Inventory Adjustments in Accounting and Their Objectives

Table of contents:

- What Are Inventory Adjustments in Accounting?

- What Is the Importance of Inventory Adjustments?

- What Are the Objectives of Inventory Adjustments?

- The Difference Between Inventory and Inventory Adjustments

- Types of Inventory Adjustments

- Inventory Adjustments for Fixed and Current Assets

- Inventory Adjustments for Revenues and Expenses

- Inventory Adjustment Entries

- Examples and Solved Exercises on Inventory Adjustments

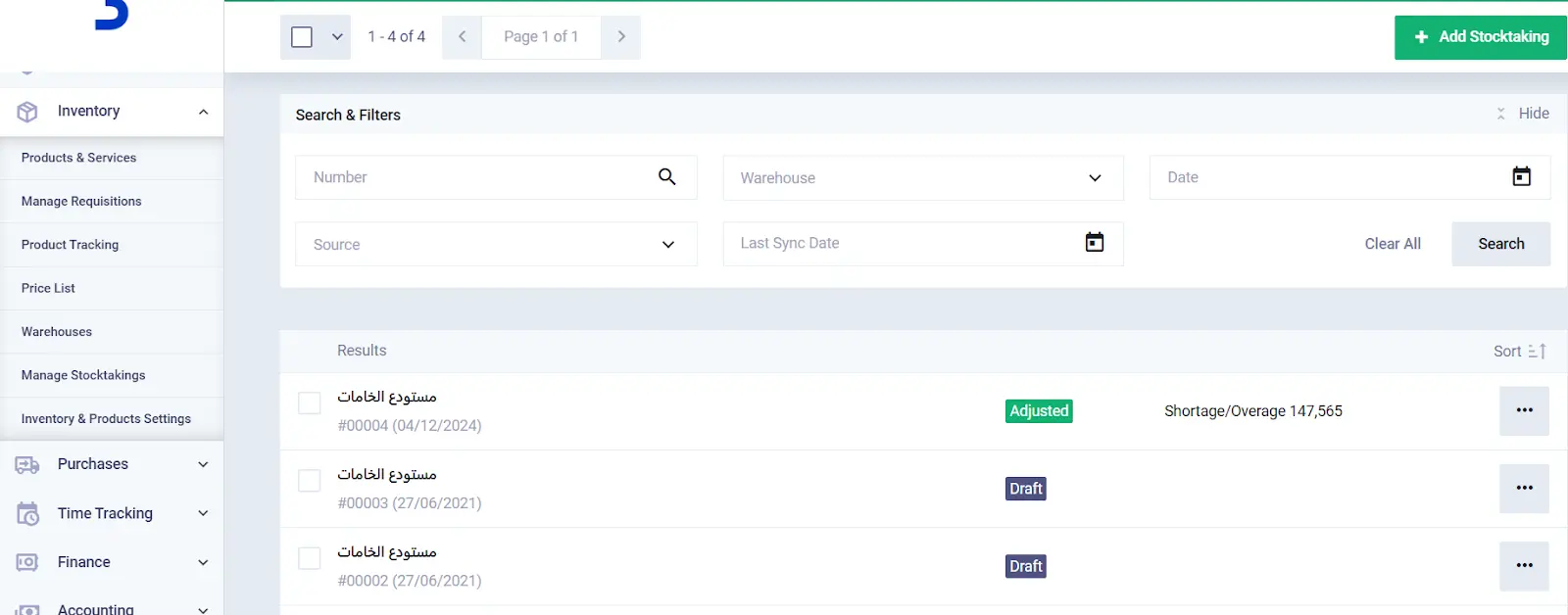

- Inventory Adjustments in the Daftra System

- Frequently Asked Questions

Financial operations in an organization are governed by the accounting cycle, which consists of several stages: starting with the economic event recorded in the journal, then posting the journal to the ledger, from which the balance is extracted and transferred to the trial balance.

Before distributing the trial balance balances to the financial statements and closing accounts, it is necessary to ensure the accounts are accurate and comply with accounting principles and standards. This is where the task of inventory adjustments comes in.

