The Importance and Types of Accounting Books

Is relying solely on practical experience a sufficient source for mastering the field of accounting? Certainly not, and this is where the role of accounting books comes in, which are considered fundamental keys to understanding how to apply accounting principles and standards in a systematic and logical manner.

Accounting books are considered the language that connects the theoretical and practical aspects of understanding financial management. Therefore, in this article, we present the types of accounting books and why we should acquire them for our libraries. We also review a list of the best financial accounting books in Arabic and English, with a brief explanatory overview of the concept of each.

What are Accounting Books?

Accounting books are educational references that include a wide range of accounting problems and topics, through which one can become familiar with basic and advanced concepts in accounting science and financial and banking sciences. Accounting books cover fundamental accounting principles and various accounting standards, such as GAAP and IFRS, and their applications.

Additionally, through accounting books, one can learn about the nature, characteristics, and importance of different types of accounting, whether financial accounting, managerial accounting, government accounting, cost accounting, tax accounting, forensic accounting, or Islamic accounting.

The most renowned accounting books are considered vital tools that help both students and professionals alike in developing the accounting skills and qualifications necessary to understand how to manage commercial businesses and economic activities.

What are the Types of Accounting Books?

There are various types of accounting books, as accounting branches into several divisions and specializations, with each book focusing on a specific division and aspect. Accounting books are divided into:

1- Accounting Books for Beginners

These present accounting fundamentals or an introduction to accounting in simple, easy-to-understand methods, such as how to make journal entries, accounting records, and daily ledgers, and the basics of understanding the accounting software.

2- Financial Accounting Books

The best financial accounting books focus on preparing and analyzing financial statements of all types, helping readers and interested parties understand how to measure the performance and financial position of companies based on financial reports.

Read more: Comprehensive Guide to Financial Accounting.

3- Accounting Principles Books

These provide detailed and practical explanations of fundamental accounting principles such as the accrual principle, matching principle, disclosure principle, materiality principle, conservatism principle, and other principles.

4- General Accounting Books

These cover general and diverse topics about accounting fundamentals, their importance in business management, laws and equations of accounting problems, common accounting errors, and other topics related to different types of accounting, such as cost accounting, auditing, credit accounting, and the roles and duties of accountants at their various professional levels.

Why Should You Acquire Accounting Books in Your Library?

Many people are keen to acquire accounting books with the goal of investing in knowledge and gaining financial skills. The following are the main reasons that encourage you to acquire accounting books for your library:

1- Gaining Financial Knowledge

Accounting books contribute to building fundamental knowledge that helps individuals analyze financial statements, prepare financial reports, budgets, and forecasts, implement internal controls, and evaluate financial performance based on scientific foundations and rules. This improves business management efficiency and increases profitability. Accounting books serve as valuable tools that help students and teachers simplify their understanding of complex financial and accounting concepts.

2- Obtaining Prestigious Jobs

Accounting books help in securing distinguished accounting positions with high salaries and competitive compensation packages, such as forensic accountant positions, financial controller, auditor, technical accountant (information and technology), financial manager, or tax manager.

3- Acquiring Necessary Accounting Skills

Accounting books are considered a fundamental means of obtaining the accounting skills necessary to fill important financial positions.

The most prominent of these skills include: leadership skills, regulatory compliance, strategic and analytical thinking necessary in business management and finance, understanding accounting standards, internal auditing skills, using accounting software, risk management skills, and professional ethics that must be adhered to in performing financial duties and responsibilities.

4- Making Sound Financial Decisions

Informed decisions can be made in personal or commercial businesses through the accounting information provided by accounting books, which help build a solid foundation of knowledge and expertise in multiple areas such as tax accounting, financial analysis, forensic accounting, creative accounting methods, and others.

5- Following Field Developments

Accounting book collections develop over time, helping to follow the latest changes in trends and new standards in the accounting field, which helps with career advancement and professional development.

What are the Best Accounting Books?

