Commercial Papers: Types and Differences from Securities

Table of contents:

- What are commercial papers?

- Why are they called commercial papers?

- What are the types of commercial papers?

- What are the characteristics of commercial papers?

- What are the conditions of commercial papers?

- When does a commercial paper expire?

- What are the benefits of dealing with commercial papers?

- Who is the holder of the commercial paper?

- What are the methods of trading commercial papers?

- What is the collection of commercial papers?

- Are commercial papers considered a contract?

- Difference between securities and commercial papers

- What is the law governing commercial papers?

- How does the Saudi Commercial Papers System work?

- What are the articles stipulated by the Commercial Papers Law in Saudi Arabia?

- What is discounting commercial papers?

- Example of applying commercial paper discounting

- What is meant by the equivalence of commercial papers?

- Frequently Asked Questions

- Commercial papers in Daftra

Commercial papers are among the most important tools used in any accounting system, and their origins date back more than 100 years, when trade between individuals and institutions increased, and maintaining liquid funds at all times became difficult.

Therefore, there had to be an easy, guaranteed means of commercial transactions under legal supervision, which is why commercial papers are more widely circulated today in all institutional transactions.

Today, you will not find any transactions conducted without commercial papers in any establishment. You can buy goods for a specified amount, and the payment can be made through one of the commercial papers, such as a check or a promissory note. Therefore, they are considered an important means of facilitating commercial transactions and of ensuring the collection of funds.

What are commercial papers?

Commercial papers are defined as papers or certificates whose form and terms are agreed upon by the parties, including the maturity date and the amount due.

They are one of the elements of short-term debt owed by the establishment, and these papers are used to finance accounts payable, inventory, and salaries, basically everything that is short-term for the establishment.

The maturity period of commercial paper ranges from a few weeks to a few months, meaning its duration does not exceed 270 days.

Therefore, the circulation of commercial papers is considered an effective financing method that can be used at any time to facilitate transactions within the establishment.

Why are they called commercial papers?

They are called commercial papers because they are primarily used in trade and business to facilitate financial and credit transactions. These papers are considered a means of converting debts and financial claims into instruments that can be easily traded, which simplifies buying, selling, and financing operations in the commercial market.

What are the types of commercial papers?

According to the Saudi system, there are 3 types of commercial papers that you can learn about in detail:

