What are Accounting Reports and Their Forms

In the world of finance and business, no company can succeed or expand without accurate financial management. This is where the importance of accounting reports comes in, which are fundamental tools for understanding companies' financial position and monitoring their performance. They are not limited to recording numbers only, but also contribute to analyzing the financial situation, tracking expenses, and monitoring cash flows, providing a strong database for making strategic decisions based on reliable information. Whether you are a business owner or an accountant, understanding the different types of accounting reports and how to prepare them represents an important step on the path to growth and financial stability.

Therefore, we present to you in this article a comprehensive guide that helps you understand accounting reports, starting from their definition and importance, and reviewing the most popular types that every business owner should be familiar with. We also review the steps for preparing these reports, along with clarifying the importance of using automation and modern accounting software such as Daftra, to simplify operations, ensure information accuracy, and make strategic decisions that drive your business toward success and sustainability.

What are Accounting Reports

An accounting report is a document issued by a company to display its financial position in previous and current periods. This report helps provide a comprehensive view that assists companies and analysts in predicting future financial position with greater accuracy.

The report may include data from various company departments or focus on a specific aspect, such as tracking the department that uses the largest amount of cash flows. Many companies, especially those that pay great attention to their financial affairs, prepare these reports at least monthly, and may prepare them more frequently if they are seeking to achieve specific financial goals.

Top 10 Accounting Reports

An accounting report can be concise, comprehensive, or customized for a specific purpose, depending on the company's needs and the purpose of its preparation.

The following are ten of the most common types of accounting reports that every business owner or financial manager should be familiar with to understand the company's financial position and analyze its performance accurately.

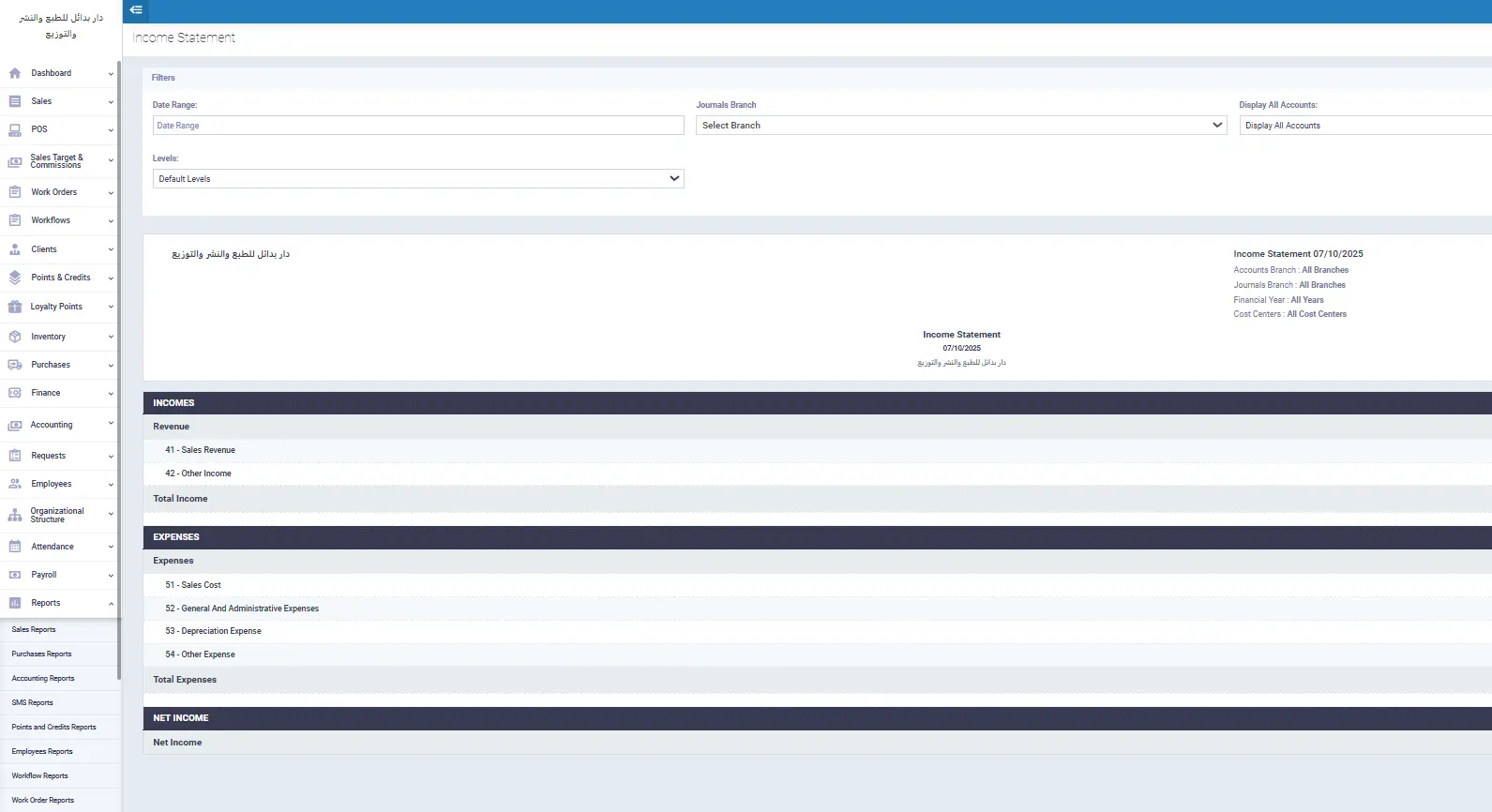

1- Income Statement:

Income statement data shows how profitable your business is during a specific time period by accurately tracking revenues and expenses. The income statement usually consists of three main elements: total revenue, total expenses, and net income.

