What are debt ratios, and what do they tell us in financial analysis?

Table of contents:

- What are debt ratios?

- What are the types of debt ratios?

- What do Debt Ratios Tell You in Financial Analysis?

- What Are the Steps to Calculate Debt Ratios?

- Example of Calculating Debt Ratios

- What Are the Benefits and Advantages of Debt Ratios?

- What Are the Disadvantages of Debt Ratios?

- What Are the Factors That Affect Debt Ratios?

- What Are the Effects of the Debt Ratio on Companies and Economies?

- What Is the Difference Between the Debt Ratio and the Debt-to-Equity Ratio?

- What Is the Debt Ratio Compared to the Financial Leverage Ratio?

- What Is Customer Debt Analysis?

- How Can Debt Ratios Be Improved?

- What Is Daftra’s Role in Improving the Debt Ratio?

- Frequently Asked Questions

What are the indicators through which a company’s reliance on external financing and its ability to meet its obligations can be measured? The simple answer lies in debt ratios, which are a type of financial ratio that measures the amount of a company’s debt, aiming to achieve the highest possible financial return with the lowest possible risk by exploring opportunities to support the company’s ability to expand and grow.

Therefore, in this article, we provide a detailed explanation of the definition of debt ratios, their importance, types of debt ratios, methods of measuring them, the effects of debt ratios on companies and economies, as well as offering the most important tips to help improve lending ratios.

What are debt ratios?

Debt ratios are financial ratios that measure the extent to which debt is used to finance investment relative to owner-provided financing. Debt ratios measure a company's financial leverage and its ability to meet its financial obligations.

The debt ratio measures the extent to which a company relies on its own capital versus external financing to fund its operations. Lending ratios are governed by both the owner’s desire to rely on borrowed funds to increase profits and the lender’s desire to limit lending due to fear of non-repayment.

What are the types of debt ratios?

Companies use debt ratios to assess financial stability. They are one of the means of evaluating whether it is possible to invest in a company. The less a company relies on debt to finance assets and activities, the lower the risks, and vice versa. The most prominent types of debt ratios are as follows:

1- Interest Coverage Ratio

This ratio of debt ratios measures the ability to pay interest on contracted loans by determining how many times interest and debt can be covered.

The higher the interest coverage ratio, the better the company's ability to meet all debt obligations and service interest, and vice versa. A debt ratio of 1.5 represents the lowest degree of safety the company enjoys. The calculation of this ratio is as follows:

Interest Coverage Ratio (Interest Earned Rate) = Operating Profit + Interest Expenses ÷ Interest Expenses or Earnings Before Interest / Total Interest Expenses.

