What is the Chart of Accounts and How to Prepare It

Table of contents:

- What Is the Chart of Accounts?

- What Are the Benefits of the Chart of Accounts?

- Why Is the Chart of Accounts Used?

- How to Create a Complete Chart of Accounts

- What Are the Main Accounts in the Chart of Accounts?

- How Are Codes Set Up in the Chart of Accounts?

- Assets in the Chart of Accounts

- Types of Assets in the Chart of Accounts

- Accrued Expenses in the Chart of Accounts

- Purchases Account in the Chart of Accounts

- Loans in the Chart of Accounts

- Employees' Account in the Chart of Accounts

- Suppliers in the Chart of Accounts

- Chart of Accounts in Daftra

The chart of accounts is, simply, a list or statement in which all of a company’s accounts are recorded. It is called a “chart” because it is structured in a tree-like form, branching into several sections, including main accounts and sub-accounts. The chart of accounts is considered the core foundation of the accounting system.

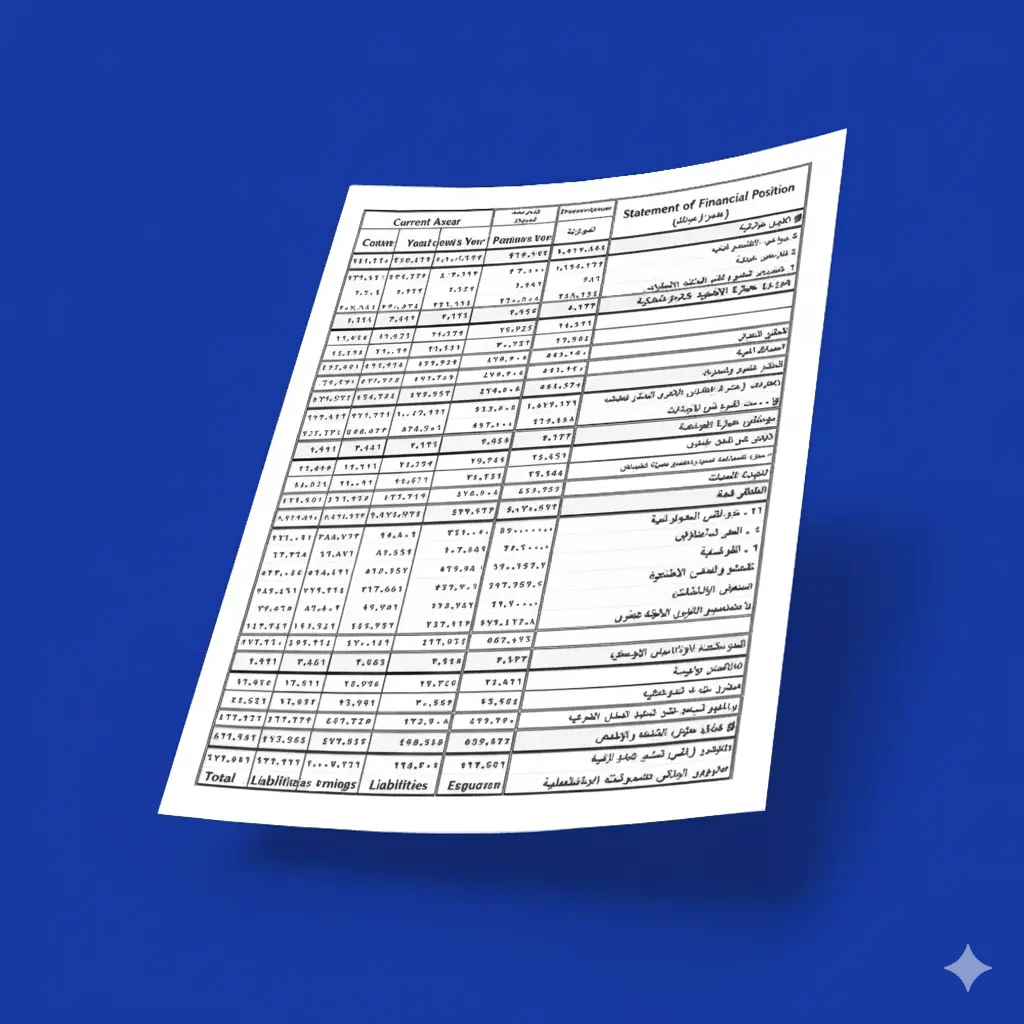

The accounts derived from the chart of accounts are divided into balance sheet accounts, which include assets and liabilities, and income statement accounts, which include the various sources of revenues as well as expense items. This section covers all types of expenses.

Article Content

- What is the Chart of Accounts?

- What are the benefits of the Chart of Accounts?

- Why is the Chart of Accounts used?

- How to create a complete Chart of Accounts

- What are the main accounts in the Chart of Accounts?

- How are codes set up in the Chart of Accounts?

- Assets in the Chart of Accounts

- Accrued expenses in the Chart of Accounts

- Purchases account in the Chart of Accounts

- Loans in the Chart of Accounts

- Employees' accounts in the Chart of Accounts

- Suppliers in the Chart of Accounts

- Chart of Accounts in Daftra

What Is the Chart of Accounts?

The chart of accounts, also known as the account guide or accounting directory, is one of the most important elements of the accounting system. To understand what is meant by the chart of accounts, we should first clarify the concept of an account. An account is a tool used to record all financial transactions under a specific category, such as sales. For example, the sales account summarizes all financial transactions related to sales.

