What are Financial Statements and Their Types

Table of contents:

- What are Financial Statements?

- Types of Financial Statements

- Preparing Financial Statements for Companies

- Order of Preparing Financial Statements

- Basis for Preparing Financial Statements

- Timing of Preparing Financial Statements

- Preparing Financial Statements for Equal Financial Periods

- Exercises on Preparing Financial Statements

- Financial Analysis of Financial Statements

- What are the Characteristics of Financial Statements?

- What are the Objectives of Financial Statements?

- The Difference Between Financial Statements and Financial Reports

- Frequently Asked Questions About Financial Statements

- How can Daftra help you prepare financial statements?

Financial statements serve as the backbone of any business enterprise, as they contribute to creating a detailed and comprehensive picture of a company's financial performance, including revenue, expenses, assets, and liabilities. Whether you are an investor, lender, or business owner, understanding financial information is absolutely essential for making informed decisions about the company's future.

In this article, we will explore together the importance of financial statements and their various types, as well as how to prepare and analyze them effectively. So, continue reading if you are ready to dive into the world of financial data.

What are Financial Statements?

The term "financial statements," sometimes referred to as financial reports, refers to five reports prepared to review a company's financial performance during a specific period. These statements contain information about assets, liabilities, revenue, expenses, net income, and other financial data. These reports are: the income statement, balance sheet, cash flow statement, statement of changes in equity, and statement of comprehensive income.

These reports aim to present the company's financial performance during the accounting period to provide this information to both external and internal parties, in addition to helping senior management make decisions and form a clear vision for the company's financial future. To ensure their reliability and accuracy, financial statements are prepared in accordance with accounting principles and by a certified accountant who is often independent of the company.

Both internal and external users can read and access these statements; however, they are typically prepared specifically for external users such as shareholders, investors, and regulatory bodies. This is because internal users—management and certain employees—have other sources of information in addition to the information contained in the financial statements.

Types of Financial Statements

The types of financial statements in accounting are those prepared by the financial accountant in accordance with the accounting principles applied in the company or organization, so that various parties can benefit from them subsequently.

It is worth noting that financial statements play a pivotal role in achieving the main objectives of accounting. In addition to being a fundamental factor relied upon when making decisions, the income statement, for example, determines the result of the economic entity's activity (profit or loss) during a specific time period.

Through the balance sheet, the financial position is determined in terms of assets, liabilities, and equity. Through the cash flow statement, net cash inflows and outflows are determined, thereby achieving the main objectives that financial accounting seeks to accomplish.

The types of financial statements in financial accounting are as follows:

1- Income Statement:

The income statement is used to present the company's net income for a specific accounting period. This period covered by the income statement is indicated in its heading, in addition to showing the company's or organization's revenues and expenses during the mentioned period, as well as the value of profits or losses resulting from the company's activities.

Accordingly, the income statement adheres to one of the most fundamental accounting principles, namely the matching principle, which requires revenues earned during a specific period to be matched against expenses incurred during the same period.

Read now: Everything you want to know about the income statement, its importance, and types.

Also read: Definition of gross income.

2- Balance Sheet:

Also known as the statement of financial position, this statement presents the financial position, which includes assets, liabilities, and equity. These three elements should be detailed to understand the contents of each element and calculate the total working capital.

It is essential to note that the balance sheet is considered a statement and not an account, because it is prepared outside the accounting books. This is one of the common accounting mistakes that many beginners make.

Read now: What is the balance sheet and how to prepare it.

