The General Ledger: Its Types and Timing of Preparation

Table of contents:

- What is the General Ledger?

- What are the Types of General Ledger?

- What is the General Ledger?

- What is the Benefit of the General Ledger?

- When is the General Ledger Prepared?

- What is the Purpose of the General Ledger?

- What is Recorded in the General Ledger?

- What is the Subsidiary Ledger?

- What is the Importance of the Subsidiary Ledger?

- What are the Classifications of the Subsidiary Ledger?

- How is the Subsidiary Ledger Prepared?

- What is the Difference Between the General Ledger and the Subsidiary Ledger?

- What are the Types of Accounts in the General Ledger?

- What is the Format of the General Ledger?

- How is the General Ledger Prepared?

- A Practical Example of Preparing the General Ledger

- When Is Posting Made from the General Ledger to the Trial Balance?

- What Comes After the General Ledger?

- What Is the Difference Between the General Ledger and the Trial Balance?

- Is There a Difference Between the General Ledger and an Account Statement?

- How Does Daftra Help in Preparing the General Ledger?

- Frequently Asked Questions

One of the most important tasks for any accountant is recording financial transactions accurately and systematically. Therefore, financial accounting is a branch of accounting that outlines all the necessary financial transactions for an entity and explains the accounting cycle it goes through.

Recording transactions in the journal and then posting them to the general ledger is considered one of the most important steps for identifying and tracking each account of the entity during the specified financial period. Through the general ledger, it is possible to determine the total debit and credit transactions and the balance of each account throughout the fiscal year.

In this article, we will take a quick tour to understand what the general ledger account is, its purpose, how it is prepared, the types of accounts it includes, and how transactions are posted from the journal to the general ledger.

Summary of Key Points

- The general ledger is one of the accounting procedures carried out by accountants during the financial year to consolidate journal entries into main accounts, aiming to track financial movements within these accounts.

- The general ledger is divided into two main types: the subsidiary ledger and the general ledger.

- The general ledger serves as the basis for preparing the trial balance required to complete the financial statements. It contains several accounts represented by assets, liabilities, equity, revenues, and expenses. The general ledger is prepared after all transactions have been recorded in the journal.

- The purpose of the general ledger is to contribute to the preparation of the overall budget, financial monitoring, and analysis, and to achieve prudent financial management that gains the trust of investors, financiers, and external parties.

- The subsidiary ledger is responsible for recording the details of each transaction according to its specific account. This facilitates obtaining the necessary data for the main accounts in the general ledger at any time.

- The importance of the subsidiary ledger lies in ensuring the accuracy of financial records, improving client account management, and assisting compliance with laws and accounting principles that require separate records for accounts.

- The main difference between the general ledger and the trial balance lies in their content and timing of preparation. The general ledger provides detailed and comprehensive information about accounts compared to the trial balance, and the trial balance cannot be prepared before the general ledger. The trial balance provides an overview of the final balances of each account according to its debit or credit nature.

- The difference between the general ledger and the account statement is that the general ledger is part of the internal accounting system of the entity, whereas the account statement is an external report issued by financial institutions such as banks.

What is the General Ledger?

The term general ledger is one of the most important accounting terms. It is a key accounting record that any accountant maintains during the financial year to consolidate various journal entries into a single account and to track the different financial movements to and from that account.

For example, if a company has a bank account in its ledger, the general ledger can consolidate all banking-related accounting transactions, whether debit or credit.

The main feature of the general ledger is that it shows the origin of every transaction for each account in the entity. Bills of exchange, checks, and all supporting documents must be retained to prevent fraud.

What are the Types of General Ledger?

- Subsidiary Ledger

- General Ledger

What is the General Ledger?

The General Ledger is an accounting tool that allows for the summarization of all financial transactions of an entity, and then consolidates the details of these transactions from the journals and subsidiary ledgers into main accounts. The general ledger is opened at the beginning of the financial year and closed at its end after preparing the financial statements and closing accounts.

The general ledger contains all accounts, such as assets, liabilities, equity, revenues, and expenses. It helps consolidate the data necessary for preparing the trial balance, which serves as the foundation for preparing the balance sheet, the income statement, and the cash flow statement.

Why is it called the General Ledger?

The general ledger is called so because it provides a comprehensive "general" view of all the financial transactions of the entity. It also presents a summary of all accounting entries recorded in other books (such as the journal) and displays the financial information of all accounts in one place.

What is the Benefit of the General Ledger?

The importance of the general ledger lies in its vital role, which allows for accurately identifying the final balances of accounts. This is a key step before moving on to the more critical and complex procedures in the entity’s accounting cycle. The importance of the general ledger stems from the following factors:

- Storing Financial Data: It helps store financial data accurately and up-to-date. The figures from this data are relied upon in preparing financial reports that provide insights into the financial health of the entity.

- Facilitating Accountants’ Tasks: It simplifies many tasks for accountants and financial analysts by helping them efficiently record and organize ongoing transactions, thus minimizing potential accounting errors that could disrupt subsequent steps in the accounting cycle.

- Using the Double-Entry Method: The general ledger follows the double-entry system, meaning that every financial transaction on the credit side has a corresponding entry on the debit side. This ensures that total debits are balanced with total credits.

- Detecting Financial Gaps and Accounting Manipulations: The general ledger provides clear explanations for discrepancies in the overall financial picture of the entity. These gaps may arise from unintentional accounting errors, such as omissions or duplicate entries, as well as from deliberate manipulations, fraud, or deceit. By referring to the general ledger, one can trace and investigate detailed, documented data to accurately identify the source of errors.