In this topic, we explore the concept of inventory adjustments, their types, and objectives. We clarify the distinction between inventory and inventory adjustments and provide detailed explanations and illustrative examples of inventory adjustments for fixed and current assets, as well as for revenues and expenses. We conclude the topic with a set of examples of inventory adjustments.

Quick Points (The Useful Summary)

- An inventory adjustment is an accounting process that aligns books and records with reality after an accurate inventory of accounts. This is reflected in inventory adjustment entries, which affect the adjusted trial balance after the adjustment.

- The purpose of inventory adjustments is to determine the company’s financial position, ensure its profitability, and identify the profits earned or losses incurred during the accounting period.

- There are several types of inventory adjustments, some involving current assets and others involving fixed assets.

- Inventory involves comparing what is recorded in the books with the actual balance, while the adjustment is the process of recording accounting entries by applying the accrual and matching principles to determine any deficit or surplus in each available balance.

- Governmental accounting does not include inventory adjustments because it is a type of non-profit accounting.

What Are Inventory Adjustments in Accounting?

Inventory adjustments are an accounting process carried out at the end of the financial period, after preparing the trial balance and before preparing the financial statements. Their purpose is to determine the results of operations during the accounting period and to verify the organization's financial position.

Thus, inventory adjustments involve a comprehensive review of all financial accounts included in the trial balance, in light of a set of accounting principles and standards, the most important of which are: the accrual principle, the matching principle, the prudence principle, and the cash basis.

What Is the Importance of Inventory Adjustments?

Inventory adjustments address and resolve several issues smoothly, as if they never occurred. These issues may include errors, theft, or helping to reprice inventory. Here is the importance of inventory adjustments and the benefits they bring to the company:

- Correcting Errors: They handle situations caused by ignorance or mistakes, such as when the bookkeeper forgets to record a journal entry related to a goods delivery due to sales.

In such cases, during inventory, a shortage in the warehouse balance not recorded in the books will be discovered. This also results in a mismatch between the ledger balance and the actual balance, where the ledger shows less than the actual.

- Preventing Theft: They address cases of theft or damage to inventory during the accounting period. Inventory may be affected by incidents that result in part of the stock being lost.

Additionally, some products may expire during storage, rendering them unsellable. In this case, the books need an inventory adjustment to reflect the actual value at the end of the accounting period.

- Repricing Inventory: Inventory adjustments are necessary when local or global economic events cause price increases or decreases. In this case, an inventory adjustment is essential to update the inventory value.

Also read: Warehouse and Inventory Management, Its Importance and Requirements

What Are the Objectives of Inventory Adjustments?

Conducting inventory adjustments achieves multiple objectives. They are a key element in ensuring the accuracy of data presented in financial statements, providing a clear and precise picture of business results during the financial period.

The main objectives of inventory adjustments can be summarized as follows:

- Net Profit: Determining the actual net profit of the organization during the accounting period.

- Providing Insights: Presenting an accurate picture of the organization’s financial position.

- Avoiding Expense Recognition Issues: Overcoming the accounting issue of identifying prepaid and accrued expenses.

- Avoiding Revenue Recognition Issues: Overcoming the accounting issue of identifying prepaid and accrued revenues.

- Reviewing Data: Ensuring that the accounts and data in the trial balance are correct and accurate.

- Supporting Decision-Makers: By providing accurate financial data that contributes to informed decision-making.

The Difference Between Inventory and Inventory Adjustments

Although the two terms are closely related, there is a subtle difference between them. Inventory involves the final audit and review of the account items included in the trial balance.

The task of inventory adjustments, on the other hand, is to prepare inventory adjustment entries based on inventory operations recorded in the accounts. They serve as a final monitoring and clearing tool before preparing the financial statements (income statement and balance sheet) to accurately reflect profit, loss, and the true business results during the accounting period.

Types of Inventory Adjustments

Regarding the types of inventory adjustments, the most important can be determined based on what is subject to an inventory adjustment, as follows:

- Prepaid expenses

- Accrued expenses

- Unearned revenues

- Accrued revenues

- Depreciation of fixed assets

- Accounts receivable are under current assets

- Notes receivable under current assets

- Securities under current assets

- Inventory under current assets

Inventory Adjustments for Fixed and Current Assets

First: Inventory Adjustments for Fixed Assets

Before reviewing inventory adjustments for fixed assets, it is worth noting that fixed assets are everything the organization owns that has a permanent nature and contributes to enhancing the production process and generating profits, such as vehicles, buildings, and machinery.

