What Are Financial Risks, Their Types, and How to Manage Them

Table of contents:

- Concept of Financial Risks

- Types of Financial Risks

- What Are the Causes of Financial Risks?

- Financial Risk Management

- Steps of Financial Risk Management

- What Are the Methods of Financial Risk Management?

- Programs That Help You Manage Financial Risks

- Financial Risk Measurement Tools

- How Can Financial Risks Be Prevented?

- What Are the Modern Models in Financial Risk Management?

- How Does Daftra Help You Manage Financial Risks?

- Frequently Asked Questions

Investment institutions and companies play an important role in the prosperity of economies around the world, as financial and economic growth is linked to their ability to keep pace with economic, financial, legal, and technological changes, which in turn ensures significant expansion and growth for these institutions.

Many institutions and companies face numerous risks while conducting their business and activities; these risks may be legal, financial, or even regulatory. Among the most prominent of these risks are financial risks, which threaten the stability of institutions and may extend to countries' economies.

Therefore, many challenges have emerged for financial managers, because financial and economic decisions are among the most dangerous and important within an institution. Accordingly, it is necessary to understand the nature of financial risks and how to manage them effectively to achieve the institution’s objectives and maintain the continuity of its activities.

Quick Points (In Brief)

- Financial risk is the inability to pay or settle a company's debts due to internal or external factors.

- There are many types of financial risks, including political risks, legal risks, market risks, financial liquidity risks, operational risks, business risks, credit risks, cash flow–related risks, growth risks, financial leverage risks, errors, and fraud.

- ancial risks, including maintaining a cash reserve, reducing accounts receivable balances, investing in employees, and contracting with insurance companies.

- The indicators that measure financial risks include: Value at Risk (VaR), Expected Tail Loss (ETL), Loss Given Default (LGD), Probability of Default (PD), and Exposure at Default (EAD).

- Various models can be applied in financial risk management, such as the historical simulation model and Extreme Value Theory (EVT).

Concept of Financial Risks

Experts believe that financial risks represent the inability to pay or settle the debts owed by a company or institution, which may result from economic instability and changes in currency and exchange rates. Others indicate that financial risks may constitute a threat of potential financial losses in markets.

In general, financial risks are among the most prominent risks institutions and companies may face. These risks are related to economic recession and losses in financial markets and arise from increased taxes, currency fluctuations, and changes in interest rates, which may lead to a company’s inability to pay its debts and dues or to cover its obligations and the costs of its activities.

Types of Financial Risks

Companies face multiple types of financial risks that affect their activities and stability. The most prominent types of financial risks are as follows:

Political Risks

We often hear about the impact of politics on the economy and vice versa. Here, it is worth noting that political decisions and conditions in countries can affect an institution and its activities, as political actions may lead to financial losses and risks for individuals and institutions.

Legal Risks

These occur as a result of the implementation of a law or a change in the legal system, which may pose financial risks for companies operating in a particular sector.

Market Risks

These risks include fluctuations in financial markets due to a lack of control over commodity prices, variations in stock and interest rates, and continuous changes in currency and exchange rates. This may lead to activities and investments losing value, as changes in interest rates and currencies result in higher costs and interest payments to banks.

There are also several risks related to basic commodities and raw materials that companies that rely on producing or processing them always face, due to price fluctuations in these materials, as is the case with automobile manufacturers.

It is worth noting that the prices of many commodities are influenced by foreign exchange factors, such as gold and oil.

Financial Liquidity Risks

This refers to the inability to provide the liquidity needed to pay due debts or cover costs. It may result from a financial market recession, leading to the inability to retain investments; therefore, they are sold for less than their true value.

In other words, it means the inability to find buyers due to a lack of liquidity in the market, such as selling goods, securities, or real estate at a price lower than their value.

Operational Risks

These refer to financial losses resulting from human factors, such as workers and employees. They may also result from certain technical or professional errors, deficiencies in digital systems, or damage to an important asset, which negatively affects capital and the financial position of the institution, or from other external factors, such as printing errors, for example.

