What is a journal, and what is the difference between it and a ledger?

Table of contents:

- What is a Journal?

- Why is it called a Journal?

- What are the components of a Journal?

- What is the General Journal?

- What is the Importance of the Journal?

- How to Prepare a Journal?

- How many columns does the journal have?

- What is the method of recording financial transactions in the journal?

- Give a practical example of recording financial transactions in the journal.

- What is the difference between the journal and the ledger?

- Why are financial transactions recorded in the journal using the double-entry method?

- What are the most common errors that occur in the journal and the ledger?

- What is the purpose of the journal, the ledger, the accounting equation, and the financial statements?

- What is the journal in Daftra?

- Frequently Asked Questions

Is it possible to know all the financial transactions taking place in an organization? The answer is yes, and this is done through the journal, which serves as a large record providing a detailed view of all accounting information and data resulting from the daily financial transactions of the organization over a specific period.

Recording in the journal is considered one of the most important stages of the accounting cycle, and without it, the other stages cannot proceed. Any error in the journal can be considered an accounting disaster with a significant impact on the rest of the ledgers and financial statements.

The financial management can, through the journal, monitor all increases and decreases in various accounts, and easily track the money flowing in and out. Therefore, neglecting or overlooking recording in the journal is not permissible; a competent accountant pays attention to every detail of the journal.

Summary of Key Points

- The journal is one of the most important stages at the beginning of the accounting cycle. It consists of pages where financial transactions are recorded daily, such as sales, purchases, and cash payments. Then, the accounting entries for these transactions are prepared, the most important of which are the simple entry and the compound entry.

- The journal consists of essential elements represented by (entry number, transaction date and nature, affected financial amounts according to the transaction statement, and the page number to be posted to in the ledger).

- The importance of the journal lies in being a primary reference for accountants for all financial activities that took place in the organization during a specific financial period. It also allows identifying the nature of debit and credit accounts, ensures the balance of different accounts using the double-entry system, and finally, the journal is the foundation for moving on to the more complex stages of the accounting cycle.

What is a Journal?

The journal is defined as one of the most important accounting records that begins the stages of the accounting cycle. It consists of pages in which financial transactions are recorded in detailed accounts, and then the accounting entries for these transactions are prepared, the most important of which are the simple entry and the compound entry.

The journal records can be used to reconcile other accounts, such as the ledger, and then the trial balance and financial statements.

Financial transactions recorded in the journal include sales and purchase transactions, cash payments, credit payments, and all other business transactions.

Why is it called a Journal?

It is called a journal because financial transactions are recorded in it daily, by updating it periodically throughout the day with new transactions occurring in the company, to maintain the accuracy of accounting records and facilitate their review and the preparation of financial reports.

What are the components of a Journal?

The journal is one of the most important accounting records that begins the stages of the accounting cycle. Its role is to record daily financial transactions occurring within the organization, such as sales, purchases, and cash or credit payments. These are the elements of the journal:

- Entry number for each financial transaction according to its chronological order.

- Date of the transaction.

- Nature of the transaction and whether it is a debit or credit.

- Statement detailing the transaction.

- Financial amounts decreased in one account and increased in another.

- Transaction document number, specifying its type (payment/receipt/entry).

- Ledger page number where the transaction is posted.

It is clear that the essential components of the journal that ensure accurate recording are: entry number, transaction date, nature, detailed statement, affected amounts, transaction document number, and ledger page number where it is posted. These components form the central structure on which the accounting cycle relies.

What is the General Journal?

The general journal is a sub-record of the journal and is used to record transactions that do not fall under other specialized records, such as the sales or purchases journal. It includes a variety of transactions such as revenues and non-recurring expenses, bank reconciliations, and accounting adjustments.

What is the Importance of the Journal?

Recording financial transactions in the journal is one of the most prominent accounting steps that cannot be dispensed with in any organization. The importance of the journal is as follows:

- Comprehensive daily reference for financial activities: It serves as a daily reference for the accountant, as it is used to record all financial activities of various types and sizes that occur daily, with their specific dates and times.

- Determining the nature of accounts: The journal is used to determine the nature of different accounts, whether they are debit or credit.

