Inventory and Stocktaking Methods

Table of contents:

- What is Stocktaking?

- What Does "Goods Inventory" Mean?

- What is an Inventory Ledger?

- Inventory Ledger Columns

- Types of Inventory Stocktaking

- Importance of Stocktaking

- Methods of Inventory Valuation

- What Is a Stocktaking Report?

- What Are the Conditions of Stocktaking?

- What Is Physical Stocktaking?

- What Is Final Inventory Stocktaking?

- What Are the Requirements for Conducting the Stocktaking Process?

- What Is the Best Method for Warehouse Stocktaking?

- Criteria to Consider When Choosing an Inventory Stocktaking Method

- What Is Recorded in the Inventory Register?

- What Are Inventory Stocktaking Policies?

- How Is Store Stocktaking Conducted?

- What Are the Benefits of Inventory Stocktaking?

- Stocktaking Timing

- Who Conducts the Stocktaking Process?

- What Is the Role of the Inventory Accountant?

- What Is the Difference Between Stocktaking and Inventory Adjustments?

- What Is the Difference Between the Trial Balance Before and After Stocktaking?

- The Difference Between Counting and Stocktaking

- The Difference Between Stocktaking and Budgeting

- The Difference Between Inventory and Stocktaking

- How Do You Perform Inventory Stocktaking in Daftra?

- Frequently Asked Questions

The process of stocktaking is considered one of the essential tasks carried out by the management of any project or company to identify the raw materials or products it has, with the aim of maintaining a balance between supply and demand and avoiding risks associated with poor allocation of inventory resources, which can lead to the accumulation of financial burdens.

In this article, we share our accounting expertise on how to improve operational efficiency, avoid unnecessary costs, and not miss sales opportunities, all of which can be achieved through effective inventory management.

What is Stocktaking?

Stocktaking is the process of counting the raw materials available in the company's warehouses for its manufacturing and production processes, as well as tracking products sold, to ensure sufficient inventory and anticipate any shortages as early as possible.

Stocktaking is used in all commercial projects, ranging from small retail shops to large industrial companies. The timing of stocktaking depends on its type, as determined by the company or project management.

What Does "Goods Inventory" Mean?

The term "goods inventory" refers to the process of recording and evaluating all goods held in the company’s inventory, with the purpose of updating the company’s financial and accounting records to reflect the current inventory value. Stocktaking ensures financial data accuracy and allows the company to monitor inventory levels, assess the need to reorder, or liquidate excess stock.

What is an Inventory Ledger?

An inventory ledger is an accounting record used to track and document the details of assets and inventory held by the organization.

Inventory Ledger Columns

The number of columns in an inventory ledger varies depending on the company’s needs and the nature of the assets being inventoried. However, it typically includes 8 columns, representing:

- Item Description

- Identification Number

- Quantity

- Purchase or Receipt Date

- Purchase Cost

- Current Value

- Storage Location

- Notes

Thus, the components of an inventory ledger include Item Description, Identification Number, Quantity, Purchase/Receipt Date, Purchase Cost, Current Value, Storage Location, and Notes. These elements ensure comprehensive documentation, facilitating review and informed decision-making.

See also:Warehouse and Inventory Management: Importance and Requirements

Types of Inventory Stocktaking

There are several methods companies use to stocktake their products inwarehouses and storerooms. Below, we explain the most prominent types of inventory stocktaking relied upon by commercial enterprises.

1. Perpetual Stocktaking

Perpetual stocktaking helps management know the inventory value at any time, as every sale or purchase of materials in the warehouse is recorded. Inventory records are updated in real-time.

2. Periodic Stocktaking

Periodic stocktaking is a type of inventory counting in which the inventory account is updated at the end of a specific period or when the company prepares its financial position statement, rather than being updated with every sale or purchase.

In this system, the inventory is physically counted as it exists in the warehouse, not just through ledger entries.

3. Surprise Stocktaking

Surprise stocktaking is conducted by management without prior notice, either to detect theft or embezzlement, or to verify product expiration dates and identify damaged goods. It also ensures that the physical inventory matches the recorded inventory.

4. Partial Stocktaking

Partial stocktaking focuses on counting specific items, locations, or categories of inventory to obtain detailed information about those products.

5. Physical or Full Stocktaking

Physical or full stocktaking is a method that confirms the results of periodic and perpetual stocktaking. It is usually conducted annually or semi-annually and includes all inventory units.

6. Electronic Stocktaking

Electronic stocktaking is a type of regular inventory counting in which stock is recorded using barcodes or RFID scanning devices. These devices read inventory data quickly and efficiently, helping to determine available quantities and identify missing products.

7. Analytical Stocktaking

Analytical stocktaking relies on data analysis to identify differences between recorded inventory and actual inventory based on financial and accounting reports.

This type of stocktaking does not require physical counting, as it focuses on available data to detect potential issues such as theft, inventory loss, or data entry errors, improving inventory management efficiency with minimal time and effort.

Thus, the types of inventory stocktaking relied upon by commercial enterprises vary according to their goals and needs and include: perpetual stocktaking, in which data is updated in real time; periodic stocktaking, conducted at the end of specific periods; and surprise stocktaking, to detect tampering or spoilage.

partial stocktaking, which focuses on specific items; physical or full stocktaking, covering all inventory units annually or semi-annually; electronic stocktaking, using devices such as barcodes and RFID; and finally, analytical stocktaking, which relies on data analysis to detect discrepancies and improve management efficiency.

