What are assets? And what are their types?

Table of contents:

- What is the definition of assets?

- What do assets mean in economics?

- What are the types of assets?

- What are the conditions that assets must meet?

- How many assets are there?

- What are the best assets?

- What are tangible assets?

- Which assets are depreciated?

- Which assets are not depreciated?

- What is the depreciation rate of assets?

- What does the term “financial assets” mean?

- What are non-financial assets?

- What are monetary assets?

- Are “resources” the same as assets?

- What is the importance of assets?

- What are the advantages of assets?

- How do you invest in assets?

- How do you buy assets?

- What does selling assets mean?

- What are the financial assets available for sale?

- What is asset valuation?

- How are assets revalued?

- What is the book value of an asset?

- What is the difference between costs and assets?

- What are real assets?

- What are movable and immovable assets?

- How are assets calculated?

- What is the cost of an asset?

- How is the useful life of an asset determined?

- What is the right-of-use asset?

- What are the returns on real estate assets?

- What are the disadvantages of assets?

- What is the difference between assets and liabilities?

- How Daftra helps in asset management

- Frequently Asked Questions

Accounting is based on a set of assumptions and principles that govern its work. Among these principles is the accounting recognition of items in the financial statements. Financial statements represent financial data related to the balance sheet, profits, income, expenses, and cash flows.

There are several types of financial statements, such as the statement of financial position or the balance sheet, which include items such as assets, liabilities, and equity. One of the most essential requirements of the statement of financial position is the accurate identification and recording of these items.

The subject of today’s article is assets, which represent the property owned by companies or individuals. Assets are considered high-value items and, therefore, can be liquidated to cover obligations and expenses.

Assets, in all their types, are considered one of the results of a company’s activities and business operations, as they contribute to generating income and managing business activities, in addition to enhancing the company’s value and position in the financial and business markets.

What is the definition of assets?

Assets can be defined as everything that a company or individuals own in the form of valuable resources. They also refer to all rights and properties owned by a company.

In other words, assets are the economic resources or all tangible and intangible items owned by a company, which can be converted into cash to settle debts or to cover the expenses of commercial and economic activities.

Assets are also referred to as resources, and they can be defined as a set of future benefits that a company may obtain as a result of financial events and changes.

Assets are considered a fundamental element of financial statements and reports, as recording the value of assets in financial statements is an important requirement that reflects the transparency and credibility of these statements, which in turn is reflected in the company’s financial position.

What do assets mean in economics?

In economics, assets are defined as everything owned by an individual or a company that has economic value and is used to generate income, increase wealth, and meet obligations while achieving a surplus.

What are the types of assets?

All experts in accounting emphasize the necessity of identifying and recording assets in the general balance sheet of companies, which is prepared at the end of the fiscal year. Experts also note that some companies and organizations may acquire certain assets to enhance their value and position.

An integrated accounting software for company management from Daftra’s cloud-based system helps you accurately classify all types of assets and organize them in a hierarchical structure in terms of asset sub-accounts.

The main types of assets include the following:

Assets are generally classified into two main categories: current assets and non-current assets. In the following lines, we will explain the main types of assets, in addition to other types of resources.

1. Current Assets

Current assets are short-term assets that are expected to be converted into cash within a financial period or an operating cycle, in order to settle debts or cover operating and investment expenses.

Current assets also include assets that can be purchased for the purpose of resale or consumption during the accounting period or the company’s operating cycle. These assets may be cash or cash equivalents; therefore, they can be considered short-term investments due to the ability to use them in cash form for commercial and economic activities, as there are no restrictions on their use.

The most important current assets include:

- Cash balances in banks and cash on hand.

- Accounts receivable (customers).

- Stocks, bonds, and bank certificates.

- Notes receivable or accounts receivable, which represent amounts owed by customers for products and services.

- Inventory, such as raw materials and finished goods.

- Prepaid expenses, such as prepaid taxes and insurance.

- Accrued revenues and amounts due.

It is worth noting that current assets usually represent a higher value in the balance sheet, as they are more liquid than fixed assets.

2. Fixed Assets (Non-Current Assets)

Non-current assets are physical items and properties that cannot be easily converted into cash, as they are held for use. Therefore, they are essential for managing business operations and increasing income.

Fixed assets, or long-term assets, are a fundamental element in the production process. They are used for a long period, typically more than one year, and their value may decrease over time.

