What Is the Profit and Loss Account and How Is It Prepared?

Table of contents:

- Definition of the Profit and Loss Account

- What Are the Benefits of the Profit and Loss Account?

- Items and Components of the Profit and Loss Account

- How to Prepare the Profit and Loss Account?

- What Is the Profit and Loss Account Closing Entry?

- What Is the Relationship Between the Profit and Loss Account and the Balance Sheet?

- Difference Between the Profit and Loss Account and the Trading Account

- What Is the Relationship Between the Profit and Loss Account and the Chart of Accounts?

- How Daftra Helps You Prepare the Profit and Loss Account

- Frequently Asked Questions

The profit and loss account answers a fundamental question: has your company achieved satisfactory profits, or has it incurred significant losses?

The outcome of the profit and loss account can be described as a report that tells the story of your business activity step by step through clear, logical, numerical data, starting with earned revenues, followed by incurred expenses, and ending with net profit or loss.

Whether you are a business owner, financial manager, or investor, we present a summary of our accounting expertise to explain the profit and loss account and its role in evaluating an enterprise's success, as it is one of the most important final accounts.

Definition of the Profit and Loss Account

The profit and loss account is one of the types of final accounts in which all revenues and expenses of a company are determined. It is prepared annually or quarterly to evaluate the company’s financial performance. If revenues exceed expenses, the result is net profit; if expenses exceed revenues, the result is a net loss.

What Are the Benefits of the Profit and Loss Account?

The profit and loss account is one of the essential financial tools that institutions rely on to assess their financial performance over a specific period.

It is not limited to measuring net profit or loss; rather, it provides a comprehensive view of how resources are managed and revenues are generated, which helps in making accurate strategic decisions that support the company’s stability and growth.

The objectives of the profit and loss account include:

- Analyzing spending and rationalizing expenses: Identifying activities and sectors where significant amounts of money were spent and those where spending was limited, thereby providing solutions to reduce and optimize costs.

- Identifying expansion opportunities: Determining whether the company can expand its activities and identifying sources of financing and investment.

- Evaluating performance and encouraging future investments: Helping investors assess the financial performance of institutions and companies that may be suitable for future investment.

- Facilitating the preparation of tax returns: Simplifying the process of filing tax returns and paying taxes.

In short, the importance of the profit and loss account lies in its ability to analyze spending patterns and identify expansion opportunities, as well as support investor decisions and facilitate tax obligations. Therefore, relying on this account represents a vital step toward accurately understanding financial performance and developing more effective future plans.

You may also find useful: Return on Investment (ROI) Account Template

Items and Components of the Profit and Loss Account

Generally, the profit and loss account in commercial and financial companies does not differ from that of industrial or other profit-oriented institutions. Therefore, all necessary items and components must be included in this account to ensure accurate results.

The profit and loss account can be divided into two main sides: the credit side and the debit side, each of which includes several items as follows:

1. General Expenses

General expenses in the profit and loss account include wages and salaries, compensation, travel allowances, taxes and fines, in addition to general expenses such as electricity and water bills, and other service charges.

2. Financial Expenses

These include lending and borrowing interest, bank charges, debit interest, losses resulting from exchange rate and currency differences, and all expenses incurred to obtain financing for activities and projects.

3. Selling and Distribution Expenses

These are the costs incurred to sell the products or services provided by the company or institution, such as marketing expenses, agents’ commissions, transportation and distribution costs, wages and incentives for sales and marketing staff, and expenses related to renting or purchasing properties, warehouses, and sales outlets.

4. Depreciation of Fixed Assets

Depreciation of fixed assets in the profit and loss account refers to allocating the cost of a fixed asset used in the production process over its useful life.

5. Asset Losses

Losses resulting from the sale of assets, shortages in cash flows or liquidity, losses arising from financial risks, as well as losses caused by damaged goods or disruptions in the production process.

6. Interest on Capital

Interest on capital in the profit and loss account is considered a reward received by partners in return for their investments in the company. It is included on the debit side of the profit and loss account, as it is classified as an expense paid by the company.

7. Credit Balance, such as Partners’ Share of Profits

This item in the profit and loss account refers to the distribution of net profit among partners according to the agreement between them, after deducting all expenses and interest on capital. The shares may be equal or different depending on each partner’s contribution.