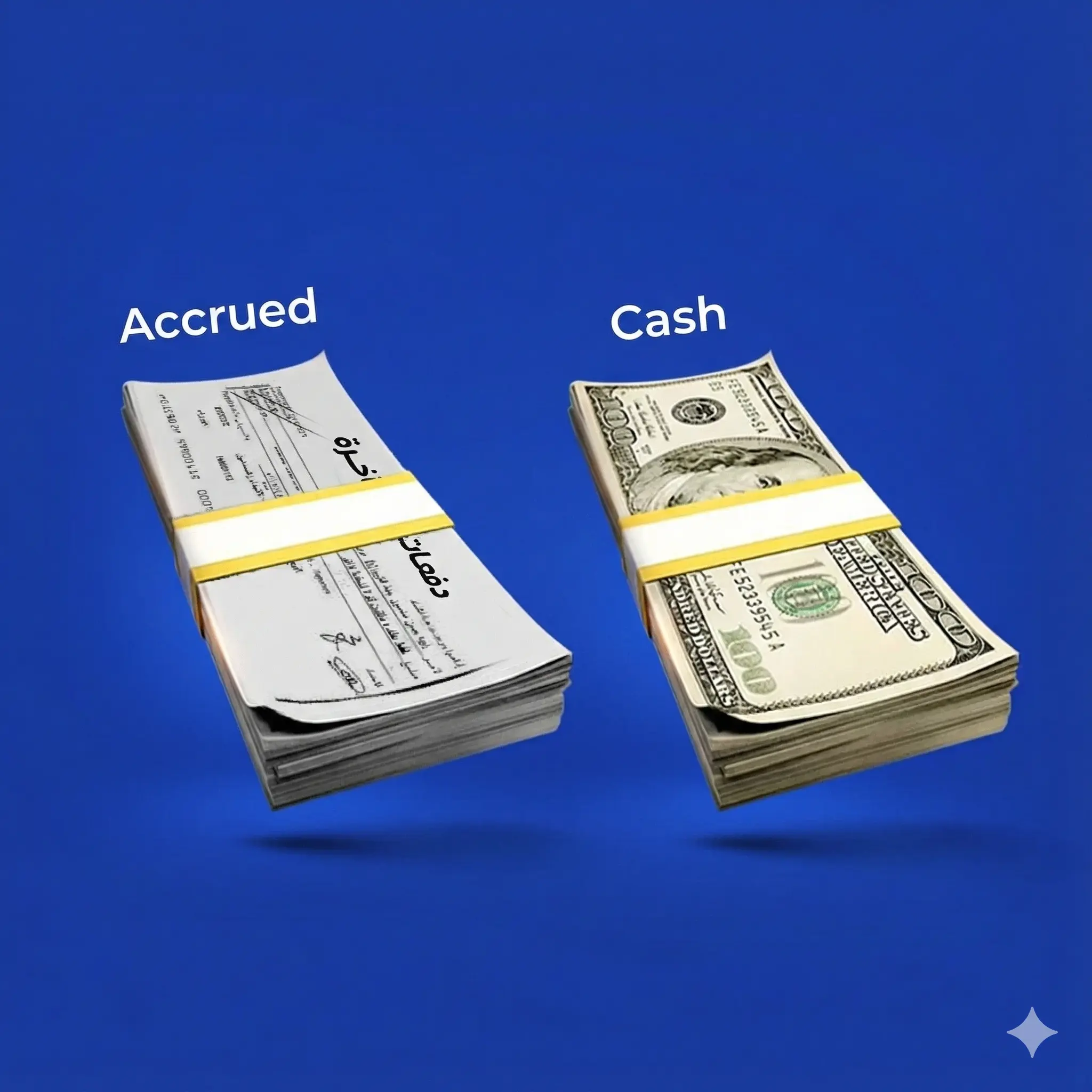

3- Cash Flow Statement:

The cash flow statement contains a presentation of cash flows that occur from the company's or organization's activities during a specific time period. Cash flows result from operating, investing, or financing activities according to the company's or organization's activities.

In each of the three types of activities: operating, investing, and financing, the cash flow statement shows cash receipts and deducts cash payments to arrive at net cash flows during the time period, thus enabling us to determine the cash balance at the end of the period.

Read now: Everything you want to know about the cash flow statement, its components, and how to prepare it.

4- Statement of Shareholders' Equity:

This is the statement that shows shareholders' equity from the basic elements that make up the accounting equation. It presents the elements related to shareholders' equity in detail in the balance sheet. Examples of shareholders' equity data include treasury shares and retained earnings.

