What is Capital and Its Importance

Table of contents:

- What is the definition of capital?

- What is the explanation of the term Capital?

- What are the types of capital?

- What is the importance of capital?

- What are the characteristics of capital?

- What is capital investment?

- What are the advantages of capital investment?

- What is the definition of the capital market?

- What is the capital account?

- What is the importance of managing capital using Daftra?

- Frequently Asked Questions

The term capital is among the most important in economics, as it is the driving force behind business management and commercial activities. So how does capital play a pivotal role in guiding strategic and investment decisions?

We answer this in detail by explaining the definition of capital, its types, importance, and characteristics. All of this and more we present to you based on our financial and accounting experience, helping you ultimately to utilize capital effectively to achieve sustainable goals and maintain a competitive position in global markets.

What is the definition of capital?

Capital is defined as anything that provides value or benefit to the organization, whether it is financial value, such as the company’s assets and bank balances, physical value, such as equipment and machinery, or intellectual value, such as patents.

What is the explanation of the term Capital?

Capital is the primary measure of institutional wealth and the primary resource that enables them to increase it.

The term capital refers to a company or institution's monetary assets and financial liquidity, whether held for savings or to cover basic expenses. Moreover, the term can be interpreted more broadly to encompass all monetary assets of the company, such as equipment, buildings, products in the company’s warehouses, and other assets.

However, when preparing the company’s budget, the capital referenced is cash flow. Although some people conflate capital with cash, they are not the same.

The term capital is broader, encompassing all resources used in business operations to conduct commercial activities and increase revenue, such as employees, investments, patents, and other assets.

Cash is the money used to complete transactions involving the purchase or sale of assets, such as buildings and equipment, and is used by the company to increase its profit margin.

What are the types of capital?

Capital is often classified into several types, based on criteria such as the source of capital or the method of use. Most companies, when preparing the annual financial budget, focus on the first three types of capital from the list of capital types, which are:

- Debt capital.

- Equity capital.

- Working capital.

- Commercial capital.

- Authorized capital.

- Venture capital.

- Fixed capital.

- Initial capital.

- Issued capital.

- Paid-up capital.

- Market capital.

- Invested capital.

Some commercial institutions specialize in financing other projects, and they also identify “commercial capital” as a fourth element in the budget.

Below, we mention each form of capital in some detail:

1- Debt Capital

It is referred to as borrowed capital. Some institutions seek to raise capital through borrowing, whether from private or government sources, and this is known as debt capital.

For any company or institution to obtain a loan, it must have a strong credit history to earn the trust of financial institutions and secure approval.

Companies view loans as a valuable opportunity to be leveraged, provided they are repaid on time and without default, as they are often the only way to secure sufficient capital to implement the investments they aim to pursue.

2- Equity Capital

The second type of capital is equity capital, which can appear in more than one form, whether as private shares, public shares, or real estate shares. Public shares are those offered for trading by listing the company’s shares on a stock exchange, while private shares are held by a closed group of investors.

3- Working Capital

Working capital is defined as the company’s current assets minus its current liabilities. Accordingly, a company whose liabilities exceed its assets is on the verge of facing an economic problem, and intervention is required before the situation worsens.

Working capital primarily focuses on measuring the financial liquidity that the company possesses in the short term, and it represents the company’s ability to cover its debts, accounts payable, and various obligations due within one year.

Working capital also indicates the financial liquidity available to meet the institution’s daily obligations, and it is calculated using the following two equations:

- Current assets − current liabilities

- Accounts receivable + inventory − accounts payable

4- Commercial Capital

The fourth type is commercial capital, a term used by companies that seek to provide financing to other emerging and medium-sized institutions with the aim of funding their commercial operations, such as purchasing goods and covering operating expenses and fixed costs.

These companies process a large number of daily transactions, as they determine the financial amounts allocated to buying or selling various securities. This type of capital is characterized by high risk and strong potential for higher returns.

5- Authorized Capital

Authorized capital is sometimes referred to as “approved capital,” and it indicates the maximum amount of capital that a company can possess and which is recorded in the commercial register.

Authorized capital is determined according to the company’s articles of association, and its value cannot be amended except with the approval of the extraordinary general assembly of shareholders.

6- Venture Capital

It is one of the types of capital used in “speculation,” meaning that capital is provided by one party to another to trade with it, in return for obtaining a percentage of the profits according to a contract between the two parties. This term is used because it carries a high risk of losing invested funds or assets.

7- Fixed Capital

It is the capital used to purchase fixed assets such as equipment, tools, and real estate, which are not consumed on a daily basis. Fixed capital reflects the company’s long-term productive capacity and is calculated as the cumulative depreciation of fixed assets.

