Trial Balance: What It Is, How to Prepare It, and Its Importance in Accounting

Table of contents:

- What is the Definition of a Trial Balance?

- Why is the Trial Balance Called by This Name?

- How is the Trial Balance Prepared?

- What is the Importance of a Trial Balance?

- What are the Components of a Trial Balance?

- What is the Purpose of a Trial Balance?

- When is Trial Balance Balanced?

- When is Trial Balance Not Balanced?

- Is Trial Balance Balance Definitive Proof of No Errors?

- What is the Difference Between Pre-Adjustment and Post-Adjustment Trial Balance?

- Does Profit and Loss Account Appear in Trial Balance?

- Does Depreciation Appear in Trial Balance?

- Does Capital Appear in Trial Balance?

- What Do the Balances in Post-Adjustment Trial Balance Represent?

- How Do You Calculate Unknown Capital in Trial Balance?

- What are the Types of Trial Balance?

- How to Read Trial Balance?

- What are the Errors in Trial Balance?

- What are the Defects of Trial Balance?

- What Accounts Do Not Appear in Trial Balance?

- What Errors Does Trial Balance Not Show?

- What is the Difference Between Trial Balance and Balance Sheet?

- What is the Difference Between Trial Balance and Statement of Financial Position?

- What is the Difference Between Trial Balance and General Ledger?

- Frequently Asked Questions

- How to generate a trial balance in Daftra

What is the main source through which the balance of each account in an organization can be determined? The answer is simply the trial balance, which is considered an indispensable step that cannot be overlooked because it serves as a control and review mechanism for the organization's books and clarifies whether the operations that were performed, before its preparation, within the framework of financial accounting are correct or contain errors or manipulation.

Therefore, we present a comprehensive guide about everything related to the trial balance, starting from its definition, importance, types, how to prepare a trial balance, the accounts that appear in the trial balance in accounting, and the most prominent errors related to it. All these details and more you will find with a detailed explanation that helps you complete financial accounting tasks easily and accurately.

What is the Definition of a Trial Balance?

The trial balance is responsible for aggregating debit and credit accounts and determining the balance of each of them. It is prepared at the end of each financial period according to its duration, and the debit side must equal the credit side for the accounts recorded in the trial balance, as it is considered one of the most important steps in the accounting cycle.

The recording process in the trial balance is done through the accounts found in the general ledger, so the general ledger accounts must be checked and reviewed well to avoid errors in the trial balance.

The trial balance can be prepared at the end of the year, but if the organization wants to prepare the trial balance every month or three months, this makes it easier to discover errors and review financial transactions, thus resulting in accuracy in the accounts.

Read also: Definition of Trial Balance Term

Why is the Trial Balance Called by This Name?

The trial balance is called by this name in relation to its function, as it is used to review the accuracy and correctness of book accounts and their balances, as well as to ensure that all accounting entries have been recorded correctly and that the sum of debits equals the sum of credits, which helps identify any potential errors and ensures the accuracy of financial data used in preparing final financial statements.

How is the Trial Balance Prepared?