The report begins by displaying the total revenue achieved during the specified period, then deducts total expenses to arrive at the profit or loss value. The purpose of this statement is to provide a clear and comprehensive picture of the factors that affected the company's net profit during that period.

To prepare an income statement, first determine the time frame for the report (quarterly or annually), then collect revenues and direct costs to calculate the cost of goods sold. After that, gross profit is calculated, and then operating expenses are deducted to reach operating profit. Non-operating income is added and its expenses are deducted to calculate net profit, while ensuring data accuracy using accounting records.

| Daftra software provides the feature of preparing income statement reports easily and accurately, showing details of revenues, expenses, and net profit during a specific time period. |

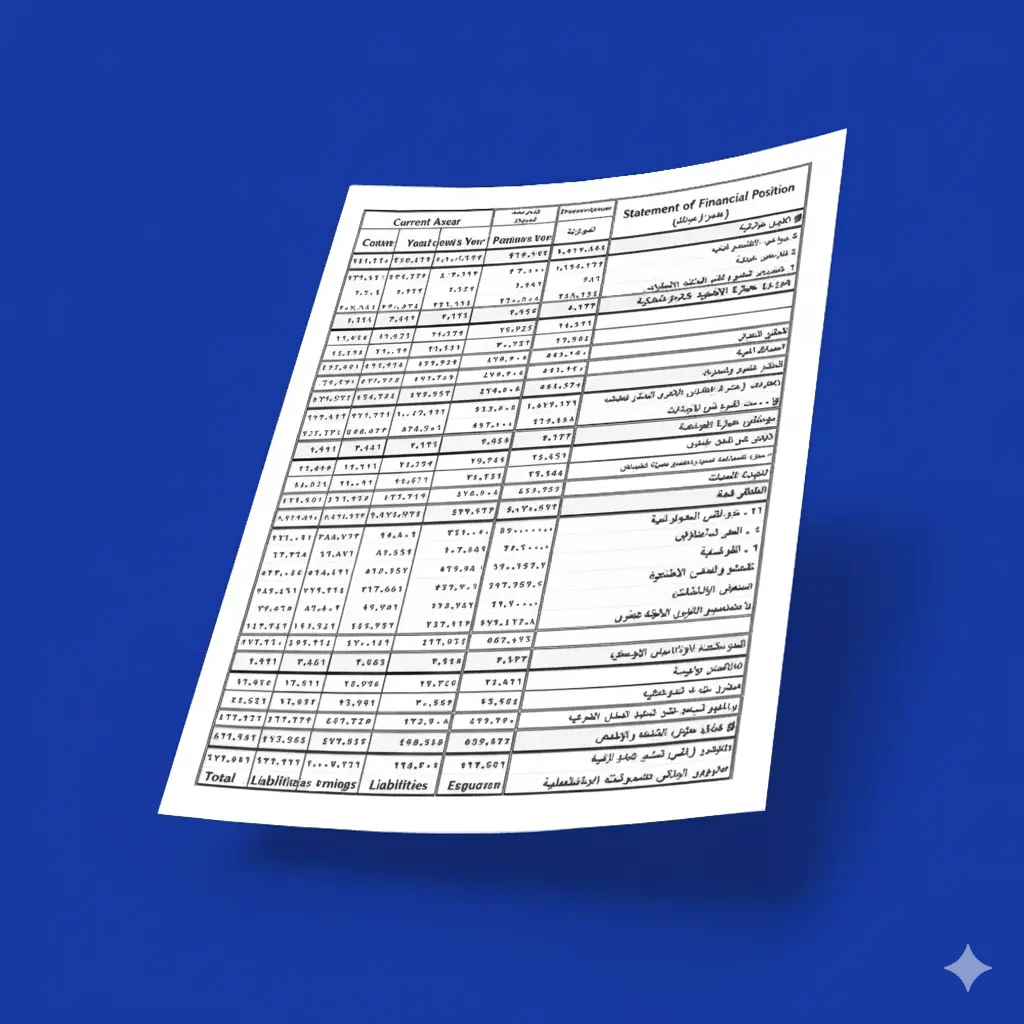

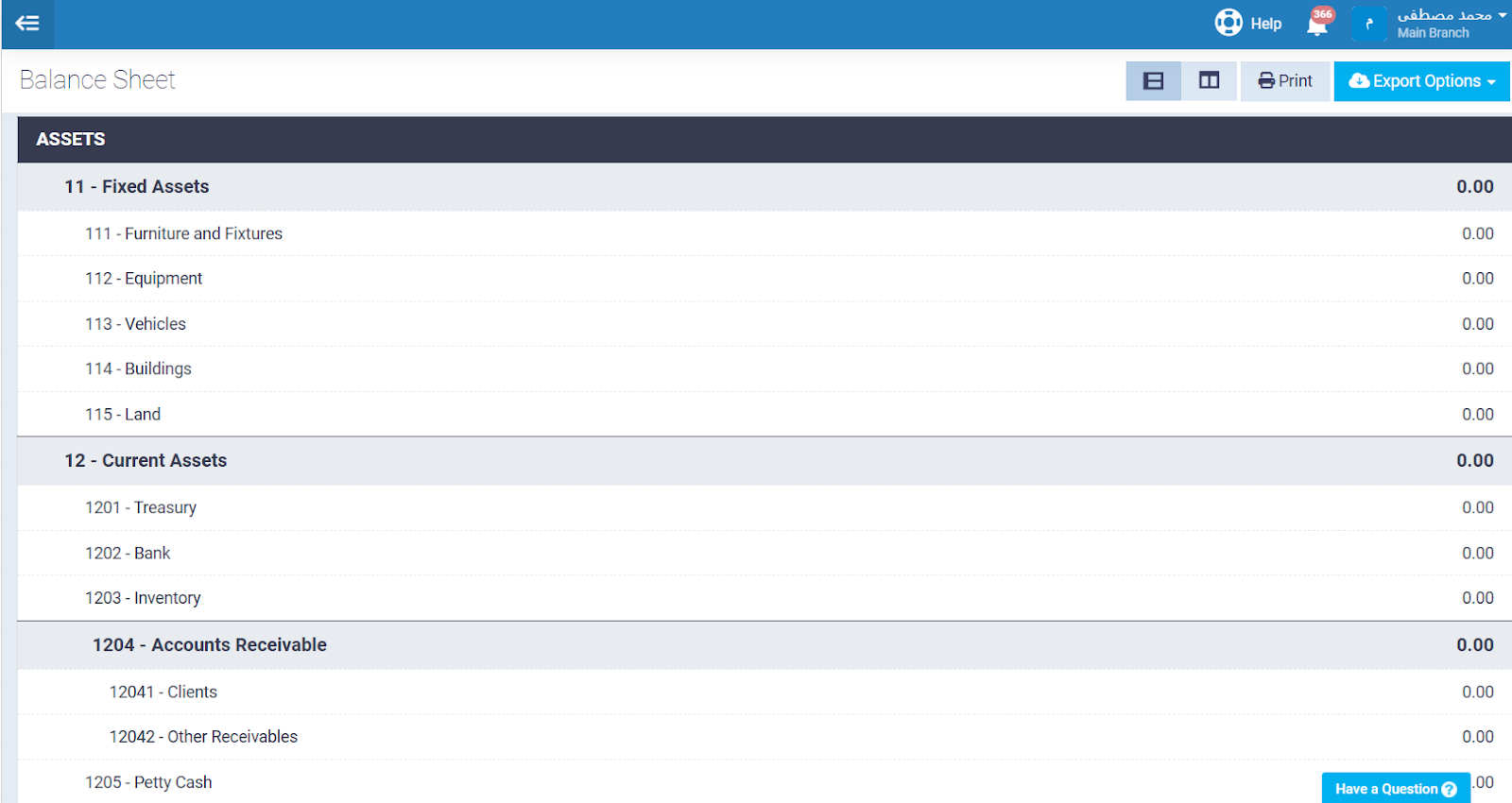

2- Balance Sheet

The balance sheet is one of the most important financial reports that shows the company's financial position on a specific date, displaying what it owns in assets and what it owes in liabilities in addition to shareholders' equity.

This report is used to analyze the company's ability to meet its financial obligations and measure its financial stability with its cash reserves. The balance sheet relies on the basic accounting equation:

Assets = Liabilities + Shareholders' Equity

Usually, the balance sheet is divided into two main sections: assets, and sources of financing, which include: liabilities (debts and obligations), and shareholders' equity (capital and retained earnings).

To prepare the balance sheet, first determine the financial period (quarterly, semi-annually, or annually), then collect the financial records for the period from the general ledger. After that, assets are calculated by dividing them into current and non-current, and liabilities are also calculated. Shareholders' equity is also calculated, and the process is simple in sole proprietorships and more complex in large corporations. Finally, the balance sheet must be balanced using the following equation: Assets = Liabilities + Shareholders' Equity, and to ensure report accuracy, both sides must be equal.

| Daftra software provides the balance sheet report in an organized manner that displays your company's assets and liabilities. |

