Journal Entries for Salaries and Wages

Table of contents:

- What Are Salary and Wage Entries?

- Journal Entries for Salaries

- The Difference Between Salary Expenses and Wage Expenses

- What Types of Employee Advances Are There and How Are They Treated Accountably?

- How Are Salaries Classified Under Expenses?

- How Are Insurance and Incentives Calculated on Salaries?

- How to Add Payroll Entries in Daftra?

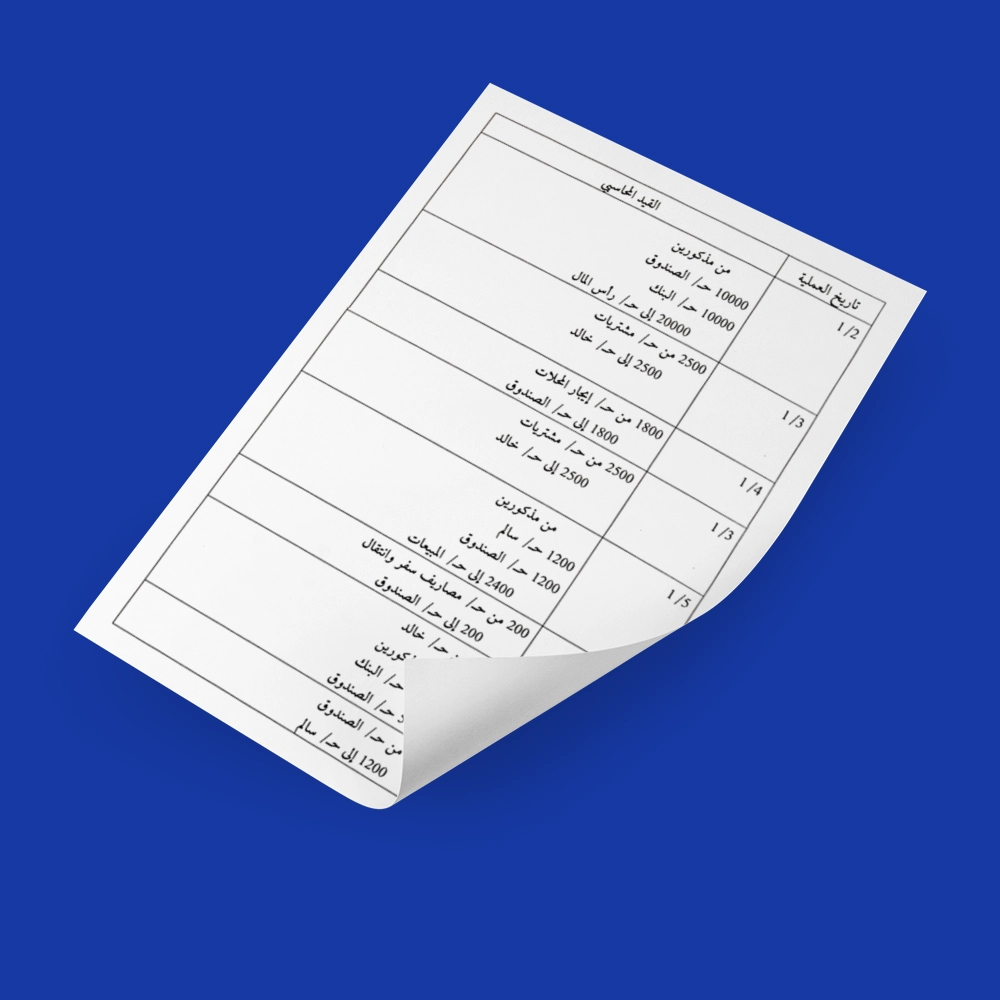

Journal entries are the most important documentation element in accounting, and the accounting cycle is based on them. Every financial transaction, whether incoming or outgoing, is recorded so that income, expenses, profit, and loss can be accurately calculated at the end of the financial period.

