Best Self-Employed Accounting Software

Table of contents:

- Best Self-Employed Accounting Software

- 1- Daftra Self-Employed Accounting Software

- 2- QuickBooks Self-Employed Accounting Software

- 3- FreshBooks Self-Employed Accounting Software

- 4- Wave Self-Employed Accounting Software

- 5- Zoho Books Self-Employed Accounting Software

- 6- Xero Self-Employed Accounting Software

- 8- ZipBooks Self-Employed Accounting Software

Self-employed companies do not need to carry out their detailed accounting tasks, prepare VAT, and manually track expenses and income, among other responsibilities. That's why they need to use accounting software that simplifies all the financial aspects and activities. The best self-employed accounting software should be chosen based on its focus on taxes, easy and user-friendly interface, attractive pricing plans, and comprehensive tools and programs. In this article, you will discover the best self-employed accounting software based on its features, pricing plans, pros, and cons.

Best Self-Employed Accounting Software

Best Self-Employed Accounting Software relies on your needs, the business fields, and the goals you aim to achieve, so let's start with the best Accounting Software and how it serves your business.

- Daftra

- QuickBooks Self-Employed

- FreshBooks

- Wave

- Zoho Books

- Xero

- FreeAgent

- ZipBooks

- TrulySmall

1- Daftra Self-Employed Accounting Software

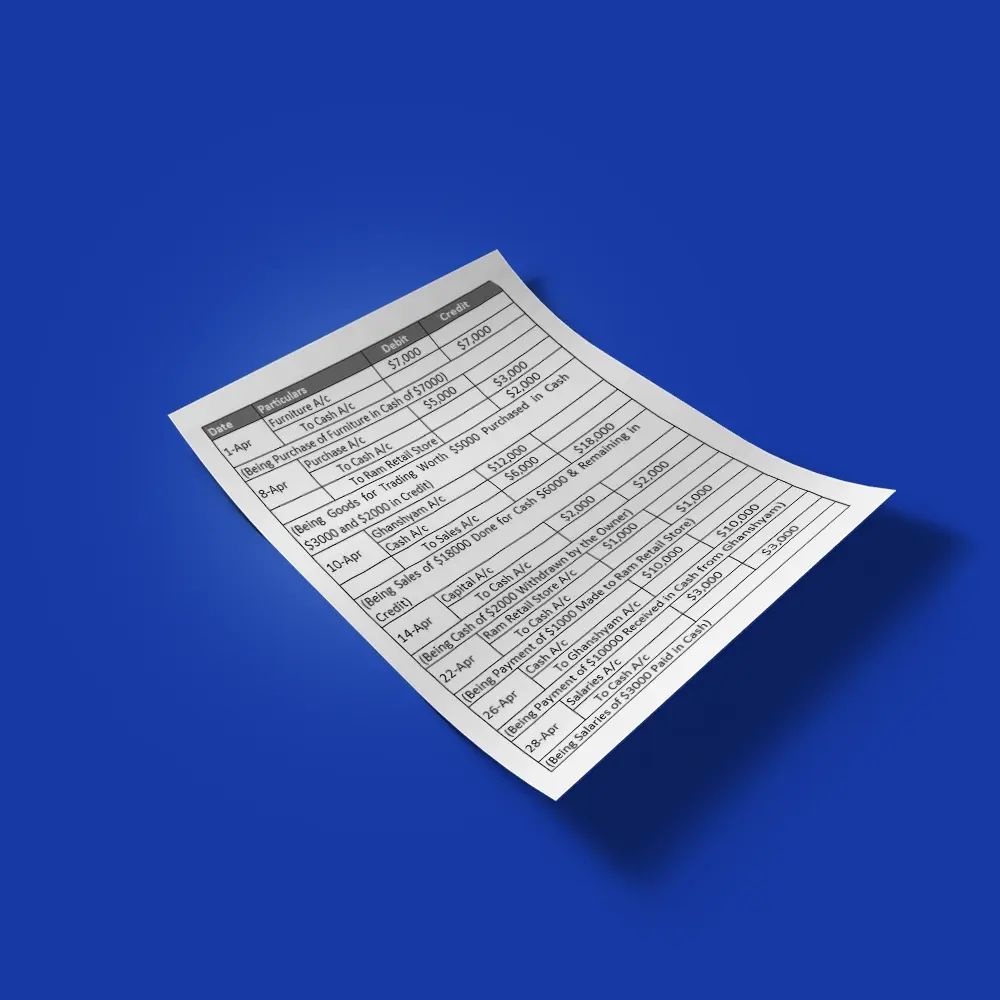

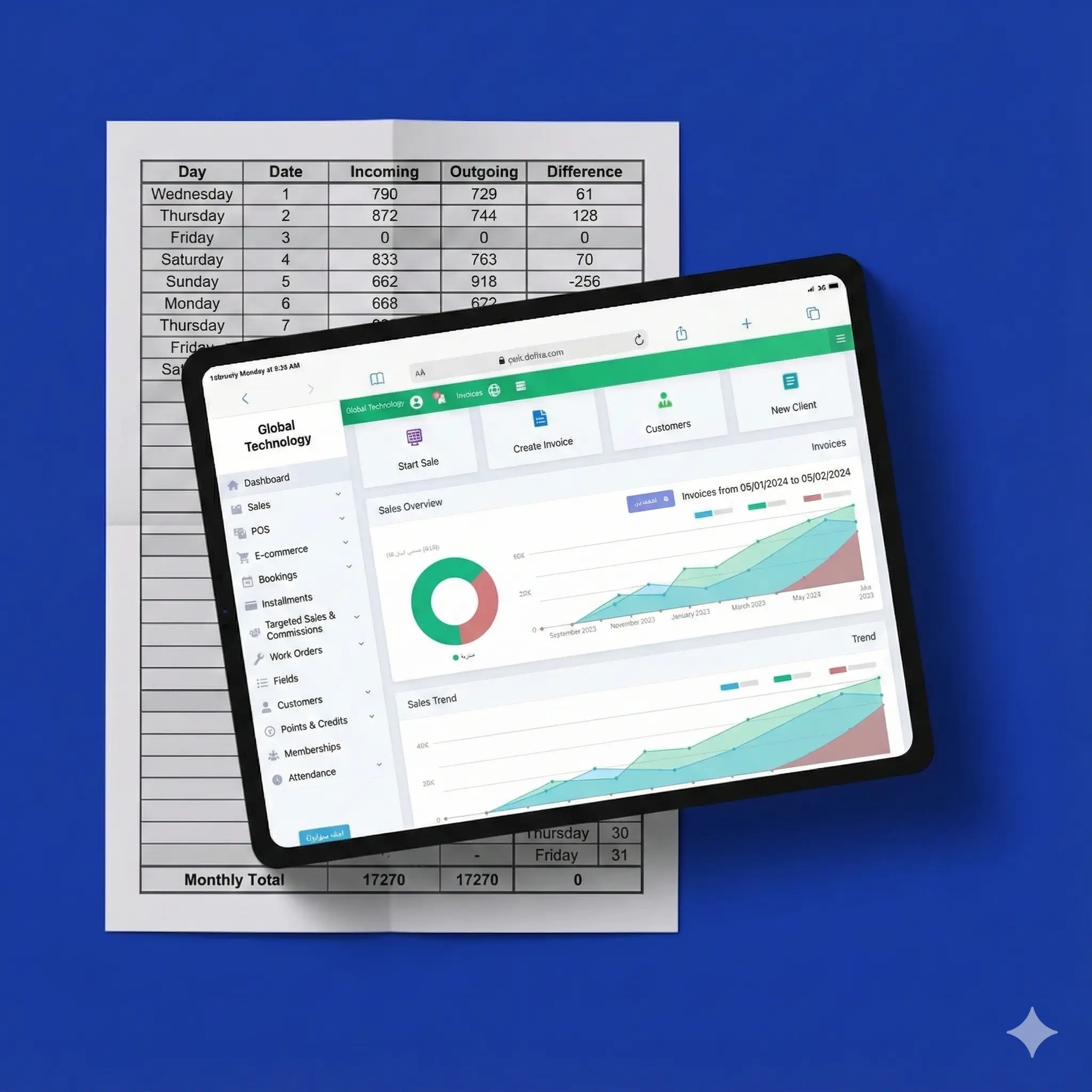

Daftra Self-Employed Accounting Software is a comprehensive system designed to manage all aspects of accounting, including expense management and tracking, General Accounting Chart of Accounts, Asset Management, Cost Centers, and Cheque Cycle. Furthermore, the Daftra ERP system offers programs for inventory, human resources, operations, and CRM.

Key features:

Daftra Integrated Modules

Daftra Self-Employed Accounting Software is one of the comprehensive programs and tools provided in Daftra software, offering management modules that serve more than 50 industries and businesses of all sizes. These modules can be activated or deactivated based on specific business needs. Daftra modules integrate and interconnect in all accounting aspects, which means you do not have to enter the same data twice or transfer financial transactions between accounting books, among other essential processes.

