What Are Accounting Books, Their Types, and the Most Common Errors

Table of contents:

- What are accounting books?

- Types of accounting books

- How to Use Accounting Books

- The Role of the Accounting Ledger in Financial Analysis

- The Most Common Errors in Accounting Books

- Tips to Avoid Errors in Accounting Books

- The Importance of Accounting Books in a Company’s Financial Transactions

- Frequently Asked Questions

Economic institutions are keen to retain all documents that prove their financial transactions, regardless of size, not only to comply with government requirements but also to be able to measure their level of development, understand their financial capabilities, and make sound decisions.

Here comes the role of what is known as the accounting books of institutions. What is their definition? What are their types? And how do institutions implement them properly?

What are accounting books?

Accounting records or books are defined as a set of documents and books used by economic institutions to prepare financial statements or records related to external financial auditing and review. They include asset, liability, and revenue books, daily journals, and various cash transactions carried out each day, including checks, invoices, and others.

Some government entities in many countries require economic institutions to retain accounting records for a long period in order to review them and verify the accuracy of the information contained in them.

There is no global agreement on the commercial documents that make up accounting books in all institutions, as this varies according to the viewpoints of stakeholders in different institutions and based on the institution’s economic position.

When an institution goes through a phase of economic recovery during the business cycle, investors tend to focus on reviewing financial statements because they feel optimistic and think about expanding investment. In contrast, during a recession, investors request data related to the balance sheet due to their hesitation in making decisions to expand investment.

More clearly, accounting books are not rigid; rather, they continuously evolve according to the current economic conditions of the institution, investors’ preferences, and the type of data they need to make decisions.

Types of accounting books

There are two types of accounting record systems used in companies. The first is the single-entry system, which is characterized by its simplicity and ease of use, and is relied upon by many small and start-up companies.

The other type is the double-entry system, which requires two columns, one for credit and the other for debit.

The company must record all its financial transactions in this manner to achieve balance in accounting operations and to track the flow of funds within the institution in order to avoid errors and detect any irregularities. This system is mainly adopted by large institutions.

Accounting books are divided into several types, each with its own direct purpose, including the following:

Transactions

Transactions are considered the starting point in any accounting records, as they involve recording anything the company has purchased, sold, or consumed during a specific period of time. Every financial activity must begin with a financial transaction.