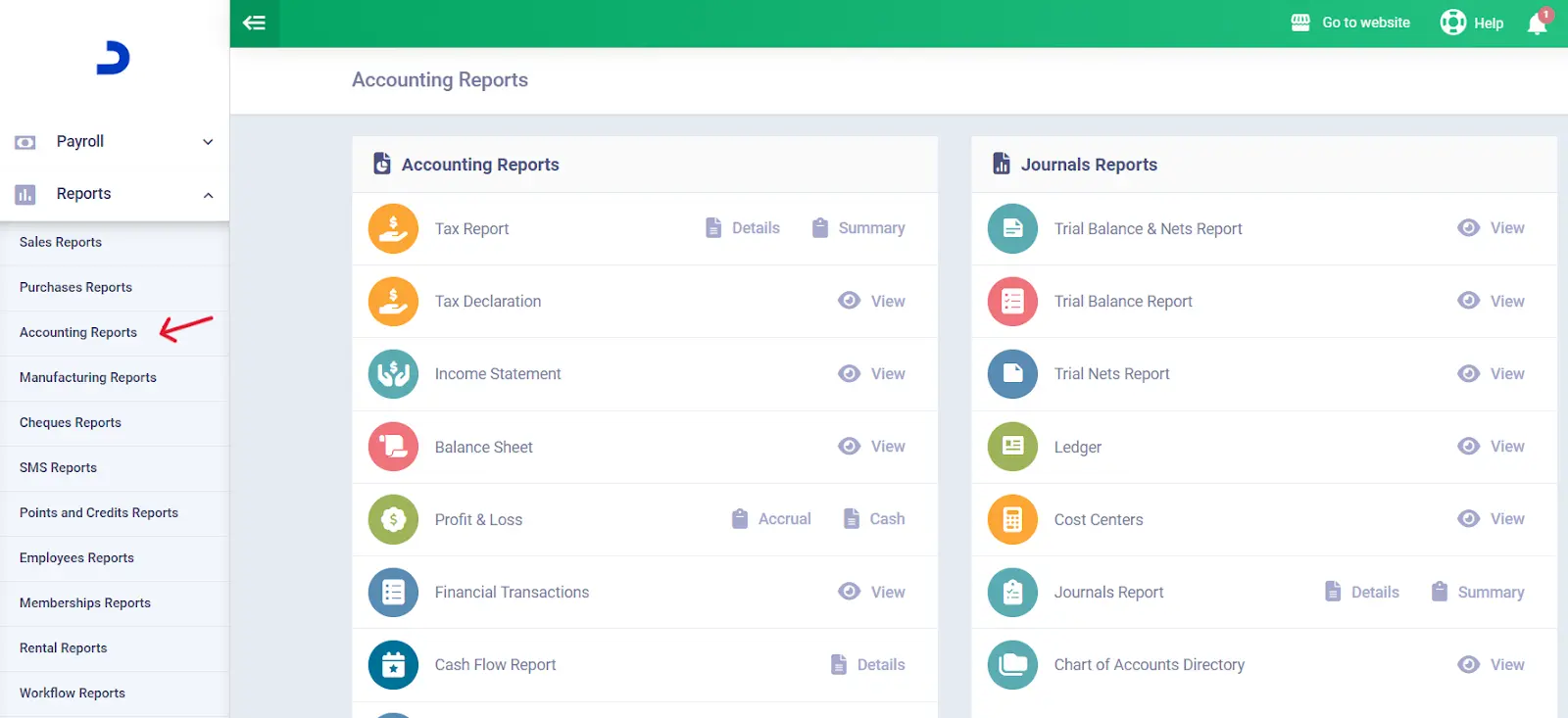

The Daftra system uses profitability reports or financial analysis over a specific period to extract the value of earnings before interest and taxes, as well as interest expenses from the financial expenses section. The system then automatically calculates the interest coverage ratio to ensure accurate results.

2- Fixed Charges Coverage Ratio

Fixed charges include interest payable, lease expenses, and other fixed burdens borne by the company. The calculation of this ratio is as follows:

Fixed Charges Coverage = Earnings Before Fixed Charges and Taxes ÷ Fixed Charges

Instead of manually calculating the fixed charges coverage ratio, it can be computed automatically by the Daftra system, which determines earnings before interest, taxes, rents, and fixed charges.

3- Debt to Total Assets (Capital) Ratio

A company’s debt ratio is essential for assessing its exposure to financial risk. It determines the proportion of debt, whether long-term or short-term, in financing assets, and is expressed as a percentage of total assets.

If the debt ratio is 100% or more, it indicates that the company’s debt exceeds its assets, whereas if the ratio is 30% or less, it indicates that the company’s assets exceed its debt. The calculation of debt ratios according to total assets is as follows:

Debt Ratio = Total Liabilities (Total Debt) ÷ Total Assets

The Daftra system includes the balance sheet (found in the financial reports section of the accounting program), from which total liabilities and total assets can be extracted. With one click, you can calculate the debt-to-total-assets ratio with 100% accuracy.

Following the same steps, you can find the following types of debt ratios in the Daftra system.

4- Debt to Equity Ratio

This ratio shows the total short-term and long-term debts and loans obtained by the company from shareholders. It illustrates the relationship between the value of capital invested by shareholders and the company’s debts. The higher this ratio exceeds 1.5, the greater the potential risk the company faces from borrowing, which could lead to bankruptcy.

