Accounting Software and How to Choose the Best Among Them

Table of contents:

- Quick Highlights (The Essentials)

- What is Accounting Software?

- Functions of Accounting Software

- The Importance of Accounting Software

- Types of Accounting Software

- Which is Better Desktop or Cloud-Based Accounting Software?

- The Future of Accounting Software

- Advantages and Disadvantages of Accounting Software

- What is the difference between Accounting Software and Enterprise Resource Planning (ERP) software?

- Why Choose Daftra as Your Accounting Software?

- Frequently Asked Questions

When a company requires a more advanced method to record and manage its accounting operations, as well as analyze the results of these operations, accounting software serves as the ideal solution. This raises common questions, such as: Which accounting software best meets the company’s needs without wasting financial resources or effort due to a poor decision? This article answers these questions to help you make the right choice for your business needs.

Quick Highlights (The Essentials) |

|

What is Accounting Software?

Accounting software represents a technological transformation of traditional accounting ledgers and the daily tasks of accountants into a digital format. This software provides the same results and manages the same operations, but in a way that aligns more closely with the modern era and its technological tools.

Functions of Accounting Software

Accounting software manages all the financial accounts of a company, whether debit or credit. Below are the key functions of accounting software:

1- Storing Transactions and Protecting Data

Accounting software ensures the complete storage of all transactions, including sales and purchases, along with their related financial documents, such as invoices, receipts, and others. It identifies the balances of all accounts linked to the company’s chart of accounts and evaluates their impact on business operations. Additionally, accounting software provides protection for financial information through advanced security software.

2- Integrating Accounting Tasks into a Single Software

Accounting software consolidates all bookkeeping, auditing, reviewing, and analysis tasks into a single, unified software. This eliminates the need to rely on outdated methods, such as Excel spreadsheets and cumbersome paper ledgers, for managing a company's finances.

3- Preparing Financial Reports

Accounting software generates financial reports and statements, including balance sheets, profit and loss accounts, and cash flow statements. These reports provide a clear view of the company's financial performance, helping to identify strengths and weaknesses and develop the best strategies and directions to improve the company's overall situation.

4- Preparing Invoices and Reconciling Accounts

Accounting software enables the creation and sending of various types of invoices to clients and tracks outstanding payments. Additionally, it performs tasks related to reconciling bank accounts and other accounts with intelligence and precision.

5- Fulfilling Tax Purposes

Accounting software streamlines the process of calculating due taxes and facilitates the efficient preparation of tax returns.

Learn more about how to choose accounting software

The Importance of Accounting Software

Using accounting software can sometimes become a necessity, especially when it is required for specific tasks such as issuing electronic invoices or meeting tax and accounting regulations in your country. In other cases, it remains an option, and business owners often ask themselves: What is the importance of accounting software? And is it worth the effort and cost? Let's explore its significance together:

1- Saving Time and Effort Through Automation

Accounting software automates repetitive and routine tasks, allowing accountants to focus on more creative and critical tasks that require their attention. This increases productivity, saves time, and reduces the need to hire additional staff unnecessarily.

2- Faster Account Processing

Instead of manually adding up amounts for each account and calculating total balances, accounting software simplifies this process. It handles transactions regardless of their volume, as its advanced algorithms process numbers much faster than the average human mind.

3- A Sustainable Asset for the Company:

Accounting software is not an expense or a depreciable asset; rather, it is an investment and a form of capital. Over time, the return on investment from purchasing accounting software becomes rewarding and exceeds the costs, generating profits either directly or indirectly, such as saving time and increasing productivity.

4- Enhancing Employee Efficiency:

Training employees on accounting software elevates their professional capabilities, opening doors for creativity, better management, and optimal utilization of available resources. The software assists in analyzing data effectively, producing reports and insights that significantly benefit your production and marketing operations, all while relying on the same workforce.

5- Ease of Error Review:

Having all files stored in one place with quick access allows you not only to review errors but also to prevent them from happening in the first place or correct them if they occur, without the significant effort required for reviewing paper-based files.

6- Accuracy of Calculations and Ease of Error Review:

Accounting software ensures that all files are accessible in one place, simplifying the process of reviewing and correcting errors. It also prevents many errors from occurring by automatically calculating totals and balances, eliminating the need to manually input figures that could be entered incorrectly. However, it’s important to note that accounting software cannot prevent errors caused by incorrect or duplicate entries made by users.

