A Comprehensive Guide to Financial Accounting

Table of contents:

- What is Financial Accounting

- Principles and Fundamentals of Financial Accounting

- What is the Matching Principle in Financial Accounting?

- What are the Importance and Objectives of Financial Accounting?

- What are the Components of Financial Accounting?

- Is Financial Accounting an Information System?

- Who Needs Financial Accounting?

- What are the Functions of Financial Accounting?

- What is the Difference Between Financial Accounting and Management Accounting?

- What is the Difference Between Government Accounting and Financial Accounting?

- What is the Difference Between Financial Accounting and Cost Accounting?

- How is Financial Accounting Divided?

- Who are Debtors and Creditors in Financial Accounting?

- How to Learn Financial Accounting?

- Why is Daftra the Magical Solution for Effective Financial Accounting?

In the era of cloud accounting, you may find that some stakeholders, such as business owners, administrators, and even accountants themselves, no longer possess a basic understanding of financial accounting and have become dependent on it.

Therefore, we decided to provide you with a comprehensive accounting guide that saves you from studying scattered fragments to only grasp the basics that anyone involved in the accounting field cannot afford to ignore. We have dedicated this article to financial accounting, as well as management accounting and other types of accounting.

This article will organize your thoughts and streamline your work, whether you are working on an electronic accounting system or a traditional system.

What is Financial Accounting

Financial accounting is considered the first branch of accounting to emerge, as it is considered one of the fundamentals of working in the accounting field from which all other accounting branches derive. Financial accounting is concerned with conducting analysis, recording, classification, and categorization of financial operations that occur within the company during the accounting period, as well as between the company and other institutions. Additionally, it involves preparing financial statements in accordance with approved accounting measurement standards, in a manner that suits accounting in general.

These financial reports aim to provide financial information about the results of the company's business operations, as well as its financial position, while also protecting the company's assets and providing profit measurement services, and determining economic units. As is well known, financial accounting uses generally accepted accounting principles to apply and implement the accounting cycle and achieve the required accounting functions and objectives.

Principles and Fundamentals of Financial Accounting

Accounting in general has a set of rules and guidelines that should be followed when reporting financial data. Companies must also present financial statements regularly in accordance with basic accounting principles. The accounting principles in financial accounting include the following:

Cost Principle: This includes amounts that are spent in cash within the list of accounting assets and are not subject to modification of the amount value.

Accrual and Revenue Recognition Principle: Through this, revenues are recognized and recorded in the accounting books and records when they are realized, and revenues are recognized along with recording them in the accounting books and records when they are realized, and the same applies to expenses.

Conservative Principle: This includes disclosing losses and profits, whether realized or expected.

Disclosure Principle: Through this, all financial information of the institution related to a specific time period is determined and disclosed.

Going Concern Principle: This principle includes settling all financial obligations of the company or institution to achieve business objectives and ensure that the company is not exposed to bankruptcy or liquidation. Monetary Unit Assumption: This includes the principle of determining the measurement of the economic activity of the institution or company by specifying a particular currency.

Matching Principle: This principle is concerned with matching received or accrued revenues and expenses according to the accrual basis followed.

Accounting Period Principle: Through this, business activities that occur in the company during the specified time period are determined to facilitate accounting operations.

What is the Matching Principle in Financial Accounting?

The matching principle in financial accounting is one of the fundamental principles upon which Generally Accepted Accounting Principles (GAAP) are based. This principle states that revenues and their related expenses must be recognized and recorded in the same accounting period. In other words, when a company records revenue, it must correspondingly record all costs associated with generating that revenue, even if these costs were paid in a different period.

This principle helps provide a more accurate picture of the company's financial performance during a specific period, and provides a clear understanding of how revenues are generated and their associated costs.

What are the Importance and Objectives of Financial Accounting?

Financial accounting is considered the backbone of general accounting, and the first building block, without which you cannot build any accounting system. All types branched out from it and developed it as the origin and foundation. Here are some points that clarify why this importance exists:

- Knowing what happened in the company during past periods, analyzing the current situation, and financial forecasting for the following accounting periods.

- Issuing accounting reports and financial statements.

- Estimating profit and loss resulting from the institution's main activity.

- Anticipating the company's investment scope and identifying its obstacles.

- Gaining insight into making calculated financial decisions and avoiding risk.

- Estimating the company's liquidity and its non-fixed assets.

