Current ratio and how to calculate it, and the quick ratio

Table of contents:

- What is the Current Ratio?

- What is the Explanation of the Current Ratio?

- What is the Quick Ratio?

- What is the Importance of the Current Ratio?

- What is the Current Ratio Formula?

- How to Calculate the Current Ratio?

- Practical Example of Calculating the Current Ratio

- What are the Current Ratio Indicators?

- How Does Daftra Help You Improve the Current Ratio?

- Frequently Asked Questions

Your company has significant debt that should all be paid within one year. Can you pay off these debts within your company’s operating cycle, or will you drown in debt and miss out on investment opportunities and anticipated partnerships?

The current ratio answers this question with unparalleled efficiency, and with a simple calculation, every company should compute it. In financial analysis, the current ratio is an indicator that helps interpret the financial picture accurately.

We will detail below everything related to the current ratio and what it reveals about the company’s financial situation. You will find all these details and more, along with guidance on calculating the current ratio, to help you make sound investment decisions.

What is the Current Ratio?

The current ratio, also called the liquidity ratio, measures a company's ability to pay its obligations due within a year. It compares your short-term assets to your short-term liabilities and indicates the extent to which your current assets can cover your current liabilities.

What is the Explanation of the Current Ratio?

Short-term assets arising from collecting customer invoices can be realized within months, enabling you to pay short-term liabilities such as checks due within less than a year. Therefore, if your short-term assets are many and of high value compared to your short-term liabilities,

You can treat them like cash, reducing your near-term debt concerns. This means, in accounting terms, that the current ratio (liquidity) in your company is good.

The concept of the current ratio is based on the company’s actual ability to convert these various current assets, such as accounts receivable, other receivables, and inventory, into cash whenever a cash payment is due. However, care should be taken to avoid losses from converting current assets that are not yet ready to be turned into cash, particularly inventory, which may take longer to sell.

Also read: What are debt ratios and what do they tell us in financial analysis?

What is the Quick Ratio?

The quick ratio is a subset of the current ratio, more realistic, and needed by some businesses; investors pay close attention to it.

The quick ratio differs from the current ratio in that it excludes inventory from the current assets used in the calculation. The formula for calculating the quick ratio is as follows:

Quick Ratio=(Current Assets – Inventory)/Current Liabilities

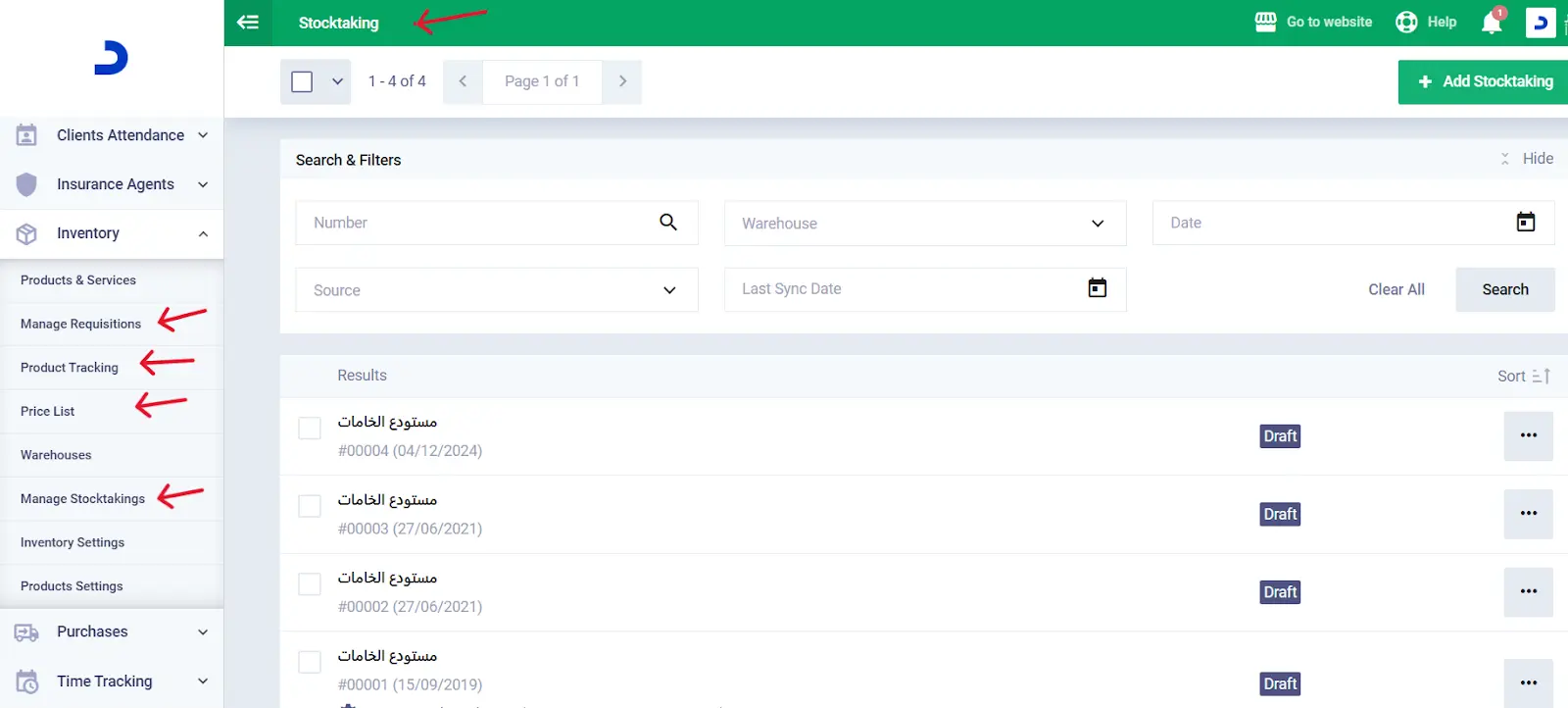

Daftra's accounting system automatically calculates the quick ratio using your data recorded in the balance sheet and chart of accounts, including all accounts related to inventory, assets, and other categories.

What is the Importance of the Current Ratio?

The current ratio is considered one of the most important financial indicators that determine the company’s financial position because it measures the company’s ability to meet its financial obligations. Below are the main uses of the current ratio in financial analysis:

1- Evaluating Performance and Financial Liquidity

The current ratio measures a company’s ability to meet short-term obligations by assessing whether current assets cover current liabilities. It reflects the company’s ability to pay its debts on time.

In addition, the current ratio helps assess the company’s financial performance over time by comparing ratios across periods.

Financial analysts can then identify trends and drivers of fluctuations in liquidity, such as revenue volatility due to low demand for products and services, poor inventory management, increased debt and unexpected expenses, changes in credit terms and delayed supplier payments, or changes in government financial policies that affect interest rates and taxes.

2- Attracting Investors

A high current ratio indicates a strong financial position and the company's ability to meet obligations while maintaining high investment returns, which may attract investors seeking profitable, safe opportunities.

3- Comparison with Competitors

The current ratio is used to compare a company’s financial position with competitors in the same industry, helping identify strengths and weaknesses and take corrective actions to improve it.

4- Negotiation with Lenders and Creditors

The current ratio is an important tool for negotiating with creditors and lenders. If the current ratio is high, it serves as strong evidence of the company’s creditworthiness and ability to meet obligations, supporting its position in negotiating favorable credit terms.

5- Financial Planning

The importance of the current ratio in financial analysis is growing, especially when used in financial planning to determine funding needs for expansion or new projects, and to identify financing strategies, such as reducing debt or improving asset management.

What is the Current Ratio Formula?

Current Ratio=Total Current Assets/Total Current Liabilities

To ensure the company can meet its short-term obligations, the current ratio should be between 1 and 2. The risk and danger indicators increase as the current ratio increases.