- Compliance with Laws and Accounting Principles: The general ledger is an essential accounting procedure required for compliance with laws, regulations, and accounting principles, such as balance, financial disclosure, and reliability.

Thus, the importance of the general ledger lies in its accuracy in storing data, facilitating accountants’ tasks, relying on the double-entry system to ensure financial balance, detecting errors and manipulations, and ensuring compliance with accounting principles and regulations, making it an indispensable step in the accounting cycle of any entity.

When is the General Ledger Prepared?

The general ledger is prepared after tracking and recording transactions in the journal and posting them to the subsidiary ledger.

Then, the general ledger is prepared with the final balances of the main accounts related to the subsidiary transactions posted from the journal. This is a key step for preparing the trial balance (by totals or balances), followed by the preparation of the financial statements and the closing accounts of the entity.

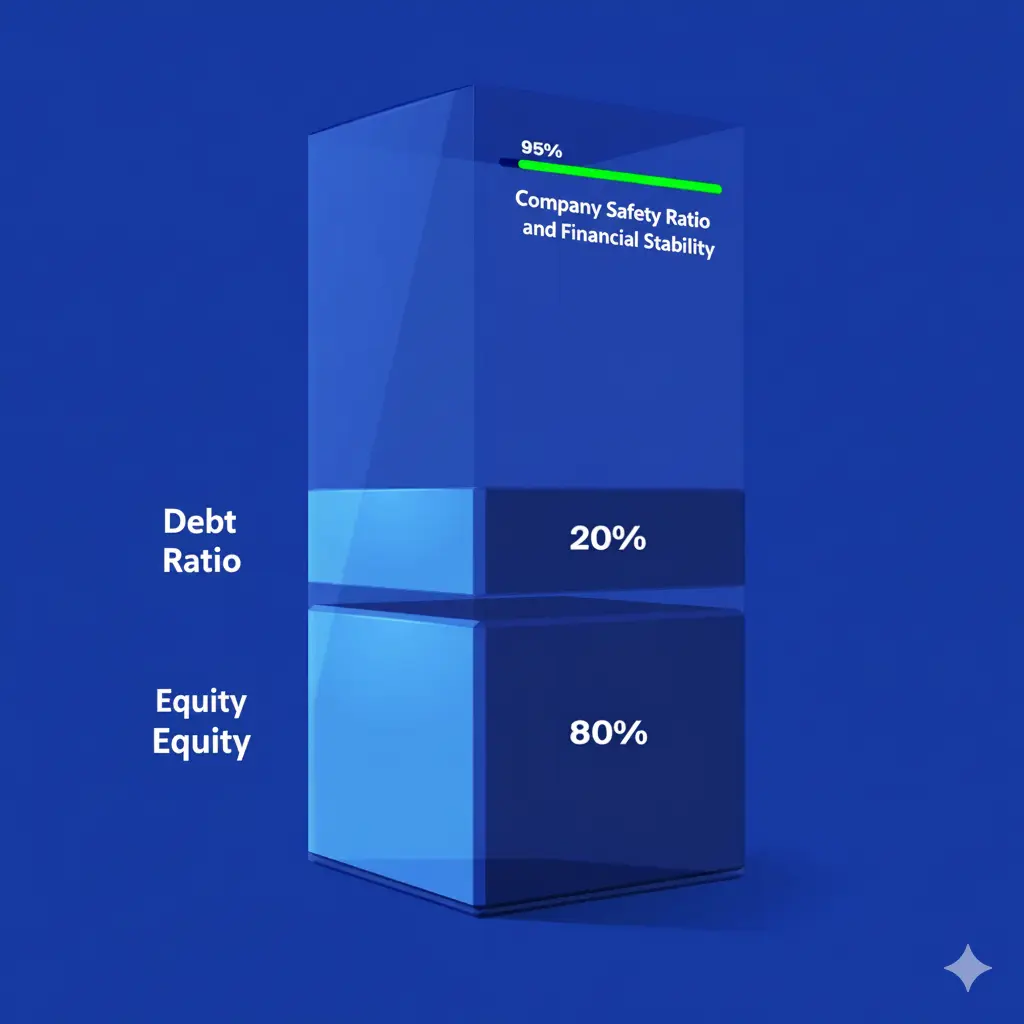

What is the Purpose of the General Ledger?

The general ledger ensures that entities comply with the principles of transparency and accountability. Through its accounting data, financial reports can be prepared, serving as clear evidence of the entity’s financial credibility to creditors, suppliers, and other stakeholders. The following are the main objectives of the general ledger:

- Contributing to the Preparation of the General Budget Financial data in the main accounts of the general ledger, such as assets, liabilities, revenues, and expenses, help partially forecast the entity’s future estimated budget. This is achieved by comparing general ledger data over accounting periods. Business owners, analysts, auditors, and financiers rely on these comparisons to determine financial trends and future directions related to the entity.

- Financial Monitoring and Analysis Tracking the details of financial activities in the general ledger helps identify trends and opportunities, assess cash liquidity, and evaluate potential risks to the business. This contributes to an accurate analysis of the entity’s financial position and performance.

- Achieving Prudent Financial Management Account details in the general ledger are used for planning business needs, such as determining the financing required for expansion and growth, managing inventory, allocating financial resources efficiently, and controlling procurement processes.

Business owners and responsible parties benefit from the documented data in the general ledger to easily identify the value of assets, the amount of liabilities, costs, obligations, revenues, and profit metrics. All this information supports informed decision-making to gain the trust of investors and stakeholders by taking timely measures to address financial issues and enhance productivity and profitability.

