How to Close Accounts at Year-End

Closing the accounts at the end of the financial year represents a major challenge for many companies, as this period is one of the most important phases any organization goes through. During this time, the company evaluates how successfully it has achieved its goals and focuses on planning for the new year. But how can this period pass without complications?

Many companies make a serious mistake during the year-end closing process by postponing these tasks until the final month. As a result, completing the closing procedures may take around 25 to 35 days.

However, some companies manage to finish this process in just 10 days. The difference between the two cases is simple: proper organization and starting the work from the beginning of the year to avoid accumulating tasks.

In this article, we explain how you can properly and efficiently close your company’s annual accounts.

What is year-end account closing for companies?

Year-end closing, or closing the accounting books, refers to the process in which the financial management team reviews all the financial transactions of the organization and the accounting records related to the completed fiscal year, ensuring that both match accurately.

The year-end closing process includes verifying the company’s expenses, revenues, income, assets, and everything related to investments and equity.

What is the purpose of closing the final accounts?

The purpose of closing and rolling forward the accounts is to prepare a final financial statement in anticipation of any review conducted by government entities.

This statement is kept as part of the company’s official accounting records. Year-end account closing also aims to achieve several other objectives, such as:

- Evaluating the company’s economic performance and determining its ability to achieve the goals set at the beginning of the fiscal year.

- Identifying areas that require managerial intervention for improvement and better results.

- Providing accurate information to shareholders, investors, and all stakeholders to understand and assess the company’s financial position and enhance their ability to make informed decisions.

How to close accounts at the end of the financial year?

What makes the year-end closing process difficult is the lack of organization that many companies suffer from, such as missing documents, especially suppliers’ invoices and receipts, or having them but in an inaccurate state.

Additionally, human errors may occur due to pressure and fatigue experienced by the team during a short and busy period, or errors caused by a lack of skills or negligence. Manual entry of complex financial transactions, poor communication, unclear responsibilities among employees, and other organizational issues can also be major causes of problems during the closing of the books.

Therefore, here are clear and simple steps that will make it easier for you to apply proper year-end closing procedures:

1. Create a Timeline for the Closing Process

Before anything else, you should establish a clear timeline for the financial closing process, along with the tasks that need to be completed and the team members responsible for each one, in order to maintain workflow organization and stability.

The first step in creating this timeline is to prepare a schedule that includes all key activities involved in the year-end closing process.

This includes account reconciliation, evaluating assets and liabilities, and other essential procedures. After listing these activities, arrange them, assign deadlines, clarify each team member’s responsibilities, and monitor the execution of each task.

With the Daftra accounting system, you can easily define and manage financial periods and closed periods through the general ledger settings, making the year-end closing process significantly easier.

2. Collect Financial Documents for the Closing Process

Next comes the stage of gathering all financial documents related to the closing process. At this stage, you will need to collect documents related to the company’s transactions, such as bank statements, inventory counts, last year’s tax returns, vendor data, payroll reports, and more.

3. Reconcile Bank Statements

At this stage, you should focus on ensuring the accuracy of your statements, identifying any errors, and updating transactions that have not yet been recorded.

This requires comparing each transaction in your bank statements with the entries in your general ledger to ensure there are no discrepancies.

The "Treasuries and Bank Accounts" section under the Finance module in the Daftra accounting system helps you manage and track bank statements accurately, with data automatically updated by the system for each transaction.

4. Review Accounts Payable and Receivable

The company should review payable and receivable accounts during the year-end closing. Accounts payable represent what the company owes to suppliers and external parties, while accounts receivable represent the funds the company expects to collect within a certain period.

During financial closing, the company should organize these accounts, review outstanding invoices, and ensure they are accurately recorded in the designated ledgers. Automated journal entries in the Daftra cloud system help review accounts payable and receivable accurately during the accounting period, culminating in proper year-end closing.

