The Concept of Financial Forecasting, Its Methods, and Implementation Steps

Table of contents:

- The Concept of Financial Forecasting

- The Importance and Benefits of Financial Forecasting

- Types of Financial Forecasting

- Financial Forecasting Methods

- Steps of Financial Forecasting

- Financial Forecasting Tools

- The Relationship Between Financial Analysis, Financial Forecasting, and Financial Planning

- Artificial Intelligence Tools in Financial Risk Forecasting

- Daftra Makes Financial Forecasting More Accurate!

- Frequently Asked Questions

Economic institutions are considered the primary drivers of economic and financial activity in society, and this is achieved through effective management, planning, and control. An institution's many tasks and roles, such as production and financial functions, contribute to its success. No institution can carry out its functions without sound financial planning and well-informed forecasting of its future financial conditions.

In strategic planning, good planning translates a company’s goals, strategy, and policies into executable plans. Good planning aims to meet the institution’s requirements and secure the necessary funding from various financing sources. Sound financial planning within an institution is based on financial forecasting, which involves anticipating future developments.

Here, it must be clarified that there is a distinction between planning and forecasting: forecasting involves estimation and setting expectations, and, at this stage, the institution's financial planning process is carried out.

In this article, we discuss the concept of financial forecasting, its importance and benefits, the types of forecasting, the main methods, and the steps of forecasting.

Quick Points (Brief Summary)

- Financial forecasting is the process of reaching financial expectations based on estimates and evaluations derived from reality and previous records. Through it, a company’s financial needs can be determined in the short and long term.

- There are multiple types of financial forecasting, and each type serves a specific purpose. These include short-term financial forecasting, long-term financial forecasting, forecasting of primary data, income, sales, budget, and cash flow.

- The methods used in financial forecasting processes are all statistical, including regression analysis, percentage method, straight-line method, qualitative forecasting, and others.

Financial forecasting consists of a set of basic steps: defining the objective, data collection, determining the time frame, exploratory analysis, selecting the appropriate method, and analyzing results.

- Financial forecasting relies on analysis, and it is indispensable in budget planning. We find a bidirectional relationship between financial forecasting and financial analysis, and between financial planning and financial forecasting.

The Concept of Financial Forecasting

Forecasting, as previously mentioned, is the anticipation of future events; that is, estimates of what may occur in the near future based on available information and data.

Financial forecasting is one of the tasks of the financial manager in an institution and involves anticipating the institution's or company's financial requirements over the short and long term.

It also involves predicting the institution's economic and financial future based on information in financial reports, including data on cash flow, revenues, expenses, and its financial position. Financial forecasting may also be subject to estimation.

Financial forecasting can be summarized as a stage that precedes financial planning and determines the institution’s future financial capabilities. It predicts the institution’s performance and evaluates the results of its commercial and financial activities.

The Importance and Benefits of Financial Forecasting

Financial forecasting offers numerous benefits that benefit companies and enable continuous development. The importance of financial forecasting lies in achieving strong results, meeting a company's goals, supporting decision-making, enabling expansion, and enabling accurate planning, among other benefits.

Below is a detailed explanation of the importance of financial forecasting:

- Strong Results: Financial forecasting yields significant financial outcomes, leading to more stable cash flow and improved access to investments and bank loans.

- Expressing Needs: Through financial forecasting, department heads can articulate their budgetary needs to achieve each department's objectives in support of the company’s overall goals.

- Achieving the Desired Company Goals: Financial forecasting provides accountability across individuals and departments for financial resources, enabling the company to meet its target figures. What can be measured can be managed.

- Supporting Strategic Decision-Making: With a clear future plan in place, decision-makers can make sound investment decisions based on historical data and carefully developed forecasting models.

- Financial Risk Management: Financial forecasting guides institutions and companies in selecting the most effective methods for managing financial risks. Forecasts include the strengths and weaknesses of financial performance during the upcoming accounting period.

- Expansion and Growth: Financial forecasting helps institutions, companies, and governments expand and grow at all levels and dimensions, contributing to financial and economic stability and prosperity.

- Accurate Planning: Financial forecasting supports well-informed planning by assessing the size of available resources and how and when they can be used to achieve desired objectives.

