What are Temporary Accounts and Permanent Accounts, and the Difference Between Them

Table of contents:

- What Are Permanent Accounts?

- Which Accounts Fall Under Permanent Accounts?

- What Are Temporary Accounts?

- Which Accounts Fall Under Temporary Accounts?

- The Difference Between Temporary Accounts and Permanent Accounts

- Advantages and Disadvantages of Each Type of Account

- Practical Example of Permanent and Temporary Accounts

- How Daftra Helps You with Your Temporary and Permanent Accounts?

- Frequently Asked Questions

Do you find it challenging to understand the difference between permanent accounts and temporary accounts? Do you feel confused about which types of accounts to use? If these questions are weighing on your mind, you are not alone, many of us face challenges in understanding this fundamental concept.

Together, we will explore permanent accounts and temporary accounts, explain the differences between them in a clear and simplified way, and provide you with distinctive and focused content that explains the concepts in an easy-to-understand manner.

Here, you will find a detailed explanation of permanent accounts and how to use them, along with a clarification of temporary accounts and their role during the financial period. We will also present practical examples that illustrate how to apply each type of account in both practical and personal life.

What Are Permanent Accounts?

Permanent accounts are accounts that are not closed at the end of the financial period. They represent financial balances that are carried forward from one year to another and appear in the statement of financial position (balance sheet) at the end of the period.

Permanent accounts are the accounts that maintain their current balances over time, and all accounts in the balance sheet are considered permanent accounts; these include asset accounts, liability accounts, and equity accounts. Auditors carefully examine them.

Permanent accounts are also called real accounts because they include balance sheet activity related to future periods, as their balances are retained and carried forward to the beginning of the next year instead of being closed.

Example: The inventory balance at the end of the year is carried forward to the new year and becomes the opening inventory balance.

Which Accounts Fall Under Permanent Accounts?

Many accounts fall under permanent accounts and form part of them. These include fixed asset accounts, current asset accounts, supplier and creditor accounts, as well as cost accounts. These accounts are explained in detail in the following points:

- Fixed Asset Accounts: Include fixed properties such as real estate, machinery and equipment, and vehicles, which are recorded in fixed asset accounts.

- Current Asset Accounts: Include financial assets such as cash and bank balances, short-term investments, and accounts receivable (amounts owed by other entities).

- Supplier and Creditor Accounts: Used to record financial transactions related to suppliers and creditors, such as purchases on account and sales on account.

- Cost Accounts: Used to record production and operating costs, such as raw material costs, wages, and overhead expenses.

What Are Temporary Accounts?

Temporary accounts are a fundamental part of the accounting system and are used to record financial transactions that occur during a specific accounting period. Temporary accounts typically include revenues, expenses, profits, and losses.

These accounts play an important role in the preparation of financial statements. They appear in the financial statements for the current period only, after which they are closed, and their balances are transferred to permanent accounts at the end of the accounting period, such as sales and expense accounts in the income statement.

Therefore, temporary accounts can help you track your economic activity, manage your company’s financial affairs, and maintain a clear record of the amount of profit and loss generated by the business.

Which Accounts Fall Under Temporary Accounts?

Temporary accounts include the accounts that reflect the company’s revenues and expenses. These accounts are closed at the end of each accounting period by transferring their balances to the retained earnings account.

These accounts include revenue accounts, expense accounts, personal withdrawal accounts, temporary profit accounts, and temporary loss accounts. Below is a detailed explanation of these accounts:

- Revenue Accounts: Accounts that record the company's revenue earned during the accounting period. They include sales revenue, rental income, interest income, dividend income, and so on.

- Expense Accounts: These are the accounts that record the expenses incurred by the company during the accounting period. They include selling expenses, marketing expenses, general and administrative expenses, depreciation expenses, tax expenses, and so on.

- Personal Withdrawal Accounts: These are the accounts that record the personal withdrawals made by the owners of the company from the business.

- Temporary Profit Accounts: These represent the positive differences between revenues and expenses during the accounting period. If revenues exceed expenses, the result is considered a temporary profit.

- Temporary Loss Accounts: These represent the negative differences between revenues and expenses during the accounting period. If expenses exceed revenues, the result is considered a temporary loss.

The Difference Between Temporary Accounts and Permanent Accounts

As mentioned, an organization deals with many types of accounts, which are considered an integral part of its operations and activities. There are several types of accounts recorded in the accounting books of organizations, including permanent accounts and temporary accounts. The main difference between these accounts is as follows:

- Temporary Accounts: Closing is done by transferring the balances of debit accounts and recording them on the credit side, and then the balances on the credit side are transferred and recorded on the debit side until the balance becomes zero.

