Everything You Need to Know About Financial Management

Table of contents:

- What Is Meant by Financial Management?

- Explanation of Financial Management

- What Are the Principles of Financial Management?

- What Are the Areas of Financial Management?

- What Is the Importance of Financial Management?

- What Are Financial Management Strategies?

- What Are the Branches and Departments of Financial Management?

- What Are the Objectives of Financial Management?

- What Are the Scope Areas of Financial Management?

- The Difference Between Financial Management in the Public and Private Sectors

- Tips for Organizing and Improving Financial Management

- Use Daftra for More Efficient Financial Management

- Frequently Asked Questions

- Conclusion

Financial management is a fundamental function in any organization. Its success is measured by the extent of its contribution to achieving the organization’s long-term objectives through the efficient use of its financial resources.

Historically, the role of financial management has expanded alongside the development of the business management landscape. Its modern scope includes monitoring financial markets, mergers and acquisitions, and other investment-related activities, as well as potential financing sources.

This article reviews the definition of financial management, its importance, and its various divisions. It also explains the principles on which it is based and the objectives it seeks to achieve in institutions across both the public and private sectors.

What Is Meant by Financial Management?

The term financial management refers to the optimal handling of an organization’s financial resources in a way that achieves its objectives. This begins with obtaining the necessary capital or financing, continues through managing it, increasing the organization’s market value, and achieving profitability, and ultimately extends to ensuring the organization’s survival and growth.

Explanation of Financial Management

Financial management first requires the organization to clearly define its objectives. This is followed by identifying its current and potential financial resources and developing a plan to achieve the previously determined goals based on these factors.

In later stages, financial management focuses on reviewing and adjusting the plan in progress based on its contribution to the company’s success and the achievement of its objectives.

Financial management also addresses short-term developments while not compromising the organization’s long-term goals.

What Are the Principles of Financial Management?

Financial management is built on several key principles that should be followed to establish a successful financial management function. The most prominent fundamentals of financial management include:

- Transparency: Financial management is fundamentally based on the principle of transparency, which allows relevant parties access to the necessary financial information.

- Documentation: Proper, accurate, and consistent organization and documentation of financial reports are among the most important aspects of financial management, reflecting the organization's integrity.

- Adherence to accounting standards: Financial management’s compliance with recognized accounting standards ensures that financial decisions are grounded in a solid, realistic foundation.

- Structure or methodology: Financial management relies on a defined structure or methodology that is consistently followed to ensure efficient, effective financial performance.

- Periodic accountability: Financial management is governed by two core principles—control and responsibility—which ensure the identification and correction of any deviations in financial transactions.

- Continuous evaluation: Review and evaluation are key characteristics of financial management, measuring the effectiveness of current spending in generating profits for the organization.

- Continuity: Demonstrating financial soundness by ensuring the organization’s continued ability to meet its obligations while maintaining its productive or service activities and achieving profits.

Direction: Sound leadership, supervision, and administrative guidance of the company’s capital, including human resources, assets, and financial liquidity.

What Are the Areas of Financial Management?

The areas of financial management, also known as the departments of financial management, are associated with the various stages of financial decision-making within an organization, including planning, implementation, and evaluation. Below are the areas of financial management and how they function:

1- Planning

Financial management determines the organization’s investment objectives, current resources, and expected revenues and expenses. The action plan is then developed based on these factors.

2- Establishing executive procedures

Various practical details related to processing financial data are finalized, and the responsibilities of financial management are distributed in a manner that ensures smooth and accurate execution, data confidentiality, and accountability of those responsible in cases of corruption or embezzlement.

3- Budgeting

Preparing a budget helps limit the waste of the organization’s financial resources. It also helps identify areas of spending that require adjustment—either increases or reductions—and provides the liquidity necessary for the organization’s activities.

4- Risk management and evaluation

Financial management works to identify the company’s debts and settle its liabilities and obligations on time. Investment decisions are then made using appropriate metrics and strategies, especially during periods of uncertainty.

These metrics help assess the likelihood of exposure to financial risk or loss and provide the necessary compensatory controls. Such risks include inherent, credit, liquidity, and operational risks, among others.

What Is the Importance of Financial Management?

Financial management is so important that it is indispensable for any organization, whether in the public or private sector. In addition to directing and efficiently utilizing resources, organizations benefit from financial management functions in several ways. These are outlined below by answering the question: What are the objectives of financial management?