Debt Ratio = Total Debts ÷ Total Shareholders’ Equity

5- Debt to Equity Contribution Ratio

This ratio indicates the total contribution of equity, such as capital, reserves, and retained earnings, in financing assets. The calculation is as follows:

Debt to Equity Ratio = Total Debt ÷ Equity

6- Debt Service Coverage Ratio

This debt ratio assesses the company’s ability to service both principal and interest payments from profits and sales. The higher this ratio, the more it indicates the company’s ability to meet its financial obligations. The calculation is as follows:

Debt Service Coverage Ratio = Cash Flow from Operating Activities ÷ Total Debt

7- Capital Structure Ratio

The capital structure, or cost of capital, is the mix of financing used to fund a company’s assets and operations, including equity, bonds, and bank borrowing. In the case of financing based on debts and liabilities, the company will need to service the debt through regular interest and principal payments.

In the case of equity financing, the company will not be obligated to pay interest. The following is the method to calculate the debt ratio according to the capital structure ratio:

Capital Structure Ratio = Long-Term Debt ÷ (Long-Term Financing Sources + Preferred Shares + Shareholders’ Equity)

What do Debt Ratios Tell You in Financial Analysis?

The debt ratio expresses the relationship between total liabilities and assets. By analyzing these ratios, company owners and investors can assess the company’s financial stability, and lenders can determine the extent to which their funds are exposed to risk. Below are the formulas and indications explained by debt ratios in financial analysis:

1- High Debt Ratio

This ratio is greater than 1. This level of debt ratio indicates the institution’s inability to meet its debt and other financial obligations on time, as it borrows excessively to finance operating activities, and its assets are insufficient to cover those obligations. This means that the institution’s financial resources are in the red zone.

2- Low Debt Ratio

These are debt ratios below 1. They indicate that the institution’s assets and property exceed its liabilities because capital exceeds debt. In this case, the institution does not need to borrow to finance its operations or activities.

3- Moderate Debt Ratio

This means the debt ratio equals 1, indicating that the institution’s assets and debts are equal. In the event of repaying debts, all of the institution’s assets must be offered for sale.

In summary, debt ratios in financial analysis express the extent to which a company relies on debt to finance its financial operations and assets. Accordingly, you can evaluate its ability to meet repayment obligations on time while mitigating financial risk.

What Are the Steps to Calculate Debt Ratios?

Debt ratios are one of the steps that determine a company’s financial position; therefore, accuracy must be considered in the steps for calculating all financial ratios. The debt ratio can be calculated monthly, quarterly, or at the end of each financial period, depending on the need.

Accounting software can also automate these ratios and calculations, but it remains important to understand them as well.

Learn about the most important steps for calculating debt ratios:

1- Determine the total amount of your debts

Determine the total debts and financial obligations, whether long-term or short-term. These may include wages, debts, credit card balances, utilities, or bills.

2- Determine the total assets

The company's total assets can be determined by reviewing accounting records and the balance sheet. These assets include accounts receivable, inventory, and others.

3- Calculate the debt ratio

After identifying debts and assets as explained, total liabilities are divided by total assets to calculate the debt ratio, which varies by institution's activity.

As mentioned previously, calculating debt ratios follows three steps: determining total debt, determining total assets, and applying the appropriate formula to calculate the debt ratio.

Read also: What are liquidity ratios and how can they improve the financial position of companies?

Example of Calculating Debt Ratios

Below are the balance sheet and income statement of Al-Rida Saudi Trading Company as of 2024/12/31. The required task is to calculate the debt ratios:

Balance Sheet | |||

| Assets | Amount | Liabilities and Equity | Amount |

| Current Assets | Current Liabilities | ||

| Cash | 500,000 | Creditors | 400,000 |

| Short-term securities | 30,000 | Notes payable | 130,000 |

| Debtors | 34,000 | Accrued expenses | 97,000 |

| Total current liabilities | 627,000 | ||

| Ending inventory | 45,000 | Long-term liabilities | |

| Prepaid expenses | 25,000 | Long-term loans | |

| Total current assets | 634,000 | Total long-term liabilities | 370,000 |

| Fixed Assets | Equity | ||

| Buildings | 900,000 | Capital | 700,000 |

| Accumulated depreciation – buildings | 88,000 | Cash reserve | 103,000 |

| Equipment | 168,000 | Retained earnings | 80,000 |

| Accumulated depreciation – equipment | 90,000 | Total equity | 883,000 |

| Total fixed assets | 1,246,000 | Total liabilities | 1,880,000 |

| Total assets | 1,880,000 | ||

Income Statement | ||

| Statement | Partial | Total |

| Net sales | 1,400,000 | |

| Cost of goods sold | 1,000,000 | |

| Gross profit | 400,000 | |

| Operating expenses | ||

| Administrative expenses | 30,000 | |

| Selling expenses | 20,000 | |

| Depreciation expense | 18,000 | |

| Total operating expenses | 68,000 | |

| Other income | ||

| Rental income from property A | 8,000 | |

| Total other income | 8,000 | |

| Income before interest and taxes | 340,000 | |

| Interest expense | 20,000 | |

| Income after interest | 320,000 | |

| Taxes | 55,000 | |

| Income after taxes | 265,000 | |

Calculating Debt Ratios Using the Balance Sheet and Income Statement

- Debt Ratio = Total current and long-term liabilities / Total assets

= (627,000 + 370,000) / 1,880,000 = 0.53

- Debt to Equity Ratio = (Total current liabilities + non-current liabilities) / Equity

= (627,000 + 370,000) / 883,000 = 1.13 (A debt ratio higher than 1 is correct, which means that creditors own more than half of the assets).

- Current Liabilities to Equity Ratio = Current liabilities / Equity

= 627,000 / 883,000 = 0.71

- Equity to Fixed Assets Ratio = Total equity / Total fixed assets

= 883,000 / 1,246,000 = 0.71

- Interest Coverage Ratio = Earnings before interest and taxes / Interest expense

= 340,000 / 20,000 = 17 times (meaning that loan interest can be paid from earnings before interest and taxes 17 times).

You can now download a debt ratio template to help you calculate indebtedness easily and conveniently for free from Daftra.

What Are the Benefits and Advantages of Debt Ratios?

One of the main objectives of debt ratios is to evaluate a company's financial position and future by comparing its total liabilities with its capital. Below are the most important advantages of debt ratios:

1- Guiding investors’ decisions

Debt ratios help investors determine whether or not to invest in a company, as investors need to ensure that the company has sufficient assets to cover liabilities and financial obligations. Debt ratios also provide indicators that help lenders assess whether the company can repay its loans.

2- Making sound financial decisions

Debt ratios provide company management and owners with indicators about the possibility of developing or expanding the company’s commercial and operational activities according to the availability of sufficient resources.

These ratios indicate the company’s ability to service its debt; if the debt ratio rises, management can implement cost-saving measures. Conversely, the lower the ratio, the greater the possibility of obtaining additional financing.

3- Predicting financial risks

Debt ratios are an indicator for predicting financial risks and applying sound financial policies to address them. Among the most prominent risks associated with debt ratios are:

- High interest costs due to high debt ratios and failure to generate sufficient revenue to cover interest expenses.

- Liquidity risks arise from high debt ratios, which occur when cash flow is insufficient to cover short-term obligations.

- Instability in the institution’s profits due to high debt ratios that increase fixed costs, ultimately resulting in losses.

- Bankruptcy risks due to the company’s inability to repay its debts.

- High debt ratios affect the company’s credit rating, reducing its chances of obtaining future financing.

- Impact on operating activities: increased debt ratios and the resulting obligations negatively affect the institution’s competitiveness and its ability to innovate and develop to drive expansion and growth.

As previously mentioned, calculating the debt ratio is critical for maintaining company stability and avoiding financial risk. It is also a key factor in providing clear information and data to investors, lenders, and decision-makers to help them make the best decisions.

What Are the Disadvantages of Debt Ratios?

Despite the importance and benefits of debt ratios for companies and institutions, they also have shortcomings. It is good to use debt ratios as guidance, but it is not good to make them the sole and decisive standard. Below are the most prominent disadvantages of debt ratios:

1- Inaccuracy of debt ratio results

Sometimes debt ratios do not provide an accurate or comprehensive assessment of the condition of the institution or company. They may show a high level of financial leverage, suggesting the company faces significant financial risks, even though this may not be the case in reality.

