What are final accounts and their types, with practical exercises

Undoubtedly, final accounts are one of the most important steps in the accounting cycle, and no financial accountant can overlook them. They are considered the key step in determining the financial position of any organization, identifying profits and losses at the end of the financial period, understanding the operating performance of the organization, and assessing its overall financial condition.

Therefore, final accounts represent the accounts that are closed at the end of the financial year in order to clarify the entity’s activities during that year.

In addition, there are several main types of these accounts that every accountant must be familiar with and prepare, each according to its specific purpose. Accordingly, in this article, we will learn in detail the definition of final accounts and how they are prepared.

What Are Final Accounts?

Final accounts are the final stage of the accounting process (the accounting cycle). At this stage, the various accounting records summarized in the trial balance are used to prepare the final accounts in order to determine the profits or losses of a commercial entity.

How Is This Process Carried Out?

- First, financial transactions are recorded in the journal, and then posted to the respective accounts in the ledger.

- These accounts are then summarized in the trial balance, which ensures that total debit balances equal total credit balances.

- Finally, the final accounts are prepared, which include: Trading Account, Profit and Loss Account.

What Are the Objectives of Final Accounts?

Final accounts have several objectives that companies use to gain maximum benefit. These objectives include determining totals, preparing the financial position, identifying assets and liabilities, in addition to preventing fraud and identifying weaknesses. Below is a detailed explanation of the objectives of final accounts:

- Determining totals: Identifying the gross profit or loss and the net profit or loss achieved by the entity during a financial period through the profit and loss account.

- Preparing the financial position: Preparing the statement of financial position to determine the true financial status of the entity.

- Assets and liabilities accounts: Identifying the entity’s assets and liabilities for each financial period.

- Helping to prevent fraud: Final accounts assist management in detecting fraud and errors and in exercising control over various accounts.

- Identifying weaknesses: They help identify different weaknesses within the entity, address them, and support management in making future decisions.

- Investment forecasting: Final accounts are a primary source for investors to determine whether an investment opportunity exists.

- Determining value: Determining the value of the entity and providing all necessary information and data for its proper valuation.

You can download a free final accounts template from Daftra.

Types of Final Accounts

There are two main types of final accounts in a commercial entity: the Trading Account and the Profit and Loss Account. Each type differs in terms of its purpose and the method of preparation. The types of final accounts can be explained as follows:

1. Trading Account

The trading account is the first of the final accounts prepared by the financial accountant. It consists of seven accounts that represent the purchasing and selling activities of products within the entity.

Net sales revenue is compared with the cost of sales to determine the gross profit or gross loss.

There are several accounts included under the trading account, such as closing inventory, opening inventory, purchases, purchase returns, purchase expenses, sales, and sales returns. These accounts are explained in detail below:

Closing Inventory:

When goods are purchased at the beginning of the year, and part of them are sold, the remaining goods at the end of the year are considered closing inventory. It is recorded on the credit side of the trading account because it represents unrealized revenue.Opening Inventory:

In the new financial year, the closing inventory of the previous year becomes the opening inventory of the current year and is recorded on the debit side.Purchases:

All purchases are considered expenses; therefore, they appear on the debit side of the trading account.Purchase Returns:

Goods may be returned due to damage or non-conformity with specifications. As a result, purchases are reduced by the value of returns (a reduction in expenses), so they appear on the credit side.Purchase Expenses:

Any expenses incurred on goods from the time of purchase until they are placed in the warehouse—such as transportation costs, purchase commissions, and customs duties—are recorded as purchase expenses and appear on the credit side of the trading account.- Sales:

All sales of goods represent revenue; therefore, they appear on the credit side of the trading account.

- Sales Returns:

Goods may be returned due to damage or non-conformity with specifications. This reduces sales (a reduction in revenue), so sales returns appear on the debit side.