In general, the general ledger aims to support the entity in budget preparation, financial monitoring, and analysis, and achieve prudent financial management, using accurate data for financial forecasting, performance evaluation, and effective decision-making that enhances operational efficiency and stakeholder confidence.

Also read: What is an External Audit and How to Conduct It

What is Recorded in the General Ledger?

The general ledger in accounting is the main record where all of a company’s accounting entries are consolidated. The following accounting transactions are recorded in the general ledger:

- Journal Entries: All daily financial transactions of the entity, such as sales, purchases, expenses, revenues, and others, are recorded here. Transactions are recorded according to the double-entry system, documenting each transaction with both a debit and a credit entry.

- Posting from the Journal: Transferring entries from the journal to specific accounts in the general ledger.

- Opening and Closing Balances: The general ledger contains the opening balances of each account at the beginning of the accounting period and the closing balances at the end.

- Accounting Adjustments: Calculating the final balance of each account (referred to as “balancing”) and determining whether the final balance is a debit or a credit.

- Various Transactions: The general ledger reflects changes in each account resulting from different transactions, such as increases or decreases in assets, liabilities, equity, revenues, and expenses.

Thus, financial transactions are recorded in the general ledger, including journal entries, postings from the journal, opening and closing balances, and accounting adjustments, providing a comprehensive and accurate view of the movement of accounts within the entity.

What is the Subsidiary Ledger?

The subsidiary ledger is responsible for recording detailed data and information for each account and transaction, such as bank transactions, customer accounts, and fixed asset transactions. Therefore, every account in the general ledger that requires detailed information can be easily found in the subsidiary ledger.

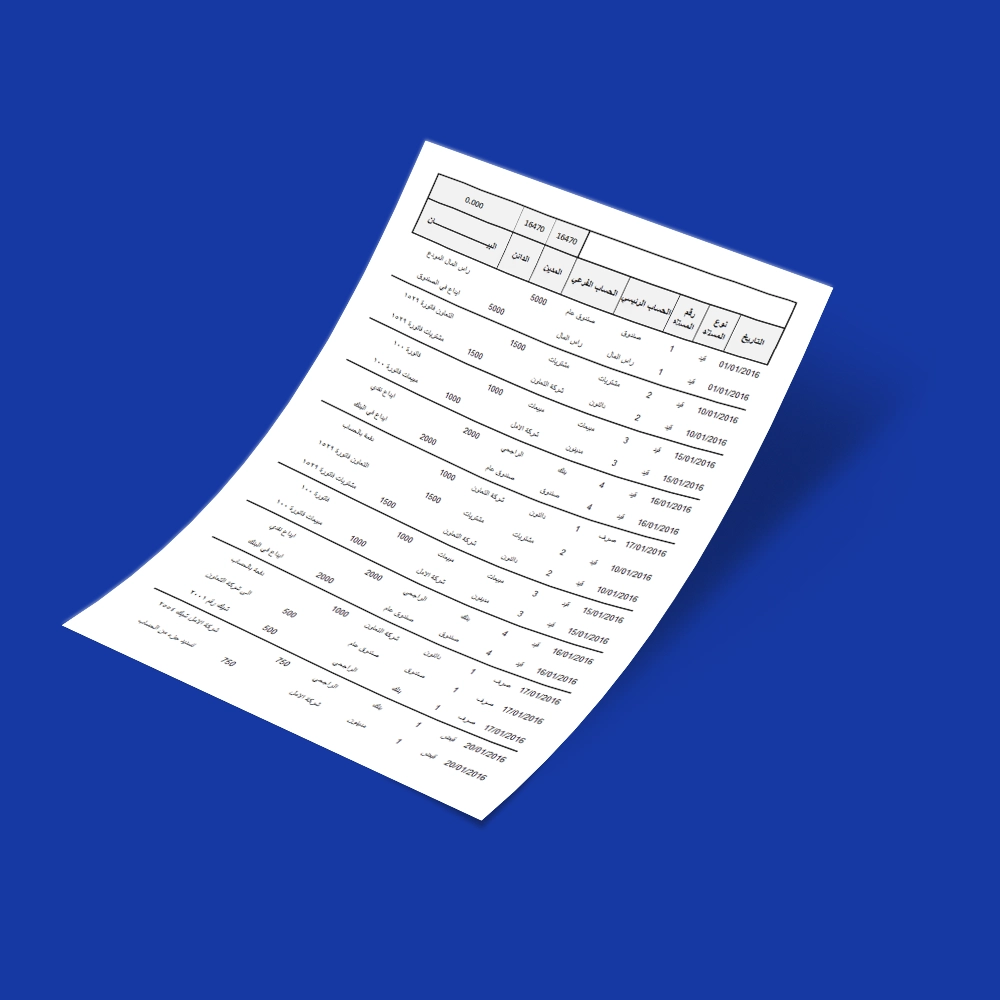

A sample format of the subsidiary ledger is provided for illustrative purposes.

What is the Importance of the Subsidiary Ledger?

The subsidiary ledger is an important accounting tool used to support the general ledger by providing a higher level of detail. The importance of the subsidiary ledger lies in the following:

- Providing Detailed Financial Information: It offers deeper insights into financial transactions that may not be available in other accounting records.

- Financial Data Analysis: It helps analyze data and understand financial movements in greater detail.

- Ensuring Accuracy of Financial Records: By reconciling and matching the balances of the subsidiary ledger with the general ledger.

- Improving Customer Account Management: It contributes to tracking and managing customer accounts efficiently.

