Everything You Need to Know About Single-Entry Bookkeeping

Table of contents:

- Key Points

- What is Single-Entry Bookkeeping?

- Is Single-Entry the Same as Simple Entry?

- What is the Theory of Single-Entry in Accounting?

- How Does Single-Entry Bookkeeping Work?

- How Do You Record Single-Entry Bookkeeping?

- What Are the Most Important Practical Examples of Single-Entry Bookkeeping?

- How is Profit and Loss Calculated in Single-Entry Bookkeeping?

- What is the Single-Entry Bookkeeping System?

- How Does Daftra Help You Implement Single-Entry Bookkeeping?

- Frequently Asked Questions

Accounting or accounting fields are important factors for ensuring business continuity and success. Among all accounting systems used, double-entry bookkeeping is the preferred choice for medium and large companies to ensure accuracy and transparency of financial data. However, single-entry bookkeeping is considered an acceptable alternative in some cases, although it lacks the accuracy and transparency provided by double-entry bookkeeping. Nevertheless, single-entry bookkeeping still has good qualities as follows:

- Simplicity and ease of implementation

- Moderate cost

- Time and effort savings

- Recording fewer transactions

In this article, you will discover what single-entry bookkeeping is, how to implement it in small companies, and how it is calculated.

Key Points

- The single-entry system maintains one side of each transaction and records each transaction in a single entry, as used in completing income and expense statements.

- It is used in small businesses that lack the resources and financial capacity to support a comprehensive accounting system.

- Nominal accounts and real accounts are not recognized in the single-entry system, as it does not include assets and liabilities, nor does it include the balance sheet.

- Simple entries are a type of double-entry, not single-entry, as double-entry bookkeeping is divided into simple entries and compound entries.

- Calculating a company's profit or loss with single-entry bookkeeping can only be done by having the total capital at the end of the year and the total capital at the beginning of the year.

- Single-entry bookkeeping requires following specific rules, such as making cash entries on the debit side, making payment entries on the credit side, in addition to debiting increases and recording decreases for the capital account.

- By knowing the value of capital at the beginning and end of the accounting period, profit or loss can be calculated accurately, and once the balance for each account is determined, the balances are arranged in a specific way that helps with comparison and analysis.

- Bookkeeping is a vital tool for organizing and documenting financial transactions in one place, making it easier for companies and individuals to understand their financial position accurately and retrieve information easily when needed.

What is Single-Entry Bookkeeping?

Single-entry bookkeeping is an accounting system that relies on recording financial transactions in only one account for each business transaction. This system aims to simplify the transaction recording process and reduce costs and time consumed in accounting transactions, instead of using the double-entry system, which requires recording transactions in two reciprocal accounts.

Transactions are recorded in a cash book that includes details for each transaction, such as date, description, and whether it is an expense or income. The company maintains only the cash book and personal accounts for creditors and debtors without creating a general ledger. Each company transaction is recorded in the cash book without applying double-entry bookkeeping principles.

Nominal accounts and real accounts are not recognized in the single-entry system, which is used to record daily and periodic company operations such as sales, purchases, and expenses. Accounts are not divided into categories such as assets, liabilities, and expenses in single-entry bookkeeping, but rather the transaction is recorded in only one account, which facilitates inventory of liabilities and assets and determines the profitability of the accounting period at its end.

Is Single-Entry the Same as Simple Entry?

What is the difference between simple entry and single-entry? This is a question many people ask, but there are differences between these two types of entries, which relate to assets and liabilities, development, information provision, transaction recording, and uses as well. Here are the detailed differences between simple entry and single-entry:

| Simple Entry | Single-Entry |

| Includes assets and liabilities | Does not include assets and liabilities |

| More advanced and accurate | Basic and simple system |

| Provides more information about money movement | Does not provide sufficient details about money movement |

| Records each transaction in two accounts, with only one side as the creditor and the other as the debtor | Records each transaction in only one account |

| Simple entry is used in small and medium-sized companies | Single-entry is primarily used in small and personal projects |

What is the Theory of Single-Entry in Accounting?