Importance of Stocktaking

Stocktaking aims to determine the quantity of goods or products to be sold, as well as the available raw materials. Inventory is evaluated at the end of the financial year to calculate the cost of goods sold and the cost of unsold inventory. This has a significant impact on the profits of commercial enterprises.

The importance of inventory stocktaking for companies includes:

1. Determining Gross Profit

Stocktaking helps determine the gross profit, which is the difference between sales revenue and the cost of goods sold (COGS).

To calculate gross profit, the cost of goods sold is matched with the accounting period’s revenue using the following formula:

Cost of Goods Sold (COGS)=Opening Inventory+Purchases−Closing Inventory

This formula illustrates how inventory quantity and value affect production costs and, consequently, the company's gross profit at the end of the financial year.

2. Verifying Financial Position

Knowing the closing inventory value in the balance sheet helps determine the company’s financial position. Over- or underestimating inventory can misrepresent working capital and the company's overall financial condition.

3. Detecting Theft and Embezzlement

Stocktaking helps prevent or quickly detect warehouse theft, as companies must conduct stocktaking periodically and reconcile physical inventory with ledger records.

Companies should also conduct surprise stocktakes occasionally, without prior notice, to detect employee theft or embezzlement.

Accordingly, the importance of stocktaking lies in several key aspects, most notably: determining gross profit by identifying the cost of goods sold and ensuring the accuracy of the company’s financial position by precisely determining the closing inventory value.

Finally, it helps in detecting theft or embezzlement by reconciling what is recorded in the accounting records with the actual inventory in warehouses, whether through periodic or surprise stocktaking.

See also:

What is an Item Card in Warehouses and Its Components

What are Stocktaking Adjustments in Accounting and Their Objectives

Methods of Inventory Valuation

There is more than one method used by project and company management in the process of counting and valuing materials in their warehouses. Among the methods of inventory valuation are the following:

1. First-In, First-Out (FIFO) Method

This method assumes that the first items purchased and entered into the warehouse are the first to be sold.

It is considered one of the most commonly used methods in inventory valuation due to its simplicity and ease of application. It is typically used by companies dealing with perishable products.

During periods of inflation and rising prices, the cost of goods remaining in inventory is lower because they were purchased at lower prices before the increase. These goods are sold at higher prices, resulting in a higher profit margin. However, this also results in a higher tax burden for the company.

2. Last-In, First-Out (LIFO) Method

According to this method, the products most recently entered into the warehouse are sold first, while older inventory remains for longer.

This method is used for non-perishable products, but it is rarely adopted because older products may lose value and remain unsold, leading to significant losses.

However, companies may use this method during inflationary periods, as higher-cost materials are sold first while lower-cost items remain in inventory. In this case, the cost of goods sold increases and the profit margin decreases, resulting in lower taxes payable by the company.

3. Average Cost Method

Under this method, the cost of all materials and products in inventory is calculated collectively. It is used when inventory items cannot be separated from one another, making it difficult to apply individual valuation methods.

The average cost per unit is calculated using the following formula:

Average Unit Cost = Total Cost of Goods in Inventory ÷ Total Number of Units in Inventory

4. Inventory Valuation Based on Cost (Cost-Based Classification)

This method is known as ABC Analysis, in which inventory items are classified into categories based on their cost relative to the percentage of sales generated by each category.

The main objective is to identify high-cost and low-cost products. This method supports inventory valuation by enabling sound decision-making regarding pricing strategies based on product cost to achieve appropriate profitability, forecast demand, and provide accurate information on how inventory costs affect financial performance.

5. Just-in-Time (JIT) Method to Reduce Inventory Waste

This inventory valuation method relies on ordering inventory only when it is actually needed. It helps reduce storage costs and avoid excess inventory.

However, it may result in inventory shortages if supply chains are delayed, and it is not suitable for all industries.

6. Specific Identification Method

This method involves tracking and calculating the cost of each inventory unit individually. It helps determine profits accurately based on the actual cost of each unit.

7. Variable Costing Method

This method evaluates and calculates inventory based on the variable costs associated with producing inventory units. These costs include raw materials and labor. In other words, they are costs that change with changes in production volume. This method helps determine the short-term profit margin.

Thus, inventory valuation methods vary according to the nature of a company’s products and its objectives. These methods include: the First-In, First-Out (FIFO) method suitable for perishable goods; the Last-In, First-Out (LIFO) method for non-perishable goods; and the Average Cost Method for collectively calculating unit costs.

In addition, there is cost-based inventory valuation (ABC analysis) for classifying products according to their cost, the Just-in-Time (JIT) method to reduce waste, the Specific Identification Method to determine the exact cost of each unit, and finally the Variable Costing Method, which is based on costs that vary with production volume.

What Is a Stocktaking Report?

A stocktaking report is an official document that records the results of the stocktaking process. It is important for accounting and auditing purposes, as it helps confirm accounting records and verify their accuracy. It may also be used as evidence in external audit cases or for insurance purposes. The elements of a stocktaking report include the following:

- Details of inventory items, such as description, quantity, and, sometimes, the estimated value of each item.

- Date and time of stocktaking: to document when the stocktaking process was carried out.

- Names and signatures of the stocktaking committee members: recording the names and signatures of the individuals who performed the stocktaking.

- Stocktaking notes and comments: documenting any notes or comments regarding the condition of items or any issues observed during stocktaking.

- Summary of stocktaking results: a summary of the main outcomes of the stocktaking process.