7- Preservation of Historical Data:

Due to the accumulation of physical records, shifting work software, or even migrating from one software to another, a significant amount of critical data can be lost. This loss hinders the ability to analyze previous years' data and generate insightful budgets and detailed reports. A cloud-based ERP software solves this issue by providing secure backup copies that safeguard your work and ensure data continuity.

8- Integration of All Accounting Processes:

An ERP software creates seamless integration across all accounting operations. For instance, a journal entry automatically updates your chart of accounts, purchase invoices are reflected in expenses, and so on. This harmonious synchronization makes your accounting processes more efficient, accurate, and valuable.

9- Simplifying Accounting Oversight:

Auditing accountants is an independent task typically carried out by experienced professionals under the role of reviewers. Simplifying this process ensures that it is conducted accurately and consistently, verifying the correctness of accounting operations and preventing any potential manipulation.

10- Integration with Point of Sale (POS):

Point of Sale software can either work independently, integrate with accounting software, or be part of the same software. POS software is particularly useful in retail, such as supermarkets, where it connects to barcode scanners and issues payment receipts instantly, streamlining sales operations.

11- E-Commerce:

Integrating accounting software with e-commerce platforms is a widely requested feature. It saves merchants significant effort by allowing them to manage their accounts directly within the software, eliminating the need for a dedicated accountant. This seamless connection simplifies operations for online businesses.

Types of Accounting Software

Accounting software varies based on several factors, including:

1- Business Size

Accounting software is categorized into programs for small businesses and those for medium and large enterprises. As businesses grow, their needs evolve to include inventory management, customer relationship management (CRM), and enterprise resource planning (ERP) software. A comprehensive ERP software is designed to manage and integrate all aspects of business operations efficiently.

2- Operating Type

Accounting software can be classified into Desktop-based programs and Cloud-based programs. With the increasing challenges of storage, the high cost of desktop software, and its inability to be accessed from devices other than those where it is installed, the demand for cloud-based accounting software has significantly increased.

These programs are characterized by affordable monthly subscriptions, making them accessible to small, medium, and large businesses alike. They are easy to update, quickly adaptable to external requirements such as integration with government entities, and compatible with other software via APIs. Due to these advantages, cloud-based accounting software will be the main focus of this article.

3- Tasks to Be Accomplished

The types of accounting software vary depending on the tasks required, which are often based on the different types of accounting. Financial accounting tasks are the most in demand, as they handle general accounting functions such as managing sales and purchases, recording financial transactions, and preparing financial reports.

Additionally, they provide accurate data, results, and information to support sound decision-making, track payments, and issue tax and electronic invoices in compliance with entities such as the Zakat, Tax, and Customs Authority. This software also helps in tracking assets and liabilities and calculating employee payroll efficiently.

4- Cost

Accounting software can be categorized based on cost into:

- Free Accounting Software: Offers basic features and is suitable for small businesses or individuals.

- Low-Cost Accounting Software: Performs limited tasks at affordable prices, ideal for startups.

- Mid-Cost Accounting Software: Provides more advanced features and functions, meeting the needs of medium-sized businesses.

- Subscription-Based Accounting Software: Typically offers comprehensive, flexible features that can be customized, along with 24/7 technical support. This type is targeted at large companies or enterprises.

Which is Better: Desktop or Cloud-Based Accounting Software?

Every accounting software has its own advantages and disadvantages, and what may be considered an advantage by some might be seen as a disadvantage by others, and vice versa. In this section, we will discuss the key features of Desktop-Based Accounting Software and Cloud-Based Accounting Software to help understand their differences and suitability for various needs.

1- Cost

Most cloud-based programs operate on a subscription model that is paid periodically, with updates applied automatically at no additional cost. In contrast, desktop-based programs require a one-time payment, but additional expenses arise with each software update. Based on user experiences, cloud-based programs are generally more cost-effective, as the annual subscription often proves to be lower compared to the costs associated with desktop-based solutions.

2- Flexibility

When a more advanced software with better features becomes available, it is easy to switch to a new cloud-based program. On the other hand, desktop-based programs are harder to replace, as they require a one-time purchase. This makes the desktop software an integral part of the company that cannot be easily replaced over the years of its operation.

3- Program Configuration

Cloud-based accounting software does not require reconfiguration with every update. In contrast, desktop-based software often requires the technical support team from the developer company to handle updates or maintenance. On the other hand, cloud-based programs apply updates automatically without any effort or time consumption.