8. Net Losses

Net losses are an undesirable result in the profit and loss account and represent a negative indicator that occurs when expenses exceed revenues. Therefore, they appear on the debit side of the profit and loss account.

9. Credit Bank Interest

This refers to interest earned by the company from banks on deposits or current accounts.

10. Gains from the Sale of Fixed Assets

The profit realized by the company when it sells one of its fixed assets (such as buildings or machinery) at a price higher than its book value.

11. Gains from Changes in Exchange Rates

These are profits realized when the value of a foreign currency held by the company increases against the local currency, depending on market fluctuations.

12. Investment Income

Investment income is considered an additional and important source of revenue in the profit and loss account, earned from the company’s investments in shares, bonds, or real estate.

13. Net Profit

This is the difference between total revenues and total expenses. It is transferred from the trading account to the profit and loss account on the credit side if there is a profit.

14. Interest on Drawings

Interest on drawings in the profit and loss account is the interest paid by partners on amounts they withdraw from the company for personal use, which results in a reduction in partners’ capital equity.

15. Debit Balance such as Partners’ Share of Losses

This represents the proportion of losses borne by the partners during a specific financial period. It also reduces partners’ capital equity and appears as a debit balance.

In summary, the profit and loss account consists of a set of items that illustrate the financial position of a company’s activities during a specific accounting period.

It includes various types of expenses (general, financial, selling, and depreciation), along with losses and gains arising from operating and investment activities, interest on capital and drawings, and the partners’ share of profits or losses.

Together, these elements present the true financial performance of the institution and help determine the net profit or net loss.