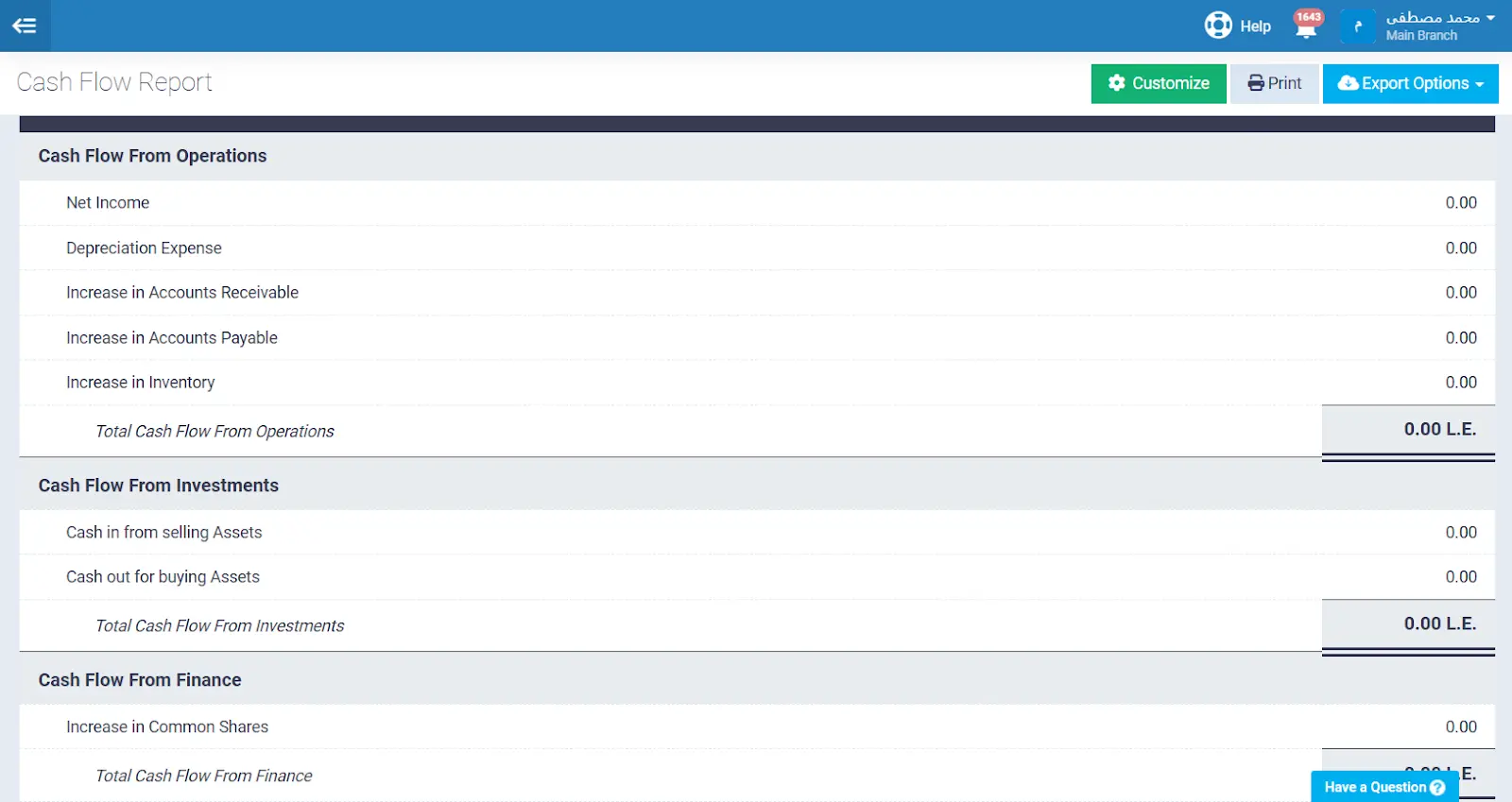

3- Cash Flow Statement

The cash flow statement is a financial report that summarizes the movement of cash in and out of the company during a specific time period, and is one of the most accurate sources in clarifying the company's ability to provide cash liquidity.

This statement relies on three main sources: cash flows resulting from operating activities, investing activities, and financing activities.

The cash flow statement is considered an important link between the income statement and the balance sheet, and is an essential and mandatory part of any company's financial reports.

The process of preparing the cash flow statement goes through several main steps, starting with determining the appropriate time frame according to the nature of the entity's business, then reviewing income statements and balance sheets to ensure data accuracy and completeness. After that, the opening cash balance is determined, then cash flow from operating activities is calculated using the appropriate method.

Then non-cash transactions are collected, such as depreciation and bad debts, then operating, investing, and financing activities are analyzed in detail. After that, the closing cash balance is calculated and compared with the opening balance to monitor differences. Finally, prepare the cash flow statement in a table that includes the three activities (cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities), and their results are summed to reach the final net cash flow.

| Daftra software provides the cash flow statement report accurately and organized, displaying the movement of cash liquidity in and out of the company through operating, investing, and financing activities. This report helps companies monitor their cash flows accurately and make effective financial decisions to ensure liquidity stability. |