Business Risks

This is a type of approach undertaken by institutions to increase profits, such as incurring high costs to promote and market a new product or service.

Credit Risks

These refer to the inability of a party to repay a debt or make payments, or to fulfill certain obligations stipulated in the contract concluded between the two parties, leading to financial losses.

Cash Flow–Related Risks

An imbalance between cash inflows and outflows is considered one of the financial risks a company may face. This risk includes the company's inability to meet all immediate, long-term, or medium-term obligations.

It is often affected by the policies followed in cash management. If a company grants its customers a credit period of up to 120 days while it must pay its suppliers within 60 days, then cash flow is negative, as cash outflows exceed cash inflows.

Growth Risks

Growth is one of the most important objectives for all companies. However, it is associated with certain risks. The pursuit of growth may place pressure on liquidity and strain infrastructure, as it will serve more than one branch or headquarters, among other uses.

Growth may consume equipment or overburden employees. In addition, poorly planned growth decisions affect the company’s image and reputation, making financial risk ongoing.

Financial Leverage Risks

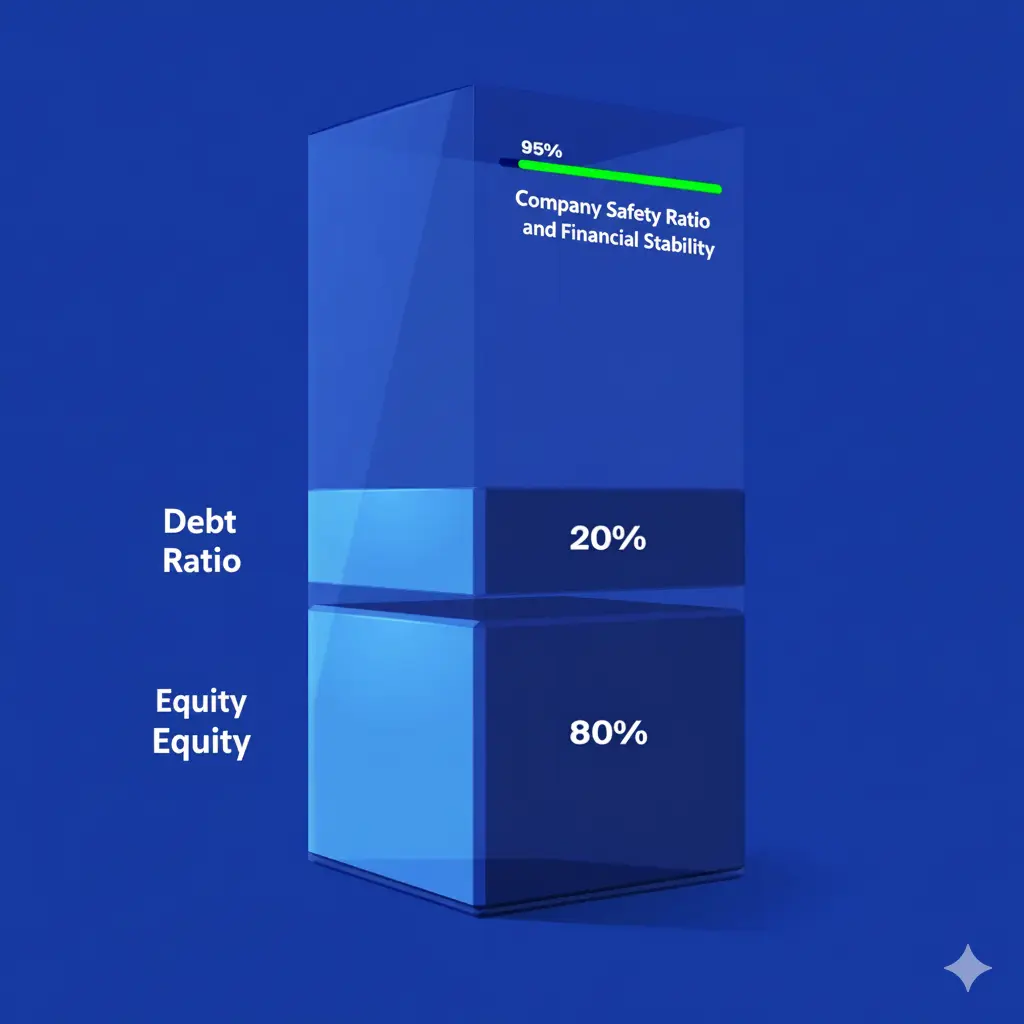

The concept of financial leverage involves using borrowed funds for operating activities or new investments. Financial risk arises from the possibility that loans and their expected interest may exceed the return on investment for these activities, thereby increasing the financial burdens on the company.

Global Risks

Certain global events may pose financial risks to a company. For example, the COVID-19 pandemic changed many business models, making them more flexible in the new situation. Likewise, regional wars or wars between two countries often affect the surrounding geographical area.

In addition, changes in the exchange rates of some global economies may create new financial risks, especially for industries that rely on imported goods in foreign currencies.

Read also: The Impact of Exchange Rate Changes on Accounting Operations

Errors

Managers need accurate information to make sound decisions. Lack of accuracy constitutes a fundamental risk that may lead to severe financial losses. Errors occur during the performance of tasks, during data collection, or from other elements within employees’ responsibilities.

Fraud

A company may be exposed to many attempts at fraud, especially those stemming from cybersecurity. Cybersecurity attacks may result in asset losses, reduced profits, and other consequences. Exposure to fraud may lead to numerous legal issues with customers, affecting the company’s reputation and increasing its long-term losses.

What Are the Causes of Financial Risks?

It can be said that financial risks may arise from various factors. The following are the most prominent factors and reasons that lead institutions to be exposed to financial risks:

