Profit Margin, Its Types, and How to Calculate It

The objectives pursued by each economic institution may differ, but what they all have in common is their clear aim to achieve the highest possible level of profits. But how can we determine whether an institution has succeeded in achieving this goal? This is where measuring the profit margin comes into play, which we will explain in the following lines.

What Is Profit Margin?

Profit margin is defined as a measure used to determine a company’s ability to generate money through selling its products or services. It is usually expressed as a percentage, indicating the portion of total revenue that the institution is able to retain as profit over a specific period of time.

Businesses, investors, and credit rating agencies use the profit margin metric to assess the financial health of a company or institution before making decisions related to business expansion, investment, or lending. This helps them understand how effectively the company is managed and predict its potential future growth.

Types of Profit Margin

There are three main types of profit margin that management should focus on measuring in order to evaluate the financial health of the institution and make well-informed decisions. These types are as follows:

1. Gross Profit Margin

The gross profit margin is used to determine the profit margin generated by a specific product or service on its own, rather than the total profit achieved by the company as a whole.

It is calculated by deducting the direct expenses required to produce these products from the revenues generated by them. This helps identify the most and least profitable products and encourages management to use this data to reprice certain products or discontinue them altogether.

This type of profit margin focuses on the direct costs associated with the product, such as labor wages and raw material costs, but does not take into account fixed expenses such as rent, utilities, equipment purchases, or taxes.

2. Operating Profit Margin

While the gross profit margin focuses only on the direct costs required for products, the operating profit margin takes into consideration all the daily operating expenses incurred by the institution, such as overhead costs, operating and production expenses, sales, and administrative expenses.

This margin also accounts for the depreciation of the company’s assets but excludes debts and taxes.

Ultimately, the operating profit margin provides a more objective and accurate picture of what the company actually earns from its sales after deducting the operating expenses it incurs on a daily basis.

You can rely on an operating net profit calculation model to easily and automatically calculate the profit margin.

3. Net Profit Margin

The net profit margin measures the gains a company achieves after deducting all its expenses from the revenues it generates. The expenses deducted when calculating this margin include product production costs, administrative expenses, taxes, debts, and other costs.

After that, the net profit margin is expressed by calculating the percentage of the company’s profit from its sales. This percentage is considered a highly accurate indicator for measuring the financial health of organizations.

Best Strategies to Improve Profit Margin

If you are looking for ways to improve your organization’s profit margin, the approach is quite straightforward. You can either reduce the amount of expenses and costs you incur, increase the profits you generate, or combine both methods, which is the most effective solution.

But how can this be achieved? Below, we present a set of strategies that you can rely on to achieve this goal:

1. Reduce Total Operating Costs

It is important to look for the best service you can receive at the lowest possible price. Therefore, we advise you to search for effective ways to reduce office expenses, utilities, raw materials, employee wages, equipment used, maintenance and repair costs, and other related expenses.

Always try to negotiate the lowest price you can pay without undermining employees’ rights, so as not to affect their job satisfaction, and without using lower-quality materials that could negatively impact customer satisfaction, leading to greater losses instead of profits.

Always strive to maintain a balance and achieve the best possible gains without causing negative effects on other aspects of your organization.

If you want to calculate the actual production costs of products or services to help you estimate expected profits, you can rely on the added profit margin model provided by Daftra.

2. Choose More Profitable Products

It is important to conduct break-even analysis from time to time on the products you sell in your organization to identify those that cost you a lot but generate only minimal profits. In such cases, you should eliminate them or replace them with other products that achieve a higher profit margin.

Therefore, we recommend staying constantly informed about market developments and identifying competitors’ products that generate higher profit margins, then producing similar products to enhance your overall profitability.

3. Change Your Pricing Strategy

Your products may have excellent features, but incorrect pricing can directly affect your profits. Therefore, consider changing the pricing strategies you rely on. Pricing can be based on the value your products provide or on the total cost of production plus an appropriate profit margin. At that point, you may discover how incorrect your previous pricing was.

Read also: The Concept of Product Pricing and the Latest Pricing Strategies

4. Increase Customer Loyalty to Your Organization

Making customers feel that you care about their opinions and after-sales service is enough to encourage them to continue dealing with your organization. When customers feel a sense of loyalty and belonging, you can save a significant portion of your advertising budget. Moreover, these customers can act as promoters for your business by encouraging those close to them to deal with your organization and defending you during times of crisis.