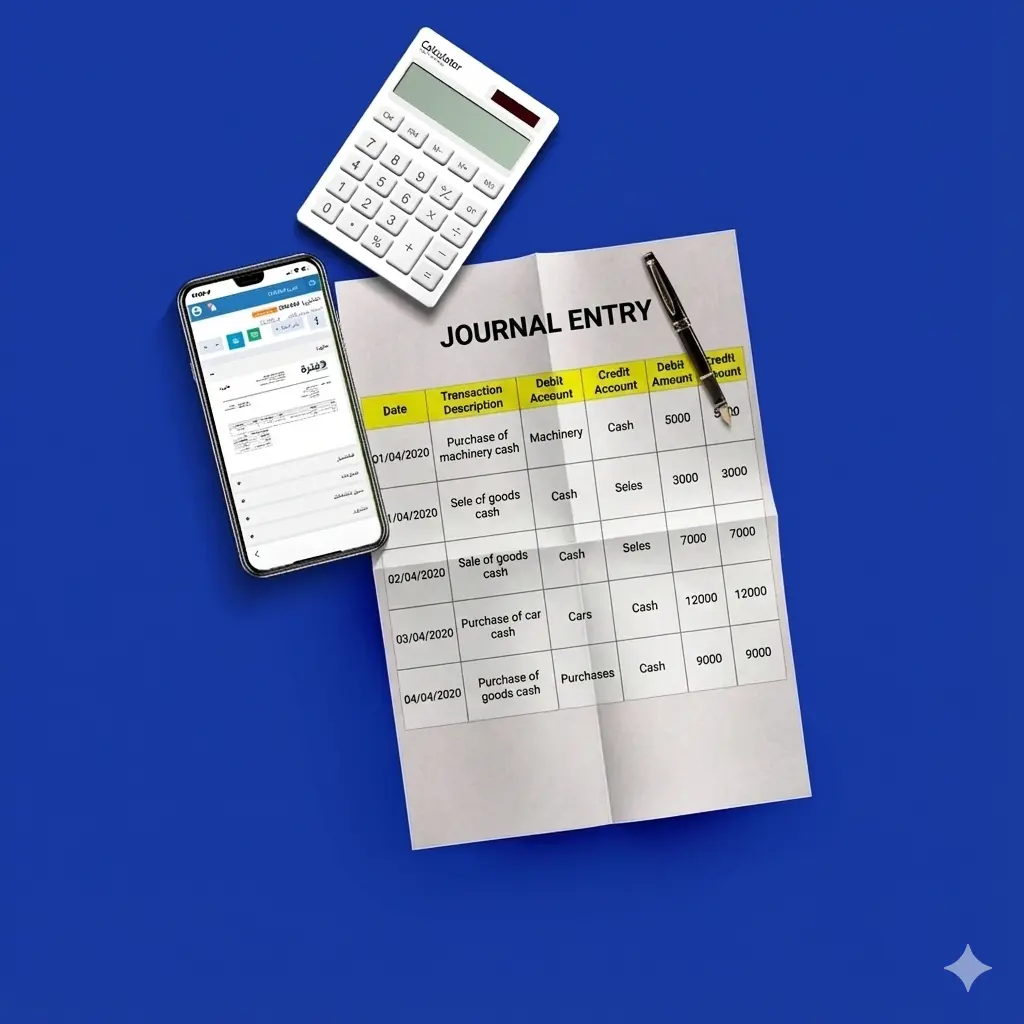

Journals

Some institutions rely on the idea of having one main journal to record all transactions, while other institutions tend to create a separate journal for each aspect of the business. Regardless of the approach you follow, you must record all transactions that occur in your institution daily and with complete accuracy.

You can also download a ready-to-use journal template for free from Daftra.

General Ledgers

The general ledger is a record that includes all transactions carried out by the company during the previous period, organized by account types.

The general ledger contains various debit and credit transactions, as well as all information related to each transaction, such as its date, description, and total amount, in addition to some descriptive details that clarify the nature of the transaction.

The general ledger is considered the primary source that institutions rely on when preparing the trial balance and the company’s financial statements.

You can download a general ledger template for free from Daftra.

Trial Balances

The trial balance consists of the total of all debit and credit balances of the institution during the business cycle, noting that the entries must be balanced once this stage is completed. If this does not occur, it means there is an error in the accounts that must be corrected as soon as possible.

You can download a ready-to-use trial balance template for free from Daftra.