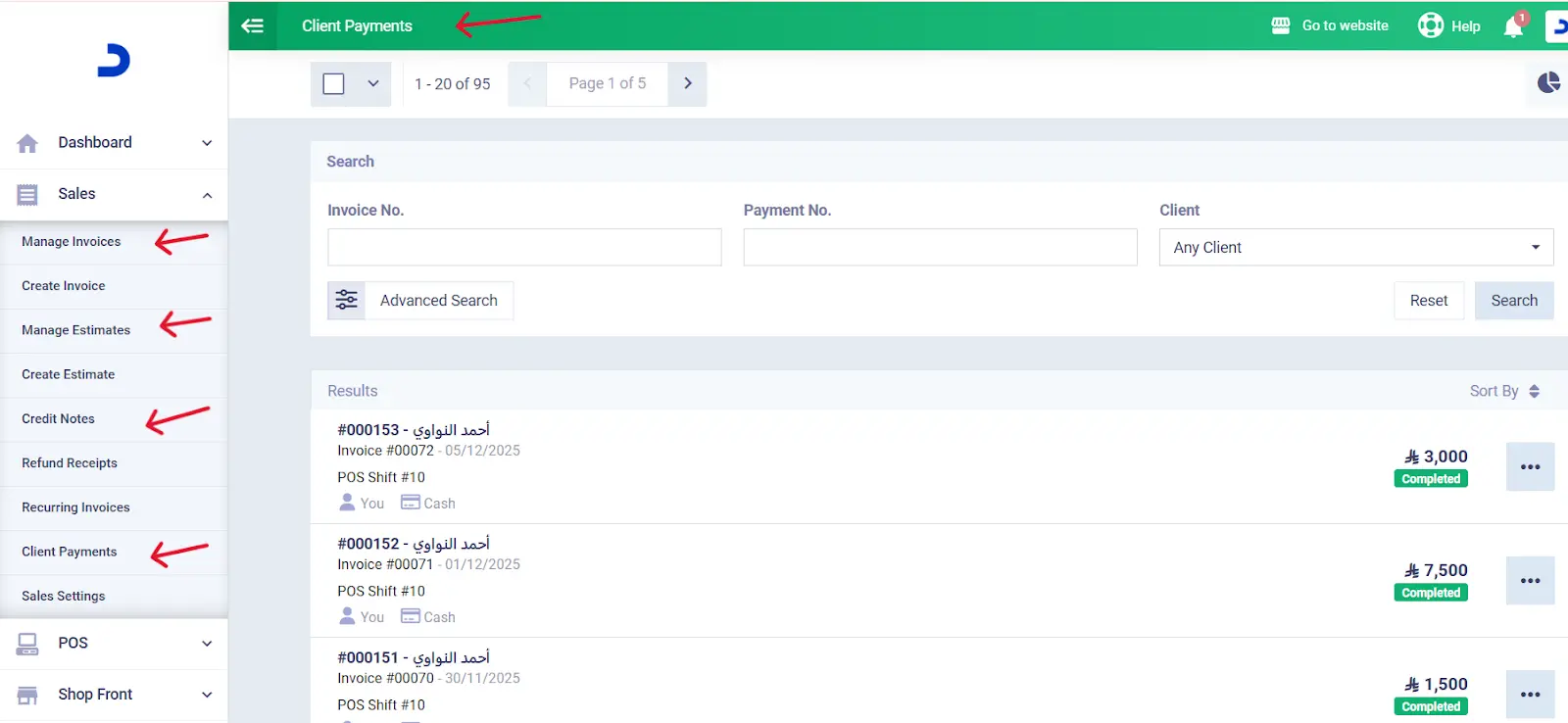

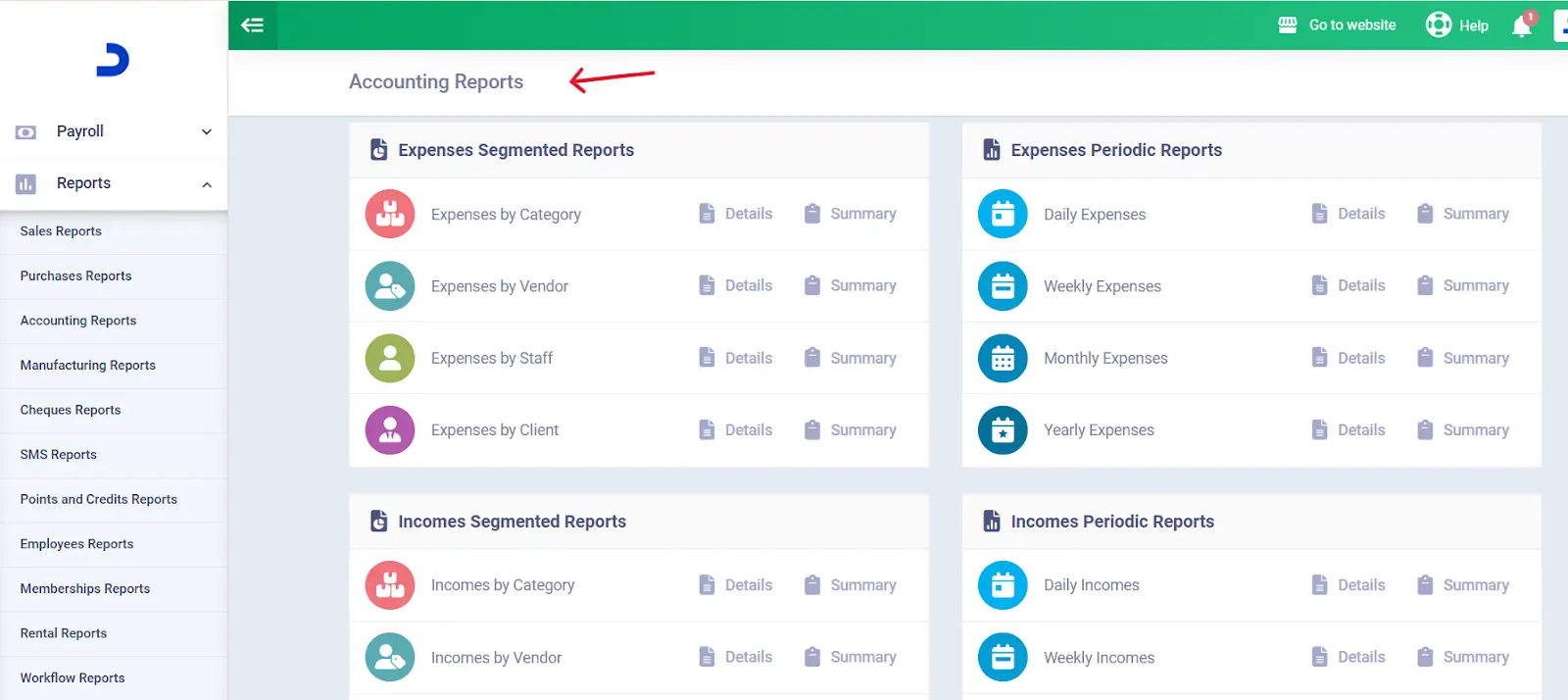

The Daftra system helps ensure accurate results through automated calculations, using the company’s pre-entered data to access programs and reports related to the accounting process. For example, when calculating the current ratio, the calculation automatically accesses the balance sheet to determine current assets and current liabilities.

How to Calculate the Current Ratio?

To calculate the current ratio, your business must follow several steps, such as inventory counts, listing securities due for payment or receipt within a period not exceeding a year, and other tasks related to collecting and organizing financial data. This allows you to easily calculate current assets and current liabilities.

After collecting and calculating all current assets and current liabilities, all you need to do is apply the current ratio formula in financial analysis and divide total current assets by total current liabilities.

Download now a ready-to-use current ratio calculation template from Daftra for free.