- Compliance with Accounting Laws and Principles: requires separate records for accounts.

In short, the subsidiary ledger enhances accounting efficiency by providing accurate and detailed financial data, aids in analyzing financial movements, ensures the accuracy of records, supports customer account management, and ensures compliance with accounting standards, making it an essential part of any entity’s financial system.

What are the Classifications of the Subsidiary Ledger?

The subsidiary ledger is classified based on the type of accounts being tracked. The most common classifications include:

- Accounts Receivable Subsidiary Ledger: Contains all transactions related to customers, including sales, credits, payments, and discounts, and shows the individual balance for each customer separately.

- Accounts Payable Subsidiary Ledger: Tracks all transactions related to suppliers, such as purchasing operations.

- Inventory Subsidiary Ledger: Tracks inventory details, including classifications, quantities, and costs.

- Fixed Assets Subsidiary Ledger: Identifies the current value of each fixed asset and tracks details related to cost, depreciation, and book value.

- Cost Subsidiary Ledger: Tracks production and operational material costs and is used to determine the individual cost of each operation or product.

In summary, the types of subsidiary ledgers vary according to the nature of the accounts they serve, such as customer accounts, suppliers, inventory, fixed assets, and costs. Each type provides detailed information that helps manage accounting operations efficiently, contributing to improved financial control and ensuring the accuracy of accounting information.

How is the Subsidiary Ledger Prepared?

Preparing the subsidiary ledger is an important accounting step for organizing and tracking financial details related to specific accounts. It is prepared through a series of steps, including:

- Identifying Accounts: Determine which accounts require a subsidiary ledger from the general ledger.

- Designing the Subsidiary Ledger Template: Create a template for the specific accounts, including essential data such as transaction dates, descriptions, and newly added balances.

- Recording Financial Transactions: Record transactions related to the account in the subsidiary ledger in an organized and systematic manner.

- Updating Account Balances: Update the account balance in the general ledger after each transaction to ensure information accuracy.

- Verifying Entries: Check the entries in the subsidiary ledger and ensure they match the related general ledger account, confirming that the total balances of subsidiary and general accounts reconcile in both ledgers.

In short, preparing the subsidiary ledger requires identifying target accounts, designing an appropriate template, accurately recording transactions, continuously updating balances, and ensuring consistency with the general ledger to maintain the accuracy and integrity of the accounting system.

You can also use Daftra accounting software to easily prepare the subsidiary ledger. It provides integrated tools that allow you to create dedicated subsidiary ledgers for customers, suppliers, assets, and other accounts. Daily transactions are recorded and automatically linked to the main accounts in the general ledger, with balances updated instantly after each transaction.

What is the Difference Between the General Ledger and the Subsidiary Ledger?

Although the subsidiary ledger is considered part of the general ledger, there are several differences between the two. The details can be explained through the following comparison:

| Comparison Aspect | Subsidiary Ledger | General Ledger |

| Primary Purpose and Use | The purpose of the subsidiary ledger is to track the details of subsidiary transactions recorded in the journal and is used to prepare the general ledger. | The main purpose of the general ledger is to summarize the transactions posted from the subsidiary ledger into main accounts, then consolidate the final balances of these accounts for preparing the trial balance, financial statements, and closing accounts. |

| Account Balance | The accounting values in the subsidiary ledger must reconcile with the values posted or reflected in the general ledger. | Accounts and their final balances must reconcile with the financial data in the trial balance. |

| Similarity | Each group of transactions shares similar characteristics. | Each transaction belongs to a different account. |

| Details of Financial Transactions | Detailed information is provided for each transaction. | Information is summarized for each transaction. |

| Content and Organization | The subsidiary ledger consists of a set of transactions included under a single account or a group of accounts. | The general ledger contains multiple main accounts, with transactions organized separately and concisely within them. Each transaction is ultimately recorded in its respective account, and the account balances are used to total the final balance for each account. |

The differences between the general ledger and the subsidiary ledger lie in their purpose and level of detail. The subsidiary ledger is used to track detailed financial transactions related to specific accounts, such as customers or suppliers, while the general ledger is used to summarize these transactions into main accounts for preparing the trial balance and financial statements.

The subsidiary ledger focuses on detailed information for each transaction, whereas the general ledger provides summarized information. Both require balance reconciliation; the entries in the subsidiary accounts must align with the accounts in the general ledger to ensure the accuracy of the accounting system.

What are the Types of Accounts in the General Ledger?

Accounts in the general ledger vary to cover all financial aspects of an entity. The different types of accounts in the general ledger are as follows:

- Asset Accounts: These include fixed and current assets, cash accounts, prepaid expenses, and accounts receivable.

- Liability Accounts: These include accounts payable, various debts of the entity, and notes payable.

- Revenue Accounts: These include sales accounts and service fees.

- Expense Accounts: These include salaries and wages, office expenses, and depreciation expenses.

- Equity Accounts: These include stock accounts, divided into common stock, preferred stock, and shares, as well as retained earnings accounts.

Each entity may have different accounts; for example, some entities may have a stock account, while others may not, in which case it can be classified under equity accounts. In summary, the types of accounts in the general ledger include assets, liabilities, revenues, expenses, and equity, and their use is determined according to the nature of the entity’s activities and financial structure.

What is the Format of the General Ledger?

The general ledger is organized in a structured format that facilitates the analysis of accounting entries. Its elements are coordinated to help track changes in each account, and each section of the general ledger is dedicated to a specific account (such as cash, sales, purchases, or wages). The general ledger consists of the following elements:

- Account Title: Appears at the top of the section or page assigned to the account.

