A Comprehensive Guide to Financial Planning: Definition, Importance, and Steps

Table of contents:

- The Concept of Financial Planning

- Reasons for Resorting to Financial Planning

- Financial Planning Tools

- Steps and Stages of Financial Planning

- What Is the Importance of Financial Planning?

- Benefits of Financial Planning

- Economic Factors Affecting Financial Planning Decisions

- What Are the Objectives of Financial Planning?

- What Are the Advantages of Financial Planning?

- What Are the Factors Affecting Financial Planning?

- What Is the Role of a Financial Planner?

- What Is the Most Important Step in Financial Planning?

- How Does Daftra Help You in the Financial Planning Process?

- Frequently Asked Questions

Do you suffer from poor financial planning for your project or company? Financial planning, in general, is considered a roadmap for your company’s finances. It also helps in determining how your future goals can be achieved.

Usually, individuals and companies have a vision and objectives, and a financial plan is immediately created to support those goals. This financial plan outlines the resources and activities you and your company will need, along with the expected timeframes to achieve these objectives.

Therefore, financial planning is extremely important for the success of any project, as it complements the overall business plan and ensures the defined goals are achievable. If you would like to learn more about financial planning or the financial plan,

Quick Points (In a Nutshell)

- Financial planning is a fundamental process within every company that seeks to achieve its financial goals and stay up to date with economic changes.

- Financial planning depends on many economic factors such as inflation rates, interest rates, exchange rates, and market trends.

- There is more than one approach you can adopt in financial planning, such as: pay yourself first, organizing obligations, how much money you should set aside, and the 50/20/30 rule.

- You should set goals that meet the SMART criteria, so that the goals are specific, realistic, applicable, easy to measure, and bound by a time frame.

- The steps of financial planning consist of five stages: assessing the financial situation, identifying risks, defining financial goals, choosing a strategy, and finally implementing it.

The Concept of Financial Planning

Financial planning is a process that contributes significantly to managing your financial life and reducing financial pressures that you may face which could negatively affect you. It is also defined as a set of plans required to obtain funds and determine how they can be used. Therefore, financial planning refers to identifying financial requirements, investments, and growth over a specific period of time.

Financial planning is a fundamental element of a company's success. Without financial planning, a company will operate in financial randomness, which may result in greater losses. Therefore, financial planning for a company serves as its future financial guide.

Reasons for Resorting to Financial Planning

If you are not completely sure whether you are ready to allocate time to create a financial plan, you should read the following reasons, as financial planning is a good idea. Among the most prominent reasons are the following:

Setting Priorities for Financial Goals

If an individual is saving to make a certain purchase, or if a company is saving for a specific investment, the financial plan helps organize the associated expenses. This allows the individual to plan for a major future purchase and enables the company to plan for a major investment as well.

Eliminating Financial Randomness

By creating a financial plan, income can be allocated effectively to achieve previously defined goals with ease, away from randomness that can distract from achieving those goals, and thus make it difficult to reach the desired goals.

Financial Planning Tools

Financial planning tools are a set of tools that help achieve the short-term and long-term financial goals included in the financial plan. Since there are many financial planning tools, you may find it difficult to determine which tools are the best to use. However, based on the financial plan's specific objectives, appropriate planning tools can be identified.

For example, if the goal of the financial plan is to increase wealth and achieve profits, then financial planning tools that help accomplish this should be used. When planning to purchase a house or a car, wealth-building tools are used within the financial plan. Examples of these tools include:

- Opening bank accounts.

- Investment funds.

- Investing in bonds.

There is another type of financial plan tool, which is:

Risk Mitigation Tools

These tools are used when the goal of financial planning is to reduce the impact of future financial risks. Some individuals resort to such tools in order to protect themselves from future financial threats, as they also help provide long-term financial peace of mind.

Among the most prominent tools for reducing future financial risks are, for example:

- Life insurance subscriptions.

- Car insurance.

- Health insurance.