Practical Example of Calculating the Current Ratio

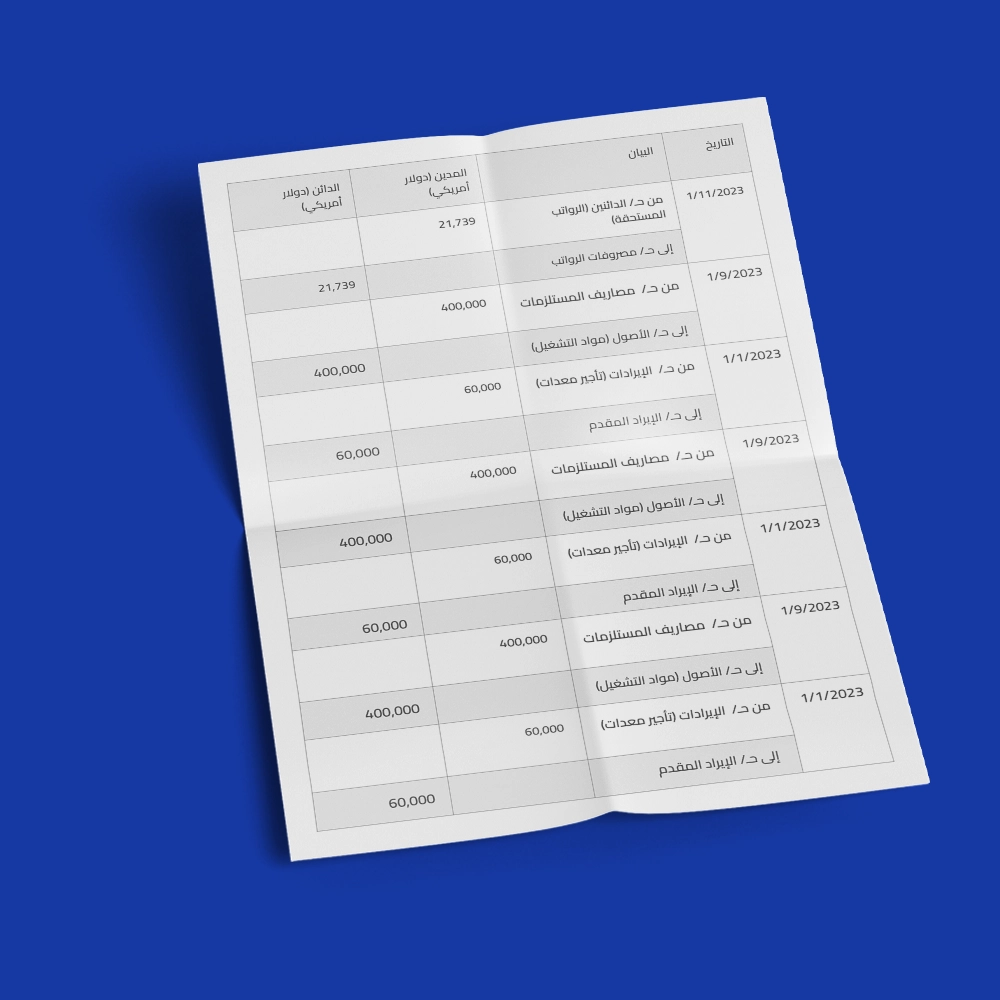

After inventory counting and listing securities for a certain company, the following was found:

The company has $20 million in cash, $20 million in accounts receivable due within a year, and $20 million in inventory available for sale in the next few months. Short-term debt amounts to $15 million, and accounts payable equal $15 million.

Calculating the company’s current liquidity ratio:

Current Assets = 20 + 20 + 20 = $60 million

Current Liabilities = 15 + 15 = $30 million

Current Ratio=Total Current Assets/Total Current Liabilities

60 / 30 = 2 (This ratio means the current ratio is good, and the company can pay its obligations while achieving a profit surplus).

What are the Current Ratio Indicators?

When interpreting current ratio indicators, a low current ratio (less than 1) indicates that the company may face financial difficulties meeting short-term obligations, which increases investment risk and undermines the confidence of financiers and lenders.

A high current ratio (greater than 1) indicates good financial liquidity for the company. However, very high current ratios can indicate that the company is not capitalizing on suitable investment opportunities to expand and grow its operations.

How Does Daftra Help You Improve the Current Ratio?