It is clear that the stocktaking report is an official document that accurately records the results of the stocktaking process. It is relied upon in accounting and auditing, and may also be used as a reference in external inspections or insurance.

The report includes essential elements such as details of inventory items, the date and time of the stocktaking, names and signatures of the stocktaking committee, notes and comments recorded during the process, and a summary of the final stocktaking results.

What Are the Conditions of Stocktaking?

To ensure the accuracy of financial information and the credibility of accounting records, certain conditions must be met for the stocktaking process to be effective and reliable, ensuring completeness, accuracy, and proper organization.

The stocktaking process requires several conditions to ensure its accuracy and effectiveness, most notably:

- Data accuracy: Stocktaking data must be accurate to reflect the actual inventory status.

- Comprehensiveness: Stocktaking must include all inventory items, including raw materials, work in progress, and finished goods.

- Appropriate timing: Selecting the appropriate time to conduct stocktaking, whether at regular intervals (such as the end of the financial year) or when an accurate financial assessment is required.

- Organization and coordination of stocktaking data: Stocktaking data must be recorded in a structured, organized manner.

- Data review: Reviewing and verifying stocktaking data to ensure its accuracy.

- Compliance with accounting standards: Stocktaking must be conducted in accordance with applicable accounting standards.

- Protection of stocktaking data: Safeguarding stocktaking data from damage or loss.

It is evident that among the most important conditions for stocktaking are achieving accuracy and comprehensiveness in recording inventory data, selecting the appropriate timing, and organizing and coordinating data systematically.

In addition, data must be reviewed and verified, accounting standards must be complied with, and stocktaking data must be protected from damage or loss. Collectively, these conditions ensure the effectiveness and reliability of the stocktaking process and enhance the credibility of financial records.

What Is Physical Stocktaking?

Physical stocktaking is the process of auditing and recording the actual quantities of materials or goods available in inventory at a specific point in time. The physical stocktaking process includes the following elements:

- Inspection and counting of physical assets, including products, raw materials, finished goods, and other items.

- Determining the value of these assets: based on purchase cost or current market value.

- Documenting the results: recording these results in the company’s accounting records.

Physical stocktaking is a precise process that involves inspecting and counting physical assets in inventory, whether products, raw materials, or finished goods, determining their value based on purchase cost or current market value, and formally documenting these results in the company’s accounting records.

You may also be interested in: How to Code Inventory Items for More Accurate Inventory Tracking and Stocktaking

What Is Final Inventory Stocktaking?

Final inventory stocktaking is the process of determining and recording the total quantity and value of available inventory at the end of a specific accounting period, such as the end of the financial year.

What Are the Requirements for Conducting the Stocktaking Process?

A successful stocktaking process requires a set of basic requirements that ensure it is carried out accurately and in an organized manner. These elements help achieve reliable stocktaking results that reflect the actual inventory status. The most important requirements include:

- Advance planning: by determining the appropriate time and method for conducting stocktaking.

- Providing human resources: ensuring the availability of sufficient trained personnel to carry out the stocktaking.

- Providing tools and equipment, such as electronic counting devices, scales, and computers.

- Organizing inventory: arranging it in a way that facilitates counting.

- Providing documents and forms for recording stocktaking results.

- Ensuring inventory security: taking the necessary measures to protect inventory during stocktaking.

- Verifying the accuracy of recorded data: reviewing recorded data and ensuring its correctness to guarantee accurate results.

Accordingly, the requirements for conducting the stocktaking process include proper planning, providing qualified staff, preparing the necessary tools, organizing inventory appropriately, providing recording documents, protecting inventory during stocktaking, and finally reviewing the accuracy of recorded data to ensure the reliability of results.

What Is the Best Method for Warehouse Stocktaking?

Company management must choose the most appropriate inventory stocktaking method, as it directly affects the company's profit margin. The chosen method can lead to significant changes in the cost of goods sold, net income, and closing inventory balance.

It should be noted that each method has its advantages and disadvantages. For example, adopting the LIFO method results in lower profit, as the most recently purchased items are usually more expensive. In contrast, adopting the FIFO method results in higher profit, since older inventory items generally have lower costs.

Criteria to Consider When Choosing an Inventory Stocktaking Method

There are several criteria to consider when selecting the optimal inventory valuation method, including:

- If you expect inventory costs to increase, it is preferable to adopt the LIFO method.

- If inventory costs are low, it is preferable to adopt the FIFO method.

Company or project management should analyze the advantages and disadvantages of each method to choose the most suitable approach based on its business conditions and strategic vision.

What Is Recorded in the Inventory Register?

The inventory register helps accurately organize and manage inventory by documenting all details for each inventory item. It contains comprehensive information that enables easy inventory tracking and continuous evaluation of its status. The following elements are recorded in the inventory register:

- Item description: details about each inventory item, such as name, type, and sometimes brand or model.

- Identification number or code: a unique identifier for each item, such as a SKU (Stock Keeping Unit).

- Number of units: the quantity of units available in inventory for each item.

- Purchase or receipt date: the date the item was purchased or received into inventory.

- Purchase cost: the value at which the item was purchased.

- Storage location: the location where the item is stored within the warehouse or store.

- Expiration or validity date: the date by which products with a shelf life expire.

- Item condition: information about the item’s condition, such as new, used, damaged, etc.

- Notes: any additional remarks or relevant information related to the item.

Thus, the components of the inventory register include essential data such as item description, identification number, number of units, purchase date, purchase cost, storage location, expiration date, item condition, and related notes. This ensures accurate and comprehensive inventory documentation.