Many individuals and companies use both profit-growth and future financial risk-reduction tools to develop a comprehensive financial plan that increases wealth and provides protection.

Financial Estimation Tools

These tools are among those widely used by many during the financial planning process. They involve estimating the size of expenses and revenues, and attempting to set forecasts for both, as well as the company’s productivity. These tools greatly help reduce expenses and increase profits based on the financial projections in the financial plan.

Among the most prominent financial estimation tools used by companies and individuals when developing their financial plans are, for example:

- Monthly estimated financial budgets, which are most often used by individuals in personal financial planning.

- Annual estimated financial budgets, which are most often used by companies in their financial plans.

Steps and Stages of Financial Planning

The financial planning process includes essential steps that must be followed to achieve the desired goals. Financial planning steps are divided into three categories: planning, implementation, and results. These steps are as follows:

The planning process consists of three main steps: evaluating the financial situation, identifying risks, and defining future financial goals. Through the following paragraphs, you can learn about these steps in detail:

Planning Steps

Step One: Evaluating the Financial Situation

Before starting the long-term financial planning process, it is necessary to assess the current financial situation. Doing so will help you understand where to begin your financial plan. The financial situation of your company is evaluated through:

- Identifying the company’s assets, which include company savings and its investment sources.

- Identifying the financial rights of the company’s shareholders, such as capital and profits.

- Identifying the company’s liabilities, which include loans and debts that the company must repay to other external parties.

Step Two: Identifying Risks

No financial plan is free of risks. Therefore, after determining the financial situation, the risks that the financial plan may be exposed to must be identified. Understanding your level of risk tolerance will help determine what the financial plan should look like.

Step Three: Defining Future Financial Goals

Once the current financial situation has been evaluated and the risks associated with the financial plan have been identified, you can finally begin defining your financial goals. In this step, the company’s financial priorities are determined and set as achievable future goals. Usually, there are more goals than the company's financial liquidity can support

At this step, the goals can be divided into three types:

- Short-term goals are achievable within a short period, such as monthly insurance payments.

- Medium-term goals, which can be achieved within a medium period of time, such as life insurance.

- Long-term goals, which can be achieved over a long period, such as purchasing a car.

Implementation Steps

After completing the planning phase, the execution phase begins. The implementation process consists of two main steps: choosing the financial strategy and executing the financial plan. Below are the implementation steps in detail:

Step Four: Choosing the Appropriate Strategy to Achieve the Goals

In this step, a set of financial strategies is identified, from which the most suitable one is selected to achieve the financial goals defined in the previous steps. Future financial projections are also prepared, followed by setting the strategy for the specified financial budget.

It must be taken into account that the strategy should include defining the time frame for achieving the financial plan, as well as determining profits and forecasting future financial outcomes.

Step Five: Implementing the Financial Plan

In this step, the developed financial plan is implemented to achieve the set goals. To do so, financial planning tools are utilized, which in turn aim to achieve the specified goals within the defined time frame.

Result Steps

Step Six: Reviewing the Financial Plan

There is still a final step that must be followed once the financial plan is implemented. It is important to realize that the social and economic environment changes over time. What may be considered a sound investment today may become obsolete tomorrow.

Such factors make it essential to review the financial plan periodically and make adjustments when necessary.

Read also: The Concept of Total Quality Management, Its Importance, and Its Different Stages

What Is the Importance of Financial Planning?

Financial planning mainly involves strategies and policies that will ultimately help you grow your money in the future.

However, for many individuals and investors, the importance of a financial plan may not be clear. Therefore, in the following points, we will explain the importance of financial planning, which includes maintaining stability, assisting with investment decisions, reducing uncertainty in market trends, anticipating obstacles, and, finally, helping with decision-making.

You can learn more information regarding the importance of financial planning in the following paragraphs:

- Maintaining stability: Financial planning helps balance inflows and outflows of funds.

- Assisting in investment: It also ensures the availability of financial resources for investment within companies that practice financial planning.

- Using the financial plans: It helps reduce any uncertainty resulting from changing market trends.