1- Achieving and increasing company and shareholder returns

Profit generation is one of the main objectives of organizations, in addition to being—alongside investments—the factor that ensures their survival and continuity. Through financial management, organizations can select investment areas and strategies that increase profitability and enhance their market value.

2- Providing financial liquidity

Organizations need adequate liquidity to avoid disruptions in production or service delivery. In the absence of sufficient liquidity, organizations may be forced to borrow or sell assets, which could harm their competitive position and long-term economic standing.

3- Achieving the organization’s long-term goals

Financial management contributes to mapping out the roadmap necessary for achieving the organization’s future objectives, such as expanding its operations into new geographic areas or increasing its investments in a particular field.

4- Maintaining sound and balanced financial planning

All organizations need to maintain a balance between their expenses and revenues and keep pace with any changes that may disrupt this balance. Effective financial management enables organizations to meet their financial obligations on time.

5- Optimal utilization of financial resources

One of the fundamental objectives of financial management is directing the organization’s financial resources toward channels that achieve the maximum benefit. Many modern management models are based on achieving the highest returns at the lowest costs, which optimal financial management makes possible.

6- Providing safe investment opportunities

Organizations that possess balanced financial management offer safe channels for investors to direct their funds, benefiting both parties and the economy as a whole.

Use the investment calculator to determine the value of returns from different investments and the profit margin.

What Are Financial Management Strategies?

The stages of financial management vary across organizations based on size, objectives, and other characteristics. Consequently, each organization needs to determine the optimal financial management approach that best meets its needs. Accordingly, the most prominent, logical, and commonly adopted financial management strategies are outlined below:

1- Building on Financial Data from Previous Periods

It is essential to continuously refer to revenues and expenses from previous years in order to derive insights regarding the organization’s performance and potential areas for improvement.