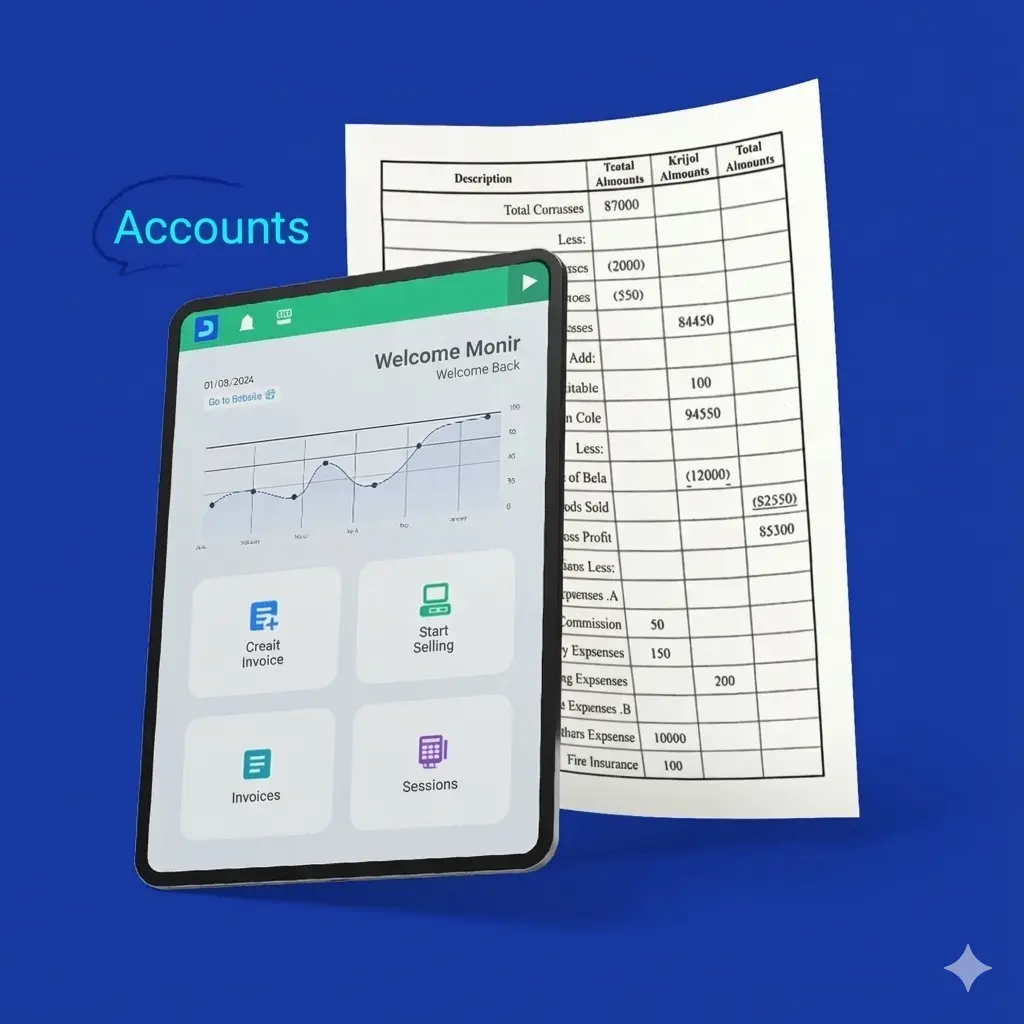

Financial Statements

Financial statements are the final document that brings together all other accounting documents and records. The purpose of preparing these statements is to present them to shareholders or regulatory authorities for account review.

Economic analysts and regulatory bodies also use these statements to form a general, comprehensive, and deeper view of the company’s financial activity.

You can rely on the three financial statements template from Daftra to start using it immediately.

How to Use Accounting Books

After clarifying the meaning of accounting books, we will explain here how to use accounting books effectively in a way that helps you manage your business, as follows:

Choosing the Appropriate Accounting Software

One of the first steps any company should take is choosing accounting software with capabilities that suit the nature of its business, in order to maintain organized and reliable accounting records that can be easily referred to at any time.

Organizing and Recording Accounting Records and Books

Companies should retain all their accounting records, such as purchase and sales invoices, bank statements, and other financial documents, and organize and classify them according to the time period, to make it easy to refer to them when needed.

Entering Data Promptly

Due to work pressure, some companies may be negligent in adding their accounting data and financial documents to the system on a regular basis, which may lead to overlooking some documents or making errors in recording them, resulting in problems. Therefore, we recommend allocating a specific time on a weekly basis to carry out this necessary task.

Periodically Verifying Account Balances

Sometimes discrepancies may occur in financial records due to certain errors that the company may not notice. Therefore, it is recommended that management periodically review its financial accounts, identify bank balances, shareholder and customer balances, and financial data related to each department, and compare them with each other to ensure their accuracy and easily detect errors.

Keeping a Backup Copy

Companies often lose their documents unexpectedly for reasons that are sometimes technical and sometimes related to actual incidents. Therefore, you should keep a backup copy of all your accounting records on another computer to avoid any technical issues, and keep another copy outside the company as a precaution to avoid losing documents due to fire, theft, or other incidents.

Hiring a Professional Accountant

Do not think that using professional accounting software will eliminate the need for a professional accountant. Their role is to add documents on an ongoing basis, periodically review account balances, take action in case of any errors, and assist you at every step through their extensive experience.

You can also rely on a monthly accounting report template from Daftra, which interacts with the company’s various accounts, such as assets and liabilities, with the aim of monitoring work on a regular basis.

Training Employees

Investing in human resources is important for any institution. You should focus on professionally training your employees on how to enter financial data into accounting software, review accounts, and other matters that will help you avoid many problems resulting from employees’ lack of awareness of the importance of these processes.

The Role of the Accounting Ledger in Financial Analysis

The accounting ledger plays a fundamental role in various companies and institutions, as it represents the repository in which all the company’s financial transactions are recorded.

This ledger helps manage cash flow so that the institution can meet its short-term obligations, analyze profitability, and thus choose the areas that require lower costs and generate higher revenues.

In addition, an important aspect is that the accounting ledger helps make financial analysis for institutions more accurate, which contributes to clarifying the company’s financial health, the stability of its operations, and supporting informed decision-making.

The Most Common Errors in Accounting Books

Institutions often discover a problem in their accounts without knowing the reason. Below, we explain the most common errors in accounting books to help you identify them and find effective solutions.

Error in Entering the Original Amount

This is one of the most common errors companies make when maintaining accounting books. Entering any number incorrectly leads to errors in all calculations related to that transaction. For example, entering 100 instead of 10 when adding the value of a product purchase.

Duplicate Recording of the Same Transaction

This is another common error that occurs due to a lack of focus while recording transactions, resulting in the same transaction being recorded twice in the books. For example, if you record the purchase of raw materials for production twice, you will eventually find that your expenses are higher than the actual amount. As a result, the accounting records will not reflect the true financial position of your institution.