Daftra Expense Management Software

Daftra Expense Management Software accomplishes financial control, manages expenses, and tracks payments in real-time, categorizing costs, attaching documents, and automating expense accounts. The Daftra Expenses system allows the division of expenses across multiple accounts and allocation to cost centers with percentages. Besides, managing recurring expenses through one-time entries. Even more, you are enabled to create custom expense categories. Additionally, it features detailed and visual expense reports that can be categorized by staff, vendor, or client.

Daftra Online Accounting Software

Whatever your business field, Daftra General Accounting Software is designed for more than 50 industries, including POS & Retail, Business Services, Professional Services, Medical, Logistics, Tourism, Transportation & Hospitality, Body Care & Fitness, Learning, Automotive, Real Estate & Construction, and more. Track your expenses and income through vouchers, tax calculations, and reporting, as well as the program's features for automated and manual journal entries. You can also customize the chart of accounts and manage cost centers. The software offers professional financial reporting for income statements, balance sheets, trial balances, and other financial reports. In addition, you can access Daftra accounting software from your mobile to manage and track your finances. Daftra offers four applications, including the Daftra Business App, POS App, and ESS Application.

Daftra Asset Management

Daftra Asset Management enables the automatic management of both current assets and fixed assets. The software also supports GAAP-compliant depreciation methods, including Straight-Line, Declining Balance, and Units of Production. Ease your experience in managing asset values (purchase, current, salvage) and assigning them to the employees. Additionally, you can track tasks, view reports, and access transaction history from either the website or a mobile device.

Daftra Cost Centers

Daftra Cost Centers provides easy cost and profit management by allowing users to assign cost centers to journal entries and allocate costs accordingly. In addition to monitoring income and expenditure and tracking transactions, it features the automated assignment of cost centers to accounts, as well as providing the option to operate them manually during the entry of income, expenses, or journal transactions.

Daftra Cheque Cycle

Daftra Cheque Cycle software integrates with all payment systems to allow users to manage different bank accounts and chequebooks. The system supports payable cheques and receivable cheques and tracks their statuses. A single click ensures payment confirmations, as well as managing chequebooks, tracking receivables and payables, and monitoring the cheque cycle from issuance to delivery, collection, rejection, or cancellation.

Pros

- Easily track and categorize expenses and income.

- Access Daftra on the go through its mobile app.

- Accepts payments via multiple gateways like PayPal, Stripe, and other.

- Create professional invoices with custom branding options.

Daftra Self-Employed Accounting Software Pricing Plans

| Plan | Price (Monthly) |

| Free Plan | $0 |

| Starter Plan | ~$8/month |

| Professional Plan | ~$20/month |

| Enterprise Plan | Custom Pricing |

Read also: Best accounting software in Saudi Arabia

2- QuickBooks Self-Employed Accounting Software

The QuickBooks Self-Employed software is designed to support decision-making by making the accounting aspects easy and efficient through providing cash flow visibility, maximizing tax deductions, and preparing tax returns. Manage and monitor income, expenses, and profit throughout the year with QuickBooks' friendly interface; experience the feature of spending tracking and tax optimization, among other tools.

Pros

- Simple design, ideal for freelancers, contractors, and Self-Employed.

- Automatically categorizes personal and business expenses by connecting to bank accounts.

- Automatically calculates quarterly tax estimates.

Cons

- Only a single user can access the account, limiting collaboration.

- Basic reporting options, with no advanced financial analytics.

QuickBooks Self-Employed Pricing

| Plan | Price ($/Month) |

| Self-Employed | $15/month |

| Self-Employed Tax Bundle | $25/month |

| Self-Employed Live Tax Bundle | $35/month |

Read also: Best Accounting Software for Small Business

3- FreshBooks Self-Employed Accounting Software

The FreshBooks Accounting Software efficiently serves the self-employed community, offering an easy experience in creating invoices, tracking online payments, and sending payment reminders, as well as organizing and managing financial transactions and data. FreshBooks provides all the professional financial reports needed to analyze financial performance and support the decision-making process. Additionally, the software enhances customer relationships by providing the following features: estimates, proposals, project management, time tracking, client profiles, and account statements.

Pros

- Offers 24/7 customer support via phone and email.

- Track client interactions, project details, and payment history in one place.

- Easily manage finances from anywhere with the mobile app.

Cons

- Limited offline capabilities for expense tracking or invoicing.

- Plans generally include only one user, with additional charges for more users.