- Forecasting obstacles: Through the financial plan, unexpected situations that could impede company growth can be avoided.

- Assisting in decision-making: Financial planning provides sound guidance for making informed decisions, as a solid financial plan enables a company to be more targeted and focused in the market.

Now that you understand the importance of a clear, well-defined financial plan, let us look at some of its objectives.

Benefits of Financial Planning

Financial planning has many benefits for your organization, both internally among departments and externally in the market and competition with other companies. The benefits of financial planning include supporting company goals, better cash flow management, and reducing expenses. Below are more details about the benefits of financial planning:

1- Supporting Company Goals

Every company has its own goals. To clarify, no organization can achieve its goals without the financial resources to support them. Financial planning determines the company’s current financial position, and based on that, it becomes possible to estimate the revenues the company is expected to achieve in the coming quarter or the next year.

It is also necessary to determine the corresponding expenses and obligations associated with these revenues. Therefore, financial planning helps identify the appropriate time to start working on a new project, introduce modern technology, or establish a new department within the company.

2- Better Cash Flow Management

When is cash flow considered acceptable for your company? The financial plan sets cash flow forecasts and helps you prepare the necessary actions in case actual performance deviates from expectations. By providing a comprehensive financial plan, you can identify revenue- and expense-related challenges and incorporate them into the necessary precautionary measures.

3- Reducing Expenses

Every financial plan prepared by an organization is based on the activities implemented during the previous plan. This allows reviewing expenses that were underestimated and those that were overestimated. It also becomes easier to verify the inflation rates for each commodity or product.

Economic Factors Affecting Financial Planning Decisions

Several factors affect financial planning decisions, and they are often related to economic factors outside the company rather than within it. These include market trends, interest rates, inflation rates, and exchange rates. Below is a more in-depth explanation of these factors:

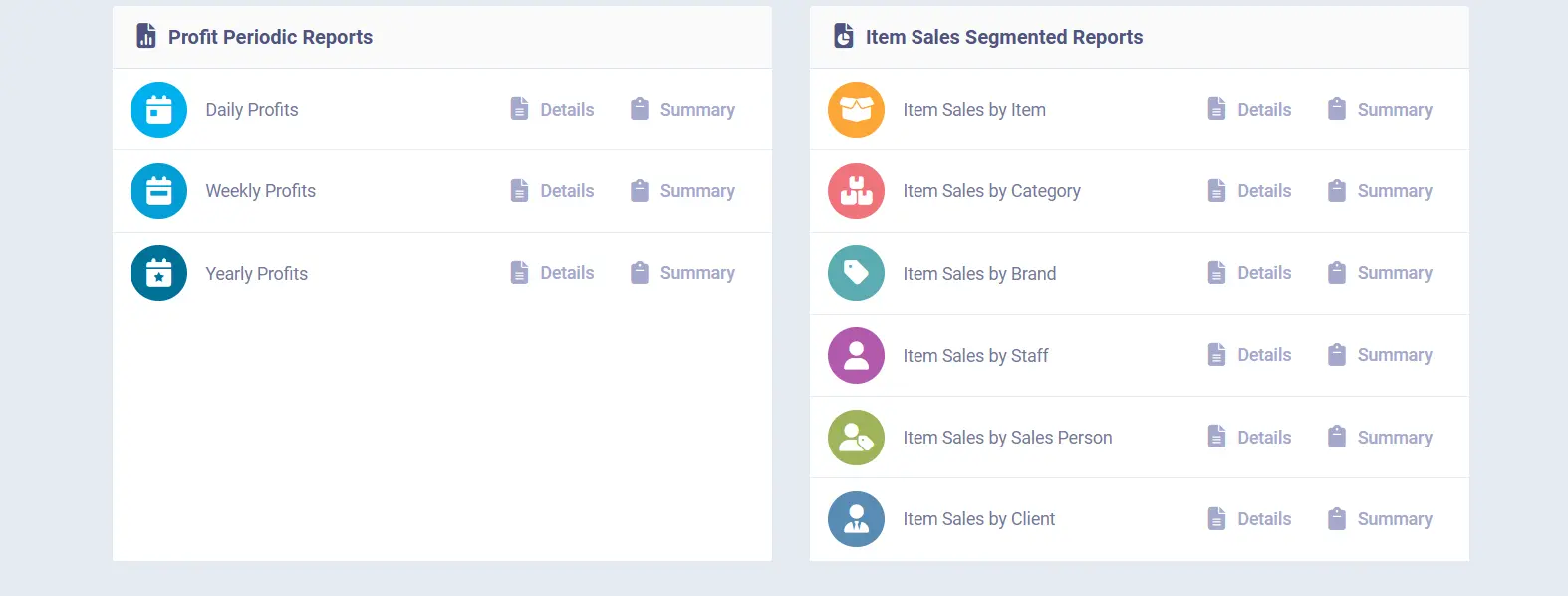

1- Market Trends

By continuously reviewing periodic reports on the industry and sector, you can identify market trends and determine which products are rising or falling in price. You can also monitor stock market indicators, whose decline may signal an expected economic downturn.

2- Interest Rates

When the central bank raises deposit and lending interest rates, it signals an increase in inflation. Accordingly, investment strategies are adjusted, and the financial plan is updated in line with the bank-approved updates.

3- Inflation Rates

By monitoring the Consumer Price Index (CPI), it is easy to identify the extent of changes in the basket of goods and services that matter to households and individuals. Financial planning should take into account the expected rise in prices if inflation rates are rising steadily.

4- Exchange Rates

Exchange rates are among the most important factors affecting financial planning for international business activities and those involving multiple foreign currencies. Expected dates for exchange rate liberalization should be monitored to ensure expenses and revenues are adjusted in line with the current financial situation.

Read also: The Effects of Changes in Exchange Rates on Accounting Operations and Financial Statements

What Are the Objectives of Financial Planning?

The objectives of financial management or financial planning include identifying capital requirements, determining the capital structure, formulating specific financial policies, utilizing resources, balancing cash flows, and developing financial contingency plans. Below are more details about the objectives of financial planning:

- Identifying capital requirements: Capital requirements depend on several factors, such as the cost of current and fixed assets, promotional expenses, and long-term planning.

- Determining the capital structure: The proportion of capital required for operations represents the capital structure. This structure includes decisions regarding the debt-to-equity ratio for both short-term and long-term periods.

- Formulating specific financial policies: These include policies on cash control, borrowing, lending, and related matters, all framed within a financial plan.

- Utilizing resources: One of the key objectives of financial planning is to use scarce resources to achieve maximum returns on investments at the lowest possible costs.

- Achieving balance between internal and external cash flows: This helps ensure the financial stability of your company.

- Developing financial contingency plans: Especially when a company is exposed to financial risks that may affect business continuity, contingency financial plans help the company overcome these risks easily, saving time, effort, and money.

Understanding the objectives and purposes of financial planning makes it easier to appreciate its advantages, which we will discuss next.

You can use a profit margin calculator to determine the value of gross profit, net profit, or operating profit.

What Are the Advantages of Financial Planning?

There are many advantages to financial planning that can have long-term positive effects. These include creating a safety net for the future, assessing the present and the future, and finally developing successful financial strategies. In the following paragraphs, you will learn more about the advantages of financial planning:

Creating a Safety Net for the Future

Financial planning helps determine the direction of financial decisions and identify various investments that can solve future financial problems. For example, investing in different funds may help repay loans.

Assessing the Present and the Future

Financial planning helps in obtaining an evaluation of the current and future financial situation, making it easier to make decisions at any time. In addition, it prevents making incorrect decisions that could negatively affect financial well-being in the present and the future.

Forming Successful Financial Strategies

A financial plan also helps develop effective financial strategies that optimize the use of available financial resources. As a result, resources are used more wisely and leveraged to the maximum possible benefit.