In addition, debt ratios do not highlight differences among debt types or the terms under which the loans were taken. Therefore, debt ratios vary with the nature of companies’ activities.

2- Focus on return on investment rather than profits

They do not take the company’s profits into account, focusing instead on assets and return on investment only when evaluating the financial position. Of course, a company may be performing well and achieving growing profits without this being taken into account.

3- Variability of debt ratios

Healthy debt ratios vary, especially across different business sectors and among different companies. As a result, comparisons may be unfair due to differences in each company's conditions.

4- Inaccurate future projections of debt ratios

Debt ratios overlook the future outcomes of current loans and procedures. A debt may not yield returns commensurate with its current value, but over time it may generate substantial profits for the entity. Therefore, it is advisable to rely on managerial accounting forecasts alongside financial ratios.

What Are the Factors That Affect Debt Ratios?

Below are the most important factors that should be considered when analyzing the debt ratio:

- Expansion policies and their impact on capital structure: Growth and expansion plans and the financing strategies used to form the capital structure. Institutions that rely more on debt exhibit higher debt ratios, and companies seeking rapid expansion resort to debt to finance new activities, thereby increasing debt ratios.

- Impact of economic conditions on financing decisions: General economic factors, such as recession or inflation, naturally affect companies’ ability to bear debt. In such cases, some companies may avoid borrowing due to uncertainty about their ability to meet debt repayment obligations.

- Relationship between interest rates and reliance on debt: Higher interest rates discourage companies from relying on debt, whereas lower interest rates increase their willingness to borrow to finance investments.

- Impact of the company’s financial health on the debt ratio: The financial health of the company, reflected in good financial performance, enables it to bear higher debt ratios. Conversely, if financial performance is weak, borrowing and reliance on debt should be avoided to prevent the risks of high debt ratios.

- Role of financial management in balancing capital structure: The strategies followed in financial planning and the ability of financial management to make decisions that help achieve a balance between debt, equity, and assets.

As explained previously, all factors affecting debt ratios must be considered, including debt levels, income and profits, asset values, interest rates, capital structure, the country’s economic conditions, and the nature of the activity.

What Are the Effects of the Debt Ratio on Companies and Economies?

The debt ratio affects assessments of companies' financial health and the overall state of the economy, and it measures their ability to meet obligations to avoid losing the trust of investors and suppliers. Below are the most prominent effects of debt ratios:

1- Constraints on decision-making

Companies with high debt ratios lack flexibility in making certain financial decisions related to expansion and investment in new projects.

2- Higher interest rates

Banks are forced to raise interest rates, especially for companies with lower credit ratings, which increases borrowing or financing costs for companies. Higher interest rates may put pressure on profits and affect investor returns.

3- Financial instability

High debt ratios combined with companies’ inability to repay their debts lead to financial instability, exposure to bankruptcy risks, and loss of assets.

4- Economic growth

Highly indebted companies reduce investment, leading to slower economic growth. This contrasts with companies that use debt effectively and efficiently to finance investments and drive growth.

5- Debt ratios and the labor market

Companies burdened with high debt ratios refrain from hiring new employees and sometimes resort to laying off current employees to reduce payroll costs, which affects rising unemployment rates.

What Is the Difference Between the Debt Ratio and the Debt-to-Equity Ratio?

The difference is that debt ratios measure total debt relative to total assets (Total debt / Total assets), whereas the debt-to-equity ratio measures total debt relative to total equity (total debt/total equity). Therefore, the debt-to-equity ratio is part of the institution's overall debt ratio.

What Is the Debt Ratio Compared to the Financial Leverage Ratio?

Financial leverage is one of the most prominent accounting terms associated with debt ratios. Financial leverage is the extent to which a company uses borrowed capital to increase return on equity. Here, debt ratios are used to measure financial leverage by comparing the debt ratio to the equity ratio.

What Is Customer Debt Analysis?

Customer debt analysis involves preparing comprehensive reports on amounts owed by customers, considering factors such as customers’ ability to repay outstanding debts, the time required to collect payments, and the expected proportion of bad debts that will remain uncollectible due to customer bankruptcy.

