What is the Financial Leverage Ratio and Its Importance for Companies

Table of contents:

- What does the financial leverage ratio mean?

- What is the financial leverage ratio law?

- How is the financial leverage ratio calculated?

- What are the types of financial leverage ratios?

- What is the importance of the financial leverage ratio?

- What is the difference between operating leverage and financial leverage?

- How are financial leverage ratios evaluated?

- What is the impact of financial leverage ratios on a company’s profitability?

- What are the factors affecting financial leverage ratios?

- What is Daftra’s role in improving financial leverage ratios?

- Frequently Asked Questions

The financial leverage ratio is one of the most important financial ratios, illustrating the relationship between debt and capital. But how can debt be used to enhance returns, achieve investment goals, and maintain financial stability?

The answer simply depends on the financial management’s ability to adopt financing plans in order to choose the structure of funding sources, whether through equity or borrowing, to achieve a balance between risk and profit. In this context, we discuss the role of financial leverage ratios, their types, how to calculate them, and their impact on institutional financial performance.

All these details and more, along with practical examples of applying the laws to calculate the financial leverage ratio, are available to help business owners and financial officials strike a balance between internal and external financing to support expansion and sustainability in a competitive market.

What does the financial leverage ratio mean?

The financial leverage ratio measures the extent to which debt is used to finance assets and activities, thereby increasing profits. That is, it is the total debt divided by shareholders’ equity or total assets.

For example, if the financial leverage ratio is 70%, this means the company's funding structure includes 70% loans and other external financing and 30% self-financing or shareholders’ equity.

The company’s debts include the total liabilities, meaning what it owes in short-term and long-term debts, while shareholders’ equity includes paid-up capital, along with reserves and retained earnings.

Financial leverage ratios are among the most important financial measures used to assess a company's ability to meet its financial obligations.

They are also among the factors shaping the structure of financing within institutions and companies, as companies sometimes rely on a mix of equity and debt to finance operations. Therefore, financial leverage ratios must be applied appropriately to enable companies and institutions to generate higher profits.

What is the financial leverage ratio law?

Financial and business experts believe that the importance of financial leverage ratios lies in their ability to develop and expand the company’s activities, in addition to increasing its profits, provided these ratios are well understood, and their steps and laws are applied accurately.

The following are the laws of financial leverage ratios:

External financing ratio

It is an indicator of the extent to which the company relies on external financing sources to fund its assets and activities, such as bank loans, overdrafts, new partnerships, venture capital, issuing shares, leasing, installment purchases, or government grants.

A high external financing ratio is a positive indicator of profitability when the interest rate is below the return on investment. However, it also has a negative impact on the company’s independence, as shareholders own shares in exchange for their participation in the capital structure.

The following is how to calculate this ratio:

External financing ratio = Total long-term debt / Total assets

Debt-to-equity ratio

This ratio indicates the extent to which the company’s total debt is relative to equity, which includes capital, reserves, and retained earnings.

It indicates the extent to which the company relies on debt to finance operations rather than using its own assets.

A company with a high debt-to-equity ratio may face financial risks because it relies heavily on debt to finance its operations. If the company fails to repay the debt, the value of its shares may be reduced.

The following is how to calculate this ratio:

Debt-to-equity ratio = Total long-term and short-term debt / Total equity

Debt-to-assets ratio

This financial ratio shows the portion of the company’s assets financed by creditors. This ratio includes total short-term and long-term debts and obligations.

If this ratio exceeds 1, the company’s debt exceeds its assets, which may expose it to significant financial risk. If the ratio is less than 1, the company’s assets exceed its liabilities.

The following is how to calculate this ratio:

Debt-to-assets ratio = Total liabilities ÷ Total assets

Debt-to-capital ratio

This ratio measures the portion of the company's total capital used to purchase assets as a percentage of total capital.

It can also be a useful indicator to avoid investing in a business in case there is no financial liquidity.

The higher the debt-to-capital ratio, the greater the risk that the company will be unable to repay its debts.