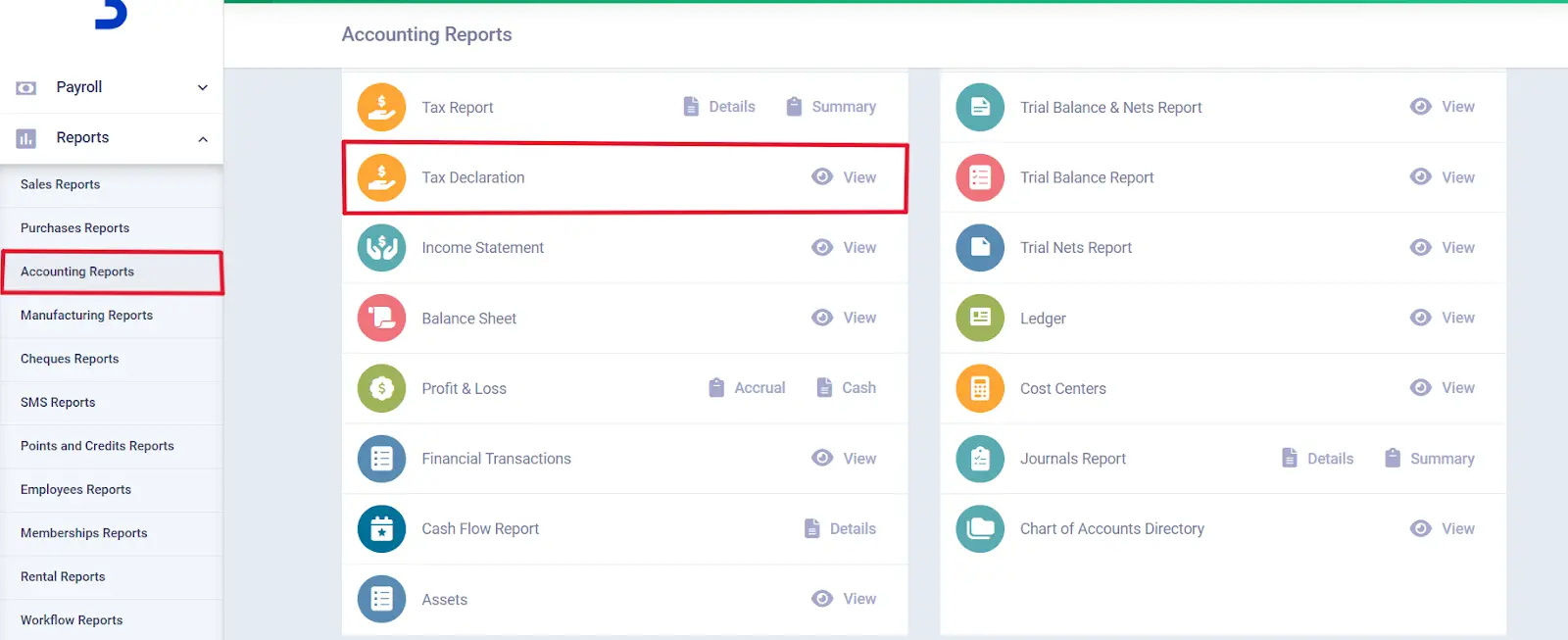

Figures from previous years can also serve as benchmarks to assess the extent of financial performance improvement or decline. Through the integrated accounting software Daftra, financial data can be compared across different time periods using the financial reports provided by the system, such as profit and loss statements and balance sheets.

In addition, the smart solutions available in the Daftra system can be utilized, particularly the ability to obtain customized reports from the chart of accounts via the system dashboard, enabling more accurate analysis of past financial performance.

2- Scheduling Financial Transactions

Technology-enabled features can be leveraged by scheduling financial transactions to run automatically at predefined times. Scheduling helps maintain order and accuracy in financial transactions, especially in meeting the organization’s financial obligations.

The Daftra system can be used to schedule financial transactions in both the sales and purchasing modules, leveraging its automated features to facilitate accurate tracking and enable more efficient, effective financial management.

Among the most notable features of the Daftra cloud system in tracking financial transactions are:

- Preparing and issuing approved electronic invoices in accordance with the requirements of the Zakat, Tax and Customs Authority, the Egyptian Tax Authority, or the Jordanian Income and Sales Tax Department. These invoices help track financial transactions with greater accuracy.

- Daftra assists in managing payments due from financial transactions by payment status, ensuring timely collection and cash liquidity.

The ability to link bank accounts to the Daftra system to track financial transactions directly and accurately.

3- Proactive Budgeting

Budgets are often set based on forecasts of future revenues and expenses, which helps create an approximate picture of the organization’s financial needs and obligations.

It is also beneficial to maintain a continuous budgeting process throughout the fiscal year or budgeted period, enabling financial forecasts to be compared with actual performance.

4- Continuous Expense Tracking

By continuously tracking the organization’s expenses, it is possible to ensure adherence to the established budget and introduce any necessary adjustments at the appropriate time. The expense accounting and tracking software within the Daftra system can be used to record, categorize, and automatically track expenses and to generate detailed expense reports.

One of the most common methods of tracking expenses is through account statements, which provide a summary of the organization’s financial performance over an extended time frame. Through account statements, the organization’s profits and losses can be reviewed, and the necessary decisions taken to improve performance.

5- Determining Profit Shares

One of the most important financial management strategies is determining the financial ratios according to which the organization’s profits will be distributed. This includes defining the portion to be distributed to shareholders and the portion to be retained to support the organization’s future investments.

You can use the profit margin calculator to determine gross profit, net profit, and operating profit for different operations.

6- Capital Structure Planning

Capital structure planning involves evaluating the advantages and risks associated with the various forms of capital owned by the organization and balancing those advantages against the risks.

The asset management software within the Daftra system helps evaluate and manage assets of all types.

7- Investment Planning

It is essential to define the organization’s investment priorities in order to direct them toward the investments that are most beneficial to the organization in the long term. Planning in this context includes making decisions related to increasing, reducing, or even fully withdrawing the organization’s investments in a particular sector or entity.

8- Working Capital Planning

Planning how to manage working capital is necessary in a way that covers the organization’s supplies, purchases, and various needs without harming its operational activities.

You can review more information here about working capital, investors, and how to manage them.

What Are the Branches and Departments of Financial Management?

Financial management is divided into several branches, each addressing a specific aspect of management. Their activities are integrated and complementary. The branches of financial management can be classified as follows:

1- Accounting and Financial Analysis

Financial analysis helps calculate and evaluate the organization’s revenues and expenses to create a realistic picture of its financial position. This is later used to assess the organization’s financial performance and identify areas of weakness, using tools such as asset turnover ratios and other financial ratios.

2- Financial Planning

This involves determining the optimal way to direct the organization’s financial resources so as to cover basic expenses and provide the liquidity necessary to achieve the company’s objectives and deal with emergency situations. Reviewing previous years’ budgets and using the indicators they provide can be helpful when preparing the current year’s budget.