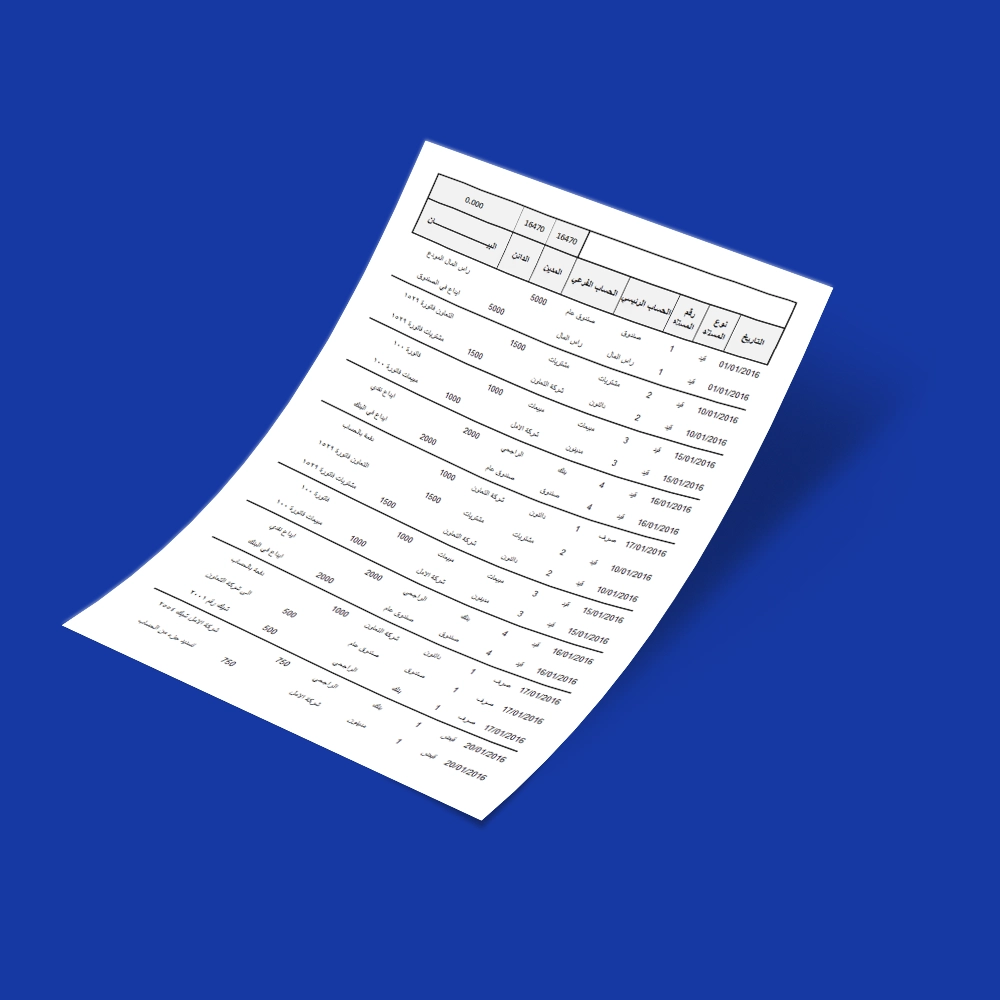

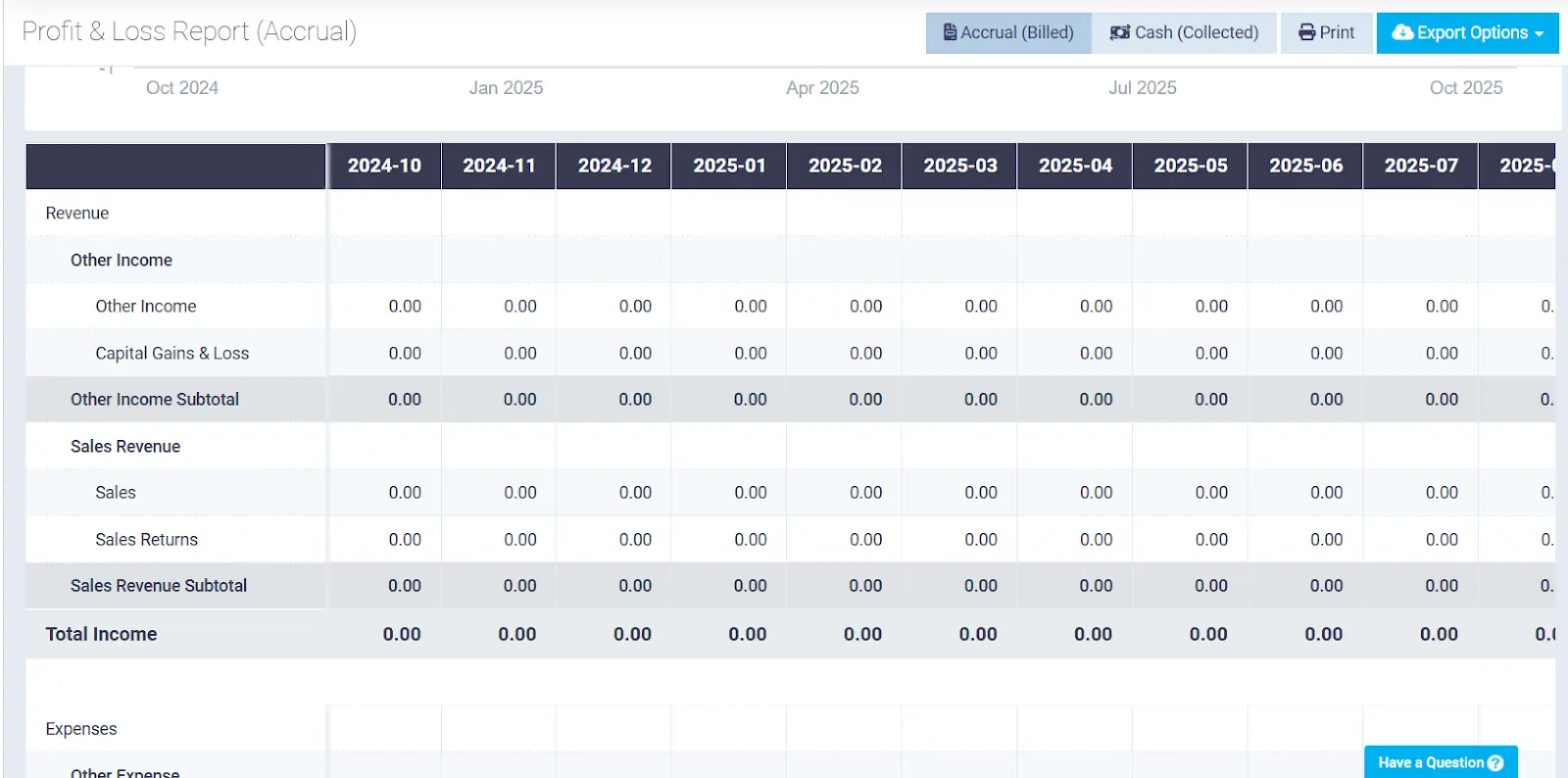

4- Profit and Loss Account

The profit and loss account is a financial report that shows a summary of the company's revenues, costs, and expenses, in addition to net profit or loss during a specific time period. This statement aims to clarify how efficient the company is in generating revenues, controlling expenses, and achieving profits.

To prepare the profit and loss account, we start by determining the time period, then recording all revenues resulting from operating activities, along with expenses such as salaries, advertising, and other costs. Expenses are then deducted from revenues to extract net profit or loss, where revenues are recorded on the credit side and expenses on the debit side.

At the end of the period, results are balanced and transferred to the capital account or retained earnings, and accounts are closed in preparation for the next period.

| Daftra software provides a comprehensive profit and loss statement report, displaying revenues, costs, and expenses accurately, helping companies measure their efficiency in achieving profits and controlling expenditures. The report provides precise details about net profit or loss during a specific time period, contributing to making informed financial decisions. |

5- Expense Report

An expense report is a form used by employees to document expenses incurred while performing their duties inside or outside the company. These expenses are classified into specific categories such as office supplies, travel expenses, accommodation, printing, software, maintenance, and others.

When filling out an expense report, the employee must enter basic information including their name, department, expense date, add the amount paid, name of the payee, and the client or project associated with the expenses. The account under which the expense is recorded is also specified, and any necessary clarification for accounting is added.

If there is a previous advance, its amount is deducted from the total expenses and the employee is asked for reimbursement for the difference only, with the necessity of attaching receipts to prove the expenses. The report is usually accompanied by official receipts used as evidence of expenses, which are relied upon for employee reimbursement.

| Daftra software provides expense reports in an organized and accurate manner, allowing employees to document expenses related to tasks inside or outside the company. The report allows categorizing expenses according to different categories, and includes all necessary details such as the amount paid and the name of the beneficiary, with the ability to deduct previous advances and attach receipts to prove expenses. |