To classify and organize all financial transactions within an organization, we rely on the chart of accounts, which serves as an organizational map that makes it easy to refer to any account and identify its position among other accounts. Typically, the numbering system begins with balance sheet accounts, followed by income statement accounts, as follows:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

What Are the Benefits of the Chart of Accounts?

Using a chart of accounts is considered the best way to ensure the proper organization of accounting data procedures, whether through accounting software or manual recording.

Although designing a chart of accounts requires significant effort from the finance team at the beginning, it later simplifies all procedures and saves time spent on recording transactions, as well as adding new accounts or deleting old ones.

The chart of accounts makes it easy to access all details related to a specific section of accounts. For example, you can access employee wages or the wages of employees in a specific department within just a few seconds. The importance of the chart of accounts can be summarized as follows:

- Unlimited levels, allowing an infinite number of branches.

- Full flexibility in adding and modifying accounts.

- Ensures proper organization of accounting financial data.

- Easy access to accounting financial information.

- Facilitates the financial review process by examining main and sub-accounts.

- Saves time and effort in recording transactions and in adding or removing accounts.

- Supports decision-makers by facilitating managerial accounting processes related to organization and financial planning.

Why Is the Chart of Accounts Used?

The chart of accounts, also referred to as the account guide, is used to ensure success in the first step of the accounting system and to support sound decision-making in all procedures followed in the later stages.