Since employee and worker salaries and wages are important items that fundamentally affect the determination of net profit, we have dedicated this article to discussing how to prepare journal entries for salaries and wages, with a detailed explanation of the nature of each entry and the mechanism for treating it accountably.

What Are Salary and Wage Entries?

Salary and wage entries are a set of journal entries that aim to process and calculate financial transactions related to employee and worker salaries and wages in the institution, and thus prepare accurate financial statements on the basis of which sound financial decisions are made.

In light of this, these entries - specifically - should be prepared accurately and regularly, by dividing employee lists into several classifications, including departments, positions, segments, and work shifts. On this basis, salary components are added for each employee.

The step that follows is collecting attendance and departure data for employees and recording it automatically through an accounting program or manually. Then, determining any other source that may affect the salary value, such as advances, insurance, and salary deductions due to absence, tardiness, or otherwise.

Then we begin processing salary and wage entries, such as the accrual entry, through which the employee's entitlement to salary expense is established. And the deduction entry through which advances, insurance, and other items are processed. We will clarify what these entries mean in the coming lines.

Journal Entries for Salaries

Naturally, the salary and wages item includes everything paid to the employee in exchange for performing their work duties, including their salary, bonuses, allowances, and the insurance pay paid by the company, in addition to salary deductions.

As we explained above, while discussing the nature of salary and wage entries, accrual entries, deduction entries, additional entries, and disbursement entries are salary and wage entries, and they represent in their mentioned order the stages of paying salaries to employees, taking into account any factor that may contribute to increasing or decreasing the salary and stating this in the account movement.

A payroll is used to organize employee salaries and basic information about them during a specific accounting period.

Salary and Wage Accrual Entry

The accrual entry is the one that establishes the employees' right to receive salaries from the company, and what is meant by salaries here is basic salaries. Based on this, a list of company employees is prepared with clarification of each employee's salary, and then clarification of the total employee salaries.