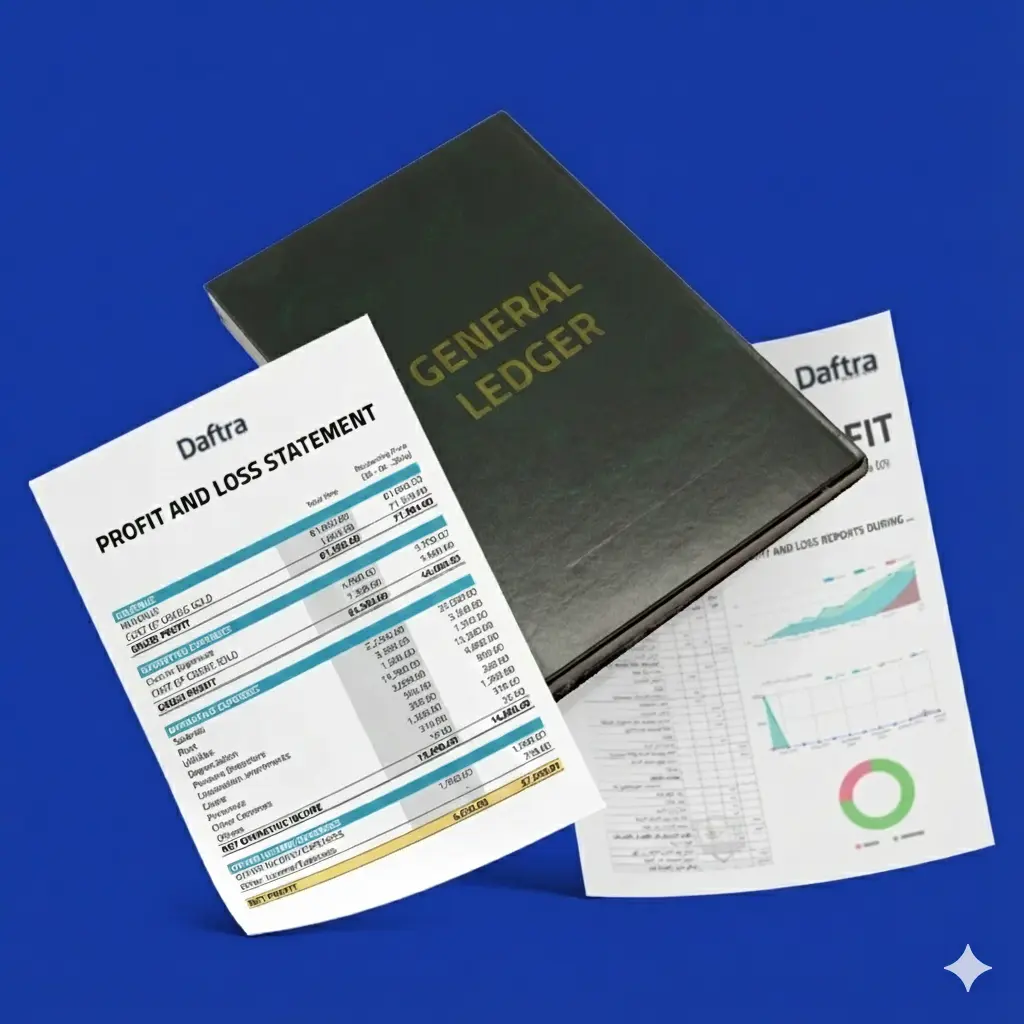

Format of the Profit and Loss Account

To ensure accurate financial analysis and performance evaluation over a specific accounting period, the profit and loss account is prepared in an organized format that clearly shows the relationship between revenues and expenses. Below is the format of the profit and loss account:

| Revenues | Credit | Expenses | Debit |

| Gross Profit Balance | XX | Gross Loss Balance | XX |

| Lending Interest | XX | Administrative Building Rent | XX |

| Discount Received | XX | Employees’ Salaries | XX |

| Bank Interest | XX | Depreciation of Buildings and Administrative Equipment | XX |

| Securities Income | XX | Borrowing Interest | XX |

| Rental Income | XX | Discount Allowed | XX |

| Water and Electricity | XX | ||

| Repairs, Maintenance, and Insurance of Administrative Buildings and Equipment | XX | ||

| Fire Insurance | XX | ||

| Bad Debts | XX | ||

| Telegraph and Telephone | XX | ||

| Printing and Stationery | XX | ||

| Transportation Expenses | XX | ||

| Compensation | XX | ||

| Advertising | XX | ||

| Sales Transportation | XX | ||

| Sales Commission | XX | ||

| XX | Net Loss | XX | Net Profit |

By reviewing the format of the profit and loss account, it becomes clear that it consists of a two-sided table: the credit side, which includes revenues and gains, and the debit side, which includes all expenses and costs.

By totaling revenues and expenses, the net profit or net loss is calculated, reflecting the result of the institution’s financial activity.

Download now: A ready-made Profit and Loss Account Excel template for free to easily apply profit and loss calculations.

How to Prepare the Profit and Loss Account?

It can be said that the profit and loss account is a measure used to evaluate a company’s performance and financial condition. Through this account, a complete picture of the company’s profits, expenses, and costs related to its activities can be presented.

Therefore, it is always recommended to prepare it carefully to avoid the company incurring multiple fines and interest. The main steps to prepare the profit and loss account are as follows:

1. Determine the Time Frame for the Profit and Loss Account

First, the period during which net profits or expenses will be determined and calculated must be defined.

2. Record Expenses and Revenues

All expenses and revenues should be recorded and calculated from the beginning up to the moment of preparing the profit and loss account. Keep all records that show the volume of profits and expenses resulting from the company’s activities, and record only revenues generated from the company’s activities by creating a table.

3. Document and Record Losses from the Trading Account (if any)

Losses arising from the trading account, if any, should be recorded. Then, expenses such as commissions, advertising costs, and other previously mentioned expenses should be entered on the debit side, while revenues should be recorded on the credit side.

4. Calculate Net Profit or Loss

Revenues and profits can be subtracted from expenses to obtain the final result, whether it is net profit or net loss.

You can use Daftra’s Discount Calculator to easily calculate any percentage or determine the discounted value.

5. Posting to the Capital Account

Post the results, transferring the calculation outcome—whether net profit or net loss—to the capital account. If total credits exceed total debits, the result is net profit. If total debits exceed total credits, the result is a net loss.

6. Closing the Profit and Loss Account

The income statement account is zeroed or closed at the end of the financial year, which will be explained later. The results are then transferred to retained earnings, which are the profits kept by the company for reinvestment.

It is clear that preparing the profit and loss account involves defining the time period, accurately recording all expenses and revenues, documenting losses from the trading account if they exist, calculating net profit or loss by comparing total revenues with expenses, transferring the results to the capital account, and finally closing the account at the end of the financial period.

Correctly applying these steps ensures accurate results and helps in making informed financial decisions that improve the company’s overall performance.

