The Effects of Currency Exchange Rate Changes on Accounting Operations and Financial Statements

Table of contents:

- Summary of Key Points

- What is the Impact of Exchange Rate Changes on Accounting Operations?

- Illustrative Examples with Numbers of the Impact of Exchange Rate Changes on Accounting

- How the Accounting Treatment of a Company’s Various Transactions is Conducted When Exchange Rates Change

- What Are the Five Common Terms Related to Exchange Rates and Accounting Operations?

- Which International Accounting Standard Governs Exchange Rates?

- Can Accounting Software Assist in Accounting Treatment When Exchange Rates Change?

- Frequently Asked Questions

Currency exchange rate changes are the hidden process that plays a crucial role behind the scenes of various accounting operations for financial transactions. So, how can currency rates control the records and financial positions of companies?

The answer lies simply in understanding how currency conversion is accounted for and processed, which helps avoid the negative effects that most companies around the world face due to global foreign currency fluctuations compared to local currencies.

Therefore, in this article, we provide a comprehensive guide on the impact of exchange rate changes on accounting operations, with explanations and illustrative examples. This also includes clarifying the necessary steps to process various accounting transactions when exchange rates change, and how to report these changes in the company’s financial statements.

Summary of Key Points

- Exchange rate changes refer to the difference resulting from converting a unit of foreign currency to a local currency or vice versa at different exchange rates, which affects assets, liabilities, expenses, revenues, and other financial data that make up the accounting system.

- The impact of exchange rate changes on accounting operations appears through the effect on revenues and expenses, the impact on assets and liabilities, the distortion of financial statements, the effect on financial performance, the impact on business taxes, and the effect on the company’s competitive position and market share.

- The accounting treatment of the company’s various transactions when exchange rates change is carried out by following the following strategies: standardizing the currency used in accounting formulas, applying natural hedging and financial hedging, ensuring geographic and operational diversification, and translating financial statements according to Generally Accepted Accounting Principles (GAAP).

What is the Impact of Exchange Rate Changes on Accounting Operations?

Fluctuations in the foreign exchange market are among the most important factors affecting the estimation of assets, liabilities, expenses, revenues, taxes, and other essential elements of the accounting system.

Therefore, accountants and financial officers must be aware of how to deal with these changes to make appropriate decisions and take the necessary corrective actions that ensure the continuity of financial operations efficiently and effectively.

The following are the main impacts of exchange rate fluctuations on accounting operations:

1/ Impact on Revenues and Expenses

Changes in currency exchange rates have a significant effect on the company’s revenues and expenses. Essentially, the company presents its sales and services in a single currency, but this currency may directly cause an increase or decrease in the company’s revenues and income compared to foreign currencies.

Similarly, when purchasing or importing goods and production materials from a supplier in foreign currencies, exchange rate changes naturally affect the value of all these transactions, the company’s expenses, and cash flows.

2/ Impact of Exchange Rate Changes on Assets and Liabilities

Borrowing and lending in foreign currencies result in debts or investments linked to the same currency. Therefore, a decrease in the value of the local currency relative to the foreign currency will also lead to an increase in liabilities or a decrease in assets on the company’s balance sheet.

It is always necessary to calculate total net debt obligations as a percentage of total assets to understand the financial impact on the balance sheet when exchange rates change.

Thus, the impact of the company’s assets and liabilities is reflected in the financial statements recorded in the cash flow statement. For example, if a company is based in Saudi Arabia and has a branch in the United States, an increase in the value of the US dollar relative to the Saudi riyal increases the value of the subsidiary’s assets and also increases its liabilities when translated into Saudi riyals. In this case, the financial statements of the subsidiaries must be consolidated in the parent company’s financial statements, which is known as “currency translation,” affecting the reported values of assets, liabilities, revenues, and expenses in the parent company’s financial statements.