8- Initial Capital

Initial capital, or start-up capital, refers to the funds invested at the beginning of a project or when establishing a new company. It is used to cover initial costs and to establish the operations needed to start work and drive growth in the early stages.

The components of initial capital include incorporation costs, purchasing equipment and devices, purchasing inventory of goods and raw materials, covering rent costs, salaries, utilities, and the expenses of the initial marketing budget for promoting and advertising the company’s products and services.

9- Issued Capital

It is the value of the shares offered for public subscription. The value of issued capital can be controlled, unlike what was mentioned regarding authorized capital, provided that the value of the issued capital does not exceed the amount specified for authorized capital.

10- Paid-up Capital

It is the actual value of the shares purchased from the issued capital. Accordingly, paid-up capital reflects the amounts actually paid for shares offered for subscription. The value of paid-up capital is lower than that of both issued and authorized capital.

Download now for free: Additional Paid-up Capital Template

11- Market Capitalization

Market capitalization refers to the value of the financial assets listed by a company or a specific entity in the financial market. It is calculated using the following formula (Market Capitalization = Number of outstanding shares × Current share price).

Market capitalization is a useful metric for investors and financiers to assess the appropriate investment destination, as it is an important measure for analyzing the financial position of companies across different business sectors.

12- Invested Capital

Invested capital is the total of working capital and long-term assets, as it refers to the total funds that a company raises through issuing securities to shareholders. From this, we conclude that the value of invested capital is greater than the value of working capital.

13- Owned Capital

Owned capital is the amount that a company owes to its owners or owners. Owned capital refers to the value of what the owners have invested in the company in terms of assets or cash funds.

The types of capital vary by source, function, and risk level. Some are financed through debt capital, such as loans, while others come from equity capital, such as share sales. Working capital and commercial capital cover daily operations, while fixed capital is used to purchase long-term assets.

Initial capital is used during the establishment stage. There are also regulatory types such as authorized, issued, and paid-up capital. Some types carry a higher risk, such as venture capital, while market capitalization and invested capital are used to evaluate financial performance.

This diversity of capital forms helps companies achieve financial balance and make well-considered investment decisions.

What is the importance of capital?

The importance of capital lies in its role in supporting productive and investment activities, as well as in its contribution to economic development and financial stability. Therefore, capital is considered a key element of the economic process today. The importance of having capital is represented as follows:

1- Increasing and multiplying productivity

It is true that you can start a business with insufficient capital, but it is essential if you want to increase your project's productivity and expand the products you offer.

With major technological developments in production systems, the role of capital has become more significant. What can be produced manually over a long period can be produced in multiples within a short period using specialized equipment and machinery, which capital enables.

2- Providing equipment and raw materials for manufacturing

Capital undertakes the task of providing the raw materials necessary for production in good quality and sufficient quantity, and it also provides the devices that facilitate the production process, without which it would be impossible to improve and increase productivity.

3- The core of the economic development process

Due to its strategic and influential role in increasing productivity, capital occupies a central position in the process of development and advancement of nations, as it helps supply countries with machines, tools, equipment, and advanced infrastructure that ultimately lead to development in society.

Regardless of the economic system followed by a country, whether capitalist, socialist, or mixed, all of them need sufficient capital to help advance their country.

4- Creating more job opportunities

With dense population growth, there must be a significant increase in the capital of the state and institutions to expand economic projects in order to provide more job opportunities.

5- Maintaining national security

At the present time, defense equipment and weapons have become extremely expensive. If a country has factories for military equipment, it can manufacture these weapons domestically, but this will require a substantial capital investment.

One of the most important factors determining a state's strength is its economic power. The greater a country’s economic capabilities and potential, the more influential it becomes in international decision-making, in addition to providing protection for its land.

6- Achieving financial stability

Capital provides the liquidity needed to help companies address financial and economic challenges, enhancing their financial stability and business sustainability.

7- Empowering startups

Capital is the vital means that enables small and startup companies to launch new projects and supports their growth and their ability to compete in the business market.

8- Attracting investors and achieving returns

Strong capital reflects a company’s strength, credibility, and trust in the business market, encouraging investors to choose companies with large capital as ideal investment destinations. Through effective capital investment, higher returns and profits can be achieved for both investors and business owners.

The role of capital is to increase productivity, provide equipment and raw materials, and support economic development. It also creates job opportunities, enhances national security, and supports financial stability, while enabling startups to grow, attract investors, and deliver returns.

Therefore, having sufficient, well-managed capital is essential to achieving economic and institutional progress. Through Daftra’s business management software, you can manage your capital and all aspects of your business with ease, from issuing invoices and managing sales, inventory, customers, and employees, to accounting and the complete workflow cycle.