The following is how to calculate this ratio:

(Short-term debt + Long-term debt) ÷ (Short-term debt + Long-term debt + Shareholders’ equity)

For example, if Company (X) has short-term debt of $600,000, long-term debt of $750,000, and total shareholders’ equity of $900,000, the calculation of the debt-to-capital ratio will be as follows:

Debt-to-capital ratio = (600,000 + 750,000) / (600,000 + 750,000 + 900,000) = 1,350,000 / 2,250,000 = 0.6 (This means that 60% of the company’s capital consists of debt).

How is the financial leverage ratio calculated?

The financial leverage ratio is calculated by combining total debt and total equity. The following are the main steps required to calculate the financial leverage ratio:

- Calculate the financial leverage ratios in accordance with the previously mentioned laws.

- Compare the financial leverage ratio with that of competitors in the same industry.

- Analyze financial leverage ratios by comparing the company’s current ratio with prior periods to assess the rate of change in debt.

- Analyze the effects of financial leverage ratios on the company’s financial position and performance.

- Make corrective decisions to improve capital structure, reduce debt-related risks, and increase investor returns.

You can rely on the financial leverage ratio template from Daftra to use for free. Download it now!

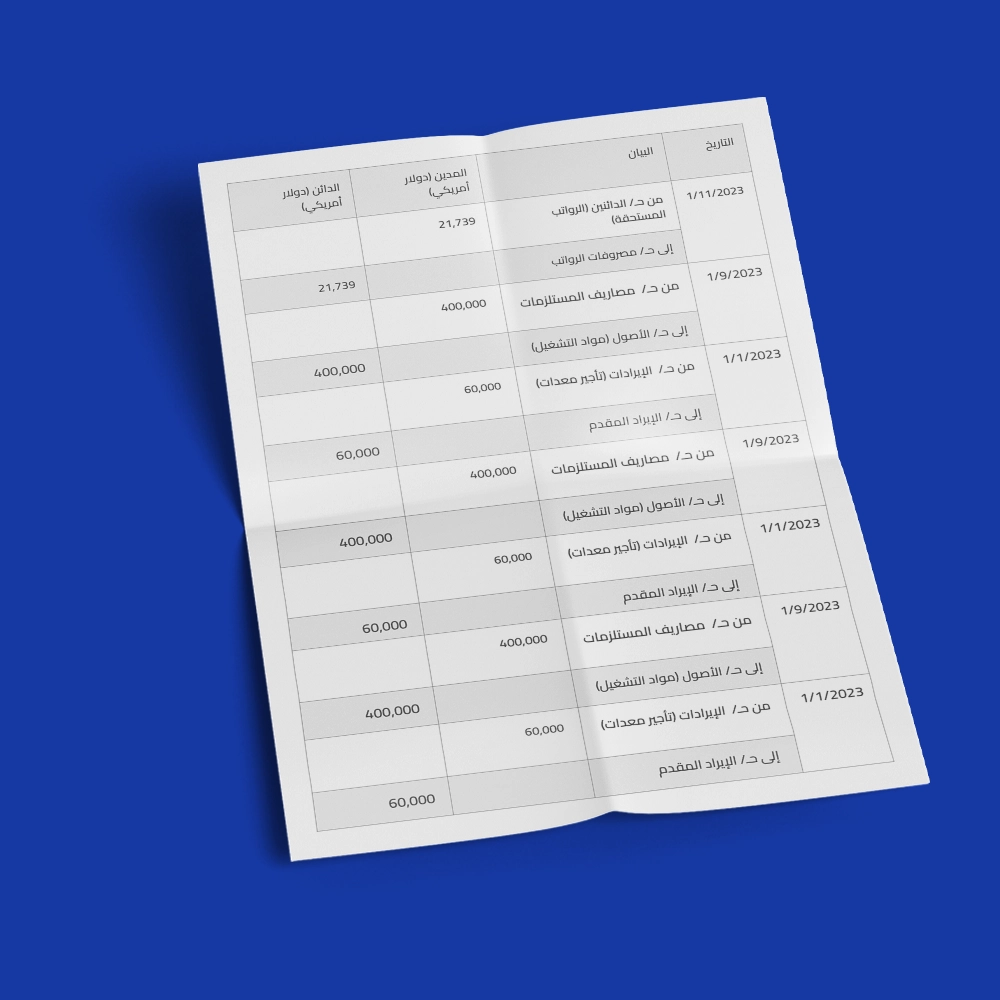

Practical example of calculating financial leverage ratios

Al-Yusr Import and Export Company owns assets estimated at about $400,000, and $100,000 in debt. The task is to calculate the financial leverage ratio.