4- Security and Privacy

Cloud-based programs are hosted on secure cloud platforms provided by global companies, making security and privacy the responsibility of the developer and the cloud service provider. In contrast with desktop-based programs, the company using the software must have a robust IT infrastructure to maintain data privacy and confidentiality. This includes using antivirus software, cybersecurity measures, and other tools, making security the company’s full responsibility.

5- Automation

Automation and automatic features are often abundant in cloud-based programs, aiming to save time and reduce user effort. On the other hand, desktop-based programs rarely include automation, as their development approach typically does not prioritize such features.

The Future of Accounting Software

Accounting software is continuously evolving, with every new feature enhancing accounting operations. The most prominent features that are becoming standard in modern and future accounting software include:

1- Integration with Business Applications

Many features have become a basic part of every accounting program, as every accounting program now includes customer accounts. It is now possible to integrate the program with a Customer Relationship Management (CRM) software, starting the journey with the customer from the beginning, from their state as a potential customer to becoming a permanent customer with a dedicated account. Additionally, e-commerce platforms have become essential for every business specializing in retail. Every account registered on the platform turns into an account classified under customer accounts. There are thousands of important applications that the accounting program needs to incorporate into its functions.

2- Support for Analytics and Forecasting

Artificial intelligence is rapidly advancing and gradually appearing in accounting software. One of the most important elements that can evolve thanks to AI's superiority is financial forecasting. Through analysis, accounting software can identify potential risks or challenges a business may face in the future, leading to improved outcomes. The software acts as a manager for past records and a guide toward a better financial future.

3- Greater Consideration for Diverse Work Software

With the rise of remote work models, accounting software is striving to accommodate this aspect as part of its functionality. Many accounting and financial responsibilities can now be managed remotely. These programs adopt the Agile project management methodology to incorporate features like business intelligence, reporting for market growth, analytics, and more.

Advantages and Disadvantages of Accounting Software

Advantages of Accounting Software

The advantages of accounting software vary depending on the features and capabilities of each program, as well as the subscription package and the services it offers. However, there are some fundamental advantages that you can benefit from when subscribing to a cloud-based accounting software, including:

1- Data Format Control

You can choose how to display and store your data, whether as Excel files, contact lists, or printed documents. Additionally, you can keep backups of your data and share it in real time with anyone who needs access. All of this can be done without requiring large storage spaces, eliminating the need for traditional data storage and transfer methods.

2- Customer Tracking

This involves monitoring their purchases, maintaining their records, and offering better marketing and sales promotions through the contact details saved in their profiles. This ultimately leads to increased sales.

3- Better Tax Calculation

Facilitates the inclusion of taxes within issued invoices, incorporates all types of taxes into the accounting software, and takes steps toward creating and submitting tax returns in the required format in compliance with your country’s government policies.

4- Utilizing Various Payment Methods

This allows you to cater to your customers' preferences, whether they pay in cash, by credit card, or through bank transfers. Additionally, it enables integration with your bank accounts to manage all customer payment operations seamlessly.

5- Preventing Data Theft

Cloud-based accounting software provides a high level of security, relying on encryption and advanced technologies to protect your data from theft or unauthorized access.

What Are the Disadvantages of Accounting Software?

Be cautious when addressing the disadvantages of accounting software. It’s not just about purchasing software but understanding the pros and cons of accounting software in general — and more importantly, the specific drawbacks of the software you plan to purchase. Here are the most notable disadvantages to watch for and ensure your chosen software is free from them:

1- Dependence on Internet Connectivity

Cloud-based accounting software requires a stable internet connection, and any instability in the network can result in losing access to the software and its features.

2- High Costs for Some Businesses

Small businesses may find it difficult to afford the monthly subscription fees for accounting software, especially if they are compelled to adopt it due to government-mandated digital transformation and electronic invoicing. This often forces them to look for cheaper alternatives, even if they come with limited features. In such cases, it is advisable to look for balanced solutions, as some programs offer excellent services at reasonable prices.

3- Issues with Branch Integration

Some accounting software struggles with integrating multiple branches. The problem is not only in connecting the branches but also in separating the cost accounting and financial operations of each branch. This can result in inaccurate reports, especially if the software is built on low-quality software.

4- Difficulty in Configuring Accounting Software

Certain industries face challenges in aligning their business activities and needs with the available accounting software. Additionally, some users may gain access to sensitive data they should not see due to a lack of robust customization options in controlling data access and user permissions.

5- Program Slowness

If the company hosting the accounting software does not account for server load, it can lead to slow program performance, making it difficult to work efficiently on the platform.

6- Failure to Perform Assigned Tasks

Some accounting software lacks essential features needed for smooth accounting operations, forcing accountants to combine digital and manual work. This can lead to wasted effort, duplicated data, and reduced productivity.