Based on the accounting matching principle, which states that every revenue is matched by an expense and vice versa, fixed assets generate company profits and therefore require an expense to account for depreciation and efficiency loss due to usage.

Depreciation

Depreciation is the loss of efficiency of a fixed asset due to continuous use. As noted earlier, fixed assets play an active role in the production process and in long-term profit generation, often extending beyond a single accounting period. Therefore, the cost of these assets should be allocated over the accounting periods in which they benefit, reflecting the reduction in asset value in each period.

Practical Calculation of Fixed Asset Depreciation

Depreciation can be calculated practically using the straight-line method, which allocates a portion of the asset’s value to each accounting period, after deducting the residual value over its useful life.

Using the Daftra accounting software, you can easily manage your assets and enter all related data tocalculate depreciation more quickly.

Example of Inventory Adjustment for Fixed Assets

Company (A) needed to purchase a vehicle as part of its production tools. The vehicle was valued at $600,000, had a useful life of 5 years, and a residual value of $50,000.

To avoid charging the full value of this asset to a single financial period, the annual depreciation needs to be calculated using the following formula:

Annual Depreciation = (Asset Purchase Cost – Residual Value) ÷ Useful Life

Annual Depreciation = (600,000 – 50,000) ÷ 5 = $110,000

Thus, the annual depreciation for this asset is $110,000.

Second: Inventory Adjustments for Current Assets

The following fall under current assets subject to inventory adjustments:

1- Inventory Adjustment for Accounts Receivable

A company may complete a sale on credit, delivering the goods without receiving payment immediately. In this case, the amount is recorded in the accounts receivable account. At the end of the accounting period, the balance of each client must be checked to determine the collectibility of the debt—whether collected, doubtful, or uncollectible.

Accounting Treatment for Receivables:

- Uncollectible debts: Those that cannot be collected for any reason. These are written off against the accounts receivable.

- Doubtful debts: According to the prudence principle, doubtful debts are treated as expected losses and recorded fully in the profit and loss account.

- Collected debts: No advanced treatment is needed as they have already been collected.

2- Inventory of Notes Receivable

Notes receivable include bonds and bills arising from credit sales. Inventorying these notes ensures their availability and that their value matches the ledger balance. Accounting treatment involves closing the provision (notes receivable) in the profit and loss account.

3- Inventory of Merchandise

Except for service organizations, inventory is carefully managed as one of the most important current assets. Materials in storage but not owned by the company (e.g., sold but not yet delivered to the customer) are excluded from inventory.

Inventory is valued at cost. If the market price is lower than the cost, the difference is recorded as a potential loss. The merchandise inventory is recorded in the books at the cost of the goods or the market value, whichever is lower, from the ending inventory account to the trading account.

4- Inventory of Securities

Securities include bonds and shares purchased by the company. The debit account is opened at the purchase value, and a credit is applied at the time of sale. Inventorying securities at the end of the accounting period involves confirming their availability and estimating their value. For sold securities, price declines affecting market value must be considered.

Example of Inventory Adjustment for Current Assets

If the securities account balance in the trial balance on 31/12/2019 is $3,000,000, while the market value is $1,950,000, an inventory adjustment is required.

The difference between the ledger balance and the market value is recorded as a provision for securities devaluation:

3,000,000 – 1,950,000 = $1,050,000, which is recorded as a provision for securities devaluation.

Also Read:

- What Are Periodic and Continuous Inventory and the Difference Between Them

- Everything You Need to Know About Purchase Management

Inventory Adjustments for Revenues and Expenses

At the end of its financial year, every company adjusts all its expenses and revenues and closes the accounts to ensure financial accuracy. Below is a detailed explanation of inventory adjustments for revenues and expenses:

First: Inventory Adjustments for Expenses

Inventory adjustments for expenses are among the most important stages for a company to recognize accrued expenses and exclude prepaid expenses. Expense inventory adjustments are divided into prepaid expense and accrued expense adjustments. The details are as follows:

Accounting Treatment of Accrued Expenses

In application of the accrual principle, each financial period should bear its own expenses. If the organization has paid expenses that are less than the value of the services or products received, it is obligated to pay the difference as accrued expenses.