Illustrative Example of a Trading Account

| Debit | Expenses | Credit | Revenues |

| XX | Opening Inventory | XX | Closing Inventory |

| XX | Purchases | XX | Purchase Returns |

| XX | Purchase Expenses | XX | Sales |

| XX | Sales Returns | XX | |

| XX | Gross Profit | XX | Gross Loss |

- If total expenses exceed total revenues, the result is a gross loss.

- If total revenues exceed total expenses, the result is a gross profit.

2. Profit and Loss Account

The profit and loss account is the second step in preparing the final accounts. Its purpose is to determine the net profit or loss for the financial period. It relies on the gross profit or loss derived from the trading account, after which all other revenues and expenses are recorded in the profit and loss account.

All revenues and expenses included in the profit and loss account can be illustrated in the following example:

| Debit | Expenses | Credit | Revenues |

| XX | Gross Loss Balance | XX | Gross Profit Balance |

| XX | Administrative Building Rent | XX | Interest on Loans Granted |

| XX | Employees’ Salaries | XX | Discount Received |

| XX | Depreciation of Administrative Buildings and Office Equipment | XX | Bank Interest |

| XX | Borrowing Interest | XX | Securities Income |

| XX | Discount Allowed | XX | Property Income |

| XX | Water and Electricity | ||

| XX | Repairs, Maintenance, and Insurance of Administrative Buildings and Office Equipment | ||

| XX | Fire Insurance | ||

| XX | Bad Debts | ||

| XX | Telegraph and Telephone Expenses | ||

| XX | Printing and Stationery | ||

| XX | Transportation Expenses | ||

| XX | Compensation | ||

| XX | Advertising | ||

| XX | Sales Transportation | ||

| XX | Sales Commission | ||

| XX | Net Profit | XX | Net Loss |

- If revenues exceed expenses, the result is a net profit.

- If expenses exceed revenues, the result is a net loss.

Some Notes on the Profit and Loss Account

- Borrowing Interest:

Interest paid here is considered an expense resulting from borrowing a certain amount from others; therefore, it is recorded on the debit side.

- Lending Interest:

In this case, interest is considered revenue earned by the entity as a result of lending money to others; therefore, it is recorded on the credit side.

- Bank Interest:

This represents interest earned from maintaining a bank account and is therefore recorded as revenue on the credit side.

- Property Income / Securities Income:

The income here is earned as a result of selling property or securities, so it is recorded on the credit side of the profit and loss account. However, the property itself and the securities are considered assets and are recorded in the statement of financial position, not in the profit and loss account.

- Compensation:

Compensation paid is considered an expense because it is paid to others. However, if compensation is received, it is considered revenue since the entity receives a certain amount as compensation from others.

There is another account that applies only to industrial enterprises:

Operating Account

The operating account is one of the final accounts used in industrial enterprises. Its purpose is to determine the cost of production during the financial period. However, with the existence of cost accounting today, it has become easier to determine production costs for any period in detail.

The cost of production for the period can be calculated by starting with the cost of opening raw materials, then adding other expenses such as purchase expenses, raw material purchases, direct wages, and direct manufacturing costs. All of these expenses appear on the debit side of the operating account.

What Is the Difference Between Final Accounts and Financial Statements?

There are several differences between final accounts and financial statements in terms of their use, necessity for companies, and overall concept. These differences are explained below:

- Use: Final accounts are prepared at the end of the financial period or year to present a summary of the entity’s results in terms of profit or loss.

Financial statements, on the other hand, provide a detailed presentation of all activities carried out by the entity during a specific period, including all revenues and expenses in detail. They also show the financial position of the entity in terms of its various assets and liabilities.

- Need: A single final account may be prepared depending on the nature and activity of the entity. However, financial statements cannot be dispensed with regardless of the nature of the entity’s activity. All organizations must prepare financial statements at the end of each reporting period.

- Concept: Final accounts focus on determining the profit or loss of the entity, whereas financial statements have a broader concept, as they present all business activities and transactions carried out by the entity during a specific period.