You should be familiar with the best intermediate and professional accounting books and the best ones for each section. Therefore, we present to you in the following points the best accounting books, with an explanation of their content and authors:

1- Accounting Principles Book

The book's title reflects its content, which comprehensively covers accounting principles in a smooth, easy-to-understand style. It is taught to commerce college students and graduate students, as it addresses some topics related to double-entry bookkeeping and how to recognize and record revenues.

The book is authored by Jerry J. Weygandt, who holds a Ph.D. and is a Certified Public Accountant (CPA), and is an Arthur Andersen Alumni Professor of Accounting at the University of Wisconsin-Madison, and Paul D. Kimmel, who is a CPA with a bachelor's degree from the University of Minnesota and a Ph.D. in Accounting from the University of Wisconsin.

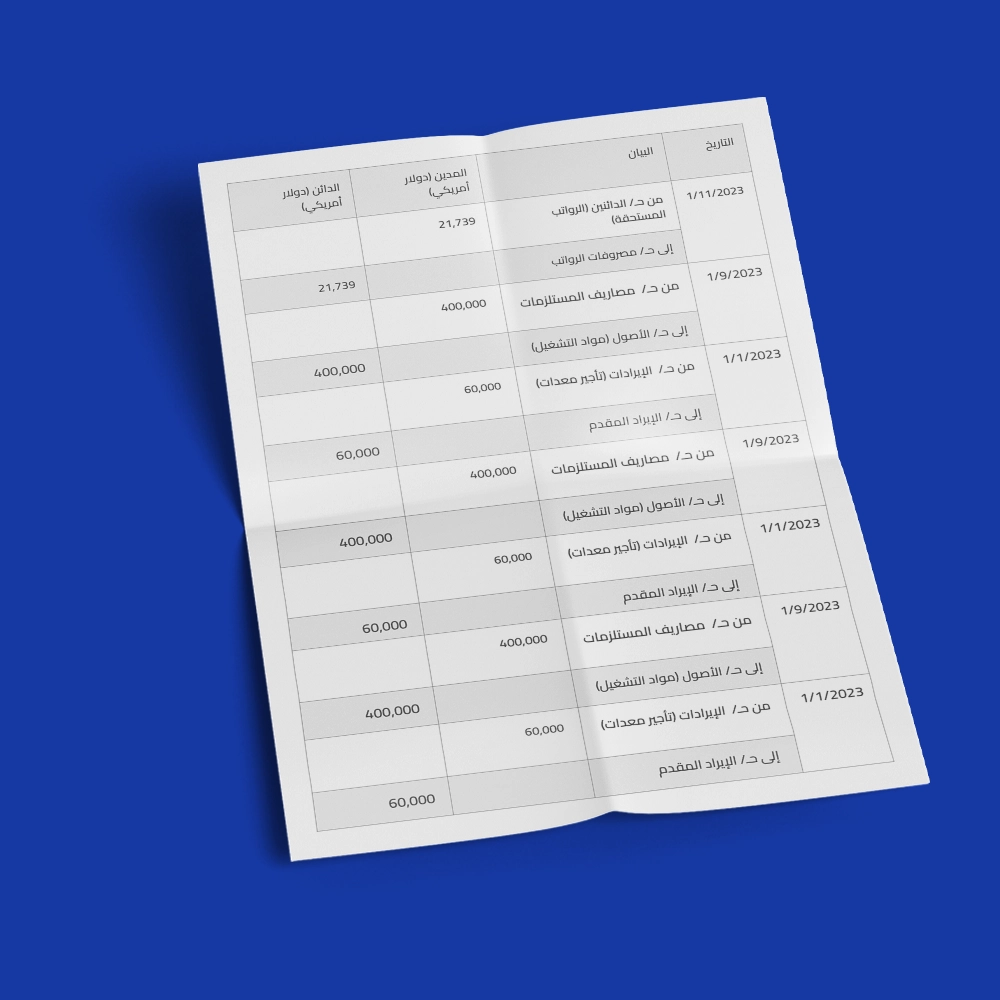

2- Financial Accounting Book

The Financial Accounting book is one of the distinguished management accounting books that provides an in-depth explanation of financial accounting, with practical and illustrative examples. The book focuses on how to prepare and analyze financial statements. The book is authored by Robert Libby, Patricia A. Libby, and Daniel G. Short.

