What Is Financial Management, Its Functions, and Its Importance for Institutions

Table of contents:

- Definition of Financial Management

- What is the importance of financial management?

- Objectives of Financial Management

- Stages and Steps of Financial Management

- Functions of Financial Management

- What are the experts’ tips for good financial management?

- Does Daftra help you in the financial management of your institution?

- Frequently Asked Questions

In recent years, numerous political, economic, and social changes have significantly affected the world of finance and business. This has led to an increased importance of accounting information, which has become a fundamental factor in financing and investment decisions. Therefore, the emergence of what is known today as financial management became necessary.

Financial management, in turn, has become one of the most important fields since the onset of the economic crisis, which was marked by financial and economic recession and the collapse of many institutions. This highlighted the need to study the content of institutional financial reports to predict economic conditions, which can be achieved by examining and analyzing financial statements.

If you are working in an institution or are interested in the world of economics, finance, and business, this article will cover everything related to the concept of financial management, in addition to its objectives, the most important stages and steps of financial management, its functions, along some controversial opinions regarding the nature of financial management.

Definition of Financial Management

Financial management is the process of planning, organizing, and controlling financial resources based on the study and analysis of financial statements, with the aim of achieving financial impacts that align with the organizational objectives and goals to be implemented.

It seeks to control financial activities and all related aspects of money within the institution and is considered a goal within the objectives of financial management.

This process later helps evaluate the risks the institution may face in the future, identify the strengths and weaknesses of its financial and business activities, assess the institution's financial position and its integration with components of the financial environment, and provide recommendations and proposals that benefit the institution in future projects and activities.

What is the importance of financial management?

The process of financial management contributes to determining the objectives of the institution, formulating or changing its policies, in addition to establishing and implementing procedures. The importance of financial management lies in achieving balance, mitigating risk, supporting decision-making, reducing costs, and increasing profits. You can understand the details of the importance of financial management in the following points:

- Balance: Maintaining a balance between expenses and income to ensure financial stability for the implementation of growth and expansion plans.

- Avoiding risks: Protecting the institution from economic fluctuations and financial risks.

- Assisting in decision-making: Provides long-term and short-term insights to make critical financial decisions.

- Reducing costs: Helps allocate funds efficiently and lower expenses.

- Increasing profits: Contributes to higher profit ratios, which reflect positively on the institution's value.

Objectives of Financial Management

In the era of finance and business, the need to implement financial management has become indispensable to ensure the success of the institution and its business activities.

Financial management aims to assess capital needs, determine the capital structure, implement sound financial policies, optimize resources, increase efficiency, and, ultimately, maintain the institution’s operations and reduce risk. Here are the objectives of financial management in detail:

1- Assessing Capital Needs

This means evaluating certain fixed financial factors such as the cost and allocation of assets, marketing and human resources costs, as well as the need for reserve capital.

2- Determining the Capital Structure

The capital structure refers to the framework that governs decision-making related to the ratios of debt or fixed assets over the long and short term. Therefore, there is always a need to develop a robust capital structure that accounts for all sources of capital.

3- Implementing Decisive Financial Policies

It is essential to formulate effective financial policies related to cash control and lending and borrowing operations, in addition to proper mobilization.

This means not wasting savings and liquidity on a single project. Here, careful consideration is required before using assets or liquidity, whether in the form of cash, shares, products, or investments in projects and companies.

4- Optimizing Resources to Achieve Maximum Profitability

This can be achieved through the optimal use of available financial resources, which reduces costs and increases liquidity to achieve the highest return on investment.

Also read: What is Compound Interest and How Can You Calculate It?

5- Increasing Efficiency

This refers to improving the efficiency of all departments within the institution and the proper distribution of resources across all departments and divisions, taking into account the needs related to each department.

6- Maintaining Institutional Operations and Reducing Risks

In the world of finance and business, there are always risks. Therefore, it is necessary to avoid all types of risks and uncalculated ventures to prevent catastrophic outcomes.

Stages and Steps of Financial Management

As mentioned earlier, the goal of financial management is to manage the flow of funds and physical resources of the institution.

