What is amortization in accounting?

Table of contents:

- What is amortization in accounting?

- What is the importance of amortization in accounting?

- How is the amortization of intangible assets calculated?

- How is a loan amortized?

- What is the difference between depreciation and amortization?

- Frequently Asked Questions

- What are the methods of amortization in accounting?

- What are the factors affecting amortization in accounting?

- What are amortization journal entries in accounting?

- What is the difference between accumulated amortization and amortization expense?

- What are the common errors associated with amortization in accounting?

Some items you personally purchase may lose value over time, whereas others may increase in value. But in business management, the situation is completely different.

Every company must account for the money it spends on purchases and determine whether these are intangible assets that cannot be sold over time or tangible assets that the company can benefit from at some point.

Within all these calculations, the concept of amortization appears. So, what is it, and how do companies calculate it?

What is amortization in accounting?

Amortization in accounting is the process of allocating the cost of an asset or long-term liability over the period during which the company benefits from that asset or liability.

In other words, the company distributes the cost of the asset or liability over a specific period equal to the asset’s useful life. This allows the company to recognize the asset's actual value each year and helps match expenses with the revenues or benefits generated by that asset or liability.

Amortization in accounting primarily targets recording the value of intangible assets, such as copyrights, patents, and others, and allocating them over their productive life in a way that ultimately affects the company’s financial statements and balance sheet, and consequently, its tax obligations.

The cost is allocated over the asset's or liability's useful life in equal periodic installments, and with each installment, the asset's value decreases until it reaches zero at the end of its useful life.

Calculating amortization is a practical application of the matching principle in accounting, one of the pillars of Generally Accepted Accounting Principles (GAAP). This principle requires recognizing expenses in the same period in which the related revenues are earned, rather than when the costs are paid.

Also read: What is fair value and how to calculate it

What is the importance of amortization in accounting?

Calculating amortization in organizations plays an important role in financial management, strategic planning, organizing financial statements, and more. The following points address the question: What are the objectives of amortization in accounting?

- Effective cash flow management: Amortization allows large liabilities or debts to be divided into smaller payments that can be met on their scheduled dates, saving a significant amount of money for other expenses or investments.

- Allocating the cost of assets: Amortization is used to distribute the cost of fixed assets over their useful life, thus benefiting from not charging the full cost of the asset at the time of purchase.

- Making informed decisions: Amortization provides accurate financial data and reports that support informed decision-making by precisely allocating the cost of intangible assets over their productive lives.

- Reducing tax rates on profits: Applying amortization in accounting and distributing asset costs leads to a reduction in the taxes the company pays.

- Financial planning: Knowing the value of amortization each year helps organizations in budgeting and accurate financial forecasting, contributing to planning, cash flow management, and making informed investments.

- Compliance with accounting standards: Amortization helps ensure adherence to accounting principles applicable to organizations operating in countries that follow Generally Accepted Accounting Principles (GAAP), as non-compliance may expose the company to legal penalties and other challenges.

- Improving the efficient management of fixed assets: Amortization supports monitoring the value of intangible assets over time, helping companies determine when an asset’s value is declining and thus take necessary actions in a timely and appropriate manner.

How is the amortization of intangible assets calculated?

Calculating the amortization of non-current assets helps accurately assess the organization's financial performance by comparing the revenues generated by the assets with the amortization costs. The following are the steps to calculate asset amortization:

1– Determining the cost of assets

The first step in calculating the amortization of intangible assets is to determine the initial cost that the company will incur. This may include the purchase price, legal fees, and other costs directly related to acquiring those assets.

At this step, an asset management program like Daftra helps set up amortization settings according to the nature of the business and assets. The program also makes it easier to track assets and provides detailed reports on purchase and sale transactions related to them.

2– Determining the salvage value

In this step, management must determine the salvage value that the company will recover at the end of the asset’s useful life. Usually, the salvage value of intangible assets is zero, as most cannot be resold once their useful life ends.

3– Determining the useful life of the asset

Here, management estimates the period during which the asset will provide the most benefit and generate revenue.