It is also characterized by an easy-to-use interface that supports Arabic, allows you to work from anywhere and at any time, provides the highest levels of security to protect your data, and offers customizable applications to precisely suit your business needs

What are the characteristics of capital?

Capital has characteristics that distinguish it from other factors of production and directly affect how it is employed and used in economic and commercial activities. These characteristics demonstrate the nature of capital and its role in supporting production. Below are the most prominent characteristics of capital:

1- It is not sufficient on its own

Capital, in its monetary sense, is not sufficient to achieve success for any company without the participation of a set of other factors, as business activities also require labor and a place through which the commercial activity is carried out.

2- Created by humans themselves

Capital is created by humans, and they control the extent of its increase or decrease. Capital is the result of human effort and hard work to build future wealth through the exploitation of natural resources by labor.

3- Not absolutely necessary

Although capital is an important factor, it is not an absolute necessity without which a business project cannot be completed. This means that if you have a place to work and labor, you can produce without having capital.

4- Capital is flexible

Capital enjoys flexibility in increasing and decreasing in a short period of time more than any other factor in the production process.

5- Subject to depreciation

If you use capital in its physical sense, such as equipment and machinery, repeatedly, this will lead to a decrease in its value. For example, when a machine is used for a long period of time, it may later become unusable due to heavy wear and tear.

6- Increases productivity

Company production can increase significantly when sufficient capital is provided for work.

7- Capital is temporary by nature

You should try to reproduce and renew capital from time to time, because it is a temporary factor.

8- Requires a cost to obtain

Capital is not a gift that you obtain for free; rather, obtaining it requires paying a high cost through performing a lot of hard work and making sacrifices.

9- A result of previous savings

When not all owned goods are consumed, they may serve as a form of future savings, creating capital. For example, if a farmer does not sell part of his crop, he can use it as seed for future crops.

The most important characteristics of capital are that it is a flexible resource that can expand or contract, depreciates with continuous use, and is created and controlled by humans.

Although it is not a necessary element to start a project, its presence increases productivity. Capital also entails costs and effort to acquire and is often the result of prior savings, underscoring its importance as a temporary economic resource that must be continuously renewed.

What is capital investment?

Capital investment is the amount of money a company invests to achieve or enhance a specific business objective.

Some institutions allocate funds to be granted as a loan to another company, to be repaid within a specified period, or to result in the lending company owning a share of the borrower's future profits. According to this definition, capital refers to cash funds.

Capital may also refer to a company's long-term acquisition of certain assets, such as real estate, machinery, and factories.

Company managers make capital investments in business operations by purchasing long-term assets that help the institution operate more efficiently and achieve faster growth. In this case, capital refers to physical assets.

Use the investment calculator to calculate the return on investment and the profit after the investment.

What are the advantages of capital investment?

Capital investment is a fundamental driver of growth for companies and economic institutions. There are several advantages to investing in companies, including helping them develop their businesses and achieve their commercial goals. The following are the most prominent advantages achieved by capital investment:

- Achieving economic enhancement: Investing in business activities provides services that satisfy community needs or solve specific problems.

- Creating new job opportunities: Through investing capital in establishing new business projects and consequently hiring new employees.

- Increasing competition in the market: By seeking to improve products by establishing new factories in a given field, companies are driven to increase their efficiency to achieve higher profits, ultimately benefiting consumers with better service.

The most important benefits of capital investment include strengthening the economy by meeting community needs, creating new job opportunities, and increasing market competition, which pushes companies to improve their products and services, ultimately benefiting consumers and the economy as a whole.

What is the definition of the capital market?

The capital market is the market where securities such as bonds and stocks are traded to raise capital for various projects.

The main objective of this market is to raise capital from individuals and entities by selling securities, and then use those funds to establish and finance new projects.

What is the capital account?

The term capital account refers to one of the accounts that make up the balance of payments. The capital account reflects the amount of change in a company’s assets and liabilities over a specific period of time.

In this account, investments, loans, and financial transfers are tracked and recorded. The capital account provides an accurate basis for assessing the company’s financial health and its ability to grow and expand.

What is the importance of managing capital using Daftra?