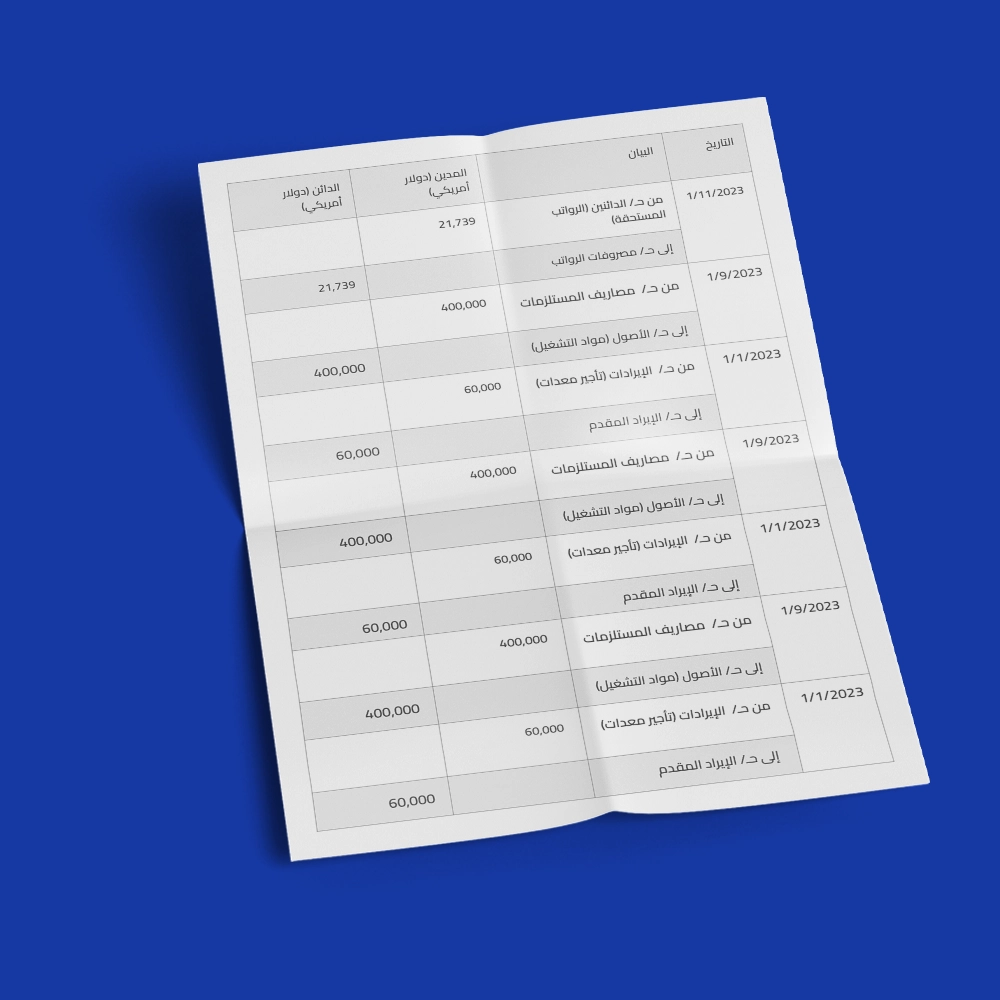

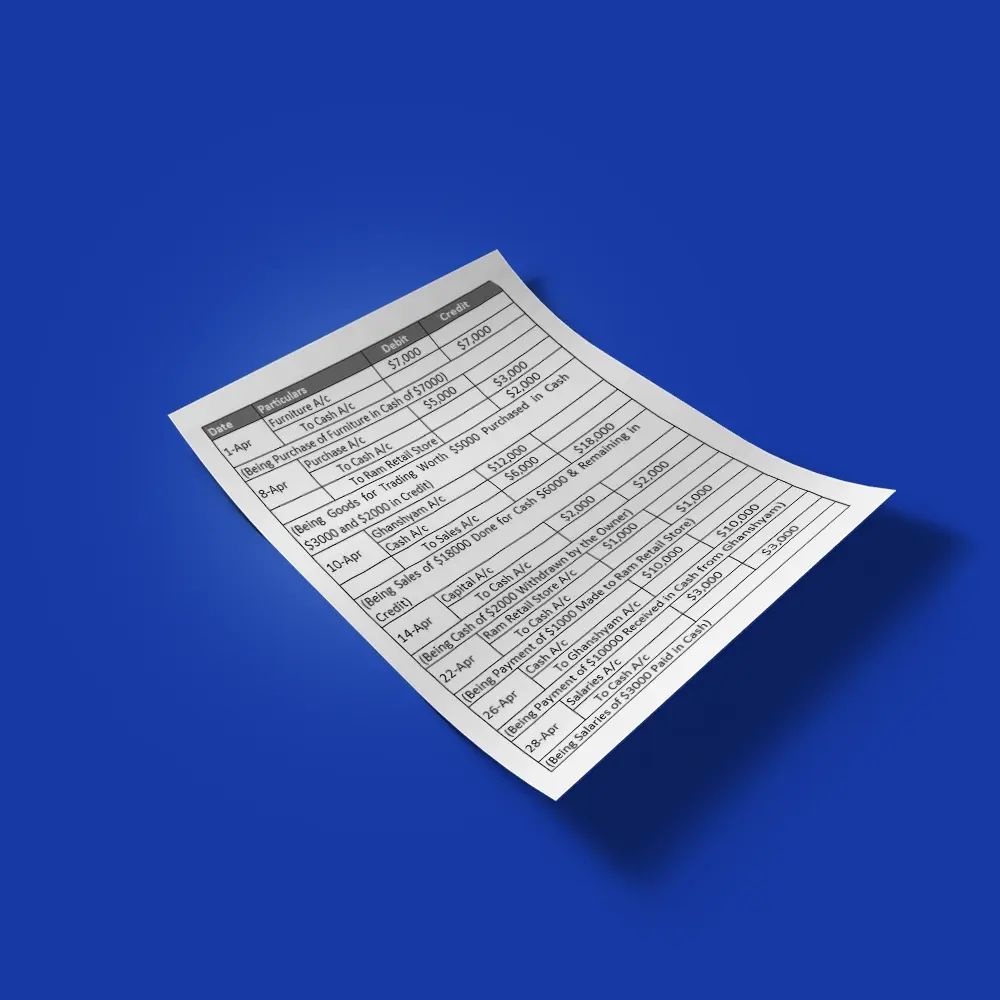

The trial balance is prepared after balancing and closing the general ledger and posting accounts with their debit and credit balances. The following are solved examples of the trial balance:

1/ Company Account Balances

| Account Description | Debit | Credit | Balance | Statement |

| Bank Account | 100,000 | 50,000 | ||

| 50,000 | 100,000 | |||

| 150,000 | 27,000 | |||

| 5,000 | ||||

| Total | 305,000 | 177,000 | 305,000 - 177,000 = 128,000 |

| Cash Account | ||||

| 50,000 | 10,000 | |||

| 50,000 | 8,000 | |||

| 8,000 | 10,000 | |||

| Total | 108,000 | 28,000 | 108,000 - 28,000 = 80,000 |

| Fixed Assets | ||||

| 20,000 | ||||

| 100,000 | ||||

| Total | 120,000 | 0 | 120,000 |

| Capital | ||||

| 300,000 | ||||

| Total | 0 | 300,000 | 300,000 |

| Expenses | ||||

| 5,000 | Rent | |||

| 3,000 | Electricity | |||

| 12,000 | Salaries | |||

| Total | 20,000 | 0 | 20,000 |

| Creditors | ||||

| 25,000 | 100,000 | |||

| Total | 25,000 | 100,000 | 100,000 - 25,000 = 75,000 |

| Purchases | ||||

| 20,000 | ||||

| 10,000 | ||||

| 30,000 | ||||

| Total | 60,000 | 0 | 60,000 |

| Sales | ||||

| 3,000 | ||||

| 15,000 | ||||

| 15,000 | ||||

| Total | 0 | 33,000 | 33,000 |

2/ Preparing the Trial Balance

Trial Balance by Totals

| Account Name | Total Debit | Total Credit | Balance |

| Capital | 300,000 | -300,000 | |

| Bank | 305,000 | 177,000 | 128,000 |

| Sales | 33,000 | -33,000 | |

| Creditors | 25,000 | 100,000 | -75,000 |

| Cash | 108,000 | 28,000 | 80,000 |

| Fixed Assets | 120,000 | 120,000 | |

| Purchases | 60,000 | 60,000 | |

| Rent | 5,000 | 5,000 | |

| Electricity | 3,000 | 3,000 | |

| Salaries | 12,000 | 12,000 | |

| Total | 638,000 | 638,000 |

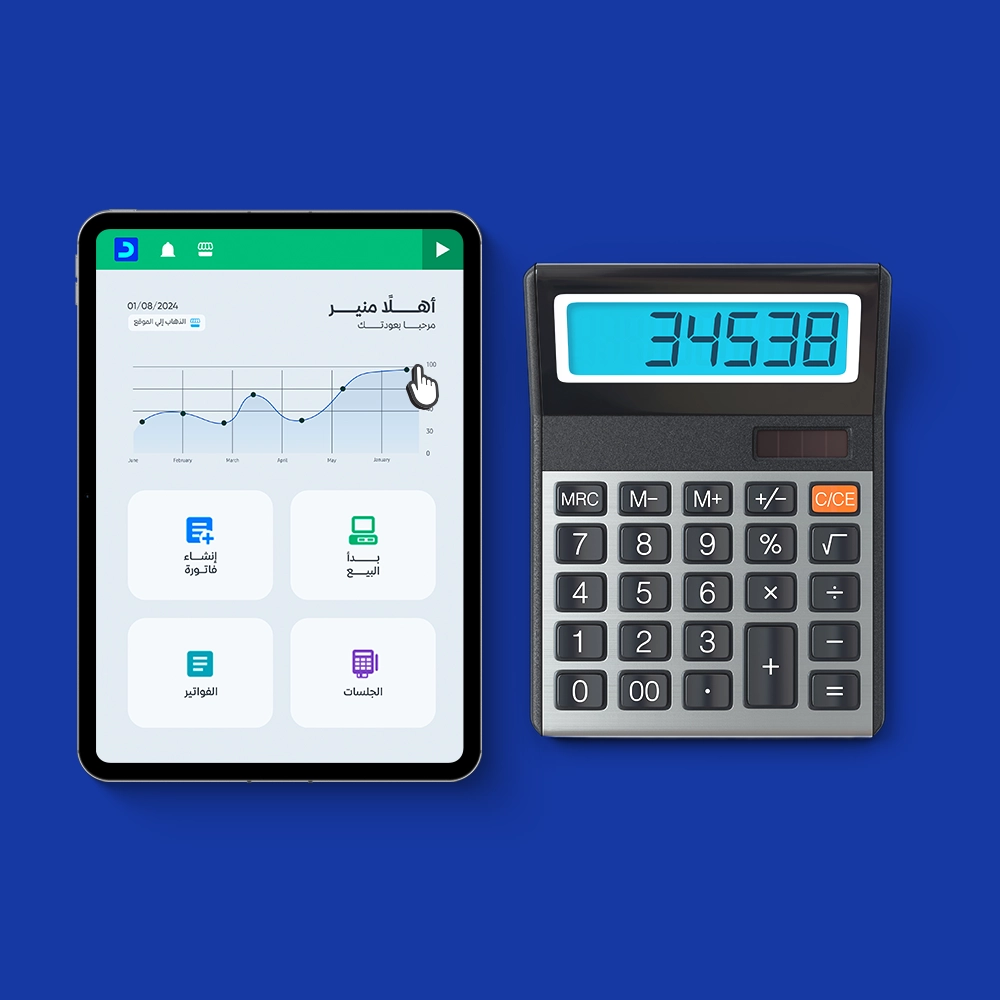

| Did you know that there is an easy way to calculate the trial balance using the Daftra accounting software? The software aggregates debit and credit balances for each account separately when requesting the trial balance calculation, preparing a table that shows the account name, reference number, debit and credit balances, and then ensuring the balance of total balances. Why rely on the manual method when there is software that helps you ensure the balance of totals for both credit and debit balances, and also ensures that records are free from accounting errors? |