3/ Distortion of Financial Statements and Impact on Financial Performance

Further distortions and accounting misstatements may occur in the entered financial statements if the company’s foreign operations are in a different currency than its functional currency and these operations are analyzed in the local currency rather than at the exchange rate used in translating the financial statements.

This, in turn, affects the company’s financial reports, performance, and actual financial position in the market.

4/ Taxes

Gains and losses resulting from foreign currency transaction differences and exchange rate differences arising from currency translation have different effects on income rates and business taxable profits.

5/ Impact on the Company’s Competitive Position and Market Share

The effect of exchange rates on the company’s future cash flows, revenues, and expenses affects the competitiveness of the company’s products and services in other markets, which in turn impacts its market share, pricing strategies, and profit margin.

It is clear that exchange rate changes have a direct and strong impact on various aspects of accounting operations, from revenues and expenses, through asset and liability valuation, to the impact on taxes and the company’s overall financial position.

Ignoring the effect of these changes may distort financial statements and lead to incorrect decisions. Therefore, accountants and financial departments must handle exchange rate fluctuations with flexibility and caution, applying appropriate accounting translation tools and precise analyses to ensure accurate reporting and effective financial performance.

Illustrative Examples with Numbers of the Impact of Exchange Rate Changes on Accounting

A Saudi trading company imported goods (inventory) from abroad for €1,000,000 on credit on 2022/5/1, with the agreement to pay on 2023/3/1. At that time, €1 was equal to 3 SAR.

Applying the monetary unit principle, the price of the purchased goods on credit is 3,000,000 SAR. At the end of the financial year, 2022/12/31, the euro exchange rate increased to 3.5 SAR.