- Primary source for preparing the general ledger: The financial data in the journal is used to prepare the general ledger with its main accounts.

- Monitoring financial transactions and the organization’s financial status: It helps management monitor financial transactions and understand the organization’s financial position, as the journal provides a detailed description of financial operations through accounting entries.

- Facilitating tax preparation and reporting: The data in the journal entries makes tax preparation easier, as accountants need to track all profits earned and expenses incurred during a specific financial period to prepare tax reports. These transactions can be easily traced through the journal records.

- Assisting in preparing main financial statements: The journal is one of the most important accounting records that helps the accountant reconcile accounts and prepare financial statements, including the balance sheet, income statement, cash flow statement, and closing accounts.

- Reducing errors: Recording financial transactions in the journal prevents any mistakes or oversights by individuals and entities dealing with the organization.

- Ensuring account balances: The journal ensures the balance of different accounts using the double-entry system, where there is a debit side and a credit side that must balance. If there is no balance, meaning that total debits do not equal total credits, this indicates a problem or error in the recording, and the accountant must refer to the transaction details in the journal and take corrective actions.

- Assisting in financial decision-making: The journal helps management make correct financial decisions. For example, if the journal records show that the organization has a surplus in cash flows, this guides business owners and investors to expand to increase profit and production. Conversely, if the organization suffers a cash deficit, it directs financial officers to take necessary measures to reduce costs.

From the above points, it is clear that the role of the journal in any organized accounting system is not limited to documentation. It contributes to determining the nature of accounts, preparing the ledger, monitoring the financial position, facilitating tax and financial statement preparation, reducing errors, and ensuring account balances.

It also supports accurate financial decision-making based on real and documented data. Therefore, the importance of the journal in achieving financial discipline and accounting success in any organization cannot be ignored.

Use an investment calculator to determine the return on different investments and profit margin.