5. Review Your Assets and Inventory

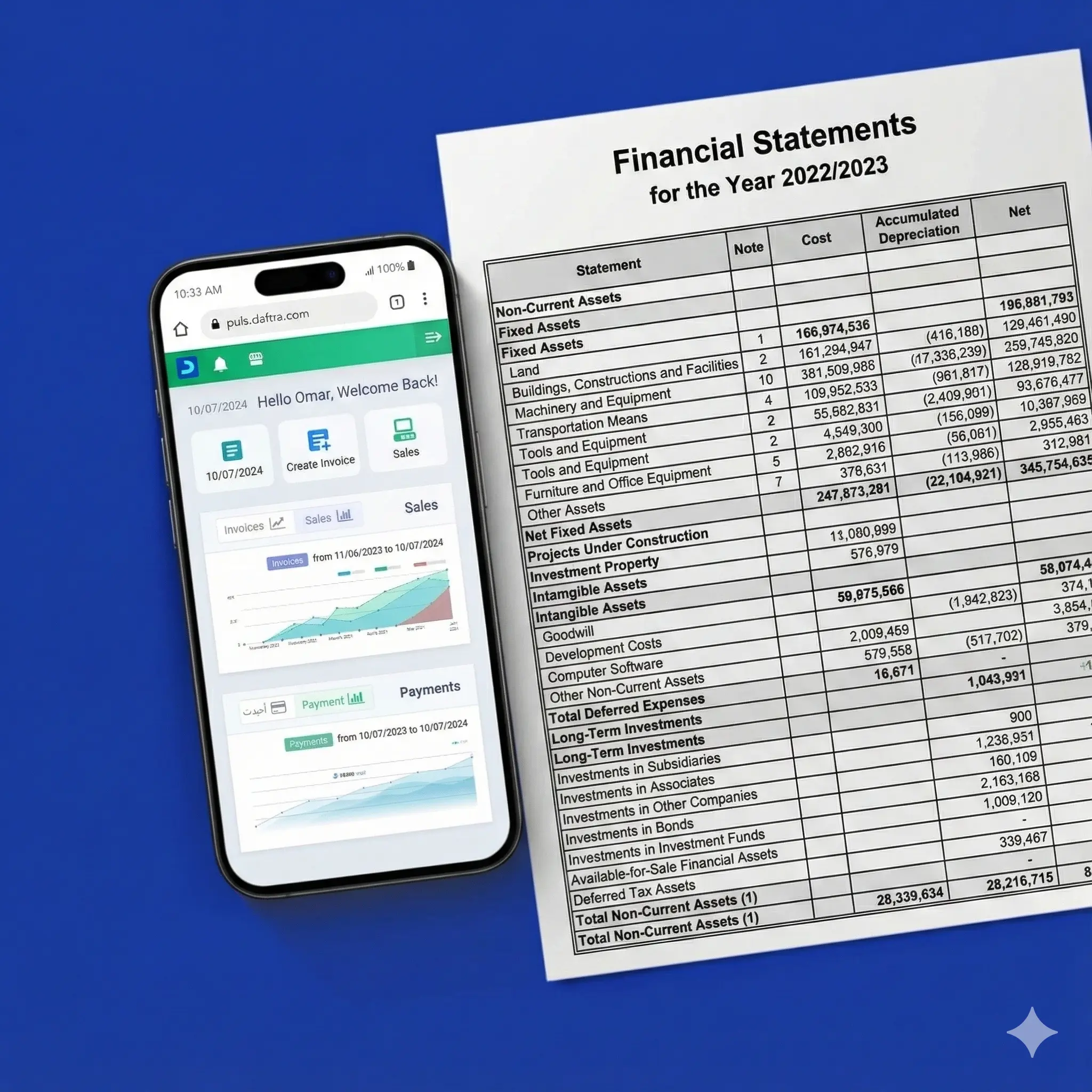

At this stage, review all assets owned by the company, whether tangible assets such as property, buildings, equipment, and vehicles, or intangible assets such as patents and brand value.

This information is needed throughout the preparation of financial statements, including during year-end closing. You should also assess the depreciation of assets, as equipment loses a portion of its value each year.

The company should professionally estimate and deduct this depreciation from asset values. A simple method is to determine the expected useful life of each asset, refer to company records for similar equipment, or consult other users. After determining the expected lifespan, estimate the resale value at the end of its use, subtract this from the purchase price, and divide by the useful life in years to approximate the annual depreciation.

Additionally, review year-end inventory to identify top-selling products and gain insights into sales performance. Daftra’s asset management system tracks various assets with automated, accurate, and reliable results.

Also read: Everything You Need to Know About Depreciation in Accounting Also see: Ready-to-use Depreciation Calculation Templates from Daftra

6. Prepare Your Income Statement

The income statement, also known as the profit and loss statement, provides a comprehensive summary of your company’s revenues, expenses, and net income or loss for the fiscal year. Management matches revenues and expenses and verifies the accuracy of the financial data.