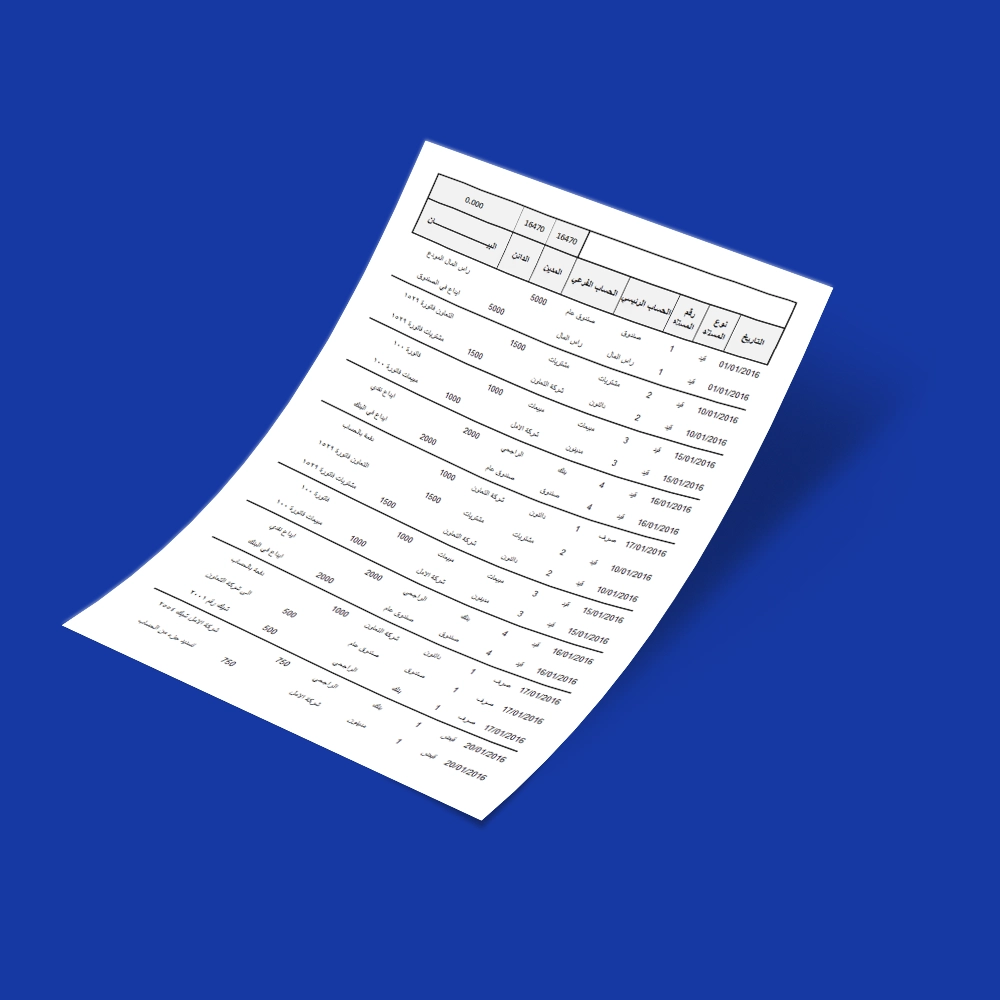

The journal entry for recording the purchase on 2022/5/1 will be as follows:

Debit: Inventory / 3,000,000

Credit: Suppliers (Foreign Currency Creditors) / 3,000,000

Gains or losses from changes in exchange rates are recorded in the income statement either at the end of the financial year or at the time of payment or collection, depending on whether the transaction is payable or receivable.

In this illustrative example, the inventory account is not affected by the increase in the exchange rate, but the suppliers' (creditors) account is affected. The unrealized losses, which have not been paid by the Saudi trading company, are recorded in the income statement as follows:

Debit: Exchange Rate Change Losses / 500,000 (transferred to the 2022 income statement)

Credit: Suppliers / 500,000

Upon payment on 2023/3/1, the euro exchange rate decreased again to 3.30 SAR per €1. Therefore, the payment journal entry is as follows:

Debit: Suppliers / 3,500,000

Credit: Cash / 3,300,000

Credit: Exchange Rate Gains / 200,000 (transferred to the 2023 income statement)

How the Accounting Treatment of a Company’s Various Transactions is Conducted When Exchange Rates Change

Exchange rate fluctuations are among the most significant challenges for companies dealing in foreign currencies, as they directly affect the accuracy of financial statements and the integrity of accounting data. To ensure transparency and compliance with accounting standards, it is necessary to follow a set of systematic procedures to address the impact of these changes.

Below are the main steps in the accounting treatment that companies should follow when dealing with exchange rate changes:

1/ Standardizing the Currency Used in Accounting Formulas

The foreign currency to be used in accounting and reporting formulas must be determined at its updated exchange rate in the financial statements when dealing with foreign currency transactions.

If the company has a balance sheet in Saudi Riyals and sells its products in US dollars, the dollar should be used to determine the value of goods sold. Conversely, if the company’s balance sheet is in Riyals and it purchases goods from another country in a foreign currency, the local currency should be used in the accounting equation to calculate liabilities.

2/ Applying a Natural Hedging Strategy

Natural hedging refers to balancing foreign currency inflows and outflows for imports and exports to reduce exposure to exchange rate fluctuations and their effects on accounting operations. This can be achieved by matching revenues with expenses in the foreign currency, whether when obtaining raw materials, borrowing, or investing.

3/ Applying a Financial Hedging Strategy

Financial hedging refers to using financial instruments such as futures contracts, swaps, stocks, and others to hedge and limit potential losses from currency changes related to a specific cash asset.

This mitigates the impact of exchange rate fluctuations on the accounting of financial transactions, as these instruments allow companies to lock in exchange rates for future transactions, reducing currency risk.

4/ Geographic and Operational Diversification

Diversifying operations, production activities, and opening multiple branches and markets in various geographic areas with multiple currencies helps reduce the impact of foreign exchange rate fluctuations on financial position and performance.

