What is Fair Value and How to Calculate It

Table of contents:

- What is Fair Value in Accounting?

- How is Fair Value Calculated in Accounting?

- What Is the Difference Between Fair Value and Market Value?

- What Are Examples of Using Fair Value in Accounting?

- What Is the Fair Value of Assets?

- What Is the Difference Between Fair Value Accounting and Traditional Cost Accounting?

- What Are the Advantages of Fair Value Accounting?

- What Are the Disadvantages of Fair Value Accounting?

- How Does Daftra Help You Calculate Fair Value?

- Frequently Asked Questions

Fair value is a fundamental concept in accounting, as it plays a crucial role in the valuation of a company's assets and liabilities. By understanding fair value and applying it correctly, companies can make important financial decisions.

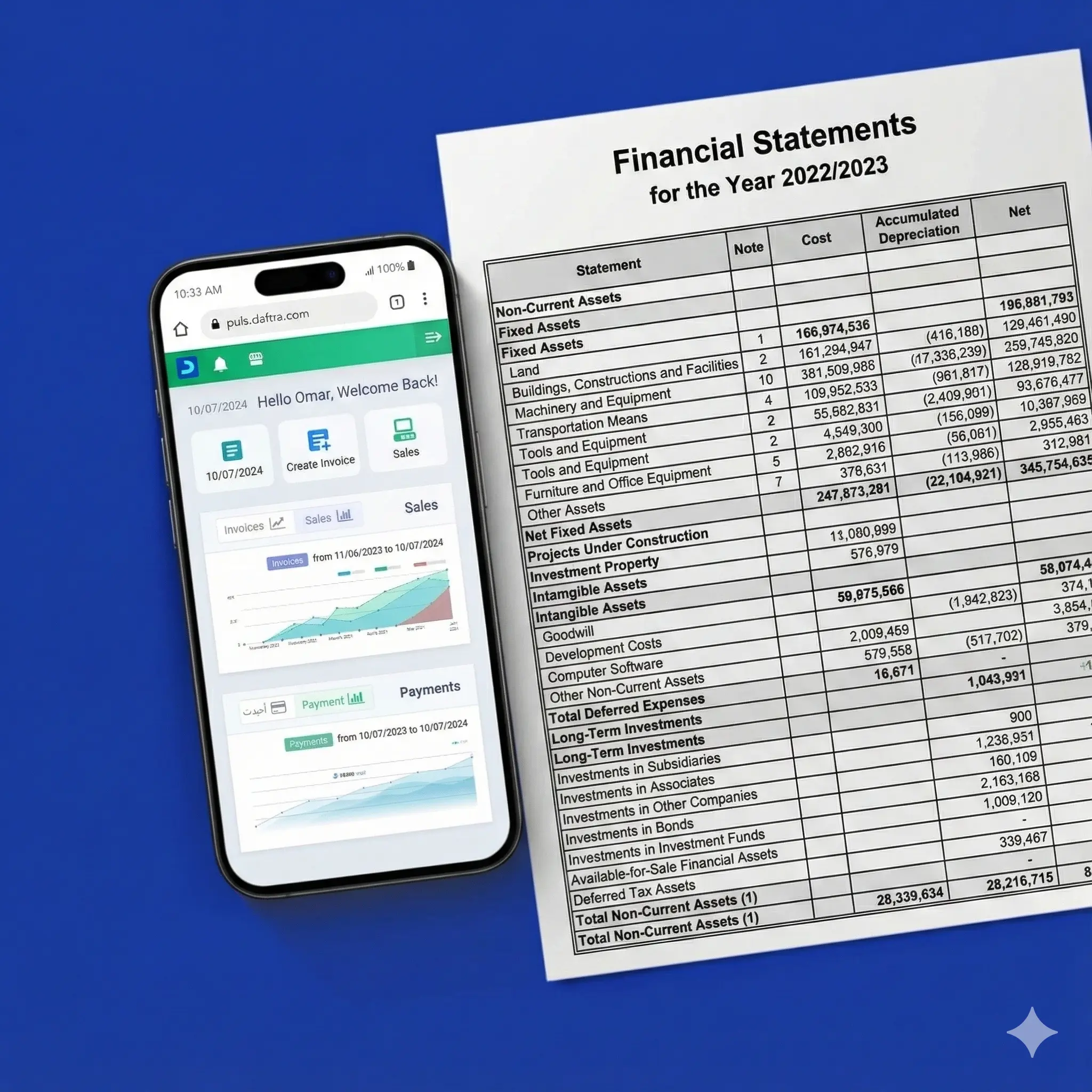

Fair value is used to estimate tangible and intangible assets, such as real estate, equipment, and intellectual property, as well as liabilities, including loans and tax obligations. When companies follow an accurate approach to determining fair value, they can produce precise and transparent financial reports and enhance investor and external stakeholder trust.