Exercises on How to Prepare Final Accounts

Here, the method of preparing final accounts will be explained through an illustrative example as follows:

Below are some data related to the entity for the year 2021 (A):

- Inventory at the end of 2020 amounted to $5,000.

- Purchases amounted to $30,000, of which $5,000 were returned.

- Transportation and customs expenses amounted to $2,000.

- Goods were sold for $60,000, and $4,000 in goods were returned.

There were also other expenses as follows:

- Employees’ salaries: $10,000

- Advertising and promotion: $6,000

- Depreciation of buildings: $2,000

- Sales transportation: $3,000

- Sales commission: $4,000

- Bad debts: $5,000

- Fire insurance: $2,000

Other revenues were recognized as follows:

- Bank interest: $3,000

- Property income: $35,000

- Securities income: $10,000

- Discount received: $2,000

- Compensation received: $4,000

Required: Prepare both the Trading Account and the Profit and Loss Account to determine the net profit or loss.

First, the trading account is prepared to determine gross profit or loss by including the seven main accounts. Any expense or revenue other than these is recorded in the profit and loss account, as follows:

Trading Account:

| Debit | Expenses | Credit | Revenues |

| 5,000 | Opening Inventory | 5,000 | Closing Inventory |

| 30,000 | Purchases | 5,000 | Purchase Returns |

| 2,000 | Purchase Expenses | 60,000 | Sales |

| 4,000 | Sales Returns | ||

| 41,000 | Total Expenses | 70,000 | Total Revenues |

| 29,000 | Gross Profit |

Here, the Profit and Loss Account is prepared by recording the gross profit at the beginning of the account on the credit side:

Profit and Loss Account:

| Debit | Expenses | Credit | Revenues |

| 10,000 | Employees’ Salaries | 29,000 | Gross Profit Balance |

| 6,000 | Advertising and Promotion | 3,000 | Bank Interest |

| 2,000 | Depreciation of Buildings | 25,000 | Property Income |

| 3,000 | Sales Transportation | 10,000 | Securities Income |

| 4,000 | Sales Commission | 2,000 | Discount Received |

| 5,000 | Bad Debts | 4,000 | Compensation Received |

| 2,000 | Fire Insurance | ||

| 32,000 | Total Expenses | 73,000 | Total Revenues |

| 41,000 | Net Profit |

Accordingly, the net profit of the entity for the year 2021 was 41,000.

You can also use a ready-made final accounts template to avoid performing all the steps manually. Instead, download a ready-to-edit final accounts template for free from Daftra.