Common mistakes made when choosing accounting software:

- Failing to assess the actual needs of the company before making a choice, and selecting software that does not align with the company's size and requirements in terms of capacity and functionality.

- Not ensuring that the software is compatible with other software used within the company.

- Not taking advantage of the trial periods of accounting software to confirm ease of use.

- Overlooking the importance of technical support and its availability when needed.

- Focusing solely on the price of the accounting software without evaluating the value it provides.

- Choosing outdated or non-upgradable accounting software may lead to future problems.

- Failing to ensure the accounting software has the necessary security features to protect financial data.

- Ignoring the reviews and opinions of current users of the software.

- Not establishing a clear training plan for employees to enable them to use the software effectively.

What is the difference between Accounting Software and Enterprise Resource Planning (ERP) software?

Accounting software is closely related to Enterprise Resource Planning (ERP) software and is often considered a part of ERP software. However, there are several differences between the two, which can be clarified through the following comparison:

| Comparison Aspect | Accounting Software | Enterprise Resource Planning (ERP) software |

| Function | Manages financial operations such as recording transactions and preparing basic financial reports. | Plans and manages all enterprise resources, including finance, sales, inventory, and HR. Also provides advanced analytics and comprehensive reports. |

| Focus or Scope | Focuses on the financial aspect. | Comprehensive in scope, focusing on all aspects of the business to provide a unified and consistent view administratively and financially. |

| Integration | Often used in isolation from other software. | A key feature is the integration and connectivity between different departments, facilitating information exchange. |

| Users | Used by accountants or financial staff. | Used by employees across all departments, such as sales, marketing, production, customer service, and accounting. |

| Scalability and Customization | Limited customization options. | Provides extensive and flexible customization options to meet diverse business needs. |

In general, it can be said that the significant price difference and the complexity of customizing comprehensive integrated software make identifying and analyzing needs the most important first step to help you decide between accounting software that issues certified electronic invoices or the need for a large, comprehensive ERP software that manages warehouses, cashier programs, procurement, and manufacturing operations.

In your opinion, which software is more suitable for your company: accounting software or ERP software?

