Everything You Need to Know About the Financial Statement

Table of contents:

- What is a Financial Statement?

- What is the Importance of a Financial Statement?

- What Can You Gain from Reading the Financial Statement?

- What is the Importance of the Financial Statement in Attracting Investors and Partners?

- What Are the Types of Financial Data?

- What Are the Common Challenges in Understanding a Financial Statement?

- How Daftra Helps You Prepare the Financial Statement

- Frequently Asked Questions

Everything You Need to Know About the Financial Statement How Can Business Owners and Investors Evaluate Opportunities and Analyze Performance in Changing Markets?

The answer lies simply in the financial statement, which is one of the most important documents through which strategic decisions can be made based on solid foundations to determine the future of investments.

Through the figures presented in financial statements, it is possible to understand the factors affecting profitability and liquidity, which helps monitor and compare the extent to which the company’s investments achieve the desired returns. In the following lines, we present a summary of our accounting expertise in defining the financial statement, its importance, types, and common challenges in understanding it.

What is a Financial Statement?

A financial statement refers to the documents that show the financial position of a company and the entity’s performance over a specific period. The financial statement contains information about everything the company owns or owes, the amount of profits and losses achieved, and the costs incurred.

Financial statements are usually prepared at the end of the year; however, they can also be prepared on a temporary basis, whether monthly, quarterly, or semi-annually. The preparation follows International Financial Reporting Standards (IFRS) or Accounting Standards for Private Enterprises (ASPE).

Financial data is collected from various sources, such as accounting systems that can prepare financial reports, like the comprehensive Daftra cloud system, financial market transactions, economic reports, and financial news platforms.

What is the Importance of a Financial Statement?

The importance of a financial statement lies in being a mirror reflecting the company’s financial health, management guidance, and future direction. Through the financial statement, it is possible to understand the details forming the company’s financial structure, including profitability ratios, liquidity, leverage, and more.

Below are the main factors highlighting the importance and objectives of the financial statement:

1- Evaluating Financial Performance

Financial statements allow evaluating the company’s financial performance over the long or short term by analyzing certain figures in the statement, such as revenues, profits, cash flow, and assessing whether the company achieves a good return on investment.

2- Understanding the Company’s Financial Health

The financial statement helps investors and partners understand the company’s financial health and assess its ability to manage obligations, expenses, and assets, as well as plan and manage the budget in general, evaluating financial security and adequacy of reserves.

3- Planning for the Future

The financial statement reveals strategies for future budget planning and growth potential. It also provides insight into the company’s plans to face financial risks, such as market fluctuations, economic downturns, and other challenges.

4- Analyzing Profitability

The financial statement helps determine the company’s success in generating profits by comparing revenues to expenses and reviewing financial data across different historical periods.

5- Compliance with Standards

Preparing financial statements is essential to comply with accounting standards, ensure transparency, and protect the rights and interests of investors and all relevant external parties. Financial statements are also used to prepare annual tax returns, which is a form of compliance with commercial and accounting regulations.

What Can You Gain from Reading the Financial Statement?

Achieving financial objectives depends on correctly reading the financial statement and using it to evaluate performance, guide decisions, forecast results, and extract recommendations and improvements that contribute to enhancing overall financial performance, sustainability, and competitive position. After reading the financial statement, the following benefits can be obtained:

1- Providing Important Financial Information

The figures and statistics in the financial statement can be used by investors and creditors to make decisions regarding investments, loans, and financing.

2- Developing Estimated Financial Budgets

Financial statements can be used to prepare logical Estimated Budgets. Through these budgets, it is possible to determine the company’s financial priorities and goals, identify plans to reduce costs, increase positive cash flow from sales revenue, asset investments, and other sources, and attract the trust of financiers and investors.

3- Identifying Strengths and Weaknesses of the Company

Reading the financial statement helps companies identify weaknesses such as high financial burdens, declining revenues, increasing operating expenses, excess inventory, and weak liquidity. It also helps identify strengths in financial management, such as the ability to achieve sustainable profits, maintain sufficient cash to cover obligations, a low debt-to-asset ratio, and achieve high-profit margins that reflect the company’s efficiency in cost management.

What is the Importance of the Financial Statement in Attracting Investors and Partners?

A company’s financial statements play a key role in attracting investors and partners, as they help enhance investment and strategic partnerships by understanding the risks associated with investment and comparing the performance of companies within the same sector. The following points highlight the role of the financial statement in attracting investors and partners:

1- Confirming the Company’s Credibility as an Investment Entity

Financial statements containing accurate and reliable information enhance the company’s credibility and support its positive image among investors, clients, and partners. This information helps protect investors’ rights, increasing their trust and supporting their investment decisions in the right opportunities.

2- Evaluating and Comparing Company Performance

Financial statements help evaluate the company’s financial and operational performance and compare it with competitors in the same field. This provides investors and partners with a clear view of market strengths and weaknesses, and investment decisions are based on this clear perspective.

3- Balancing Risks and Returns

Information from financial statement analysis helps investors and partners balance potential investment risks against expected returns. It also provides detailed information on dividend distributions for investors seeking sustainable income sources.