- Permanent Accounts: This type of account is not closed at the end of the financial period; instead, it is carried forward to the next financial year and usually appears in the statement of financial position.

The difference between permanent and temporary accounts can be seen as follows:

Difference in Terms of Purpose:

The difference between permanent and temporary accounts is evident through their purposes. The purpose of using temporary accounts is to track funds for a specific financial period. These accounts are responsible for dividing financial transactions into broad categories such as expenses and revenues, which are then further divided into subcategories like specific types of inventory.

In contrast, the purpose of using permanent accounts is to track funds over multiple periods and financial years, enabling tracking of assets, liabilities, and inventory.

Difference in Terms of Account Closure:

At the end of the accounting period, accounts must be closed. The period is determined based on the nature of the business and can be annual, quarterly, or monthly. The closure limits for temporary accounts are set for each accounting period.

A temporary account is closed by clearing its balance so that any remaining funds are transferred to a permanent account. Accountants usually prepare final entries for the company’s revenues and accounts. This differs from the closure methods of permanent accounts, as these accounts are retained until the next financial period.

Difference in Terms of Duration:

Temporary accounts can be closed on a quarterly basis, giving the company a three-month evaluation period. Some of these accounts may be closed at the end of the financial year or within a period of two months.

It is worth noting that permanent accounts do not have a set duration, as they continue until the business is closed, sold, or restructured.

Advantages and Disadvantages of Each Type of Account

Both temporary and permanent accounts have advantages and disadvantages that should be understood in order to make an informed decision about which one to use.

The advantages of temporary accounts include speed, ease, privacy, and the ability to try for a certain period. Their disadvantages include accounting restrictions and data loss.

On the other hand, the advantages of permanent accounts include access and integration, while their disadvantages appear in the time and effort required and their complexity.

You can learn about the advantages and disadvantages of both temporary and permanent accounts in detail in the following sections:

Advantages and Disadvantages of Temporary Accounts

Advantages:

- Speed and Ease: Temporary accounts allow you to quickly access the content or site you need without creating a permanent account.

- Privacy: A temporary account lets you browse and try the site or application without providing personal information.

- Trial: Thanks to temporary accounts, you can try a product or service before making a final purchase decision.

Disadvantages:

- Accounting Restrictions: Access to some content or exclusive features may be restricted to users with permanent accounts.

- Data Loss: Personal data and settings may be lost when the temporary account expires.

Advantages and Disadvantages of Permanent Accounts

Advantages:

- Full Access: A permanent account provides full access to all content and features available to registered users.

- Integration: Permanent accounts enhance your experience by storing and syncing data and settings across your different devices.

Disadvantages:

- Time and Effort: You need to go through the registration process and create a permanent account, providing some personal information.

- Complexity: Managing multiple permanent accounts across different services and platforms can be challenging.

Practical Example of Permanent and Temporary Accounts

Based on your needs and goals, you should decide which type of account best suits you. Temporary accounts are often used for quick and short-term trials, while permanent accounts are suitable for users who need continuous access and interaction with content or the platform.

Let’s assume that "Bouns Trading" company has the following balances at the end of the financial year ending December 31, 2023:

Permanent Accounts:

- Cash: $100,000 EG

- Accounts Receivable: $200,000

- Property and Equipment: $300,000

- Equity: $500,000

Temporary Accounts:

- Sales Revenue: $1,000,000

- Selling Expenses:$200,000

- Marketing Expenses: $100,000

- General and Administrative Expenses: $150,000

- Shareholders’ Profit: $250,000

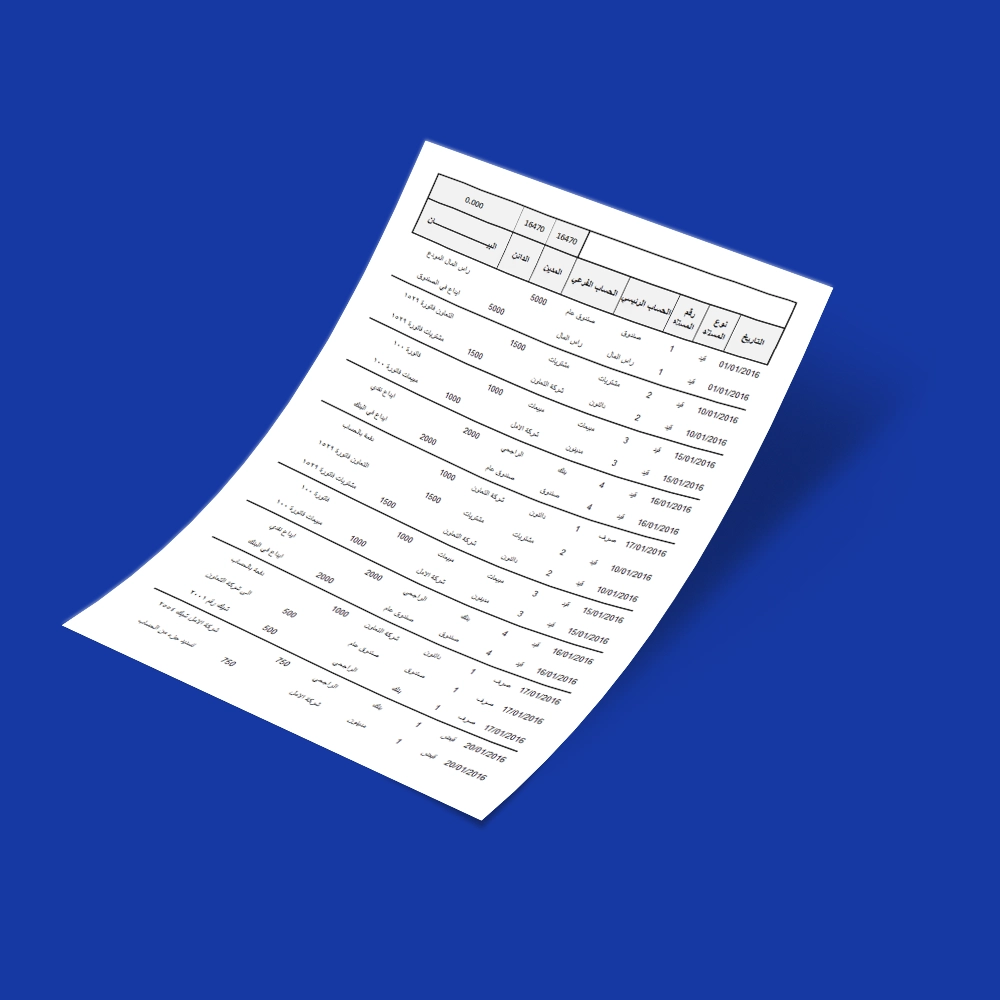

Closing Entries:

Temporary accounts are closed by transferring their balances to the retained earnings account (a permanent account).

Entry 1:

- Debit: Sales Revenue (Temporary Account)

- Credit: Retained Earnings (Permanent Account)

Entry 2:

- Debit: Retained Earnings (Permanent Account)

- Credit: Selling Expenses (Temporary Account)

Entry 3:

- Debit: Retained Earnings (Permanent Account)

- Credit: Marketing Expenses (Temporary Account)

Entry 4:

- Debit: Retained Earnings (Permanent Account)

- Credit: General and Administrative Expenses (Temporary Account)

After making the closing entries, Helwan Trading will have the following balances in its permanent and temporary accounts:

Permanent Accounts:

- Cash: $100,000

- Accounts Receivable: $200,000

- Property and Equipment: $300,000

- Equity: $750,000

Temporary Accounts:

- Shareholders’ Profit: $250,000

Analysis:

- Permanent Accounts: These accounts reflect the company’s assets, liabilities, and equity, and their balances carry over from one accounting period to another.

- Temporary Accounts: These accounts reflect the company’s revenues and expenses and are closed at the end of each accounting period by transferring their balances to the retained earnings account.