- Knowing the company's assets and comparing them with its liabilities.

- Accessing the institution's funding sources and profit sources, as well as the extent of its profit ratio in relation to the company's main activity.

- Distributing profits to the board of directors and shareholders.

- Recording, classifying, and summarizing financial transactions on a daily basis while transferring them to more sustainable entries, ensuring they can be referred to at any time.

- Transferring information to those who need it for decision-making or understanding, whether they are from inside or outside the institution.

- Understanding the causes of financial problems and reaching the root of crises in an objective manner based on unbiased data.

What are the Components of Financial Accounting?

Financial accounting consists of a group of fundamental elements, which are:

Financial Statements

Financial statements consist of four main statements:

- Balance Sheet or Statement of Financial Position: This includes assets, liabilities, and equity at a specific date.

- Income Statement or Profit and Loss Statement: This displays revenues, expenses, and the final result, either as profit or loss, during an accounting period.

- Cash Flow Statement: This shows cash inflows and outflows from operating, investing, and financing activities.

- Statement of Changes in Equity or Shareholders' Equity: This presents the changes in equity during the accounting period.

Financial Transactions

Financial transactions represent economic events that can be measured accountably and that affect the company's financial position and require recording.

Accounting Books and Records

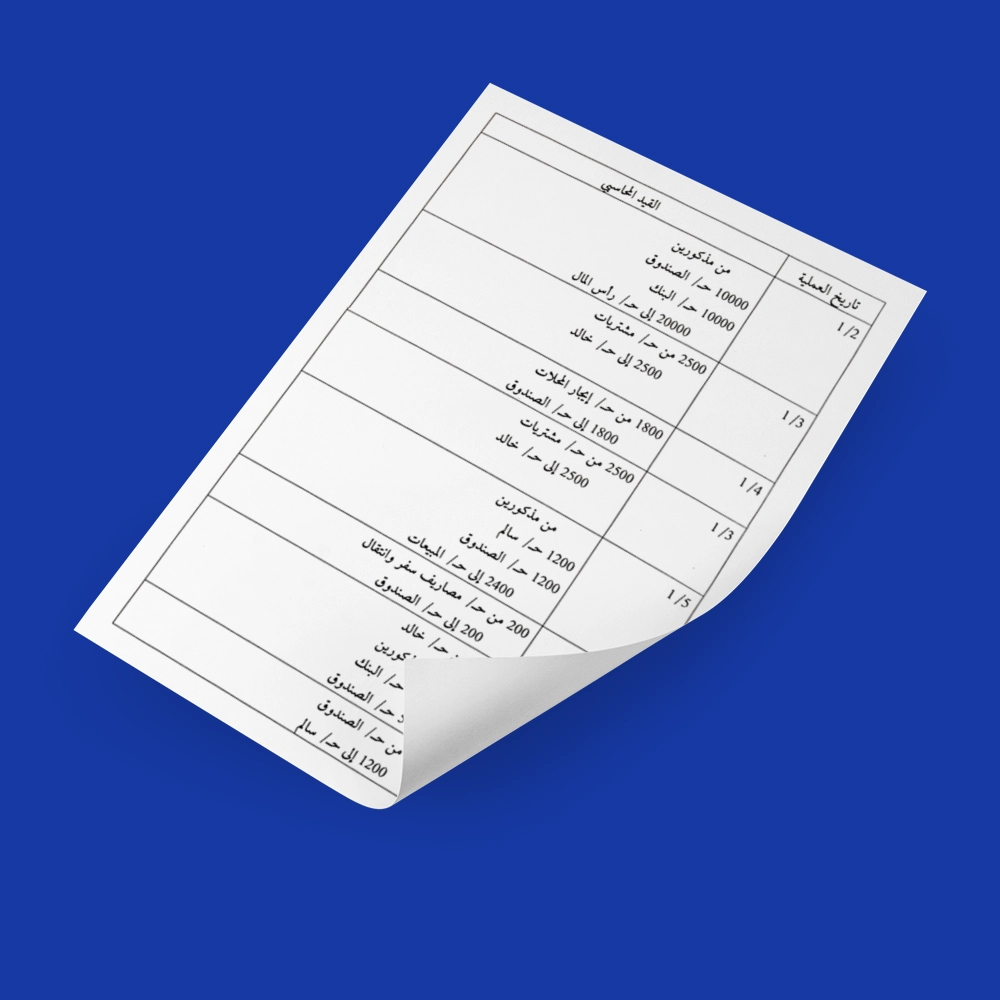

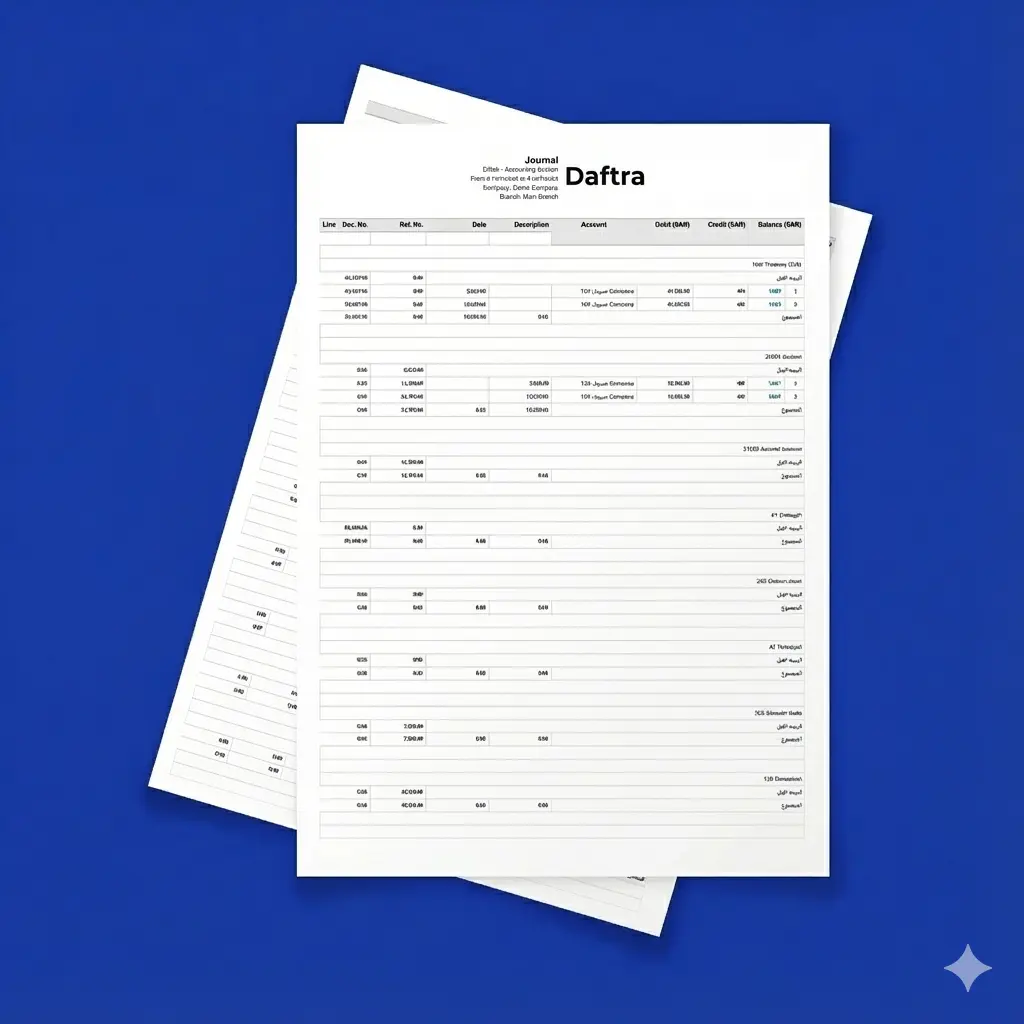

These include the Journal, where transactions are first recorded, and the Ledger, where these transactions are classified and grouped according to accounting accounts.

Accounting Documents and Evidence

Accounting documents and evidence in financial accounting include all documents that support financial transactions, such as invoices, receipts, contracts, and others.

Accounting Policies

Accounting policies in financial accounting represent a set of rules that determine how to record and evaluate financial transactions.

Review and Analysis

Both review and evaluation are among the most important elements of financial accounting. Financial statements must be analyzed and reviewed to ensure their accuracy and compliance with international accounting standards.

Financial Reports

Financial reports provide the necessary information and data that can be understood and used by internal and external users to make appropriate decisions, such as shareholders, investors, managers, and regulatory bodies.

Is Financial Accounting an Information System?