5/ Translating Financial Statements According to Generally Accepted Accounting Principles (GAAP)

Assets and liabilities should be recorded at the local currency exchange rate used in reporting at the end of the financial period, ensuring accounting entries match the exchange rate at that time. Income data should be recorded on the same date as revenue or expenses are recognized, using the exchange rate at that time.

Historical exchange rates are used to record shareholders’ equity for those entitled to profits and ownership. If the company has foreign operations keeping books in a foreign currency, this is sometimes referred to as the “Summary of Significant Accounting Policies,” in line with the principle of disclosure and reporting the methodology used for currency translation.

In summary, the accounting treatment of exchange rate changes is carried out through a set of well-studied steps aimed at maintaining the accuracy and fairness of financial data. These steps include standardizing the currency in accounting formulas, applying natural and financial hedging strategies to reduce risk, and geographically diversifying operations to distribute the impact.

Compliance with international accounting standards (GAAP) is essential when translating financial statements to ensure transparency and professional compliance. All of this helps organizations manage exchange rate fluctuations effectively and minimize their negative impact on financial reporting and decision-making.

Using the Daftra accounting system greatly facilitates implementing these steps, as it provides capabilities to handle multiple currencies, perform automatic conversions, and prepare financial statements according to updated exchange rates, reducing the chances of manual errors and enhancing the accuracy of accounting data.

What Are the Five Common Terms Related to Exchange Rates and Accounting Operations?

In the era of globalization and the expansion of companies into international markets, accounting operations have become significantly affected by exchange rate fluctuations. To keep up with this complexity, it is important to understand accounting terms related to exchange rates and make sound financial decisions. The following are the five most common terms used in this context:

- Closing Rate: Refers to the spot exchange rate at the end of the financial reporting period.

- Exchange Difference: The value resulting from translating or converting a certain number of units of one currency into another at different exchange rates.

- Exchange Rate: The ratio of one currency to another, while the spot exchange rate refers to the currency rate at delivery or immediate transaction.

- Foreign Currency: The currency is different from the official or functional currency of the parent entity and the economic environment in which it operates.

- Presentation Currency: The currency in which financial data, information, and numerical figures are presented in financial statements and final accounts.

Understanding these five terms related to exchange rates is essential for anyone working in accounting, especially in business environments dealing with multiple currencies. Starting from the closing rate, exchange difference, exchange rate, foreign currency, and presentation currency, these terms help you understand how exchange rate changes affect accounting operations.

Which International Accounting Standard Governs Exchange Rates?