4– Applying the amortization formula

In this step, management uses one of the well-known methods for calculating amortization, such as:

- Straight-line method

- Declining balance method

- Sum-of-the-years’-digits method

- Units of production method

5– Recording journal entries for amortization

Management must record amortization expenses in the company’s financial records and journals to maintain accuracy and reflect the organization’s correct financial status.

Here, the chart of accounts in a system like Daftra allows for automatic recording of journal entries for amortization expenses with precise results.

Also read: What is the asset turnover ratio?

How is a loan amortized?

The concept of loan amortization refers to the borrower repaying the debt through regular installments, consisting of two parts: the first is the portion of the principal the borrower originally received, and the second is the interest agreed upon with the lender, if the loan carries interest.

With each installment, the portion of the payment allocated to interest decreases, and a larger portion goes toward reducing the principal. This shows how the payments made by the borrower affect the loan balance and the amount that will remain owed over time.

What is the difference between depreciation and amortization?

The main difference between depreciation and amortization is that depreciation relates to the company’s tangible assets, such as buildings, equipment, and devices, whereas amortization relates to intangible assets, as explained earlier in this article.

However, tangible assets may retain value even when the company no longer needs them, as they can be sold, even at a price below the amount the company originally paid.

In this case, management calculates the asset's resale value, deducts it from the initial purchase cost, and divides the remaining amount over the asset's expected useful life. The amount allocated to each year is treated as depreciation and deducted from the company’s taxable income.

Frequently Asked Questions

What is the amortization law in accounting?

It is the method used to allocate the cost of intangible assets from fixed assets over the asset’s expected or useful life. The purpose of the amortization law in accounting is to determine the cost of using assets at a specific point in time and to evaluate the profit and loss for the period in which amortization is calculated.

What are the methods of amortization in accounting?

There are four main methods of amortization in accounting: the straight-line method, the declining balance method, the sum-of-the-years’-digits method, and finally, the method of calculating the amortization of intangible assets based on the number of units produced using these assets.

What are the factors affecting amortization in accounting?

Amortization in accounting is influenced by several factors, including:

- The asset's purchase cost and operating expenses.

- The expected useful life of the asset.

- The salvage value of the asset at the end of its useful life.

- The amortization method used affects how the asset cost is distributed over its useful life.

- The asset's operating conditions and usage affect the rate of amortization.

- Regular maintenance of the asset influences its lifespan and amortization rate.

- Sometimes economic conditions, such as recessions or inflation, affect asset values and the choice of amortization method.

What is the accumulated amortization in the balance sheet?