6- Accounts Receivable Report

The accounts receivable report is an important tool that helps companies track money that has not yet been collected from customers. This report displays information about accrued revenues and customer accounts for a specific time period, helping the company better understand its financial position and manage debt collection more effectively.

The report is not limited to mentioning outstanding amounts only, but also includes important indicators such as days sales outstanding and collection effectiveness index, which enable the company to evaluate collection performance and make decisions to improve it.

The report also helps track overdue accounts and identify customers who are repeatedly late in payment, enabling the company to reduce bad debts and increase collection efficiency.

Through this information, companies can improve cash flow, identify weaknesses in collection, and take practical steps to improve profitability and ensure financial stability.

To use the accounts receivable model effectively, first accurately fill in the debtor's data, such as name, address, invoice number, and debt details. After that, determine the amounts due and payment terms, including due date and any additional conditions. Available payment methods should be clarified, whether cash, bank transfer, or electronic means.

The debtor signs the form to prove their agreement, then it is delivered to them while keeping a copy in the company's records. It is important to follow payment dates and take appropriate action in case of delay, such as sending a reminder or taking legal steps. When receiving the amount, the form is updated to document the payment. It is also preferable to ensure that the form complies with local laws and protects the company's rights in case of non-payment.

| Daftra provides the accounts receivable report under the customer reports section under the name of aging report, which allows you to track amounts due from customers and classify them according to the due period, to help you improve collection and ensure cash flow. |

7- Accounts Payable Report

The accounts payable report provides a comprehensive view of the amounts the company must pay, including bills due soon, bills that have been paid, and any overdue payments. This information helps in financial planning, ensuring bills are paid on time, and avoiding payment delays.