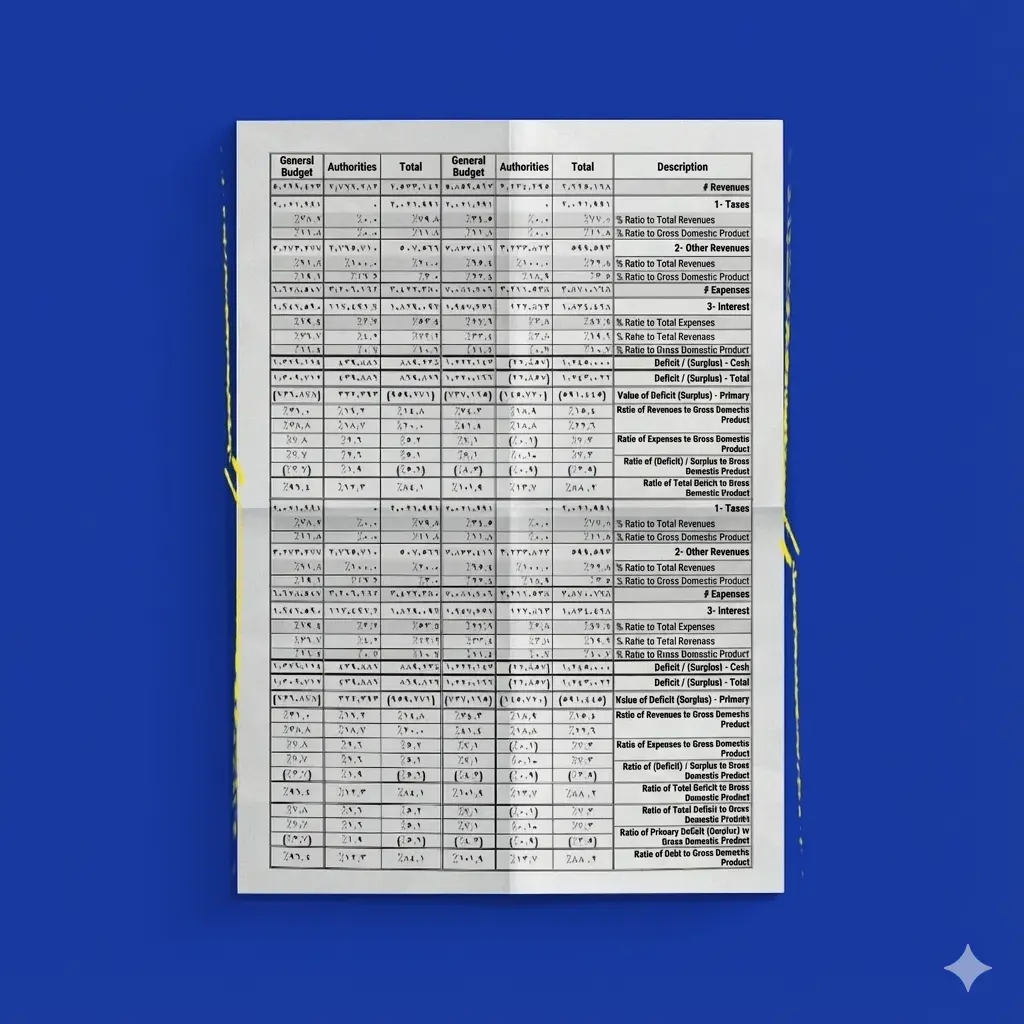

What Are the Types of Financial Data?

Some may think that financial data is limited only to the basic financial statements, but there are several types of financial data, including:

1- Statement of Assets and Liabilities

Also known as the statement of financial position or the balance sheet, it includes details of everything the company owns, such as current or non-current assets, the liabilities it owes, and shareholders’ equity.

Through the chart of accounts in the Daftra system, you can view detailed financial data for assets, liabilities, and equity, with the option to display accurate and detailed reports for this information.

2- Statement of Revenues and Expenses

This is the financial data that shows the profits and amounts the company has earned from its business activities, as well as all expenses incurred. This financial statement helps assess the company’s performance and determine its profitability. The Daftra accounting system helps you track the financial data of receipts or payments, as well as calculate profits and losses.

3- Statement of Comprehensive Income

This financial statement includes all revenues and expenses that were not recorded in the income statement. It also includes changes in the value of financial assets, such as investments that have not yet generated returns. The importance of this statement lies in providing a comprehensive view of long-term financial performance.

4- Trade Messages

These are a type of financial data that show details related to securities such as stocks and bonds. Key details include the value of the securities and the time of executing transactions. This type of financial data helps investors track their activities and evaluate investment portfolios.

5- Market Data

This financial data provides updated information on trading activities in the financial market, such as stock prices, bids, market trends, and stock exchange news.

6- Payment Transaction Data

This type of financial data provides information related to money transfers, whether mass payments (for local, international, or global business payments) or individual transfers. This data helps track cash flows and manage liquidity.