Paid expenses are charged to the profit and loss account, while any shortfall is shown on the balance sheet under other credit balances.

Example of an Inventory Adjustment for Expenses

If the trial balance at the end of the financial year shows wages and salaries of $400,000, while two months have not yet been paid, the inventory adjustment is as follows:

First, calculate the monthly wages and salaries expense:

400,000 ÷ 10 months = 40,000

Then calculate the annual wages and salaries expense:

40,000 × 12 months = 480,000

Since the actual expense paid and shown in the trial balance is only $400,000, there is an accrued expense of $80,000, which is recorded under other credit balances.

Second: Inventory Adjustment for Revenues

Inventory adjustments for revenues help recognize accrued revenues and exclude revenues that do not relate to the current period. Revenue inventory adjustments are divided into adjustments for unearned revenues and adjustments for accrued revenues, as detailed below:

1- Accounting Treatment of Unearned Revenues

Unearned revenue occurs when the organization receives funds that do not pertain solely to the current accounting period but extend to future periods. As is known, revenues appear in the profit and loss account, while any excess is transferred to the balance sheet under other credit balances.

2- Accounting Treatment of Accrued Revenues

If the organization collects less revenue than it should, the remaining amount is considered accrued revenue. According to the accrual principle, this shortfall must be addressed through an inventory adjustment to ensure that each accounting period bears what it earns and owes.

As previously known, revenues are recognized in the profit and loss account, while accrued revenues not yet received are recorded on the balance sheet under other debit balances.

Example of an Inventory Adjustment for Revenues

If the trial balance at the end of the accounting period shows rental income of $350,000, while the monthly rental income is $35,000, the inventory adjustment is calculated as follows:

Calculate the annual rental income:

35,000 × 12 months = $420,000

There is a difference between the revenue shown in the trial balance and the amount that should be collected annually:

420,000 – 350,000 = 70,000

This difference ($70,000) represents accrued rental revenue not yet received and is recorded under other debit balances on the balance sheet.