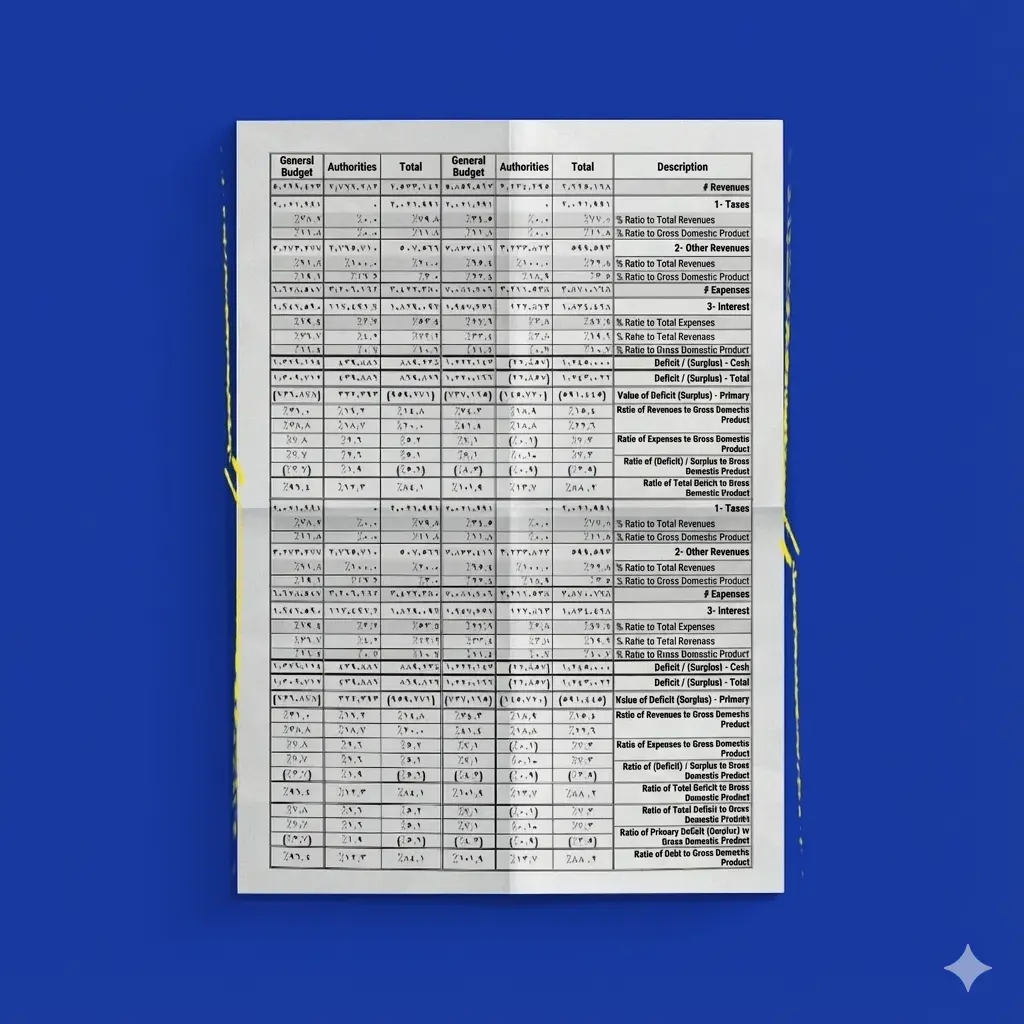

International Accounting Standard (IAS) 21 is the standard related to preparing financial statements in the local currency for transactions conducted in foreign currencies. The standard defines exchange rate changes as the difference resulting from translating a certain number of units of one currency into another. According to this standard, the impact of exchange rate changes on accounting operations is handled as follows:

- Applying the Spot Exchange Rate: Apply the spot exchange rate amounts between the local currency and the foreign currency to the foreign currency at the transaction date.

- Recognizing Exchange Differences: Recognize exchange differences resulting from settling monetary items, or recognize translation that occurred at rates different from those used in the financial period in which they arose.

- Translating Assets and Liabilities at the Closing Rate: Translate assets and liabilities for each financial position statement at the closing rate at the date of that statement.

Translating Income and Expenses at the Transaction Date: Translate income and expenses for each comprehensive or separate income statement at the exchange rates on the dates of those transactions, recognizing all resulting exchange differences in the other comprehensive income statement.

Can Accounting Software Assist in Accounting Treatment When Exchange Rates Change?

Yes, accounting software can handle accounting operations when currency exchange rates change by following these guidelines:

- Choose a cloud-based accounting program that supports multiple currencies to manage foreign exchange risk effectively, allowing the recording of financial transactions in multiple currencies according to the updated exchange rate and then generating consistent and compliant financial reports.

- The accounting software should provide indicators on the impact of exchange rate changes on the company’s performance and financial position, through reports showing balances, gains, and losses, to enable informed financial decision-making.

In this context, Daftra cloud accounting software is considered one of the best programs that automates accounting treatment when the currency exchange rate differs between purchase or sale and the payment date. The software automatically creates a journal entry to adjust the customer or supplier account against the currency change account. Learn more about the ability to change and manage exchange rates in Daftra through this link.

Frequently Asked Questions

Does a change in the currency exchange rate affect the company’s financial statements?

Yes, a change in the currency exchange rate directly affects the company’s financial statements, especially in companies dealing with foreign currencies. This affects:

- The value of assets and liabilities is evaluated at the end of the financial period.