Read also: What Is Customer Relationship Management (CRM)

How Do You Calculate Your Organization’s Profit Margin?

There are different formulas used to calculate each type of profit margin mentioned in this article. They are as follows:

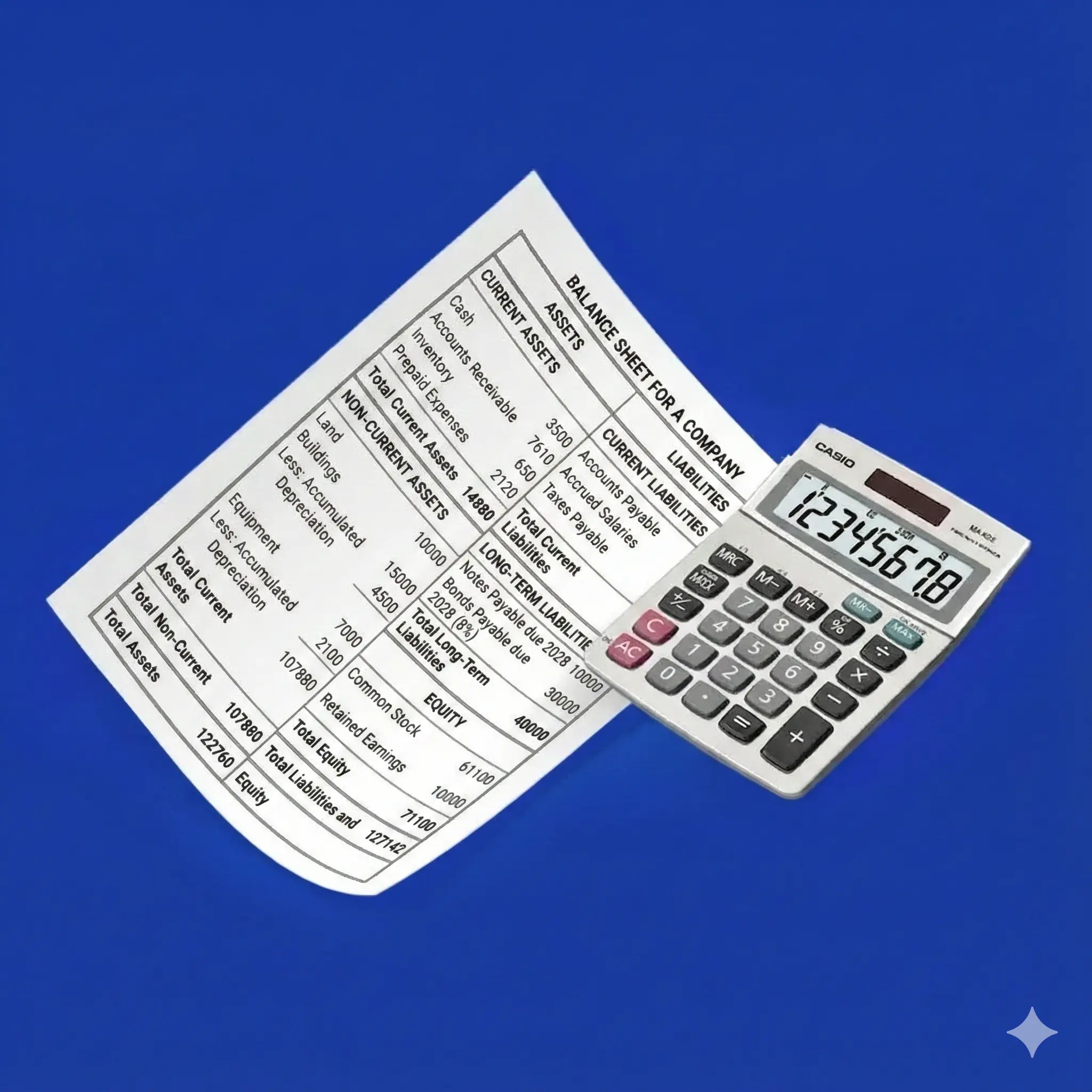

1. Calculating Gross Profit Margin

You can obtain the gross profit margin percentage by applying the following formula:

Gross Profit Margin = (Net Sales − Cost of Goods Sold) ÷ Net Sales × 100

2. Calculating Operating Profit Margin

You can obtain the operating profit margin percentage by applying the following formula:

Operating Profit Margin = (Operating Profit ÷ Sales) × 100

3. Calculating Net Profit Margin

You can obtain the net profit margin percentage by applying the following formula:

Net Profit Margin = (Net Profit After Deducting All Expenses ÷ Revenue) × 100

Instead of following traditional manual steps, you can download a ready-to-use profit margin template that automatically calculates the margin for you.