Solution:

Based on the data, the financial leverage ratio can be calculated according to two types of leverage ratios:

- Debt-to-equity ratio = Debt / Equity =

100,000 / 400,000 = 0.25 (25%)

- Debt-to-assets ratio = Total liabilities ÷ Total assets =

100,000 / (100,000 + 400,000) = 100,000 / 500,000 = 0.2 (20%)

If you do not want to calculate the debt-to-equity and debt-to-assets ratios to avoid errors, especially when values are large, it is better to rely on the Daftra accounting system, which automatically performs these calculations using previously entered data.

What are the types of financial leverage ratios?

There are many ratios used to measure financial leverage, as these ratios focus on measuring the relationships between the capital structure, interest payable on loans, and the associated financial risks. The following are the most common types of financial leverage ratios:

1- Net financial leverage ratio

Net financial leverage ratio = (Net debt - Liquid current assets such as cash, etc.) / Earnings before taxes, interest, depreciation, and amortization.

The net financial leverage ratio is a financial ratio that indicates the proportion of debt a company incurs over a given period relative to its period-end revenue. These ratios help evaluate the company’s capital structure and operating expenses, and assess its ability to meet its financial obligations.

2- Operating leverage ratio

This is the ratio of a company’s fixed costs compared to its total costs, where fixed costs remain constant each period, while variable costs change with production levels.

The operating leverage ratio measures the extent to which a company’s contribution margin depends on net operating income. A 100% contribution margin ratio is considered ideal. The higher the company’s contribution margin, the greater its ability to cover operating expenses from available cash.

The operating leverage ratio also assesses the business's operational risk, as it is used to calculate the company’s breakeven point (the point at which revenues equal expenses over a specific accounting period), helping set appropriate selling prices to cover expenses and achieve profitability.

For example, rent and property taxes are fixed costs because the company must pay the same amount each period regardless of production levels, whereas sales commissions are variable costs because sales volume is not fixed. Total cost is a mix of all costs, whether fixed or variable.

A company that uses high fixed costs and low variable costs has a high operating leverage, which increases the potential risk the company and its operations may face. Conversely, a company with low fixed costs and high variable costs is said to have lower operating leverage.

Operating leverage ratio calculation:

Operating leverage ratio = Percentage change in earnings before interest and taxes / Percentage change in sales

The Daftra accounting system automatically and accurately calculates all types of financial leverage ratios by using the expense accounting program and the income statement, which show equity and sales, and the production accounting program, which shows production levels, among others, due to the interconnection of the system’s programs.

3- Total financial leverage ratio

The total or combined financial leverage ratio refers to combining the use of both the net financial leverage ratio and the operating leverage ratio to increase the potential return on investments. This includes using both debt financing and fixed costs to purchase assets or invest in operational activities and businesses.

The combined financial leverage ratio measures the company’s overall risk from financial and operating leverage. It also helps evaluate the risks associated with the company’s fixed costs. The higher the combined financial leverage ratio, the greater the company’s exposure to financial risks, and the higher the profit opportunities.

It is worth noting that when reviewing the balance sheet and income statement, operating leverage may affect the upper part of the statement, which includes operating income, while the net financial leverage ratio affects the remaining part.

Read also: Fixed costs and variable costs, and the most important differences between them

4- Debt-to-equity ratio

The debt-to-equity ratio is a type of financial leverage ratio that indicates the total debt borrowed by the company from others compared to shareholders’ equity.

The higher the return and profits generated from investing in debt financing rather than the company’s own assets relative to the interest on loans, the higher the financial leverage and, consequently, the higher the return on shareholders’ equity.

The debt-to-equity ratio varies depending on the industry or field and is calculated using the following accounting formula:

Debt-to-equity ratio = Total debt / Total shareholders’ equity

What is the importance of the financial leverage ratio?

The financial leverage ratio is considered an important indicator for evaluating a company’s status, future, and long-term financial stability. Each type of financial leverage ratio is applied based on the company’s requirements and the nature of its activities. The following are the importance of financial leverage ratios for companies:

1- Determining investment options

Financial leverage ratios serve as indicators for comparing available investment options and determining whether to invest in a particular company. The investor needs to ensure that the company has sufficient assets to cover liabilities and obligations.