To achieve this, several steps must be implemented. We will explain these steps in detail: setting objectives, gathering information, addressing gaps and adjusting objectives, creating a financial plan, implementing it, and, finally, modifying the financial plan. The steps are as follows:

1- Setting Objectives

It is essential to ensure that the objectives you aim to achieve are smart and realistic. Objectives must be measurable and achievable, and include a defined timeframe. It is also necessary to periodically review the progress of these objectives and understand the impact of variables on them.

In this step, you should formulate a contingency plan that addresses potential obstacles and outlines strategies to overcome them.

2- Gathering Information

The financial management process relies on collecting financial and personal information, along with the quality and clarity of this information. This includes important elements such as revenues, expenses, risk position, tolerance, and capacity.

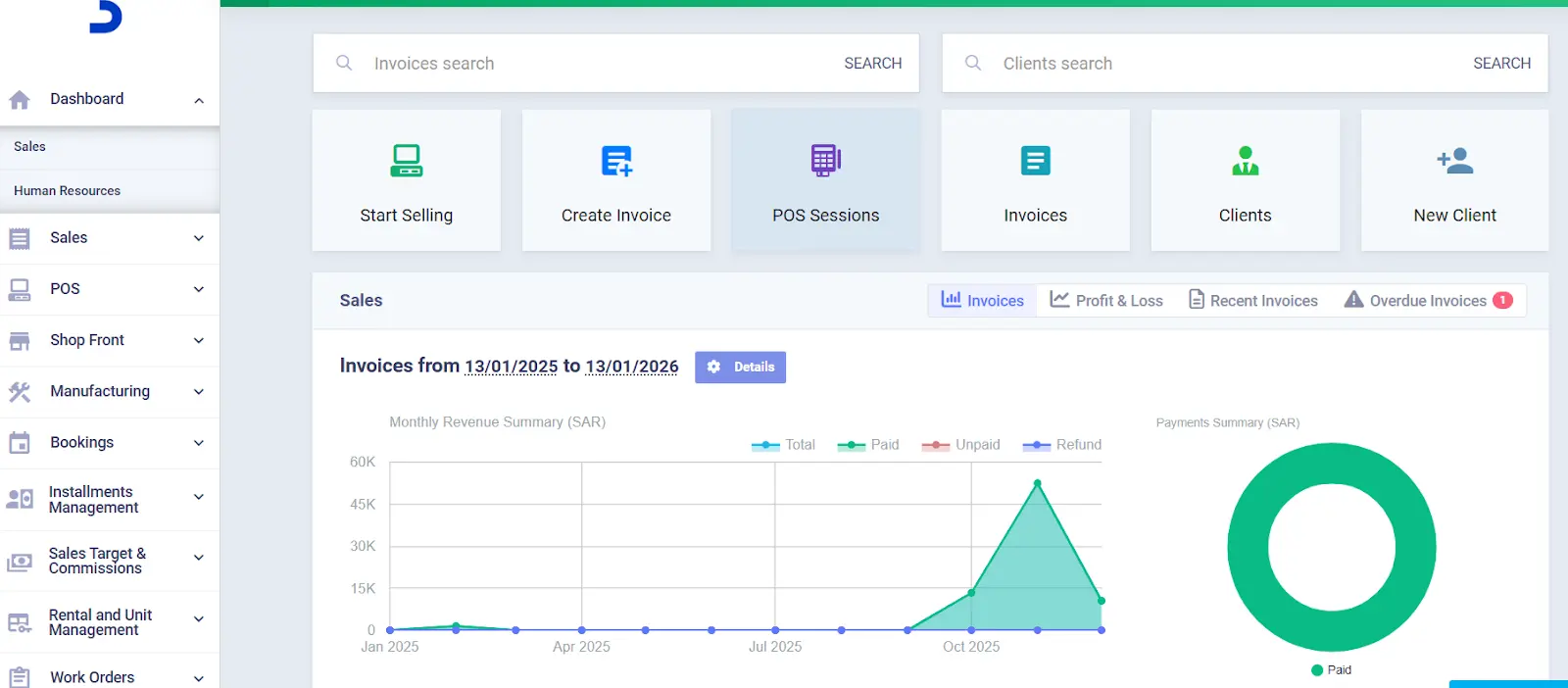

The Daftra accounting software facilitates the collection and automatic recording of information, enabling faster access.