Customer debt analysis helps assess customers’ creditworthiness before granting loans or other financing. Customers are then classified based on a review of their credit history, income, and repayment capacity, which helps determine appropriate credit limits.

How Can Debt Ratios Be Improved?

Across various business sectors and company activities, companies focus on improving their debt ratios by negotiating payment terms, increasing assets, or using other methods. Below are the most important tips that help improve debt ratios and maintain the company’s financial health:

- Developing effective marketing strategies to increase sales and diversify products and services to attract customers.

- Allocating resources and inventory efficiently to reduce expense waste and improve productivity.

- Negotiating flexible payment and repayment terms with suppliers.

- Restructuring debts and negotiating with lenders and financiers to adjust repayment terms and reduce interest rates.

- Consolidating debts to reduce the applicable interest rate.

- Improving cash flow management by collecting receivables from customers more quickly to increase liquidity.

- Continuously assessing financial risks and analyzing debt ratios, and developing plans to deal with any financial fluctuations.

- Using accounting systems and software, such as the Daftra cloud system, to improve financial planning for revenues, expenses, profits, assets, liabilities, invoices, and sales.

What Is Daftra’s Role in Improving the Debt Ratio?

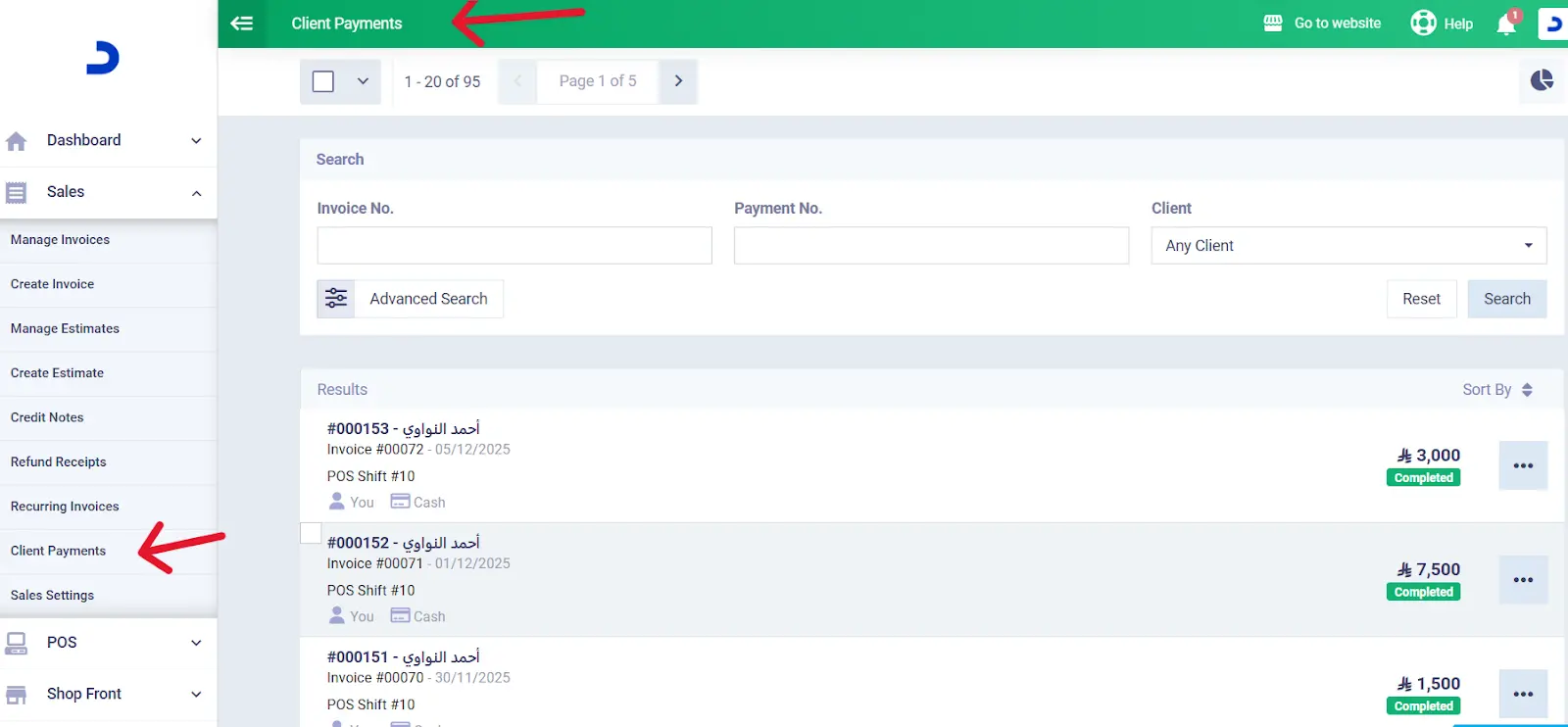

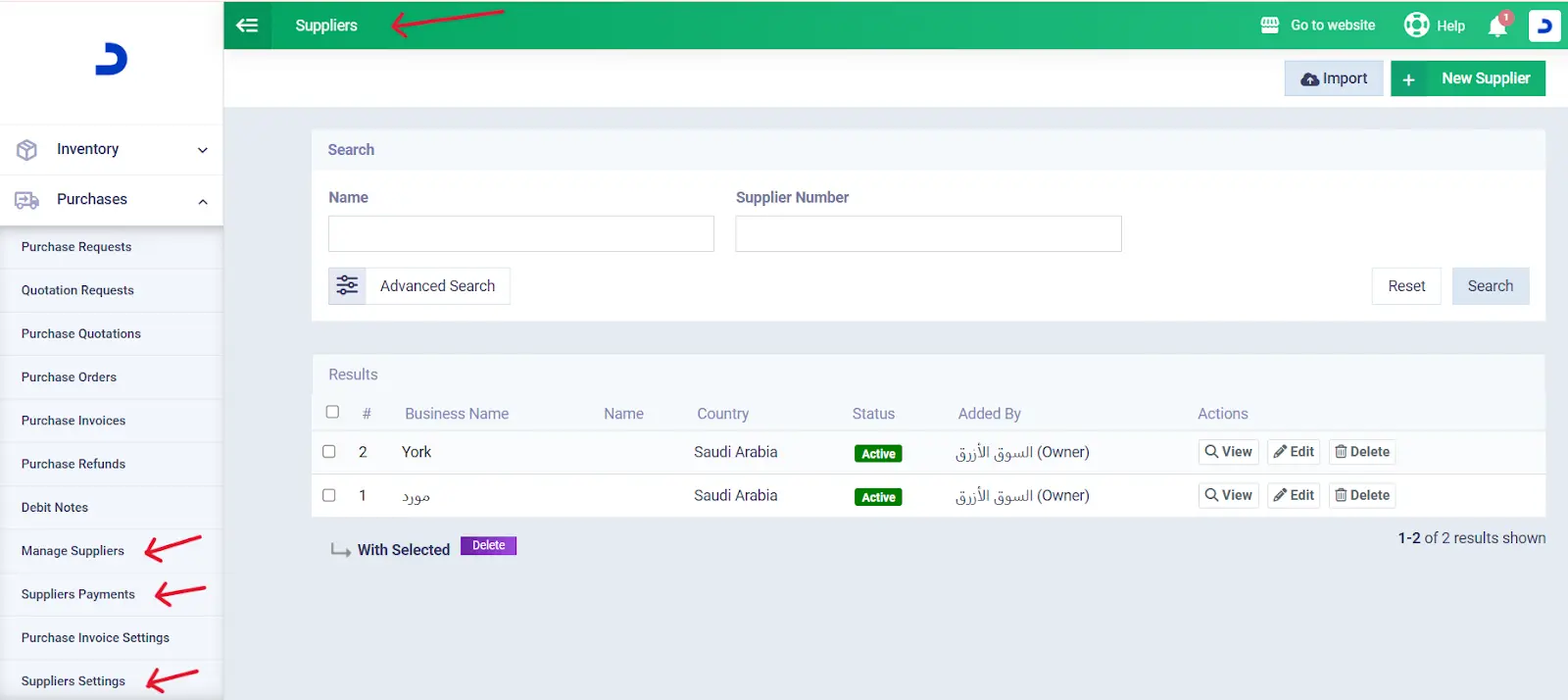

The Daftra accounting system helps improve financial debt ratios by providing integrated accounting software for business management to manage financial operations effectively and accurately. Below are the advantages of improving debt ratios:

1/ Managing customer payments helps improve cash flow and provide the liquidity needed to meet obligations.