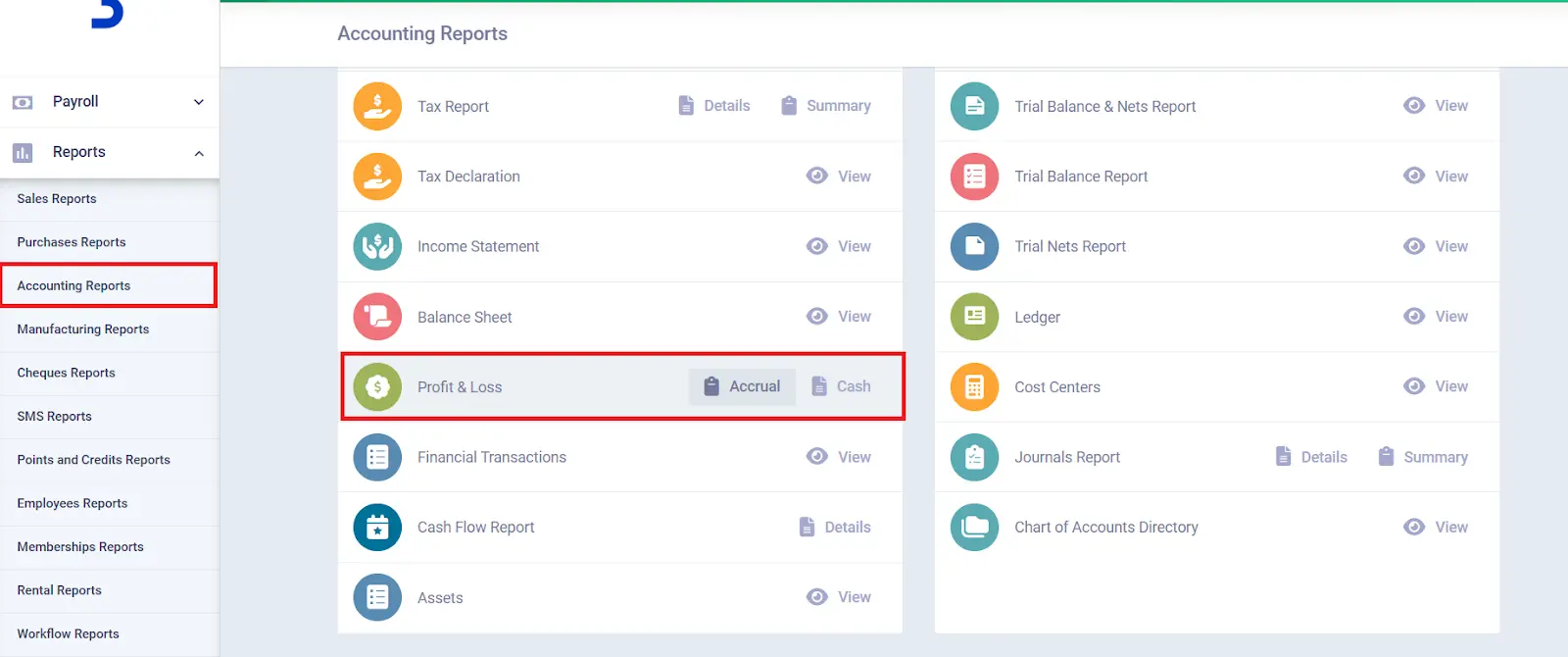

Issuing Final Accounts Using Daftra Software

Daftra’s general accounting software allows you to issue final accounts separately from financial statements and standard reports.

Starting from recording journal entries and posting them to the ledger, generating reports for each book, issuing trial balance reports and accounts receivable and payable reports, and finally preparing specific final reports such as the profit and loss account or the trading account in a clear, fast, and easy way.

Frequently Asked Questions

How are final accounts closed?

Final accounts are closed at the end of the accounting period by transferring debit and credit balances to the profit and loss account and capital accounts.

What is a final account template?

A final account template is a document that contains all data related to the company’s financial position at the end of each accounting period, usually annually. Daftra provides a ready-to-download final accounts template.

What is the definition of the final balance sheet?

The final balance sheet is one of the financial statements prepared at the end of the financial year. It shows the company’s financial position through its assets, equity, and liabilities.

What is the final account of the general budget?

The final account of the general budget is a report prepared at the end of the company’s financial year to show the revenues and expenses actually achieved compared with what was planned in the general budget.

What is the difference between the final account and the balance sheet?

- Final Account:

Prepared at the end of the accounting period. It presents the company’s financial position in detail and shows profit or loss. It includes the trading account and the profit and loss account, and is prepared first.

- Balance Sheet:

Shows the financial position at a specific point in time and is part of the final accounts. It includes equity, assets, and liabilities. It depends on the results of the final account and is therefore prepared after the final account.

Does the final account include only the balance sheet?

No, the final account includes other statements in addition to the balance sheet, such as the trading account and the profit and loss account.

What is the government final account?

It is a report that shows the results achieved by the state in implementing the general budget during the previous financial year. This report helps compare actual revenues and expenses with those that were planned.

What is the final liquidation account?

It is a document prepared by a company at the end of its operations to liquidate everything, starting with debts and assets and ending with the distribution of assets to partners and shareholders.

In conclusion, all aspects related to final accounts and how to utilize them to determine net profit or loss have been clarified. The importance of final accounts for an entity, regardless of the nature of its activities, has also been highlighted, as they play a crucial role in determining the final results of any organization.