Key examples of fixed assets include:

- Equipment.

- Furniture.

- Land.

- Buildings.

Other types of assets can also be classified into the following categories:

3. Tangible Assets

These are physical assets such as land, vehicles, real estate, equipment, inventory, securities, bonds, and cash. Tangible assets are considered the foundation of companies and organizations and are not directly available to customers. They may also be exposed to certain risks such as damage, theft, or natural disasters.

4. Intangible Assets

Intangible assets are long-term, non-physical, and non-monetary assets, but they are identifiable. Examples of intangible assets include:

- Patents.

- Trademarks.

- Broadcasting, publishing, and printing rights.

- Trade secrets.

- Software.

- Franchise rights.

- Customer lists and information.

- Licenses.

- Copyrights.

- Goodwill of a business or company.

- They may also include contracts and shares.

- Intellectual property rights, such as patents, copyrights, and trademarks.

- Computer software, applications, and databases.

- Licenses and commercial franchises.

- Investments in other companies (equity shares).

5. Investment and Commercial Assets

These are assets intended to increase a company’s profits and revenues, and they may include the following types:

- Investments in companies and economic and commercial institutions.

- Shares traded in financial markets and stock exchanges.

- Preferred securities and various currencies, in addition to cash.

- Government bonds and debt securities.

- Properties, real estate, and land.

- Durable goods and raw materials such as gold, silver, iron, and wood.

- Investment funds.

- Solar, wind, and oil energy assets.

- Life and property insurance.

Use the investment calculator to determine the return value from different investments and the profit margin.

6. Personal Assets

These are funds or properties that can be converted into cash, have financial or economic value, and are owned by individuals to generate profits, increase income, finance projects, or meet personal needs. The main types of personal assets include:

- Bank accounts such as retirement, savings, and deposit accounts.

- Bank certificates.

- Vehicles.

- Real estate and land.

- Jewelry.

- Current accounts.

- Cash.

7. Operating Assets

These are assets that generate additional profits and revenues for companies and are essential for facilitating and managing operating activities. They include equipment, technical assets, cash flow, and liquidity, as well as distribution and publishing rights.

8. Non-Operating Assets

These are assets that are not essential to daily operating activities, as operations can be managed without them. They include deposits and investments.

What are the conditions that assets must meet?

As mentioned earlier, assets are resources owned by companies or institutions. In order for these resources to be classified as assets, they must meet certain criteria. The main characteristics of assets are as follows:

1. Measurability

Asset valuation is one of the fundamental conditions and criteria that must be met. The resource, asset, or benefit arising from it must be measurable in physical or monetary units to be recognized as an asset. The value of assets and resources may be measured using historical cost or current market value.

2. Ownership

The asset must be legally owned by the institution or company so that its benefits can be utilized through use, sale, or investment without restrictions. Ownership makes it easier to convert the asset into cash or cash equivalents.

The importance of ownership also lies in the fact that some assets cannot remain under mere usage rights, as usufruct or lease contracts often stipulate that the asset cannot be transferred or sold.

3. Productivity

Regardless of its type, the asset must be usable in the production process, operational activities, or income generation.

4. Economic Benefit

The asset must provide future economic or financial benefits to the company, either by generating profits or settling debts. This can be achieved by selling the asset or converting it into cash, in addition to using some assets directly in the production process.

How many assets are there?

The number of assets depends on the type of company or entity and the nature of its activities. Assets may include real estate, vehicles, equipment, securities, cash, intellectual property rights, and others. A company or individual may expand or reduce the list of assets according to financial needs and objectives.

What are the best assets?

The preference for a particular type of asset depends on the company’s goals and financial management strategy. Some organizations may prefer investing in fixed assets such as real estate, while others may prefer holding liquid assets such as cash to meet short-term obligations.

What are tangible assets?

Tangible assets are assets that have a physical existence and can be easily measured, valued, and depreciated. They include real estate, equipment, machinery, inventory, vehicles, and others. This type of asset plays a vital role in commercial and investment operations.

Which assets are depreciated?

Depreciation is calculated for tangible fixed assets that have a defined useful life and lose value over time due to use or the passage of time, such as buildings (excluding land value), equipment and machinery such as computers and vehicles, furniture, and fittings.

Assets subject to depreciation may also include infrastructure, such as roads and bridges, in the case of government entities. Depreciation cost is charged as an expense in the company’s financial results.