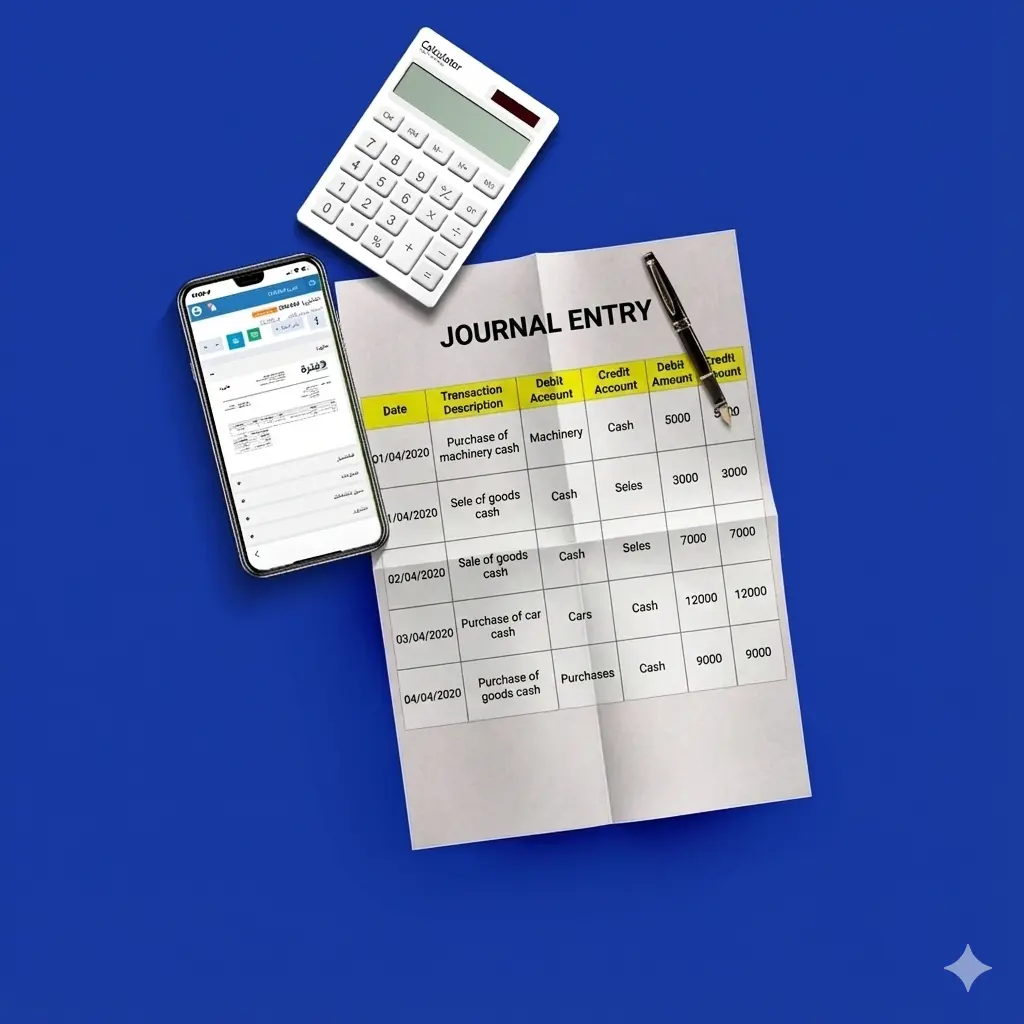

Whether the chart of accounts is for a commercial or non-commercial entity, profit or non-profit, it is considered essential, as it helps record, store, and track all items and entries, either automatically or manually. It is also characterized by its flexibility, allowing it to be modified and adjusted according to the company’s or organization’s specific account structure.

You can start creating your own chart of accounts now by using Daftra’s free, ready-made chart of accounts template.

How to Create a Complete Chart of Accounts

A chart of accounts is created in two stages. The first stage involves defining the items and levels of the accounting chart for the organization. The second stage involves assigning codes to these items.

First Stage: Defining the Levels of the Accounting Chart

Any chart of accounts is based on five main accounts, from which various items branch out. All these items are classified into levels that are determined according to the nature of the organization.

Levels of the Accounting Chart

Level One:

This level includes the main accounts of the chart of accounts: assets, liabilities, equity, revenues, and expenses. These form the foundation from which all other items branch out across several levels.

Level Two:

This level includes the sub-items of the level one accounts. Assets are divided into current assets and non-current assets. Liabilities are divided into current liabilities and non-current liabilities.

Equity is divided into capital, reserves, and retained earnings. Expenses are divided into administrative expenses, selling expenses, and operating expenses. Revenues are divided into sales revenues and miscellaneous revenues.

Level Three:

This level includes the sub-items of the level two accounts. Current assets are divided into cash and its equivalents, customers (accounts receivable), inventory, other receivables, and advances. Non-current assets are divided into long-term (fixed) assets, intangible assets, and investments.