In this article, we will explore the concept of fair value in accounting more deeply, and we will also discuss some practical examples and challenges that may be faced when applying fair value.

What is Fair Value in Accounting?

The concept of fair value in financial accounting is a measure of the current market value of a company's assets and liabilities. Therefore, fair value represents the purchase value of assets currently offered for sale.

It is also designed to serve as an important basis for a deep understanding of how financial and investment decisions are made, as it can help companies determine the actual value of liabilities and intangible assets and estimate financial obligations such as loans and tax liabilities.

The question of what fair value means can also be answered as the price that can be obtained from selling an asset or settling a liability (exit price) in an ordinary transaction between market participants, on the measurement date.

How is Fair Value Calculated in Accounting?

In accounting, fair value is the price at which an asset or liability could be sold or purchased in an active market between two independent, knowledgeable parties on the measurement date.

A set of accounting standards and principles is used to determine fair value according to the International Financial Reporting Standards (IFRS) and the U.S. Generally Accepted Accounting Principles (US GAAP).

There are several methods for calculating fair value, and the appropriate method depends on the type of asset or liability being measured. Here is how fair value is calculated in accounting in a detailed yet simple way:

1- Market Value: Fair value is calculated based on asset prices in the financial market. This method is usually used to value securities traded in financial markets, such as stocks and bonds. The accounting equation in this method is:

Fair Value = Trading Price

Example: If the trading price of a company's stock in the market is 100 Egyptian Pounds, then the fair value of the stock is 100 Egyptian Pounds.

2- Historical Cost: Fair value is calculated using the original cost of assets, adjusted over time using the inflation rate or recognized accounting depreciation rules.

The accounting equation in this method is:

Fair Value = Historical Cost × (1 + Inflation Rate) ^ (Number of Years)

Example: Suppose a company purchased a property for 100,000 Egyptian Pounds in 2020. If the inflation rate is 5%, the fair value of the property in 2023 is:

Fair Value = 100,000 × (1 + 0.05) ^ 3 = 115,762.5 Egyptian Pounds

3- Expert Valuation: In some cases, independent expert estimates are relied upon to determine fair value. This method is used for Non-current assets in financial markets, such as real estate or intangible assets.

Example: Suppose a company has a property with a historical cost of 100,000 Egyptian Pounds, and a real estate expert estimates the current value of the property to be 120,000 Egyptian Pounds. In this case, the fair value of the property is 120,000 Egyptian Pounds.

4- Present Value: This method is used to estimate the fair value of future liabilities, such as pension obligations or other financial commitments. Present value techniques are used to determine the present value of these obligations.

The accounting equation in this method is:

Fair Value = Sum of Expected Future Cash Flows / Discount Rate

It should be noted that calculating fair value can sometimes be challenging, especially when there is no active market for the assets and liabilities being measured. In such cases, potential estimates can be made based on available information and using appropriate accounting techniques.

You can subscribe to the Daftra system to save time and effort in calculating fair value through many services that help you with this, such as linking assets to cost centers, providing full management of financial transactions, or documenting accounting entries, which helps you calculate fair value with great ease.

Read also: How to Calculate Depreciation in Accounting

What Is the Difference Between Fair Value and Market Value?

Market value is the current price at which an asset can be bought or sold in the financial market, and it depends on the trading of the asset between buyers and sellers.

Fair value, on the other hand, is the value at which an asset or liability can be sold or purchased in an active market between two independent and knowledgeable parties on the valuation date.

The difference between them can be summarized in the following points:

Market Value

Market value has specific characteristics that make it different from fair value. It reflects market forces and is influenced by supply and demand, in addition to relying on recent purchase transactions and other factors. You can understand the characteristics of market value and what makes it different from fair value through the following points:

- Market forces: It reflects market forces and the asset's trading in financial markets.

- Affected by supply and demand: It is influenced by supply and demand and changes in market prices.