Yes, financial accounting can be considered an information system because it collects, processes, and presents financial data that helps users make informed decisions. It also operates with the same mechanism as an information system, where financial accounting transforms raw data from financial transactions into useful and understandable information in the form of financial statements. These statements provide insights into the company's financial performance, financial position, and cash flows, and are essential for planning, analysis, and decision-making.

Who Needs Financial Accounting?

Financial accounting is needed by all those concerned with making decisions related to the financial aspects of the company, and it is needed by managers, even those who are not financial managers. Financial accounting also benefits a wide range of parties that rely on financial data to make important financial and economic decisions. They can be divided into external and internal users as follows:

Internal Beneficiaries of Financial Accounting

- Management: Uses financial information to make decisions related to operations, investment, and financing.

- Employees: Use financial information to negotiate employment contracts or to evaluate the company's performance.

External Beneficiaries of Financial Accounting

Investors: They need financial information to evaluate the company's financial performance and make investment decisions.

- Creditors: They use financial data to assess the company's ability to repay debts.

- Suppliers and Lenders: To evaluate credit risks and make lending decisions or provide trade credit.

- Customers: They may be interested in the company's financial stability, especially if service delivery or product provision requires a long-term relationship.

- Regulatory and Government Bodies: They use financial information to ensure compliance with laws and regulations.

- Financial Analysts and Consultants: They rely on financial data to provide recommendations to their clients.

- Auditors: They use financial data to conduct reviews and provide opinions on whether the financial statements fairly reflect the company's financial position.

What are the Functions of Financial Accounting?

- Financial accounting is considered the backbone of the financial system for any company and plays a vital role in providing necessary information to all concerned parties. Its functions can be identified in the following points:

- Recording and documenting all financial transactions in an organized and accurate manner.

- Collecting and summarizing financial data in the form of understandable and clear financial statements.

- Financial reporting involves preparing financial statements that reflect the company's financial position, performance, and cash flows.

- Analyzing and interpreting financial statements to provide insights into financial performance and future expectations.

- Ensuring compliance with accounting standards, regulations, and tax and financial laws.

- Providing the necessary financial information to help make appropriate decisions that increase productivity and profitability.

- Financial accounting helps in preparing budgets and financial planning for the company.

What is the Difference Between Financial Accounting and Management Accounting?

- Management accounting differs from financial accounting in its objectives, where financial accounting aims to serve information users from outside the organization. In contrast, management accounting aims to serve information users from within the company.

- Financial accounting is concerned with evaluating the company's performance in general, while management accounting is concerned with evaluating the performance of units in a specialized manner.

- Management accounting is concerned with both historical and future data. In financial accounting, the focus is on historical data.

- Management accounting relies on statistical, mathematical, and accounting methods.

- Management accounting has no legal obligation to use management accounting methods. However, in financial accounting, companies are obligated to prepare basic financial statements such as the statement of financial position, which shows the institution's financial position by matching liabilities with assets, and the income statement that shows profits and losses.

- Information statements in financial accounting are prepared repeatedly and periodically at the end of each time period. In management accounting, accounting information is prepared when needed.

- In financial accounting, financial statements are subject to examination and review by external parties, but this does not happen in management accounting, where the information provided by management accounting is subject to examination and review by internal auditors within the company.

- Financial accounting is more objective as it is based on financial statement figures, making it highly disciplined, while management accounting also includes forecasts and planning, which makes it less objective.

- Financial accounting relies on standards like IFRS, while management accounting does not.

- Financial accounting is mandatory; reports must be issued annually, unlike management accounting.

- Management accounting relies more on creativity, analysis, speed, and planning than financial accounting.

What is the Difference Between Government Accounting and Financial Accounting?

The difference between government accounting and financial accounting can be identified based on a set of elements:

Objectives

Government accounting aims to track public revenues and expenditures, ensure effective use of public resources, and maintain transparency in government financial transactions, while financial accounting aims to provide accurate and detailed financial information to external users about the financial performance and financial position of private companies.

Users

The main beneficiaries of government accounting are citizens, government officials, and donor and lending agencies, while the primary users of financial accounting are investors, creditors, banks, and financial analysts.

Accounting Standards and Regulations

Government accounting is subject to a set of government accounting standards that may differ from country to country and focus on budgeting and accountability, while financial accounting is subject to international financial accounting standards or generally accepted accounting principles and focuses on transparency and comparability.