- Supporting Decision-Making: Financial forecasting supports financial decision-making for the institution, whether in the short or long term.

- Risk Avoidance: Financial forecasting can serve as a tool to improve financial and economic management performance within an institution. It helps anticipate financial risks, assess their scope and impact, and determine how to address them, in addition to evaluating business results and analyzing financial statements.

- Future Budgeting: Financial forecasting supports the preparation of future budgets and the tracking of activity costs against the projected budget.

- Attracting Investors: Financial forecasting helps attract investor interest in the institution’s activities and operations, which increases capital and production.

- Business Expansion: Financial forecasting supports the expansion of activities and operations, such as launching a new product line, increasing capital, conducting acquisitions, or opening a new sales outlet, as these decisions are informed by financial forecasts.

Types of Financial Forecasting

Many companies and institutions use financial forecasting for various purposes, and several types are suitable for each objective. These types include short-term financial forecasting, long-term financial forecasting, forecasting of primary data, income forecasting, sales forecasting, budget forecasting, and finally, cash flow forecasting.

In the following lines, you will find a detailed explanation of each type of financial forecasting:

1- Short-Term Financial Forecasting

The forecasting period here may be monthly or quarterly. This type enhances the company’s ability to adapt to financial market conditions and the broader economic environment, which may necessitate numerous changes to the business plan. This type focuses on the estimated cash budget, which helps in short-term planning and control.

Short-term financial forecasting is linked to sales operations, inventory, and production activities.

2- Long-Term Financial Forecasting

This type of forecasting covers a full fiscal year or an entire business season, during which a comprehensive business plan is developed for financial events and activities related to the institution.

This type provides the funds and liquidity needed to finance long-term investments and operations, with multiple financing sources that vary in cost.

It also helps develop the business plan and conduct analytical comparisons at the end of each season or financial period.

3- Primary Data Forecasting

This type focuses on future reports based on assumptions made during preparation, such as expected market conditions and financial market status.

These data can help determine future revenues and expenses and contribute to budget preparation.

However, a drawback is that it does not include one-time expenses or ongoing purchase operations, and it does not comply with accounting principles.

4- Income Forecasting

This type is essential for investors, suppliers, and many stakeholders within the institution. It is integral to preparing cash flow statements and forecasting the balance sheet. Therefore, many decisions can be informed by the data produced by this type of forecasting.

This type is based on analyzing expenses and revenues, as well as measuring the institution's financial growth rate, to assess its future financial and cash position.

5- Sales Forecasting

Sales forecasting helps institutions understand the size of their resources and when and how they can be used and allocated.

This type of financial forecasting involves predicting the volume and percentage of sales of products and goods promoted by the company, or the rate of customer use of the company's services, over a specific financial period or business season. In other words, it focuses on profit and revenue levels.

It also supports budget preparation, production cycle planning, and the efficient management and allocation of resources.

6- Budget Forecasting

Budget forecasting helps track activity costs against the projected and actual budgets. The budget, in general, determines the institution's financial position and overall commercial and economic performance, whereas budget forecasting determines the outcomes of the institution’s operations and activities.

It creates expectations about the institution's future performance and defines the ideal outcome it seeks to achieve.

7- Cash Flow Forecasting

This type also helps prepare and determine budgets, especially in the short term, and defines the requirements and expenditures of projects and activities.

To accurately forecast cash flow, several factors must be identified, including financial liquidity, income, revenues, and expenses for a specific financial period.

This type requires estimating cash inflows and outflows during a specific financial period, making it more accurate in the short term.

Read also: Definition of the Direct Method for Calculating Cash Flows

Financial Forecasting Methods

There are many modern methods that institutions employ in financial forecasting. With the development of mathematics and statistics, reaching solutions has become easier for financial analysts and reviewers.

An analyst can study financial phenomena to determine whether variables are related, then identify the dependent variable and the independent variable. There are many methods used for forecasting, and below are the most prominent financial forecasting methods:

Regression Analysis Method

This method analyzes all aspects of the institution’s financial and commercial activities to identify its most important financial requirements. Regression analysis is divided into several types:

- Simple Regression: Focuses on the overall sales ratio across the season without examining the impact of variables on sales.