- Weak coordination and management: The inability of the institution to coordinate between human resources management and financial management, in addition to the inability to plan, organize, and monitor the implementation of plans and activities, as well as the lack of competencies and flexibility in understanding the changes occurring in the financial market.

- Flaws in the institutional strategy: The presence of deficiencies in the institution’s strategy, as strategy is linked to financial and economic decisions. Any flaw in the strategy may result in financial risks arising from internal procedures, specific individuals within the system, or deficiencies in operations and systems.

- Fluctuations in the economic environment: There are several factors related to the economic environment and the elements of the economic system, such as income, production, inflation rates, interest rates, currency and exchange rates, as well as the state’s financial and economic policies and the general investment climate.

- Risks of transactions with other parties: There are several reasons related to transactions with institutions and other parties, such as suppliers, customers, or any party involved in financial transactions.

- High cost of financing and low liquidity: The high cost of obtaining funds from various sources, and the decline in financial liquidity and cash flows of the company or institution.

- Legal and regulatory challenges: The surrounding legal environment may also play a role through labor, tax, and investment, import, and export laws.

- Intense market competition: Some experts believe that competition may also play a role, as an institution may be exposed to national or international competition, in which all its activities and resources are subject to it, potentially leading to financial risks.

The causes of financial risks institutions may face are numerous, including internal factors such as weak coordination and management and flawed strategy, as well as external factors such as fluctuations in the economic environment, high financing costs, legal challenges, and intense market competition.

The nature of transactions with other parties may also contribute to these risks. Therefore, understanding and monitoring these causes is a fundamental step in reducing the impact of financial risks on the institution's stability.

Financial Risk Management

Financial risk management is the process of anticipating and managing crises that may lead to financial losses for the institution if not handled properly. Financial risk management involves using financial analysis methods to address and manage the various financial threats an institution may face, including uncertainties arising from financial market instability.

That is, it involves dealing with financial losses the institution may encounter and carrying out many activities aimed at identifying the types of these risks, measuring their levels and expected losses, and using appropriate methods to mitigate the effects of those risks.

There are many tips that can be applied in your work to reduce financial risk losses when they occur, as follows:

1- Provide cash reserves

Maintaining a cash reserve is one of the most important ways for a company to manage financial risks, as it reduces losses when they occur and ensures business stability and continuity.