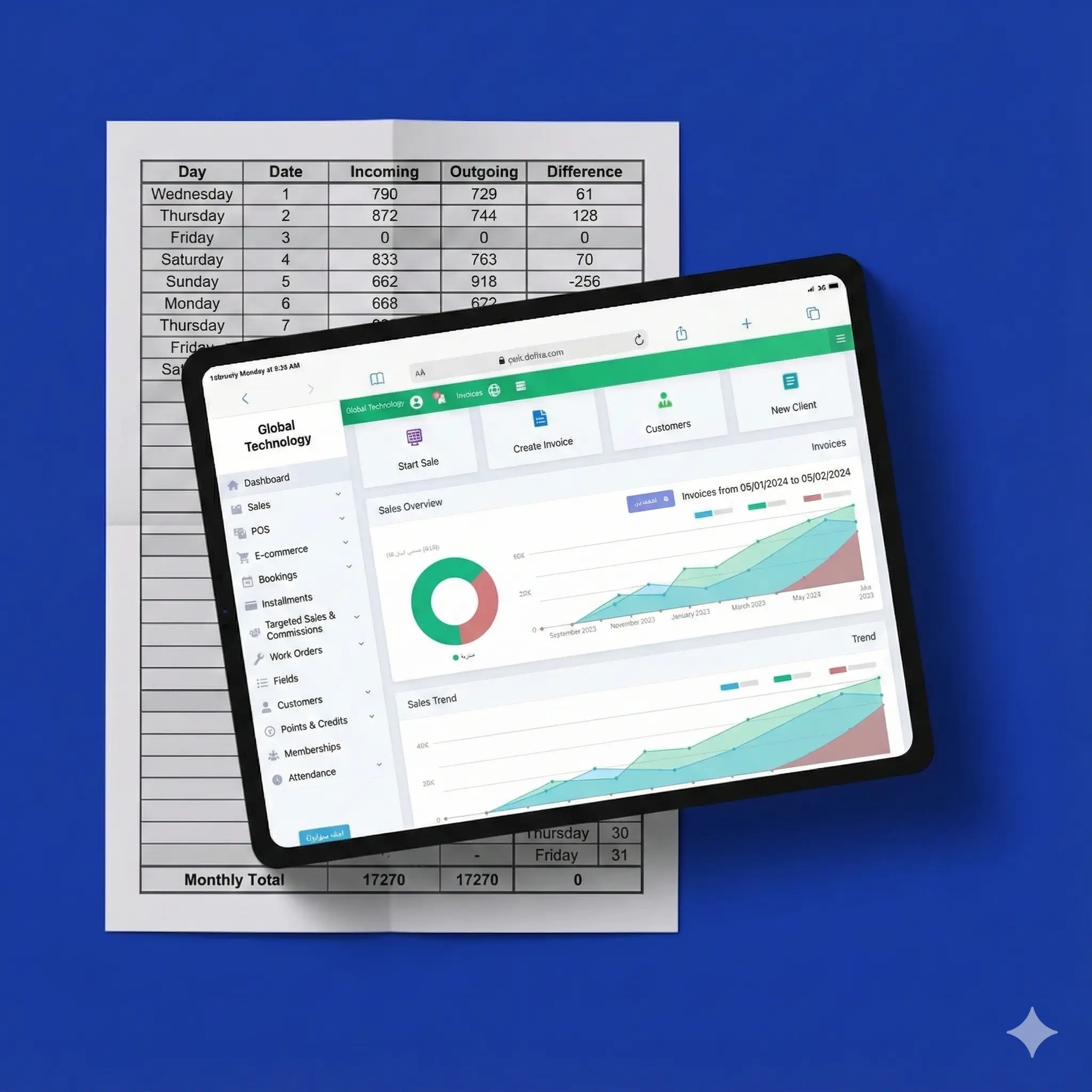

Why Choose Daftra as Your Accounting Software?

Daftra's accounting software offers exceptional management for your sales, purchases, inventory, customers, and employees. Additionally, it includes features like point-of-sale software, online stores, bookings, memberships, and more.

The software is highly flexible, allowing you to customize the features to match your business needs. This gives you a simplified interface that is easy to use while still covering all your requirements and being tailored specifically to you.

Daftra also provides excellent customer support, with detailed guides for every feature in the software and 24/7 availability to answer your questions via phone or email. Moreover, it offers a free personalized session where an expert explains how to use the software effectively to meet your needs without any complexity.

Frequently Asked Questions

What are the best accounting programs in Saudi Arabia?

The best accounting software depends on your company’s specific needs. However, Daftra is considered one of the leading solutions in Saudi Arabia. It offers comprehensive management for sales, purchases, inventory, electronic invoicing, and integrations with online stores and POS systems. Additionally, it complies fully with the requirements of the Zakat, Tax, and Customs Authority (ZATCA).

What is the best ERP accounting system?

The best ERP accounting system is one that performs core accounting functions accurately and efficiently, including:

- Recording all financial transactions and protecting data.

- Integrating accounting tasks—such as recording, analysis, and auditing—into a unified system.

- Generating accurate financial reports like balance sheets and profit and loss statements.

- Creating invoices, tracking payments, and reconciling bank accounts.

- Calculating taxes and facilitating tax return filing.

Daftra, for instance, combines accounting capabilities with several ERP features such as inventory, HR, online store management, and point of sale.

What is the best free accounting software?

Free accounting programs tend to have limited functionality, but they can be suitable for very small businesses or startups. Among the best free accounting options is Daftra, which offers comprehensive management of sales, purchases, financial reporting, and electronic invoicing.

What are ready-made accounting programs?

Ready-made accounting programs come pre-equipped with essential features such as invoicing, journal entries, and financial reporting. They only require you to enter your company’s data. Daftra, for example, offers all these features while allowing you to customize the system to fit your business model.

Does accounting software depreciate?

Yes. In accounting terms, software is classified as an intangible asset, and depreciation (amortization) is calculated over its useful life in accordance with the company’s accounting policies.

What are the benefits of accounting software?

Key benefits include:

- Saving time and effort through automation.

- Greater accuracy in calculations and reporting.

- Reduced dependency on manual processes.

- Easier tax compliance and e-invoicing.

- Improved productivity and better decision-making.

Which accounting programs are approved by ZATCA?

Approved programs are those that support electronic invoicing and comply with the authority’s standards. Daftra is one of the most recognized and trusted ZATCA-approved accounting programs in Saudi Arabia.

Is accounting software considered an asset?

Yes. Accounting software is regarded as an intangible asset when purchased for long-term use, and it is amortized over several years.

Is there any real benefit to using accounting software?

Absolutely. Using accounting software offers multiple advantages, including faster task completion, fewer errors, improved control, better tax compliance, and more informed financial decision-making.