The importance of this type of financial statement lies in the fact that it is a means to determine the value of the project's capital at the end of the period, after considering the capital at the beginning of the period, additional investment funds, net income or loss, and withdrawals.

Read now: What is the statement of equity or shareholders' equity, and its importance?

5- Statement of Comprehensive Income:

The statement of comprehensive income is considered one of the most important financial statements for external parties. This statement contains two basic elements: first, net income taken from the income statement; and second, other comprehensive income, which has a positive or negative value and in turn affects shareholders' equity and retained earnings.

The role of the statement of comprehensive income is complementary and not a substitute for the role of the comprehensive income statement we explained above, as it deals with other elements that may contribute in one way or another to changing the profit and loss equation, such as gains and losses related to foreign currencies, exchange rates, or buying and selling securities.

Also read: The impact of exchange rate changes on accounting operations.

Preparing Financial Statements for Companies

When discussing how to prepare financial statements, it is essential to note that the process involves several stages. First, a trial balance is created, which is a table that summarizes all financial transactions of the organization. This is followed by the preparation of each financial statement individually.

If we want to discuss this in some detail, we would say that financial statements are prepared by first creating a trial balance, which is a table consisting of a description column that usually includes: cash, accounts receivable, accounts payable, capital, expenses, sales, and purchases. Financial results are recorded as debit and credit entries for the above under each of the following items: opening entries, transactions, totals, and balances.

Then each financial statement is created individually, starting with the income statement, moving through the balance sheet or statement of financial position, and ending with the cash flow statement, statement of shareholders' equity, and statement of comprehensive income.

The income statement is prepared by determining revenues and subtracting expenses from them to arrive at gross profit or loss. The balance sheet is prepared by presenting assets by type and liabilities by type and determining the total of each. The cash flow statement is prepared by clarifying cash flow operations resulting from economic, operating, and investment activities during the accounting period in order to calculate net cash flow for all company activities.

The statement of changes in equity is prepared by comparing the opening balance with the closing balance, including capital and profit accounts, to arrive at net equity at the end of the period. Meanwhile, the statement of comprehensive income is prepared by adding total foreign currency gains/losses, exchange rate gains/losses, and securities gains/losses to net profit/loss to arrive at comprehensive income.

For more details on how to prepare each statement individually, you can refer to the article specific to each statement through the links I left above, where you will find detailed explanations with illustrative examples.

In the context of our discussion about financial statements,

It is important to note the existence of what are called "consolidated financial statements" that are created when there is a parent company that has one or more subsidiary companies (a group of companies). Considering these companies as one economic entity, consolidated financial statements are used.

Regarding the preparation of consolidated financial statements, this is achieved by creating a separate financial statement for each company. The company can choose to account for its investment in its subsidiary, joint ventures, or associate companies either at cost or according to financial instruments standards.

Order of Preparing Financial Statements

Regarding the order of preparing financial statements, it was previously mentioned that financial statements are prepared in ordered stages, as follows: trial balance, then income statement, then balance sheet (statement of financial position), then cash flow statement, which depends on data from the income statement and balance sheet outputs.

Basis for Preparing Financial Statements

This order in which financial statements should be prepared indicates that financial statements have a methodology. This methodology follows principles and foundations that ensure financial statements achieve their intended purpose. Among the most important principles and foundations for preparing financial statements are:

- Historical cost principle

- Realizable value principle

- Principle of truthfulness and disclosure

- Matching principle

Timing of Preparing Financial Statements

Financial statements are prepared at the end of the accounting period, which is the time period during which financial operations are recorded, and typically constitutes a full year aligned with the fiscal year. However, this is not a requirement, as it may be a quarter or half a year, taking into consideration compliance with legal requirements and policies that may differ from one country to another.

Preparing Financial Statements for Equal Financial Periods

Since we discussed the timing of preparing financial statements in the previous point, we must mention preparing financial statements for equal financial periods. What is meant by preparing financial statements for equal financial periods?

This means that the time span during which financial statements are prepared should be equal from one financial statement to another, so it should not be six months one time and a full year another time, for example. It should be noted here that preparing financial statements for equal financial periods is a practical application of one of the most important accounting principles, which is the accounting period principle.