Current liabilities are divided into suppliers (accounts payable), short-term loans, provisions, and other payables. Non-current liabilities are divided into long-term loans, long-term provisions, and deferred tax liabilities.

Level Four:

This level includes the sub-items of the level three accounts. Long-term (fixed) assets are divided into buildings, machinery, and vehicles. Intangible assets are divided into patents and goodwill.

Investments are divided into investments in associate companies, investments in subsidiaries, and investments available for sale. Customers are divided into retail customers and wholesale customers, or domestic customers and international customers.

Level Five:

This level includes the sub-items of the level four accounts and is considered an analytical level for certain items. The more analytical and detailed the levels are, the greater the accuracy and focus of the chart of accounts.

Following this approach, an unlimited number of assets, branches, sub-branches, and so on can be added.

Second Stage: Coding the Accounts

Coding the accounts simply means assigning a unique number to each main and sub-account in an organized manner. How does this work?

In the coding method, we rely on sequence and hierarchy. We start with the level one items, which are five in total. Each item is assigned a number from (1) to (5) as follows: assets are assigned code (1), liabilities (2), equity (3), revenues (4), and expenses (5).

Next, we move on to the level two items. We begin with the items branching from assets, which are two. The first is assigned (1) and the second (2), with the main account code (assets) added to them. Accordingly, current assets are assigned code (11), and non-current assets are assigned code (12).

If you believe that creating a chart of accounts is a complex task, you can rely on a ready-made template instead of starting from scratch. Download a free, fully editable chart of accounts template from Daftra now.

What Are the Main Accounts in the Chart of Accounts?

The chart of accounts is prepared across several hierarchical levels, each branching out from the previous one. The level one accounts are considered the main accounts in the chart of accounts, namely: assets, liabilities, equity, revenues, and expenses. Accounts are numbered according to this order, typically starting with balance sheet accounts, followed by income statement accounts.

Read also: Definition of the Income Statement

It is worth noting that the chart of accounts differs from one company to another, depending on the types of accounts used, as each business has its own nature. Since accounts merely reflect the transactions carried out by the organization, it is natural for charts of accounts to vary between entities. However, these differences usually appear only at the lower levels of the chart.

How Are Codes Set Up in the Chart of Accounts?

An example helps clarify the concept. When using code (1) at the beginning of the chart of accounts to represent assets, the structure of the chart will be as follows:

Assets (Code 1):

If fixed assets are included under assets, they are assigned code (11), as they fall under assets, which carry code (1) as the first main category.

If a computer is listed under the fixed assets branch, which in turn falls under assets, it will be assigned code (111).

If a category for technical equipment, such as imaging and printing devices, is added, it will be assigned code (112), since the computer is the first item under the equipment category, which itself falls under fixed assets, and fixed assets fall under assets.

The numbering process should be carried out with precision. In most companies, numbering is done as follows: assets are assigned number 1, liabilities number 2, expenses number 3, and revenues number 4. This method helps accounting staff add accounts correctly and classify them according to their type, whether they fall under assets, liabilities, expenses, or revenues.

Read also: Accounting Tables: What Are They, Their Importance, and How to Use Them.