7- Financial Data for Credit and Debit Card Transactions

This includes data related to card transactions, such as deposited or withdrawn amounts and transaction dates. Such data contributes to managing personal or business expenses.

8- Cash Flow Data

These are data that reflect incoming and outgoing cash flows and the type of activity associated with the cash movements, such as cash flows from operating activities, investing activities, or financing activities. The cash flow statement is used to analyze financial performance and support decision-making.

What Are the Common Challenges in Understanding a Financial Statement?

Some individuals, especially those who are not specialized in finance or accounting, face several challenges when trying to understand or analyze the results of a financial statement. These challenges include:

1- Unfamiliar Financial Terminology

Financial terminology can sometimes be complex and include highly technical terms that may be unfamiliar to some individuals. Therefore, written or visual educational tools are used to understand these terms, or assistance may be sought from experts.

2- Difficulty Interpreting Financial Data Correctly

It can be difficult to correctly interpret financial data, especially when multiple factors, such as economic fluctuations, growth rates, debts, and profits, affect the results.

Financial statements also contain detailed information such as assets, liabilities, revenues, expenses, cash flows, and equity. Understanding these details and connecting them to extract logical and useful conclusions requires additional time and effort. In some cases, important aspects of the financial statement may be overlooked, which leads to an incomplete picture.

3- Differences in Accounting Standards and Policies

Differences in accounting standards used across countries and companies make it more difficult to compare financial data, whether between different institutions or even within the same institution across multiple years. These differences appear in how currencies are converted, methods for estimating transaction values, and more.

4- Incomplete Financial Analysis

Sometimes, individuals rely only on the figures in the financial statement without conducting a comprehensive analysis using financial analysis tools or reliable accounting systems such as Daftra to understand trends and identify strengths and weaknesses in financial performance.

5- Personal Bias

In some cases, personal biases and opinions influence the interpretation of financial data, often to serve certain interests.

How Daftra Helps You Prepare the Financial Statement

The Daftra cloud-based accounting program is one of the comprehensive accounting systems whose smart solutions allow the generation of detailed reports on sales, purchases, expenses, assets, liabilities, general accounts, and more.

This information is used to prepare financial statements in detail, helping analyze the company’s financial performance accurately and easily.

Frequently Asked Questions

What Is the Difference Between a Financial Statement and Financial Reports?

The main difference is that the financial statement is a broad term that includes financial report data as well as other data related to account records, invoices, securities transactions, banking transactions, and more. Meanwhile, financial reports are limited to the income statement, statement of financial position, and cash flow statement.

Financial data is considered an essential component in building these financial reports, which are presented in an official and organized manner to investors and all other stakeholders.

What is the Most Important Financial Data for Companies?

- Financial data for reports such as the balance sheet, income statement, cash flow statement, and the statement of shareholders’ equity.

- Financial data that provides the necessary information about potential or expected risks.

- Financial ratio analysis data.

What Is Meant by Financial Data Analysis?

Financial data analysis refers to the process of examining, reviewing, and evaluating financial data using various tools, most notably accounting software.

Financial data analysis is carried out through several stages, including reviewing financial statements, analyzing various financial ratios, analyzing financial trends for revenues and expenses across multiple accounting periods, and finally using the results of financial analysis to forecast the institution’s future performance.

What Is a Personal Financial Statement?

A personal financial statement refers to a summary of an individual's financial position over a specific period. It includes the assets an individual owns and the liabilities and debts owed.

A personal financial statement is used for personal financial planning purposes such as tracking income and expenses, improving saving habits, and more.

What Are the Most Common Errors Related to the Financial Statement?

Common errors that affect the accuracy and reliability of financial data include:

- Misstatement of the figures presented in the financial statement.

- Omitting some items related to assets, liabilities, revenues, or expenses that affect the balance of the financial data.

- Relying on outdated financial data which affects the validity of decisions based on that data.

- Not reviewing the financial data before issuing it.

- Incorrect classification and categorization of financial data items.

- Inaccurate estimation of provisions and depreciation.

- Errors associated with omitting certain information from the financial statement.

What Is the Difference Between a Corporate Financial Statement and a Personal Financial Statement?

The difference between a corporate financial statement and a personal financial statement appears across three main dimensions: the purpose, the scope of focus, and the stakeholders who use the statement.

A corporate financial statement aims to provide detailed information about the company’s financial performance. It focuses on a broad scope, including financial statements, financial ratios, and notes. The stakeholders who benefit from a corporate financial statement are investors, creditors, and owners.

On the other hand, the primary purpose of a personal financial statement is to manage an individual’s personal budget. Therefore, it focuses on a limited scope of financial information and is used only by the individual concerned or the family.

In conclusion, the importance of the financial statement must be recognized and treated as a guiding tool that directs institutions in setting financial management strategies that support growth, expansion, and profit enhancement.

The significance of the financial statement goes beyond the numbers it presents, it empowers individuals to anticipate future challenges, prepare to manage them, and turn them into opportunities, helping them stay ahead of the competition.

Therefore, whether you are a business owner or an investor, the proper interpretation of financial data is your first step toward achieving your professional and financial goals.