2- Comparing debt to income for financial decision-making

The financial leverage ratio indicates the level of debt compared to available income. These ratios are used in economic and financial analysis and are among the most important indicators for making capital-boosting decisions in companies.

They provide management and company owners with indicators of the potential to expand operations. The financial leverage ratio also determines the degree of financial risk for the company: the higher the ratio, the greater the risks associated with debt, and vice versa.

3- Building lender confidence

Financial leverage ratios can provide indicators to lenders to determine whether the company can repay loans and to identify advantages that can be offered to companies with high credit ratings and credibility. One advantage may be allowing the borrower to obtain an interest-free loan.

4- Evaluating performance among competing companies

The financial leverage ratio is used to compare the performance of institutions within the same field or industry, aiming to identify the most efficient institutions in managing their debts and financing their assets, and to uncover trends in financial performance and companies’ financing strategies.

When the leverage ratio rises at a certain point, it may indicate that companies are pursuing an aggressive growth strategy to maintain competitiveness by leveraging debt to finance expansion or acquisitions. Conversely, a decrease in the financial leverage ratio indicates more conservative financing strategies.

5- Efficiently managing returns from debt

The financial leverage ratio can be used to enhance returns on debt investments. Companies that use debt effectively can achieve higher returns by borrowing funds with high purchasing power and repaying them with funds of lower purchasing power during a period of financial inflation, reducing the financial burden by repaying the loan at a value below its real value at the time of borrowing.

What is the difference between operating leverage and financial leverage?

Although financial and operating leverage are similar and can be confused, they differ in several ways.

The following are the main differences between financial leverage and operating leverage:

| Financial Leverage | Operating Leverage |

|

|

You may also be interested in: What are liquidity ratios, their importance, and how to calculate them

Debt-to-EBITDA ratio

This ratio measures net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) and indicates how long the company will need to generate cash to repay all its debts.

The following is how to calculate this ratio:

Debt-to-EBITDA ratio = Total debt ÷ Earnings before interest, taxes, depreciation, and amortization (EBITDA)

Net debt-to-total capital ratio

This financial leverage ratio can help determine how to repay current debts, as the total debt amount is adjusted to reflect available cash.

The following is how to calculate this ratio:

Net debt-to-capital ratio = (Total debt - Cash) / (Debt + Equity + Minority interests + Preferred stock - Cash)

You may also be interested in: What are debit ratios, and what do they tell us in financial analysis

How are financial leverage ratios evaluated?

The importance of leverage ratios lies in helping the company assess the amount of its debt and whether it can repay it on time. There are many tools to assess the company’s ability to repay.

The following is how to evaluate financial leverage ratios:

1- Low financial leverage ratio

A low financial leverage ratio occurs when the return on borrowed funds exceeds the cost of borrowing, resulting in higher owners’ returns and higher returns on assets and equity.

2- Medium financial leverage ratio

A medium level of financial leverage occurs when the return on borrowed funds equals the cost of borrowing, resulting in no change in owners’ returns and keeping the return on assets and equity the same.

3- High financial leverage ratio

A high financial leverage ratio occurs when the return on borrowed funds is lower than the cost of borrowing, reducing the return on assets and equity. This ratio indicates the company’s inability to meet its debt and other financial obligations on time, as it borrows excessively to finance operations.

Use the compound interest calculator to analyze the return on your investments automatically for free.

What is the impact of financial leverage ratios on a company’s profitability?

Financial leverage ratios play a crucial role in shaping companies' financial management strategies and in investment decisions. The following are the main effects of financial leverage ratios on a company’s profitability:

1- Impact of financial leverage ratios on financial risks

A high financial leverage ratio affects the company’s ability to repay debts, exposing it to several financial risks, including:

- Default on repayment, especially during recessions and economic fluctuations, with debt accumulation followed by increased interest on loans and pressure on cash flows that could be used for investment and expansion.

- A high financial leverage ratio may lead to a low credit rating, making it difficult to obtain additional financing due to lenders’ lack of confidence.

2- Impact on investment opportunities

Increasing financial leverage ratios may lead to the closure of some investment opportunities. In most cases, companies are less able to bear the risks associated with new projects. Therefore, debt should be maximized to achieve rapid growth while balancing the associated risks.