- Multiple Regression: Means that the sales ratio is affected by many variables that differ from one institution to another and from one financial period to another.

- Linear Regression: Clarifies the relationship between several variables by drawing a regression line in order to study the impact of these variables on each other.

Using this method, the institution's financial position can be forecast. This method also encompasses a set of techniques for identifying the relationship between the dependent variable and multiple independent variables, which are usually continuous.

Percentage Method

This method helps in preparing the institution’s general budget. It is based on studying the percentages of sales, revenues, and expenses.

Accordingly, it is possible to forecast sales ratios and figures for the upcoming financial period, as well as expenses associated with the institution’s commercial and financial activities.

You can easily calculate percentages through Daftra’s free tool.

Straight-Line Method

This method is considered the simplest among all financial forecasting methods, as it relies on forecasting the institution’s financial future based on indicators and previous studies applied to the institution.

Qualitative Forecasting Method

This method relies on the expectations of experts with experience in the market and the world of finance and business. However, it lacks accuracy. The following methods fall under this approach:

Market Research

Many institutions rely on market research because it provides many studies and data characterized by credibility.

On the other hand, this method also lacks accuracy due to the many changes in the financial and economic conditions of markets.

Delphi Method

This method relies on a questionnaire answered by a group of experts and scholars in the fields of finance and business, where the questionnaire focuses on financial and commercial topics of interest to the institution.

Moving Average

This method helps forecast the institution’s profit and sales ratios, as well as its expenses and everything related to financial matters and cash liquidity over a specific period of time.

It clarifies the company’s financial position, the risks it may face, and provides data for preparing financial statements.

Estimated Master Budget

This helps the financial analyst align cash inflows and outflows that occur over a short period of time, such as a month, for example.

It is a forecast based on sound principles for the amounts and timing of the institution's expected cash receipts and payments over a specific future period.

The primary purpose of preparing it is to ensure the institution’s continuity of operations during the planning and budgeting period.

Time Series

These are a set of measurements taken for a phenomenon over successive time periods of equal length. The construction of a time series takes the form of equations consisting of internal and external variables.

Operations Research

This uses quantitative methods to solve problems and implement decisions. Common quantitative methods include decision trees, linear programming, transportation models, assignment models, network analysis, and game theory.

Financial forecasting methods can be summarized as regression analysis, the percentage method, the straight-line method, qualitative forecasting, the estimated master budget, time-series analysis, and operations research.

Steps of Financial Forecasting

Financial forecasting is a scientific process that involves following defined steps to obtain accurate data. The financial forecasting process should go through several steps: defining the main objective, collecting data, determining a time frame, conducting exploratory analyses, and finally monitoring and analyzing the results. Here are the steps in detail:

1- Define the main objective behind the financial forecasting process

The purpose and goal of applying financial forecasting must be defined. Is the goal to know the shape and size of the upcoming budget? Or to determine the profit ratio of a group of products at a specific time? Or to understand the financial position of the institution in order to start new activities? Therefore, the objective must be clearly defined to reach the most appropriate decision.

2- Collect previous data and studies about the institution and its activities

Many experts believe it is essential to know various data and information about the institution from its inception to the present, as this helps in forecasting multiple indicators regarding the company’s financial position.

This data includes information about: profits, sales ratios, losses, expenses, cash flow, income, and revenues, as well as the profitability of stocks and investments.

3- Determine a time frame for financial forecasting

Employers and institutions must define the time period that the financial forecasting process should cover, whether long-term or short-term, with emphasis that most institutions apply financial forecasting for a fiscal year or a business season.

4- Conduct exploratory or preliminary analyses

The analysis includes historical and recorded data of the company under various economic conditions. This helps the person performing the financial forecast to determine the most important methods to follow. By tracking financial patterns of events, they can identify which pattern is expected to occur and its resulting outcomes.

5- Monitor and analyze results

Data is monitored and updated periodically due to many variables in the financial market, followed by the analysis phase conducted by the financial management.

You can also download a financial failure forecasting template to provide early warning and enable corrective measures before financial problems escalate.