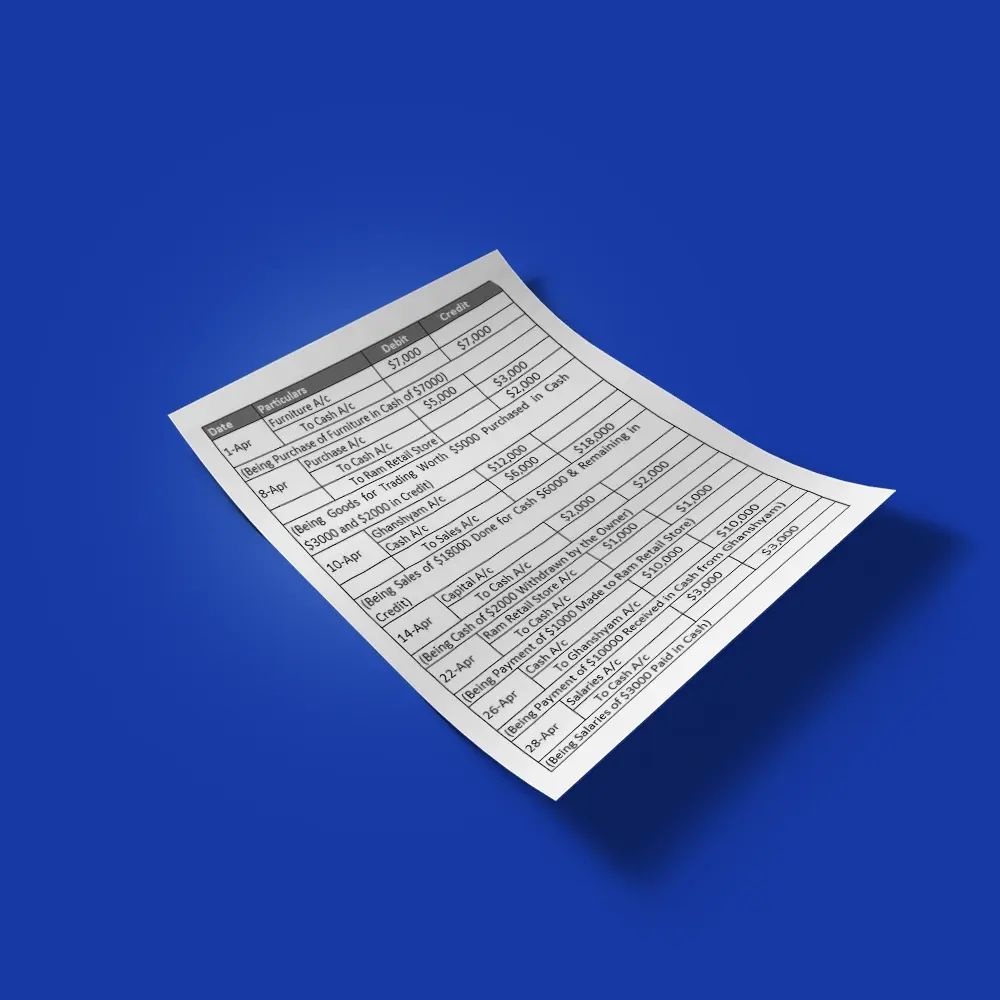

The accounting treatment for total employee salaries is done as shown in the following example:

Employee Ibrahim receives a salary of 10,000 riyals. The accrual entry is as follows:

- 10,000 Dr. Salaries and Wages Account

- To Cr. Employee Ibrahim's Account

Download now a salary path form ready to be modified for free from Daftra.

Salary Entry with Advances

Advances are one of the most important deductions from salary, along with other deductions such as insurance and others, and therefore advances fall under the deduction entry. When looking at how to treat it accountingly, we see that it is done as follows:

Employee Ibrahim's salary is 10,000, and he received an advance worth 1,000 riyals.

- 1,000 Dr. Employee Ibrahim's Account

- To Cr. Employee Ibrahim's Loan Account

Salary Entry with Social Insurance

Salaries with social insurance are very similar to advances, where both fall under the deduction entry, and they are treated accountably in the same way. Employee Ibrahim, for example, has 900 riyals deducted from his salary for social insurance, and therefore, we treat his salary entry with social insurance as follows:

- 900 Dr. Employee Ibrahim's Account

- To Cr. Social Insurance Loans Account

Salary Entry with Social Security

The deduction of the social security percentage - which is optional - is treated the same as social insurance and advances, where all fall under the deduction entry. Therefore, if employee Ibrahim is subscribed to social security and 500 riyals is deducted from his salary for that, the accounting treatment for his salary is done as follows:

- 500 Dr. Employee Ibrahim's Account

- To Cr. Social Security Loans Account

Download now the salary receipt form, ready to be modified by Daftra for free.

The Difference Between Salary Expenses and Wage Expenses

Many people confuse salaries and wages, while there is a clear difference between them from an accounting perspective. This difference can be identified in the nature of the relationship between the employer and the worker.

Salary expenses refer to compensation received by employees who work permanently for the company, with a specific and time-bound pay cycle, usually monthly. On the other hand, wage expenses refer to compensation received by workers irregularly or temporarily, such as those who work hourly, weekly, or on a piece-rate basis.

What Types of Employee Advances Are There and How Are They Treated Accountably?

There are several types of employee advances that can be classified by time period or purpose. For classification by time period, there are temporary advances and imprest funds. For classification by purpose, there are travel advances, assignment advances, transportation advances, marriage advances, personal advances, and other types.

