What are current liabilities and non-current liabilities, their types, and the relationship between them?

Table of contents:

- What Are Liabilities?

- Types of Liabilities

- What Are Current Liabilities?

- Types of Current Liabilities

- What Are the Criteria That Determine Current Liabilities?

- Benefits of Current Liabilities

- A Practical Example of How to Calculate Short-Term Liabilities

- What Are Non-Current (Long-Term) Liabilities?

- Types of Non-Current (Long-Term) Liabilities

- The Relationship Between Current Liabilities and Long-Term Liabilities

- Practical Example of How to Calculate Long-Term Liabilities

- How Daftra Helps You Manage Liabilities

- Frequently Asked Questions

Every organization carries out several different business activities during the operating cycle, where buying and selling transactions take place within a specific period. These business activities result in several outcomes, including an inventory of goods and merchandise, which is then sold to generate sales revenue, and eventually, the entity receives cash.

However, every organization has assets and liabilities during the operating cycle. Assets are owned to support the production process, such as equipment and machinery, among others. Liabilities, on the other hand, are obligations that must be paid either during the operating period or over the long term.

These liabilities are classified into current liabilities and non-current (long-term) liabilities. In general, assets and liabilities are considered among the most important fundamental elements in financial accounting. Through them, the financial position of an entity can be understood, and a complete and accurate picture can be formed.

Based on this comprehensive view, sound financial decisions can be made that achieve the operational and profitability objectives of organizations efficiently. Below is a comprehensive guide to assets and liabilities, their types, their importance in the financial system, and how to calculate them through practical application based on our accounting experience.

Summary of Key Points

- Liabilities are the financial obligations borne by an organization and must be settled on time to avoid financial shortages or imbalances.

- Current liabilities are obligations that the organization must settle within a period not exceeding one year.

- Current liabilities include several types, such as accounts payable, short-term debts, short-term bank loans, accrued profits payable, taxes payable within one year, and wages/salaries.

- Long-term liabilities include several types, such as long-term bonds, long-term loans, deferred tax liabilities, mortgages, deferred compensation, and retirement pensions.

What Are Liabilities?

In accounting, liabilities are defined as the financial obligations borne by an organization that must be settled either in the short term or the long term. Successful financial management is closely linked to how an entity manages its liabilities without causing any financial shortage or imbalance that could negatively affect the overall financial position of the organization.

In general, liability management aims to ensure the preservation of the entity’s liquidity while meeting required obligations in a timely manner.

Types of Liabilities

Liabilities are classified according to the nature of the company and its business activities. However, they are commonly divided into two main categories. The first is current liabilities, also known as short-term liabilities, as they are required to be settled within a period not exceeding one year. The second category is non-current liabilities, also referred to as long-term liabilities, which can be settled over a period exceeding one year.

What Are Current Liabilities?

Current liabilities, or short-term liabilities, are obligations of the entity that must be settled within one year. The entity must also have sufficient liquidity to meet these obligations.

However, the operating cycle of an entity may exceed one year. In such cases, current liabilities may be settled within the operating cycle. Current liabilities are usually settled through the current assets owned by the entity.

Therefore, having adequate liquidity is a fundamental requirement for settling short-term obligations. A significant level of current assets provides a sense of security to creditors regarding the entity’s ability to meet its obligations and facilitates asset and liability management efforts, which are part of the financial management departments within companies.

Types of Current Liabilities

There are several different types of current liabilities, such as accounts payable, short-term debts, accrued profits, accrued expenses, and taxes, among others. The following paragraphs explain each type in detail:

Accounts Payable

Accounts payable are short-term financial obligations of the entity to its suppliers. These are amounts owed to suppliers or vendors for invoices that have not yet been paid. The supplier usually gives the customer a period ranging from 15 to 45 days to settle the payment.

Short-Term Debts

These are the total debt payments due within one year. When evaluating the liquidity of an organization, the amount of short-term debt relative to long-term debt is particularly important. Examples of short-term debts include:

- Commercial Papers Short-term obligations resulting from business transactions within the entity, such as bills of exchange or promissory notes.

- Short-Term Bank Loans Borrowed funds are intended to increase the entity’s working capital.

- Overdrafts / Short-Term Advances An overdraft occurs when withdrawals exceed the customer’s credit limit. A short-term advance is a loan taken for a specific purpose and is repaid within a short period. Both are considered short-term debts.