Which assets are not depreciated?

Intangible assets are generally classified as non-depreciable assets, such as trademarks or copyrights, because they do not lose value over time in the same way that fixed assets like equipment or buildings, or current assets such as inventory and cash, do. Read more:

What is amortization and how to calculate it for intangible assets.

What is the depreciation rate of assets?

The depreciation rate depends on the type of asset and the method used to depreciate or utilize it. There are several methods for calculating depreciation, such as straight-line depreciation, declining balance depreciation, and others. Typically, the depreciation rate is determined based on the expected period of economic use of the asset.

For example, in the case of fixed assets such as machinery and equipment, the expected useful life of the asset is determined, and the depreciation rate is set accordingly. In this case, the straight-line method may be used, where the cost of the asset is divided by its expected useful life to obtain the annual depreciation amount.

As for intangible assets such as intellectual property, they may not be subject to traditional depreciation and are instead evaluated periodically to determine whether there is any impairment in their value. Other factors that affect the determination of depreciation rates include local tax policies and accounting regulations applicable in the country where the organization operates. Download a free, editable asset depreciation calculation template from Daftra.

What does the term “financial assets” mean?

Financial assets are intangible assets that represent ownership or the right to receive future payments due from another party. Financial assets include shares, bonds, accounts receivable, and investments in other financial securities.

What are non-financial assets?

Non-financial assets are assets that do not take the form of securities or cash, such as:

- Tangible assets: such as real estate, equipment, inventory, and vehicles.

- Intangible assets: such as patents, copyrights, trademarks, and franchise rights.

- Human assets: skills and expertise possessed by employees.

What are monetary assets?

Monetary assets are assets that can be quickly converted into cash without losing their value. They include immediately available cash and funds deposited in bank accounts that can be withdrawn on demand. Monetary assets also include amounts owed by customers to the company that are expected to be collected in the short term, as well as short-term investments such as treasury bills and certificates of deposit that mature within one year.

Are “resources” the same as assets?

Yes, “resources” is another term used to refer to assets in accounting and finance. Resources include everything a company owns that has economic value and can be converted into cash or used to generate revenue, such as cash assets, accounts receivable, inventory, real estate, equipment, investments, and other types of assets.

What is the importance of assets?

After reviewing the detailed explanation of the concept of assets, their types, and related terms, there are still many important questions frequently raised, such as: What are assets used for? What is the purpose of assets? And how can assets be utilized? These questions and more are answered below:

1. Estimating Capital Size

Assets are one of the fundamentals of accounting, as classifying and valuing assets helps determine the size of a company’s capital and cash flows.

2. Compliance with Legal Requirements

Accurate accounting of assets, especially leased assets, is a legal requirement.

3. Evaluating the Balance Sheet and Making Key Decisions

Assets help company and institutional managers understand the company’s direction. Proper identification and valuation of assets are vital for determining net worth and, accordingly, making critical strategic decisions.

For example, management’s decision to offer the company for sale or declare bankruptcy may depend on the condition of the company’s assets.

4. Controlling Costs and Expenses

Assets can help reduce expenses and tax burdens for companies through their sale or transfer of ownership.

A good understanding of assets and their categories also helps save costs; in some cases, leasing certain assets such as equipment or buildings may be more cost-effective than purchasing them.

5. Supporting Business Expansion and Growth

Assets contribute to commercial and economic activities, as some assets serve as long-term resources for managing operations, such as buildings and equipment.

Certain types of assets generate long-term gains and profits for companies, while others help attract investments, thereby enhancing company value.

6. Company Valuation and Enhancing Competitiveness

Companies that effectively utilize their assets, whether current or non-current, enjoy a competitive advantage over those that do not.

Assets provide companies with a competitive edge in gaining market share. For example, a mining company may own a strategically located mine, giving it an advantage over competing mining companies.

Investors always evaluate assets of all types when making decisions about investing in a company or institution. In general, the importance of assets lies in the fact that they are essential for all companies and institutions. Financial and accounting management must understand assets and their impact on the company’s future, as well as be well-versed in how to use assets in ways that serve the company’s interests and overall benefit.

What are the advantages of assets?

Assets have many advantages that encourage companies to acquire them. The most important advantages include:

- Source of liquidity: Many types of assets can be converted into cash and used in emergencies, such as paying debts, covering budget deficits, paying salaries and expenses, and contributing to project financing.