Financial Forecasting Tools

There are countless tools that can be employed in financial forecasting tasks. Some are faster and more efficient, whereas others are traditional tools that experienced accountants are accustomed to using because they resemble Excel spreadsheets. These tools include Daftra, Zoho, and Oracle. You will learn about each in detail in the following paragraphs:

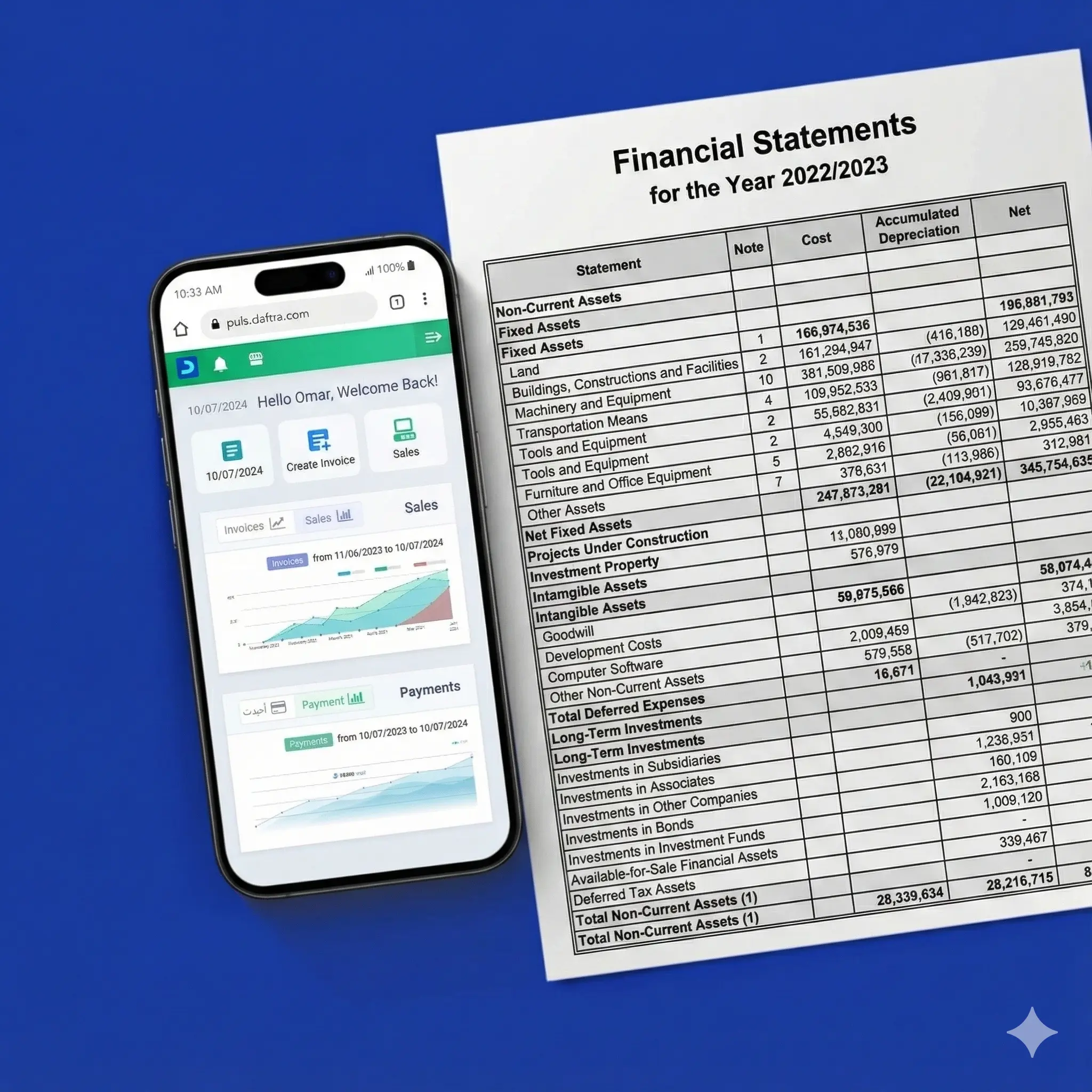

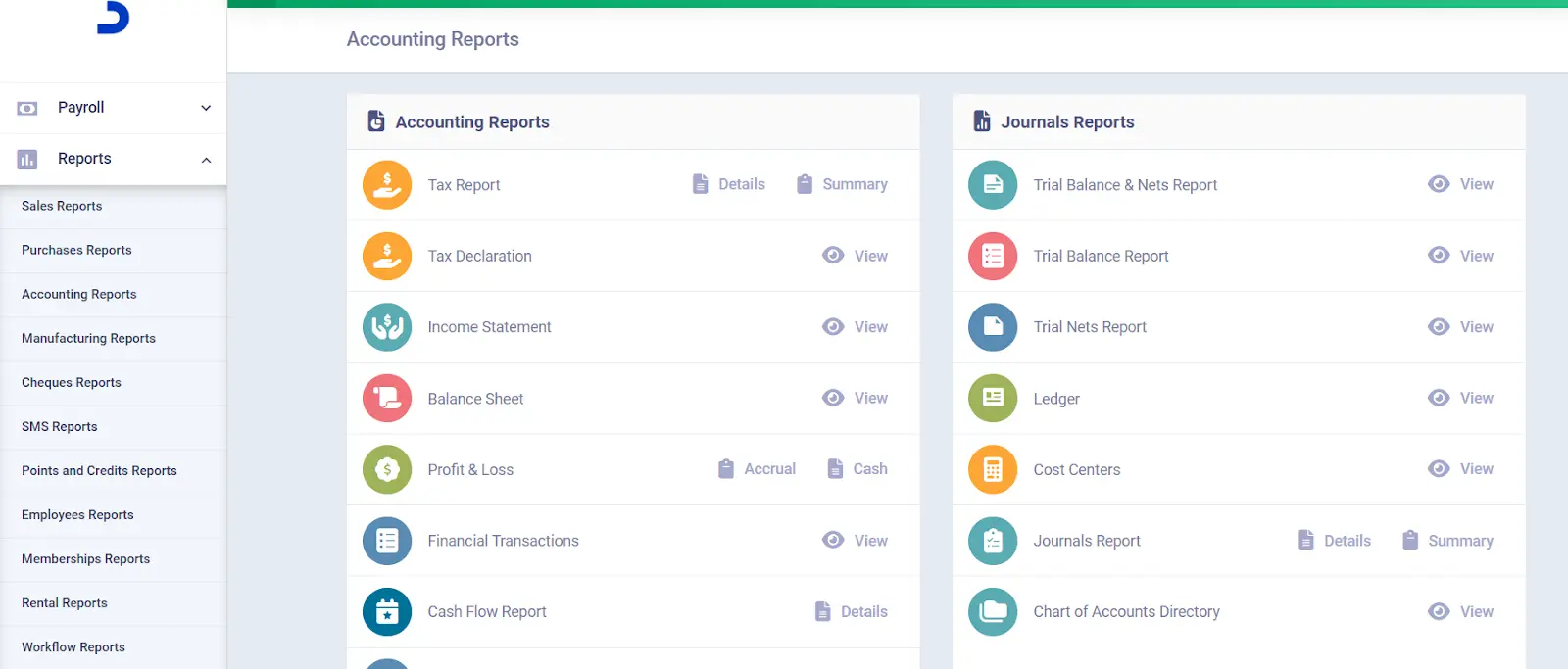

1- Daftra

Daftra improves the accuracy of financial forecasting. It is a mobile and web application suitable for companies of all sizes. By issuing reports and financial statements through Daftra, you can analyze current and historical data with great precision, enabling highly reliable financial forecasting and future budgets based on sound analytical principles. This serves to increase net profit and avoid losses.

Daftra is not limited to managing finances and accounting; it also encompasses human resources, inventory, procurement, project and operations management, and provides excellent support in marketing through programs such as loyalty points, featured lists, and client messaging.

2- Zoho Analytics

Zoho is a program for analyzing financial affairs and presents data visually. It also forecasts financial performance based on the plans under study. It improves financial management and protects financial data from vulnerabilities. Based on data analysis from more than 250 sources, it can be readily integrated to forecast upcoming financial events.