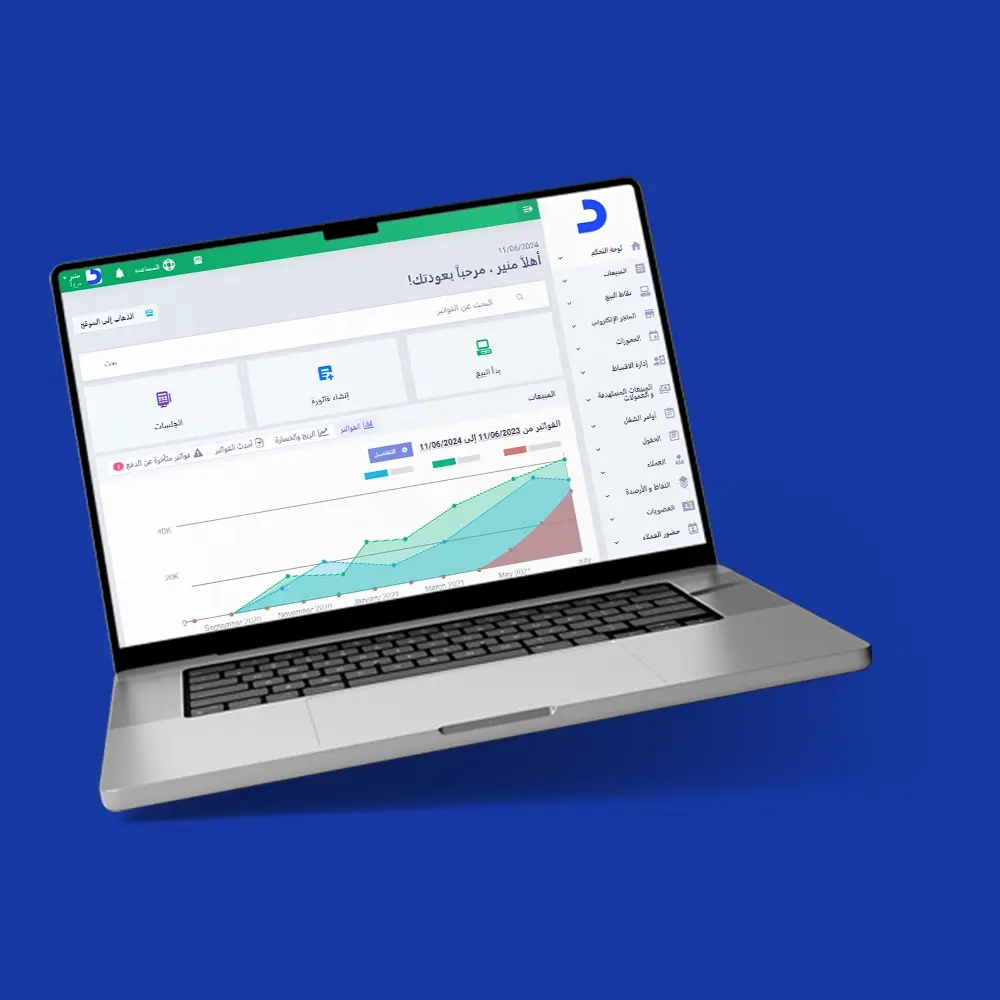

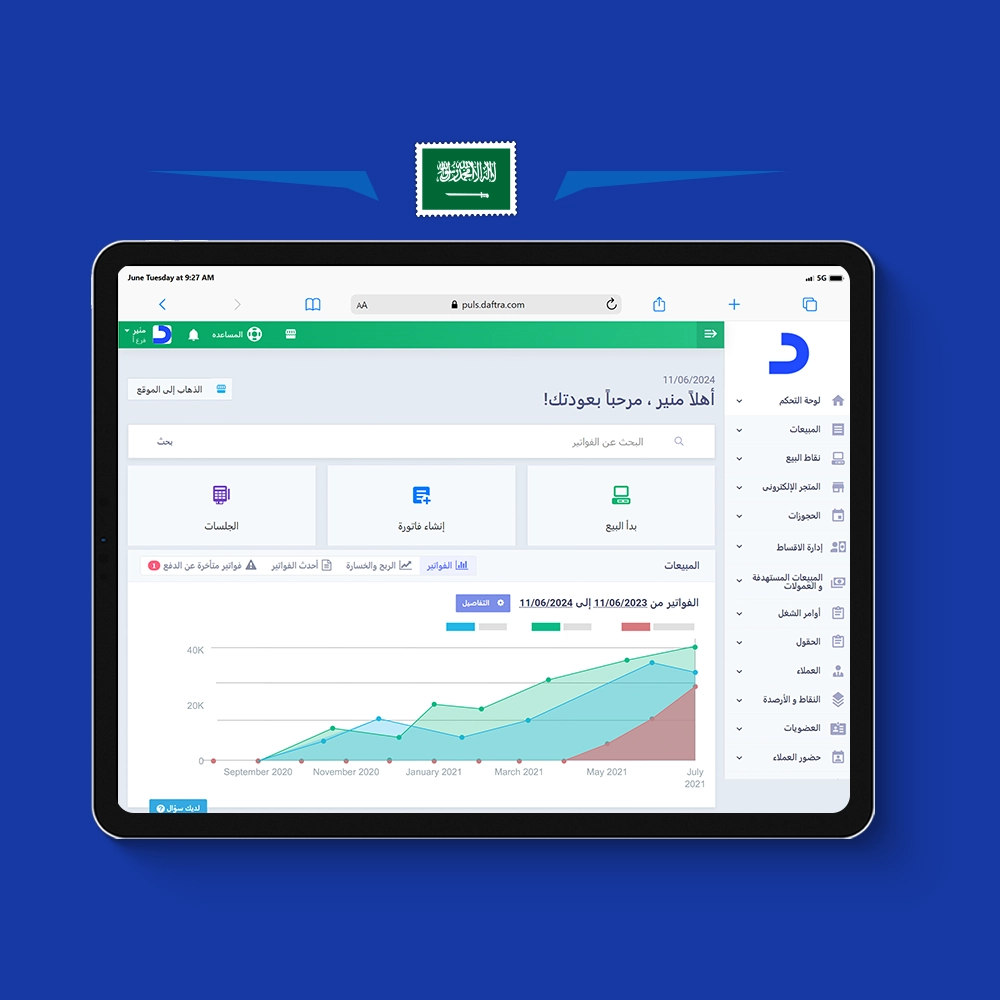

Daftra Accounting System allows you to easily record all expenses and revenues, monitor financial activity results instantly, automatically calculate net profit or loss, prepare the profit and loss account effortlessly, and generate accurate financial and tax reports free of accounting errors.

You can also rely on the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) template to help calculate profits before the necessary deductions.