- Preparation of accurate financial reports: Information and data related to assets help produce accurate financial reports. Management can use these reports to conduct financial analyses and evaluate company activities, while financial and business experts rely on them to determine whether an organization is profitable.

- Supporting company success: Assets are a positive indicator of a company’s ability to produce and grow. They are also considered a form of investment that may generate profits in the future.

- Multiple uses: Companies may use certain intangible assets, such as patents, to produce new products or services.

- Assessing financial position: Assets help accountants and auditors understand a company’s financial position and the potential risks it may face, which influences management decisions.

- Managing financial risks: Assets can serve as a financial safeguard for companies and individuals in the future, especially when facing financial risks due to changes in financial and business markets.

How can I acquire assets? Assets can be acquired in several ways, mainly depending on the type of asset and the purpose of acquiring it. The most common methods include:

- Purchase: Buying assets directly, whether real estate, equipment, or other types of assets.

- Investment: Investing funds in shares, bonds, or other investment instruments to obtain financial assets.

- Financing: Obtaining financing to purchase assets, such as mortgage loans for real estate or equipment loans.

- Leasing: Gaining the use of assets through lease or rental agreements.

- Inheritance: Acquiring assets through gifts or inheritance.

- Innovation: Owning intangible assets such as patents or copyrights through production or creative processes.

How do you invest in assets?

Investing in assets requires careful financial planning and an understanding of the market. You can follow these tips:

- Define your investment and financial goals before starting.

- Conduct thorough research on the assets you wish to invest in.

- Understand the market, trends, and factors that may affect asset values.

- Assess the risks associated with specific assets and whether they align with your risk tolerance.

- Set your budget and decide how much money to invest and how to allocate your investments.

- Choose the assets based on your research and analysis.

- Purchase the assets, whether real estate, shares, bonds, or other investments.

- Monitor your investments regularly and make necessary adjustments based on market performance and changing goals.

How do you buy assets?

The process of purchasing or acquiring assets is usually carried out by signing purchase agreements or acquiring the required items and paying the agreed price.

What does selling assets mean?

Selling assets means disposing of an asset owned by a company or an individual to a third party. Assets may have a market value, and the selling price is determined based on this value through negotiation between the concerned parties. The asset sale is then recorded in the accounting records, and asset values are updated in the financial reports of the company or individual.

What are the financial assets available for sale?

Available-for-sale financial assets are a category of investments that include shares, bonds, and other securities held for investment purposes but not intended for short-term trading or held to maturity. These assets are measured at fair market value at each accounting period, and changes in value are recorded in equity under “other comprehensive income” until the investment is sold.

What is asset valuation?

Asset valuation is the process of determining the fair market value of an asset. It may be conducted for various purposes, including buying or selling, tax planning, estate planning, or accounting and financial reporting. Asset valuation requires an understanding of the market, the actual condition of the asset, and external factors that may affect its value. In many cases, hiring a professional valuer is recommended to ensure accuracy and reliability.

How are assets revalued?

Asset revaluation means updating the book value of an asset in accounting records to reflect its current market value. This process typically involves the following steps:

- Identifying the assets to be revalued, such as real estate, equipment, or intangible assets.

- Selecting and appointing a professional appraiser with expertise in valuing the specific type of asset.

- Collecting data related to the asset, including its condition, age, usage, and other factors affecting its value.

- Choosing the appropriate valuation method based on the asset type and valuation purpose, such as the cost method, market value method, or income method.

- Conducting the valuation using the collected data and the selected method.

- Updating accounting records and adjusting the asset’s book value based on valuation results.

- Disclosing the revaluation and its impact on the asset’s book value in the financial statements.

What is the book value of an asset?

The book value of an asset refers to its value as recorded in the company’s accounting records. Its importance lies in showing the remaining value of the asset in the books. It can be used to calculate the amount of depreciation deductible for tax purposes and to determine whether the asset has lost value and requires revaluation.

The book value is calculated by subtracting accumulated depreciation and any recognized losses from the asset’s original cost, as shown in the following formula:

Book value = Original cost − Accumulated depreciation − Recognized losses

For example, if a company purchases equipment at $50,000 and a depreciation of $15,000 has been charged, the book value of the equipment would be $35,000.

What is the difference between costs and assets?