Imprest Fund

This is a monetary amount given to an employee to use for recurring small-value petty expenses, and what is spent from this fund is later replenished. The imprest fund is treated accountingly as follows:

Establishing the fund:

- Dr. Imprest Fund - Employee Name

- Cr. Checks or Bank Transfers

Replenishing expenses from the fund:

- Dr. Budget Expenditures

- Cr. Checks or Bank Transfers

Increasing the fund amount:

- Dr. Imprest Fund

- Cr. Checks or Bank Transfers

Increasing fund amount during replenishment:

- Dr. Various accounts:

- Expenditures

- Imprest Fund

- Cr. Checks or Bank Transfers

Decreasing the fund amount:

- Dr. Cash Under Settlement or Treasury

- Cr. Imprest Fund

Decreasing fund amount during replenishment:

- Dr. Expenditures

- Cr. Various accounts:

- Imprest Fund

- Checks or Bank Transfers

Closing the fund:

- Dr. Treasury

- Cr. Imprest Fund

Temporary Advances

A temporary advance is given to a company employee (not from the accounting staff) to spend on a specific expense. The temporary advance is treated accountingly as follows:

Creating the advance: Dr. Expenditures Cr. Checks or Bank Transfers

System entry: Dr. Temporary Advance Amounts Cr. Expenditures for which Temporary Advance was Made

Payment: Dr. Checks Cr. Central Bank Current Account

The Difference Between Imprest Fund and Temporary Advance

The difference between an imprest fund and a temporary advance is that the imprest fund amount is given to the employee to spend on any petty expenses usually needed by the company without precisely specifying these expenses, while a temporary advance is given to the employee to purchase a specific item.

Practical Example of How to Process Advance Journal Entries

If an imprest fund was disbursed to employee Hisham by check for 1,600 riyals, the fund was increased by 400 riyals, then expenses of 1,500 riyals were replenished, then a check for 800 riyals was issued to replenish expenses of 700 riyals, then a check for 900 riyals was issued to replenish expenses of 1,100 riyals, then the fund of 1,900 riyals was closed with 1,300 riyals spent and the remainder returned to treasury.

How would the advance be processed accountingly, and what journal entries would be recorded?

| Debit | Credit | Description |

| 1,600 | 1,600 | Dr. Imprest Fund - Employee Hisham / Cr. Checks |

| 1,600 | 1,600 | Dr. Checks / Cr. Central Bank Current Account |

| 400 | 400 | Dr. Imprest Fund / Cr. Bank Transfers |

| 400 | 400 | Dr. Bank Transfers / Cr. Cash in Mail |

| 1,500 | 1,500 | Dr. Expenditures / Cr. Bank Transfers |

| 1,500 | 1,500 | Dr. Bank Transfers / Cr. Treasury |

| 700, 100 | 800 | Dr. Various: Expenditures, Imprest Fund / Cr. Checks |

| 800 | 800 | Dr. Checks / Cr. Central Bank Current Account |

| 1,100 | 900, 200 | Dr. Expenditures / Cr. Various: Checks, Imprest Fund |

| 900 | 900 | Dr. Checks / Cr. Central Bank Current Account |

| 1,300, 600 | 1,900 | Dr. Various: Expenditures, Treasury / Cr. Imprest Fund |

How Are Salaries Classified Under Expenses?

To organize and distinguish expense sources, and since salaries are one of the most important expenses that companies incur regularly, employee salary expenses are classified according to company departments: sales expenses, marketing expenses, operating expenses, and programming expenses. Each department's employee salaries are recorded under their respective departments to facilitate accounting treatment for each.

Read also: How to calculate employee salaries easily and conveniently

How Are Insurance and Incentives Calculated on Salaries?

To understand how insurance and incentives are calculated on salaries, we need to understand the difference between base salary and variable compensation.

- The base salary is the fixed salary agreed upon between the employee and employer for performing specific duties.

- The Variable salary is a compensation that consists of the base salary plus allowances, bonuses, and any other increases.

Regarding how insurance and incentives are calculated, they are computed on the base salary, and percentage-based bonuses are also based on the base salary. This leads some companies to split compensation between base salary, additional pay, and allowances to reduce insurance contributions and bonuses based on the fixed salary amount.

