A Comprehensive Guide to Managerial Accounting

Table of contents:

Managerial accounting is considered a modern development of cost accounting. It works to identify, measure, collect, analyze, and explain financial information, which management uses in planning and control operations and helps in decision-making. Therefore, we will discuss managerial accounting in some detail in this topic, along with recommending the most beneficial methods for successfully implementing managerial accounting, as well as the best programs and systems for managing all your accounting operations, including managerial accounting.

What is Managerial Accounting?

Managerial accounting is one of the types of accounting and is considered an information system that specializes in collecting, classifying, analyzing, and storing basic data as well as information resulting from other subsystems for information within the company in the form of paper files or using electronic accounting software that allows cloud storage via the internet; for the purpose of producing quantitative information, whether financial or non-financial, to help management in planning, control, and decision-making.

Managerial accounting is often performed by a managerial accountant to help the company perform internal operational accounting duties such as managing company assets, taxes, and payroll. Managerial accounting focuses on the administrative planning and control of executive procedures to ensure the achievement of required administrative objectives, as it differs from financial accounting.

The Importance of Managerial Accounting

Managerial accounting plays a crucial role in supporting company management, encompassing planning, organizing, controlling, and decision-making. Each role is clarified as follows:

The Role of Managerial Accounting in Planning

It helps the company determine the procedures and steps to take, as well as define objectives, while establishing appropriate programs to access different resources and utilize them to achieve those objectives. The role of the managerial accountant is to perform the task of collecting data that helps management prepare plans.

The Role of Managerial Accounting in Organizing

Managerial accounting contributes to determining the best methods, procedures, and means by which the company's available resources of various types can be organized in a way that helps implement previously prepared plans.

The Role of Managerial Accounting in Control

Managerial accounting plays a crucial role in measuring and correcting actual performance to ensure the company achieves its objectives and plans. It also ensures that actual implementation aligns with established plans, enabling the ability to make informed decisions in the event of crises or deviations from previously established plans. The role of managerial accounting also appears in providing necessary information to help management perform monitoring tasks accurately.

The Role of Managerial Accounting in Decision-Making

Managerial accounting helps in choosing the most appropriate alternative from available options to ensure the achievement of management's objectives. It provides information that supports management in identifying available alternatives and determining the best choice for the company.

Objectives of Managerial Accounting

The objectives of cloud accounting are an answer to why this accounting branch was developed:

(1) The primary purpose is making decisions related to financial and administrative aspects based on analyzing current and previous data to reach the stage of favoring one decision over others. Managerial accounting decisions require two things:

- Speed: We refer to speed in decision-making and the ability to provide and prepare data in advance, enabling prompt and informed decisions at any time.

- Clarifying and reducing losses: Managerial accounting differs significantly from financial accounting.

(2) Investigation to provide the necessary data and provide tools and methods of high efficiency to analyze this data.

(3) It has an effective role in organizing and monitoring company operations.

(4) Striving for accuracy as much as possible to provide correct information and consequently reduce the probability of failure or making an incorrect decision.

(5) Motivating company employees and achieving its objectives.

(6) Proactive solution to prevent problems before they occur, which makes it an exemplary method for managing disasters and problems.

Principles of Managerial Accounting

No science exists without laws and rules, and likewise the branches of accounting science, no matter how specialized they are - such as construction accounting which focuses only on a specific sector of companies that has a different business cycle, and no matter how different their objectives are - such as corporate accounting which focuses on providing financial data related only to companies and not other organizations like profit distribution among partners, must have their own principles. So what are the most important principles of managerial accounting?

- Designing a System for Information Collection: Managerial accounting thrives on abundant information, which makes collecting information, maintaining records, and examining all reports an objective that requires established methods to gather the largest possible amount of information.

- The Principle of Measurement and Matching: This principle involves matching data from financial accounting, cost accounting, and tax accounting with the information that management needs, ensuring that all this data can be adapted to serve the purposes of the administrative process.

- The Principle of Precaution: This means reviewing reports and data provided to the managerial accountant and not accepting the correctness of the data at face value, to avoid making incorrect decisions.

- Objectivity: This means that information should be objective and not influenced by personal opinions, but based only on data.

- Working at the Administrative Level: Managerial accounting is not as comprehensive as financial accounting, for example, but it has a specific aspect in which it excels, which is the administrative aspect, and helps decision-makers in the institution.

What are the Methods of Managerial Accounting?

There are many methods used in managerial accounting, and there is no agreed-upon list of tools for managerial accounting due to the continuous development in these sciences. However, there are methods that are considered more important than others and are relied upon in the field of managerial accounting. Among these methods are: budgets, sales, and profit planning using break-even analysis (break-even point), which are explained as follows:

Budgeting Method:

It is the numerical representation of management's plans and programs, encompassing all operations and expected outcomes within the specified time period. Budgets are generally a future version of financial statements, predicting the institution's profits or losses and anticipating the financial position and cash flow process based on old financial statements and data analysis.