Exercises on Preparing Financial Statements

Here is a practical example of preparing a financial statement for a hypothetical company called "Company S" for the year 2022.

First: Trial Balance

The statement shown in the table below displays the account balances that appeared in the trial balance for Company S for the year 2022:

| Account Name | Credit Balance | Debit Balance |

| Cash | - | 15,200 |

| Capital | 18,000 | - |

| Bank | - | 9,800 |

| Revenue | 15,000 | - |

| Salaries | - | 8,000 |

| Marketing expenses | - | 800 |

| Electricity expenses | - | 1,000 |

| Rent expenses | - | 3,500 |

| Creditors | 5,500 | - |

| Accrued revenue | - | 200 |

| Total | 38,500 | 38,500 |

Second: Preparing the Income Statement

| Item | Amount |

| Revenue | 15,000 |

| Operating expenses: | |

| Rent expenses | |

| Salaries | |

| Electricity expenses | |

| Marketing expenses | 13,300 |

| Net Income | 1,700 |

Third: Closing Revenue Account

| Item | Credit Balance | Debit Balance |

| From Revenue Account | - | 15,000 |

| To Profit and Loss Account | 15,000 | - |

| Closing the revenue account in the income summary account | - | - |

Fourth: Closing Expense Accounts

| Item | Credit Balance | Debit Balance |

| From Profit and Loss Account | - | 13,300 |

| To: | ||

| Rent expenses account | 3,500 | |

| Salaries account | 8,000 | |

| Electricity expenses account | 1,000 | |

| Marketing expenses account | 800 | |

| Closing expense accounts in the income summary account | - | - |

Fifth: Statement of Changes in Equity

| Item | Amount |

| Capital at the beginning of the accounting period | 18,000 |

| Net profit | 1,700 |

| Net equity at the end of the period | 19,700 |

Sixth: Closing Income Summary Account

| Item | Credit Balance | Debit Balance |

| From Profit and Loss Account | - | 1,700 |

| To Owner's Current Account | 1,700 | - |

| Closing the income summary account in the owner's current account | - | - |

Seventh: Balance Sheet

| Item | Amount | Total |

| Total Assets: | ||

| Cash | 15,200 | |

| Bank | 9,800 | |

| Accrued revenue | 200 | 25,200 |

| Total Liabilities and Equity: | ||

| Creditors | 5,500 | |

| Capital | 18,000 | |

| Owner's current account | 1,700 | 25,200 |

Financial Analysis of Financial Statements:

To understand financial statements, one cannot rely superficially on the figures from different types of financial statements. Therefore, more than one specialized financial analysis should be conducted with the aim of clarifying and explaining the causes of financial problems, as well as understanding their effects on various elements of the company or organization, in addition to studying operational activity and profits resulting from this activity.

Comparisons are also made to track specific financial statements over several years to observe increases or decreases in the value of financial statements. This comparison is done both horizontally and vertically, and financial ratios can be relied upon to show the relationship between a set of financial data using percentages.

Financial analysis is conducted in the following steps:

- First: Determining the objective behind the analysis, to specifically focus on financial data relevant to the objective while considering all other financial data that may have an indirect relationship to the purpose of financial analysis.

- Second: Setting a time frame for the period whose financial data will be analyzed. If the objective is to evaluate the company's overall financial performance, it is preferable to conduct financial analysis for several periods to ensure objective results.

- Third: Extracting financial data and information from their accounting-recognized sources to use as material for analysis.

- Fourth: Determining the methodology and tools used in the financial analysis process.

- Fifth: Implementing the financial analysis while adhering to the previously determined methodology and tools.

- Sixth: Observing results from the analysis and proposing necessary recommendations to management to help them make decisions.

Methods of Financial Statement Analysis

The methods and approaches used in analysis differ based on the analysis objective, the nature of the analyzed material, and the time period. These methods are horizontal analysis, vertical analysis, and ratio analysis. Here is an explanation of each of the three methods:

First: Horizontal Analysis: Also known as trend analysis, where analysis is conducted to determine the percentage change between one period and another, with one being the base and the other being the period we want to observe the magnitude of change in.