The main difference between costs and assets is that costs and expenses are financial burdens incurred by a company to generate revenue. In contrast, assets are resources owned by the company that are used to generate revenue without being treated as expenses.

Costs mainly affect profit, while assets affect the overall financial position and performance of the company. The difference between costs and assets can be identified through a comparative analysis:

| Basis of comparison | Costs | Assets |

| Nature | Costs are amounts of money spent to obtain goods or services or to operate business activities. | Assets are economic resources owned by a company that are expected to generate future economic benefits. |

| Impact on financial results | Costs are deducted from revenues to calculate net profit or loss for a specific accounting period. | Assets are reported on the balance sheet and are used to generate revenues and profits over long periods of time. |

| Time period | Costs relate to a specific accounting period and are considered immediate expenses. | Assets have a long economic life and are used over multiple periods. |

| Classification | Costs can be classified as variable, fixed, direct, indirect, and others. | Assets can be classified into current assets, fixed assets, intangible assets, and financial assets. |

What are real assets?

Real assets are tangible assets that have physical value and differ from financial assets (such as stocks and bonds) and intangible assets (such as patents and copyrights). Real assets play an important role in generating overall revenues and profits for companies, especially those related to productive or agricultural industries. They include:

- Real estate: such as land and buildings.

- Equipment and machinery: such as industrial equipment and vehicles.

- Inventory: finished goods ready for sale or raw materials used in production.

- Natural resources: such as oil, gas, and minerals.

What are movable and immovable assets?

Movable assets are assets that can be transferred from one place to another without changing their structure or nature. They include vehicles, furniture, and equipment. Immovable assets are assets that cannot be easily moved and include real estate such as land and buildings.

How are assets calculated?

Assets are usually calculated by estimating their total value. This is done by collecting information about the assets and determining their fair value, either through internal company valuation or by using external experts.

The chart of accounts in the Daftra system helps you calculate assets easily according to their classification and provides a comprehensive view of the entity’s financial position through the balance sheet report generated automatically by the system. The report includes all data related to assets, liabilities, and equity.

In some cases, companies may need to revalue their assets to reflect current market value. This usually requires an appraisal by a professional. In addition, assets should be reviewed regularly and their accounting records updated to ensure accuracy. Below are some general steps and guidelines for calculating assets:

1. Methods for Calculating Current Assets

First, cash and cash equivalents are recorded at face value. Accounts receivable are recorded at face value after assessing credit quality and recognizing an allowance for doubtful debts when necessary. Finally, inventory can be valued using different methods such as standard cost, First-In, First-Out (FIFO), or Last-In, First-Out (LIFO).

2. Methods for Calculating Fixed Assets

Real estate and buildings are recorded at purchase cost plus any direct costs required to make the asset ready for use, after which accumulated depreciation is deducted. Machinery and equipment are recorded at purchase cost, less accumulated depreciation.

3. Methods for Calculating Intangible Assets

Patents and copyrights are measured at purchase cost or the cost incurred to create them, less accumulated amortization. Trademarks may be measured based on purchase cost or market-based valuations.

4. Methods for Calculating Financial Assets

Investments in shares and bonds may be measured at cost or fair market value, depending on the company’s accounting policies. Long-term accounts receivable are measured and recorded at the present value of expected future cash flows.

In general, it is essential that the method used to calculate assets remains consistent from one accounting period to another to ensure the reliability of financial information.

What is the cost of an asset?

The cost of an asset includes all expenditures necessary to acquire it and prepare it for use. Examples include:

- Purchase price and fees: the amount, fees, and commissions paid to acquire the asset.

- Transportation and installation costs: expenses incurred to transport the asset to the company’s location and install it.

- Improvement and modification costs: expenses incurred to improve or modify the asset to suit the company’s needs.

How is the useful life of an asset determined?

The useful life of an asset is usually determined at the time of purchase and is used to calculate depreciation over the asset’s life. Useful life estimates may be reviewed and adjusted if necessary. Determining an asset’s useful life depends on several factors, including:

- Type of asset: Assets have different useful lives; for example, buildings generally have longer useful lives than equipment or furniture.

- Usage conditions: How and under what conditions the asset is used affects its useful life.

- Maintenance and repairs: Assets that are regularly maintained and repaired may have longer useful lives.

- Technology and advancements: Technological changes may render an asset obsolete before the end of its physical life.