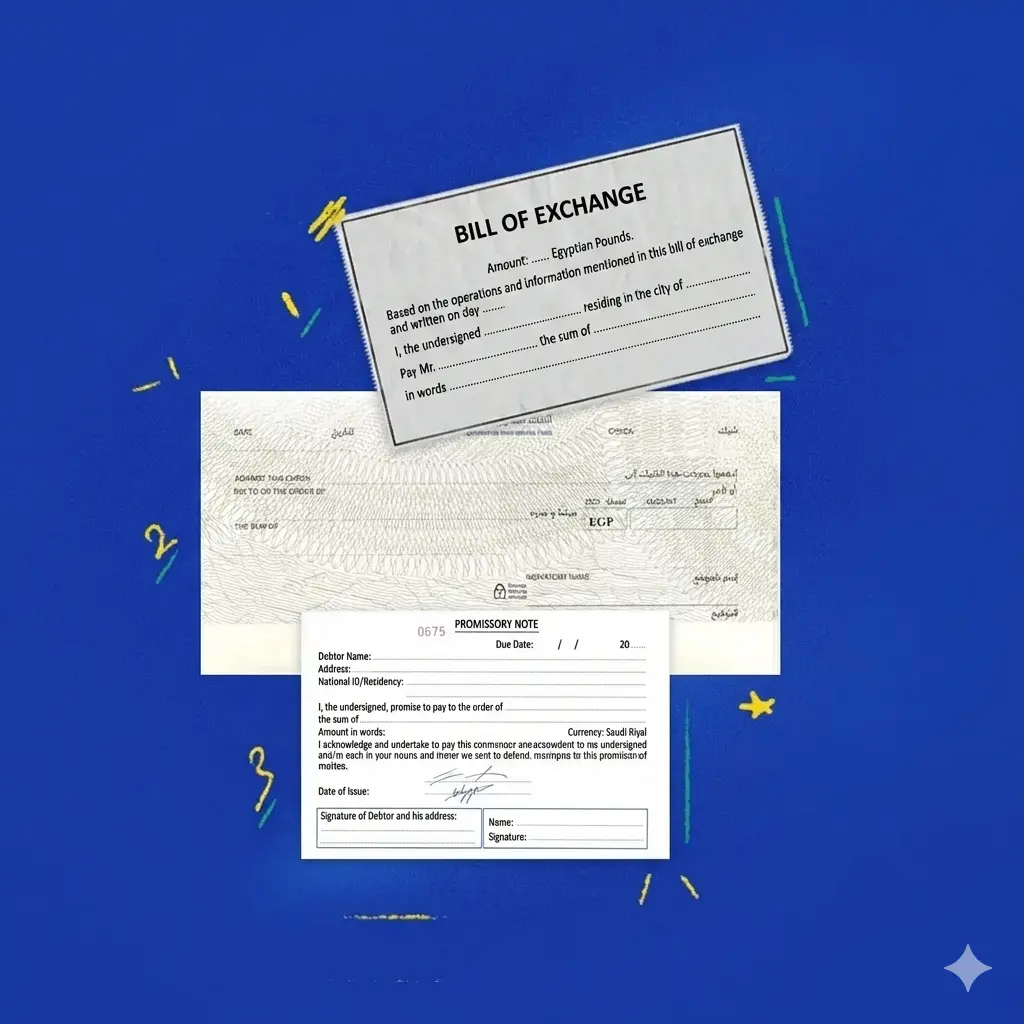

1- Bill of Exchange (Promissory Note)

The bill of exchange is classified as one of the commercial papers that involve 3 parties:

- Drawer: The party who orders the issuance of the due amount, e.g., the bank.

- Drawee: The party who must pay the amount to the beneficiary, e.g., the business.

- Beneficiary: The party who receives the money from the drawee, e.g., the suppliers.

In a bill of exchange, the payment period, the due amount, the issuance date, the names of the parties, and their signatures are all specified.

Download a bill of exchange template to edit for free from Daftra.

2- Cheque

A cheque is also one of the commercial papers that involves 3 parties:

- Drawer: The one who issues the payment order.

- Drawee: The bank that pays the specified amount in the cheque.

- Bearer or Beneficiary.

These elements must also be available on the cheque: the issuance date, the parties' signatures, and the amount to be paid.