- Revenues and expenses are recorded in a foreign currency.

- The income statement records exchange differences as gains or losses.

- Taxes are due to differences in taxable profits.

What are the financial effects of exchange rate fluctuations?

The financial effects of exchange rate fluctuations include:

- Impact on revenues and expenses: Changes in the exchange rate directly affect the value of revenues and expenses when dealing with foreign currencies, leading to an increase or decrease in profits or costs depending on the direction of the change.

- Impact on assets and liabilities: Exchange rate fluctuations affect the value of loans or investments in a foreign currency. A decrease in the local currency increases liabilities or decreases the value of assets when evaluated on the balance sheet.

- Distortion of financial statements: Not using the correct exchange rate when translating transaction results in inaccurate data, which distorts financial reports and affects the assessment of the company’s true financial performance.

- Tax impact: Exchange rate differences arising from transactions or translation affect taxable profits, which may change the company’s tax obligations.

- Impact on competitiveness: Fluctuations affect cash flows and total costs, thus influencing product pricing in the global market, potentially reducing competitiveness and market share.

What is the risk of exchange rate changes on the company’s financial statements?

The main risk is that exchange rate changes may lead to:

- A sudden decrease in profits or unexpected losses.

- Distorted financial estimates related to assets and liabilities.

- Flawed management decisions can occur if relying on inaccurate financial data.

- Increased financial liabilities if the local currency decreases against the foreign currency, especially for loans or long-term obligations in foreign currencies.

How does foreign exchange affect financial statements?

Foreign exchange affects financial statements in two main ways:

- Currency translation effect: When preparing consolidated financial statements, the financial results of foreign subsidiaries are converted into the local currency, which may change the final value of revenues or assets.

- Exchange rate difference effect: When monetary transactions (such as payments or collections) are settled, differences between the exchange rate at the transaction date and the settlement date are recorded as gains or losses.

How can foreign exchange rates pose a risk to companies?

Foreign exchange rates pose a risk to companies in the following situations:

- Financial instability due to sudden exchange rate fluctuations.

- Loss of the ability to accurately forecast future cash flows.

- Increased operating costs if the company relies on imported inputs.

- Higher tax risk when calculating profits resulting from currency exchange differences.

- Threat to competitiveness in international markets if exchange rates affect the final prices of products or services.

Are exchange rate changes necessarily good or bad for a company?

No, exchange rate changes are not necessarily always good or bad; their impact depends on the nature of the company’s activity, financial structure, and the type of foreign currency transactions. For example:

- An increase in a foreign currency may benefit a company if it exports products to foreign markets, as revenue value increases when converted to the local currency.

- Conversely, the same currency increase may cause losses if the company relies on importing raw materials, as costs rise.

Therefore, the impact of exchange rate changes can be positive or negative and varies from company to company depending on its financial position and international transactions.

How can companies hedge against exchange rate risk?

Companies can hedge against exchange rate risk through two main strategies:

- Natural Hedging

- Balancing foreign currency inflows and outflows between revenues and expenses.

- Example: If a company sells in dollars and also imports in dollars, fluctuations in the dollar will have little effect on net cash flow.

- This type of hedging does not require financial instruments but relies on balanced operational planning.

- Financial Hedging

- Involves using financial instruments such as forward contracts or swaps.

- These tools allow companies to lock in the exchange rate for future transactions, reducing the impact of fluctuations.

- Financial hedging is more commonly used by companies exposed to sharp exchange rate fluctuations that want to protect their profits from volatility.

In conclusion, the impact of exchange rate changes on accounting operations is one of the most important factors governing market movements and determining business directions. Therefore, companies must comply with international accounting standards for the accounting treatment of various transactions when exchange rates change and follow guidance to successfully manage these effects. This includes monitoring exchange rate movements regularly and maintaining a balance between risks and opportunities that can be leveraged when dealing with foreign currency changes.