Accrued Profits Payable

These are dividends announced by the board of directors at the end of the financial period for distribution to shareholders. They are considered payable because they have not yet been distributed and are recorded as a liability until settlement.

Taxes Payable Within a Year

Various types of taxes are recorded as short-term liabilities, including:

- Income taxes owed to the government but not yet paid.

- Payroll taxes withheld from employees but not yet remitted.

- Sales taxes are collected from customers and are payable to the government.

Accrued Expenses

These are costs or expenses recorded in the books but not yet paid, considered short-term liabilities typically settled using current assets such as cash. Examples include:

- Interest payments on outstanding loans.

- Warranties on products or services are not fully settled.

- Property taxes or other due taxes for the period.

- Employee wages, bonuses, and accrued allowances.

Payroll Liabilities

These include payroll amounts due within the year, such as withheld employee payments or installments for health insurance.

What Are the Criteria That Determine Current Liabilities?

There are several criteria used to identify current liabilities, such as the financial obligation itself, financial settlements, the use of the obligation, and the maturity date. Below are more details about the criteria for determining current liabilities:

- Financial Obligation: When the financial obligation is settled during the entity’s operating cycle.

- Financial Settlements: Financial obligations must not exceed one year.

- Use of the Obligation: When the obligation is not held for long-term purposes and is used for business operations.

- Maturity Date: When the financial obligation becomes due within 12 months.

Benefits of Current Liabilities

Current liabilities are highly important and have a strong impact because they help in measuring liquidity ratios, the quick ratio, and the cash ratio. Below is a clearer and simpler explanation of the benefits and importance of current liabilities:

- Measuring the Current Ratio: Total current assets ÷ current liabilities.

- Measuring the Quick Ratio: (Current assets − inventory) ÷ current liabilities.

- Measuring the Cash Ratio: Cash and cash equivalents ÷ current liabilities.

In all three ratios, a higher ratio indicates stronger liquidity for the entity and a greater ability to meet its obligations. Use the profit ratio calculator to determine the profit value from two figures, calculate a ratio, or add or subtract it from a specific value.

A Practical Example of How to Calculate Short-Term Liabilities

On 01/09/2020, Al-Huda Economic Group purchased goods from Al-Thabet Company on credit for 50,000. On 01/10/2020, Al-Huda Group issued a bill of exchange to Al-Thabet Company for 50,000 for a period of 12 months at an interest rate of 8%.

Also, on 01/10/2020, Al-Huda Group borrowed 75,000 from Bank (X) and signed a bill of exchange with a face value of 81,000 for a period of 12 months with no stated interest.

Required:

Prepare the journal entries for the current liabilities of Al-Huda Group.

Solution

On 01/10/2020, Al-Huda Group issued a bill of exchange to Al-Thabet Company for 50,000 for 12 months at an interest rate of 8%, as a settlement for the goods purchased on credit on 01/09/2020.

The journal entry is as follows:

$50,000 Dr / Accounts Receivable

Cr / Notes Payable $50,000

Interest calculation up to 2020/12/31: 50,000 × 8% × (3/12) = $1,000

Accordingly, the entry is:

$1,000 Dr / Interest Expense

Cr / Interest Payable $1,000

On 2020/10/1, Al-Huda Group borrowed $75,000 from Bank (S) and signed a promissory note with a face value of $81,000 for a period of 12 months, with no stated interest.

The journal entry is as follows:

$75,000 Dr / Cash

Cr / Notes Payable $75,000

To calculate interest, we first subtract the actual amount borrowed by Al-Huda Group from the face value of the promissory note:

81,000 − 75,000 = $6,000

Then we apply the interest calculation for 3 months: 6,000 × (3/12) = $1,500

The journal entry is:

$1,500 Dr / Interest Expense

Cr / Notes Payable $1,500

What Are Non-Current (Long-Term) Liabilities?

Non-current or fixed liabilities are obligations that a company is required to settle over a period of more than one year, and they are also referred to as long-term liabilities.

Non-current liabilities are considered an important part of a company’s long-term financing structure.

Organizations resort to long-term debt to obtain capital for financing purposes. The reason for financing may be the purchase of capital assets or investment in new capital projects.

Types of Non-Current (Long-Term) Liabilities

There are several categories of non-current liabilities, including long-term bonds, long-term loans, deferred tax liabilities, pension obligations, deferred compensation, and many other types, which can be explained as follows:

Long-Term Bonds

Bonds are financial instruments that are issued and traded in the securities market. Long-term bonds are one of the various types of bonds.