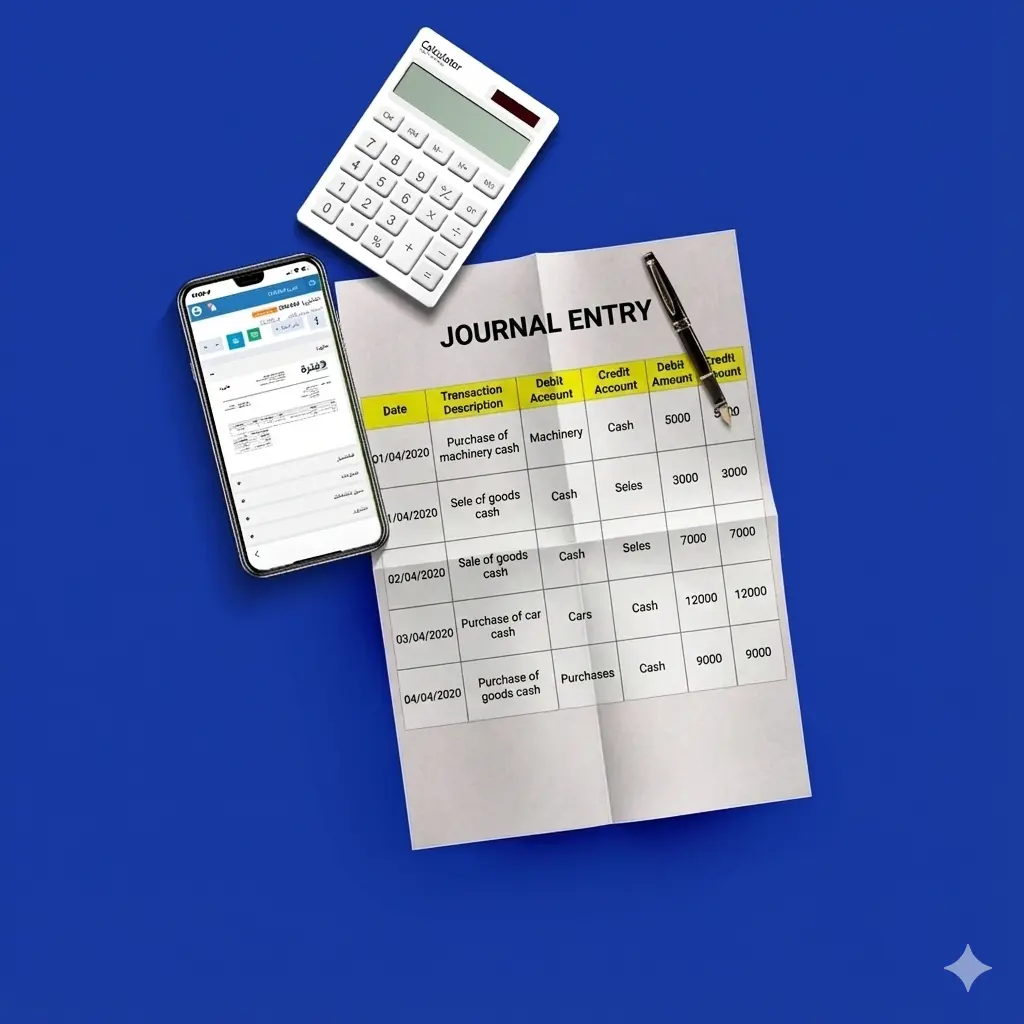

How to Prepare a Journal?

As mentioned before, in the journal, transactions that occur in the organization cannot be overlooked, so there must be a system to record these transactions. Here, the method of preparing a journal using Excel will be explained:

1- In the journal, there are essential elements that must be present, such as: entry number, date, statement, type of accounts (debit or credit), and financial amounts.

Therefore, a column is created for each of the above elements.

| Entry Amounts | ||||||

| Credit | Debit | Credit | Debit | Statement | Transaction Date | Entry Number |

2- When recording each entry, the entry number or transaction number can be written, followed by the date of each financial transaction.

3- Write a description of the transaction in the statement column.

4- Record the daily entries by specifying the accounts affected by the transaction, indicating which is a debit and which is a credit in the entry column.

| Entry Amounts | ||||||

| Credit | Debit | Credit | Debit | Statement | Transaction Date | Entry Number |

| 50,000 | 50,000 | Cash | Equipment | Purchase of equipment in cash | 1/2/2022 | 1 |

| 12,000 | 12,000 | Cash | Prepaid Rent | Payment of prepaid rent | 4/2/2022 | 2 |

| 30,000 | 30,000 | Revenue | Cash | Receipt of funds for services | 8/2/2022 | 3 |

5- You can record all daily entries in this way easily, but there is one condition that must not be overlooked: the total debit amounts must equal the total credit amounts. Therefore, you can use the SUM function to calculate the total of each column of the amounts above.

The SUM function is written as: =SUM(E2:E4), which means that the amounts from cell E2 to cell E4 will be added. In this way, it is possible to determine whether there is an error in the recording or not.

How many columns does the journal have?

The number of journal columns varies depending on the size of the company and the nature of the transactions carried out within it. However, the journal usually consists of 8 basic columns, which are (transaction date, entry number, transaction description, debit account, credit account, debit amount, credit amount).

What is the method of recording financial transactions in the journal?

Recording financial transactions is one of the most important tasks performed by the accountant; therefore, it is essential to record these transactions accurately. Transactions are recorded in the journal using the double-entry method, which is based on recording the transaction twice on the credit side and the debit side, where one increases and the other decreases.