Read also: What Is Contribution Margin and How to Calculate It

Common Mistakes in Calculating Profit Margin

Calculating profit margin is a fundamental step for every business organization when making decisions such as adding or removing a product, setting marketing strategies, and identifying ways to develop the business.

This requires the company to pay close attention during the calculation process and ensure that the results reached are as accurate and realistic as possible.

However, there are several common mistakes that financial institutions make when calculating different types of profit margins, including the following:

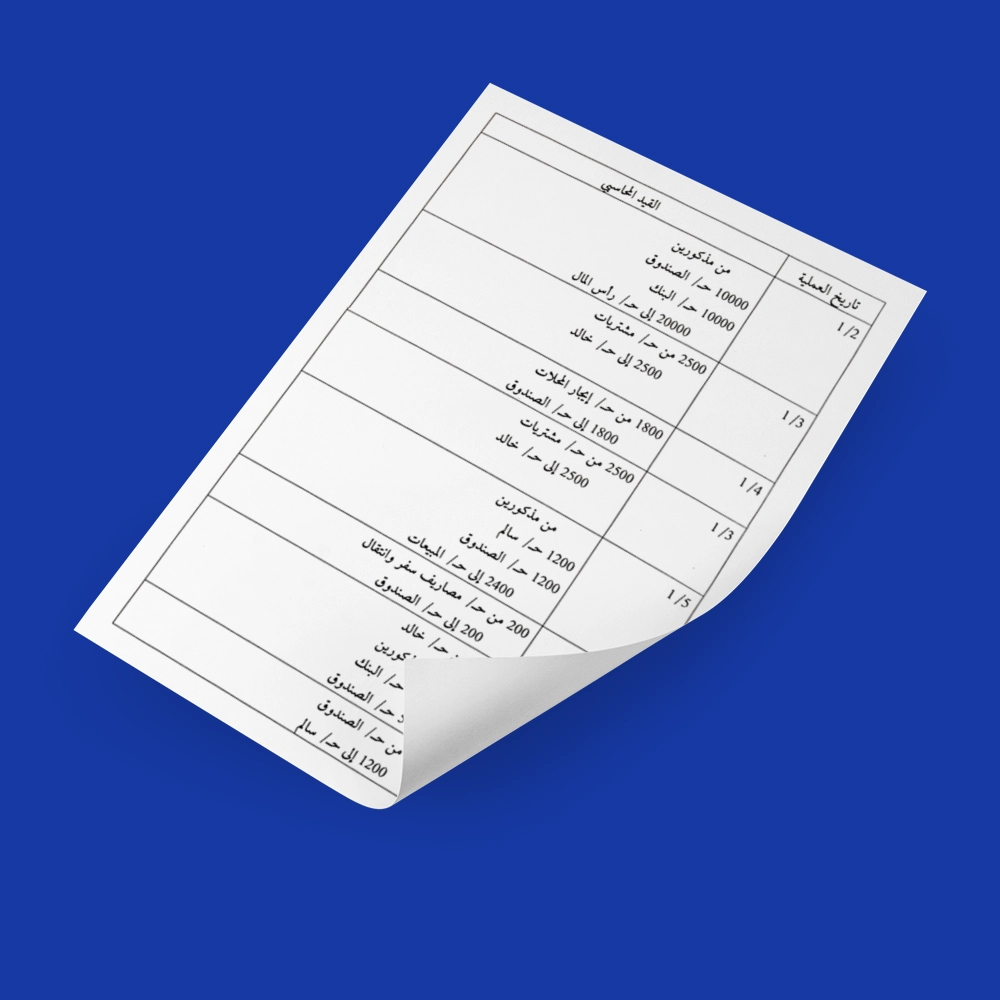

1. Forgetting Some Costs

Many companies make a serious mistake when calculating various types of profit margins by forgetting or overlooking some costs that should be taken into account. For example, a company may focus only on raw material costs while ignoring administrative, packaging, marketing, labor, and other expenses. As a result, the calculated profit margin percentages will be inaccurate.