| Download the Free Trial Balance Template from Daftra Now |

What is the Importance of a Trial Balance?

The importance of a trial balance cannot be overlooked due to the process it provides for ensuring the accuracy and correctness of financial records through error detection. Learn about the importance of the trial balance in accounting in the following points:

- A trial balance discovers accounting errors that occurred in the journal or general ledger.

- A trial balance is considered the foundation for preparing final accounts, as it helps in aggregating balances and transferring them directly to final accounts.

- It ensures that the organization's accounts that were made in the journal and general ledger have the same debit or credit amounts, and the trial balance is considered the main responsible party for the accuracy of accounts transferred to the organization's balance sheet.

What are the Components of a Trial Balance?

A trial balance consists of two types of accounts: debit balances and credit balances. These accounts differ according to their nature, and trial balance accounts include four basic items (revenues, expenses, assets of all types, and liabilities of all types). The following is an explanation of trial balance components and how they are distributed:

1/ Expenses

Expenses in the trial balance in accounting refer to any expense that the organization pays, which is a debit account, and they are classified in the trial balance under the debit side balance, represented in rent, electricity expenses, employee wages, and salaries.

2/ Revenues

Revenues in the trial balance are any financial amount that the organization receives in exchange for selling goods and services, and revenues are classified in the trial balance under the credit account, represented in sales revenue, revenue from asset sales, and securities revenue.