- How it is determined: It is determined based on the most recent buying or selling transactions of the asset in the market.

- Dependence on market conditions: It can be higher or lower than fair value depending on market conditions and investor evaluations.

Fair Value

Fair value reflects the asset's value and represents an independent estimate that is not based on a single factor. It reflects economic changes, and through the following points, you can learn about the characteristics of fair value:

- Reflection of asset value: It reflects the value of the asset or liability in the case of selling or purchasing in an active market.

- Independent estimation: It is based on an independent and informed assessment of the asset or liability.

- Use of various techniques: It may use specific valuation techniques, financial analysis, and market information to determine fair value.

- Highlighting economic and market changes: It reflects economic changes and updated market conditions in the valuation of assets and liabilities.

It should be noted that fair value and market value can be identical in the presence of an active market and efficient trading of the asset. However, in some cases, there may be differences between them as a result of independent valuations or changes in supply and demand in the financial market.

What Are Examples of Using Fair Value in Accounting?

Many people may wonder, “What are examples of fair value?” This question arises to increase knowledge and clarify the meaning of fair value. Below are some of the examples you are looking for:

- Share value: The value of stocks and bonds traded in the open market is measured at their current market price.

- Contract value: The value of forward and futures contracts is measured based on their price in the market.

- Asset value: The value of non-traded assets, such as real estate and equipment, is measured based on the marginal method.

- Liability value: The value of non-traded liabilities, such as long-term debt, is measured using the marginal or estimation method.

What Is the Fair Value of Assets?

When valuing a company, one of the most important considerations is the fair value of its assets. This can be a complex calculation process due to the existence of multiple methods for determining an asset's value.

The most common method is to use market value, defined as the price that would be paid to sell the asset in the open market. However, this approach may not always be optimal, as it does not account for the asset's unique characteristics.

Another method for calculating the fair value of an asset is the cost method. This method values the asset at its original purchase price, adjusted for any subsequent changes in its value. This method is commonly used for assets that cannot be easily traded in the open market, such as land or buildings.

The income approach is another common method for valuing assets. This method values assets based on their ability to generate income and is often used for businesses or investment properties.

The fair value of an asset can also be calculated using the replacement cost method, which values the asset based on the cost of replacing it with a similar asset.

From the previous paragraphs, you now understand what the fair value of assets means. However, you should also know that several factors affect the fair value of a company’s assets, including supply and demand, financial performance, economic conditions, and others. Below are these influences explained in detail.

Factors Affecting the Fair Value of a Company’s Assets:

- Supply and demand: The fair value of assets is affected by supply and demand in the market. If there is strong demand for assets, their fair value is likely to increase, and vice versa.

- Financial performance: A company’s financial performance can affect the value of its assets. If the company achieves strong profits and sustainable growth, the value of its assets is likely to increase.

- General economic conditions: The overall economy and economic conditions influence asset values. During periods of economic recession, asset values may generally decline, while during periods of economic growth, values may rise.

- Industry factors: Asset values also depend on specific industry factors. For example, in a particular industry, modern technology, innovations, or the company’s geographic location may be factors that affect asset value.

- Expected future cash flows: Expected future cash flows of assets are considered an important factor in determining fair value. If there are positive expectations regarding future returns from assets, their value is likely to increase.

What Is the Difference Between Fair Value Accounting and Traditional Cost Accounting?

There is no doubt that fair value accounting is a more modern accounting method, recommended by senior financial valuers, due to its ability to provide multiple valuation strategies and global value accounting.

On the other hand, many researchers believe that traditional cost accounting methods are better and more logical than modern methods, as in modern approaches, any new process can also be manipulated using these methods.

In some cases, cash flows, historical data, or data related to disclosure, presentation, and accounting valuations may be manipulated to present incorrect results in favor of management, thus producing figures that are difficult to verify.

In fact, it is impossible to rely entirely on a specific accounting strategy without careful analysis of the accounting information provided by that strategy and the quality of reports approved by official and trusted authorities.

In brief, the differences between fair value accounting and traditional cost accounting lie in the fact that fair value accounting relies on market conditions and subjective estimates. It is more modern and aligned with developments, but it also changes with market fluctuations, leading to volatility in financial statements, and it is more costly.

Traditional cost accounting, by contrast, relies on historical records and does not reflect market changes or current market conditions because it is not updated. It is also always stable and recorded only in cases of loss. In addition, it is low-cost and suitable for small enterprises.