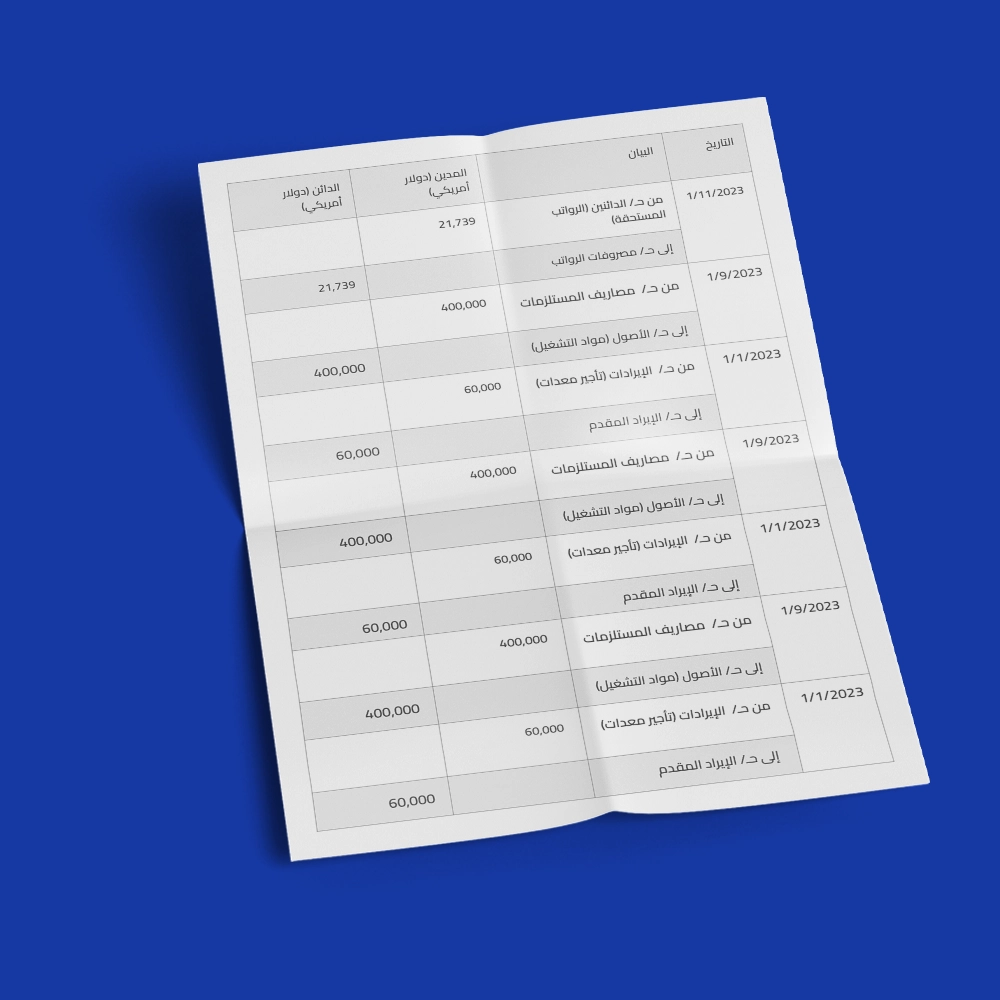

Give a practical example of recording financial transactions in the journal.

On 2/1/2022, some equipment needed by the organization for its business operations was purchased for 50,000 riyals, and payment was made in cash.

On 2/4/2022, cash rent was paid in the amount of 12,000 riyals for a period of four months.

On 2/8/2022, 30,000 riyals were received from a customer in exchange for providing certain services.

On 2/15/2022, office supplies were purchased on account for 5,000 riyals.

On 2/20/2022, goods worth 20,000 riyals were sold on account.

On 2/28/2022, the electricity bill was paid in the amount of 4,000 riyals.

On 2/28/2022, employee salaries amounting to 15,000 riyals were paid.

These are some of the transactions that occurred during the month of February in the organization, and they can be recorded in the journal as follows:

| Credit | Debit | Description | Transaction Date |

| 50,000 | 50,000 | From A/C Equipment To A/C Cash | 1/2/2022 |

| 12,000 | 12,000 | From A/C Prepaid Rent To A/C Cash | 4/2/2022 |

| 30,000 | 30,000 | From A/C Cash To A/C Revenue | 8/2/2022 |

| 5,000 | 5,000 | From A/C Office Supplies To A/C Accounts Payable | 15/2/2022 |

| 20,000 | 20,000 | From A/C Accounts Receivable To A/C Sales | 20/2/2022 |

| 4,000 | 4,000 | From A/C Expenses To A/C Cash | 28/2/2022 |

| 15,000 | 15,000 | From A/C Wages To A/C Cash | 28/2/2022 |

In this example, it becomes clear how to record a set of real financial transactions that occurred during a month in the journal using the double-entry method, where the affected accounts in each transaction are identified, along with the debit and credit sides.