2- Keep accounts receivable balances low

High accounts receivable balances indicate amounts not yet collected from customers, which reduces cash flow and poses a risk to the business as a whole.

3- Reduce unnecessary debt

You may need to bridge cash flow gaps through loans and long-term investments. These are often associated with banking expenses or loan interest, which doubles the burden and makes repayment difficult. Reducing loan balances also provides the company with greater flexibility to address emergencies, seize opportunities, and manage unforeseen challenges.

4- Contract with insurance companies

This is similar to maintaining a cash reserve, except that the company interacts with an independent company rather than doing so internally. Sometimes, dealing with insurance companies is one of the main solutions to confront risk when it occurs, whether related to cybersecurity, product liability, crime, commercial property claims, workers’ compensation, or business interruption.

5- Invest in employees

Financial risks are often caused by employees through mistakes stemming from misunderstandings, lack of experience, or insufficient skills. Therefore, employees should be constantly informed of developments in their field of work and tasks to prevent costly mistakes.

Financial risk management is considered a necessary process to protect the institution from potential crises that may lead to significant financial losses, through market analysis, addressing surrounding uncertainties, identifying and measuring risk types, and working to reduce their effects.

The impact of financial risks can be mitigated through a set of measures, the most important of which are: providing cash reserves, keeping accounts receivable balances low, reducing unnecessary debt, contracting with insurance companies, and investing in employee training to avoid costly errors.

Steps of Financial Risk Management

The process of financial risk management includes many tools and steps that help address these risks. The following are the most prominent of these tools:

Setting Objectives

The objective of the financial risk management process must be determined, as it seeks to achieve a set of goals, such as the survival and continuity of the institution, cost reduction, and others. Despite its importance, many institutions ignore this step, leading to deficiencies in financial risk management.

Identifying and Assessing Financial Risks

This step identifying risks is considered one of the most important steps and tools in the financial risk management process, as it forms the basis for the other stages. It depends on early detection of risks, as well as on identifying their causes and the expected losses.

There are several methods for identifying risks, such as preparing financial statements, seeking insurance assistance, and using a risk register.

Then comes the risk assessment stage. Risk assessment depends on the type of risk itself. There are critical risks that may result in the institution's collapse and bankruptcy; important but non-critical risks whose impact does not reach bankruptcy but may require the institution to borrow to cover costs and continue its activities; and non-important risks whose losses can be compensated within a short period.

Searching for Alternatives

This refers to searching for the best way to deal with expected risks. Sometimes a decision is made on the most appropriate methods for managing risks, either according to a previously established plan or based on criteria that determine the most suitable ways to handle them.

Evaluation and Review

The evaluation and review step helps in discovering some errors, which leads to correcting certain decisions.

The stages of financial risk management include a set of procedures aimed at protecting the institution and ensuring its continuity. They begin by clearly defining objectives, identifying financial risks and assessing their severity, searching for appropriate alternatives to address these risks, and ending with an evaluation and review process to ensure the accuracy of decisions and correct the course when necessary. These steps enhance the institution’s ability to address financial challenges.

What Are the Methods of Financial Risk Management?

After identifying the steps of financial risk management, the next stage is selecting the most appropriate method to address these risks. The methods vary depending on the nature of the institution, the type of risk, and the potential impact. The following are the most prominent methods of financial risk management:

Full Risk Coverage Method

This means avoiding all activities that result in financial risks, or transferring the losses resulting from financial risks to a second party through insurance contracts, for example.

Open-Field Method

This refers to not addressing risks in cases where the level of risk is not concerning enough to justify the cost of managing it.

Calculated Risk-Taking Method

Here, the maximum level of risk that the institution can bear is determined, and then all appropriate methods are taken to confront this risk.

Financial risk management strategies vary between completely avoiding risk through full risk coverage, leaving the field open when the potential impact is low, or bearing calculated risks within limits that can be managed. The choice of the most appropriate method depends on the level of risk, the cost of addressing it, and the institution’s ability to bear its consequences.