Illustrative Example of Chart of Accounts Coding

| #1 | Assets | |||

| #11 | Current Assets | |||

| #111 | Cash | |||

| #112 | Customers | |||

| #123 | Inventory | |||

| #12 | Non-Current Assets | |||

| #121 | Long-Term (Fixed) Assets | |||

| #1211 | Buildings | |||

| #1212 | Machinery | |||

| #1213 | Vehicles | |||

| #122 | Intangible Assets | |||

| #1221 | Patents | |||

| #1222 | Goodwill | |||

| #123 | Investments | |||

| #1231 | Investments in Associate Companies | |||

| #1232 | Investments in Subsidiary Companies | |||

| #1233 | Investments Available for Sale | |||

| #2 | Liabilities | |||

| #21 | Current Liabilities | |||

| #211 | Suppliers | |||

| #212 | Short-Term Loans | |||

| #22 | Non-Current Liabilities | |||

| #221 | Long-Term Loans | |||

| #222 | Long-Term Provisions | |||

| #223 | Deferred Tax Liabilities | |||

| #3 | Equity | |||

| #31 | Capital | |||

| #32 | Reserves | |||

| #33 | Retained Earnings | |||

| #4 | Revenues | |||

| #41 | Sales Revenues | |||

| #42 | Miscellaneous Revenues | |||

| #5 | Expenses | |||

| #51 | Administrative Expenses | |||

| #52 | Selling Expenses | |||

| #53 | Operating Expenses | |||

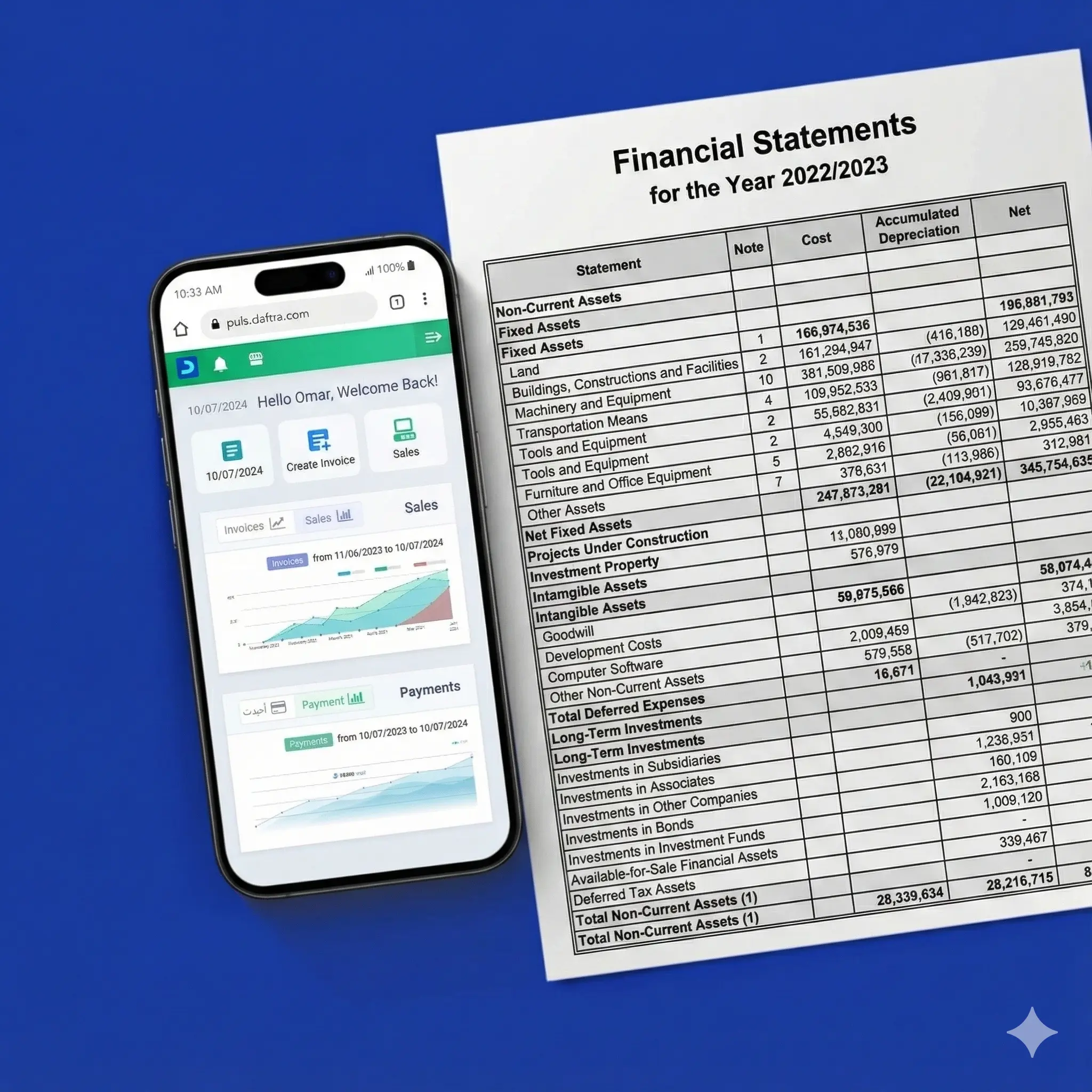

Assets in the Chart of Accounts

There are many definitions of financial assets, but one of the clearest and simplest defines them as all economic resources owned by an organization that can be utilized and measured in accordance with accounting principles. Assets can be classified into fixed assets, current assets, and intangible assets.

Types of Assets in the Chart of Accounts

Fixed Assets:

These are resources and properties used over the long term to facilitate production processes and complete tasks, not for resale. Examples include buildings, furniture, vehicles, and equipment.

Current Assets:

Also known as liquid assets, these are cash resources and properties that are utilized by being sold or converted into cash within a specific period, usually one year. Examples include short-term investments, cash, and inventory.

Intangible Assets:

These are non-physical (intangible) properties that nevertheless contribute directly to the sustainability and success of the organization, such as reputation, market presence, copyrights, and ownership rights.

In the chart of accounts, the assets category is usually assigned code (1). Under assets, the following are included:

- Fixed assets (11): including furniture (111), equipment (112), means of transportation (113), buildings (114), and so on.

- Current assets (12): including cash on hand (121), bank accounts (122), inventory (123), and so on.

- Intangible assets (13): including copyrights (131), patents (132), and so on.

See also: Ready-to-use and editable restaurant chart of accounts template from Daftra.

Accrued Expenses in the Chart of Accounts

Accrued expenses are expenses that relate to the current financial year but have not yet been paid. Common examples include accrued rent and accrued salaries. Regarding their position in the chart of accounts, accrued expenses usually appear as a sub-account under other expenses in the chart of accounts.

Purchases Account in the Chart of Accounts

The purchases account is one of the fundamental accounts in the chart of accounts, as it records all purchases made by the company from its suppliers. In the chart of accounts, the purchases account falls under current assets, which in turn fall under assets.

Loans in the Chart of Accounts

Loans are considered important accounts in the chart of accounts, as they are used to record all financial transactions related to loans obtained by the company from banks or other financial institutions. As for the position of the loans account in the chart of accounts, it falls under liabilities, also referred to as obligations.

Employees' Account in the Chart of Accounts

Employees are a key element in the formation of any organization and are involved in many financial transactions, such as salaries and wages, employee advances, and sales commissions, among others.

Regarding employee accounts in the company’s chart of accounts, salaries and wages are recorded as sub-accounts under expenses, while employee advances are recorded as sub-accounts under current assets, which are themselves sub-accounts of the main assets account.

Suppliers in the Chart of Accounts

The suppliers' account is used in the chart of accounts to record all financial transactions related to suppliers and to track amounts due to and from them. In terms of its position in the chart of accounts, the suppliers account appears as a sub-account under creditors, which is one of the sub-accounts of liabilities, specifically current liabilities.

You can also rely on Daftra’s supplier account reconciliation template, which is an important accounting tool for understanding financial obligations and ensuring transparency between parties in business relationships.