2/ Managing suppliers and purchases, and controlling inventory purchase costs.

3/ Daftra provides accurate financial reports that help analyze financial performance and profits, plan budgets, and manage debts and debt ratios.

Frequently Asked Questions

What are good debt ratios?

Debt ratios may vary, as mentioned earlier, according to the activity of the institutions. Therefore, there is no universal standard. In general, good debt ratios do not exceed 2.

This means the company has 1 unit of capital for every 2 units of debt, corresponding to 25%. This ratio indicates the balance between debt and assets used to finance business operations and activities.

Can debt ratios be negative?

There is nothing indicating that debt ratios can be negative. This may occur due to recording errors or temporarily. It may result from some categories and assets with small values recorded in the balance sheet but not included in debt ratio calculations. This means total liabilities will never be less than zero.

What is the difference between debt ratios and activity ratios?

The difference is that debt ratios show how the capital structure is formed and its reliance on different funding sources, while activity ratios focus on the optimal use of resources and their impact on financial performance.

What is the difference between indebtedness and the debt ratio (borrowing ratio)?

Indebtedness is a general term that expresses the level of an institution's financial commitment, while the debt ratio, or borrowing ratio, is a percentage or decimal used to measure indebtedness and assess the company’s financing strategy relative to total assets.

Who uses debt ratios?

Debt ratios are used by:

- Investors, to evaluate financial risks related to investing in a particular institution.

- Financiers and lenders, to assess the company’s credit rating and its ability to repay loans.

- Financial managers, to evaluate the financial health of institutions and make sound decisions regarding funding sources, investment, and expansion.

- Financial analysts, to assess performance and financial position by comparing competitors in the same sector or industry.

- Shareholders, to evaluate the company’s sustainability and competitiveness, and to decide whether to retain or sell shares.

How can I calculate the debt-to-equity ratio?

Calculating the debt-to-equity ratio requires identifying the necessary data: capital, reserves, and retained earnings. Then, total debt is divided by total equity to assess the relationship between financial operations and funding.

Debt-to-equity ratio = Total debt / Total equity

What is the debt collection ratio?

The debt collection ratio is the percentage that shows the financial value to be recovered from a debtor who has delayed payment or for other reasons.

What is the borrowing ratio for companies in Saudi Arabia?

There is no fixed borrowing ratio in Saudi Arabia; it varies by financing type, the company’s financial condition, and the lender. Company borrowing ratios range between 12% and 14%.

What is the debt burden ratio?

The debt burden ratio is the percentage of the company’s monthly income allocated to repaying long-term or short-term debt. It is calculated by dividing total monthly debt payments by total monthly income.

Is a 50% debt ratio good?

A 50% debt ratio is considered good when calculating debt-to-equity, but it is high when calculating debt-to-income.

What is a good debt burden ratio?

There is no fixed good debt burden ratio. It varies depending on the company’s financial status, asset value, growth stages, and future goals.

How do you know your liabilities ratio?

You determine your liabilities ratio by analyzing the financial ratios mentioned earlier in the article. This shows the company’s ability to meet obligations and assesses its capacity to generate the necessary cash flows.

Conclusion

An individual should spend according to what they have and borrow according to what they can repay. This principle also applies to institutions and companies.

The financial position is one of the most important criteria for evaluating the status and future of companies and institutions. Therefore, the debt ratio measures a company’s ability to meet its obligations by comparing total liabilities to total capital.

If the debt ratio is high, it indicates the company has been financed excessively with debt and loans, making it more vulnerable to bankruptcy. Conversely, a low ratio indicates a safer financial position.

Therefore, all liabilities and assets should be accurately recorded to ensure the correctness of financial ratio calculations, including debt ratios. This helps produce accurate results and figures that contribute to a comprehensive evaluation in financial analysis.