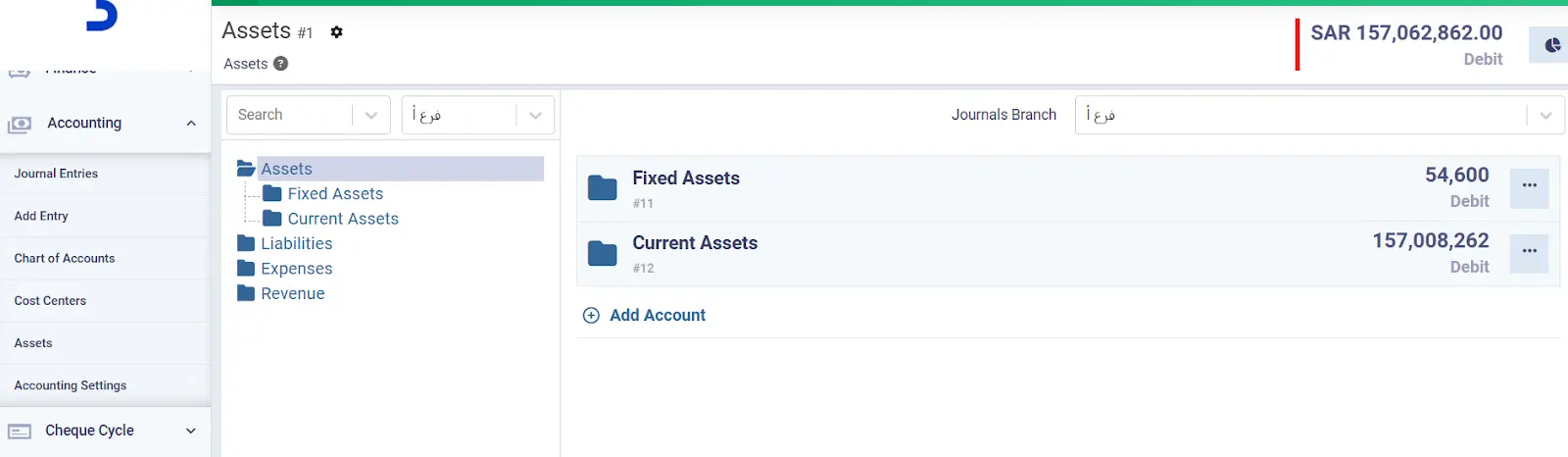

Your assets, bank accounts, and everything considered as capital are recorded in the accounting software and tracked through the chart of accounts in Daftra in an organized manner that separates different types of capital. This makes it easier for you to identify suitable investment opportunities and take more accurate and beneficial investment steps.

In conclusion, after explaining the importance of capital, its uses, and its characteristics, it is clear that managing this vital resource requires smart, precise strategies. Therefore, business owners should adopt modern technology, such as accounting software, to manage capital efficiently and more effectively, thereby achieving business objectives and professional investment returns.

Frequently Asked Questions

Why is it called capital?

It is called capital because it represents the head or beginning of the funds that are invested in business activities. This naming reflects the development of concepts: the term capital was originally used to refer to the wealth owned by individuals, and it later came to include assets and property.

What does capital represent?

Capital represents funds such as cash and assets such as equipment and buildings that companies and individuals use to manage their businesses. It reflects the company’s assets and capital, which are considered the basis of the institution's market value.

What is the interest on capital?

Interest on capital is the financial return earned from investing capital in businesses or projects. Interest is usually calculated as a percentage of the invested amount according to the following formula:

Net profit (or return) ÷ invested amount × 100

The interest on capital varies by investment type or business activity.

What are the components of capital?

Capital consists of several main elements, the most important of which are: working capital, such as cash; fixed capital, which includes long-term assets such as buildings and equipment; human capital, which consists of workers or individuals; intellectual capital, such as patents; and social capital, such as social relationships among individuals.

What are the sources of capital?

Sources of capital include:

- Borrowing (debt capital)

- Selling shares (equity capital)

- Founders’ investments (initial or owned capital)

- Reinvested operating profits (working capital)

- High-risk investment financing (venture capital)

- Offering shares for subscription (issued and paid-up capital)

- Fixed assets (fixed capital)

What are the benefits of capital?

The functions of capital include:

- Increasing and multiplying productivity

- Providing equipment and raw materials for manufacturing

- Being the core of the economic development process

- Creating more job opportunities

- Maintaining national security

- Achieving financial stability

- Empowering startups

- Attracting investors and achieving returns

What is the difference between a company’s capital and its assets?

Capital is the funds that investors contribute to the business or company, while assets are all the resources owned by the company, including cash, equipment, real estate, land, accounts receivable, and others. Capital is considered part of the company’s assets.

What is the difference between capital and assets?

Capital is the source of funding or wealth that a company provides to manage its daily operations and purchase raw materials to run operational activities, while assets are the economic resources owned by the company and used in its operations, such as equipment and buildings.

Is capital a debit or a credit?

Capital is considered a credit because it represents the funds that investors have contributed to the company to start and continue business operations. The company is obligated to its owners and investors for these funds; therefore, the funds are recorded in equity on the balance sheet.

What is capital in the balance sheet?

Capital in the balance sheet represents the funds invested by business owners in the company. Capital is recorded in the equity section of the balance sheet because it represents the owners’ equity in the company.