- Expected usage: The company’s estimates regarding how and for how long the asset will be used.

- Industry and legal standards: Some industries have specific standards for determining asset useful lives, and laws may prescribe useful lives for certain assets.

What is the right-of-use asset?

A right-of-use asset refers to the right to use a specific asset for a defined period based on an agreement or contract. The right-of-use asset is recognized on the balance sheet when the entity is a lessee in a lease contract and is measured based on the present value of expected future lease payments.

What are the returns on real estate assets?

Returns on real estate assets come from two main sources. The first is rental income, which is the income earned from leasing property. The second is capital appreciation, resulting from an increase in property value over time. It should be noted that while real estate asset returns can be high, they also involve risks, including market fluctuations, maintenance costs, and risks related to tenants.

What are the disadvantages of assets?

Despite the importance and necessity of assets for companies and individuals, assets also have certain drawbacks. The main disadvantages of assets include:

1. Loss of Value

Some types of assets, such as bonds and shares, may lose value due to fluctuations in financial and business markets. In this context, selling certain assets before their maturity may result in a loss of value or reduced returns.

2. Illiquidity Constraint

Some assets cannot be easily liquidated, meaning they cannot be quickly converted into cash. Certain assets, such as buildings or real estate, may take a long time to sell.

3. Contractual Restrictions and Obligations

Some assets are subject to restrictions, such as mandatory holding periods during which they cannot be sold or leased. Violating these restrictions may result in penalties imposed on the owner.

What is the difference between assets and liabilities?

The main difference between assets and liabilities lies in their impact. While liabilities affect a company’s cash flow and debts, assets impact the overall financial position of the company.

Assets are all the tangible or intangible resources owned by a company. They are part of the company’s capital and can be converted into cash to contribute to financing and generating profits. Their value may also increase over time.

Liabilities, on the other hand, are obligations that the company must settle. They are not limited to cash and may include goods or services that the company must deliver, or incomplete transactions. Liabilities represent what the company owes to a third party, and their value may decrease over time or be settled, sometimes in exchange for cash.

Overall, both assets and liabilities are fundamental elements of accounting, forming the basis of the balance sheet.