We also note that the transactions are recorded in a clear chronological order, with the accounting entry for each transaction explained. This reflects adherence to basic accounting principles and later facilitates posting these entries to the ledger and then preparing the financial statements.

To make recording financial transactions in the journal easier, you can use the Daftra accounting software to enter accounting transactions in an organized and chronological manner, with automatic identification of the affected accounts and the debit and credit sides. This helps reduce errors, save time, and ensure the posting of entries to the ledger and the smooth completion of the accounting cycle.

Thanks to its simple interface and support for financial reports, Daftra becomes an effective tool for any accountant seeking to comply with accounting principles and organize financial records professionally.

You can download a journal template in PDF and Excel format to facilitate the process of recording accounts in the journal without the need to create a ledger from scratch.

What is the difference between the journal and the ledger?

The journal and the ledger are accounting books responsible for recording accounting transactions in any organization. But what is the difference between the journal and the ledger? The ledger differs from the journal in several characteristics, as shown in the following table:

| Basis of Comparison | Journal | Ledger |

| Definition | The journal is considered a daily record in which the accountant records all business transactions that occur in the organization. | The ledger is a book in which the accountant records a separate page for each account and determines the balance of that account at the end of each period. |

| Purpose | The purpose of the journal is to identify the business transactions that occur in the organization day by day and post the account balances to the ledger. | The purpose of the ledger is to determine the balance of each account opened in the ledger and transfer it to the trial balance. |

| Importance | The importance of the journal lies in ensuring that no transaction occurring in the organization is overlooked, assisting in preparing the ledger, and reconciling different accounts. | The importance of the ledger includes determining the different balances of each account at the end of each period and assisting in preparing the trial balance. |

| Method of Recording and Organization | In the journal, recording is done in chronological order on specific dates, according to the double-entry principle. | In the ledger, recording is done based on the type of account opened in the book. |

The journal and the ledger differ in both function and organization. The journal is used to record all financial transactions on a daily basis and in chronological order, according to the double-entry method, with the aim of ensuring that no transaction is overlooked.

The ledger, on the other hand, is used to group and summarize transactions according to the type of each account. A separate page is opened for each account to determine its balance at the end of the period, which helps in preparing the trial balance and reconciling accounts.

In short, the journal records events first, and then this data is posted to the ledger to analyze it and track the balance of each account.

Why are financial transactions recorded in the journal using the double-entry method?

Financial transactions are recorded in the journal using the double-entry method to ensure the accuracy of financial records and maintain the balance of the accounting equation.

This ensures an equal effect on both sides of the accounting equation (Assets = Liabilities + Equity), which helps maintain the accuracy and integrity of accounting records, facilitates tracing financial responsibility during auditing and financial analysis, ensures compliance with internationally recognized accounting standards, and ultimately improves sound decision-making in financial management.

Read also: What is the accounting equation and its main components and limitations?

What are the most common errors that occur in the journal and the ledger?

Accounting errors vary from one book to another, so attention must be paid to them during recording and review. Below are the most common errors that may occur in the journal and the ledger:

Journal Errors

- Recording errors: These may include recording an incorrect amount, using the wrong account, or recording the same transaction on an incorrect date.

- Errors of omission: These result from failing to record a specific transaction.

- Failure to properly apply the double-entry principle: This leads to an imbalance in the accounting equation.

- Errors in transaction description: Inaccurate or unclear description of the transaction.

Ledger Errors

- Posting errors: Posting an incorrect amount or posting a transaction to the wrong account.

- Addition errors: Errors in calculating the final balance of an account.

- Errors of omission: Result from failing to post a transaction from the journal to the ledger.

In summary, journal errors include problems related to recording, omission, failure to adhere to the double-entry principle, or inaccurate transaction descriptions. Ledger errors, on the other hand, mainly involve incorrect posting, incorrect totaling, or omission of transferring transactions from the journal. This requires continuous review to avoid such errors.

What are the main differences between journal errors and ledger errors?