Sales and Profit Planning Using Break-Even Analysis (Break-Even Point):

The definition of break-even point is the sales volume at which total revenue equals total costs. At this point, the company achieves neither profits nor losses, and therefore any production level below the break-even point results in a loss percentage that increases as the distance from the break-even point increases.

Conversely, any production level that exceeds the break-even point is considered profit, and its percentage is the percentage of increase in distance from the break-even point. This means that any revenue that covers total costs without leaving a profit surplus is considered this level of activity as the break-even point.

Frequently Asked Questions

Is managerial accounting difficult?

Managerial accounting is not considered as difficult as it is precise and requires a great deal of speed, and is based on financial forecasting, which makes it not the ideal destination for recent graduates and those without experience in the field.

How can the principles of managerial accounting be used?

The principles of managerial accounting are used in:

(1) Cases of making decisions related to financial and accounting aspects, such as:

- Reducing or canceling one of the types of products or services we provide.

- Manufacturing or purchasing one of the components.

- Accepting or rejecting a deal.

- Dealing with some problems, such as the lack of qualified employees for a specific position.

(2) It helps in planning processes such as cost analysis and budget preparation.

(3) Control and direction in some aspects based on providing accounting opinions generated from knowledge, forecasting, and proposing alternative choices while clarifying their benefits and harms.

How does the managerial accountant help management in pricing decisions?

The managerial accountant can predict costs and profits to know the critical limit for pricing that cannot be reduced below, and the upper limit that cannot be exceeded, with the help of the marketing department and other departments knowledgeable about competitors' prices, the company's position in the market, and the appropriate pricing strategy.

How does managerial accounting serve the process of motivating the organization's management and employees to achieve the organization's goals?

When making sensitive decisions in any organization is based on randomness, the results are catastrophic, which discourages the institution's employees. However, managerial accounting provides strong data analysis that offers valuable assistance to decision-makers and employees within the institution, supporting the company's success and achievement of its goals, which is reflected in employee satisfaction and their confidence in their work.

Is Daftra software suitable for managing managerial accounting operations?

Daftra's accounting software provides managerial accounting with what it requires in terms of providing data instantly and delivering reports that help analyze this data, as well as linking all company departments to each other to make more accurate decisions by knowing where work has progressed in each department.

In addition to providing the ability to evaluate work and control, it also grants certain authorities to managers, which facilitates the process of data-driven decision-making.