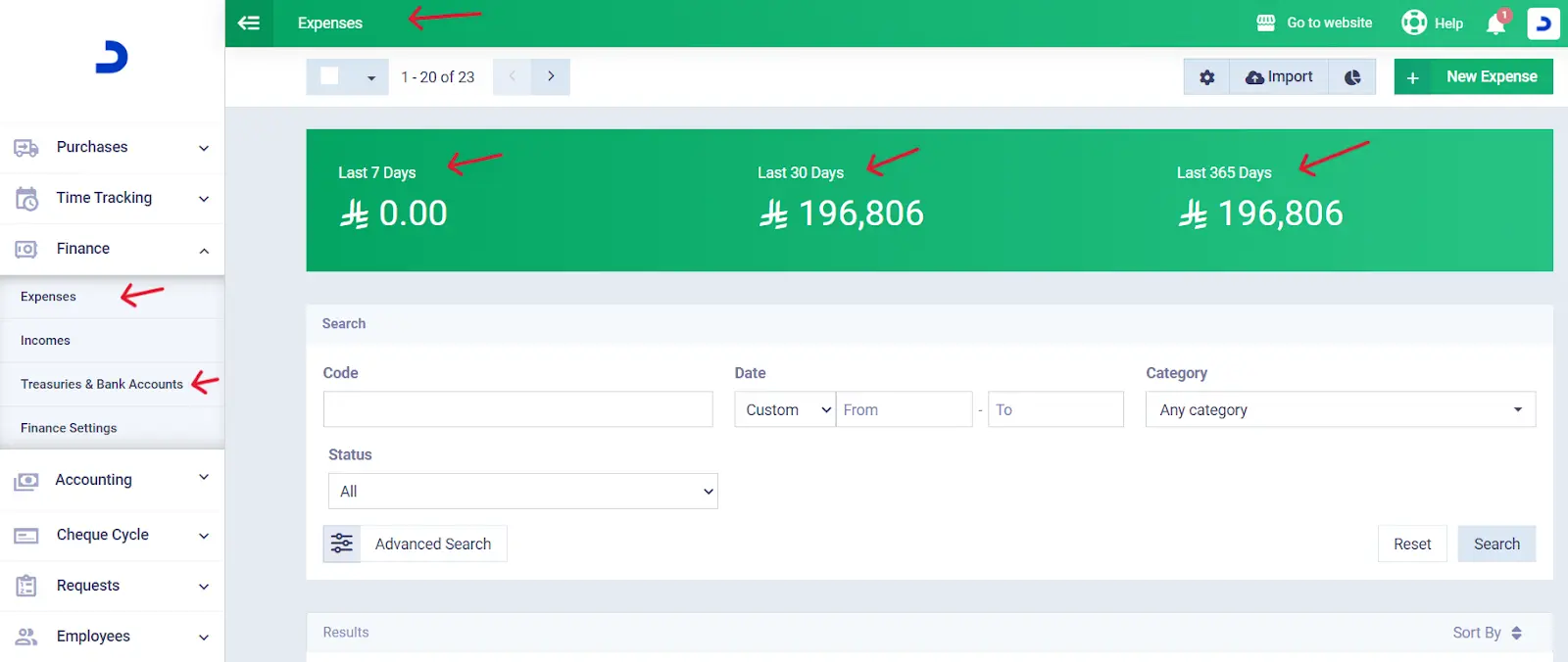

Improving the current ratio requires effective management of assets and liabilities, which Daftra’s integrated company management accounting software provides through smart, automated solutions that ensure comprehensive, balanced financial management for your organization.

One of Daftra’s main features in improving the current ratio (current liquidity) is:

Improving the management of inventory and warehouse levels, thereby avoiding risks associated with excess or insufficient inventory, which negatively affects the current ratio in financial analysis.

Integrated sales management software helps companies increase sales and improve customer payment collection, which in turn improves the company’s quick ratios.

Through a company's expense-tracking and management program, expenses can be rationalized and resources allocated efficiently, thereby increasing liquidity and improving the current ratio.

- The Daftra cloud system provides accurate financial reports that can be viewed anytime, anywhere, helping business owners easily assess their financial situation with just a few clicks through the Daftra dashboard, which is user-friendly and supports Arabic.

These financial reports from Daftra also help evaluate the effectiveness of the financial policies in place and identify profit and loss, enabling informed decisions to improve financial ratios, such as the current ratio, for example, by changing customer payment and collection terms or adjusting credit policies with suppliers and financiers.

The current ratio is a vital process indispensable for understanding your company’s current or future financial position. Calculating it helps you settle your financial matters early and avoid taking on loans or liabilities you may not be able to repay in the near future.

Alternatively, you can expand and spend based on the assumption that your current assets will generate liquidity to cover your needs soon. Therefore, calculate financial ratios in general, and the current ratio in particular, on a regular basis.

You can rely on Daftra’s cloud accounting software, which helps you calculate the current ratio automatically and easily.

Frequently Asked Questions

What is a good current ratio?

A current ratio of 1 is considered good, indicating that current assets fully cover current liabilities. If the current ratio is less than 1, it indicates difficulty in paying debts. If the ratio is above 1, that is also good, but the company should ensure it is using its current assets efficiently.

How do you calculate the current ratio?

The current ratio is calculated using the standardized accounting formula:

Current Ratio=Current AssetsCurrent Liabilities

What is the Quick Ratio?

The quick ratio, or acid-test ratio, is a financial metric that measures a company’s ability to meet short-term obligations by converting current assets into cash. Examples include securities and cash assets.