3- Addressing Gaps and Adjusting Objectives

The information collected in the previous step is reviewed and analyzed. Based on this information, a comprehensive report on the institution’s current financial position is prepared to identify key strengths and weaknesses, assess the institution's capacity to bear risk, and evaluate the feasibility of allocating assets for investment. This helps determine whether to adjust the previously set plan or objectives.

4- Creating a Comprehensive Financial Plan

This involves working according to a financial timeline and setting a specific budget that aligns with the objectives and the information gathered earlier. A specific amount must be allocated for costs and expenditures for each period, and this amount should be adhered to within the established budget, with expenses tracked accordingly.

5- Implementing the Plan

Now it is time to execute the process, apply the plan, and monitor changes and investment returns to ensure adherence to the timeline.

6- Adjusting the Financial Plan or Objectives

If circumstances change or new variables emerge that make it difficult to meet requirements or achieve the plan’s objectives, the solution may involve adopting a new approach and adapting the plan or objectives accordingly.

Functions of Financial Management

The tasks and functions of implementing financial management are as follows:

Maintaining financial ease and achieving financial balance by ensuring a minimum level of cash and liquidity, which prevents risks such as failure to pay dues, which may result in damages like the failure of the institution and declaring bankruptcy to settle debts.

Maintaining the level of financial performance, which is achieved by reducing costs and increasing revenue rates, but this depends on the suppliers of material resources, in addition to customers who desire certain prices and high quality.

Maximizing the institution's value by achieving effective outcomes and generating financial surpluses, achieved through conducting future feasibility studies.

These studies determine some factors and risks that may threaten the institution’s value, and the most prominent of these risks are:

- Problems related to production stoppages.

- Problems related to quality and type.

- High costs.

- High interest and exchange rates.

- Decrease in market share.

- Emergence of substitute goods and products.

- The development and success of competitors.

Controlling the material risks that the institution may face, as there are many risks that may lead to the failure of the institution’s work, such as:

- Risks related to future activities and projects.

- Risks also arise from financing the institution’s assets.

- Along with risks associated with rising costs, there may be risks of financial failure or bankruptcy.

- In addition to environmental risks due to instability.

- Risks related to the political and administrative environment in which the institution operates.

What are the experts’ tips for good financial management?

Experts have suggested some tips for achieving good financial management. These tips are commitment, debt repayment, scheduling, and seeking help. Here are the details of each tip for financial management:

- Commitment: Adhere to the financial plan and do not change it except in extreme necessity or in the event of any changes.

- Track spending levels.

- Debt repayment: Pay off all debts and avoid them completely.

- Scheduling: Automate savings and payments by scheduling debts and future bills so that minimum payments are made.

- Seeking help: Consult financial experts and advisors.

Does Daftra help you in the financial management of your institution?