How Daftra helps in asset management

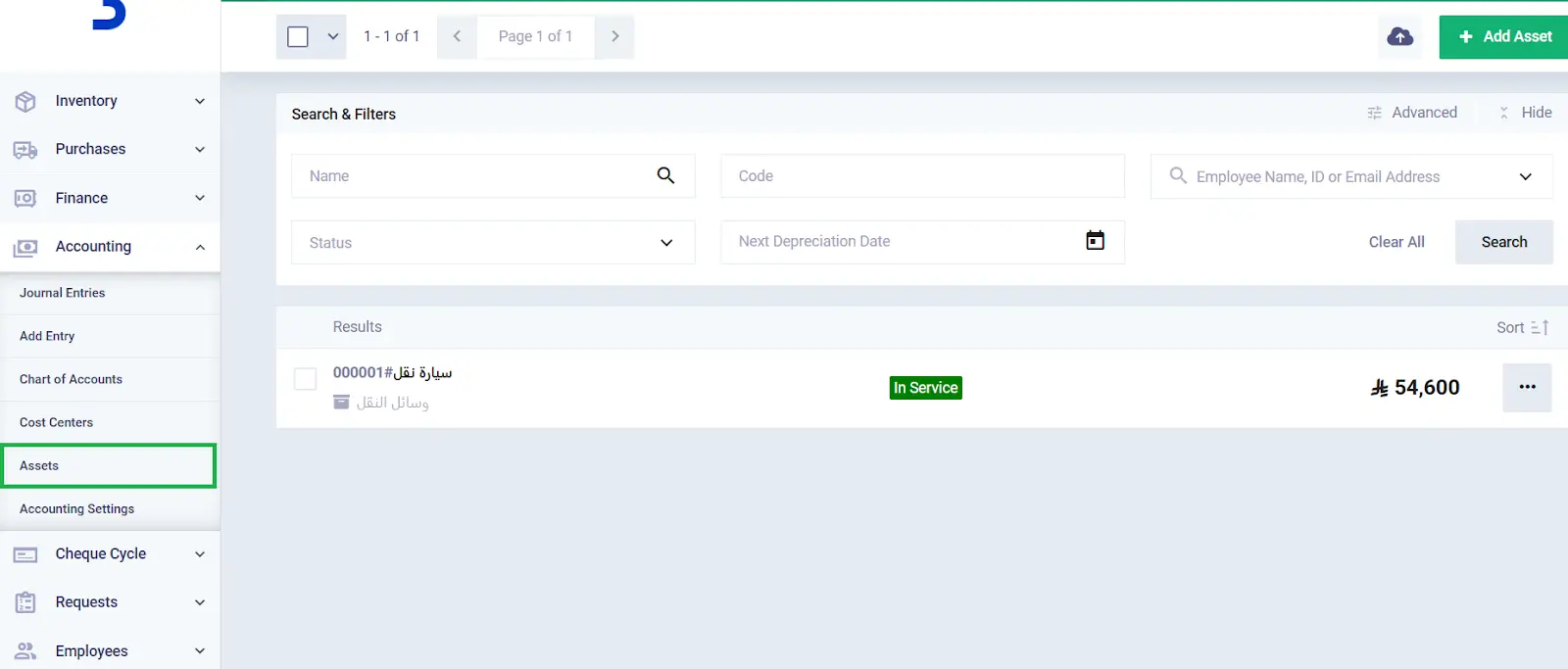

The Daftra asset accounting software allows you to add all types of assets you own, automatically create accounting entries for these assets, and automatically update their balances in the chart of accounts.

You can categorize each type of asset to filter and track it separately from other types. Additionally, you can revalue an asset, capitalize it, or calculate depreciation on assets using your chosen depreciation method, which is an essential part of your accounting processes.

Frequently Asked Questions

Are stocks considered assets?

Yes, stocks are considered financial assets. If a company owns shares in other companies, these shares are classified as part of its assets on the balance sheet.

Is capital considered an asset?

No, capital is not classified as an asset in accounting. It is part of equity, representing the funds invested by owners, shareholders, or partners in the company. Therefore, capital is a primary resource for the business but is not considered part of the assets used in daily operations.

What are bank assets?

Bank assets include cash, loans granted to customers, investments in securities, real estate, and other resources expected to generate economic benefits.

Is gold considered an asset?

Yes, gold is considered an asset. It can be classified as a fixed asset if held for sale or as an investment if kept to increase in value.

How do I differentiate between assets and liabilities?

Assets are the properties and resources owned by a company or individual, whereas liabilities are financial obligations that the company or individual must settle.

Are creditors assets?

No, creditors are not assets. They are parties to whom the business owes money and represent liabilities on the company’s balance sheet.

Why are assets debits and capital credits?

In double-entry accounting, every transaction affects two sides of the balance sheet. When a company buys an asset, the debit side (assets) increases by the asset’s value, and the credit side (either liabilities or equity) increases by the same amount.

For example, if a company purchases equipment worth $44,000, cash (an asset) will decrease by $44,000 (debit), and equipment (an asset) will increase by $44,000 (debit).

Why do assets equal liabilities?

This reflects the accounting equation: Assets = Liabilities + Equity.

It means all company assets are financed either through debt (liabilities) or owner investments (equity).

Read now: What is the Accounting Equation and Its Key Components and Limitations?

Are cars considered assets?

Yes, cars are tangible assets. Note that cars depreciate over time, meaning their value decreases.

Is a house considered an asset?

Yes, a house is a tangible asset that may increase in value over time and can generate income if rented.

Are software programs intangible assets?

Software is generally considered an intangible asset, though classifications may depend on local accounting rules and standards. Some countries may have specific rules regarding software asset classification.

What are total assets?

Total assets refer to the sum of cash, cash equivalents, short-term investments, accounts receivable, inventory, prepaid expenses, and other assets.

Is investment considered an asset?

Yes, investments can be assets, including financial investments in stocks and bonds or real estate investments in commercial, administrative, or residential properties.

How do I calculate total assets?

Total assets are calculated by summing all assets listed on the company’s balance sheet, usually divided into current assets, fixed assets, and intangible assets.

What is the difference between assets and net assets?

Assets are the economic resources owned by a company. Net assets are calculated by subtracting total liabilities from total assets, showing the company’s net value, also known as equity.

Conclusion

It is essential for the accounting sector in companies to understand the concept of assets and all their types accurately. Understanding assets in all their classifications affects a company’s financial position and balance sheet and is crucial for achieving its financial goals.