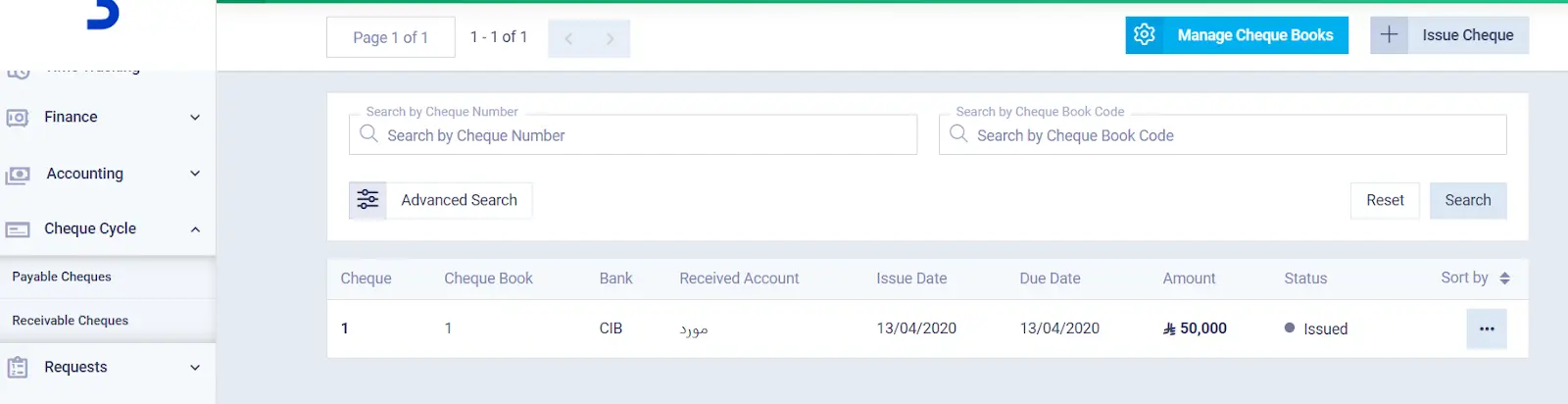

Through the Daftra Cheque Cycleprogram, you can organize cheque statuses, accurately manage their data, and record cheques, whether cashed immediately or postponed until the specified payment date.

3- Promissory Note (Order)

A promissory note is one of the commercial papers that involves only 2 parties:

The issuer of the note who prepares a note with a specific due amount in favor of the beneficiary within a specified time.

It is important in every commercial paper to include the signatures of all parties, the issuance date, and the due date, to ensure the rights of the creditor and to ensure compliance with Saudi regulations.

Download a free promissory note template.

What are the characteristics of commercial papers?

Commercial papers are an important element of financial management, so it is essential to be familiar with their features to maximize their benefits for the various parties involved. The most prominent characteristics of commercial papers are:

- Commercial paper is short-term, meaning it has a specific maturity that cannot be extended.

- Commercial papers are considered documents to prove debts owed by the business.

- Every commercial paper has a specific form set by law, and it cannot be dealt with in any other way to ensure rights.

- Self-sufficiency of commercial papers, meaning each commercial paper is considered a sufficient obligation without referring to any other evidence.

- Independence in commercial papers, meaning all parties of the commercial papers must have separate signatures from each other.

- Commercial papers are characterized by high financial liquidity, making it easy to convert them into cash within a short period.

What are the conditions of commercial papers?

The conditions of commercial papers are fundamental matters that must be adhered to to protect the rights of creditors and debtors, enhance trust between commercial parties, facilitate the collection and payment processes arising from commercial papers, and organize credit transactions within a legal framework that prevents chaos and fraud.

The most important conditions of commercial papers are:

- Correct drafting of the commercial paper and signing it by the issuing party.

- The commercial paper must specify the amount to be paid.

- The commercial paper must represent an unconditional promise to pay or an order to pay.

- Identification of the person or entity to whom the amount should be paid in the commercial paper.

- Specification of the payment due date.

- The commercial paper must be negotiable.

When does a commercial paper expire?

A commercial paper expires over time according to the limitation periods specified in different laws. For example, there may be a limitation period ranging from one year to several years from the date of maturity of the commercial paper, or from the date of the last acknowledgment of the debt, or from a failed collection attempt.

What are the benefits of dealing with commercial papers?

Commercial papers offer many benefits, including facilitating commercial transactions, easing payment processes on commercial papers, and providing legal guarantees to protect the parties who benefit from them. The most important benefits of commercial papers are:

- Facilitating financial transactions: Commercial paper helps prevent delays due to liquidity constraints, so most traders use it when funds are unavailable.

- Guarantee document: Commercial papers are recognized as a valid credit tool, so they cannot be doubted or feared.

- Negotiability: Ownership of commercial papers can be transferred from one party to another through endorsement or possession.

- Cost reduction: Commercial paper is one of the most important documents used to reduce costs associated with financial transactions, such as transfer fees, bank fees, and credit costs.

- Ease of tracking debtor payments: Commercial papers are the easiest tool for settling financial obligations because they only require dealing in the general form of commercial papers, and they mature at a specific time.

- Improving cash flow: Commercial paper is highly liquid, so it is not necessary to pay all the business’s dues in cash; it can be used to finance short-term needs.

