Accounting methods, their types, and the best method for your company

Table of contents:

- What is the concept of accounting methods?

- What are the different types of accounting methods?

- What is the difference between the Italian, French, English, and American accounting methods?

- On what basis can a company change its accounting method?

- What Are the Best Accounting Methods for Companies?

- What Are the Accounting Methods Used in Restaurant Accounting?

- What Is the Simplest Accounting Method?

- What Are the Benefits of Each Accounting Method?

- What Is the Difference Between Cash Accounting and Accrual Accounting?

- Frequently Asked Questions

Accounting methods, their types, and the best method for your company Are you unsure how to choose the right accounting method for your business? Did you know that the way you record financial transactions has a major impact on your business success? Using the correct accounting method gives you an accurate picture of your company’s financial position and enables you to make better decisions about how to manage your money. The right accounting method helps you track profit or loss, manage inventory, and make future investment decisions.

Therefore, we present a comprehensive guide to the concept of accounting methods, their types, the differences between them, and the benefits of each method. Continue reading to learn more about accounting methods and to choose the one that best suits your business.

What is the concept of accounting methods?

Financial accounting methods refer to the set of rules a company follows to record and track its financial transactions. Choosing the right accounting method is essential because it reflects the company’s short- and long-term financial health, improves its chances of obtaining proper financing from lenders and financial institutions, and makes it easier to forecast future business growth. The main differences between basic accounting methods depend on the nature, principles, and size of the business.

These methods fall into three categories: the cash basis, the accrual basis, and the hybrid method. As for country-specific accounting methods (Italian, French, English, American), they differ in how financial transactions are organized and classified, the types of books used, and the procedures followed. These methods are based on the accounting traditions and regulations of each country and vary in details such as the number and type of accounting books, recording procedures, and posting processes between books.

What are the different types of accounting methods?

There are three accounting methods, and they depend on the nature, principles, and size of the business, as well as reporting requirements and applicable accounting standards. These methods differ in how financial transactions are recorded.

1. Cash Accounting

In this method, transactions are recorded only when cash is actually received or spent. Sales are recorded when payment is received, and expenses are recorded only when the bill is paid. This method is used by small businesses and individuals for personal financial management.

2. Accrual Accounting

In this method, transactions are recorded when they occur, not when the cash is received or paid. For example, a purchase order is recorded as revenue even if the money has not yet been received, and expenses are recorded even if the amount has not yet been paid. The accrual method provides an accurate picture of the company’s true financial position because it matches revenues with expenses.

This method allows all incoming revenues to be recorded, gives a better understanding of profitability, facilitates creating financial forecasts and budgeting, and helps businesses seek financing more easily.

3. The Hybrid Accounting Method

This is a combination of cash and accrual accounting. It allows short- and long-term financial transactions to be recorded when they occur. This method can be difficult for individuals without strong accounting knowledge. The rules followed in this method include:

- If income is recorded using the cash basis, expenses must also be recorded using the cash basis.

- If income is recorded using the accrual basis, expenses must also follow the accrual basis.

- The accrual method must be used to record sales and purchases when inventory is involved

The Daftra accounting software applies various accounting types and methods within its system to align with your business activity. You can easily customize the interface and tools from the settings or request assistance from Daftra’s technical support team.

What is the difference between the Italian, French, English, and American accounting methods?

These methods differ from the previously mentioned financial accounting methods in how accounting transactions are organized and classified, the types of books used, and the procedures followed. The Italian, French, English, and American accounting methods are based on the accounting traditions and regulations of each country.

They differ in details such as the number and type of accounting books, the way entries are recorded, and the posting procedures between the different books.

These accounting methods are divided into four approaches: The Italian method – The French method – The English method – The American method.

Below is a simplified explanation of each of the four accounting methods:

1. The Italian Method

This method begins by recording the company’s transactions in the general journal, then posting these accounting entries to the general ledger, preparing a trial balance, and finally preparing the final accounts and the balance sheet. This method is easy to apply and does not require a large number of books or accounts, and it allows the financial position to be prepared at any time. However, this method is not suitable for large companies with many purchasing and sales transactions.

2. The French Method

This method begins by recording the company’s transactions in auxiliary journals, then creating central journal entries in the central journal. After that, entries from the auxiliary journals are posted to the subsidiary ledger, while the totals from the central journal are posted to the general ledger. This is followed by preparing the trial balance, and finally preparing the final accounts and the balance sheet. This method simplifies the recording and posting process for accountants, saving time and effort when preparing financial statements.