Failure to Record Transactions

Sometimes, the financial management of an institution may fail to record certain financial transactions for various reasons, such as postponing the recording of transactions in the accounting books, which leads to forgetting to record some invoices. This results in an imbalance between the debit and credit sides and affects the overall financial data.

Entering Data in the Wrong Account

This is a simple error that often occurs due to work pressure, but it leads to serious consequences. In this case, you did not fail to record the invoice and entered its value correctly, but you placed the amount on the opposite side from where it should be.

For example, recording a transaction under deductions instead of revenues creates a major problem in the accounting process.

Tips to Avoid Errors in Accounting Books

Errors in accounting records may lead to many problems in managing an institution. Below, we present some tips to help you avoid such errors, including the following:

Regularly Comparing Records

Commit to periodically comparing the figures in the accounting records with those in bank statements to ensure that the numbers match in both. This helps you detect errors early and correct them quickly.

Monitoring Unjustified Accounting Changes

When noticing sudden and significant unjustified changes in profit or payment accounts, this may be a clear indication of an error in recording the accounting books. Therefore, it is advised to review the accounts to identify and immediately correct the errors.

Checking for Duplicate Data

Before completing your work of recording financial data and transactions, it is recommended to review the entered figures and ensure that they are not duplicated.

Keeping Financial Documents and Records

It is important to keep all invoices and financial documents organized in one file so that you do not overlook recording any of them, and to make it easier to review the accounting records whenever needed.

Training the Team and Developing Their Skills

Ensure that the financial department team in your institution has a high level of understanding, experience, and awareness of common errors that occur when completing accounting books, so they can learn how to avoid them and maintain the quality of work in the best possible way.

Using Accounting Software

Reliable accounting software saves a lot of time and effort in recording financial transactions in the designated books. For example, what we offer in the Daftra software helps you complete your operations easily, smoothly, and in an organized manner, and alerts you when errors occur, providing you with a professional accounting experience.

The Importance of Accounting Books in a Company’s Financial Transactions

Accounting books play an important role in managing a company’s financial aspects and help management make informed decisions based on accurate information and facts. The importance of accounting books includes the following:

Better Compliance with Laws

Organizing and maintaining accounting records is no longer a luxury for companies. Many countries’ laws require companies and institutions to keep their accounting records for a specified period for review and to ensure the reliability of the company’s financial data. Therefore, organizing these books helps you avoid penalties that governments may impose.

Monitoring Company Growth

Accounting records show the economic growth achieved by the company during a specific period, which helps management identify its strengths and weaknesses, find solutions to problems, and target the market effectively.

Identifying Sources of Income

Every economic institution earns income from multiple sources. Reviewing accounting books helps companies identify the sources that generate the most income to maintain them, as well as recognize sources generating lower income and explore ways to develop them, all based on reliable and accurate information.

Tracking Expenses Related to Liabilities

Accounting books help identify the institution’s expenditures to fulfill its obligations accurately. Regular recording of liabilities helps institutions avoid problems when completing annual tax declarations.

Organizing Workflow

Organizing accounting books contributes to the stability of workflow within the institution and prevents wasting time searching for accounting data, allowing easy and quick access to any financial documents whenever management needs them.

Financial Forecasting

Past accounting books help companies analyze their financial situation accurately, make necessary adjustments to projects, and conduct financial forecasting for potential future scenarios.

Frequently Asked Questions

What are the three accounting books?

There are three main types of accounting books: the general ledger, the sales book, and the purchases book.

What is the general ledger in accounting?

The general ledger is the largest book in accounting, as it contains all the transactions of the institution, shows the debit and credit accounts, and is referred to when preparing the trial balance or the company’s financial statements.

What are the mandatory accounting books?

Saudi law specifies a set of mandatory accounting books that any store must use if its capital exceeds 100,000 Saudi Riyals. These are: the original journal, the inventory book, and the general ledger.

What are the names of the government accounting books?

There are many government accounting books in Saudi Arabia that help organize financial management in various institutions. Among these books are:

- General Ledger

- General Journal

- Fixed Assets Book

- Revenue Book

- Expenses Book

- Liabilities Book

- Budget Book

- Financial Control Book

- Final Accounts Book

What are examples of accounting books?

There are many accounting books used by companies, such as the transaction book, journal, general ledger, trial balance, financial statements, and others.

In conclusion, this article provides a comprehensive guide on accounting books in companies and everything related to them. If you are interested in the field of finance and business management, learn more specialized information in this field by following our articles.

You can also rely on Daftra accounting software, which helps you produce accounting books automatically and easily.