Accounting errors are among the challenges that an accountant may face when recording transactions, and their nature varies depending on the book used. Therefore, it is important to understand the differences between journal errors and ledger errors in order to avoid them and improve the accuracy of accounting records.

The differences between journal and ledger errors can be summarized as follows:

- Stage at which the error occurs: This refers to the accounting process during which the error may occur. Journal errors usually occur during the initial recording stage of transactions, while ledger errors may occur during the stage of grouping transactions and tracking balances.

- Scope of impact: Journal errors affect the accuracy of recorded transactions and consequently impact all subsequent accounting records. Ledger errors affect the accuracy of final account balances and the resulting financial statements.

- Ability to detect and correct errors: Detecting and correcting errors in the journal is more difficult because it requires reviewing all recorded transactions in detail. In contrast, detection and correction are easier in the ledger by matching final account balances with the financial data posted to them.

It is clear that the main differences between journal errors and ledger errors lie in three key points: first, the stage at which the error occurs, as journal errors appear during the initial recording stage, while ledger errors appear during the accumulation of balances.

Second, the scope of impact of these errors, where journal errors affect all accounting records, while ledger errors affect the accuracy of final balances and data; and finally, the ease of detection and correction, which is more difficult in the journal due to the need for detailed review, and easier in the ledger through balance reconciliation.

What is the purpose of the journal, the ledger, the accounting equation, and the financial statements?

Each accounting element plays an important role in the accounting system, and understanding its purpose helps ensure accurate recording, processing, and analysis of financial transactions. Below is a comparison that explains the purpose of the journal, the ledger, the accounting equation, and the financial statements.

| Type | Purpose |

| Journal | Recording financial transactions on a daily and sequential basis, detailing them accurately, and verifying that each transaction is recorded correctly according to the double-entry method. |

| Ledger | Grouping financial transactions according to their different account types, tracking the balances of each account, and then preparing reports used to compile and prepare the financial information included in the financial statements, which ultimately helps analyze the company’s performance and financial position. |

| Accounting Equation | Ensuring the balance of accounting records and the equation (Assets = Liabilities + Equity), and assisting in evaluating the company’s financial performance in order to make appropriate decisions. |

| Financial Statements | Providing detailed information about the company’s performance and financial position, and offering a comprehensive view to management, investors, and relevant stakeholders to help them plan and forecast future trends. |

From the comparison, we note that the journal focuses on recording daily transactions, while the ledger focuses on grouping them by accounts. The accounting equation ensures the balance of records, while the financial statements provide a comprehensive picture of the company’s performance and financial position.