Download a free editable inventory stocktaking template from Daftra

What Are Inventory Stocktaking Policies?

Each organization sets policies and guidelines for the inventory stocktaking process, which must be communicated to employees and reviewed before starting theprocess to achieve the highest level of organization and accuracy. Inventory stocktaking policies include the following rules:

1. Selecting Employees Not Responsible for Custody

It is preferable to select employees who are not responsible for inventory custody to conduct stocktaking with greater transparency and without any conflict of interest.

2. Determining the Frequency of Stocktaking

Management must choose the stocktaking system to be followed, whether periodic stocktaking or perpetual stocktaking, determine the time intervals for conducting stocktaking, and inform employees of these schedules accurately.

3. Determining Stocktaking Tools and Equipment

When establishing stocktaking policies, management must determine the tools and equipment required by the stocktaking team so they can be provided before the stocktaking process begins.

4. Determining Inventory Levels

Management must define the minimum and maximum inventory levels, as well as the safety stock level below which inventory should not fall, to ensure that the production process is not negatively affected at any time during the year.

5. Determining the Annual Stocktaking Budget

Management must determine the total cost of inventory storage, administrative and operational activities, stocktaking procedures, and any other related expenses within the stocktaking policy.

Inventory stocktaking policies consist of a set of organizational rules that ensure the stocktaking process is carried out accurately and systematically, starting with selecting employees who are not responsible for custody to ensure transparency, determining stocktaking schedules and tools, setting clear inventory levels, and allocating an appropriate budget for stocktaking operations.

Adhering to these policies helps organizations improve the accuracy of inventory data and ensure efficient business continuity.

How Is Store Stocktaking Conducted?

Store stocktaking is an essential step to ensure the accuracy of inventory data and control available stock levels. This process requires careful organization and adherence to specific steps to ensure products are counted correctly and documented accurately, thereby improving inventory management and supporting sound financial decision-making. The steps for store stocktaking include:

- Temporarily closing the store (if necessary): to facilitate the stocktaking process without disruption.

- Organization and arrangement: organizing and arranging goods systematically to facilitate counting.

- Dividing the store: dividing the store into sections to organize and simplify the stocktaking process.

- Using stocktaking tools, such as tablets, barcode scanners, or manual counting devices.

- Documenting data: recording data related to the quantity and type of each item.

- Reviewing: reviewing recorded figures to ensure accuracy.

- Updating accounting records: based on stocktaking results, followed by updating the store’s financial records.

By following stocktaking steps, from temporarily closing the store, organizing goods, and using appropriate stocktaking tools to reviewing and updating accounting records, an effective, accurate stocktaking process can be achieved that reflects the store's actual inventory status, enhancing operational and administrative efficiency.

What Are the Benefits of Inventory Stocktaking?

There are many benefits resulting from inventory stocktaking, as it helps companies develop better plans and methods for managing operations. Stocktaking contributes to the following:

1. Improving Cash Flow

Stocktaking helps identify fast-selling products and reorganize best-selling lists. This helps rationalize spending and direct funds to the right areas, rather than investing in low-demand products.

2. Avoiding Inventory Shortages

By identifying products with high customer demand, companies can forecast required quantities over a specific period and prepare in advance to prevent inventory shortages.

3. Increasing Customer Satisfaction

Knowing which products sell more than others helps improve the quality of low-performing products or adjust their features to attract more customers.

4. Reducing Inventory Waste

Understanding what customers purchase and in what quantities helps avoid holding inventory until it expires. Stocktaking supports developing a production strategy aligned with actual sales volumes.

5. Preventing Production Delays

Some raw materials require long lead times to obtain. Inventory stocktaking enables companies to initiate procurement procedures early to avoid shortages that could disrupt production.