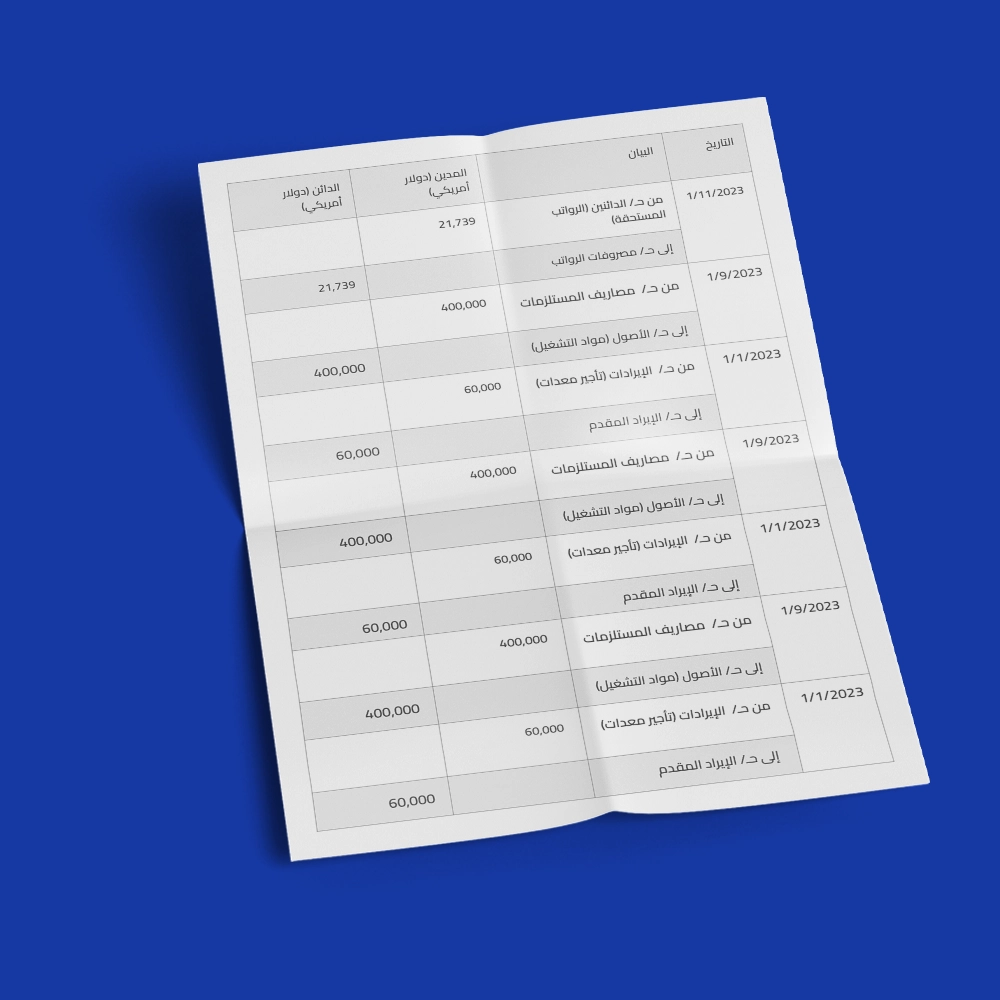

What Is the Profit and Loss Account Closing Entry?

It is the entry that companies prepare at the end of each financial year or accounting period when preparing financial reports and statements. In this step, companies may close certain accounts so that the balances of some accounts become zero at the beginning of the new financial year.

These accounts are placed in the income summary account, which includes one account for profit and another for loss. Then, credit accounts such as revenues and profits are closed by transferring them to debit accounts, while debit accounts such as expenses and costs are closed by transferring them to credit accounts.

Also read:How to Close Accounts at the End of the Financial Year in an Organized Manner

What Is the Relationship Between the Profit and Loss Account and the Balance Sheet?

The profit and loss account is used to analyze balance sheets, as it is one of the elements that affect certain changes that may occur in the balance sheet during each financial year.

The profit and loss account is prepared before issuing the balance sheet, as it is not possible to prepare the balance sheet for the accounting period or the new financial year without first determining the profit and loss account.

Also see: Cumulative Return Account Template for calculating total losses or profits from investments in a specific project or investment portfolio over a given period.

Difference Between the Profit and Loss Account and the Income Statement

The profit and loss account is one of the components of the income statement. The income statement is merely a presentation of financial information and data extracted from the trading account and the profit and loss account, without performing any calculations.

The income statement consists of four elements: revenues, expenses, losses, and profits.

On the other hand, the profit and loss account involves many calculations to determine profits and losses, providing clear numerical results.

From this comparison, it is clear that the difference between the profit and loss account and the income statement is that the profit and loss account is used to perform calculations that show the net profit or loss.

In contrast, the income statement is just a presentation of those results and data without any calculations, making the profit and loss account an essential component of the income statement.

Difference Between the Profit and Loss Account and the Trading Account

Final accounts, or result accounts that determine the outcome of a company or institution’s activities, are divided into two accounts:

- Profit and Loss Account

- Trading Account

The trading account reflects the process of selling or purchasing the products or services promoted by the company. This account compares the net sales profit achieved by the company with the cost of these sales during the financial period.

After this comparison, we arrive at the final result, or the gross result, which may be a profit or a loss. From here, we move to the next stage: the profit and loss account.

In the profit and loss account, profits and losses related to the company’s activities are determined, excluding the gross profit or loss derived from the trading account.

The result of the trading account is recorded in the profit and loss account, while the profit and loss account is recorded in the capital account and then reflected in the balance sheet.

The difference between the trading account and the profit and loss account is that the trading account focuses on measuring the results of sales and purchase operations to reach the gross profit or loss.

On the other hand, the profit and loss account determines the net outcome of the activity—profit or loss—after adding other revenues and subtracting expenses. It serves as a continuation of the trading account before transferring the final results to the capital account.

Also useful:EBIT (Earnings Before Interest and Taxes) Template

What Is the Relationship Between the Profit and Loss Account and the Chart of Accounts?

The chart of accounts is an index that includes all the accounting transactions carried out by a company, whether commercial, industrial, or economic. It also contains all the account numbers and names that make up the accounting system.

The accounts in the chart of accounts are divided into two sections:

- Balance Sheet Accounts: These include asset, liability, and equity accounts, which reflect the company’s financial position.