Single-entry is considered a foundation for analyzing financial resources and obligations at the beginning and end of the fiscal year. At the beginning of the fiscal year, single-entry reviews available financial resources, including balances in main accounts that can be considered capital.

It also determines obligations and debts that must be paid to start the fiscal year. At the end of the period, single-entry reviews the remaining values of assets and obligations after the end of the accounting period.

After knowing what the theory of single-entry is, all accounts are linked through the following equation:

Capital = Assets - Liabilities

The system focuses on capital at the beginning and end of the accounting period because calculating a company's profit or loss with single-entry bookkeeping can only be done by having the total capital at the end of the year and the total capital at the beginning of the year, as shown in the following equations:

Opening Capital = Opening Assets - Opening Liabilities

Closing Capital = Closing Assets - Closing Liabilities

Net Profit and Loss = Closing Capital - Opening Capital

| The Daftra software helps you execute this equation easily by providing many tools, such as allowing entry of various financial transactions into the system, and also gives you the ability to record daily transactions in addition to extracting balances and obtaining permanent reports. The information that you obtain through the software helps you complete the single-entry equation easily and quickly. |

How Does Single-Entry Bookkeeping Work?

Single-entry bookkeeping involves recording one financial transaction using only one account in the ledger. This means there is no corresponding account used to record the transaction. The answer to the question of what the single-entry method involves is one transaction, following account rules, documenting transactions, and ensuring balance. Below, you will learn how single-entry bookkeeping works in detail:

- Recording only one transaction: This means that the single account related to the financial transaction must be identified and recorded in the ledger without needing a corresponding account.

- Following rules related to each account type: The debit side and credit side must be determined based on the nature of the financial transaction. For example, personal account entries are made on the debit side for accounts receivable and on the credit side for accounts payable.

- Documenting transactions: Every transaction must be fully documented, including the transaction date, account used, description of the financial operation, and the amount associated with it.

- Ensuring entry balance: Balance of the entry must be ensured, where the total debit balances must equal the total credit balances in the entry.

Examples of Applying the Previous Rules:

To better understand single-entry rules, here are more illustrative examples:

- If cash is received from a customer, this transaction is debited on the debit side.

- If payment is made for goods to a supplier, this transaction is credited on the credit side.

- If goods related to the business are sold on credit, this transaction is debited to the customer's personal account.

- If company funds are invested, the capital account will be credited.

Therefore, recording single-entry is an important process in accounting that contributes to documenting financial operations accurately and systematically. Recording single-entry requires a set of simple steps that can help ensure the accuracy of financial data and accounting reports.

How Do You Record Single-Entry Bookkeeping?

Through the following steps, you will learn how to record single-entry bookkeeping easily, starting from the financial transaction, account identification, recording, documentation, and review:

- Identify the Financial Transaction: Determine the financial transaction that needs to be recorded. This transaction can be a purchase, sale, debt payment, receipt of money, or any other financial operation.

- Identify the Account: In single-entry bookkeeping, only one account is used to record the transaction. The account is chosen based on the type and nature of the transaction, such as a cash account, a bank account, or a sales account.

- Record the Transaction: After identifying the account, record the transaction in the ledger, writing the account name and the value of the financial transaction associated with it.

- Document the Transaction: To ensure accuracy of accounting records, the transaction must be marked with appropriate documentation, such as the transaction date and a brief description of it.

- Audit and Review: Once the transaction recording is completed, the accuracy of the entry must be verified and matched with approved financial documents, and the accuracy of accounting records must be reviewed.

The following template illustrates the practical format of single-entry bookkeeping:

| Date | Account Number | Account Name | Description | Amount | Balance |

| xxxxx | xxxx | A/C xxxx | xxxx | xxxx | xxxx |

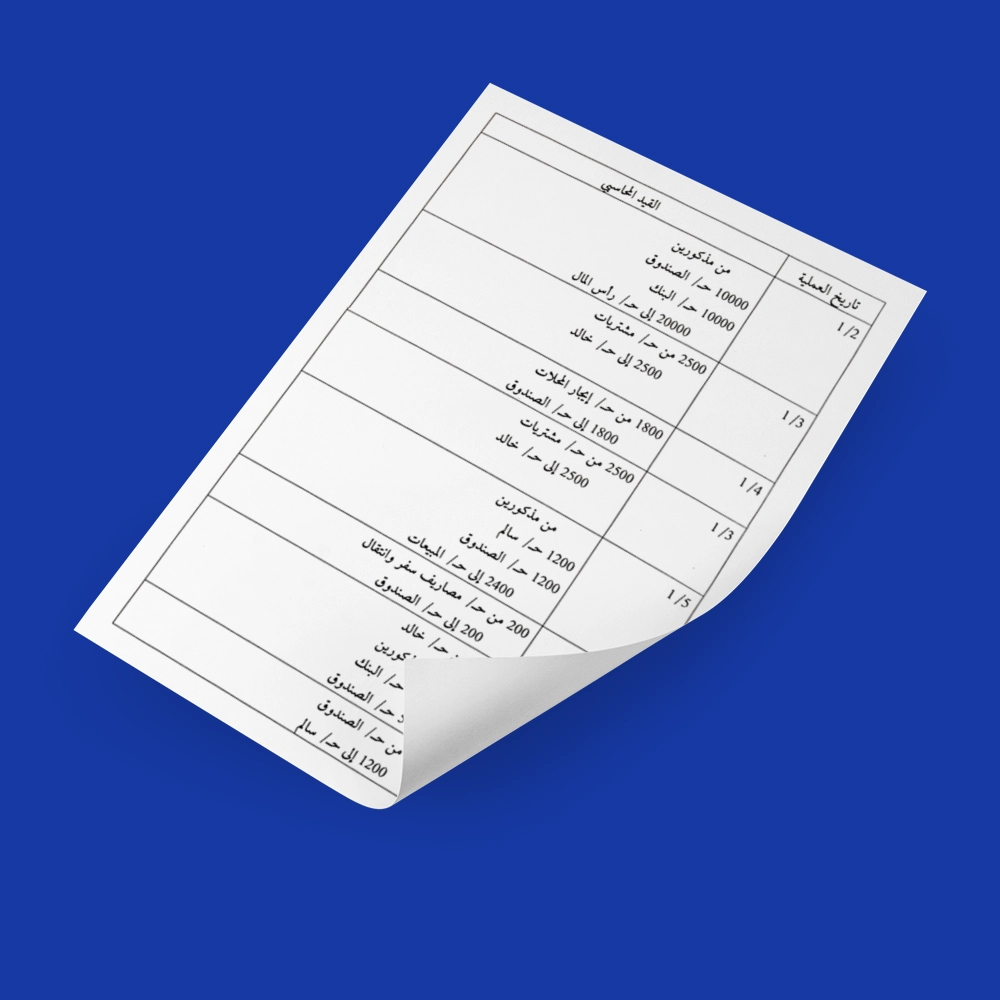

What Are the Most Important Practical Examples of Single-Entry Bookkeeping?

Through practical examples, you can easily understand the single-entry method. In the following paragraphs, you will find a comprehensive practical example to explain this method:

- A customer paid $60,000 to purchase goods from a store on 2/1/2023.

- Meanwhile, the store purchased electrical equipment on 2/31/2023 for the store on credit for $5,000.

- The total cash with which the store began the accounting period was $50,000.

- The total creditors' balance was $10,000.

Required: Record the single entries

Single Entry:

| Date | Account Number | Account Name | Description | Revenue (USD) | Expense (USD) | Total Balance (USD) |

| 2/1/2023 | 536 | Cash A/C | Goods sale | 60,000 | 110,000 |

| Date | Account Number | Account Name | Description | Revenue (USD) | Expense (USD) | Total Balance (USD) |

| 2/31/2023 | 666 | Creditors A/C | Office equipment | 5,000 | 15,000 |

How is Profit and Loss Calculated in Single-Entry Bookkeeping?

After recording individual entries during the accounting period, the next step is to determine the total balance for each main account.