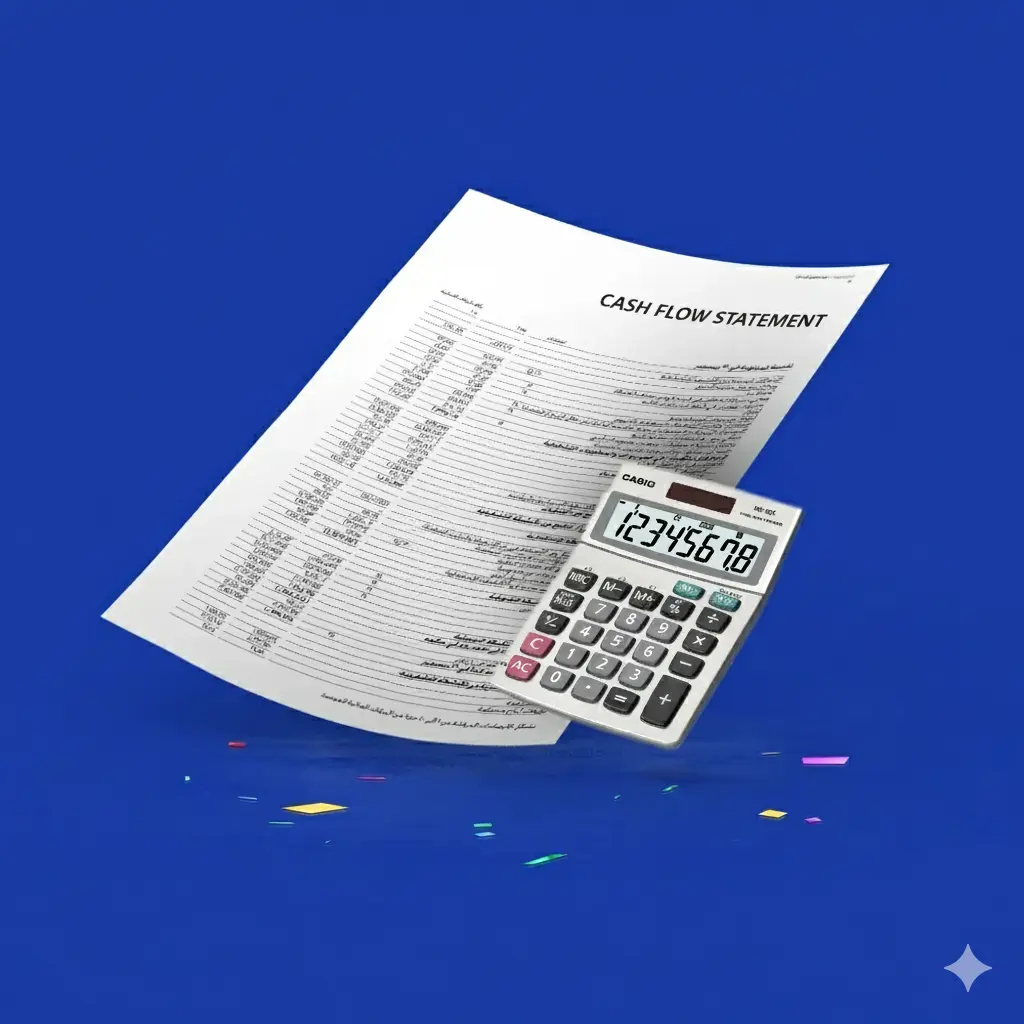

How Daftra Helps You with Your Temporary and Permanent Accounts?

Daftra software helps you in many aspects related to your temporary and permanent accounts. It automatically creates the closing entry and clears the temporary account, resetting the period to zero. This ensures periodic reports without manual intervention.

Daftra also helps in classifying accounts and automatically distributing them between temporary and permanent, giving you better organization. In addition, Daftra provides financial reports to help you manage your accounts.

You can now subscribe to Daftra accounting software with a 14-day free trial.

Frequently Asked Questions

What is the validity period of temporary accounts?

There is no specific time or validity period for temporary accounts. Some companies close them quarterly, while others prefer to close them at the end of the year.

Is interest income a temporary account?

Yes, interest income is classified as a temporary account because it is part of the revenue accounts.

Are all temporary accounts income statement accounts?

No, not all temporary accounts are income statement accounts. Temporary accounts are accounts that are zeroed out at the end of each year. The income statement account is a type of revenue account, which is one type of temporary account, but not all temporary accounts are income statement accounts.

Is cash a permanent or temporary account?

Cash is a permanent account, not temporary, because permanent accounts carry their balances from one accounting period to another.

Are all temporary accounts asset or liability accounts?

No, temporary accounts are not asset or liability accounts. Temporary accounts record revenues and expenses for a specific period, while assets and liabilities are permanent accounts that extend from one accounting period to another.

Is the purchases account a temporary account?

Yes, the purchases account is a temporary account. It records the cost of goods purchased and is later transferred to inventory or cost of sales at the end of the accounting period.

Is equipment a permanent or temporary account?

Equipment is a permanent account; it is recorded and not transferred at the end of the accounting period.

Are receivable accounts temporary accounts?

No, receivable accounts are permanent accounts that remain from one accounting period to another.

Is merchandise inventory a permanent or temporary account?

Merchandise inventory is a permanent account. It is included in the balance sheet and carried forward from one accounting period to another.

What are the three temporary accounts that are closed?

- Revenue accounts

- Expense accounts

- Profit and loss accounts

Do permanent accounts include inventory?

Yes, permanent accounts include inventory, which is carried forward between accounting periods and is not closed.