What Are the Factors Affecting Financial Planning?

There are several factors that affect financial planning and may have either negative or positive impacts. Therefore, it is important to identify the most prominent of these factors to avoid negative effects on financial planning.

These factors include human factors, savings versus investment, global issues, inflation rate, and productive capacity. Below is a detailed explanation of these factors:

1- Human Factors

Human factors are those related to employees within a company or institution, and they strongly influence the financial planning process. These factors include selecting a highly efficient and suitable workforce, as well as choosing individuals with experience in the economic and financial field who have a good understanding of financial markets and how they operate.

You can obtain a distinctive, purposeful, and effective financial plan when it is developed by individuals with strong financial expertise. Conversely, you can expect an ineffective financial plan when it is developed by individuals with limited experience in financial planning.

2- Savings vs. Investment

The size of savings and the level of investment affect financial planning. Savings are an important factor in the financial plan, and investing significantly helps generate more money. Increasing savings and investment undoubtedly has a positive impact on the financial plan and helps achieve its intended goals.

You can use an investment calculator to determine the return value from different investments and the profit margin.

3- Global Issues

Global issues also have an important impact on the financial plan. All economic problems affecting the country and the world must be taken into consideration. It is noticeable that financial plans are negatively affected by global events such as economic crises, conflicts, and wars.

4- Inflation Rate

The inflation rate is another external factor that significantly affects the financial plan. The higher the global inflation rate, the greater the problems and negative impacts faced by financial plans.

5- Productive Capacity

It should not be overlooked that an increase in productive capacity affects the progress of the financial plan. When productive capacity is weak, the financial plan is likely to fail, even if it is properly and soundly designed. Therefore, when starting financial planning, it is essential to ensure that productive capacity is at a good level of output.

Other factors can also affect personal financial planning. Among the most prominent of these factors are changes in income, job changes, and changes in family dynamics. You can learn more details about these factors in the following paragraphs:

1- Change in Income

When an individual experiences a change in income, their purchasing power will increase or decrease. This change will significantly affect the ability to spend money, invest, and repay debts.

2- Job Change

When an individual obtains a new job, a variety of new expenses and costs must be calculated. For example, a new job may lead to increased transportation or communication expenses.

3- Changes in Family Dynamics

A financial plan should be created or adjusted when family dynamics change, such as the birth of a child. This is necessary because several new expenses will be added, affecting personal income.

What Is the Role of a Financial Planner?

The role of a financial planner is a key position found in all companies and institutions. Their main role is to organize investment channels, determine expenditure areas, and set priorities among them.

They also monitor updates to laws and taxes to account for them. The financial planner is responsible for setting the boundaries that the company should follow when making decisions to achieve the expected financial goals.

What Is the Most Important Step in Financial Planning?

The most important step in financial planning is setting clear, achievable goals within the business context. If specific goals with a defined time frame are not established, it will not be possible to carry out financial planning that adequately supports the business.

How Does Daftra Help You in the Financial Planning Process?

All the methods you pursue to generate profits and strive to make the growth rate of your savings higher than the inflation rate may not yield the best results. Let me tell you that investing your savings in a project is considered the most profitable approach and may multiply your capital many times over the years if planning and management are done properly.

Since there are tools that help maximize these profits by regulating workflow and analyzing financial and operational aspects, it is essential to be familiar with Daftra’s accounting and sales software, which is considered a leader among Enterprise Resource Planning (ERP) systems.

Moreover, you will not be able to complete tax processes or issue electronic invoices—mandatory in most Arab countries—without it.

Frequently Asked Questions

How can your goal be time-bound when planning financially?

To commit to a comprehensive goal, it should be SMART and have the following characteristics:

- Specific: Specificity can take the form of saving a specific amount of money, increasing revenues by a specific amount, reducing expenses, and other activities.

- Measurable: The goal should be defined in terms of specific financial values. For example, saving $50,000 in expenses.

- Achievable: You should be confident that the company has sufficient resources and capabilities to achieve it.