3- Impact on management strategies

Companies with high financial leverage ratios tend to adjust their financial management strategies, potentially reducing debt by selling assets or rationalizing expenses.

In summary, financial leverage ratios significantly affect a company’s profitability and can indicate whether it is exposed to financial risk. In this regard, it is important to use an accounting system, such as Daftra, to obtain accurate, comprehensive results for financial leverage ratios for each period.

What are the factors affecting financial leverage ratios?

Identifying the factors affecting financial leverage ratios is important when calculating these ratios to ensure accurate results and enable proper analysis. The following points outline the factors that influence financial leverage ratios:

- Debt ratios contribute to the company’s capital structure.

- Cost of borrowing compared to the interest associated with repayment.

- The efficiency of cash flow management and strategies followed in debt repayment.

- Type of industry or field of work, as some sectors require high levels of debt to establish large investments, resulting in a higher financial leverage ratio.

- Market supply-and-demand fluctuations create volatility in sales and profits, affecting debt repayment and financial leverage ratios.

- Some companies’ aspirations to acquire other companies make them rely more on debt to finance operations.

What is Daftra’s role in improving financial leverage ratios?

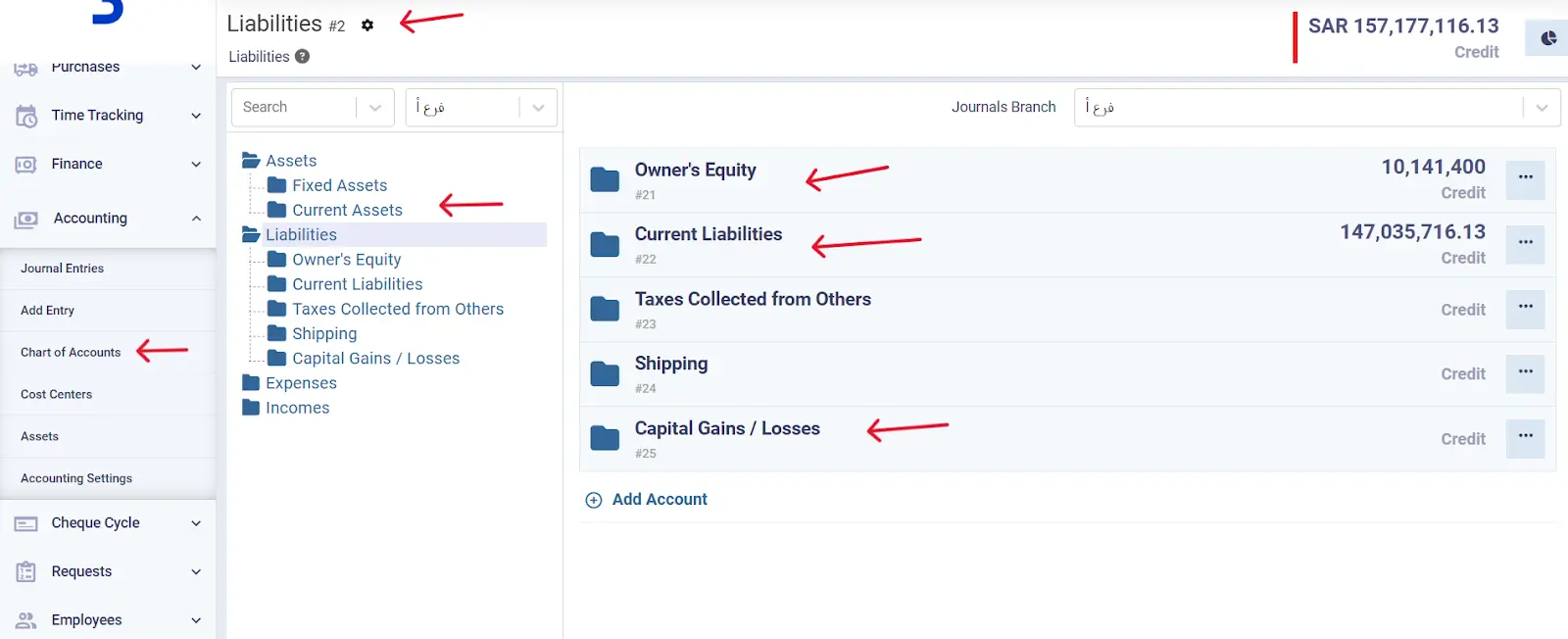

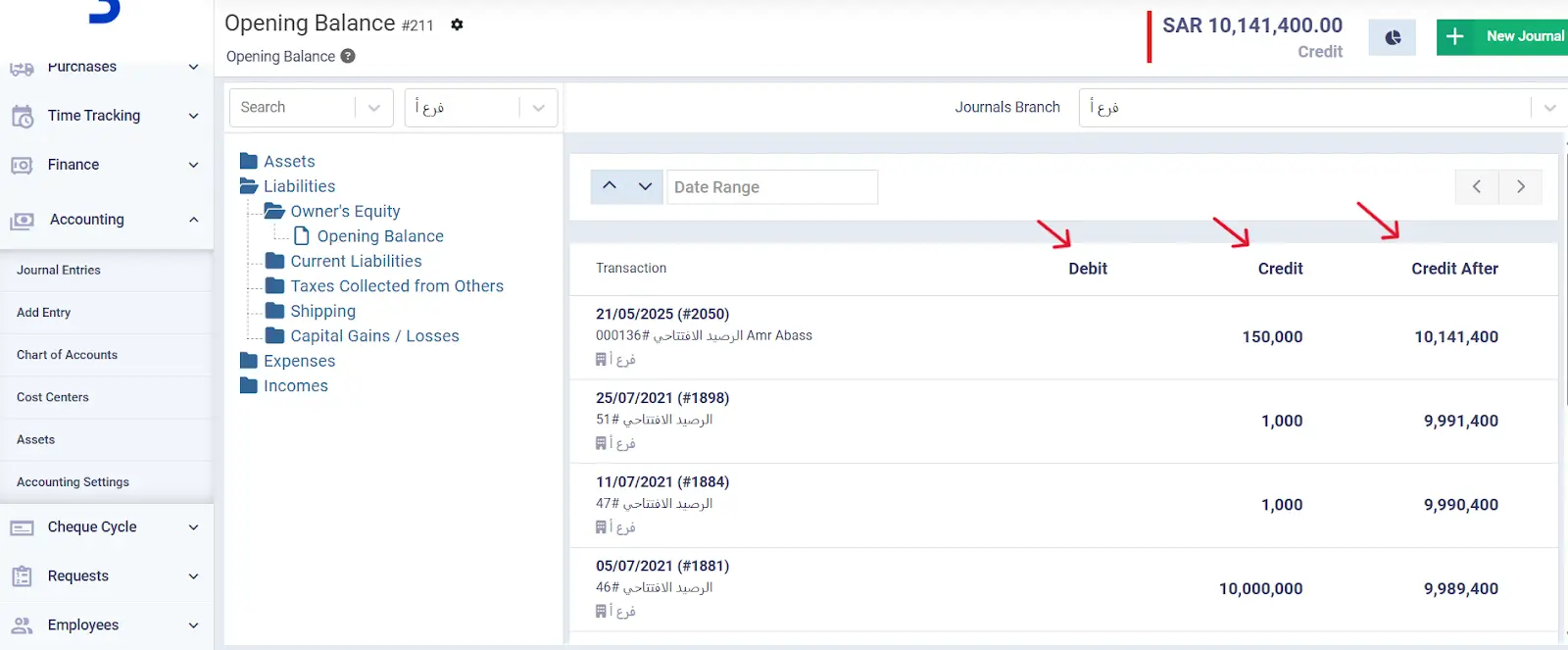

Daftra is a comprehensive ERP system for managing all your business operations. It enables management of financial leverage ratios, including assets, capital, equity, and liabilities, such as short- and long-term debt and loans. Daftra features a simple, smooth user interface that is easy for non-specialists to use.

Business owners and financial managers can make sound decisions by leveraging the system's intelligent solutions and automated processes to manage accounts and structure capital using financial leverage ratios, while helping them avoid risks associated with these ratios.

Ultimately, it delivers high returns and profits while meeting debt repayment and financing obligations, maintaining positive cash flow, and ensuring sustainable business growth.