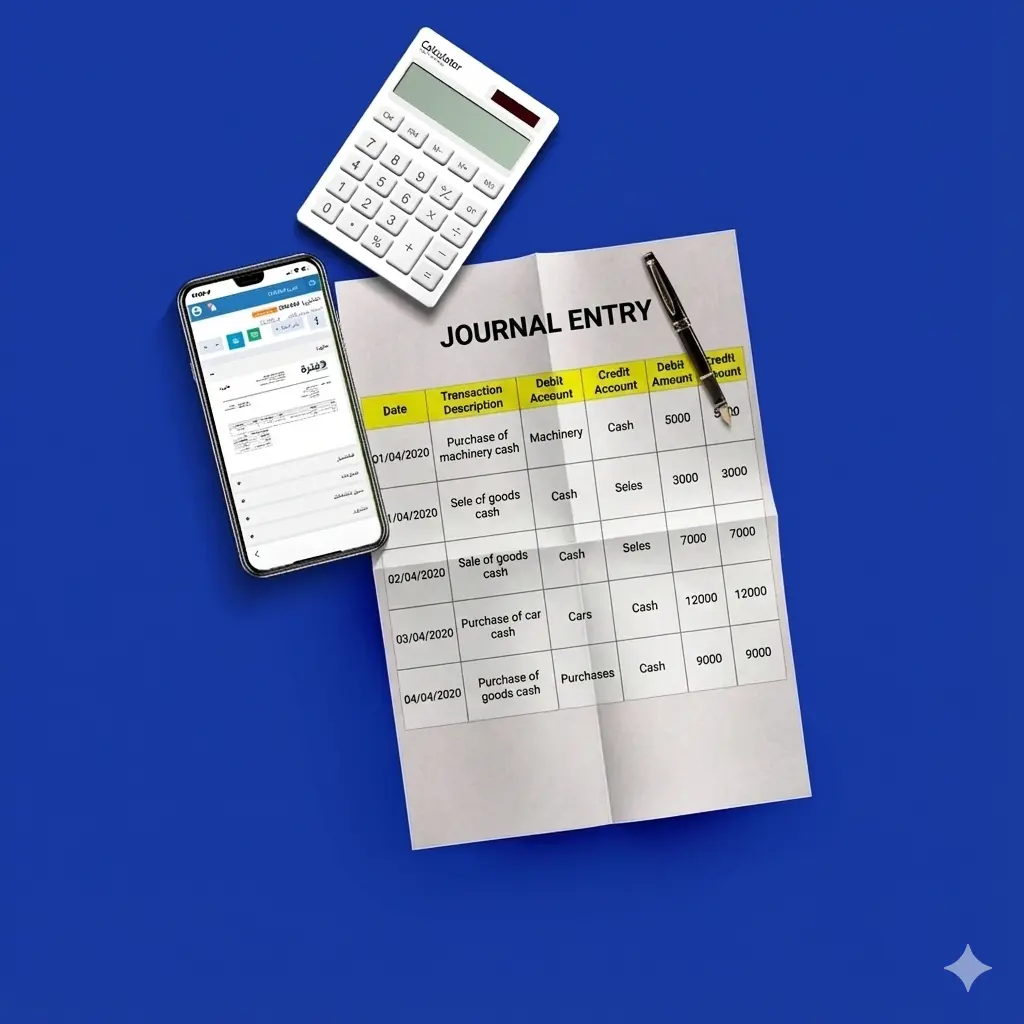

Inventory Adjustment Entries

Inventory adjustment entries are entries recorded to adjust account balances in order to ultimately determine the result of operations—profit or loss—and accurately identify the project’s financial position. They represent the practical application of the matching principle and the principle of the independence of accounting periods, with the accrual principle being foremost among them.

Through this article, you learned that inventory adjustments affect both expenses and revenues.

- In the case of unpaid expenses, the inventory adjustment entry at the end of the period appears as follows:

| Statement | Debit | Credit |

| From A/C Expense X | XXXXX | |

| To A/C Accrued Expenses | XXXXX |

- In the case of prepaid expenses, the inventory adjustment entry at the end of the period appears as follows:

| Statement | Debit | Credit |

| From A/C Prepaid Expense | XXXXX | |

| To A/C Expense X | XXXXX |

- In the case of revenues received in advance, which are considered a liability on the company, the inventory adjustment entry at the end of the period appears as follows:

| Statement | Debit | Credit |

| From A/C Revenue X | XXXXX | |

| To A/C Unearned Revenue | XXXXX |

- In the case of accrued revenues not yet received, the inventory adjustment entry at the end of the period is recorded as follows:

| Statement | Debit | Credit |

| From A/C Accrued | XXXXX | |

| To A/C Revenue X | XXXXX |

Examples and Solved Exercises on Inventory Adjustments

Below is a set of examples of inventory adjustments through which you can apply the practical treatment of the different types of inventory adjustment entries, as follows:

Example (1): Inventory Adjustment for Depreciation Value

If an organization purchases a group of operating machines for a value of $2,000,000, with a useful life of 5 years and a residual value of $15,000, then the annual depreciation installment is $397,000, by applying the following formula:

Annual Depreciation = (Cost of the Asset – Residual Value) ÷ Useful Life

Annual Depreciation = (2,000,000 – 15,000) ÷ 5 = $397,000

Example (2): Inventory Adjustment for Securities

If the balance of the securities account on 31/12/2018 is $80,000, while the market value of these securities according to market prices is $65,000, an inventory adjustment is made by creating a provision for the decline in securities prices and charging it with the difference:

80,000 – 65,000 = $15,000.

Example (3): Inventory Adjustment for Prepaid Expenses

At the end of the financial year, the trial balance shows that the rent for one of the company’s warehouses is $300,000, while the monthly rent is $22,000. Therefore, an inventory adjustment is required to calculate the actual expense value.