- Profit, Expense, and Revenue Accounts: These represent the outcome of the company’s activities over a specific financial period.

The chart of accounts includes multiple levels, starting with main accounts, followed by sub-accounts, and then more specialized accounts.

Each group of accounts is coded using sequential numbers to track the financial and accounting transactions performed by the company during each financial period.

Thus, it becomes clear that the profit and loss account is connected to the chart of accounts because it relies on the sub-accounts classified within the chart to accurately measure financial performance over a specific financial period.

Also useful:EBT (Earnings Before Taxes) Account Template

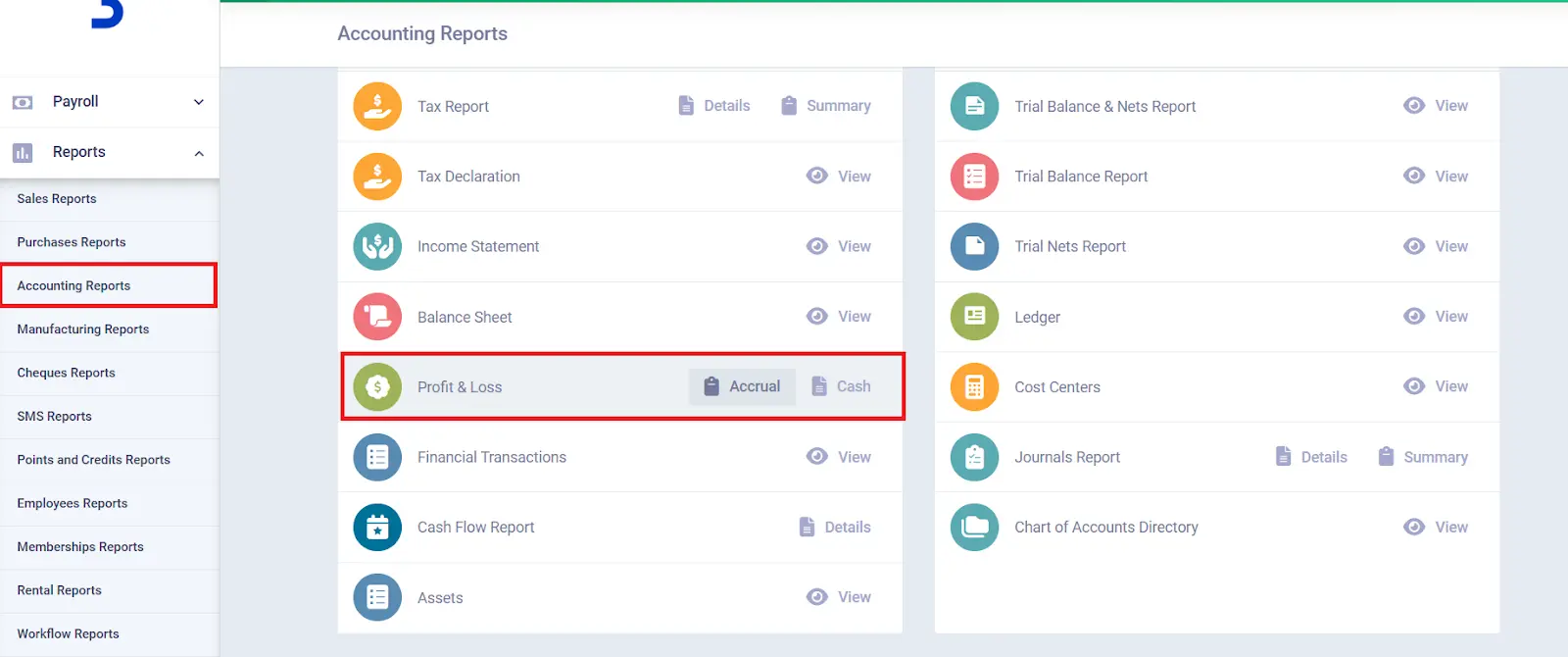

How Daftra Helps You Prepare the Profit and Loss Account

Throughout your accounting operations, you will find that final accounts, such as the profit and loss account, are the end result. The Daftra accounting software makes it easy to perform these final account calculations based on your recorded financial transactions in the system.

In the end, you can generate these accounts in the form of reports that provide specific financial information based on the type of final account.