Accounts payable reports also contribute to cost control and fraud risk reduction through expense analysis and monitoring payment management effectiveness. Various reports can be used to track expenses by departments or locations, and detect duplicate or suspicious invoices, helping improve financial management and make accurate decisions regarding payments.

The form begins by identifying basic data such as invoice date and number, customer name, amount due, paid, and remaining. The record must be updated regularly with each transaction recorded accurately, and remaining debts tracked using formats that make it easy to identify the status of each debt.

It is important to add a field for debt status (paid, partial, unpaid, or under review) and include customer contact information to facilitate communication. It is also recommended to prepare periodic reports that reflect the overall financial situation and help in making administrative decisions, while following up on overdue debts and taking necessary action when needed.

| Daftra provides you with purchase reports to track your payments and accounts payable to suppliers. |

8- Budget Report

A budget report is a financial presentation that shows business or project performance during a specific time period, by comparing actual spending with what was planned in the budget. This report aims to evaluate budget compliance and determine whether spending was according to plan, exceeded, or was less than expected.

Usually the report includes two main columns: one showing the estimates included in the budget, and the other showing actual expenses during the same period.

To prepare a budget report, one begins by determining the basics, such as task planning, resource allocation, and cost estimation. This data is recorded as a reference for comparison with actual results later. After that, the report is created and customized by identifying important information such as project title, status, and budget details including planned costs, resource costs, and completion percentage. The report includes comparing actual costs with planned costs, helping track financial performance and make informed decisions to ensure budget compliance.

The report includes four basic components: actual costs (amount actually spent), planned costs (expected costs according to budget and schedules), budget (total funds required to achieve objectives), and remaining budget (amount remaining after accounting for actual costs).

9- Sales Report

A sales report, or sales analysis report, is a comprehensive record of all sales activities that occur in the company during a specific time period. This report provides sales managers with an overview of sales operations and trends occurring during the concerned time period, helping understand sales funnel stages more deeply. It also provides an analysis of all sales representatives' performance on the team.

To prepare a sales report, first determine the report topic and target audience so that data matches the reader's needs. Then, choose important metrics and accurately determine the sales period. Add necessary calculations to show trends, and ensure any unusual data is addressed. Charts or graphs should also be added to illustrate information visually. Then add a summary explaining the importance of data and how it affects sales strategies. Finally, save a copy of the report for future reference.

| Daftra software provides sales reports that display all sales activities during a specific time period (daily, weekly, monthly, and annually), and also provides product sales reports, customer sales reports, employee reports, and sales representative reports, allowing analysis of employee and sales representative performance. The report helps companies understand the sales funnel more deeply and make strategic decisions based on this data. |

10- Monthly Accounting Report

A monthly accounting report is a document that organizes and displays the company's financial information over a month. This report includes basic accounting data that helps analyze the company's financial position periodically. The types of data displayed by the report vary, with each type reflecting a specific aspect of the financial position, such as assets, liabilities, and revenues.

The accounting report helps clarify outstanding amounts, cash flows, and details of business transactions that occurred during the month. It also provides a comprehensive view of changes in financial position, such as how revenues are generated and how expenses affect profitability. Additionally, the monthly accounting report is used to discover any problems that may affect cash flow or the company's ability to pay debts.

Through this report, companies can monitor their financial performance regularly and make informed decisions to improve cash flows and ensure long-term profitability and sustainability.

To prepare a monthly accounting report, start by determining the report's objective, such as comparing revenues with expectations or monitoring cost center performance. After that, collect data from different systems and tools to ensure accuracy, and you can speed up this process using automation. Then, establish a unified framework for reports with key performance indicators (KPIs) to ensure data consistency across time periods.

After that, we analyze data to understand gaps between actual and planned figures, and use charts to represent results visually, making them easier to understand quickly.

The Importance of Accounting Reports in Company Financial Management

Accounting reports are among the fundamental tools that companies rely on to comprehensively understand their financial position, and they are essential for ensuring business continuity and making sound financial decisions. Their importance lies in a range of benefits, including:

- Measuring the company's success in achieving its objectives

- Documenting and tracking financial transactions accurately

- Helping comply with budgets and controlling expenses

- Evaluating the company's overall financial condition

- Analyzing the profitability of products or services precisely

Through reviewing accounting reports, companies can:

- Track their financial performance across different time periods

- Ensure their financial soundness

- Organize all business transactions and invoices

- Provide accurate data to legal and tax authorities

- Share financial information with investors and financial managers

Regular monitoring of financial affairs helps companies avoid errors and save time and costs, especially when dealing with tax obligations. Additionally, tracking cash flow helps predict future revenues, contributing to accurate budget preparation and future planning.

In the face of daily challenges, it may be difficult to notice financial problems or identify sources of losses. Here, the importance of accounting reports emerges in providing management with a clearer and broader view that helps them make informed decisions based on actual data.

Similarly, these reports constitute an important reference for financial analysts, providing them with the necessary tools and information to evaluate financial performance and convey an accurate picture to company management.

