What is bookkeeping, its types, and its importance

Table of contents:

- What is bookkeeping?

- What types of ledgers do merchants keep?

- How is Accounting Bookkeeping Done?

- What is the Importance of Accounting Bookkeeping?

- What is the difference between accounting and bookkeeping?

- What are the consequences of not maintaining bookkeeping?

- How do accounting systems help with bookkeeping?

- Frequently Asked Questions (FAQs)

Have you ever seen a shopkeeper keeping a ledger, recording all the sales and purchases of his small shop in detail, including both completed transactions and credit sales?

Or do you recall a scene in a historical movie showing an ancient Egyptian writing down business and financial transactions on papyrus?

These very scenes illustrate what bookkeeping is. Although it is an ancient practice, it remains relevant today in a more complex and expanded form due to its importance.

How about we explore bookkeeping and its significance in more detail in this article?

What is bookkeeping?

Bookkeeping is a term used in the world of business, trade, and accounting, and it refers to the simple financial recording of daily transactions for the purposes of control, accuracy, and oversight.

A ledger is the book where your financial transactions are recorded, and bookkeeping means managing these transactions by recording them accurately and organizing them in the most useful way.

What types of ledgers do merchants keep?

Some merchants use a single, simple ledger to record daily transactions. As tracking becomes more sophisticated, they may use a general ledger where these transactions are posted after being categorized.

Others may add ledgers for inventory or legal documents. Let’s take a closer look at the common types of accounting ledgers used by merchants in the following lines:

Journal Ledger

The journal ledger is an accounting record used to document all daily financial transactions in detail. Transactions are organized by date, helping to track the company’s daily financial activities.

General Ledger

The general ledger is an advanced version of the journal ledger, containing the company’s various accounts after transactions are posted from the journal. Accounts are classified by type, such as assets, liabilities, revenues, and expenses.

Inventory Ledger

The inventory ledger is used to track available stock. It includes information on quantities on hand, quantities received, and quantities sold or used, helping to manage inventory efficiently.

Stocktaking Ledger

The purpose of the stocktaking ledger is to document the results of physical inventory counts. It is updated periodically to record the actual quantities in stock, ensuring the accuracy of the inventory records in the inventory ledger after matching them with the stocktaking results.

Cash Ledger

The cash ledger is a financial record designed to track all cash inflows and outflows from your treasury. It helps monitor daily cash movements and ensures the accuracy of cash accounts.

Securities Ledger

The securities ledger manages legal aspects, contracts, and securities-related documents. It covers all transactions related to securities, such as stocks and bonds, including purchase and sale details and the value of the securities, helping to manage financial investments and avoid potential legal errors.

The Daftra system includes various types of bookkeeping, covering daily journal entries, the chart of accounts program, invoice and voucher management, and other tools that help you avoid errors and prepare accurate and comprehensive financial reports.

How is Accounting Bookkeeping Done?

Despite the simplicity of accounting bookkeeping, there are practical steps that should be followed to ensure accuracy and correctness. The steps are as follows:

- Gather all supporting documents for financial transactions, such as invoices, payment and receipt vouchers, and checks. These documents are referred to as source documents.

- Analyze the source documents according to expenses and receipts, and try to organize them clearly to facilitate the recording of financial transactions.

- Record the financial transactions found in the source documents in the journal according to the date and type of transaction.

- After closing the temporary records, post the ongoing transactions to the ledger.

- Close the accounting periods at the end of each period, which is the appropriate time to prepare the trial balance and tax declarations.

- Issue the required financial statements and reports , such as the income statement, balance sheet, and cash flow statement.

What is the Importance of Accounting Bookkeeping?

Accounting bookkeeping helps achieve a minimum level of control over financial transactions and improves the process of making informed financial decisions. Its benefits include:

- Organizing, classifying, and analyzing financial transactions to obtain useful information that guides the company financially.

- Separating personal ownership from company ownership, protecting you from financial and legal liabilities that may affect your business.

- Paying the correct tax dues based on actual transactions without overestimation, and avoiding financial penalties resulting from non-compliance with tax laws that require proper bookkeeping.

- Improving financial and spending practices based on insights gained from accurately tracking financial transactions.

You now have a comprehensive and efficient management system for all accounting and business ledgers related to your work, provided by the Daftra system, where you can manage expenses and revenues, handle taxes and zakat, and prepare various accounting reports.

What is the difference between accounting and bookkeeping?

Bookkeeping is the process of recording and maintaining accounts, known as "record and bookkeeping," which involves recording financial transactions without delving into deeper and more analytical accounting processes. While bookkeeping is a part of accounting, accounting cannot be reduced to bookkeeping alone.

Accounting focuses more on analytical and inferential aspects, interpreting the financial data recorded, and deriving insights to improve the financial performance of a business. Therefore, accounting is a more strategic and analytical tool, whereas bookkeeping is limited to the organizational aspect of recording transactions.

What are the consequences of not maintaining bookkeeping?

Bookkeeping is the simplest way to track the financial aspects of your business. Failing to keep books often results in the absence of recording, analyzing, and controlling financial transactions, leading to several consequences:

- Accounting chaos: It becomes difficult to determine the profit or loss status of your business. Daily earnings figures do not immediately indicate profits; analysis over time is required.

- Lack of transparency: You cannot accurately evaluate employee performance or overall business efficiency without proper bookkeeping and accounting analysis.

- Financial mismanagement: Sound financial decisions rely on accurate data, which cannot exist without bookkeeping, leading to potentially costly mistakes.

- Poor strategic planning: Business strategy is based on analyzing past financial periods. Businesses that ignore bookkeeping cannot plan effectively.

Businesses that do not follow proper bookkeeping methods are often considered non-compliant by legal authorities, which can result in tax assessments based on inaccurate estimates.