- Debt settlement: Commercial papers can also be used to settle business debts, such as accounts payable.

- Reducing financial risks: Commercial papers limit the risks associated with non-fulfillment of obligations, as they set clear conditions for dealing between parties and serve as legal evidence to resolve financial disputes.

- Improving financial planning: Commercial paper provides a clear picture of financial obligations, enabling the business to manage its costs efficiently.

Who is the holder of the commercial paper?

The holder of the commercial paper is the person who currently owns it and has the right to collect the monetary value recorded on it. If the commercial paper is negotiable (i.e., it can be transferred from one person to another), the holder can be anyone who legally obtains it, whether through transfer, gift, or sale.

What are the methods of trading commercial papers?

Commercial papers can be traded through a set of methods:

- Endorsement: The holder of the commercial paper signs the back of the paper, enabling transfer of ownership to another person.

- Delivery: In the case of commercial papers negotiable by delivery, it is sufficient to hand over the paper from the holder to the new party.

- Assignment: The rights of the commercial paper can be transferred to another person through an assignment contract.

- Sale: Commercial papers can be sold in the financial market or through banks and financial institutions.

What is the collection of commercial papers?

The collection of commercial papers is the process through which commercial paper is converted into cash. Collection can be done by banks or financial institutions that present the commercial paper for payment upon maturity.

In the case of cheques, they are presented to the drawee bank to obtain the funds. In the case of bills of exchange and promissory notes, the holder can request the person or entity who promised to pay (the debtor) to fulfill their promise upon maturity.

Are commercial papers considered a contract?

Yes, commercial papers are considered contracts, as they represent agreements between two or more parties that create specific financial obligations and rights. For example, a bill of exchange is a contract that includes an unconditional promise to pay a specified amount of money at a specified time, on demand, to a specified person or to the holder of the paper.

Difference between securities and commercial papers

The main difference between securities and commercial papers lies in the function and use of each. Securities are used to own shares in various institutions, while commercial paper is used to guarantee the collection of debts owed by businesses.

The differences between securities and commercial papers can be clarified through the following elements:

1- Definition

Commercial paper is a document that cannot be bought or sold, but its ownership can be transferred by endorsement and possession. Securities are financial contracts that can be bought or sold in the financial market.

In general, commercial paper represents funds that must be collected, while securities are investments issued by institutions and governments.

2- Components

Securities can be divided into:

- Stocks: Stocks are issued in the financial market to own a share in another business. There are types of stocks: bearer shares, nominal shares, and registered shares.

- Bonds: Institutions issue bonds in the financial market for purchase, and the bondholder is the creditor of the business that issued the bonds. Bonds are usually issued to resolve institutional crises and can be either cash bonds (issued against money) or in-kind bonds (issued against assets such as land or buildings).

Commercial papers can be divided into:

Bills of exchange, cheques, and promissory notes. Each of these commercial papers proves the indebtedness of one party to another, with a specified due date for repayment.

3- Importance

The importance of securities lies in their role as a significant investment for any institution, used for new projects, to increase capital, or even to pay specific obligations. Securities are a source of investment because they generate returns and are actively traded.

The importance of commercial paper lies in facilitating various commercial transactions, ensuring debt collection, and facilitating its conversion to cash.

4- Duration

Commercial papers are issued for a short-term period, while securities are issued for a long-term period.

5- Guarantor parties

In commercial papers, the guarantor parties are the signatories of the commercial paper. In securities, the guarantor is the issuer, not the signatories.

What is the law governing commercial papers?

The country’s commercial law is the prevailing legislation governing commercial papers. Additionally, there are agreements and treaties that regulate the use of commercial papers, such as the Geneva Convention on Commercial Papers.

These laws specify the terms and conditions that must be met for a document to be considered valid as commercial paper.

How does the Saudi Commercial Papers System work?