- Account Number: A unique number may be assigned to each account to facilitate identification and tracking.

- Transaction Date: Records the date of each transaction.

- Entry Description: Explains the nature of the transaction or related details.

- Reference: Can refer to the journal entry number or any other document related to the transaction.

- Debit and Credit Amounts: Records the amounts added to or deducted from the account.

- Balance: The new balance is calculated after each entry and classified as either a debit or a credit balance.

From the structure of the general ledger, it is clear that it is a precise and organized accounting tool, allowing detailed tracking of each account through its core elements such as date, description, amounts, and ending balance. This organization facilitates account review and accurate, transparent financial performance analysis.

How is the General Ledger Prepared?

After accounting transactions have been recorded in the journal, the remaining accounting stages are completed by posting from the journal to the general ledger. This is done by transferring debit and credit amounts to their respective accounts in the general ledger. The posting process from the journal to the general ledger is carried out through the following steps:

- Opening a Page for Each Account in the General Ledger: A separate page is opened for each account in the general ledger to facilitate the posting process. Each general ledger account must include the account name, date of creation, details of daily transactions and their timing, and the total ending balance of the account.

- Format of General Ledger Accounts: Accounts in the general ledger take the form of a T-account, where debit transactions appear on the right side, and credit transactions appear on the left side of the general ledger table.

- Preparing Double-Entry Transactions: This is done by:

- Recording the debit amount on the debit side as per the journal entry, while noting the corresponding credit party in the description field.

- Recording the credit amount on the credit side, while noting the corresponding debit party in the description field.

- Updating Balances: Account balances in the general ledger are updated periodically with debit and credit amounts to ensure that balances posted to the trial balance remain in equilibrium. This process is known as account reconciliation in the general ledger.

If the debit and credit sides do not balance, necessary adjustments are made to correct discrepancies or accounting errors resulting from unrecorded, duplicated, or incorrectly recorded transactions in the journal.

- Closing Accounts and Posting Balances: Accounts are closed by aggregating the final amounts of each general ledger account, determining their balances, and posting them to the trial balance.

Download the General Ledger Template Now and Edit It for Free from Daftra

The Daftra accounting system enables you to prepare the general ledger with ease. You can open dedicated pages for each account and record daily transactions in an organized manner in accordance with the double-entry system.

It also allows you to automatically post entries from the journal, update balances periodically, and ensure account balance reconciliation at every stage of the accounting cycle.

Daftra also helps you reconcile and close accounts, with the ability to post balances directly to the trial balance, saving time, reducing errors, and providing accurate financial reports that support confident decision-making.

A Practical Example of Preparing the General Ledger

If the journal entries are as follows:

| Debit | Credit | Description | Date |

| 500,000 | From Bank Account | 2019-03-01 | |

| 500,000 | To Capital Account | ||

| 200,000 | From Furniture and Fixtures Account | 2019-03-04 | |

| 200,000 | To Bank Account |

Required: Post these entries to the general ledger. Solution:

| Bank Account | |||||

| Debit | Credit | ||||

| Amount | Description | Date | Amount | Description | Date |

| 500,000 | To Bank Account | 2019-04-01 | 200,000 | From Furniture and Fixtures Account | 2019-04-03 |

| 300,000 | Balance | 4-30 | |||

| 500,000 | 500,000 | ||||

| 300,000 | Opening Balance | 5-1 | |||

After explaining all the details related to the general ledger and applying them through a practical example, here is a general ledger template ready for download.

When Is Posting Made from the General Ledger to the Trial Balance?

The trial balance is prepared by listing all the accounts recorded in the general ledger. Its purpose is to ensure that the transactions recorded in the journal and the general ledger are accurate. A table is prepared showing the total debit, total credit, and account name, as illustrated in the explanatory sample below:

| Account Name | Total Credit | Total Debit |

|---|---|---|

| Bank | 219,000 | 420,000 |

| Capital | 300,000 | |

| Rent | 20000 | |

| Cash on Hand | 1500 | 15000 |

| Equipment | 120000 | |

| Revenues | 54500 | |

| Total | 575000 | 575000 |

From this illustrative example, we observe that the total amounts of the debit accounts equal the balances of the credit accounts, indicating that the trial balance is balanced and that the accounts and their financial transactions posted in the general ledger are accurate. The Daftra accounting software allows you to automatically post accounts from the general ledger to the trial balance without human intervention, thereby minimizing accounting errors

.