How do accounting systems help with bookkeeping?

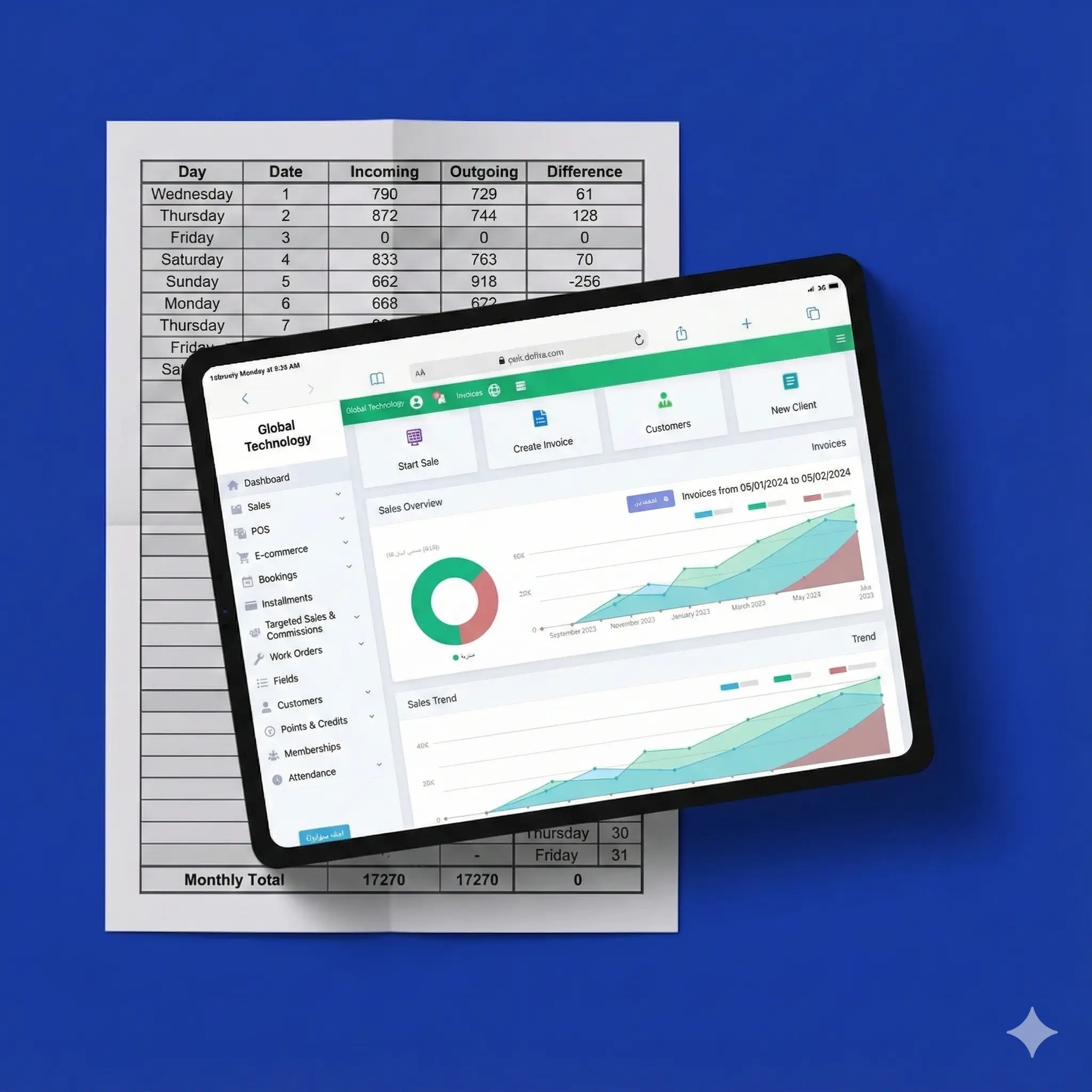

Accounting systems automate a large portion of the bookkeeping process, saving time and effort in manually entering and organizing financial data.

The level of automation depends on the system used. In today’s business environment, accounting systems are essential, not optional. Relying solely on traditional bookkeeping limits the benefits you can achieve.

Programs such as Daftra’s electronic accounting system can simplify bookkeeping with a few clicks.

In conclusion, understanding bookkeeping provides insight into the history and evolution of accounting practices. However, it is not sufficient on its own to manage all financial transactions. Exploring modern accounting systems can simplify your work and improve your return on investment.

Frequently Asked Questions (FAQs)

What is the bookkeeping process?

Bookkeeping is the process of recording a company’s financial transactions, both revenues and expenses, to maintain accurate records and provide comprehensive data for informed accounting decisions.

What are bookkeeping services?

Bookkeeping services involve recording and summarizing all financial transactions, preparing financial reports, and ensuring compliance with tax regulations and other laws.

When must a trader keep commercial books?

A trader must keep commercial books whenever they engage in a commercial transaction.

Are civil companies required to maintain commercial books?

Civil companies are not required to maintain commercial books as they are not considered commercial entities and are not subject to commercial law.

Who is required to maintain commercial books?

Anyone who engages in commercial transactions and has acquired the status of a trader is required to maintain commercial books.

What are the advantages of maintaining commercial books?

The advantages include making better financial decisions, managing risks, facilitating tax procedures, easing access to loans, and other benefits.

What are the conditions for maintaining commercial books?

Commercial books must be in Arabic, clear, comprehensive, reflect the trader’s financial position, and detail rights and obligations related to commercial activities.

What is the penalty for not maintaining commercial books?

Penalties can be civil or criminal and may result in risks such as bankruptcy, fraud accusations, financial fines, and other legal consequences.