Accounting Entries in Tourism Companies

Table of contents:

- What is the Importance of Accounting Entries in Tourism Companies?

- What Departments of Tourism Work Do Tourism Accounting Entries Apply To?

- What is the Accounting Entry for Airline Ticket Refunds?

- Revenues in Accounting Entries for Tourism Companies

- How to Record Revenue Entries in Daily Journals for Tourism Companies?

Comprehensive Guide to Financial Accounting

As is well known, accounting is the art of communicating financial information about an economic entity to managers, shareholders, and other stakeholders. This communication takes the form of financial reports that show whether economic resources are under management control, and whether these reports show the volume of profits or losses.

In all cases, the function of the accounting officer is to clarify the financial position of the company or institution accurately and with high integrity. These reports include: trial balance, balance sheet, income statement, accounts receivable, accounts payable, and others, according to the requirements and needs of each company. In accounting entries specific to tourism companies, they differ only in some details and particulars, as they include two sections: tourism and travel.

What is the Importance of Accounting Entries in Tourism Companies?

- Maintaining books with all accounting transactions recorded

- Monitoring company revenues and expenses, and overcoming embezzlement and financial manipulation

- Ease of evaluating expenses and profits of tour groups to determine their success or loss

- Understanding the company's financial position and reaching business results

What Departments of Tourism Work Do Tourism Accounting Entries Apply To?

- Trip planning and organization for various types of tourism: domestic, international, and religious

- Tourism transportation: aircraft, conventional mass transit, and individual transportation

- Travel tickets

Tourism Department

This covers everything related to accommodation and hotel reservations, as well as transportation and all tourist-related visits in the country where they are located. All these arrangements have expenses and revenues, and some reservations must be prepaid while others are on credit terms.

Travel Department

In this section, everything related to flight reservations is recorded: issuing airline tickets, flight details, reservation details, and details about cancellations or booking modifications. This department is considered more complex than hotel booking procedures, so we rely on using a chart of accounts consisting of:

- Assets

- Liabilities

- Expenses

- Revenues

Read also: Accounting entries for salaries and wages

Everything you need to know about cost accounting

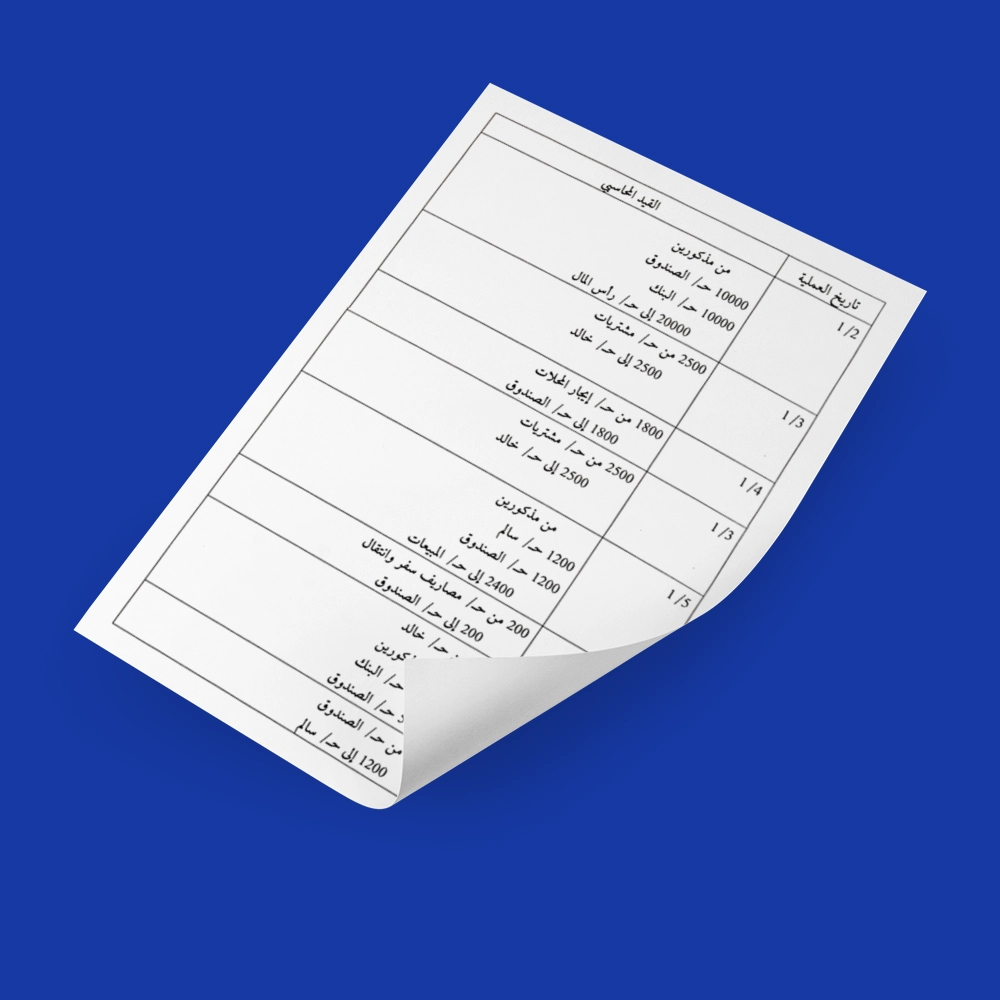

There are some differences in accounting entries in tourism companies, and the differences appear in the creditor account that bears ticket costs during the sales process.

Payment in this account is made at the end of each period, and the duration of this period is two weeks, meaning the account is settled twice each month: once on the 15th of the month and once on the 31st of the same month.

One of the most commonly used terms in preparing accounting entries in tourism companies is "IATA," which refers to accounts payable and is an abbreviation for "International Air Transport Association." This is the account for which we explained how payment is made and the time period in which settlement occurs.