The commercial papers system facilitates commercial transactions within the following framework:

1- Bill of Exchange

A bill of exchange is a commercial instrument that involves three parties: the drawer, the drawee, and the beneficiary. It contains the date of issuance, due date, amount due, and the names and signatures of the three parties.

The bill of exchange remains in the possession of the creditor until the amount is paid, after which it is disposed of. Objections to payment are only allowed in cases of inability to pay the due amount.

Under the commercial papers system, the creditor must ensure that all details of the bill of exchange are complete and correct.

2- Promissory Note

The promissory note in the Saudi commercial papers system is very important, especially for credit and financing, and it also serves as a tool to guarantee the collection of funds. The note must include the specified credit amount in Saudi Riyals, the commitment to pay, the due date, the debtor’s signature, and their address.

There are cases related to the note in the Saudi commercial papers system:

- If the debtor refuses to pay the value of the note, the creditor must file a claim in court.

- If non-payment is proven, a fine or imprisonment may be imposed

What are the articles stipulated by the Commercial Papers Law in Saudi Arabia?

The Commercial Papers Law in the Kingdom stipulates several articles that work together to form a legal framework that protects the rights of parties dealing with commercial papers in Saudi Arabia and ensures the transparency and credibility of financial transactions conducted through cheques, bills of exchange, and promissory notes.

The most important articles of the Commercial Papers Law in the Kingdom are:

- The person signing the bill of exchange must have full legal capacity, and the obligation falls on them. Minors or persons without full legal capacity have invalid signatures and are not obligated to pay.

- Endorsement of commercial papers must be unconditional; any condition set is void.

- Objection to the maturity of commercial papers is only allowed in the case of loss or bankruptcy of the debtor.

- If there is a copy of the commercial paper, the creditor can collect the money, and the duplicate can be used to settle the debt.

- If there is no copy and the commercial paper is lost, it can be issued by the Ministry of Commerce and Industry, provided that ownership of the bill of exchange is proven.

Thus, with these conditions and the system applied to commercial papers in the Kingdom, business continuity and facilitation are ensured.

What is discounting commercial papers?

The process of discounting commercial papers is considered a credit operation offered by banks. If the creditor wants to collect the amount due before the maturity date, the bank applies a discount, called the discount rate.

There is what is called the total discount or “agio,” which is:

Discount rate + bank commission + collection fees

The cheque is one of the commercial papers that is not subject to discounting, unlike bills of exchange and promissory notes. Discounting is only carried out if the debtor has a good reputation with the banks.

Commercial papers must comply with the applicable laws and regulations.

Example of applying commercial paper discounting

The process of discounting commercial papers can be illustrated in the following example:

If the value of a commercial paper is $200,000, and the client wants to discount it at the bank before the maturity date, and the bank's conditions are:

- Collection fees = $1,000

- Commission = $2,000

How can the discount rate be calculated if the client receives $170,000 for the commercial paper?

First, calculate the total discount or “agio”:

200,000 - 170,000 = $30,000

Then, the discount value = total discount - (collection fees + commission)

= 30,000 - (3,000) = $27,000

Thus, the discount value of the bill of exchange = $27,000.

What is meant by the equivalence of commercial papers?

The equivalence of commercial papers refers to a principle in commercial law that considers commercial papers equal in strength and effect, regardless of the original debts or contracts that led to their issuance.

This means that the holder of the commercial paper has the right to collect the debt indicated in the paper without having to prove or defend the original relationships between the primary parties, which facilitates the trading of commercial paper as a financial instrument.

Frequently Asked Questions

Is a cheque considered commercial paper?

Yes, a cheque is one of the types of commercial papers. It is a written and unconditional order issued by a person (the drawer) to instruct a bank or financial institution (the drawee) to pay a certain amount of money to another person (the beneficiary) or to the bearer of the cheque.

Which commercial paper contains only two parties?

The promissory note is a type of commercial paper that usually contains only two parties: the issuer (debtor) and the beneficiary (creditor).

Who is the endorser in commercial papers?