Programs That Help You Manage Financial Risks

As with any concept or department within accounting and financial management, there are many programs developed by top programmers to make companies’ monitoring of financial risks more practical and deliver better results. The following are the most prominent of these programs:

MetricStream

This application provides a set of tools that help companies manage risks, improve decision-making, enhance financial performance, protect investments, and reduce losses.

Numertix

It helps in pricing financial instruments and in reaching optimal solutions for managing financial risks, assessing them, and predicting their impact.

Actico

This program is characterized by its ability to record risks and obtain the necessary financial data. It also allows the design of models to be tested to simulate the current labor market situation and determine the optimal method for dealing with risks before implementation.

Protecht

This program provides a database on loans, loan applicants and loan approvals, financial risk analysis, and information on preparing analytical reports.

Financial Risk Measurement Tools

There are many statistical tools and methods used to measure financial risks. The following are the most prominent of these tools:

Range

The range is the difference between the highest and lowest value of a financial variable. It is a relative indicator of risk, as a higher range indicates a higher level of risk, and vice versa.

Standard Deviation and Variance

These are the most commonly used measures for assessing financial risks. They measure the degree of dispersion of the financial variable’s values and their deviation from the arithmetic mean. The greater the standard deviation, the higher the level of risk.

The difference between the range and the standard deviation lies in the fact that the range measures and describes risk in general by relying on the highest and lowest values, while the standard deviation measures risk more accurately because it measures the dispersion of values around the arithmetic mean.

Beta Coefficient

This measures the sensitivity of the financial variable’s values to changes that occur in another variable. A high beta coefficient indicates a high degree of sensitivity and, consequently, a higher level of financial risk.

Coefficient of Variation

This is a relative measure of the degree of dispersion, as it links the level of risk measured by the standard deviation to the arithmetic mean (average) of the financial variable’s values. It is calculated by dividing the standard deviation by the arithmetic mean. The higher the coefficient of variation, the higher the risk indicators.

Financial risks may threaten the future of investment in countries if they are not handled properly. Hence, the importance of financial risk management and its activation to confront these risks and reduce their severity, as risk management helps ensure the survival of institutions and their resources.

How Can Financial Risks Be Prevented?

In fact, financial risk cannot be completely prevented, but the likelihood of its occurrence can be reduced, or its impact on the company can be limited. This can be achieved through the availability of the following elements in your business model:

1- Stay informed about business developments

Being constantly aware of what is happening within your business and familiar with every detail of financial resource management requires the use of an accounting system integrated with an Enterprise Resource Planning (ERP) system, which converts every activity in your business into various types of expenses and revenues.

The Daftra business management system helps you stay informed about business developments through an integrated accounting system and real-time reports that cover all aspects of the company, and it is cloud-based, so you can access it anytime, anywhere.

2- Use indicators related to financial risks

You cannot manage financial risks without indicators that alert you to upcoming risks that should be taken into consideration. There are several indicators that can be employed, such as Value at Risk (VaR) and Expected Tail Loss (ET), which measure market risk.

Other indicators include Loss Given Default (LGD), Probability of Default (PD), and Exposure at Default (EAD), which relate to credit risk.