Second: Vertical Analysis: Vertical analysis, or static analysis as it can be called, is conducted within one period rather than two periods, where each item is analyzed as a percentage of its total.

Third: Ratio Analysis: There are several financial ratios used in financial analysis, the most important of which are liquidity ratios, activity ratios, debt ratios, and profitability ratios.

- Liquidity ratios are used to measure the company's ability to meet its short-term obligations.

- Activity ratios are used to measure the company's efficiency in managing its current assets.

- Profitability ratios are used to measure the company's ability and potential to generate profits and predict investment returns.

- Debt ratios measure the extent to which the company relies on debt to finance its investments and assets and determine financing sources, whether internal or external.

Practical Examples of Financial Statement Analysis

In the following lines, I will present practical examples of financial analysis using each of the analysis methods we just mentioned.

Example of Horizontal Analysis: If we want to know the percentage change in current assets between 2020 and 2021, 2020 would be the base year. Based on this, we subtract the value of current assets in 2021 from the base year 2020, then divide by the current assets value for the base year, and multiply this number by 100 to get the percentage change. It's important to note that we must compare the same time span between two periods, not between a year and a month, for example.

Example of Vertical Analysis: If we want to know the percentage of cash from total assets, we divide cash by total assets, and this will show us the cash percentage of total assets as part of the whole, thus enabling us to determine the percentage change that occurred in each account individually during a single period.

Example of Ratio Analysis: Analysis using financial ratios is conducted by comparing two items from the financial statement, such as comparing profits to sales to arrive at the profitability ratio, and comparing current assets to current liabilities to determine the liquidity ratio, and so on.

What are the Characteristics of Financial Statements?

Financial statements are distinguished by several characteristics, the most important of which are:

Clarity:

Financial statements provide data and information about financial operations based on their actual content.

Relevance:

This ensures that financial statements provide management accounting with sound financial data, helping decision-makers in the company or organization evaluate the current situation and predict future events.

Comparability:

Financial statements provide the ability to compare them in order to determine the direction of the financial position.

See also: Definition of comparative financial statements.

Materiality:

Financial statements contain all important elements that affect the decision-making process, and the financial information necessary to determine the organization's position.

Reliability:

This means the truthfulness of data and information contained in financial statements, free from influence by personal ideas or thoughts of those responsible for preparing these statements. In addition, reliability includes applying the completeness of information provided through financial statements.

What are the Objectives of Financial Statements?

Financial statements should achieve the required objectives to ensure they communicate the financial truth upon which critical and non-critical organizational decisions are based. Among the most important objectives that financial statements should achieve are:

- Focusing on all groups related to financial statements, especially current and potential investors and creditors.

- Monitoring information that helps estimate the size of risks affecting the company's cash flows.

- Using measures of change in crises and materials related to measuring the company's income.

- Providing reliable information about the company's economic elements to measure strengths and weaknesses.

- Providing information about changes appearing in total resources resulting from profit-targeted activities, in order to understand expected returns from the investment process.

- Disclosing all appropriate data and information for the needs of individuals using the financial statements.

The Difference Between Financial Statements and Financial Reports

In accounting, there are what are known as financial reports alongside the financial statements that we detailed above. In reality, many people confuse the two, and some think they are the same thing when they are actually different. Financial statements are a specific set of reports, which are five: income statement, balance sheet, cash flow statement, statement of shareholders' equity, and the statement of comprehensive income was recently added to the above.

Financial reports, however, are of two types:

- First type: Related to financial statements, which are periodic financial reports consisting of financial statements with additional explanatory notes and supplementary disclosures used to support decision-making. Therefore, they provide both financial and non-financial information.

- Second type: Non-periodic financial reports that are not linked to financial statements, but are created as needed to monitor the company's financial performance.

Frequently Asked Questions About Financial Statements

How are financial statements audited?