They are typically payable over a period exceeding seven years and usually carry a higher interest rate than short-term and medium-term bonds.

Organizations issue or hold these bonds in order to finance projects and support long-term investments.

Deferred Tax Liabilities

These are taxes that are due within a specific period but have not been paid during that period. Therefore, they are considered liabilities that extend for more than one year.

Mortgage Payable

A mortgage arises when an organization borrows funds and, in return, pledges one of its owned properties as collateral for the loan.

Deferred Compensation

These relate to products that have been sold or services that have been provided as part of the company’s operating activities, but payment has not yet been received. The company will receive payment for these products or services at a later date, typically after at least one year.

Pension Obligations

An organization establishes pension plans for its employees. When pension benefits accumulate, they are classified as long-term liabilities, as their settlement period may exceed one year.

Deferred Revenue

If there are revenues that have been earned but not received during the year, they are classified as deferred revenue. The delay may be due to processing delays; however, as long as more than one year has passed, they are considered deferred revenues.

The Relationship Between Current Liabilities and Long-Term Liabilities

Liabilities, in general, represent the obligations of an organization, whether they are short-term or long-term.

However, the combination of current liabilities and long-term liabilities reflects the total actual liabilities of the organization.

Therefore, the well-known equation for total liabilities is:

Liabilities = Current Liabilities + Non-Current Liabilities

This is an equation that every accountant should be familiar with before preparing the statement of financial position.

Accordingly, both current liabilities and long-term liabilities are presented on the liabilities side of the balance sheet.

Here is an illustrative example of how liabilities are presented in the statement of financial position:

| Partial Amount | Total Amount | Description | Partial Amount | Total Amount | Description |

| XX XX XX XX | Assets Current Assets Cash Treasury Notes Receivable Inventory | XX XX XX XX XX | Liabilities and Equity Current Liabilities (Short-Term) Accounts Payable Short-Term Loans Dividends Payable Loan Interest Salary Liabilities | ||

| XX | Total Current Assets | XX | Total Current Liabilities | ||

| XX XX XX XX | Fixed Assets Land Buildings Vehicles Equipment | XX XX XX XX | Long-Term Liabilities Long-Term Loans Long-Term Bonds Deferred Compensation Deferred Revenue | ||

| XX | Total Fixed Assets | XX | Total Long-Term Liabilities | ||

| XX | Total Assets | XX XX | XX | Owners’ Equity Capital Profits and Losses Total Equity | |

| XX | Total Liabilities and Equity |

In this way, we have learned that liabilities, in all their types, are indispensable in preparing the statement of financial position for any organization.

Practical Example of How to Calculate Long-Term Liabilities

On 2020/1/1, Al-Iman Company issued bonds with a face value of $500,000, carrying a 6% nominal interest rate, payable on December 31 of each year for a period of 4 years. The prevailing market interest rate was 8%.

Required: Prepare the bond discount amortization schedule, given that the present value factors are 0.683 and 3.170.

Solution

Annual cash interest expense

= 500,000 × 6% × 1 year

= $30,000

Bond issue price (long-term liabilities)

= Present value of the bond principal + Present value of total interest payments

= (500,000 × 0.683) + (30,000 × 3.170)

= $436,600

Bond discount

= 500,000 − 436,600

= $63,400

Effective annual interest expense

= 436,600 × 8% × 1

= $34,928

| Year | Bonds at Beginning of Period | Cash Interest | Effective Interest Expense | Amortization of Bond Discount | Bonds at End of Period |

| 2020 | 436,600 | 30.000 | 34,928 | 34.928 - 30.000 = 4.928 | 436.600 + 4.928 = 441,528 |

| 2021 | 441,528 | 30.000 | 441,528 * 8% = 35,322 | 5.322 | 441.528 + 5.322 = 446,850 |

| 2022 | 446,850 | 30.000 | 446.850 * 8% = 35,748 | 5.748 | 446.850 + 5.748 = 452,598 |

| 2024 | 452,598 | 30.000 | 452.598 *8% = 36.209 | 6.209 | 452,598 + 6.209 = 458,807 |

Use the discount calculator to determine the discount value before and after pricing.