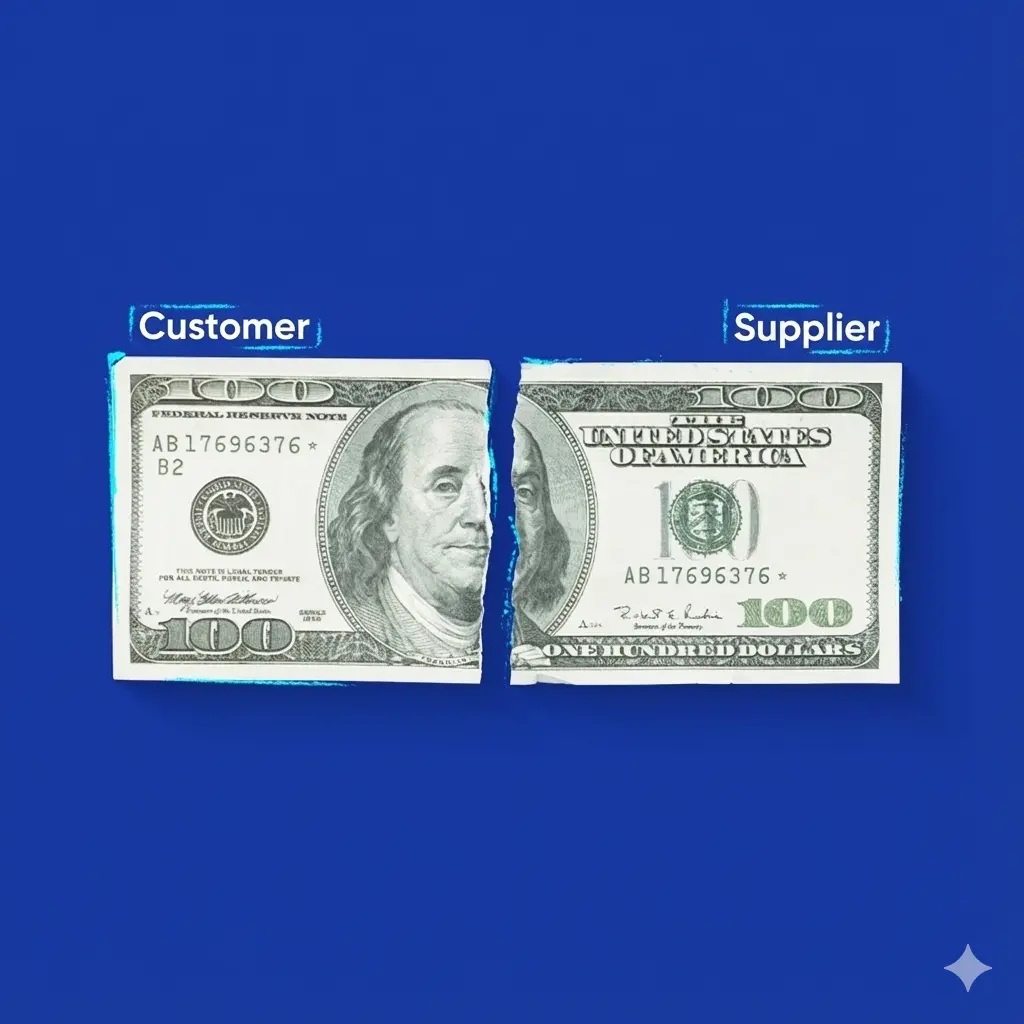

6. Negotiating Better Prices

Knowing which products sell out quickly allows companies to purchase larger quantities from suppliers, giving them leverage to negotiate better pricing.

In summary, inventory stocktaking helps companies improve cash flow by identifying best-selling products and optimizing spending. It also helps avoid shortages by forecasting demand, increases customer satisfaction through product improvements, reduces inventory waste by determining optimal quantities, prevents production delays by securing raw materials on time, and provides opportunities to negotiate better prices when purchasing high-demand products in bulk.

Related Articles:

What Is a Receipt Voucher and Its Contents, with a Free Downloadable Template

What Is the Inventory Documentation Cycle and Its Types, with a Ready-to-Use Template

Stocktaking Timing

Each company or organization’s management determines the appropriate time to conduct inventory stocktaking based on its management approach. Some companies conduct stocktaking on a monthly basis, while others prefer to carry it out annually during the last quarter of the company’s financial year.

Who Conducts the Stocktaking Process?

The company or organization’s management forms a stocktaking committee consisting of the company’s financial accountant, a technical member, the warehouse keeper whose inventory is being stocktaked, and one or more workers, depending on the volume of inventory.

If you are looking for a model to help you with inventory stocktaking, you can download a free inbound and outbound inventory form from Daftra, which helps small businesses and stores manage their operating expenses and revenues resulting from goods trading.

What Is the Role of the Inventory Accountant?

The inventory accountant is the professional responsible for managing and executing stocktaking operations within the organization. This role is essential in ensuring the accuracy of accounting records and providing vital information for financial and operational decision-making. The duties of the inventory accountant include:

- Organizing and planning stocktaking operations, including setting schedules and determining required resources.

- Supervising the physical stocktaking process, including physical counting and valuation.

- Recording stocktaking results and analyzing data by entering results into accounting records and analyzing discrepancies and changes in inventory.

- Preparing stocktaking reports and presenting them to management.

In summary, the responsibilities of the inventory accountant include managing and executing stocktaking operations, organizing and planning them, supervising their implementation, recording and analyzing results, and preparing the necessary reports for management. These tasks contribute to improved inventory management and ensure the transparency and reliability of financial data.

Read also:A Comprehensive Comparison to Choose the Best Inventory Stocktaking Software

What Is the Difference Between Stocktaking and Inventory Adjustments?

Understanding the difference between stocktaking and inventory adjustments is essential to ensure accurate inventory management and accounting records. Each plays a distinct role in monitoring and improving inventory data, with different objectives and procedures. The differences can be identified as follows:

1. Definition

Stocktaking is the physical process of counting and recording all goods or materials in inventory, while inventory adjustments are accounting entries made to align recorded values with the actual values determined through stocktaking.

2. Purpose

Stocktaking aims to determine the actual quantity and value of available inventory, while inventory adjustments aim to ensure that accounting records accurately reflect the actual inventory status.

3. Implementation Procedures

Stocktaking procedures include physically counting, measuring, or weighing materials and recording this information. Inventory adjustments, on the other hand, involve analyzing discrepancies between recorded accounting values and actual values discovered during stocktaking and making the necessary adjustments in the accounting records.

In short, the difference between stocktaking and inventory adjustments lies in the fact that stocktaking is the physical process of counting and recording inventory quantities and values, while inventory adjustments are accounting modifications made to ensure accounting records match the actual data resulting from stocktaking. Both are essential to ensure the accuracy and reliability of inventory-related information.