3- Oracle

Oracle represents an integrated solution for planning and budgeting, recording, forecasting activities within the system. It integrates core financial operations in planning, operations, and decision-making. Oracle improves the accuracy of forecasts and plans and reduces the time required for budgeting, planning, and forecasting processes, which previously took weeks or months.

The Relationship Between Financial Analysis, Financial Forecasting, and Financial Planning

Financial analysis is the process of evaluating a company’s financial health and performance during previous and current accounting periods to make appropriate and more effective decisions in the future.

Based on this income analysis, financial forecasts can be developed to guide the company toward market and economic trends to which it is exposed. Therefore, financial forecasting can be regarded as a product of financial analysis.

When logical forecasts for the company’s near- and long-term future are developed, the plan and its elements can be readily determined. It outlines the steps to be followed in execution to achieve the expected results and objectives. These activities rely primarily on the financial forecasting conducted in a previous stage.

The following model can be used to understand the relationship:

Financial Analysis > Financial Forecasting > Financial Planning. Each depends on the preceding stage.

Artificial Intelligence Tools in Financial Risk Forecasting

Recently, numerous artificial intelligence tools have emerged to assist accountants in financial forecasting. Based on the experience of many users, AI tools have demonstrated speed and accuracy, as they learn quickly by collecting data from various sources and integrating it into a single platform, thereby highlighting expected financial risks.

The most important AI tools in this function are Planful, Workday, and Anaplan. Here are the details of each:

1- Planful

It is a platform specialized in financial planning, analysis, and risk forecasting. The cloud-based program relies primarily on AI features to plan the company’s financial resources and to help it make better, faster, and more accurate decisions. It is suitable for large companies.

2- Workday

This is a suitable solution for institutions, providing modeling solutions. The Workday platform creates standard models and automatically detects errors using its AI-based system. The platform also learns from the activities of all users, enabling the AI to develop through real-world transactions.

3- Anaplan

This software combines data, people, and planning responsibilities. The application includes budget preparation, financial forecasting, specialized financial planning, operational planning, and other accounting functions. The program is flexible, allowing it to analyze three types of data simultaneously to improve accuracy. It also updates forecasts automatically based on market trends.

Daftra Makes Financial Forecasting More Accurate!

By issuing reports and financial statements through Daftra, you can analyze current and historical data with great precision, enabling highly reliable financial forecasting and future budgets based on sound analytical principles, thereby increasing net profit and avoiding losses.

Daftra is not limited to managing finances and accounting; it also encompasses human resources, inventory, procurement, project and operations management, and provides excellent support in marketing through programs such as loyalty points, featured lists, and client messaging.

Frequently Asked Questions

What are the types of financial forecasting charts?

- Short-term forecasts: These typically cover the current fiscal year and focus on cash flows and budgets.

- Long-term forecasts: Responsible for long-term forecasting and helping in decision-making and strategy formulation.

- Qualitative forecasts: Rely on qualitative analysis of data and information.

- Quantitative forecasts: Depend on statistics and mathematical methods.

What is the relationship between financial analysis, financial forecasting, and financial planning?

Financial analysis aims to determine the company’s current financial position by analyzing various financial data. Financial forecasting relies on this data and analysis to predict the company’s future financial position. Financial planning uses both analysis and forecasting to set company objectives and determine how to achieve them.

What is financial forecasting analysis?

Financial forecasting analysis is the analysis of financial data and the company’s situation to predict its future financial position.

How is financial forecasting done for companies?

Financial forecasting for companies is carried out through several steps:

1- Define the goal the company wants to achieve.

2- Collect the company’s financial data.

3- Choose the appropriate forecasting method.

4- Build predictive models using the selected forecasting method.

5- Conduct future financial forecasts.

6- Interpret and analyze the results accurately.

7- Continuous review and updates until the desired goal is reached.

Financial forecasting provides the institution and its management with the framework upon which planning and control of projects and financial and commercial activities are based. Financial forecasting, based on analyses using mathematical and statistical methods, ensures the quality of the information used to prepare financial statements and the budget.

Therefore, the results of financial forecasting are derived from current and historical financial statements.

Thus, this article has covered the definition of financial forecasting, explained its importance and key benefits, described the types and methods of financial forecasting, and outlined the essential steps for financial forecasting.