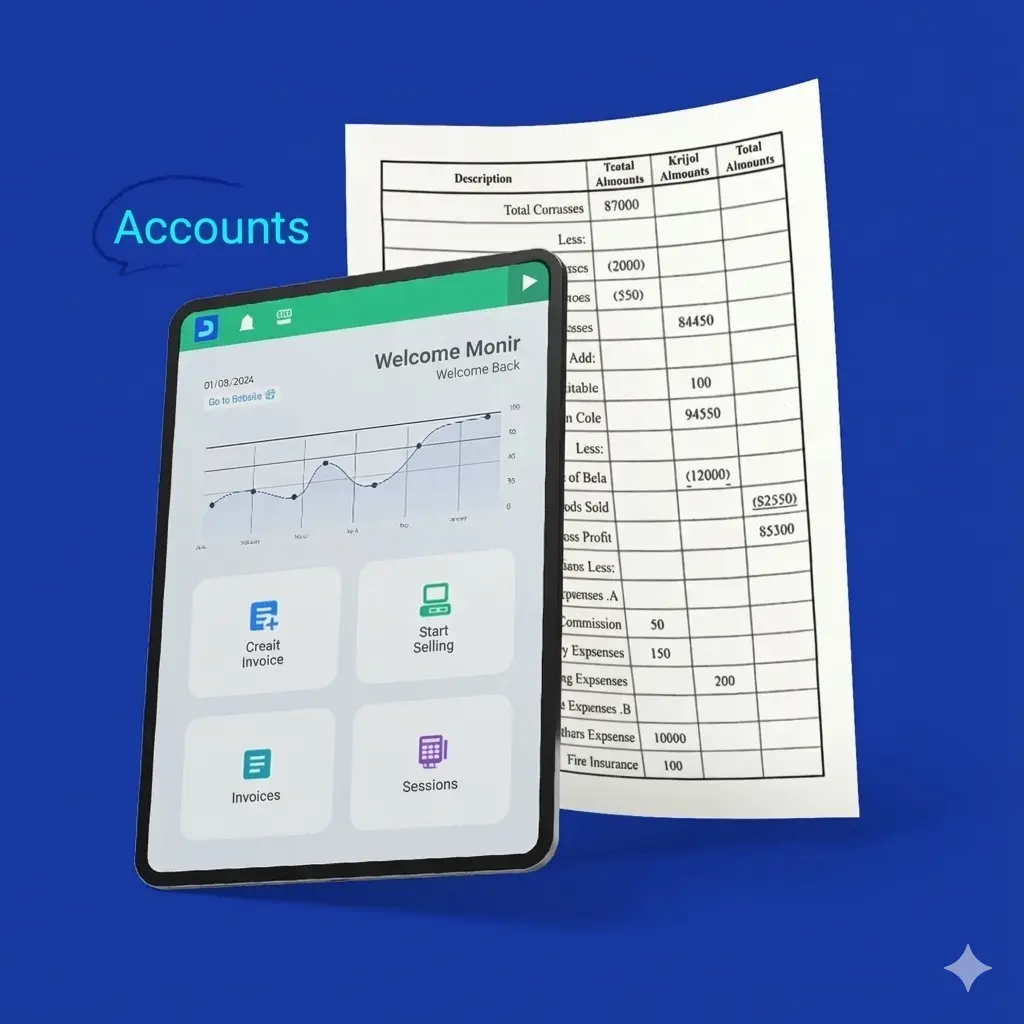

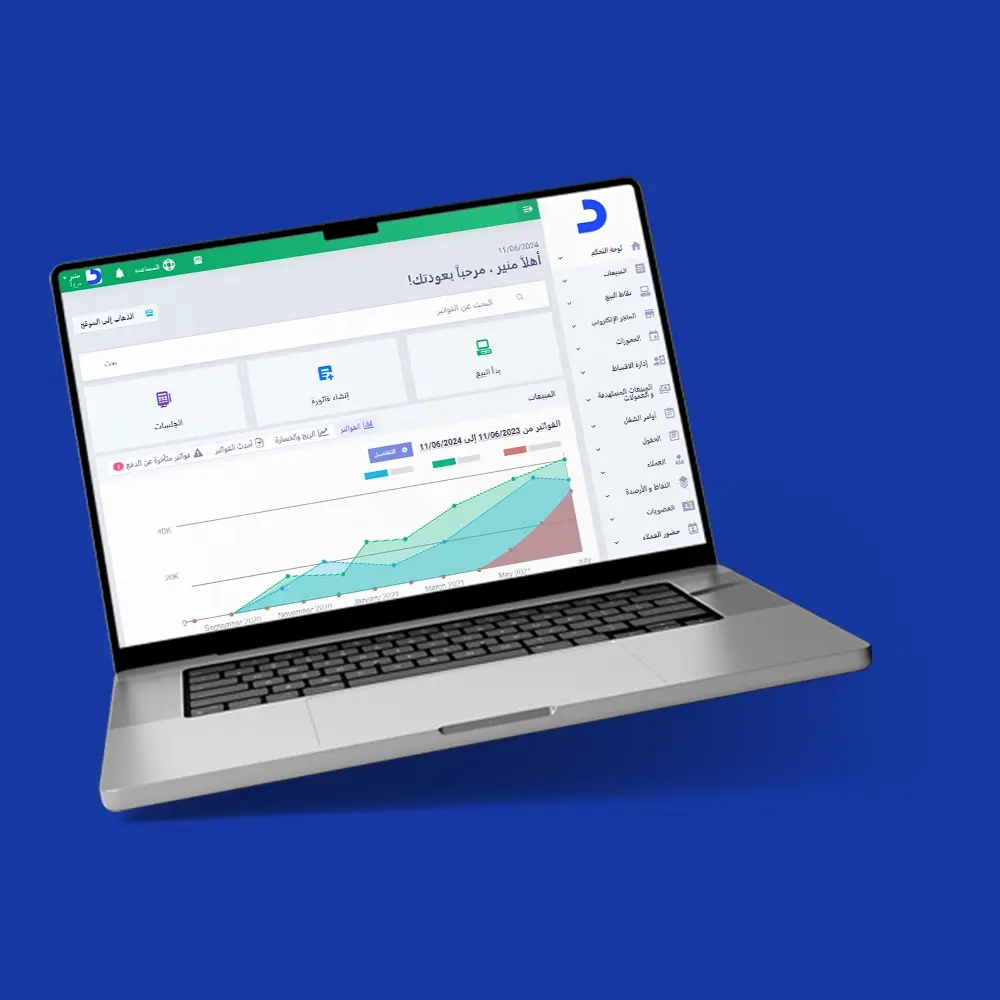

Daily operations include recording airline and hotel reservation sales transactions, whether cash or credit, which are daily accounting transaction entries that we explained how to manage and modify in detail using the Daftra software for tourism company management.