Financial statements are audited by a certified financial auditor, who is usually independent of the company, especially when there are external parties such as shareholders, to ensure objectivity. According to accounting rules and professional standards, the auditor performs his duties by verifying:

- The accuracy of financial data and its compliance with international accounting standards.

- The absence of any conflicts or errors in the information.

- The performance of the internal control system in managing financial resources.

- The company's ability to bear financial risks.

- The company's potential to achieve gains in the future.

In light of the above, the auditor issues his final report and comments and recommendations regarding the financial statements, based on which financial decisions are made.

Where does Value Added Tax (VAT) appear in financial statements?

The location where VAT appears in financial statements differs based on whether the tax is in a sale or purchase transaction. In the case of purchases, VAT appears in the balance sheet under current assets (debit), and in the case of sales, VAT appears in the balance sheet under short-term liabilities (credit).

Who is responsible for preparing financial statements?

Usually, the company's accountant or a group of accountants in the company undertakes the task of preparing financial statements based on professional standards. In other cases, large companies seek assistance from accounting firms or external accounting offices that take responsibility for preparing financial statements.

Who is primarily responsible for the truthfulness and fairness of financial statements?

The person responsible for the truthfulness and fairness of financial statements before external users, such as shareholders and lenders, is the company president, while the primary responsible person before the company president is the financial manager. In case of using an external accountant, they become responsible before the company and its external users as well.

How do you read financial statement ratios?

The most important financial statement ratios are read in light of the following equations:

- Current ratio = Current assets ÷ Current liabilities

- Quick ratio = (Current assets - Prepaid expenses) ÷ Current liabilities

- Cash ratio = (Cash + Short-term investments) ÷ Current liabilities

- Gross profit margin = Gross profit ÷ Net sales

- Net profit margin = Net profit ÷ Net sales

- Debt ratio = Total debt (short-term debt + long-term debt) ÷ Total assets

When are financial statements prepared?

Financial statements are prepared at the end of the financial period, including the income statement, balance sheet, cash flow statement, statement of shareholders' equity, and statement of comprehensive income.

Who are the beneficiaries of financial statement auditing?

There are several parties that benefit from financial statement auditing as follows:

- Investor: Financial statements indicate the company's prospects for expansion and continuity in the future.

- Regulatory authority: Government agencies use financial statements to ensure companies comply with the law.

- Shareholders: Shareholders benefit from financial statements to ensure the company's performance and compliance with the law.

- Management: Management benefits from financial statements in several matters, including decision-making and obtaining financing.

How are financial statements consolidated?

Here are the basic steps for preparing consolidated financial statements:

- Identifying subsidiary companies that must be included in consolidated financial statements.

- Determining accounting policies and procedures used by each subsidiary.

- Adjusting separate financial statements of each company to comply with the parent company's accounting policies and procedures.

- Eliminating inter-company transactions between sister companies, and including only subsidiaries.

- Calculating non-controlling interests for subsidiaries not 100% owned by the parent company.

- Merging separate financial statements of subsidiaries with the parent company's financial data to create consolidated financial statements.

How are financial statements reviewed electronically?

Accounting software now plays a major role in preparing financial statements, as it records daily entries from the beginning of the accounting period in the chart of accounts, and based on this, financial statements are created. However, this requires using accounting software by a professional accountant familiar with the system the program operates on, so they can provide recommendations and interpret financial data to benefit senior management in decision-making.

Which companies are required to prepare financial statements?

All companies - including sole proprietorships - are required to prepare financial statements and submit them to relevant parties and competent regulatory authorities.

How can Daftra help you prepare financial statements?

Relying on accounting software has become indispensable with the development we are experiencing in all fields. However, Daftra is not designed just for issuing and recording invoices, but is designed with the assistance of accounting experts to cover the accounting cycle from beginning to end and issue financial statements automatically and effortlessly.

Daftra helps you adjust the chart of accounts settings and record daily entries automatically and accurately for use in issuing income, balance sheet, and cash flow reports, thus issuing financial statements. Not only this, but Daftra also provides you with the service of consulting with one of the certified accountants to help you provide clarifications and recommendations.