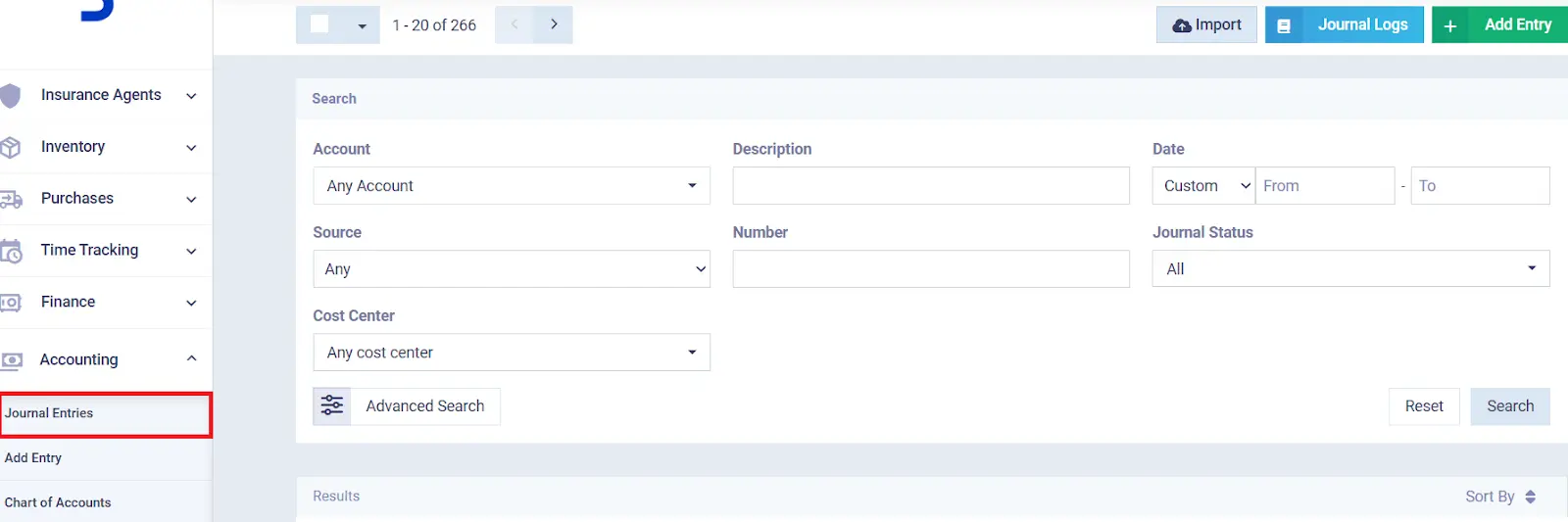

What is the journal in Daftra?

Daftra accounting software automatically records your accounting entries, with the option to add manual entries for any other transactions. These entries are organized in the chart of accounts according to the classification of the expense or revenue from which the entry arises. These daily entries are issued in a report called the Journal Entries Report, and then they are posted to the ledger.

By clicking on General Accounts Reports in the “Daftra” dashboard, you can quickly and easily generate and save the journal entries report, which saves you the trouble of using paper books or accounts saved on Office programs that could be lost at any time.

In conclusion, preparing daily journal entries has become easy through various accounting software, and through the journal, the financial accountant can detect accounting errors early before any major problems or accounting discrepancies occur in the financial statements and the company’s closing accounts.

Therefore, it is essential to pay attention to the journal and not overlook any business transaction that occurs within the specified financial period.

Frequently Asked Questions

What is the journal in financial accounting?

The journal is an accounting record used to record a company’s daily financial transactions in an organized and detailed manner. It is considered the first stage of the accounting cycle. Accounts are classified into debit and credit using the double-entry method, which ensures the accuracy of accounting data.

What are the types of journals?

Journals are used to record daily transactions such as sales, purchases, revenues, and expenses. Types of journals include:

- General journal

- Purchases journal

- Sales journal

- Expenses journal

- Cash receipts journal

- Cash payments journal

- Subsidiary journal

What are the elements of a journal?

The basic elements of a journal are:

- Entry number

- Transaction date

- Transaction description

- Nature of accounts (debit/credit)

- Accounting amounts (debit/credit)

- Transaction document number

- Ledger posting page number

How do I prepare a journal?

Steps for preparing a journal in accounting:

- Identify the details of the financial transaction, such as entry number, date, description, debit account, credit account, and amounts

- Identify the accounts involved in the transaction

- Record the double entry (debit and credit)

- Write a brief description of the transaction

- Ensure the accuracy of the entered data

How can I record accounts in the journal?

Accounts are recorded using the double-entry method, where each financial transaction is entered twice: once on the debit side and once on the credit side, affecting at least two accounts. Transactions are recorded in chronological order according to their date.

What is the purpose of the journal?

The purpose of the journal is to accurately record all daily financial transactions and document them according to the double-entry system, so they can later be posted to the ledger and used to prepare the balance sheet and financial statements.

What is the relationship between the journal, the ledger, and the trial balance?

The journal is used to record transactions first, then these entries are posted to the ledger, where they are grouped by account. From the ledger, the trial balance is prepared to ensure account balances are equal before preparing the financial statements.

How can I record expenses in the journal?

Expenses are recorded in the journal by entering the expense details. The steps for recording expenses are:

- Enter the transaction date

- Enter the debit account name

- Enter the amount paid

- Enter the credit account name affected by recording the expense

- Enter a description of the financial transaction

What is the benefit of the journal?

The journal helps in:

- Comprehensive documentation of all financial transactions

- Identifying debit and credit accounts

- Preparing the ledger and financial statements

- Tracking cash flows

- Facilitating tax reporting

- Detecting accounting errors early

- Supporting accurate financial decision-making