called GASB, and although they relate more to the United States of America, you will not find a big difference between them and what is applied in various parts of the world.

The most important principles of government accounting are:

- The system of recording financial transactions in government accounting may follow either single-entry or double-entry accounting.

- Depending on the division of government agencies into different sectors, expenses and profits are recorded under these agencies; they are not all classified comprehensively at the same time.

- Recording government assets and continuously revaluing them, as they are important wealth and resources for the country.

- Annual and perhaps quarterly or semi-annual reports are issued to evaluate the performance of institutions belonging to the government sector.

- The necessity of accuracy in budget release dates, so that government procedures proceed in their routine course of approvals for officials, voting on the budget, and others.

Is public accounting the same as government accounting?

The short answer is yes, public accounting is the same as government accounting. The term "public" is a distinguishing criterion that separates government accounting from other types of accounting, and it is also applied to financial accounting and related corporate accounting operations, such as private accounting, which focuses on matters concerning private funds, not public funds, and the public property of the state, as in government accounting.

However, one must distinguish between public accounting and general accounting. While public accounting refers to government accounting, general accounting is a term that refers to accounting itself in general, with everything that falls under one accounting branch.

What are the functions of government accounting?

Government accounting, as we said, does not aim to generate profits, so what are the functions it performs?

The functions of government accounting are divided into two main functions:

Monitoring:

The monitoring function is considered the strongest foundation of government accounting, where it must be ensured that all government agencies preserve property and apply laws to achieve the greatest benefits at the lowest costs.

Management:

It is known that administrative decisions based on an accounting basis are considered under the branch of managerial accounting, but because government accounting has a special nature and is not subject to all the rules and methods of financial accounting, the administrative financial aspects are considered under the heading of government accounting itself and among its functions.

What distinguishes government accounting?

There are many advantages that are specific to government accounting compared to other types of accounting, the most prominent of which are:

- Government accounting will not tell you whether you made profits or incurred losses, as this is not part of its functions at all.

- The rules followed for recording financial transactions are subject to government financial policies and regulations.

- All financial transactions are banking.

- A budget is allocated to each government agency in the general budget, and governments must adhere to it.

- Internal accounting auditing is not from an external party like accounting in companies and private entities.

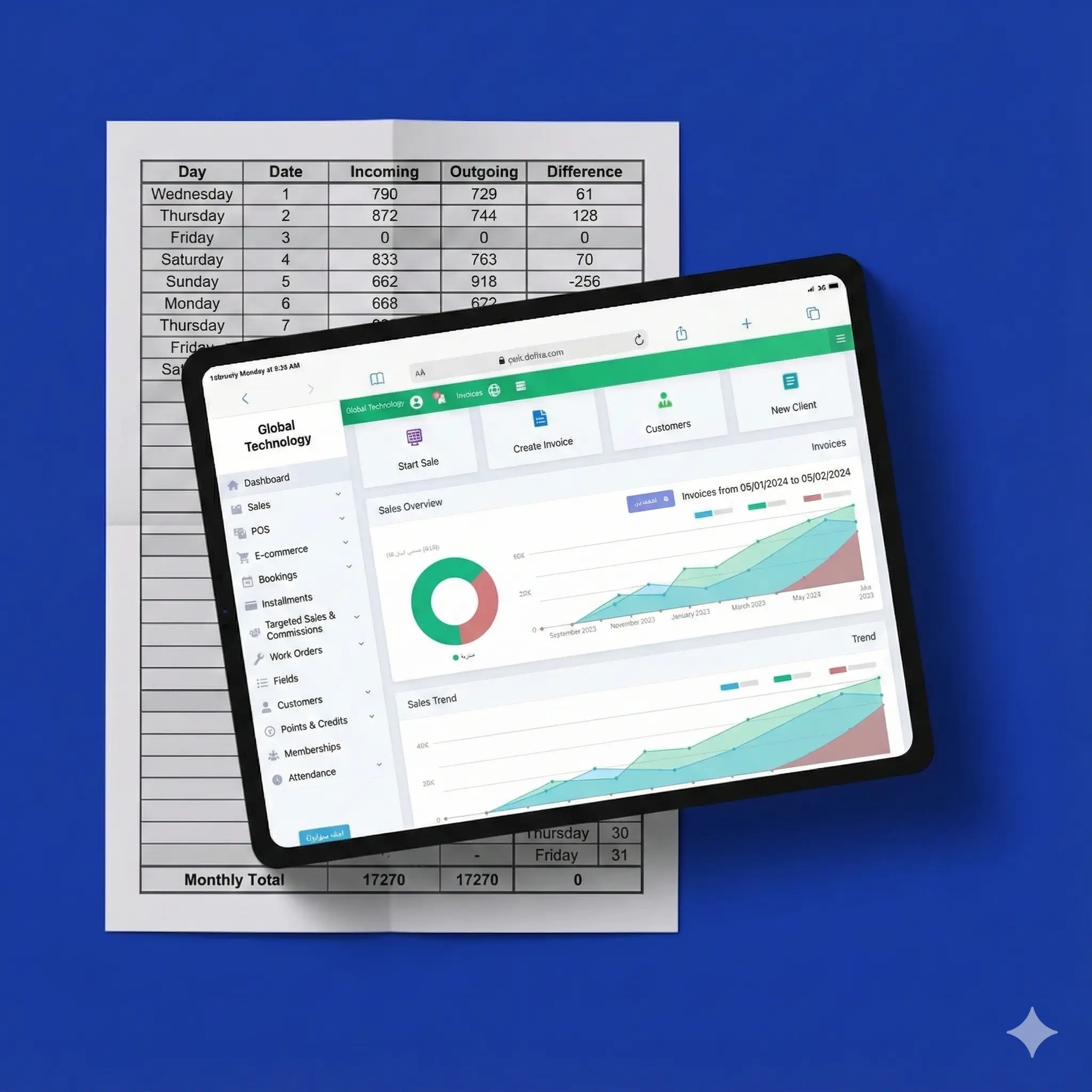

Is Daftra suitable for managing the accounting of government companies?

Daftra's accounting software has a tremendous ability to be adapted to suit the needs of the entity that uses it. The system can also be configured to manage government agencies, both revenue and non-revenue, in a way that serves the principles and rules of government accounting in your country. Daftra will not only help you manage accounting work, but also assist you in controlling employees, administrative operations, and oversight, among other tasks. In short, Daftra can always be in the form you want.