Learn more: Direct Costs and Indirect Costs and the Difference Between Them

2. Confusing Fixed and Variable Costs

Another mistake that some companies may make when calculating their profit margin is a lack of sufficient awareness of fixed costs, which do not change with production volume, such as rent or employee salaries, and variable costs, which are affected by production volume, such as raw material and shipping costs.

Treating variable costs as fixed can lead to misleading profit margin results, giving management the false impression that the company has achieved higher net profit than it actually has.

3. Ignoring Sales Seasons and Discounts

Some companies experience higher profits during certain seasons and lower profits during others. In such cases, the ideal solution to boost sales may be to launch a set of offers and discounts on lower-selling products.

This is where the problem arises, as management may overlook accounting for these discounts, which naturally reduce revenues. As a result, profit margin calculations become inaccurate.

4. Failing to Regularly Update Prices

With rising inflation rates worldwide, companies should be fully aware of the prices of materials required for manufacturing, the expected increase in overhead costs, salary increases, and other types of expenses. These prices should be updated regularly when calculating profit margins to ensure that the results are consistent with the prevailing economic conditions.

5. Not Reviewing Data

An error in a single figure at any stage of profit margin calculation can lead to completely incorrect results with serious consequences.

Therefore, profit margin calculations should be reviewed more than once, preferably by more than one person with a high level of expertise, to ensure the highest possible level of accuracy. Companies can also rely on periodic external audits to verify the accuracy of the data.

Read also: How to Calculate Profit Percentage from Sales

The Difference Between Profit Margin and Net Profit

Many people confuse the concepts of profit margin and net profit, but there is a subtle difference between the two terms.

Simply put, net profit is the amount remaining from sales after deducting production costs, operating expenses, taxes, and other expenses. Profit margin, on the other hand, is a percentage that shows the rate of profit a company has achieved relative to the revenue it has generated.

Ultimately, both profit margin and net profit help assess a company’s financial health and the effectiveness of management in maximizing profits from its revenues.

Factors Affecting Profit Margin

Management’s awareness of the factors that positively and negatively affect profit margin is essential in order to increase profits and reduce expenses to the lowest possible level. Among the most prominent factors that influence profit margin are the following:

1. Sales and Revenue

Naturally, an increase in a company’s sales leads to higher revenues and, consequently, higher net profit, provided that costs are managed efficiently. Therefore, organizations seek to boost sales through various methods such as marketing strategies, discounts, promotions, and special offers.

2. Cost of Goods Sold (COGS)

The second factor affecting profit margin is the level of cost incurred by the organization to produce the products it sells or the services it provides. Accordingly, companies should look for ways to minimize these costs by adopting strategies such as purchasing raw materials in bulk, negotiating better purchasing deals, improving service quality to reduce waste, and other cost-reduction measures.

Read also: The Importance of Cost–Benefit Analysis

3. Operating Expenses

Another important aspect companies must consider is the operating expenses incurred during different stages of production, such as rent, salaries, administrative expenses, utilities, and other overhead costs.

Companies can explore alternative solutions to save more money, such as hiring specialists on a temporary or part-time basis instead of full-time employment, adopting energy-saving practices, or using simpler and more efficient management methods, all aimed at reducing unnecessary costs as much as possible.

4. Pricing Strategies

As explained earlier in this article, choosing the right pricing strategy can increase sales. However, it is important to note that pricing strategies must be based on several factors to avoid negative impacts on the product and the organization.

These include studying the market, analyzing competitors, and assessing customers’ willingness to accept price changes, which ultimately helps in identifying the most suitable pricing strategy for your product.

5. Enhancing Efficiency and Productivity

One of the most effective ways to improve profit margin is to enhance employee efficiency within the organization. This enables employees to work more smoothly and professionally, improves their performance, increases productivity, and reduces problems caused by poor planning or randomness. Ultimately, all of this benefits the company and contributes to higher overall profitability.

In conclusion, this article has covered profit margin, its different types, and how to calculate it accurately, while highlighting the key factors that affect it and effective strategies for improving profitability. This supports your organization, helps maintain its financial health, and drives further growth.

You can also rely on Daftra to calculate profit margin automatically, as it provides a cloud-based accounting software that helps you manage your business with ease.