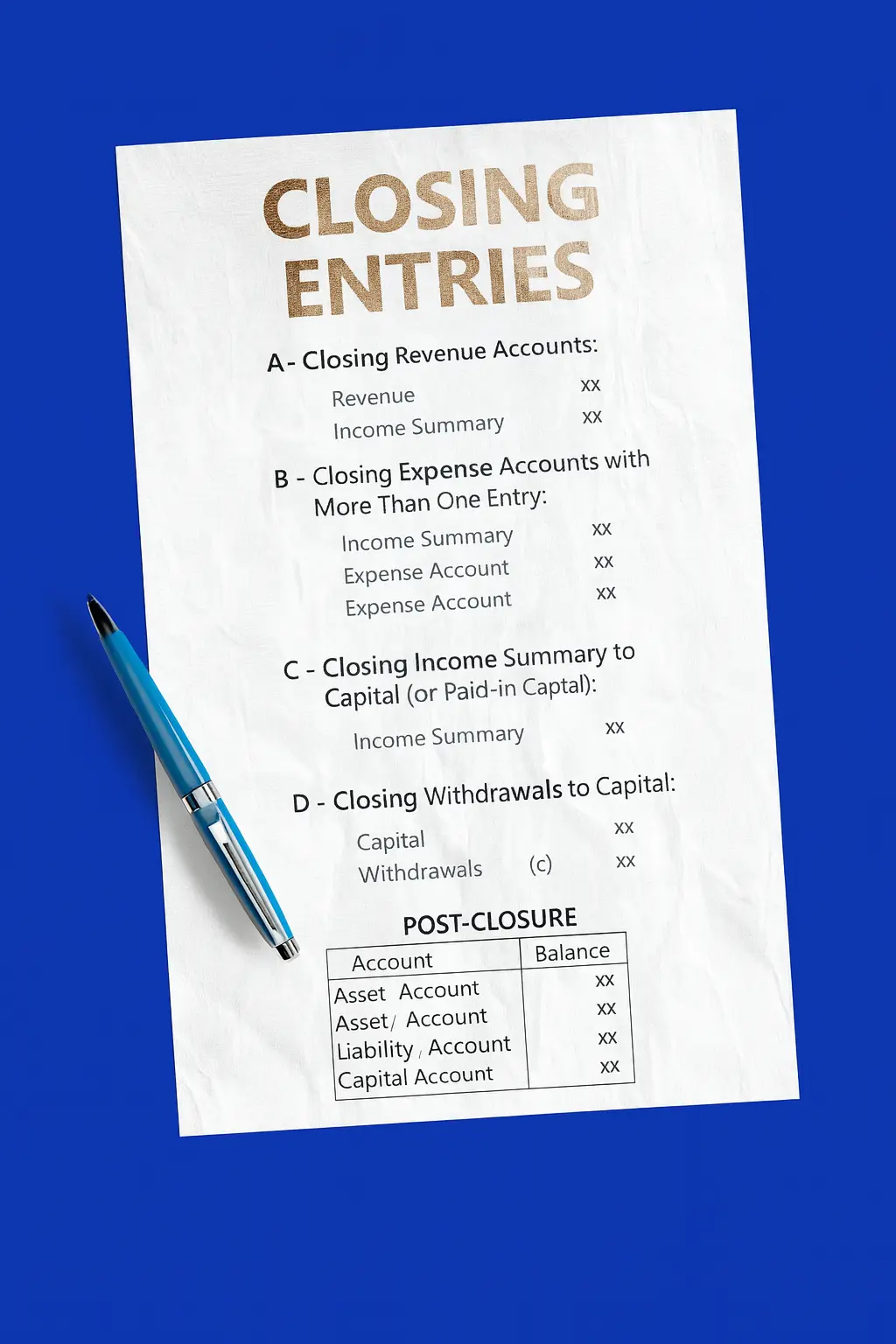

What Comes After the General Ledger?

After all entries have been updated and posted in the general ledger, the stage of preparing the financial statements begins. This stage is a fundamental part of the accounting cycle and plays an important role in providing accurate and reliable financial information to stakeholders. It includes the following steps:

- Closing Temporary Accounts at the End of the Accounting Period: Such as revenue and expense accounts, in order to update the retained earnings balance in the balance sheet.

- Preparing the Balance Sheet: This presents the financial position of the entity at a specific point in time and includes assets, liabilities, and equity.

- Preparing the Income Statement: This shows revenues and expenses during the accounting period and reflects the resulting profit or loss.

- Preparing the Cash Flow Statement: This evaluates and measures cash inflows to and outflows from the entity based on operating, investing, and financing activities.

- Analyzing and Reviewing the Financial Statements: To assess financial performance and support managerial decision-making.

After preparing the general ledger, the accountant performs several steps, including closing temporary accounts and preparing the main financial statements, such as the balance sheet, income statement, and cash flow statement. These statements contribute to evaluating the entity’s financial position, enabling management and stakeholders to make strategic decisions based on reliable data.

What Is the Difference Between the General Ledger and the Trial Balance?

The trial balance presents a summary of the balances posted from the general ledger in order to verify the accuracy of entries recorded in the journal and to ensure that debit and credit accounts are balanced, enabling the completion of the remaining accounting procedures for preparing financial reports.

This means that the difference between the trial balance and the general ledger lies in the level of detail provided by each and the timing of preparation. The general ledger provides detailed information for each of its main accounts, along with a summary of the financial transactions related to each account.

The trial balance, on the other hand, shows the final balance of each account according to its debit or credit nature, and it cannot be prepared without first preparing the general ledger.

Is There a Difference Between the General Ledger and an Account Statement?

Yes, there is a difference between the general ledger and an account statement, despite the similarity in their role of tracking financial transactions. Each serves a distinct function and holds different importance within the financial and accounting system. The differences between the general ledger and the account statement can be explained as follows:

1. Definition and Function

The general ledger is a core component of an entity’s accounting system, where all financial transactions are recorded according to the double-entry system (debit and credit) across different accounts. In contrast, an account statement is a report issued by a bank or financial institution that shows all transactions made on a specific account over a defined period of time.

2. Content

The general ledger contains details of all accounts used in accounting, such as assets, liabilities, revenues, and expenses. An account statement, on the other hand, includes transaction details such as deposits, withdrawals, fees, and interest.

3. Purpose

The purpose of the general ledger is to provide a comprehensive and detailed view of the entity’s financial position and to support the preparation of financial statements. Conversely, the purpose of an account statement is to provide the account holder with accurate information about transactions carried out on their account and to help them track and manage their funds.