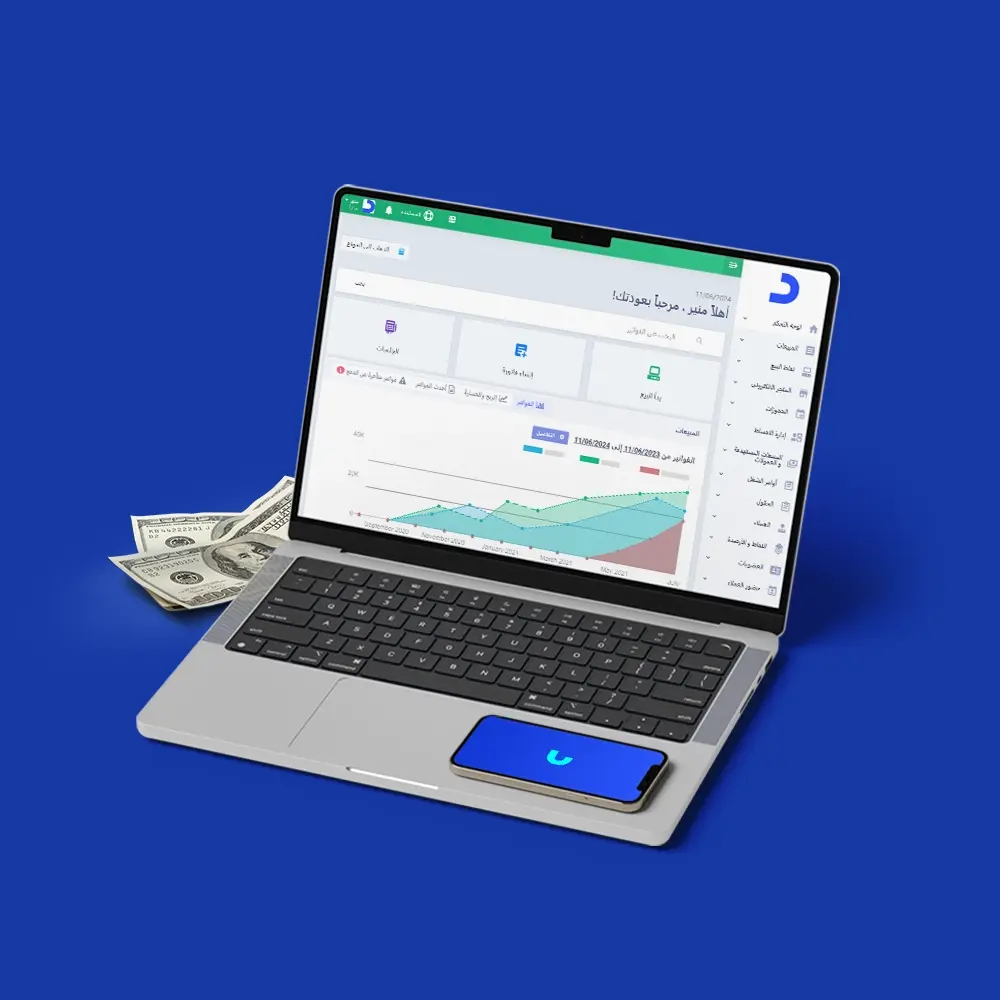

How to Add Payroll Entries in Daftra?

You can use the Daftra system to add payroll entries in two ways: automatically or manually. Daftra includes an integrated payroll management program containing all transactions related to employees and salaries, automatically generating payroll entries according to accounting principles. You can also add entries manually with flexibility in data assignment and settings configuration.

Through the Daftra system, you can also add salary templates and components, create pay slips, and generate payroll reports. It also allows you to add employee advances and determine their installment payment mechanism with automatic processing in payroll entries.