First, calculate the actual annual rent expense based on the monthly rent:

Annual warehouse rent cost = 22,000 × 12 = $264,000.

The difference between the expense shown in the trial balance and the amount that should actually be incurred:

300,000 – 264,000 = $36,000.

Thus, it is clear that there is a prepaid expense of $36,000 recorded under other debit balances.

Example (4): Inventory Adjustment for Accrued Expenses

On 31/12/2020, it was found that the trial balance for wages and salaries showed a balance of $1,100,000, while wages and salaries for one month had not yet been paid to employees and workers. How is the inventory adjustment for this expense made?

Monthly wages and salaries expense = 1,100,000 ÷ 11 = $100,000.

Thus, the monthly wages and salaries expense equals $100,000. To calculate the actual annual wages and salaries expense:

100,000 × 12 months = $1,200,000.

Since the expense shown in the trial balance is $1,100,000, while the actual wages and salaries expense is $1,200,000, it is clear that there are accrued expenses of $100,000, which are recorded under other credit balances.

Example (5): Inventory Adjustment for Unearned Revenues

On 31/12/2016, the trial balance showed a balance of $410,000 under rental income, while the monthly rental income was $30,000. How is the inventory adjustment for this revenue made?

The annual rental income is calculated based on the given monthly amount:

30,000 × 12 = $360,000.

Since the rental income shown in the trial balance is $410,000, while the revenue that should have been received is only $360,000, this indicates that $50,000 of the revenue was received in advance and recorded under other credit balances on the balance sheet.

Example (6): Inventory Adjustment for Accrued Revenues

If, at the end of the accounting period, the trial balance shows a balance of $150,000 under rental income, and the monthly rental income is $15,000, then the inventory adjustment is as follows:

Since the monthly rental income is $15,000, the annual rental income is $180,000. As the revenue collected and shown in the trial balance is $150,000, this indicates that $30,000 in accrued revenue has not yet been received and is transferred under other debit balances on the balance sheet.

Inventory Adjustments in the Daftra System

Daftra allows you to create entries for inventory adjustments, as well as perform both periodic and perpetual inventory through Daftra’s accounting module and inventory module. In addition, Daftra provides detailed financial reports that provide all the data you need to carry out inventory adjustments.

Similar Articles:

What Is an Item Card, and what is the Difference Between It and a Stock Card?

What Is a Receipt Voucher, Its Contents, and How It Works, with a Free Downloadable Template

What Is the Document Cycle for Warehouses

Frequently Asked Questions

What is the purpose of inventory adjustments for expenses and revenues?

The purpose of inventory adjustments for revenues and expenses is to verify the company’s profitability and determine whether it achieved profits or incurred losses during the accounting period.

When are inventory adjustments made?

Inventory adjustments are made at the end of the accounting period.

Why are inventory adjustments not used in governmental accounting?

The purpose of inventory adjustments is to verify the company’s financial position and determine its profitability, which conflicts with the objective of governmental accounting. Governmental accounting aims to allocate revenues to provide subsidized services and does not seek profit; therefore, it does not require inventory adjustments.

What is the effect of the accrual basis on inventory adjustments for nominal accounts?

Nominal accounts are closed at the end of the accounting period through inventory adjustments. Under the accrual basis, each accounting period is charged with its related revenues and expenses.

What are inventory adjustments for inventory?

After completing the inventory stocktaking process, there may be discrepancies between recorded quantities and actual inventory quantities. Here comes the role of inventory adjustments, which help reconcile these differences.

What is the difference between inventory and inventory adjustments?

- Inventory: The process of physically counting and identifying inventory and assets.

- Inventory adjustments: A process performed after inventory to reconcile recorded items with what actually exists in reality.

What are inventory adjustments for accounts receivable?

They are in the process of reviewing customers’ accounts receivable at the end of the financial year to verify their balances and determine whether any amounts need adjustment or are uncollectible for any reason.

In Conclusion

We hope that the concept of inventory adjustments has become clear after reviewing the definition and types of inventory adjustments, such as adjustments for fixed assets, current assets, and revenues and expenses, along with practical examples to provide a complete and clear understanding without any ambiguity.