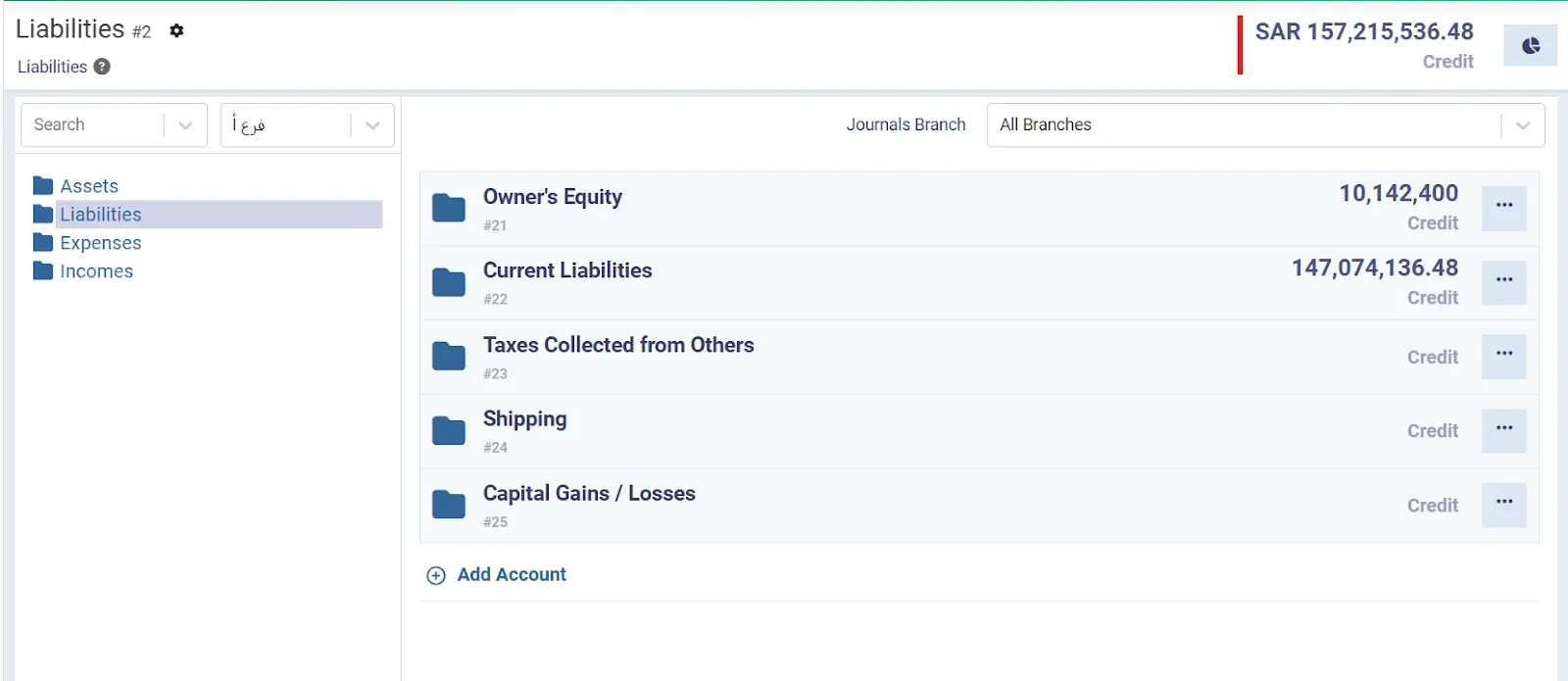

How Daftra Helps You Manage Liabilities

Liabilities are a key pillar of your accounting system. Daftra’s accounting software provides accurate calculation and management of all types of liabilities, enabling you to match them against assets, issue the balance sheet, and clearly understand your company’s financial position.

You can find liabilities under a dedicated tab within the chart of accounts in the system, making it easy to review them and identify the source of journal entries related to your various liabilities. Finally, it should be noted that liabilities are obligations of the organization, and it is natural for these liabilities to exist in their various types, whether current liabilities (short-term) or non-current liabilities (long-term). Through this blog, we have explored all the elements of current liabilities as well as all the elements of non-current liabilities.

Frequently Asked Questions

What is the difference between current assets and current liabilities?

Current assets are items that a company owns and can usually convert into cash within one year or a short period, while liabilities are obligations that the company is required to settle, typically within the same period.

What is a liability treasury?

A liability treasury refers to the cash or liquidity allocated to settle the company’s obligations.

What is the difference between liabilities and expenses?

Liabilities are obligations that the company must pay to external parties, such as debts or loans. Expenses, on the other hand, are funds the company spends on its operational needs and resources used in running the business.

Are liabilities the same as obligations?

Yes, liabilities are the same as obligations or debts that the company must settle.