What Are the Advantages of Fair Value Accounting?

Fair value accounting has many advantages that make it preferable for companies, as it helps provide accurate information, reflects changes in assets, and also helps improve decision-making. Below are the advantages of fair value accounting in detail:

1- Providing more accurate and objective information

Fair value reflects the market value of assets and liabilities at the measurement date, which may differ significantly from their historical values.

Therefore, fair value accounting can provide more accurate and objective information about a company’s financial position and financial performance.

2- Better reflection of changes in the value of assets and liabilities

The values of assets and liabilities change over time, and fair value can reflect these changes better than historical cost.

Accordingly, fair value accounting can help provide a more accurate picture of the true value of assets and liabilities.

3- Helping improve financial decision-making

The information provided by fair value accounting can help investors and company managers make more accurate financial decisions.

For example, the fair value of assets can help determine the value of a company, and the fair value of liabilities can help determine the company’s risks.

What Are the Disadvantages of Fair Value Accounting?

Fair value accounting has some disadvantages that may be troubling. These disadvantages may appear in large fluctuations in financial reports, difficulty in comparing company performance over time, and challenges in disclosing information. Below are the issues of fair value accounting explained more clearly:

1- Significant fluctuations in financial reports

Fair value depends on market prices, which can fluctuate significantly. Therefore, fair value accounting may lead to significant fluctuations in financial statements, making it difficult for users to understand a company’s performance.

2- Difficulty in comparing company performance over time

The values of assets and liabilities can vary significantly across companies, depending on market conditions. As a result, fair value accounting can make it challenging to compare company performance over time.

3- Creating difficulties in financial information disclosure

It can be challenging to determine the fair value of assets and liabilities, particularly when there are no active markets for them. Consequently, fair value accounting may pose challenges for accurately and transparently disclosing financial information.

How Can These Disadvantages Be Reduced or Eliminated?

Through specific measures, the disadvantages of fair value accounting can be reduced, such as setting specific usage standards, providing explanations, or using different metrics. Below are the detailed steps that can help eliminate these disadvantages:

- Using specific standards to measure fair value: Clearly defined fair value measurement standards can help reduce fair value fluctuations.

- Providing clear explanations of fair value: Clear explanations of fair value can help users better understand the fair value of assets and liabilities.

- Using other performance measures: Other performance measures, such as cash flows, can be used to reduce reliance on fair value in measuring company performance.

In summary, fair value in accounting is an important tool for valuing assets and liabilities and supports strategic financial decision-making. Calculating fair value requires the use of various accounting methods and is characterized by its benefits and applications.

Fair value should be estimated in accordance with recognized accounting standards, taking into account market factors and current conditions.

Regarding the difference between market value and fair value, it is important to understand that market value reflects the value at which assets can be sold in the market, while fair value reflects the value that can be achieved in a sale transaction between the concerned parties. Fair value depends on future estimates and specific accounting standards.

We must also distinguish between fair value accounting and traditional cost accounting. Fair value accounting focuses on estimating the fair value of assets and liabilities using different methods. In contrast, traditional cost accounting relies on recording the actual costs of acquiring and maintaining assets.

In conclusion, fair value in accounting is crucial for understanding the true value of assets and liabilities in financial statements. Accountants and financial professionals must be aware of fair value calculation methods and their accounting applications. Understanding fair value supports strategic financial decision-making and enhances transparency and reliability in financial reporting.

How Does Daftra Help You Calculate Fair Value?

The accounting software provided by the Daftra system facilitates fair value calculations, as it offers advanced technologies and tools. Daftra enables you to document various accounting entries, such as sales, purchases, pricing, and valuations, information essential for calculating fair value.

It allows you to link assets to cost centers, prepare detailed financial reports, manage vouchers and financial transactions, and also helps you automatically enter estimated valuations.

Therefore, Daftra is a distinguished choice for simplifying the calculation of fair value and making it more accurate.

Frequently Asked Questions

What Is the Fair Value of Saudi Stocks?

The fair value of Saudi stocks is the value that financial analysts believe represents the true value of the company and the price the stock deserves, based on multiple studies of the company’s condition, financial position, and future expectations.

What Is the Fair Value Rule?

It is the price or amount at which assets are sold or at which liabilities can be settled in the open market.