In summary, the fundamental difference between the general ledger and the account statement lies in purpose and usage. T

he general ledger is used internally by the entity to organize and manage accounting records as a whole, while the account statement is an external tool used to monitor movements in a specific account over a defined period. Both are essential but serve different roles within the financial cycle.

Download a ready-to-edit Account Statement template now for free from Daftra.

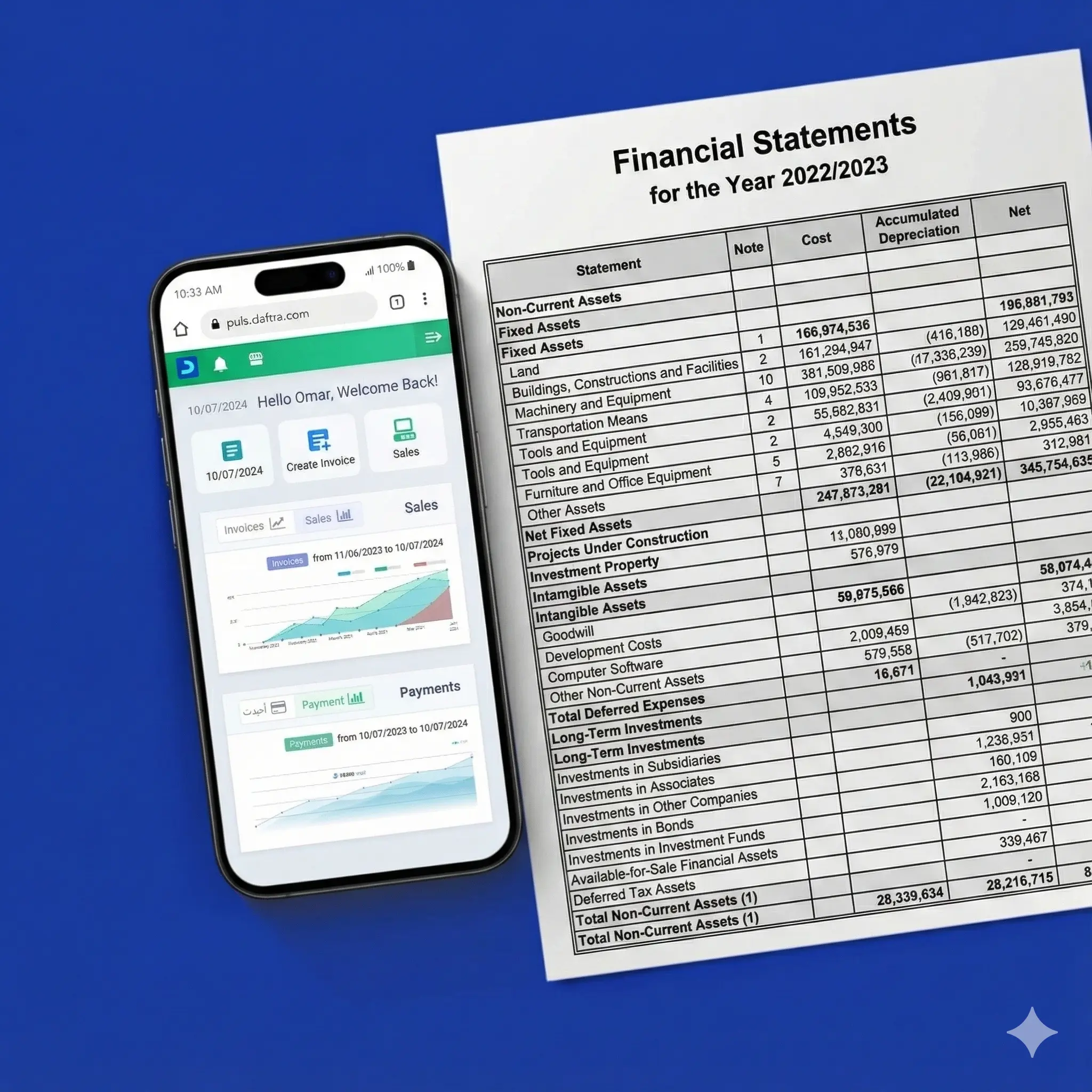

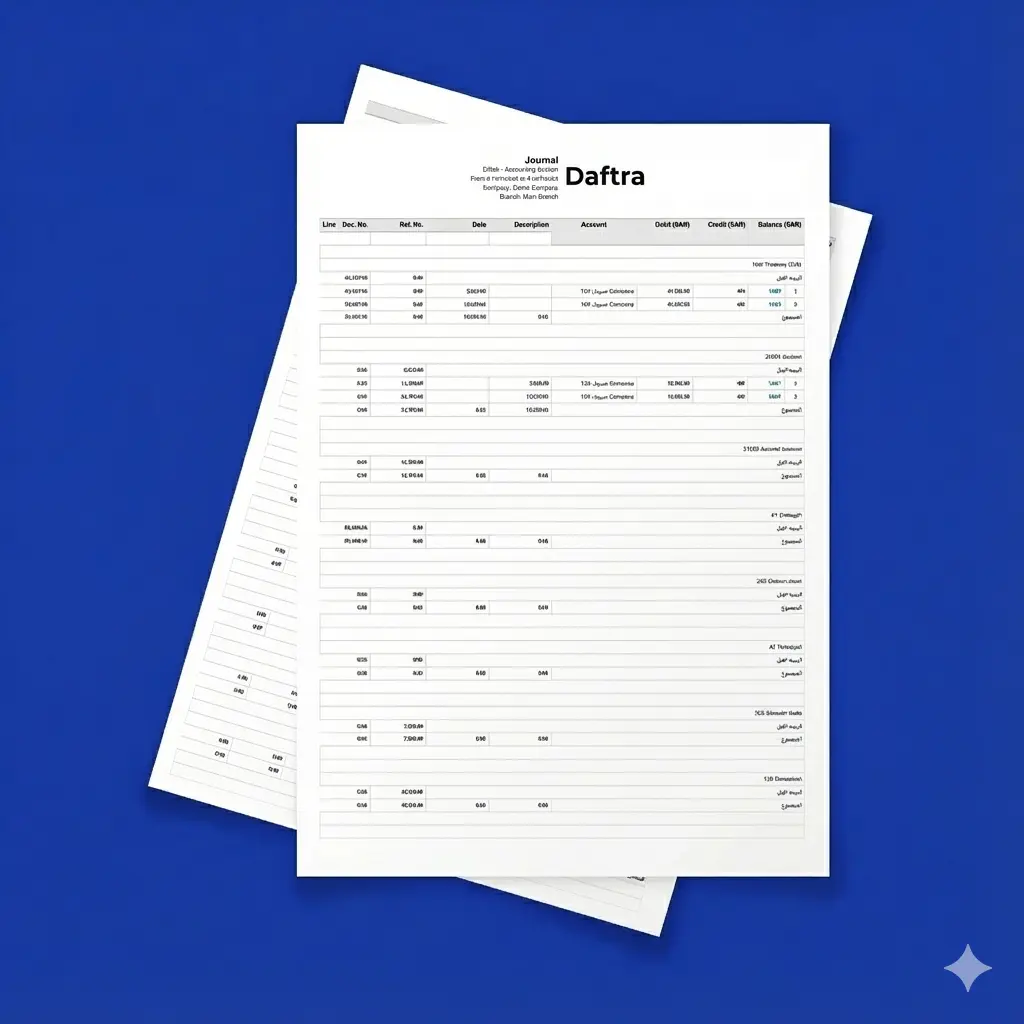

How Does Daftra Help in Preparing the General Ledger?

Through Daftra’s accounting software, you can rely on the data entered as manual journal entries or automatic entries generated from your transactions and recorded on the system dashboard.

Daftra then converts these entries into a general ledger report that can be generated instantly, displaying total assets, liabilities, and all accounting items arranged according to the debit and credit principle.

The software also allows you to control and filter results through search settings to view any specific account in the general ledger. In addition, you can access the details of any journal entry by clicking on it, or download the general ledger report in the format of your choice.

In conclusion, after reviewing all the details related to the general ledger based on our accounting experience, we advise every financial accountant to ensure the completion of all accounting cycle procedures, including the preparation of the general ledger and its related accounts.

This should be done while strictly adhering to the proper steps of recording and posting from the journal to the general ledger, in order to ensure the accuracy of the final debit and credit balances transferred to the trial balance, which will be relied upon in preparing financial reports and final accounts.

Frequently Asked Questions

What is an account ledger?

It is an accounting record in which all journal entries related to a specific account are compiled, with the aim of tracking debit and credit movements for each account within the entity during the fiscal year.

What is the purpose of the ledger?

The purpose of the ledger is as follows:

- To compile transactions related to each account in one place.

- To prepare the trial balance and financial statements.

- To detect manipulation and accounting errors.

- To assist management in financial analysis and strategic decision-making.

Why is it called the ledger?

It is named so because it provides a comprehensive and overall view of all financial transactions within the organization and is considered a primary reference for summarizing all entries recorded in other books.