3/ Assets

Current assets appear in the trial balance on the debit side if there is an increase in their balance, but if they decrease, their balance becomes a credit, such as the cash account or bank account. Fixed assets appear on the debit side in the trial balance because they are always purchased, but if they are sold, they become sales revenue and appear on the credit side.

4/ Liabilities

Liabilities appear on the credit side in the trial balance in accounting because they are considered debts of the organization, represented in current liabilities and fixed liabilities.

What is the Purpose of a Trial Balance?

There are several main objectives for preparing a trial balance in institutions and companies, besides verifying account balance and discovering errors, and other objectives represented in the following:

1/ Preparing Financial Statement Reports

Trial balance helps in preparing financial reports at the end of the fiscal year, as it provides the necessary data for preparing financial statements, such as transferring the final balance of expenses and revenues from trial balance to the income statement, and transferring asset and liability accounts to the financial position.

2/ Discovering Accounting Errors

Trial balance helps in discovering errors when preparing accounts, as it is possible that the financial accountant makes several errors when recording daily entries, and therefore the debit side does not match the credit side in trial balance, and then common accounting errors are searched for such as duplicate recording of some transactions, or oversight of others, or errors in entering numbers related to transaction values and so on.

3/ Summarizing Accounts

Trial balance in accounting summarizes all computational operations that occurred in the organization during the financial period, thus eliminating the need to refer back to the journal and read double-entry transactions.

Read also:

When is Trial Balance Balanced?

Trial balance is balanced when the sum of debits equals the sum of credits, which indicates that all accounting entries have been recorded correctly and that there are no recording errors. Trial balance balance is considered an indicator of the accuracy of accounting records, and some accounting errors may appear in it that are compensated and corrected.

When is Trial Balance Not Balanced?

Trial balance is not balanced based on several reasons or errors in recording or posting financial or accounting operations. Learn about the reasons or cases when trial balance data in accounting is not balanced:

- Errors in entering accounting entries such as writing a number incorrectly or in the wrong account.

- Not recording the accounting entry completely, or ignoring part of it.

- Unbalanced entries, which occurs when the sum of debits does not equal the sum of credits in a specific entry.

- Errors in summing account balances in trial balance.

Is Trial Balance Balance Definitive Proof of No Errors?

No, trial balance balance is not definitive proof of the absence of errors even if it shows that the sum of debits equals the sum of credits. It is possible for errors to occur when recording entries such as recording an entry in the wrong account but with the correct amount, or not recording a specific entry, or recording the entry more than once. Therefore, it is necessary to conduct additional reviews and analyses to ensure the accuracy of accounting records.

What is the Difference Between Pre-Adjustment and Post-Adjustment Trial Balance?

The pre-adjustment trial balance is a report prepared at the end of the accounting period before conducting inventory and adjusting entries. It shows all book accounts and their balances as recorded in the accounting books without any modifications, with the aim of verifying that the sum of debits equals the sum of credits and identifying any potential errors before making adjustments.

Post-adjustment trial balance is the report that is prepared after conducting inventory and adjusting entries. It shows book accounts and their balances after making necessary modifications to ensure the accuracy of financial data for use in preparing final financial statements.

Does Profit and Loss Account Appear in Trial Balance?

The profit and loss account does not appear as a separate account in trial balance, and is represented by other individual accounts in trial balance such as revenue and expense accounts. The main objective of trial balance is to verify that the sum of debits equals the sum of credits, while net profit and loss calculation is done when preparing the income statement.

Does Depreciation Appear in Trial Balance?

Yes, depreciation appears as an expense in expense accounts in trial balance. Additionally, there may be an accumulated depreciation account, which is a contra account that shows the total value of accumulated depreciation on fixed assets and also appears in trial balance in accounting and is used to calculate the book value of fixed assets.

Does Capital Appear in Trial Balance?

Yes, the capital account appears in the trial balance in accounting and shows the amount of investment made by owners in the company. It records changes in capital resulting from retained earnings, withdrawals, or new capital additions. The capital account balance in trial balance shows the total value of owners' equity at the end of the accounting period.

What Do the Balances in Post-Adjustment Trial Balance Represent?

The balances in post-adjustment trial balance represent the book values of accounts after making all necessary adjusting entries. These adjustments may include adjusting accrued revenues and expenses, recording depreciation, adjusting inventory, and correcting any potential errors, with the aim of ensuring that balances reflect the true financial position of the company.