FreshBooks Self-Employed Accounting Software Pricing

| Plan | Price ($/Month) |

| Lite | $17 |

| Plus | $30 |

| Premium | $55 |

| Select | Custom Pricing |

Read also: Best Accounting Software for Small Business

4- Wave Self-Employed Accounting Software

The Wave Self-Employed Accounting Software is designed to streamline the accounting management process for self-employed individuals by providing features within the system, such as payment options for clients, including bank transfers, credit cards, and online payments. It automatically sets payment reminders and recurring invoices, while also offering various invoice templates, customizable options, and an easy setup process. The software supports speedy money transfers, multiple currencies, and various languages. You will find the following features in Wave accounting software: graphs, charts, and dashboards for analyzing income and expenses, read-only bank connections, 256-bit encryption, and auto-organized income, expenses, and payments data in the system.

Pros

- Easily upload and store receipts using the mobile app.

- Automatically syncs across devices for seamless access to financial data.

- Create and send unlimited professional invoices.

Cons

- The mobile app lacks some advanced features available on the web version.

- Free users are limited to email support, with no phone or live chat support.

Wave Self-Employed Accounting Software Pricing

| Plan | Price ($) |

| Core Accounting Software | Free |

| Payment Processing | 2.9% + $0.60 per transaction (credit card) |

| 1% per transaction (ACH) | |

| Payroll | $40/month base + $6 per employee |

Read also: Best ERP software in Saudi Arabia

5- Zoho Books Self-Employed Accounting Software

The Zoho Books Self-Employed Accounting Software is designed to simplify the management of invoices, expense tracking, tax readiness, time tracking, and other financial aspects by supporting customization methods for tools and programs. Zoho Books saves time and effort through its automated software, which reduces manual data entry, organizes data, prepares invoice templates, and more. On top of all the system features is a user-friendly interface. In minutes, you will be able to create and convert quotes to professional invoices, plus set up payment reminders and track billables. Not just that, but even automated recurring invoices.

Pros

- Integrates seamlessly with other Zoho apps (like Zoho CRM, Zoho Projects).

- Automates recurring billing for regular clients.

- Provides 24/7 email and chat support for all users.

Cons

- Does not include payroll functionality, requiring third-party integrations.

- Some advanced customization options are limited.

Zoho Books Self-Employed Accounting Software Pricing

| Plan | Price ($/Month) |

| Free | $0 |

| Standard | $20 |

| Professional | $50 |

| Premium | $70 |

| Elite | $150 |

| Ultimate | $275 |

Read also: Best Accounting Software for Mobile (IOS / Android)

6- Xero Self-Employed Accounting Software

The Xero Self-Employed Accounting Software features automated bank reconciliation, customizable invoice templates, tailored options, an expense management tool, and the ability to create professional financial reports. The Xero software features third-party app integrations, tax preparation, payment reminder settings, bill payment tracking, and support for multiple currencies and languages. Additionally, you can capture bill and receipt details to reduce the time spent and automate data entry.

Pros

- Automatically tracks and categorizes expenses.

- Quickly reconcile bank transactions.

- Supports sales tax calculations (e.g., VAT, GST).

- Integrates with over 1,000 apps, including Stripe and PayPal.

Cons

- Payroll services are not included and require additional subscription fees.

- No Free Plan.

- Limited and Basic Customization Options.

Xero Self-Employed Accounting Software Pricing

| Plan | Price ($/Month) |

| Starter | $13 |

| Standard | $37 |

| Premium | $70 |

Read also: Best Time & Attendance Software in Saudi Arabia

8- ZipBooks Self-Employed Accounting Software

ZipBooks Self-Employed Accounting Software offers three plans, along with the option to use the software on your mobile device. It features easy-to-send and track invoices, bank feed import, recurring billing, and time tracking. It features a user-friendly interface that streamlines invoice creation, payment tracking, report generation, and tax preparation. The software features integrated accounts, interactive charts/graphs, and easy financial data sharing with accountants. Reduce time spent and effort with ZipBooks through its automated payment reminders, recurring invoices, and other financial management tools.

Pros

- The free tier includes essential features like invoicing, expense tracking, and financial reporting.

- Create and send unlimited professional invoices.

- Offers a mobile app for managing finances on the go.

Cons

- Fewer third-party integrations compared to competitors.

- Financial reports are limited in detail and customization.

ZipBooks Self-Employed Accounting Software Pricing

| Plan | Price ($/Month) |

| Starter | Free |

| Smarter | $15 |

| Sophisticated | $35 |

| Accountant | Custom Pricing |

In a nutshell, QuickBooks is recommended for the self-employed to track taxes and mileage, while FreshBooks is more suitable for service-based businesses. While Zoho Books offers comprehensive features, Xero is better suited for a long-term client base. Bring up Daftra, the best self-employed accounting software that suits all-sized businesses and serves more than 50 industries.