3- Managerial Accounting Book

It provides explanations on managerial accounting and how to use it in decision-making within organizations, covering topics such as cost analysis and strategic planning. The book is authored by Ray H. Garrison, Eric W. Noreen, and Peter C. Brewer.

4- Advanced Accounting Book

The book covers advanced financial topics such as international financial reporting and economic and commercial acquisitions. The book is considered an important reference for accountants and financial analysts. The book is authored by Joe Ben Hoyle, Thomas Schaefer, and Timothy Doupnik.

5- Financial Statement Analysis Book

This book helps understand how to analyze financial statement data, which helps understand the company's performance and financial position, helping analysts, investors, managers, and relevant stakeholders make appropriate business decisions. The book is taught to students to help them learn the keys to logical analysis of financial statements. The book is authored by John J. Wild, K. R. Subramanyam, and Robert F. Halsey.

How Does Daftra Help You Manage Your Accounts Easily?

Daftra cloud-based software is one of the integrated accounting software that provides comprehensive solutions to help manage accounts in smarter, more accurate ways, in a faster time, and with less effort.

If you are an accountant and want to work with an integrated electronic accounting software approved by the electronic invoicing software of the Zakat, Tax and Customs Authority, as well as the Egyptian Tax Authority, here are the main solutions that Daftra offers:

- Daftra provides an integrated sales software for company management with solutions that help facilitate sales operations, issue approved electronic invoices, prepare price quotes and send them to customers automatically, control commission software, as well as the ability to use the point of sale (POS) software whether connected to the internet or not, manage customer payments, and provide more offers and discounts to customers through the customer loyalty points software.

- The inventory and warehouse management software helps track product movement, monitor inventory levels, issue various warehouse vouchers, and provide detailed warehouse reports. All these solutions and more are provided by Daftra in a smart and automated way to manage accounts easily, effectively, and efficiently.

- The asset management software calculates asset depreciation using multiple methods and issues reports related to the general ledger, financial transactions, and balance sheet.

- The check management software from Daftra facilitates organizing checks in the form of checkbooks and linking them to bank accounts, and controlling check entry settings whether by direct disbursement or disbursement on a specified date.

- Daftra provides a glossary table of various accounting terminology definitions and ready-made accounting templates in multiple formats for download and direct use, within the framework of supporting accounting knowledge and facilitating the application and use of various accounting models necessary for business and account management.

Conclusion In conclusion, we have clarified the importance of accounting books and highlighted the most important accounting books that suit different interests of beginners seeking to understand the basics, or professionals and experienced individuals who want to delve deeper into understanding advanced accounting strategies.

Finally, if you are one of those interested in the field of accounting, make sure to read the most important accounting books to achieve your financial goals and enhance your professional and personal capabilities. Do not neglect using digital accounting software alongside books to strengthen your skills and expertise and form clearer insights about financial management of various businesses and activities.

Frequently Asked Questions

How many books are there in accounting?

There is no specific number of accounting books, because accounting contains several sections, so its sources and explanations vary.

What are the primary and secondary books of accounting?

The primary accounting books are accounting principles books and specialized accounting books. Everything else is considered secondary books.

What is the main book for accounts?

The Accounting Principles book is the main book for learning accounts in an in-depth way. The Accounting Principles book provides a method for using all accounting tools in analyzing and organizing financial data and making decisions based on reading data.

What are the five original books entered in accounting?

Learn about the five most important accounting books now:

- The Bookkeeper Rises

- The Innovator's Dilemma

- The Best Accounting Book In General

- Financial Shenanigans

- Profit First

Is Accounting 101 a good book?

Accounting 101 is a good book for beginners because it focuses on presenting accounting fundamentals. The book provides an easy explanation of basic and secondary accounting concepts.

What is the greatest accounting book known in the world?

There is no greatest accounting book known in the world, but there are important and essential accounting books that should be used during the accounting learning journey. You can start with the "Accounting 101" book because it provides easy and clear explanations. While you can rely on the "Comprehensive Accounting" book from the For Dummies series for its comprehensiveness in various accounting sections and branches.