Read also:The Best Warehouse and Inventory Management Software

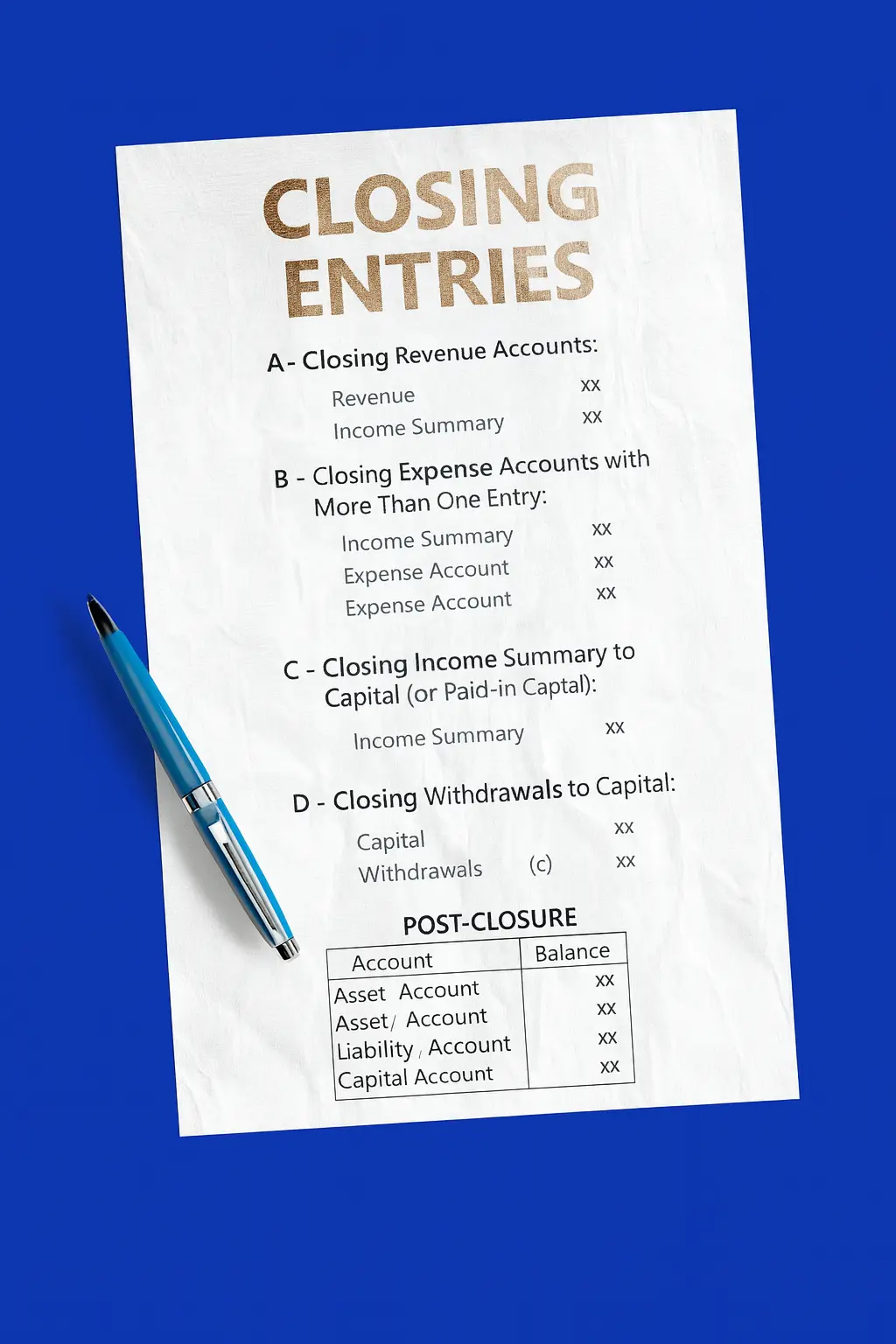

What Is the Difference Between the Trial Balance Before and After Stocktaking?

The trial balance before and after stocktaking is an accounting tool used to evaluate and monitor inventory and financial records. They differ in terms of timing and purpose, which affects the values and figures presented in each. The differences are as follows:

1. Trial Balance Before Stocktaking

Prepared before conducting the physical stocktaking, it reflects figures and values as recorded in the accounting books prior to verifying actual quantities. It is used to identify potential discrepancies between accounting records and actual inventory.

2. Trial Balance After Stocktaking

Prepared after completing the physical stocktaking and making the necessary adjustments, it reflects the adjusted values based on the physical stocktaking results. It is used to present an accurate, up-to-date picture of the organization’s financial position after stocktaking.

In general, the trial balance before stocktaking shows figures as expected or planned, while the trial balance after stocktaking shows figures as they actually are after verification and adjustments.

In summary, the difference between the trial balance before and after stocktaking is that the trial balance before stocktaking shows figures and values recorded in the accounting books before verifying actual quantities.

while the trial balance after stocktaking reflects adjusted values based on the physical stocktaking results and adjustments, providing a more accurate picture of the financial position.

The Difference Between Counting and Stocktaking

The difference between counting and stocktaking lies in their use. Counting is used for operational purposes, such as determining requirements for new purchase orders or verifying the presence of all items.

Stocktaking, however, is a more comprehensive process that includes counting and valuing physical assets (such as goods and equipment) and recording them in accounting records. It focuses on determining quantities and financial value and is used for accounting and financial purposes, such as updating accounting records and ensuring the accuracy of financial data.

The Difference Between Stocktaking and Budgeting

Stocktaking involves recording and valuing the company's physical assets at a specific point in time, focusing on tangible assets such as inventory and equipment. Budgeting, on the other hand, is a financial estimate of expected revenues and expenses for a future period.