7. Create Your Balance Sheet

The balance sheet provides an overview of the company’s financial position for the fiscal year. It categorizes the company’s assets, liabilities, and shareholders’ equity into:

- Current items: Company assets such as cash, accounts receivable, and inventory, as well as liabilities such as accounts payable, short-term loans, and accrued expenses.

- Non-current items: Assets such as long-term investments, and liabilities such as long-term debt and deferred tax obligations.

8. Review Payroll and Tax Records

The company should review payroll records, identify any changes, and reconcile them with other accounting records. Similarly, all tax documents should be reviewed to ensure completeness and compliance.

9. Review Contracts and Financial Agreements

During year-end closing, the company should review all contracts and agreements signed during the fiscal year with suppliers, vendors, clients, partners, and owners. Ensure all terms, rights, and obligations, especially financial aspects such as expenses, compensations, and dispute resolution mechanisms, are accurate. Review invoices expected to be collected before the year-end as well.

10. Prepare the Cash Flow Statement

The cash flow statement summarizes all cash inflows and outflows resulting from operating, financing, and investing activities during the reporting period.

11. Final Review and Set Next Year’s Goals

Finally, review all steps completed during the year-end closing process, ensure compliance with the planned timeline, and verify that no step was missed. Then, set the goals for the next fiscal year based on the outcomes of this year’s closing.

Practical Example of Year-End Account Closing

Below is a practical example of closing the fiscal year accounts for a company: Here, we assume that the company "XXX" prepares an adjusted trial balance after making adjusting entries for salaries and depreciation.

This allows the company to complete the year-end closing process by preparing closing entries. We assume that company "XXX" earned revenues of $570,000. Salaries amounted to approximately $155,000, service expenses were $18,000, and rent expenses were $22,000.

The company also distributed dividends to shareholders totaling $35,000 for the year 2024. Using this data, we can create a table to record the company’s journal entries, which would be as follows:

| Date | Account Name | Debit | Credit |

| 31-12-2024 | Revenues | 570,000 | |

| 31-12-2024 | Income Summary | 570,000 |

| Date | Account Name | Debit | Credit |

| 31-12-2024 | Income Summary | 195,000 | |

| 31-12-2024 | Salaries Expense | 155,000 | |

| 31-12-2024 | Service Expenses | 18,000 | |

| 31-12-2024 | Rent Expense | 22,000 |

Now, we notice that we have a credit balance of SAR 570,000 and a debit balance of SAR 195,000. This results in an Income Summary balance of SAR 375,000. We will transfer this amount to the Retained Earnings account as follows:

| Date | Account Name | Debit | Credit |

| 31-12-2024 | Income Summary | 375,000 | |

| 31-12-2024 | Retained Earnings | 375,000 |

This entry closes the temporary Income Summary account and updates the Retained Earnings account. In addition, company "XXX" distributed dividends to shareholders; therefore, we must close the Dividends account into Retained Earnings as well, which reduces the Retained Earnings balance for the fiscal year 2024.

| Date | Account Name | Debit | Credit |

| 31-12-2024 | Retained Earnings | 35,000 | |

| 31-12-2024 | Dividends | 35,000 |

How Does Daftra Help You Close Your Fiscal Year Accounts?

Don’t let accounting become a stressful task while managing your business. Join Daftra’s accounting software, which offers you comprehensive features that enable you to manage your financial transactions accurately, without needing prior experience in the field.

Daftra’s accounting system helps you instantly calculate your company’s taxes based on the regulations in your country. It also supports you in managing your financial transactions and recording your expenses and revenues professionally.

Daftra further assists you during the year-end closing process, allowing you to set your preferred closing period, whether monthly, quarterly, semi-annual, or annual, with the ability to make adjustments to the closing period whenever needed. This ensures you can manage your company’s accounts efficiently and in an organized manner.

FAQs

What accounts are not closed at year-end?

The accounts that are not closed at the end of the year are permanent accounts, which carry their balances into the new accounting period. These include assets, liabilities, and owners’ equity accounts.

What is a closing entry?

Closing entries are the journal entries used to determine the ending balances of permanent accounts that will be carried forward to the new fiscal year, after closing temporary accounts and preparing the financial statements for the current year.

What does closing balance mean?

The closing balance is the final balance of temporary accounts that are zeroed out at the end of the accounting period to prepare the financial statements.