- Realistic: The goal should align with other goals, be realistic, and consistent with the company’s vision.

- Time-Framed: The goal should have a specific timeline with a clear beginning and end and be divided into a set of milestones that demonstrate the company’s progress toward its objectives.

What are the five steps of financial planning?

1- Determining the financial situation.

2- Setting the financial goal.

3- Analyzing current expenses and income.

4- Developing an integrated financial plan.

5- Creating a budget that takes all previous steps into account.

What is the basic rule of financial planning?

There is more than one basic rule for financial planning that can be applied to individuals and companies. You can start planning based on the following two rules:

1- Pay yourself first (obligations): After closing the accounting period, company revenues appear. At this point, the obligations that the company must pay during the new accounting period—such as expenses and profit distributions—should be determined. The amount is then set aside in a separate account.

2- How much money should you set aside (reserve): What is the amount of cash available in the company’s accounts as a result of profits? If there is a need to expand a production line or start a new project, an amount should be set aside as a reserve, deducted from profits.

What is the 50/30/20 rule in financial planning?

This rule is applied to individuals, but it can also be applied to companies. Fifty percent of financial resources remaining after tax are allocated to essential needs, twenty percent to savings, and thirty percent to discretionary expenses.

What are the most common financial planning formulas?

1- Savings Formula

Savings = (Income – Expenses) × (Time)

The difference between expenses and income represents net savings.

2- 40-30-20 Ratio Formula

40% for the company’s essential needs (such as office rent, electricity, water, and gas).

30% for discretionary items (such as travel allowances and meals).

20% for savings and investment.

These ratios provide a practical way to distribute income across different categories.

3- Debt Ratio Formula

Debt Ratio = (Total Debt / Total Assets) × 100

This represents the level of debt compared to assets. It is important to keep the debt ratio low, as a high ratio can lead to financial problems.

How do you create a successful financial plan?

1- Define financial goals.

2- Determine net income.

3- Plan the budget and identify how it will be allocated.

Who is responsible for financial planning?

The Chief Financial Officer (CFO) is responsible for financial planning in a company, as they oversee all financial matters.

What are the tasks of a financial planning specialist?

- Developing financial plans and implementing them.

- Preparing budgets.

- Analyzing financial data.

- Providing financial advice.

- Continuous monitoring and follow-up of financial performance.

- Managing risks and dealing with them.

What are the fundamentals of personal financial planning?

- Clearly defining financial goals.

- Tracking personal expenses.

- Financial investment.

- Debt management.

- Continuous financial education.

What is the most challenging process in a financial plan?

Monitoring cash flow is considered one of the most challenging processes in a financial plan. Cash flow monitoring involves tracking a company's cash inflows and outflows. This process requires great accuracy and focus because it directly affects the financial plan; therefore, it is considered one of the most challenging tasks.

What is meant by a financial plan?

It is a document that defines the financial position of a company or individual, the future financial goals they seek to achieve, and how to achieve them.

How can your goal become specific in financial planning?

- Define your goal with a clear, precise title.

- Make your goal measurable in terms of performance, progress, and changes.

- Ensure it is realistic and achievable.

- Make sure your goal aligns with your financial capabilities, not just a passing idea.

- Set a specific timeframe for achieving the goal.

What are the steps of family financial planning?

- Setting financial goals.

- Preparing a monthly budget.

- Managing debts.

- Creating an emergency fund.

- Investing.

- Financial awareness for family members and children.

What personal factors affect financial planning decisions?

- The income of the person responsible for the financial plan.

- Personal expenses and their rate.

- Savings and investment.

- The defined financial goal.

- Potential risks.

- Lifestyle and living patterns.

Conclusion

Life is good when you have a plan; therefore, financial planning is important for everyone. Financial planning includes evaluating your current situation and making decisions based on your needs and future goals.

When life events change rapidly and unexpectedly, having a strong financial plan helps you stay on track toward the goals you seek to achieve. Therefore, financial planning is essential to avoid financial losses.