It covers all financial aspects of the company, including revenues, expenses, assets, liabilities, and equity, and is used for financial planning and controlling the company’s financial performance.

The Difference Between Inventory and Stocktaking

The relationship between inventory and stocktaking is interdependent, meaning that stocktaking ensures inventory accuracy and enhances asset management efficiency. This relationship can be better understood through the following comparison:

| Inventory | Stocktaking |

| Inventory refers to the physical assets owned by the company, including raw materials, work-in-progress, and finished goods. Its purpose is to hold goods that will be used in production or sold to generate revenue. It focuses on tangible assets that are part of the company’s daily operations. | Stocktaking is the process by which these assets (inventory) are counted and valued, with the aim of providing an accurate picture of their current quantity and value. In short, inventory is the company's physical assets, while stocktaking is the process of identifying and recording these assets in the accounting records. |

The difference between inventory and stocktaking is that inventory represents the physical assets owned by the company, such as raw materials, work in progress, and finished goods, and is held for use in production or for sale.

Stocktaking, on the other hand, is the process of counting and valuing these assets to obtain an accurate picture of the current quantity and value of inventory. Accordingly, stocktaking ensures inventory accuracy and enhances asset management.

You can download a Warehouse Daily Log template from Daftra, ready for editing and use, to facilitate inventory stocktaking.