3. The English Method

In this method, a separate journal is assigned to each type of transaction. The English method is similar to the French method, but differs in that entries are posted directly from the journal to the general ledger.

4. The American Method

This method uses a single book that functions as both a journal and a ledger at the same time. It is easy to apply and saves time and effort in recording and tracking accounting transactions. However, it is not suitable for large companies due to the high volume of their transactions.

On what basis can a company change its accounting method?

Companies are advised to use a consistent accounting method when recording their financial transactions. However, they can obtain approval to change the method to suit the nature and size of the business. For example, a company may start small but expand over time into a large company with branches in several locations. Similarly, a small company may generate high revenues and handle a large number of financial transactions. When requesting a change, it is required that the purpose is not to manipulate accounts for representation or tax-related reasons.

You may also be interested in: The Importance of Accounting Books

What Are the Best Accounting Methods for Companies?

The accrual basis of accounting is considered suitable for large companies, for example, construction companies that engage in long-term projects and do not receive cash payments until the project is completed.

If such companies use the cash basis, they would only record revenues when cash is received, while still incurring all expenses. This would make their financial records appear weak, especially when seeking bank loans or investor funding.

The accrual basis solves this issue by recording revenues and expenses when they are recognized, regardless of when cash is received or paid. This provides lenders with an accurate picture of the company’s financial position and offers a clear view of the revenue the company is entitled to, even if it hasn’t received it yet.

Read also: Accounting Tables, What Are They? Why Are They Important? And How to Use Them

What Are the Accounting Methods Used in Restaurant Accounting?

Restaurant accounting refers to the process of recording and analyzing the restaurant’s financial data. Accounting software can be used to manage these processes, from creating professional invoices to managing cash flow and tracking time.

Having an effective accounting method is essential for restaurant owners to monitor their business performance, improve financial management, gain deeper insights into the restaurant’s financial status, track cash flows more accurately, and strengthen inventory management.

The cash basis accounting method is one of the most commonly used methods in restaurant accounting, as restaurants deal with a large amount of daily cash transactions. Cash accounting allows restaurants to record income when cash is received from services provided, as well as record expenses and costs paid to meet operational needs.

What Is the Simplest Accounting Method?

The cash basis accounting method is one of the simplest, as cash receipts and payments are recorded only when they are received or paid. This method is ideal for small businesses because it provides a clear view of expected income, is easy to use, does not require extensive accounting knowledge, and does not require a specialized accountant to record transactions.

What Are the Benefits of Each Accounting Method?

Each accounting method offers its own unique benefits when properly applied. Below are the advantages of each method:

Benefits of Cash Accounting

- Simple and suitable for small businesses

- Easy to use and does not require a specialized accountant

- Provides an accurate picture of the cash entering and leaving the business at any time

- Helps avoid tax burdens since taxes apply only when money is received

- Does not require extensive accounting knowledge

- Does not require the use of accounting software

Benefits of Accrual Accounting

- Reflects an accurate picture of the company’s financial position during a specific accounting period

- Records and tracks financial transactions even if cash has not been received or paid

- Tracks what the company owes to suppliers and what customers owe to the company at any time

- Helps investors and analysts measure business performance

- Important for forecasting profits and expenses and making future decisions

What Is the Difference Between Cash Accounting and Accrual Accounting?

The key differences between cash accounting and accrual accounting lie in three main factors: timing, complexity, and accountability. Cash accounting works well for small businesses because it is simple and easy to use, while large companies need to use the accrual method because it is more comprehensive.