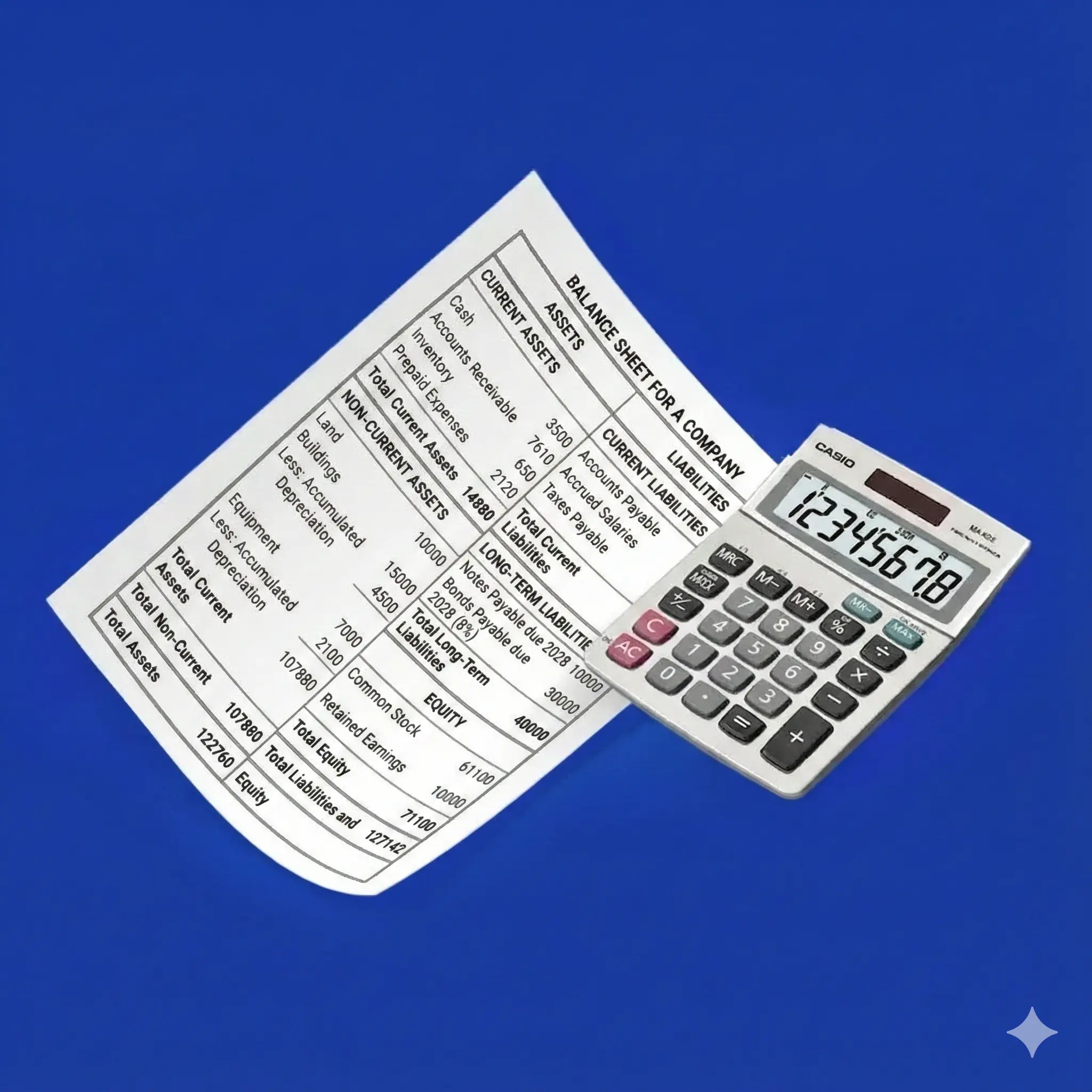

Accumulated amortization is an account linked to fixed assets in the balance sheet. It is used to calculate the book value of assets without affecting their original cost. The expenses recorded in this account are classified as credit amounts.

How can accumulated amortization be calculated?

Accumulated amortization can be calculated using the following accounting formula:

Accumulated Amortization=Annual Amortization (Straight-line or Declining Balance)×Number of Years the Asset Has Been Used

What are amortization journal entries in accounting?

Amortization journal entries in accounting refer to the accounting process used to distribute the cost of an asset over its useful life. The entries include three types: amortization entry, fair value entry, and transfer entry.

These entries are processed by recording the amortization expense as a debit in the income statement to reduce profits, then transferring it as a credit in the accumulated amortization account, and finally transferring the entry to the balance sheet and deducting it from the fixed asset’s value to reflect the book value.

What is the difference between accumulated amortization and amortization expense?

The difference lies in scope: amortization expense is a sub-step in allocating the cost of an asset over its useful life, which then contributes to the total accumulated amortization recorded in the accounts.

What are the common errors associated with amortization in accounting?

- Inaccurate estimation of the asset’s useful life.

- Using inappropriate amortization methods for the asset.

- Omitting accounting adjustments for book amortization and tax amortization.

- Failing to record some amortization entries or recording them incorrectly.

- Ignoring the salvage value of the asset after its useful life ends.

- Not updating amortization estimates based on the asset’s operational usage.

In conclusion, this article has covered the most important aspects of the amortization concept in accounting and its impact on company management. If you want to manage your company’s assets easily, you can rely on Daftra accounting software, which helps manage assets and their accounts simply and efficiently from anywhere, following various accounting principles.