3- The Executive Aspect

Organizations often need to choose between several areas of expenditure depending on their resources and changing priorities over time. It is essential to strike a balance among these aspects when making financial decisions. This branch of financial management is critical to the organization’s survival and prosperity.

4- Financial Control

Financial control includes the controls established by the organization to ensure the accuracy and validity of its financial data and its compliance with applicable regulations and laws.

Aspects of financial control include ensuring the security of financial assets, protecting them from fraud or embezzlement, and safeguarding investors’ rights.

Financial control also involves the use of specific commercial instruments that guarantee rights, such as checks and promissory notes; the clearing of liabilities through financial receipts; and accounting, auditing, and review methods.

5- Financial Reporting

Financial reporting refers to the accurate documentation of how the organization’s financial resources are spent, supported by the necessary documentation, while noting any deviations in spending from the pre-established institutional plans and objectives.

You can use a ready-to-edit, free-to-download financial report template from Daftra to improve financial management.

What Are the Objectives of Financial Management?

Financial management has core objectives toward which its efforts are directed in order to achieve its primary goal—namely, the survival and growth of the organization. Among the objectives of financial management are:

- Organizing cash liquidity and ensuring its availability when needed.

- Keeping pace with local and global economic changes.

- Meeting financial obligations to creditors.

- Maintaining an appropriate cash reserve to face any unexpected events.

- Linking investment-regulating legislation with financial decisions.

- Studying the market and the organization’s position compared to competitors.

- Timely and disciplined publication of financial data enhances the organization’s credibility.

- Financial monitoring and review, and establishing an internal system to control the organization’s financial affairs.

- Protecting organizations from severe losses that could lead to bankruptcy.

- Improving the efficiency of the organization’s operations and its advertising and marketing activities.

- Measuring the organization’s level of success and comparing its current performance with past performance.

- Increasing the organization’s profits, profitability, and investment returns, and improving its competitive advantage in the market.

- Managing mergers and acquisitions transactions and coordinating among the various parties involved.

What Are the Scope Areas of Financial Management?

Despite the diversity of financial management activities and departments and their variation from one organization to another, these activities can be confined to a few common scope areas in which they are concentrated, namely:

1- Investment

Making investment decisions in long-term fixed assets whose productive life extends for years, such as land and heavy machinery, or in current assets that can be easily converted into liquidity, such as inventory and cash, thereby serving the organization’s interests and objectives.

2- Financing

Providing the necessary financing for the organization’s various areas of activity from appropriate funding sources, which are determined based on factors such as expected return and financing period, among others.

3- Profits

An organization’s profits are typically divided between retained earnings and profits distributed to investors and shareholders. Retained earnings are directed toward covering the organization’s current and future expenses in line with its plans to expand its activities, presence, or other objectives.

The Difference Between Financial Management in the Public and Private Sectors

The difference between financial management in the public sector and financial management in the private sector lies in focus. Financial management in the public sector focuses on delivering public services and sustaining resources, whereas in the private sector, it emphasizes generating profits for stakeholders.

Below are the main aspects that illustrate the difference between financial management in the public and private sectors:

1- Financial Management in the Private Sector

In the private sector, capital ownership is held by investors and entrepreneurs, including companies that provide products and services. Financial management in the private sector focuses on evaluating an organization’s profitability and competitive market conditions and is the most common type of economic management.

- Objectives: Private-sector organizations primarily aim to generate profits, increase organizational returns, and expand investment. They may also contribute indirectly to certain social objectives.

- Financing: The primary sources of funding for private sector organizations include retained earnings, loans, and shareholder investments.

- Investment: The success of private-sector investment decisions is typically measured by the returns they generate.

2- Financial Management in the Public Sector

Financial management in this sector involves monitoring the spending of public funds owned by various state ministries and institutions.

- Objectives: Financial management in the public sector focuses on achieving social welfare goals and improving citizens’ quality of life.

- Financing: Public-sector funding sources differ from those in the private sector and include taxes, fees, and license revenues, state profits from its assets and investments, and borrowing.

- Investment: Profit is not the primary priority in public sector investment decisions; it comes second to achieving public benefit for the state.

Financial management in the public sector is similar to monetary management in non-profit organizations, as both prioritize social and moral impact. However, nonprofit organizations differ from the public sector in funding sources and investment channels.