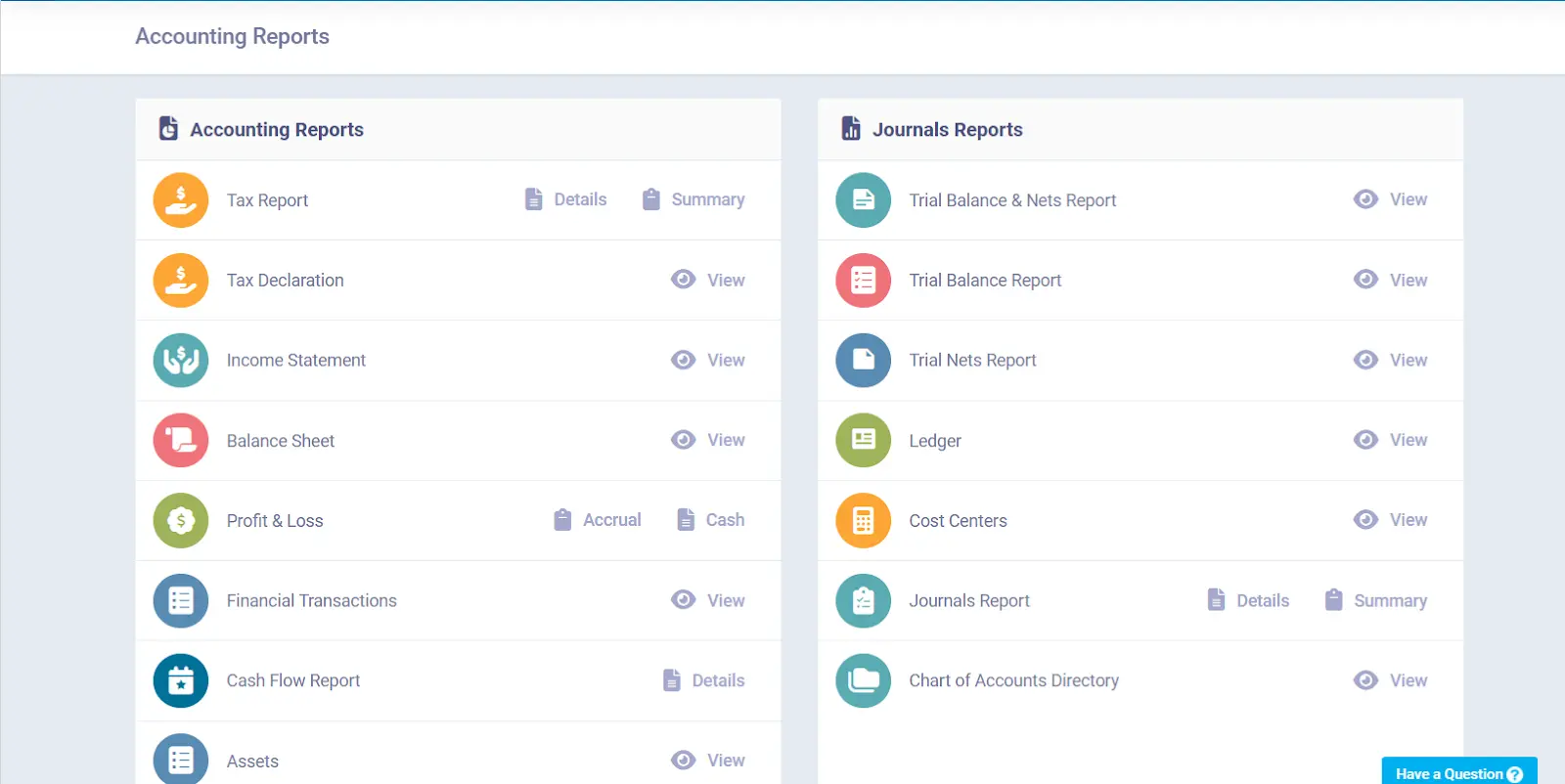

Extract Your Reports Automatically with Daftra Without Complex Accounting Processes

Daftra accounting software provides an integrated suite of accounting automation solutions that help companies develop their operations through intelligent tools for preparing reports and analytics. These solutions enable invoice management automation, simplify approval workflows, handle exceptions efficiently, and ensure compliance with laws and regulations.

It also provides a set of ready-made reports and real-time dashboards that offer precise analytics for tracking payments, team efficiency, and various spending areas. These tools help companies identify invoices facing exceptions, analyze direct and indirect spending, and identify suppliers causing delays.

Conclusion Accounting reports are tools that clarify a company's financial health and future directions. Through careful monitoring of expenses and revenues, and analysis of balance sheet data and cash flows, management can make more accurate and effective financial decisions. These reports also help comply with budgets and identify strengths and weaknesses.

With technological advancement and the availability of modern accounting software, it has become easy to prepare these reports automatically and accurately using tools like "Daftra" software, saving time and effort while improving the quality of financial analysis. Instead of complex calculations and manual data organization, you can now obtain accurate and comprehensive reports. This makes it easier for you to make informed financial decisions and easily share important figures with stakeholders in your company.