What are the components of the ledger?

The ledger consists of:

- Account title

- Account number (if any)

- Entry date

- Description

- Reference (entry number or document)

- Debit amount and credit amount

- Remaining balance

What is the difference between the ledger and the journal?

The difference between the ledger and the journal is that the journal records all financial transactions in chronological order with debit and credit details, while the ledger groups these transactions by account type to show the movement of each account during the accounting period. In short, the journal shows when the transaction occurred, while the ledger shows its impact on the accounts.

How do I prepare a ledger?

A ledger is prepared by following these steps:

- Posting entries from the journal to each account.

- Opening a separate page for each account.

- Recording the details (date, description, debit, credit).

- Updating the balance after each transaction.

- Ensuring balance before transferring balances to the trial balance.

What are examples of general ledger accounts?

The types of general ledger accounts include:

- Asset accounts: including fixed and current assets, cash, prepaid expenses, and accounts receivable.

- Liability accounts: including payable accounts, various debts of the entity, and notes payable.

- Revenue accounts: including sales and service fees.

- Expense accounts: including salaries and wages, office expenses, and depreciation expenses.

- Equity accounts: including share capital accounts (ordinary shares, preferred shares, and common shares) as well as retained earnings.

Is the ledger the same as an account statement?

No, there is a difference:

- Ledger: An internal part of the accounting system that displays details of all accounts within the entity.

- Account statement: An external report, usually issued by a bank, showing movements on a single account only (such as a bank account).

What is the relationship between the journal, the ledger, and the trial balance?

The relationship is sequential within the accounting cycle: transactions are first recorded in the journal, then posted to the ledger to be grouped by account type, after which the trial balance is prepared to verify the equality of balances. Finally, this data is used to prepare financial statements that reflect the entity’s financial position.

What is the difference between posting and balancing?

Posting is the transfer of entries from the journal to the relevant accounts in the ledger, while balancing is the calculation of the final balance for each account after totaling debit and credit amounts.