3- Create a cash management strategy

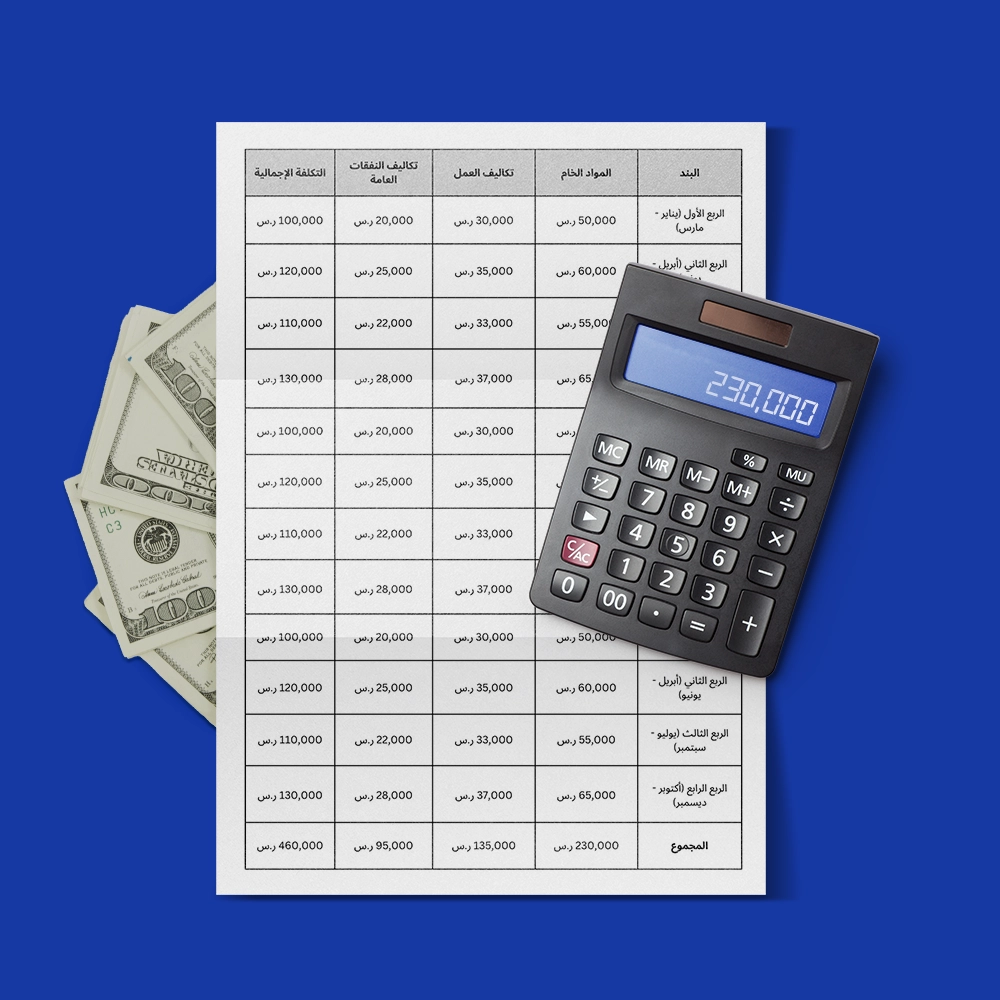

The depletion of cash financial resources is one of the most important factors that expose a business to financial risks. Creating an integrated cash management strategy helps you plan to address financial risks and prevent them from occurring.

Determining financial forecasts for cash inflows and outflows, and accounting for exchange rates, bank interest rates, and other details, can help prepare a plan to manage cash resources effectively.

Financial risks cannot be completely prevented, but their likelihood and impact can be reduced through several key elements of the business model.

These include staying constantly informed about business developments through an integrated accounting system, using indicators of financial risk to alert the company to potential threats, and creating an effective cash management strategy that supports proactive planning to address potential financial crises.

What Are the Modern Models in Financial Risk Management?

With the development of markets and the increasing complexity of financial risks, modern models have emerged that help institutions predict and manage risks more effectively. The following are the main models that can be applied in financial risk management:

1- Historical Simulation Model

This is one of the methods used to calculate Value-at-Risk (VaR). This method evaluates the impact of market changes on the company, enabling the anticipation of the effect of future market changes. For example, if the highest loss in profits reached 10%, then the expected losses will not exceed this percentage if the change is repeated.

2- Extreme Value Theory (EVT)

This is a statistical theory aimed at studying extreme and rare events. It provides a framework for modeling rare, high-impact events.

Modern risk management models, such as historical simulation and extreme value theory, are considered advanced tools, enabling institutions to assess market changes and address rare events with significant impact, thereby enhancing their ability to predict and prepare for future risks.

How Does Daftra Help You Manage Financial Risks?

Over the past decades, the need for Enterprise Resource Planning (ERP) systems has increased. For example, Daftra’s accounting software helps you control accounting operations, anticipate risks before they occur, and alert you to them, enabling you to address and prevent them.