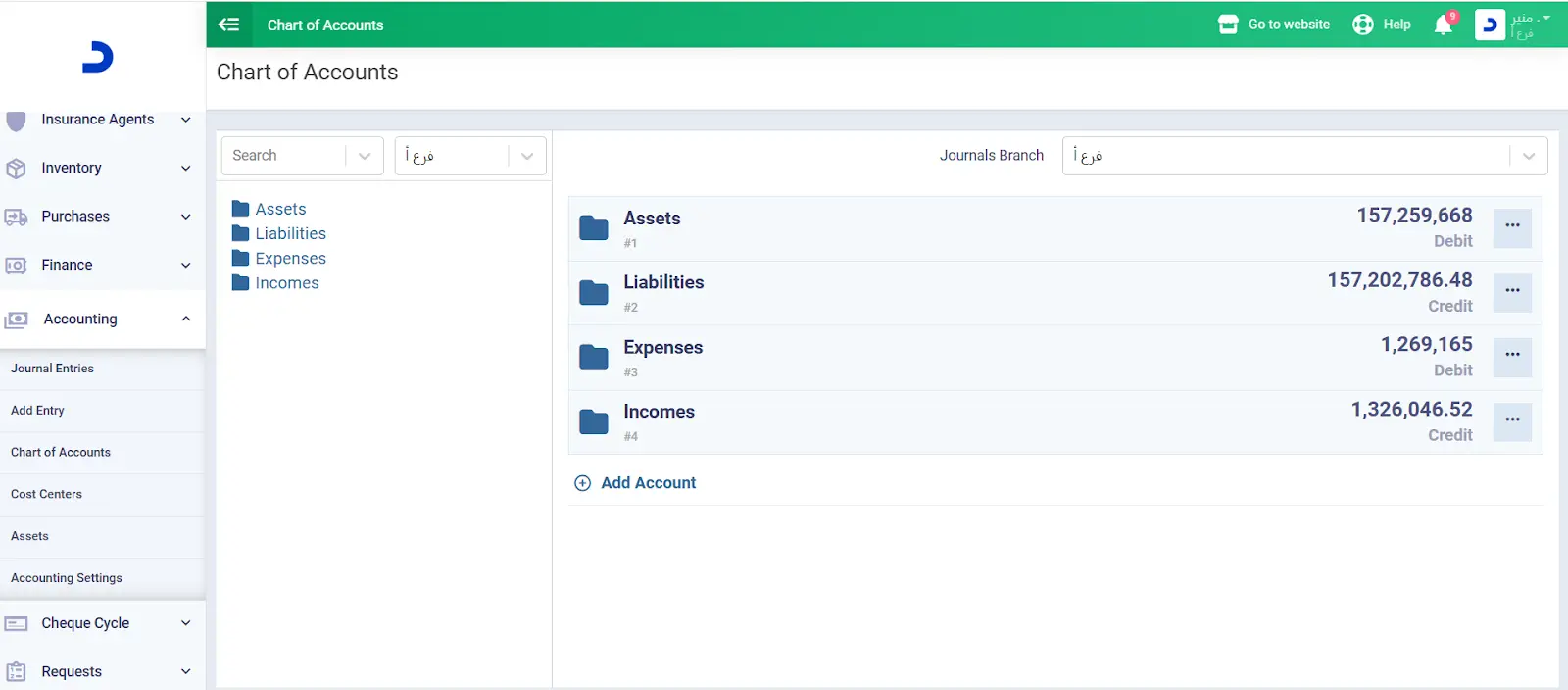

Chart of Accounts in Daftra

The General Accounting application in Daftra offers a range of advanced solutions that help you complete your accounting processes automatically and with ease. One of the most important features provided by Daftra’s General Accounting application is the chart of accounts.

With the expertise of accounting and programming specialists, Daftra’s chart of accounts has been designed to include main and sub-accounts by default, while providing full flexibility to add, modify, or delete any main or sub-account. This allows you to customize your chart of accounts to suit the nature of your organization’s activities.

This concludes our explanation of the chart of accounts, its purpose, and how to set it up. Today, accounting systems have nearly eliminated the need for paper-based methods.

Daftra’s accounting system offers automated management of everything related to the chart of accounts, enabling you to reduce accounting staff costs while enhancing the efficiency and accuracy of your business operations.