By knowing the value of capital at the beginning and end of the accounting period, profit or loss can be calculated accurately. Once the balance for each account is determined, the balances are arranged in a specific way that helps with comparison and analysis. This arrangement involves classifying accounts based on their nature and the type of operations they represent, and the arrangement is usually as follows:

Example

The following data were available for an individual project (amounts in dollars):

| Details | 1/1/2020 | 31/1/2020 |

| Assets | Cash | 60,000 |

| Accounts Receivable | 40,000 | 70,000 |

| Inventory | 30,000 | 50,000 |

| Liabilities | Accounts Payable | 15,000 |

Additional transactions: Capital withdrawal of 50,000 Capital addition of 25,000

Required: Calculate total profit and loss

- Opening Capital = Opening Assets - Opening Liabilities

= (60,000 + 40,000 + 30,000) - 15,000 = 115,000

- Closing Capital = Closing Assets - Closing Liabilities

= (100,000 + 70,000 + 50,000) - 25,000 = 195,000

- Total Profit and Loss = Closing Capital - Opening Capital + (Additions - Withdrawals)

= 195,000 - (115,000 + 25,000 - 50,000) = 105,000

What is the Single-Entry Bookkeeping System?

Bookkeeping is a vital tool for organizing and documenting financial transactions in one place, making it easier for companies and individuals to understand their financial position accurately and retrieve information easily when needed. When it comes to analyzing financial performance and extracting data for preparing financial reports, bookkeeping becomes an essential tool.

Using the single-entry system, each financial transaction is recorded in only one account, making it easier to track and understand.

The ledger includes all recorded accounting entries, starting from the opening balance of each account and ending with the total closing balance, providing a comprehensive picture of the company's financial activity during the accounting period.

Thanks to the accuracy and continuity of recording financial transactions, company management can make strategic decisions based on accurate and reliable information.

So what is single-entry bookkeeping? Single-entry bookkeeping is considered a vital tool for financial management and making smart decisions in business management. The single-entry bookkeeping system is illustrated in the following template:

| Date and Description | Account Type | Expenses | Income | Account Balance |

| 02/08 Opening Balance | Capital A/C | $8,000 | ||

| 02/09 Sales | XXX | $2,000 | $10,000 | |

| 02/10 Rent | XXX | $1,000 | $9,000 | |

| 02/11 Closing Balance | XXX | $9,000 | ||

| Total | XXX | XXX | XXX |

Single-entry accounting is most suitable for small cash-based businesses that have a limited number of transactions and do not need to track assets and liabilities.

It can provide a basic income statement to determine profitability, but it does not provide a balance sheet to show assets and debts. As companies grow, they transition to double-entry accounting systems that provide more financial control and reporting capabilities.

In the future, single-entry accounting may decline in use as small businesses adopt more technology and automated accounting solutions. Additionally, the single-entry system is an informal system and is not used internationally like double-entry bookkeeping.

Therefore, it is unlikely to be used in tax-registered companies with multiple business transactions. However, the simplicity of single-entry will remain attractive to some small businesses, despite its limitations.

Overall, single-entry accounting fills a niche for tracking basic income and expenses, but it lacks the accuracy and comprehensive reporting of double-entry accounting.

How Does Daftra Help You Implement Single-Entry Bookkeeping?

Daftra offers you many advantages that make implementing single-entry bookkeeping easy by providing an integrated system that allows you to automatically enter your financial transactions and daily operations. It also provides you with periodic accounting reports so you can analyze all annual and monthly expenses, along with many other features that give you all the information needed to implement single-entry bookkeeping simply.

Subscribe to Daftra accounting software to get multiple tools and ease in all your operations.

Frequently Asked Questions

What is an Entry in Accounting?

An entry in accounting is a record of financial transactions in the company's accounts, which consolidates all the company's internal and external financial activities.

What are the Advantages of Single-Entry Bookkeeping?

- It does not contain complex details and is characterized by great simplicity and ease.

- It helps record financial transactions faster and more simply.

- It suits small companies and helps them form a complete picture of their financial operations.

Who is the Single-Entry System Suitable For?

- Small business and enterprise owners.

- Freelancers and self-employed individuals.

- Owners of small assets.

- Those who have simple cash-based businesses.