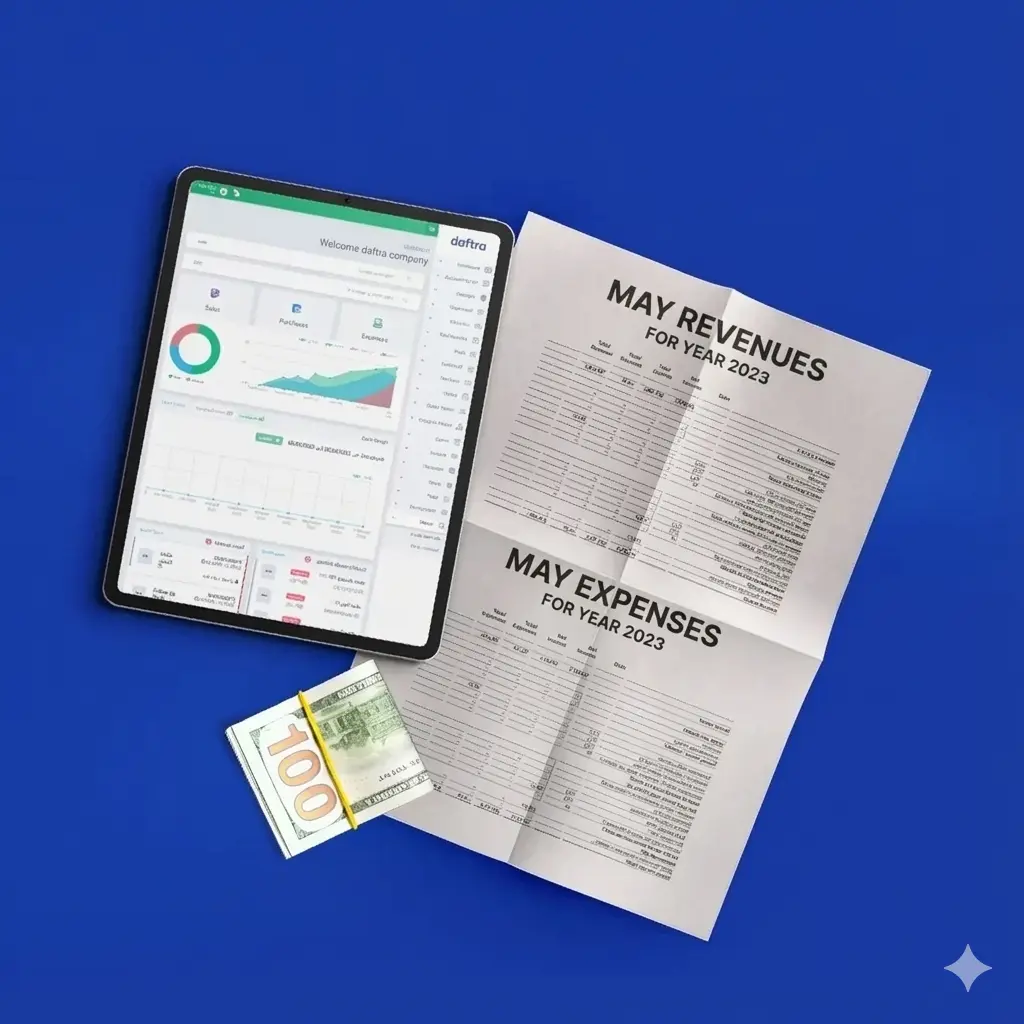

The essence of financial management is to assess the current status of the institution and create a future financial plan that aligns with the institution’s goals. The Daftra accounting software supports the evaluation and information-gathering stages, ensuring full awareness of the company's financial and accounting aspects.

This certainly reflects on the quality of forecasting and planning, and benefits you if you want to prepare a budget. Hence, we can say that implementing a system for managing institutional resources and planning, leveraging Daftra’s capabilities, is the first step toward achieving financial management.

Frequently Asked Questions

What are the tasks of the financial manager?

- Monitoring daily financial transactions.

- Preparing payroll.

- Monitoring bank accounts.

- Preparing reports and analyzing financial performance.

- Internal control and setting financial policies.

- Managing financing relationships.

What is the difference between the administrative account and the management account?

- Management account: A tool for estimating expenses; it reflects the forecasts relied upon for management, helps in making financial decisions, and is prepared at the beginning of the financial period.

- Administrative account: A document that summarizes the revenues and expenses that have been executed, reflects actual results, and works on reviewing and monitoring performance. It is prepared at the end of the financial year and is based on operations already carried out.

What are the types of management in an institution?

- Financial.

- Administrative.

- Strategic.

- Operational.

- Human resources.

- Projects.

- Operations.

- Risks.

- Quality.

What are the objectives of management accounting?

- Evaluating managers’ performance.

- Determining the contribution of each product or service to the overall result.

- Providing various information to managers to facilitate planning and control.

- Assisting managers in achieving the institution’s objectives.

What is the difference between management and administration?

- Administration: The process of planning and setting objectives, structuring the resources available in the institution, in addition to leadership, and closely monitoring team performance.

- Management: The process of implementing plans on the ground, continuous coordination, ensuring the achievement of the desired results for the institution, and continuously improving performance.

What are management skills?

- Planning.

- Organization.

- Flexibility.

- Problem-solving.

- Communication.

- Leadership.

- Dealing with others.

What are management accounts?

They are a system that helps provide financial and non-financial data and information to assist a company or institution in planning, control, continuous monitoring, and decision-making.

Thus, the article has explained the definition of the concept of financial management, the objectives of financial management and the importance of these objectives, the steps and stages of applying financial management, in addition to the most important functions and tasks of the financial management process, as well as experts’ advice on ensuring good financial management.