How Do You Calculate Unknown Capital in Trial Balance?

Calculating unknown capital in trial balance requires following some necessary steps such as identifying different types of assets and liabilities and others. Calculate unknown capital in trial balance by using the following equation:

Unknown Capital in Trial Balance = Assets - Liabilities

What are the Types of Trial Balance?

There are 3 types of trial balance, each differing from the other in concept and preparation, but they share in providing a means to identify accounting errors and facilitate the preparation of various financial statements. Learn about the types of trial balance in accounting through the following points:

1- Trial Balance by Totals:

This is a statement prepared on a specific date, showing the totals of the debit side and totals of the credit side for all accounts related to assets, liabilities, expenses, and revenues that appeared in the general ledger, except for the account balance carried forward in the general ledger.

Illustrative Example of Trial Balance by Totals:

| Account Name | Debit | Credit |

| Capital | 40,000 | 140,000 |

| Cash | 245,000 | 240,000 |

| Bank | 47,000 | |

| Sales | 75,000 | |

| Rent Expense | 4,000 | |

| Suppliers | 40,000 | 45,000 |

| Purchases | 80,000 | |

| Salary Expense | 34,000 | |

| Equipment | 70,000 | |

| Bank Loan | 60,000 | |

| Total | 560,000 | 560,000 |

2- Trial Balance by Balances:

This is a statement similar in form to the trial balance by totals, but it contains the carried forward or transferred balance in the general ledger.

Here we do not take the sum of account balances in the general ledger as we did in the trial balance by totals, but we take the transferred balance after balancing the account.

The objective of this balance is to ensure the correctness of the balancing that was done in the general ledger.

Here is an illustrative example of Trial Balance by Balances:

| Account Name | Debit | Credit |

| Capital | 100,000 | |

| Cash | 5,000 | |

| Bank | 47,000 | |

| Sales | 75,000 | |

| Rent Expense | 4,000 | |

| Suppliers | 5,000 | |

| Purchases | 80,000 | |

| Salary Expense | 34,000 | |

| Equipment | 70,000 | |

| Bank Loan | 60,000 | |

| Total | 240,000 | 240,000 |

3- Complete Trial Balance (by Totals and Balances):

Trial balance by totals and balances can be prepared in one balance, showing the status of all accounts during a specified period.

The difference between debit and credit balances in trial balance by totals in accounting is taken and the difference is placed in trial balance by balances.

This will be illustrated in the following example:

| Account Name | Trial Balance by Totals | Trial Balance by Balances | ||

| Debit | Credit | Debit | Credit | |

| Capital | 40,000 | 140,000 | 100,000 | |

| Cash | 245,000 | 240,000 | 5,000 | |

| Bank | 47,000 | 47,000 | ||

| Sales | 75,000 | 75,000 | ||

| Rent Expense | 4,000 | 4,000 | ||

| Suppliers | 40,000 | 45,000 | 5,000 | |

| Purchases | 80,000 | 80,000 | ||

| Salary Expense | 34,000 | 34,000 | ||

| Equipment | 70,000 | 70,000 | ||

| Bank Loan | 60,000 | 60,000 | ||

| Total | 560,000 | 560,000 | 240,000 | 240,000 |

Similar Articles: What is Chart of Accounts and How to Prepare It

How to Read Trial Balance?

Trial balance in accounting is a table containing several columns, where book accounts are arranged in rows. The proper way to read it is through the following steps:

- Look at the first column that contains the names of book accounts.

- Review account balances in the following columns. There may be a column for debits and another for credits, or there may be one column for balances with specification of whether the balance is credit or debit.

- Check the balance by ensuring that the sum of debits equals the sum of credits.

- Pay attention to account details and carefully review balances to ensure they appear logical and that there are no obvious errors.

What are the Errors in Trial Balance?

There are several errors that affect trial balance equilibrium that may occur during the posting or recording stage, or errors that were overlooked. Learn about trial balance errors in detail through the following points:

1- Compensating Errors

Compensating errors in trial balance occur when numbers are recorded incorrectly, but the balance between balances remains intact. This type of error is difficult to detect, which negatively affects the accuracy of financial analysis results.