Recording airline ticket sales includes: (From customers, from ticket cost, to ticket cost, to BSP PAYABLE)

The term “BSP PAYABLE” refers to a payable billing and settlement plan.

Hotel reservation sales are recorded as follows: (from h/customers, from /hotel cost, to /hotel sales, to h/name of tourism agent)

We note that the creditor's account is the name of the tourism agent, and of course, there is more than one tourism agent, and this is different from airline tickets, in which the creditor's account is an account “IATA”.

IATA's payment process is done periodically based on a periodic report made by IATA on its website, and is as follows:

(From H/BSP PAYABLE, to H/Bank)

Payment process for a tourism agent

(from H/name of tourism agent, to H/bank)

What is the Accounting Entry for Airline Ticket Refunds?

This process is carried out in two stages:

- First Stage

Processing the ticket refund through the ticket booking officer on the ticket reservation system.

This differs from one airline to another, where we find some airlines process refunds for their tickets through systems and respond the next day on the IATA website.

There are other airlines that require preparing a refund form and sending it manually to the airline, waiting for at least a week until the airline responds on the IATA website with approval or rejection. In case of approval, the accounting treatment stage begins as follows:

( From BSP PAYABLE, From Ticket Sales, To Ticket Cost, To Customer Name or Returned Tickets)

- Second Stage

We notice a reverse entry is made for the airline ticket sales entry in two cases:

- Closing the entry in the customer name account - This is the normal case used when tickets were originally sold on credit terms.

- Closing the entry in the returned tickets account (intermediary account) - This is used when tickets were originally sold for cash, and the ticket value will be returned to the customer as follows:

( From H/ Returned Tickets, to H/ Bank or Fund)

Read also: A comprehensive guide to contracting, accounting, and how to apply it

A comprehensive guide to financial accounting

Revenues in Accounting Entries for Tourism Companies

In these entries, the following are recorded:

- A commission is obtained from booking tickets for airlines, for which an account is allocated in the name of the airline's currency.

- A commission is obtained from booking tickets for the benefit of ship companies, and an account is allocated to them in the name of the ship's currency.

- Revenues from foreign tourism trips are divided into:

- Revenues from sightseeing trips and archaeological visits

- Revenues from religious tourism trips, including trips to perform Hajj and Umrah, throughout the year

- As for domestic tourism, it includes:

- Regional antiquities visits

- Tourist attractions

Revenue collection is done through invoices issued by tourism transportation companies. The invoices are filled out on documents called "work orders," which serve as the company's document for collecting operation fees, whether on credit or during the operation time. Vehicle work orders are collected and categorized according to each service provider type, such as hotels, tourism companies, or tourism centers. After this step, work orders are processed into invoices and directed to the service recipient.

The work order must clearly show all trip details and must be approved by the operations manager as well as the accounting manager. There are also other entities, such as customs, that review these accounts through an independent record called the “movement register.”

This ledger is the account in which all operating orders for the month are recorded, while the revenue analysis ledger is the ledger in which revenues are divided according to cars to determine the production value of each car individually during the accounting month.

Read also: What is an external review and its importance

How to Record Revenue Entries in Daily Journals for Tourism Companies?

Revenue journals in tourism service companies have two subsidiary books:

- Tourism services revenue journal, which usually refers to group invoices, and the registration data is as follows:

This primarily refers to group invoices, and the entry data should be in the following format:

- Date

- Invoice number

- Value in foreign currency (transaction type - its value)

- Value in local currency

- Revenue

- Value Added Tax

- Customer information

- Cash Receipts Journal

This records revenues not related to group invoices.

Revenue diaries in aviation agencies:

1- Registration data:

- Ticket number

- Ticket items

- What is collected for the airline

- Agency commission

- Sales tax

- Departure fees

Total

2- Collection method: (cash – check – forward)

- How to Calculate Ticket Value:

The value of the ticket specified by the airline + tourism company commission + tax + departure fee = Total (which is what is collected from the customer).

In the end, all accounting transactions in the tourism sector are normal accounting transactions, not much different from the laws recognized in accounting.