The system provides a wide range of reports on sales, purchases, inventory, employees, and other areas, enabling accurate monitoring across the business. This helps adjust what needs adjustment, identify weaknesses and work on them, and plan using a systematic approach based on the results of previous periods.

.webp)

Frequently Asked Questions

What are the methods for measuring financial risks?

Financial risks are measured using statistical tools such as:

- Range: The difference between the highest and lowest value.

- Standard deviation and variance: Measure the extent to which values deviate from the average.

- Beta coefficient: Measures the sensitivity of a financial asset to market movements.

- Coefficient of variation: The ratio of the standard deviation to the arithmetic mean.

What are financial risk ratios?

Financial risk ratios are measured through analytical indicators such as:

- Value at Risk (VaR)

- Expected Tail Loss (ETL)

- Probability of Default (PD)

- Loss Given Default (LGD)

- Exposure at Default (EAD)

What are the objectives of financial risk management?

Financial risk management aims to:

- Maintain the stability and continuity of the institution.

- Reduce potential losses and costs.

- Protect assets and resources.

- Respond quickly to financial crises.

What is the importance of financial risk management?

Its importance lies in:

- Protecting the institution from crises and major losses.

- Adapting to market fluctuations and the economic environment.

- Ensuring the institution's financial and operational stability.

- Improving financial decision-making and reducing negative surprises.

What are the four main financial risks?

The most prominent core financial risks are:

- Market risk

- Financial liquidity risk

- Credit risk

- Operational risk

What financial risks do projects face during implementation?

Projects face several types of financial risks during implementation, the most notable of which are:

- Market risks: Such as fluctuations in currency, interest, and commodity prices, which affect project costs and expected returns.

- Financial liquidity risks: The inability to provide the necessary cash to cover ongoing costs or settle obligations.

- Operational risks: Resulting from human or technical errors that may disrupt workflow or affect quality.

- Credit risks: Such as delays or failure by suppliers or partners to meet their financial obligations.

- Growth risks: Rapid expansion without careful planning may strain resources and hinder implementation.

- Financial leverage risks: Reliance on debt financing may amplify risks if expected returns are not achieved.

- Error and fraud risks: Accounting errors or cyberattacks that affect financial resources and data during implementation.

What is an example of financial risk?

Examples of financial risks include changes in stock prices or interest rates, as well as exposure to financial fraud or legal issues.

Example: If a company delays collecting its receivables from customers while being required to pay obligations within a short period, this leads to a liquidity problem that represents a financial risk.

Another example: If a company faces an unexpected scandal or financial fraud, stock prices will decline rapidly, leading to financial losses for investors.

What is the difference between financial risk and market risk?

- Financial risk: Includes all financial threats, such as liquidity, credit, operational, and growth risks.

- Market risk: A subcategory related to fluctuations in market prices such as interest rates, currencies, and commodities.

What is the difference between financial risk and operational risk?

- Financial risk: Relates to losses resulting from financial and economic changes.

- Operational risk: Results from internal human or technical errors that affect operations.

How are financial risks calculated?

There are several statistical tools and methods used to measure and calculate financial risks, the most prominent of which are:

- Range: The difference between the highest and lowest value of a financial variable. It is considered a relative indicator of risk; the wider the range, the higher the risk.

- Standard deviation and variance: Used to measure the dispersion of values around the arithmetic mean. The higher the standard deviation, the greater the financial risk.

- Beta coefficient: Measures the sensitivity of a financial variable to market changes. A high beta indicates that the financial asset is more exposed to fluctuations and therefore carries higher financial risk.

- Coefficient of variation: Links the standard deviation to the arithmetic mean and is used as a relative indicator to estimate the level of risk. The higher its value, the higher the risk indicators.

What are the consequences of financial risks?

Some of the consequences that companies may face due to financial risks include:

- Significant financial losses

- Inability to meet obligations

- Threats to the institution’s survival

- Negative impact on the company’s reputation

- The possibility of entering into legal disputes

Thus, the article explains the concept of financial risks and their most important types, the causes of financial risks, how to manage them, and the tools used to measure them.