For example, you have a "Cash" account in (Assets) in trial balance, and a "Sales" account in (Revenues), and you were supposed to record 50,000 Saudi Riyals as sales, but instead you recorded 5,000 Riyals in the sales account, but the cash account was recorded at its correct value of 50,000 Riyals.

When analyzing compensating errors in trial balance, we find that despite the recording error in sales, the numbers were recorded equally in the end (50,000 Riyals in cash and 5,000 Riyals in sales), and therefore trial balance remains balanced. However, despite this balance, the financial record does not reflect actual sales, which affects other financial decisions.

2- Errors of Omission:

These are errors that occur as a result of forgetting to record a complete daily entry in the journal, and therefore not recording that entry will make trial balance balanced but with incorrect balances.

3- Other Errors Such As:

Not posting one of the sides, whether debit or credit, from journal entry to general ledger, and therefore this error affects trial balance equilibrium.

- Posting the debit side to the credit side and vice versa, i.e., posting the credit side to the debit side... and this does not affect balance.

- When balancing accounts in the general ledger, an error can occur and therefore when transferred to trial balance, it will be incorrect.

- Addition can be done incorrectly when adding the debit side and credit side, and therefore totals are transferred incorrectly, so trial balance equilibrium does not occur.

Therefore, after what has been mentioned about the importance of trial balance in accounting and how to prepare it, and its different types…

We realized that there cannot be an organization that does not prepare trial balance to help with control and understanding of transactions that occurred in a concise and understandable manner.

What are the Defects of Trial Balance?

There are some defects that may appear when preparing trial balance, such as not detecting all errors or ensuring the accuracy of all financial accounts. Learn in the following points about trial balance defects before preparing it so you can avoid them:

- Does not detect all accounting errors.

- Does not guarantee the accuracy of all entries and correctness of book accounts.

- Preparing trial balance requires significant time and effort.

- Trial balance can be misleading in some cases, and users may rely excessively on trial balance and consider it evidence of financial accuracy, which may lead to ignoring the need for additional reviews and analyses.

What Accounts Do Not Appear in Trial Balance?

Temporary accounts are those that do not appear in trial balance, and are defined as accounts containing balances that transfer over time to permanent accounts, such as: income summary account and division result account.

Additionally, nominal accounts do not appear in trial balance and are considered a special type of temporary accounts that deal with all financial transactions during the accounting period and close at its end. It includes all income statement accounts plus withdrawal accounts.

Control accounts also do not appear in trial balance in accounting, which are accounts whose purpose is to provide detailed analysis of the company's balance sheet. Control accounts include accounts for notes payable and notes receivable.

What Errors Does Trial Balance Not Show?

You may sometimes wonder about errors that cannot be detected in trial balance. Through the following points, you will learn about types of errors that do not appear in trial balance:

- Compensating errors that occur when an error is made in one account and an opposite error is made in another account with the same amount.

- Negligence errors resulting from completely ignoring an accounting entry.

- Errors of incorrect transfer of numbers from one book to another.

- Errors of writing numbers incorrectly but recording them on the correct side of the account.

What is the Difference Between Trial Balance and Balance Sheet?

Trial balance is an accounting report that shows all book accounts and their balances at the end of a specific accounting period and is used to prepare financial statements.

The balance sheet or statement of financial position is one of the main financial statements that shows the company's financial position at a specific point in time by showing transactions related to assets, liabilities, and owners' equity items.

Here we find that the balance sheet is opposite to trial balance in accounting as it shows values after making all adjustments and is used to provide financial information to investors, creditors, and other external users and concerned parties.

What is the Difference Between Trial Balance and Statement of Financial Position?

Usage is the main difference between them, where trial balance is used primarily as an internal tool to verify the accuracy of accounting records, while the statement of financial position is used to provide comprehensive financial information to owners, investors, partners, and other concerned parties with the aim of evaluating the financial position and performance of the institution and making sound decisions.

What is the Difference Between Trial Balance and General Ledger?

The general ledger contains all accounting details and individual entries and shows all changes occurring to accounts and their balances, while trial balance in accounting shows a summary of final balances for each account at the end of the accounting period.

Frequently Asked Questions

Why doesn't ending inventory appear in the trial balance?