The endorser is the person who transfers ownership of the commercial paper to another party (the endorsee) through the endorsement process, thereby transferring the rights attached to the commercial paper to the endorsee. This can be done by a named endorsement, specifying the name of the endorsee, or a blank endorsement without specifying the name of the endorsee.

Who is the beneficiary in commercial papers?

The beneficiary in commercial paper varies depending on the type of paper. The beneficiary is the person who receives the value or amount of the commercial paper upon its maturity.

When does a commercial paper become an ordinary paper?

A commercial paper becomes an ordinary paper in two cases:

- Failure to meet the legal conditions of the commercial paper or the absence of the previously mentioned elements of commercial papers, whether it is a bill of exchange, cheque, or promissory note.

- When the legal period for trading the commercial paper expires.

Is a commercial paper an ordinary instrument?

No, commercial paper is not an ordinary instrument; it is a document that creates a commitment to pay a specified amount at a certain time, subject to several conditions.

What is the relationship between commercial papers and bankruptcy?

Commercial paper may cause bankruptcy if the payment is not made on time. At the same time, commercial paper can be used as a credit tool to settle and restructure debts during the bankruptcy process, thereby protecting creditors holding the commercial paper.

What are the types of commercial documents?

Commercial documents include invoices, contracts, bills of exchange, promissory notes, letters of guarantee, cheques, payment receipts, and ownership documents.

What are the guarantees of the holder of a commercial paper?

The legal guarantees for the holder of a commercial paper include:

- The right to claim payment of the amount due on the commercial paper according to its terms.

- The right to recourse against the guarantors or signatories of the commercial paper provides additional protection for the holder.

- The right to receive interest on the amount due if the debtor delays payment, provided that this clause is specified in the terms of the commercial paper.

- The holder of the commercial paper has the right to easily transfer its ownership to another party, facilitating its trading.

What are the types of commercial paper cases?

Cases related to commercial papers include:

- Cases of bounced cheques (insufficient funds).

- Cases of fraud, deceit, or manipulation of cheque details or promissory note contents.

- Cases of illegal transfer of ownership of commercial papers without complying with their legal conditions.

- Cases related to contractual disputes over the provisions stated in commercial papers.

- Cases of debtor bankruptcy concerning the value of commercial papers.

What is the difference between a cheque, a bill of exchange, and a promissory note?

The main difference between a cheque, a bill of exchange, and a promissory note lies in the method of payment associated with them. A cheque is an order for immediate payment, while a bill of exchange and a promissory note can be paid on specific due dates depending on the parties involved in the transaction.

Another difference is that cheques are governed by the Securities Law, while bills of exchange and promissory notes are governed by the Commercial Papers Law.

What is the statute of limitations for commercial paper cases?

The statute of limitations for commercial paper cases varies depending on the type of case. For example, cases related to promissory notes and bills of exchange expire after 3 years from the due date, while cases related to cheques may expire 6 months from the date of presentation.

What are the types of equivalence of commercial papers?

Commercial papers can be made equivalent in several ways:

- Equivalence by nominal value: achieved by exchanging commercial papers with adjustment of the due date or the number of commercial papers to ensure financial equivalence.

- Equivalence by postponing the debt's due date.

- Equivalence by consolidating a group of commercial papers into one paper while considering the total value of the debts.

What are electronic commercial papers?

Electronic commercial papers are commercial documents used in digital transactions rather than in the traditional paper format. Examples include electronic invoices, electronic cheques, digital signatures, and electronic contracts and bills of exchange.

Commercial papers in Daftra

Depending on the types of commercial papers, such as cheques, bills of exchange, receipts, or sales invoices, the Daftra sales and invoices management software helps you document and issue commercial papers in both digital and paper formats.

Finally, it should be noted that today we rely heavily on commercial papers in business transactions, and it is rare to find an institution that does not deal with them, as they are an easy and effective tool for business continuity.

Commercial paper is like the fuel that keeps the vehicle running and enables its operation.