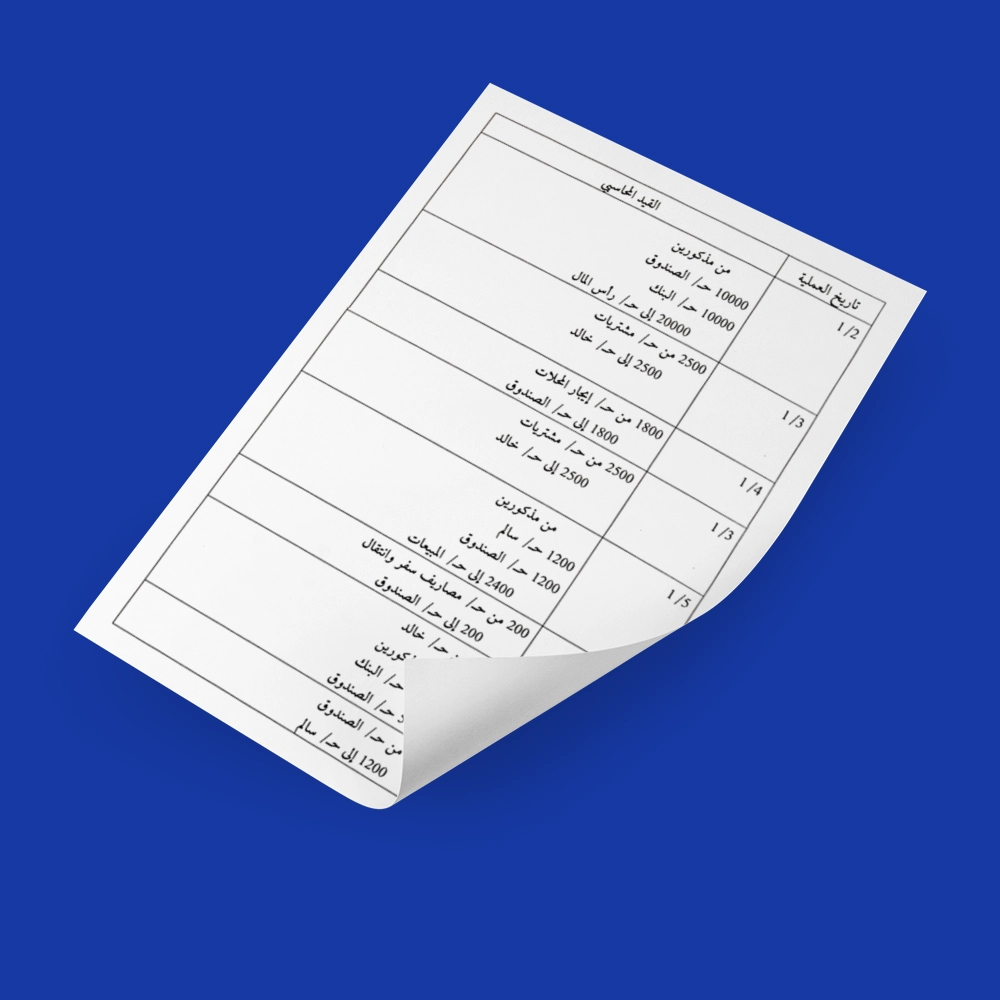

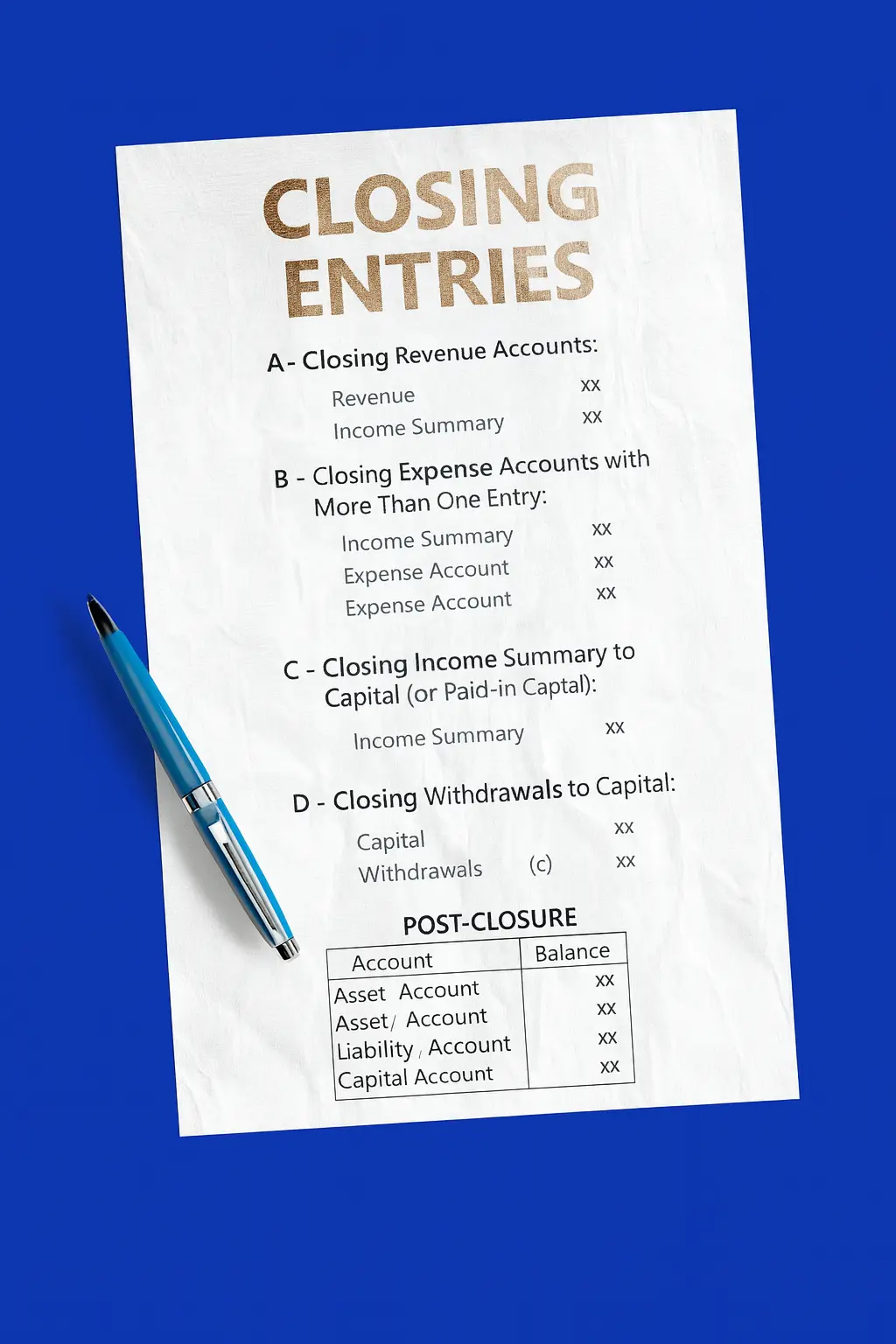

In conclusion, it can be said that the foundations of managerial accounting consist of a set of accounting systems used to document economic activities through documents and records, then classify them with the aim of determining specific facts related to the main and subsidiary activities of the economic unit in order to implement precise control.