Because ending inventory is classified as an adjusting entry, meaning it is used at the end of the accounting period to adjust the cost of goods sold and calculate inventory in the statement of financial position. Trial balance displays book accounts and their balances before making adjusting entries.

Does beginning inventory appear in the trial balance?

Yes, it appears because it is considered one of the book accounts that show the value of available inventory at the beginning of the accounting period. It is recorded on the credit or debit side of the trial balance based on the nature of the accounting software used (periodic inventory software or perpetual inventory software). Beginning inventory account is used to record purchases and sales that occurred during the accounting period and is adjusted at the end of the period to reflect ending inventory.

Do purchases appear in the trial balance?

Yes, the purchases account appears in the trial balance, as it represents all recorded purchases made by the company during a specific accounting period. The purchases account is used again to calculate the cost of goods sold and update inventory balance.

What is the difference between trial balance and income statement?

The difference between trial balance and income statement is their outcome. Trial balance shows account balances generally at the end of the accounting period, while the income statement shows the result of the difference between revenues and expenses, and this result represents profit or loss.

Do the owner's drawings appear in the trial balance?

The owner's drawings do not appear in the trial balance in accounting because it displays assets against liabilities, while the owner's drawings appear in the statement of financial position under the equity section. This results in an increase in the debit side and a decrease in the credit side of capital or partners' accounts by the same value as the owner's drawings.

What is the difference between trial balance by balances and totals?

The difference between trial balance by balances and totals is in the nature of data displayed.

- Trial balance by balances: displays total operations consisting of the sum of debit and credit balances for each account.

- Trial balance by totals: displays the final balance of debit and credit accounts.

What are the levels of trial balance?

Trial balance levels are the first level which is an unadjusted report, and the second level which is the adjusted report.

- First level trial balance: Unadjusted trial balance is the total of general ledger account balances before adjustment.

- Second level trial balance: Adjusted trial balance is the total of account balances after adjustment.

What are retained earnings in trial balance?

Retained earnings in trial balance are the remaining financial value from company profits that have not been distributed to shareholders, and are usually used to finance company assets and investments.

How can I prepare a balance sheet from trial balance?

Preparing a balance sheet from trial balance requires ensuring balance equilibrium in the adjusted trial balance report before posting to the balance sheet, then classifying accounts into assets, liabilities, and equity.

What is post-closing trial balance?

Post-closing trial balance is a financial report that includes all balances of assets, liabilities, and equity in the general ledger at the end of the period. This process is performed after closing temporary accounts such as revenue and expense accounts.

Does capital appear in trial balance?

Yes, capital appears in trial balance because capital represents company equity shown in the credit account within the trial balance.

Does the cost of goods sold appear in trial balance?

Yes, the cost of goods sold appears in the trial balance under expense accounts.

Is the statement of financial position the same as trial balance?

No, the statement of financial position is not a trial balance. The statement of financial position, also called the balance sheet, is a financial report that shows assets, liabilities, and equity and does not participate in the process of verifying the balance of credit and debit balances.

Do expenses appear in trial balance?

Yes, expenses appear in trial balance because it includes debit accounts, which are expenses.

What is the difference between pre-adjustment and post-adjustment trial balance?

- Pre-adjustment trial balance: is a financial report that includes credit and debit balances as previously recorded.

- Post-adjustment trial balance: is a financial report that includes total balances after inventory and adjustment operations.

What account does not appear in trial balance?

Revenue and expense accounts, profit and loss account, and ending inventory account do not appear in trial balance.

What accounts appear in trial balance?

Credit accounts and debit accounts are what appear in trial balance.

What items will not appear in the trial balance?

Temporary accounts, such as expenses, accounts that carry no balances, accounts that were omitted, estimated accounts, such as allowance for doubtful accounts, personal accounts related to individuals within the company, and accounts that have not yet been posted.

How to generate a trial balance in Daftra

The primary purpose of a trial balance is to review and correct errors before moving to the step of issuing financial reports and statements. It is performed as a basic procedure within the accounting cycle and cannot be completed without it. In Daftra's accounting software, you have general accounting reports that contain trial balance totals and balances reports, through which you control the time period for which you want to issue reports, display the report then print it or save it on your device in the appropriate format, without taking more than 3 minutes.