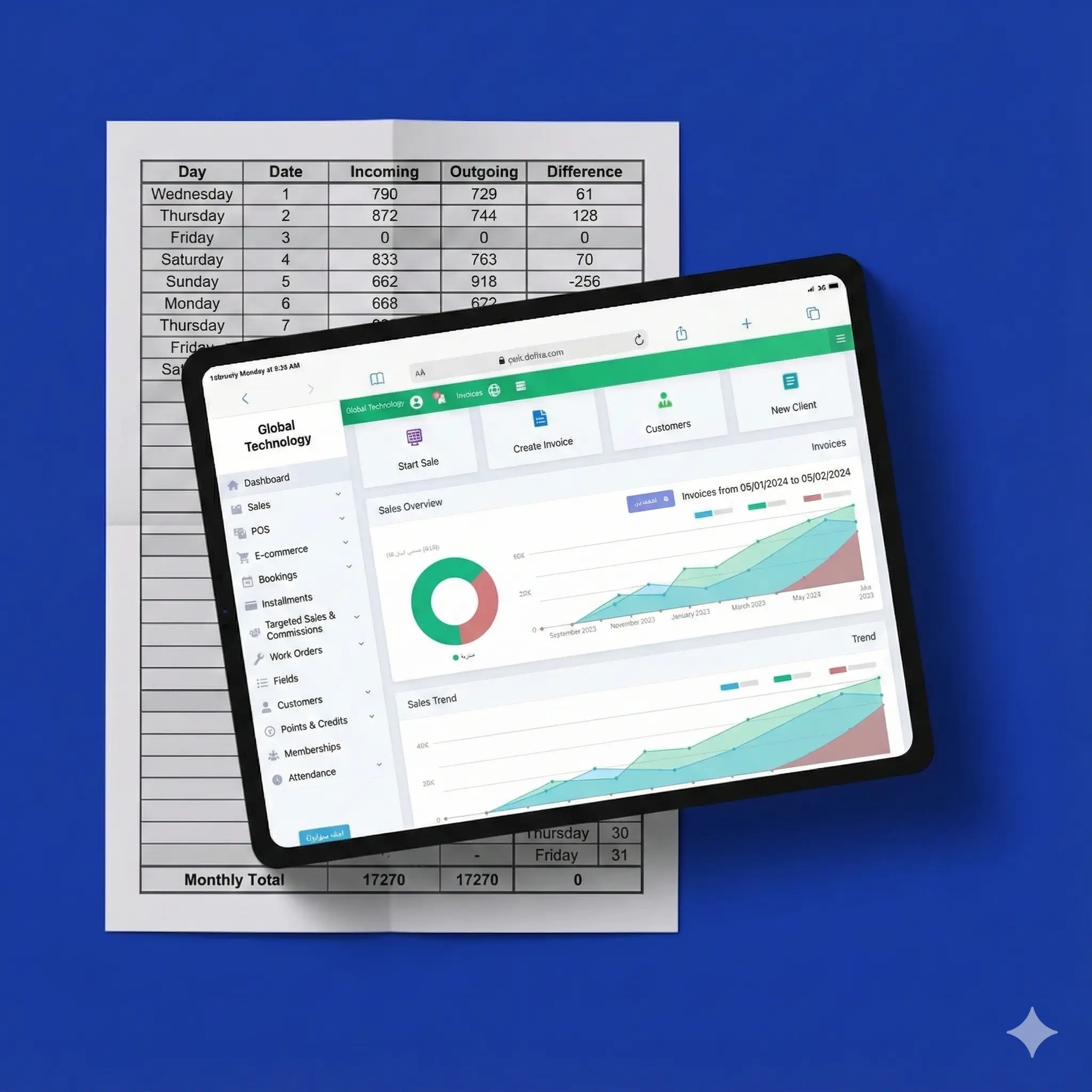

The differences between the two methods can be summarized in the following table:

| Aspect | Cash Accounting | Accrual Accounting |

| Usage | Small businesses | Large companies |

| Tax calculation | In the year cash is paid or received | When revenue or expense is recognized |

| Invoice tracking | Invoices are counted when paid | Invoices are created, tracked, and updated regularly until paid |

| Paying amounts owed to vendors | Bills are recognized when paid | Bills are recognized as liabilities before payment |

Frequently Asked Questions

What are the modern methods of cost calculation?

Here are three modern methods of cost calculation:

- Activity-Based Costing (ABC): A method used to analyze the activities involved in production.

- Target Costing: A method for setting a target cost for a product and working to achieve it.

- Standard Costing: A method that updates the estimated product cost and then compares it with the actual cost later.

What are the accounting methods for taxes?

Here are the accounting methods for taxes:

- Cash basis

- Accrual basis

What are the accounting methods for income tax?

Accounting methods for income tax are either the cash basis, which records tax when a purchase or sale is completed, or the accrual basis, which records tax as soon as the transaction occurs, regardless of when cash is received or paid.

How many accounting methods exist?

There are currently three accounting methods:

- Cash basis

- Accrual basis

- Modified accrual basis

Finally, understanding accounting methods and the characteristics of each is important for making better financial decisions for your business. Choosing the right accounting method allows you to obtain an accurate picture of your company’s financial position and achieve your financial goals.