Reports

Government accounting reports include the state's general budget, performance reports, and other financial reports that reflect the government's financial activity, while financial accounting reports include standard financial statements such as the balance sheet, profit and loss statement, statement of equity, and cash flow statement.

Focus

Government accounting focuses on accountability and appropriateness in the use of public funds, while financial accounting focuses on profitability and financial efficiency of private companies.

Accounting Basis

Government accounting relies on the cash basis, or accrual basis, or a combination of both, according to government rules and regulations, while financial accounting usually uses the accrual basis of accounting, which recognizes revenues and expenses when they occur and not when cash payment or receipt occurs.

What is the Difference Between Financial Accounting and Cost Accounting?

The difference between financial accounting and cost accounting can be identified based on a set of fundamental factors:

Purpose

Financial accounting aims to provide financial information about the company to external users such as investors, creditors, banks, and regulatory bodies, while cost accounting focuses on calculating and analyzing the cost of products or services that the company produces. It is primarily used by management within the company to make decisions related to cost and operations control.

Users

Financial accounting serves external users, while cost accounting benefits internal management elements.

Reports

Financial accounting reports are in the form of standard financial statements, while cost accounting reports are customized for internal management needs and include cost details.

Regulations and Standards

Financial accounting is subject to fixed and clear standards such as IFRS or GAAP, while cost accounting is not restricted by strict standards like financial accounting and can be adapted according to the company's needs.

How is Financial Accounting Divided?

Financial accounting is divided into two types based on the cash basis and accrual basis to show the financial position, determine profit and loss, financial flows, and changes in shareholders' equity during the specified time period. Each type of financial accounting has its characteristics and conditions, which are as follows:

- Cash Accounting: This is a method through which cash is received to record financial transactions and records every addition or deduction made by the creditor in each transaction that occurs. Economic events that do not have cash inputs are considered unimportant. This type of accounting is performed by the Internal Revenue Service in a company or institution.

- Accrual Accounting: This includes all operating activities within the company that are recorded, which includes cash accounting and all transactions that do not have cash flows, known as accruals. It is used by publicly traded companies, as this method receives market attention. These accounts are divided into credit accounts, which are the accumulation of money that the company owes to sellers until they are settled, and these are accounts payable, and the second section is debit accounts, which are all the money that customer debtors owe to the company or institution and are known as customer receivables.

Financial accounting can also be divided according to function, time period, or type of activity, as explained in the following:

Financial Accounting According to Its Functions

- Recording and documenting financial transactions in accounting books.

- Classifying and grouping transactions into specific accounts.

- Preparing financial statements from accounting records.

- Analyzing and evaluating financial data to extract insights and useful information.

Financial Accounting According to Time Period

- Accrual-based accounting: Recording transactions when they occur, regardless of the timing of cash flows.

- Cash-based accounting: Recording transactions when cash payment or receipt is made.

Financial Accounting According to the Type of Activity It Relates To

- Operating Accounting: Related to the daily activities of the company.

- Tax Accounting: Related to calculating taxes and tax obligations.

- Management Accounting: Focuses on providing information to management for decision-making.

Who are Debtors and Creditors in Financial Accounting?

Debtors in financial accounting are individuals or companies who owe money to the company as a result of purchasing goods or services on account (i.e., without immediate payment). In accounting records, debtors are recorded as assets because they represent amounts receivable that the company is expected to receive in the future.\

While creditors in financial accounting represent individuals or companies to whom the company owes money, due to the company's purchase of goods or services on account. In accounting records, creditors are recorded as liabilities because they represent amounts that the company must pay in the future.

How to Learn Financial Accounting?

Financial accounting can be learned through the following steps:

- Attending training courses and educational grants related to basic accounting concepts such as assets, liabilities, equity, revenues, and expenses.

- Studying Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Learning to use digital accounting software and systems such as Daftra, QuickBooks, or Microsoft Excel.

- Developing accounting experience and skills through solving accounting examples and problems, and preparing simple financial statements.

- Obtaining some professional certifications, such as Certified Public Accountant or Certified Management Accountant.

Why is Daftra the Magical Solution for Effective Financial Accounting?

Each accounting type is not handled separately, nor is one accounting principle applied while ignoring another. Therefore, Daftra's accounting program is the magical solution for accounting management that includes everything your business needs, regardless of how different your requirements are, and no matter how far your goals extend. Enjoy a free 14-day trial where you can verify that the system suits your requirements with the best quality and most suitable price.