Frequently Asked Questions

What does 1/100 leverage mean?

It means that if you are a trader, for every Dollar you deposit, you can trade and purchase products worth up to $100.

Why do brokers provide leverage?

Brokers provide leverage to attract clients to trade, increase revenues, and achieve higher returns. However, it is essential to be aware of the risks associated with leverage ratios.

What is a good leverage ratio for beginners?

It is recommended that leverage ratios for beginners be low, between 1:1 or 1:5. This means that a capital structure consisting of internal or external funding worth $1,000 enables investing in a trade ranging from $1,000 to $5,000.

This is because low leverage ratios help reduce the risks associated with trading for beginners who initially focus on understanding market trends without being exposed to large losses. Therefore, leverage ratios above 1:10 or 1:20 should be avoided initially, as they may adversely affect trading decisions.

What is the leverage ratio in insurance?

The leverage ratio in insurance is a financial tool that measures the extent to which a company relies on debt to finance its daily operations.

What is leverage policy?

Leverage policy is the use of borrowed funds with the aim of increasing sales volume, expanding company operations, or making an investment. All companies share one common goal, which is increasing profitability.

What is the consumer leverage ratio?

The consumer leverage ratio is a financial tool that shows the amount of debt an individual uses to finance their operations or investments.

What is the leverage ratio in the capital structure?

The leverage ratio in the capital structure is a financial tool that measures the extent to which a company relies on debt to finance assets, investments, daily operations, and others.

The leverage ratio in the capital structure is calculated using the following accounting formulas:

Debt-to-equity ratio: (Total debt / Total equity).

Debt-to-assets ratio: (Total debt / Total assets).

How is the optimal leverage ratio determined?

The optimal leverage ratio is determined based on several factors, including the nature or activity of the industry, set objectives, and the acceptable level of risk. However, there is no fixed ideal ratio.

What is the leverage ratio for a non-banking finance company?

There is no fixed leverage ratio for a non-banking finance company, as it varies according to what is determined by regulatory authorities. It is calculated by dividing total external liabilities by owned capital.

What is the difference between coverage ratio and leverage ratio?

The difference between the coverage ratio and the leverage ratio lies in the focus of each ratio on a different objective. The leverage ratio measures the extent to which a company relies on debt to finance its investments and assets, while coverage ratios assess the company’s ability to repay its debts using either its profits or its assets.

What is a good leverage ratio in real estate?

A good leverage ratio in real estate ranges between 1 to 2.5, which is considered a moderate ratio. However, investors must take potential risks into account.

What is the difference between solvency and liquidity in the leverage ratio?

Solvency is a financial tool used to measure a company’s ability to repay its long-term or short-term debts. Liquidity, on the other hand, is a financial tool used to measure a company’s ability to meet its short-term obligations. Finally, the leverage ratio measures the extent to which a company relies on debt.

What is the unified leverage ratio formula?

The unified leverage ratio formula is:

Debt-to-equity ratio calculation = Total debt / Equity.

What is a safe leverage ratio?

A safe leverage ratio is one that is less than 1:1 or 100%. This depends on the type of activity, economic conditions, and the company’s strategy and objectives.

What is the leverage ratio for financial institutions?

The leverage ratio for financial institutions is a financial tool that measures the extent to which a financial institution relies on debt to finance assets, investments, and various operations. A good leverage ratio for institutions ranges between 1:1 and 3:1.

What is the Tier 1 leverage ratio?

The Tier 1 leverage ratio measures financial soundness in banks. It involves determining the bank’s capital and comparing it to total assets.

The calculation formula for the Tier 1 leverage ratio is:

Tier 1 leverage ratio calculation = Tier 1 capital ÷ Total leverage exposure measure.

Conclusion

In conclusion, after clarifying everything related to leverage ratios, their types, and calculation methods with practical examples, it can be said that leverage is a powerful tool when used appropriately and with an understanding of the associated risks, enabling companies to enhance their investment opportunities toward growth and sustainability.

If you are a business owner and wish to use leverage safely and effectively, start now by using an integrated accounting software for business management so you can manage your cash flows with ease and accuracy, analyze financial ratios more effectively, and finally always remember that “investment success does not depend solely on achieving returns, but on the ability to manage the capital structure efficiently.”