Tips for Organizing and Improving Financial Management

Establishing and maintaining effective financial management for an organization is both necessary and a significant challenge for those responsible. Following the tips below may help improve financial management for companies and individuals:

1- Establishing an Emergency Fund

For financial management to be successful, it is essential to allocate funds for emergencies. The appropriate amount is determined based on the scale of the company’s activities. Experts consider saving the equivalent of three months’ operating expenses sufficient for an emergency fund and recommend investing it to generate returns.

2- Identifying the Organization’s Financing Options

Identifying potential financiers in advance helps expedite access to the required funding, thereby accelerating the organization’s operations. Successful financial management also facilitates potential financiers’ access to the information they need to make funding decisions and provides them with a reassuring picture of the organization’s transparency.

3- Taking Advantage of Tax Benefits

Benefiting from tax incentives results in greater gains for the organization and helps it avoid unnecessary expenses. Those responsible for financial management should be well informed about the tax laws and regulations applicable to their organizations to prepare reports that are legally sound and financially beneficial.

In addition to the above, efforts should be made to incorporate policies that leverage available tax benefits into the company’s daily operations.

4- Continuous Review of Financial Matters

Periodic review of financial affairs is essential to understanding the organization’s expenses, revenues, and growth rate.

Reviewing also helps identify potential financial risk patterns, such as delays in supplies or in the payment of dues by any of the parties the organization deals with. Moreover, up-to-date and accurate financial reports are required to obtain external financing.

Use Daftra for More Efficient Financial Management

Daftra’s reporting software provides insight into your current and past financial status. It helps you forecast your company’s economic future, enabling you to manage it by developing plans and mechanisms based on the figures in these reports.

The system also offers robust management of operational and accounting processes, as well as other administrative aspects such as human resources and inventory management. Download Daftra now and enjoy a free two-week trial.

Frequently Asked Questions

What is the difference between finance and financial management?

The difference between finance and financial management lies in scope and application. Finance is the study of money, accounting, and financial markets, investments, and broader financial risks. In contrast, financial management applies practical financial strategies within organizations.

What is a graduate of financial management called?

A graduate of financial management may be known by more than one title or job description, such as financial specialist, financial analyst, financial consultant, or financial manager.

What are the tasks of financial management in government entities?

The main tasks of financial management in government entities include:

- Preparing budgets for government bodies and allocating resources.

- Setting spending priorities and monitoring and tracking them.

- Managing potential financial risks.

- Preparing financial reports on profits and losses, assets, and liabilities, and analyzing financial performance using various indicators and financial ratios.

What is the relationship between financial management and accounting?

The relationship between financial management and accounting is complementary, as accounting clarifies the foundations and principles that financial management relies on when making strategic financial decisions.

What is the financial management major?

The financial management major is one of the accounting-related disciplines that focuses on managing companies’ financial resources and their associated revenues, expenses, assets, and liabilities.

What is the difference between corporate financial management and project financial management?

The difference between corporate financial management and project financial management lies in the scope of application. Corporate financial management focuses on the entity's overall financial performance and aims to achieve long-term objectives, including sustainability and financial stability.

Project financial management, on the other hand, focuses on managing the financial aspect of a specific project in order to achieve its short-term objectives.

What is the difference between personal financial management and public financial management?

The difference between personal financial management and public financial management lies in the scope of application. Personal financial management addresses individual matters, such as managing personal income and retirement plans. In contrast, public financial management focuses on managing a state’s public revenues and expenditures to achieve financial stability and economic development.

What is a financial management plan?

A financial management plan refers to the stages and strategies through which financial management operates, such as defining financial objectives, setting budgets, evaluating economic conditions, identifying funding sources, and managing risks.

What are the areas of application of financial management?

The main areas of applying financial management include budgeting, capital structure formation, and working capital management.

What are the skills of financial management?

The skills required to achieve sound financial management include:

- The ability to analyze financial data, indicators, and ratios.

- Knowledge of basic financial concepts such as costs, income, capital, assets, and liabilities, as well as an understanding of market trends and economic influences.

- Technical skills and the ability to use accounting software and systems.

- Leadership, guidance, and the ability to make well-considered financial decisions based on logical analysis.

Conclusion

Financial management is practiced across all types of organizations—both public and private—and at all administrative levels. It is considered a fundamental reason for an organization’s success and continuity.

The tasks of financial management include collecting and analyzing data, as reflected in monetary administration, planning, decision-making, and responding to emergencies and changes in both the internal and external work environment.

The objectives of financial management are not limited to monitoring an organization’s financial transactions; they also include ensuring its success, achieving its goals, and providing the resources needed to overcome challenges along the way.