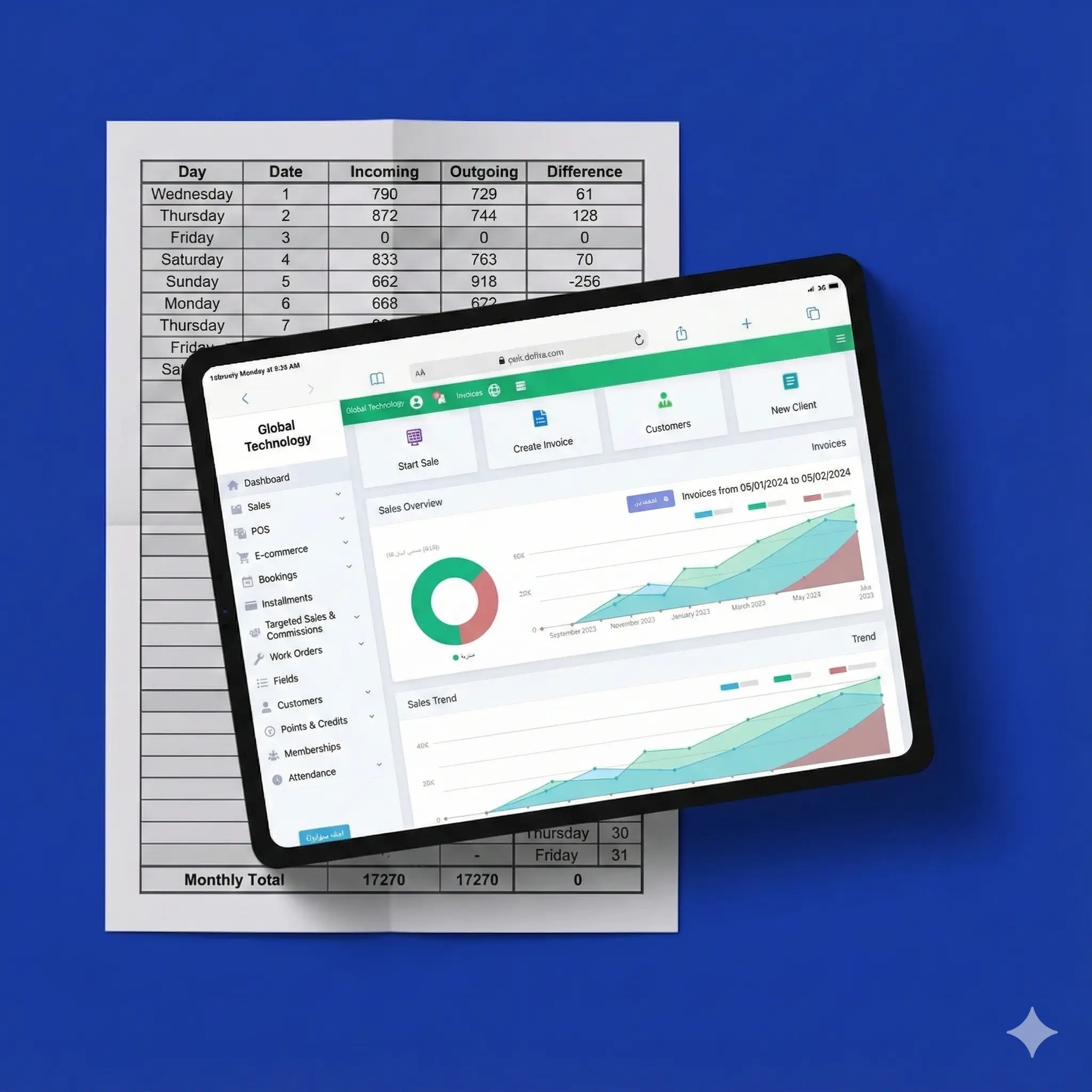

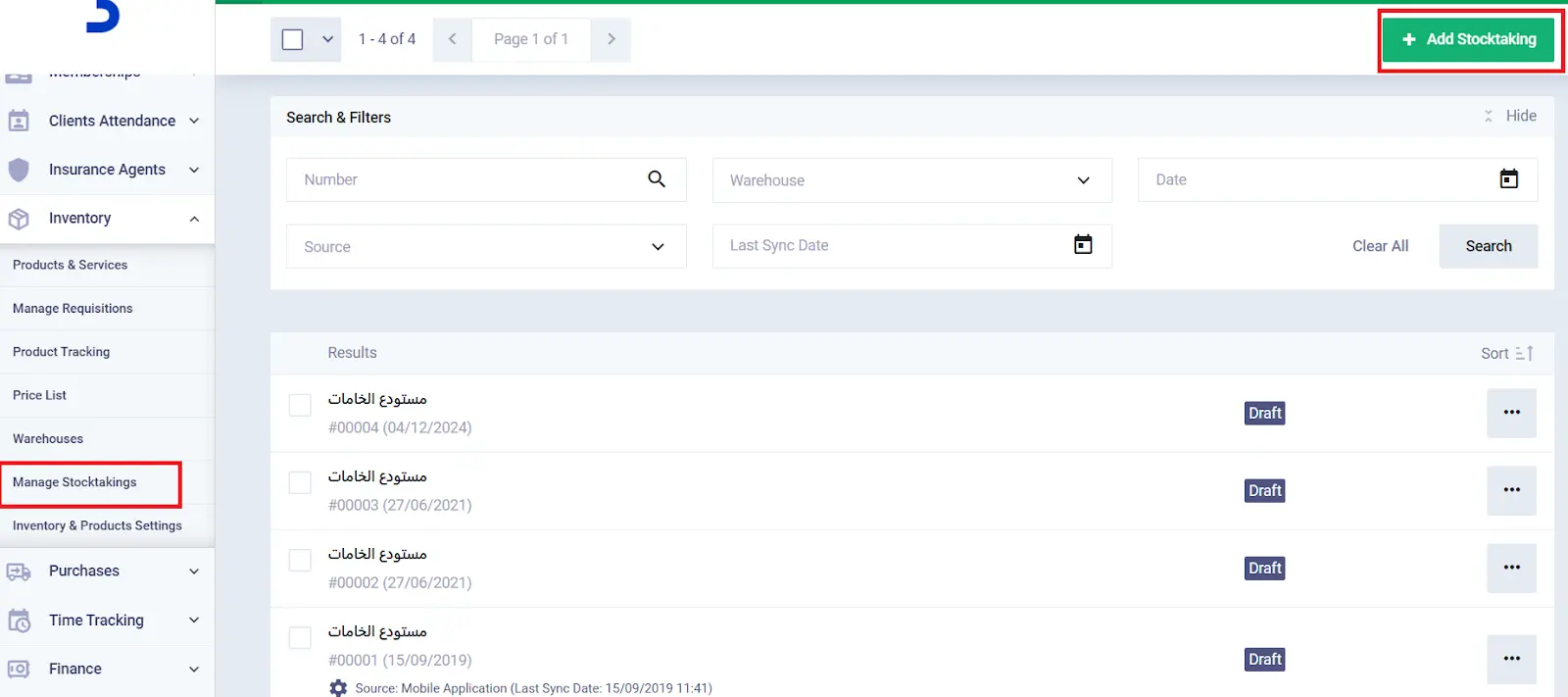

How Do You Perform Inventory Stocktaking in Daftra?

In Daftra’s inventory management software, regardless of the stocktaking method you follow, whether monthly or annual, you can use the inventory management system to reconcile the actual inventory available in your warehouses with what is recorded in the system.

This allows you to identify inventory shortages or excess quantities beyond the expected levels. You can also evaluate products based on specifications and quality, and exclude expired products or items that are no longer needed.

You can also download the inventory stocktaking applicationfromGoogle Play or the App Store.

Frequently Asked Questions

What are the most common problems encountered during inventory stocktaking?

- Inaccuracy in describing products or distinguishing between them.

- Failure to record some products, or recording them incorrectly, either overstated or understated, or recording the same product more than once.

- Disruption to company operations due to manual stocktaking, as it requires significant time and effort. In some cases, operational activities are halted to complete stocktaking procedures, leading to financial losses.

- In some cases, manipulation of inventory records by certain employees to conceal theft or other issues may be difficult to detect during stocktaking.

What Are Stocktaking Variances?

Stocktaking variances refer to surplus variances, which indicate that the actual quantity of products in the warehouse exceeds the quantity recorded in inventory records, and shortage variances, which indicate that the quantities available in warehouses are less than those recorded in the records.

What Equipment and Tools Are Required for Inventory Stocktaking?

The required equipment and tools for inventory stocktaking vary depending on the stocktaking method used and whether it is manual or digital. For example, manual stocktaking requires calculators, pens, and paper records, while digital stocktaking requires an integrated inventory management system and a barcode scanner.

What Is the Inventory Stocktaking Formula?

The value of ending inventory is calculated using the following formula:

Ending Inventory = Beginning Inventory + Purchases − Cost of Goods Sold

What Is the Purpose of Stocktaking?

The objectives of inventory stocktaking include calculating profits, presenting the company's true financial position, and detecting theft or embezzlement through periodic and surprise stocktakes of warehouses.

What Are Inventory Stocktaking Adjustments?

Inventory stocktaking adjustments are accounting entries madeto align recorded values with the actual values obtained from the stocktaking process.

In conclusion, this topic has covered everything related to the inventory stocktaking process and how to carry it out. If you have any questions regarding this process, feel free to share them in the comments.