You can try Daftra now for free for a limited period to explore the system’s capabilities, with detailed guides in multiple formats that simplify your journey in using Daftra to manage your business.

Frequently Asked Questions

What are the characteristics of the Profit and Loss Account?

The characteristics of the profit and loss account include:

- The profit and loss account presents the financial performance for a specific period, unlike the balance sheet, which shows the company’s financial position at a particular moment.

- The profit and loss account is based on the matching principle and accrual basis, focusing on matching revenues with the related expenses during the same accounting period, regardless of when cash is received or paid. This allows for calculating net profit or loss, providing a more accurate picture of the company’s profitability and financial health.

- Transparency and reliability are among the key characteristics, as it is prepared according to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

What are the factors affecting the Profit and Loss Account?

The factors affecting the profit and loss account can be summarized as follows:

- Sales volume: Higher sales increase revenues and profit, and vice versa. Sales are influenced by competition, marketing efforts, supply and demand levels, customer preferences, economic recession or growth, exchange rate changes, and inflation.

- Product pricing strategies: Prices should balance competitiveness, cost coverage, and an acceptable profit margin.

- Discounts and promotions: While they may increase sales volume, they reduce revenue per unit sold.

- Cost of goods sold: Affected by raw material costs, direct labor wages and salaries, other manufacturing costs, shipping, packaging, transportation, distribution costs, and ending inventory value.

- Interest income from investments or deposits, and interest expenses on loans.

- Profits or losses from the sale of fixed assets.

- Income tax, value-added tax (VAT), or property taxes.

What are the common errors when preparing the Profit and Loss Account?

- Ignoring some revenues or recording them incorrectly.

- Estimating expenses incorrectly affects the accuracy of the profit and loss account.

- Mixing personal expenses with business expenses.

- Incorrectly calculating assets and liabilities affects the actual profit or loss picture.

- Arithmetic errors when calculating taxes which directly affect the final net profit.

Does the Profit and Loss Account appear in the trial balance?

No, the profit and loss account does not appear in the trial balance. Although it is a final account affecting the balance sheet, it is a temporary account showing changes that occur in the balance sheet during the financial period. Therefore, it does not appear in the trial balance.

What are the objectives of the Profit and Loss Account?

The profit and loss account aims to:

- Analyze spending and rationalize expenses.

- Identify expansion opportunities for activities.

- Evaluate performance to encourage future investments.

- Facilitate tax filing and payment of due taxes.

The main objective of the profit and loss account is to calculate the net profit or loss of any project during a specific period.

How do you summarize the Profit and Loss Statement?

The profit and loss account summary is one of the final accounts used to determine the result of a company’s financial activity during a specific period, whether annually or quarterly, by comparing revenues with expenses. If revenues exceed expenses, a net profit is achieved; if expenses exceed revenues, a net loss results.

Which accounts are closed in the Profit and Loss Account?

The accounts closed in the profit and loss account are operational accounts, including:

- Revenues and profits (closed on the credit side).

- Expenses and losses (closed on the debit side).

All these accounts are transferred to the profit and loss account to determine the net profit or loss.

What are the accounting entries for the Profit and Loss Account?

The accounting entries for the profit and loss account record all revenues and expenses at the end of the financial period, with expenses debited and revenues credited to arrive at the net result. If revenues exceed expenses, the result is net profit; if expenses exceed revenues, the result is net loss.

Is the Profit and Loss Account debit or credit?

The profit and loss account is a composite account containing both sides: debit for expenses and losses, and credit for revenues and profits. Therefore, it is neither inherently debit nor credit, but depends on the final result, whether it is a profit or a loss.

How is the Profit and Loss Account closed?

The profit and loss account is closed at the end of the financial year by transferring the final result (net profit or loss) to the capital account or retained earnings. By transferring the result, the account is zeroed in preparation for a new financial period.

What are the correction entries that affect the Profit and Loss Account?

Correction entries that affect the profit and loss account are those used to adjust errors or make adjustments related to expenses or revenues. They directly impact the account’s result, either increasing or decreasing the previously calculated net profit or loss.

Conclusion

The profit and loss account is a key component of financial statements for any institution, alongside the balance sheet and cash flow statement. It provides a true picture of the company’s financial position and the results of its activities by offering ratios and figures on revenues, profits, and expenses.

This contributes to evaluating how the company manages projects and activities, and the amount spent on these projects. Therefore, accuracy and care are essential when preparing it.